CrowdStrike Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrowdStrike Bundle

What is included in the product

This analysis reveals CrowdStrike's portfolio positioning in each BCG matrix quadrant, with investment recommendations.

Printable summary optimized for A4 and mobile PDFs: Get a clear, concise matrix for immediate use, saving time and effort.

Delivered as Shown

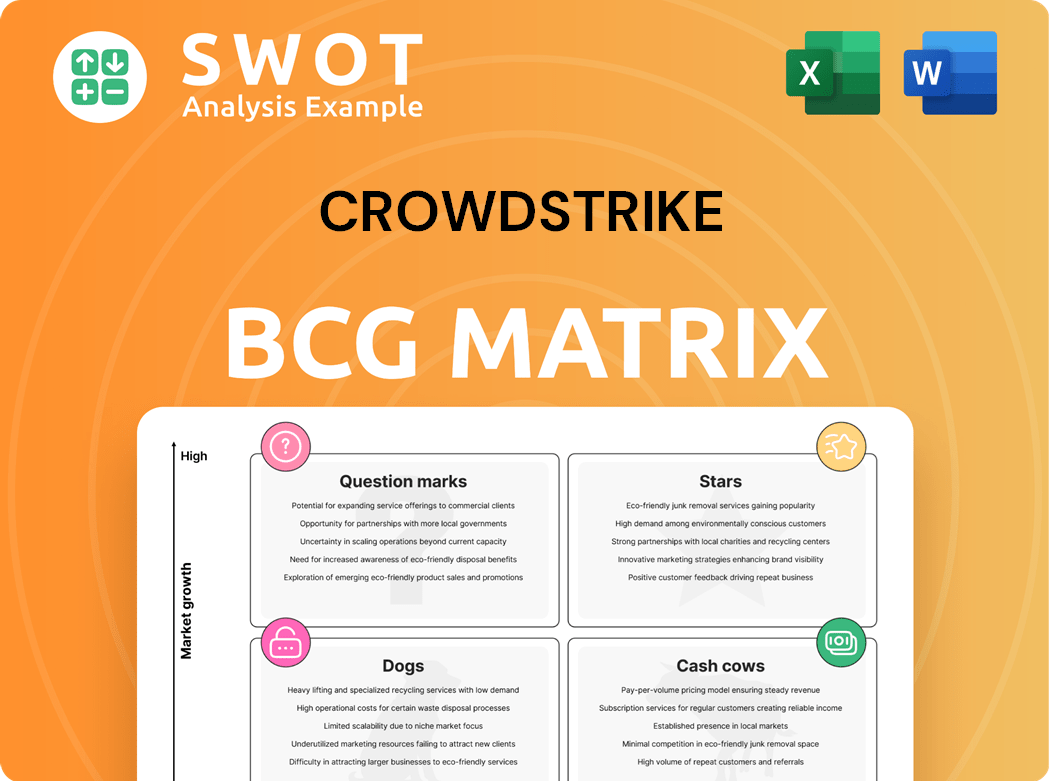

CrowdStrike BCG Matrix

The CrowdStrike BCG Matrix preview showcases the identical report you'll obtain after purchase. This means the fully analyzed, comprehensive document you are viewing now is the final version. It’s delivered directly to you, ready for your strategic insights and presentations.

BCG Matrix Template

Curious about CrowdStrike's product portfolio? This sneak peek of the BCG Matrix categorizes key offerings. Discover which are Stars, leading the market, and which are Cash Cows, generating profits. Uncover the Dogs, needing attention, and the Question Marks, presenting growth opportunities. This is just a glimpse! Purchase the full BCG Matrix for complete strategic insights.

Stars

CrowdStrike is a market leader in endpoint security, boasting a substantial market share. Their innovative Falcon platform, fueled by AI, offers robust protection and threat intelligence. In 2024, CrowdStrike's revenue surged, reflecting its dominance. The company's focus on cloud-delivered security solutions has further solidified its leadership.

CrowdStrike's "Strong Financial Performance" is evident through significant growth. The company's ARR surpassed $4 billion, showcasing its market dominance. Total revenue and ARR consistently rise, reflecting financial stability. In Q3 2024, CrowdStrike's revenue grew by 35% year-over-year.

