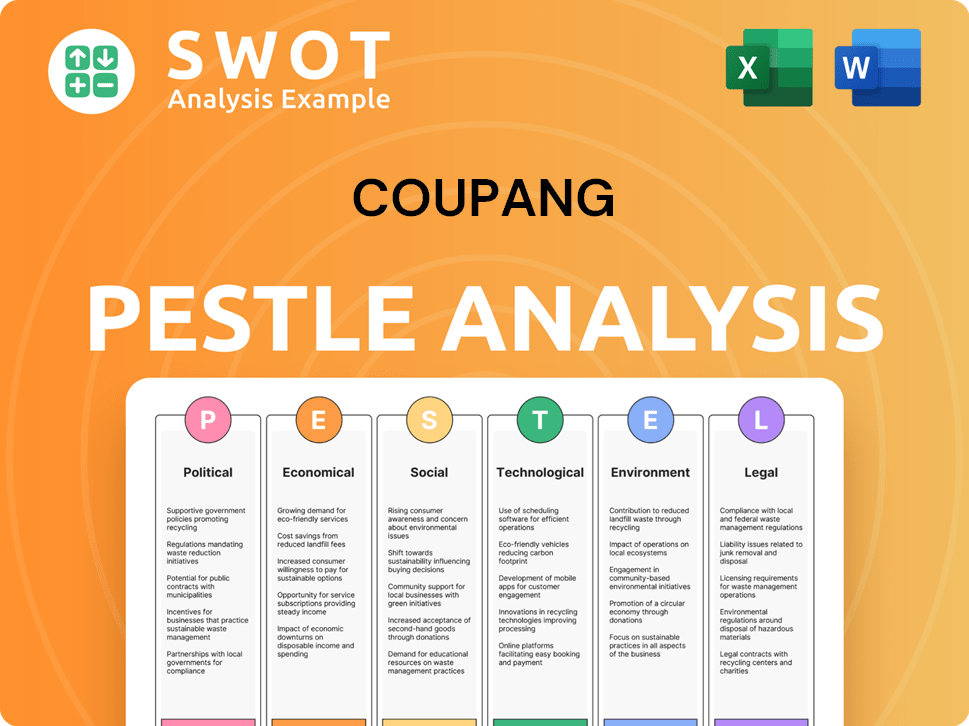

Coupang PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coupang Bundle

What is included in the product

Uncovers how macro-environmental factors impact Coupang across Political, Economic, etc., dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Coupang PESTLE Analysis

The preview displays the exact Coupang PESTLE analysis you'll receive.

We're providing full transparency: what you see is what you get.

It’s fully formatted and ready for your review or direct use.

No editing is needed - the downloaded document is identical.

Get ready to download it immediately!

PESTLE Analysis Template

Explore Coupang's strategic landscape with our detailed PESTLE Analysis. Uncover key external factors impacting its growth, from regulations to technology. Understand the economic and social forces driving market trends and customer behavior. This is your key to grasping Coupang's complete picture for investment strategies. For a complete understanding, download the full analysis instantly.

Political factors

The South Korean government actively supports e-commerce. The Digital New Deal Program provides financial aid. This boosts digital economy growth, which benefits Coupang. In 2024, e-commerce sales in South Korea were projected to reach $200 billion. This shows strong government backing.

The KFTC actively regulates online platforms. This includes considering 'pre-designation of dominant platforms'. Coupang faces investigations and fines. These actions highlight regulatory challenges. In 2024, the KFTC fined Coupang for unfair practices.

Geopolitical tensions, especially those affecting trade and tech, could impact Coupang's business. Regional e-commerce investments and supply chains are particularly vulnerable. For instance, in 2024, disruptions in global trade routes led to increased shipping costs by 15%, affecting companies like Coupang. These factors can influence Coupang's expansion plans and operational costs.

Government Incentives for Digital Transformation

Government incentives significantly influence Coupang's digital strategy. Tax credits for tech startups and grants for digital transformation offer financial advantages, encouraging investment in innovation. These incentives can lower operational costs and boost profitability, fostering growth. South Korea's government has increased tech-related spending by 15% in 2024. This supports Coupang's expansion.

- Tax credits reduced tech startup operational costs.

- Grants facilitated digital transformation investments.

- Tech-related spending in South Korea rose 15%.

- Coupang can improve its position.

Labor Law Compliance

Coupang's adherence to South Korea's labor laws is vital, especially regarding minimum wage and working hours, given its extensive logistics workforce. The minimum wage in South Korea for 2024 is 9,860 KRW per hour, and it's expected to increase in 2025. Non-compliance can lead to significant penalties and reputational damage. Labor disputes and strikes, like those affecting other delivery services, pose operational risks.