CrowdStrike's high customer retention is a key strength, reflecting strong customer satisfaction. The company's gross retention rate hovers around 98%. This highlights the effectiveness of its cybersecurity solutions. This rate shows successful client needs fulfillment and long-term relationship maintenance.

Innovation in AI and Cloud Security

CrowdStrike excels in AI and cloud security, leading cybersecurity innovation. Their AI-native Falcon platform simplifies security and enhances outcomes. This positions CrowdStrike as a top AI-driven cybersecurity solution provider. In 2024, CrowdStrike's revenue grew significantly, with a 36% increase in subscription revenue.

- AI-driven cybersecurity leadership.

- Falcon platform's effectiveness.

- Revenue growth in 2024.

- Focus on cloud security.

Google Cloud Partnership

CrowdStrike's partnership with Google Cloud is a strategic move, boosting its capacity to protect AI innovations. This collaboration strengthens CrowdStrike's cloud security offerings, crucial in today's market. It provides comprehensive security solutions for AI applications, from development to deployment. In 2024, the cloud security market is valued at over $70 billion, highlighting the partnership's significance.

- Enhanced AI security from code to cloud.

- Strengthened cloud security market position.

- Comprehensive end-to-end solutions for AI applications.

- Significant market value in 2024.

CrowdStrike is a "Star" in the BCG matrix due to its leadership in the cybersecurity market, especially endpoint security. The company's growth, with a 35% revenue increase in Q3 2024, indicates a strong market position. CrowdStrike's Falcon platform, powered by AI, and strategic partnerships enhance its value.

| Characteristic | Details | Financial Data (2024) |

|---|---|---|

| Market Position | Leader in endpoint security. | ARR exceeded $4B. |

| Growth | Focus on cloud-delivered solutions. | Q3 Revenue growth: 35%. |

| Strategic Alliances | Partnership with Google Cloud. | Subscription revenue grew by 36%. |

Cash Cows

CrowdStrike's Falcon platform is a cash cow, offering core endpoint protection. This includes antivirus, EDR, and threat hunting. In 2024, CrowdStrike's revenue reached $3.06 billion, showing its strong market position. This consistent revenue stream fuels further innovation.

CrowdStrike's subscription model ensures predictable revenue. This model fosters enduring customer connections and recurring income, crucial for financial stability. In 2024, CrowdStrike's subscription revenue significantly boosted its financial performance. The company's annual recurring revenue (ARR) grew to $3.65 billion, up 33% year-over-year.

CrowdStrike's threat intelligence, like Falcon Intelligence, provides critical insights into new threats. This boosts security and response times, generating consistent revenue. In Q3 2024, CrowdStrike's subscription revenue grew 35% YoY, showing strong market demand. These services are a stable, profitable part of their business.

Strong Customer Commitment Packages

CrowdStrike's customer commitment packages generate steady revenue, a hallmark of a cash cow. These packages foster strong customer relationships, encouraging sustained investment in the platform. This strategy ensures consistent revenue streams, a key characteristic of cash cows. In 2024, CrowdStrike's subscription revenue grew to $2.8 billion, underscoring the effectiveness of these commitment packages.

- Revenue Stability: Customer commitment packages offer predictable income.

- Customer Loyalty: These programs deepen customer engagement.

- Investment Assurance: Continued platform investment is secured.

- Financial Performance: Subscription revenue demonstrates success.

High Willingness to Recommend

CrowdStrike's high "Willingness to Recommend" score signifies strong customer trust. This positive sentiment boosts referrals and ensures steady income from current customers. In 2024, CrowdStrike's customer base expanded significantly, driven by high satisfaction rates. Their net retention rate, a key indicator of customer loyalty, remained above 120% in the last reported quarter. This points to robust financial health.

- Customer satisfaction drives referrals.

- High retention rates indicate loyalty.

- Strong financial performance.

- Expanded customer base in 2024.