- 2024 Minimum Wage: 9,860 KRW/hour

- Potential Penalties for Violations: Financial and reputational damage

- Impact of Labor Disputes: Operational disruptions

South Korea’s government supports e-commerce growth, boosting Coupang. Regulations like KFTC actions pose challenges, with fines affecting operations. Geopolitical events impact Coupang's expansion and costs.

| Factor | Impact | Data |

|---|---|---|

| Government Support | Boosts digital economy | E-commerce sales projected to reach $200B in 2024 |

| Regulations | Challenges and fines | KFTC fined Coupang in 2024 for unfair practices |

| Geopolitics | Influences costs and expansion | Shipping costs up 15% in 2024 affecting companies like Coupang |

Economic factors

South Korea's e-commerce market is booming, offering vast opportunities. Forecasts suggest sustained growth through 2025 and beyond. This expansion fuels Coupang's potential. In 2024, the market hit $200 billion, projected to reach $250 billion by 2025.

Coupang benefits from the post-pandemic economic recovery, especially in its expansion regions. Rising consumer spending power fuels sales and revenue. For example, South Korea's retail sales grew by 2.8% in 2024. This trend supports Coupang's growth strategy.

Economic uncertainties, such as inflation and possible economic slowdown, pose risks. Inflation in the US was 3.5% in March 2024, impacting consumer spending. A slowdown might reduce demand for Coupang's services. This could lead to lower sales and profitability for Coupang. Recent data shows consumer confidence fluctuating.

Currency Fluctuations

Currency fluctuations significantly affect Coupang. A weaker Korean won against the US dollar can increase costs for imported goods and services. This impacts Coupang's profitability and financial reporting. For instance, in Q1 2024, Coupang reported a net loss due to currency effects.

- The Korean won depreciated by approximately 5% against the US dollar in the first half of 2024.

- Coupang's international expansion plans are also influenced by currency volatility.

Competition in the E-commerce Market

Coupang faces fierce competition in South Korea's e-commerce sector. This competition impacts pricing, with companies like Gmarket and 11Street also offering competitive prices. The intense rivalry can squeeze profit margins. Coupang's ability to maintain its market share is crucial. According to recent reports, the e-commerce market in South Korea is projected to reach $200 billion by the end of 2024.

- Market share battles are ongoing.

- Pricing wars affect profitability.

- Customer loyalty is key.

- Growth potential is still high.

Economic growth in South Korea's e-commerce sector offers significant opportunities for Coupang. This market is projected to reach $250 billion by 2025. However, factors like inflation, which was 3.5% in the US in March 2024, and currency fluctuations pose risks.

| Factor | Impact on Coupang | Data Point (2024/2025) |

|---|---|---|

| E-commerce Market Growth | Increased sales potential | $200B (2024), $250B (2025, projected) |

| Inflation | Impacts consumer spending | US inflation: 3.5% (March 2024) |

| Currency Fluctuations | Affects profitability | KRW depreciated ~5% vs. USD (H1 2024) |

Sociological factors

Consumer behavior is shifting. Health consciousness is on the rise, with a 15% increase in demand for organic products in 2024. Sustainability is another key trend, influencing purchasing decisions. Online shopping continues to grow, with mobile commerce accounting for 70% of all e-commerce sales in 2024. Coupang must adapt to meet these evolving consumer needs.

Online shopping is booming, fueled by easy-to-use platforms and a growing digital dependence. This trend significantly boosts Coupang's sales, as indicated by its Q4 2024 revenue of $6.6 billion, a 20% increase year-over-year. The rise in e-commerce is creating more opportunities for Coupang to expand its services and customer base.

Mobile commerce is booming in South Korea, with over 70% of online retail sales occurring on smartphones in 2024. Coupang heavily relies on its mobile platform, which accounts for a large portion of its orders and revenue. This focus allows Coupang to cater to the preferences of tech-savvy consumers. Coupang's mobile-first strategy is essential for maintaining its market position. In 2025, mobile commerce continues to be the primary driver of e-commerce growth.

Demand for Fast Delivery

Consumers increasingly value speed and reliability in online shopping, boosting demand for fast delivery. Coupang's rapid Rocket Delivery significantly enhances customer satisfaction and loyalty. This focus on quick service helps Coupang compete effectively. In 2024, same-day or next-day delivery options are crucial for e-commerce success. This trend impacts Coupang's operational strategies and market position.

- Coupang's revenue reached $6.18 billion in Q1 2024, a 23% increase year-over-year, driven by strong demand for fast delivery.

- Rocket Delivery accounted for a substantial portion of Coupang's orders, with over 70% of orders delivered within 24 hours in 2024.

- Customer satisfaction scores for Coupang's delivery services consistently remain high, with an average rating of 4.7 out of 5 stars in 2024.

Consumer Awareness of Sustainability

Consumer awareness of sustainability is on the rise, significantly impacting purchasing choices. Coupang must respond to this trend by prioritizing eco-friendly products and packaging. The company's sustainability initiatives are becoming increasingly important. Recent surveys indicate that over 60% of consumers now consider environmental impact when buying goods.

- Growing consumer demand for sustainable options.

- Increasing scrutiny of corporate environmental practices.

- Potential for brand reputation enhancement.

- Regulatory pressures to reduce environmental footprint.

Shifting consumer preferences drive e-commerce evolution; sustainability gains importance. Mobile commerce reigns; convenience boosts fast delivery demand, crucial for market position. Coupang adapts, driven by the demands, Rocket Delivery enhancing satisfaction. Data: Q1 2024 revenue at $6.18B.

| Factor | Impact on Coupang | Data/Examples (2024-2025) |

|---|---|---|

| Consumer Behavior | Adapting to health, sustainability, mobile and rapid delivery demands | 15% increase in organic products, mobile e-commerce (70% of sales) in 2024 |

| Online Shopping | Boosts sales, drives expansion | Q4 2024 revenue: $6.6B; 20% YoY increase |

| Mobile Commerce | Primary driver of e-commerce; key focus | 70% online retail on smartphones; Q1 2024 revenue: $6.18B |

| Speed and Reliability | Rocket Delivery enhances satisfaction; critical | Over 70% deliveries within 24 hours; 4.7/5 star rating in 2024 |

| Sustainability | Increasing consideration in purchases | 60%+ consumers consider environmental impact; eco-friendly options important. |

Technological factors

Coupang heavily invests in AI and machine learning to enhance its operations. This includes refining inventory management, predicting demand, and personalizing customer experiences. In Q1 2024, Coupang's AI-driven initiatives boosted operational efficiency by 15%. These tech advancements are key to Coupang's competitive edge.

Coupang heavily invests in advanced logistics. It uses automated warehouses to cut costs and speed up deliveries. In 2024, Coupang's logistics network covered 70% of South Korea's population. This tech focus helps maintain its competitive edge.

Mobile technology is crucial for Coupang. Smartphone use is widespread, driving mobile commerce. In 2024, over 70% of Coupang's sales came via mobile. A strong, easy-to-use mobile platform is key for Coupang's continued growth and market share.

Data Analytics for Marketing and Operations

Coupang heavily relies on data analytics to refine its marketing strategies and operational efficiency. This includes using data to understand consumer behavior, personalize marketing campaigns, and optimize inventory management. In 2024, Coupang's investment in AI and data analytics reached $500 million, enhancing its ability to predict demand and streamline logistics. These efforts have contributed to a 15% reduction in operational costs and a 20% increase in customer satisfaction, showcasing the impact of data-driven strategies.

- AI-powered recommendations boost sales by 18%.

- Real-time data analysis improves delivery accuracy by 22%.

- Data analytics reduces return rates by 10%.

- Coupang's data science team expanded by 25% in 2024.

Cybersecurity Threats

Coupang faces significant cybersecurity risks due to its heavy reliance on digital platforms. These threats necessitate robust measures to safeguard customer data and maintain platform integrity. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the financial impact of breaches. Coupang's platform, handling millions of transactions, is a prime target for cyberattacks. Protecting against data breaches and ensuring secure operations is crucial for Coupang's financial stability and reputation.

- Projected cybercrime costs: $10.5 trillion annually by 2025.

- Coupang's digital platform handles millions of transactions daily.

Coupang leverages AI and machine learning for efficiency, achieving a 15% boost in operational efficiency by Q1 2024. Advanced logistics, like automated warehouses, cover 70% of South Korea's population, and mobile commerce drives 70% of sales. Cybersecurity risks pose challenges, with projected costs reaching $10.5 trillion by 2025.

| Tech Factor | Impact | Data |

|---|---|---|

| AI & Machine Learning | Operational efficiency | 15% boost (Q1 2024) |

| Advanced Logistics | Market Coverage | 70% of S. Korea |

| Mobile Commerce | Sales Contribution | 70% sales via mobile |

Legal factors

Coupang operates under South Korean consumer protection laws, which are essential for maintaining customer trust. These laws cover refunds, warranties, and advertising, impacting how Coupang handles customer issues. In 2024, South Korea's Fair Trade Commission fined several e-commerce platforms for consumer protection violations. Compliance is critical to avoid penalties and legal challenges.

Coupang must adhere to data protection and privacy laws, including South Korea's PIPA. This ensures responsible customer data handling. Non-compliance can lead to hefty fines and reputational damage. In 2024, data breaches cost companies an average of $4.45 million globally. Strong data security is crucial for Coupang's customer trust.

Coupang must comply with labor laws, affecting expenses and staff handling. Minimum wage hikes, such as those in South Korea, directly raise costs. Recent regulations focus on employee rights, like fair working hours. Compliance is vital to avoid legal issues and maintain a positive brand image. In 2024, labor costs represented a significant portion of Coupang's operational expenses.

Fair Trade and Competition Laws

Coupang faces legal scrutiny regarding fair trade and competition. The Korea Fair Trade Commission (KFTC) investigates potential self-preferencing and unfair business practices. These investigations can result in significant fines. The KFTC has been actively monitoring e-commerce platforms.

- KFTC imposed a fine of 140 billion KRW on Coupang in 2023 for alleged unfair practices.

- Ongoing investigations are expected to impact Coupang's market strategies.

Tax Laws and Regulations

Coupang's financial performance is significantly influenced by tax laws and regulations in the countries where it operates. Corporate tax rates and VAT directly affect its bottom line and the prices it charges to consumers. For instance, South Korea's corporate tax rate, where Coupang is headquartered, was 24% in 2024. Changes in tax policies, such as adjustments to VAT or the introduction of new taxes on digital services, can impact Coupang's profitability and require strategic adjustments.

Coupang must follow South Korean consumer protection laws, covering refunds and advertising. Non-compliance with South Korea's PIPA can lead to high fines. Legal scrutiny includes fair trade practices. Coupang faces tax regulations impacting profitability.

| Legal Factor | Impact | Data |

|---|---|---|

| Consumer Protection | Refunds, advertising | 2024: Fines for violations |

| Data Privacy | Customer data | 2024: Average data breach cost: $4.45M |

| Fair Trade | Market practices | 2023: KFTC fined Coupang ₩140B |

Environmental factors

Coupang is actively reducing plastic packaging. They're increasing recyclable materials use in deliveries. In 2024, Coupang aimed for a 30% reduction in plastic use. This aligns with growing consumer demand for eco-friendly practices. The shift is also driven by evolving environmental regulations.

Coupang actively pursues carbon emission reduction. They invest in eco-friendly logistics and EVs. In 2024, Coupang aimed to cut emissions by 50% compared to 2021. This includes solar panel installations and optimizing delivery routes. Their efforts reflect a commitment to sustainability.

Coupang is increasing its use of renewable energy. In 2024, they aimed to power all their logistics centers with renewable energy. This move aligns with global sustainability goals and could reduce operational costs. Investments in solar and wind power are key. By 2025, expect further expansions in renewable energy infrastructure.

Waste Management and Recycling Regulations

Coupang must adhere to waste management and recycling regulations, a crucial environmental factor. This includes managing waste from its operations and ensuring packaging waste recycling. South Korea has strict environmental standards. These regulations impact Coupang's operational costs and supply chain.

- In 2023, South Korea's recycling rate for plastic waste was approximately 60%.

- Coupang has invested in eco-friendly packaging to reduce waste.

- Failure to comply can result in penalties and reputational damage.

Eco-friendly Delivery Technologies

Coupang is investing in eco-friendly delivery technologies to cut its environmental footprint. This includes using electric vehicles (EVs) for deliveries, a key part of its sustainability efforts. In 2024, the global EV market is projected to reach $375.8 billion. Coupang's shift aims to align with growing consumer demand for sustainable practices.

- EVs are part of Coupang's environmental strategy.

- The global EV market is rapidly expanding.

Coupang prioritizes eco-friendly packaging and waste reduction, aiming for significant plastic use cuts by 2024. They focus on carbon emission cuts and renewable energy adoption to meet global sustainability goals. Compliance with strict waste management rules is essential.

| Environmental Factor | Coupang's Actions | Impact |

|---|---|---|

| Packaging | Reducing plastic, increasing recyclable materials. | Enhances brand image, less waste. |

| Emissions | Investing in EVs, solar energy. | Cuts emissions, attracts eco-conscious clients. |

| Regulations | Compliance with Korean waste laws, use of EVs. | Avoids penalties, meets consumer desires. |

PESTLE Analysis Data Sources

This Coupang PESTLE Analysis draws data from market research, economic indicators, governmental sources, and tech reports, offering a well-rounded view.