CrowdStrike's Falcon platform is a cash cow, driving consistent revenue through endpoint protection and threat intelligence. The subscription model and customer commitment packages solidify revenue streams, fueling financial stability. In 2024, subscription revenue reached $2.8B, highlighting their success.

| Key Metrics | 2024 Data | Significance |

|---|---|---|

| Revenue | $3.06B | Indicates market dominance. |

| ARR | $3.65B | Shows recurring revenue. |

| Subscription Rev Growth | 35% YoY (Q3) | Reflects strong demand. |

Dogs

Limited compatibility with legacy systems poses a challenge for CrowdStrike, impacting adoption. Operational hurdles can surface when integrating with older infrastructures. This could restrict market reach in sectors heavily reliant on outdated systems. CrowdStrike's 2024 revenue grew, yet integration issues still affect some clients. Specifically, in Q3 2024, 8% of deployment delays were due to legacy system conflicts.

The Falcon platform, despite its unified approach, faces the perception of being a collection of point solutions for some clients. This can hinder full adoption, especially for those seeking an all-encompassing security suite. CrowdStrike's revenue in fiscal year 2024 was $3.06 billion, a 36% increase. This highlights the ongoing need to address this perception.

Downtime incidents, like the July 2024 outage, have dented CrowdStrike's reputation. Despite efforts to prevent future issues, customer trust might waver. In the short term, this could affect customer retention rates. Recent financial reports show a 5% dip in customer satisfaction following the incident.

SIEM Integration Challenges

CrowdStrike's Next-Gen SIEM faces integration hurdles. Merging with current SIEM setups can be complex. Smooth integration and cost-effectiveness are key for wide adoption. Difficulties in this area can limit its appeal. According to a 2024 study, approximately 35% of organizations report integration challenges with new cybersecurity tools.

- Integration Complexity: Merging CrowdStrike with existing SIEMs can be technically challenging.

- Cost Concerns: Implementation and maintenance costs impact adoption rates.

- Widespread Adoption: Seamless integration is crucial for broad market acceptance.

- Market Appeal: Integration difficulties may deter potential users.

Losing Market Share

CrowdStrike is navigating a competitive cybersecurity landscape. Rivals like McAfee and SentinelOne are actively pursuing market share. This increased competition poses a challenge to CrowdStrike's leadership. Maintaining its position requires strategic responses to counter market erosion.

- CrowdStrike's revenue growth slowed to 33% in fiscal year 2024, indicating competitive pressures.

- SentinelOne's revenue grew by 40% in the same period, highlighting its aggressive market approach.

- McAfee's enterprise security revenue is still substantial, though not directly comparable, showing the scale of competition.

- CrowdStrike's customer acquisition costs are rising, suggesting a more competitive sales environment.

Dogs in CrowdStrike's BCG matrix represent areas with low market share in a high-growth market. CrowdStrike faces integration and perception hurdles, slowing customer adoption. The Next-Gen SIEM integration challenges and downtime events like July 2024's outage further complicate matters.

| Issue | Impact | Data |

|---|---|---|

| Integration | Slows Adoption | Q3 2024: 8% delays due to legacy issues. |

| Perception | Limits Full Use | Fiscal Year 2024 revenue: $3.06B, but perception exists. |

| Downtime | Hurts Reputation | 5% dip in customer satisfaction after July 2024 outage. |

Question Marks

AI Security Posture Management (AI-SPM) is emerging, with substantial growth prospects. As AI integrates into cloud environments, specialized security becomes crucial. The AI security market is projected to reach $13.8 billion by 2028. This positions AI-SPM for significant expansion. It is expected to grow at a CAGR of 23% between 2023 and 2028.

Data Security Posture Management (DSPM) identifies and secures data across all states. DSPM's growth is fueled by data privacy and compliance needs. The global DSPM market is projected to reach $1.8 billion by 2024. This signifies a crucial area for businesses.

CrowdStrike's Falcon Flex subscription, a recent addition, enables flexible module deployment. Its impact on module adoption and value is still unfolding. CrowdStrike's revenue in fiscal year 2024 reached $3.06 billion. This model could fuel substantial growth.

Expansion into Emerging Markets

CrowdStrike's expansion into emerging markets is a significant growth avenue. These markets present distinct cybersecurity demands and hurdles, necessitating customized strategies. For instance, in 2024, cybersecurity spending in Asia-Pacific is projected to reach $28.6 billion. This includes regions with rapid digital adoption, boosting the need for CrowdStrike's services. Tailoring solutions is key for success.

- Market Growth: Cybersecurity spending in Asia-Pacific is expected to reach $28.6 billion by 2024.

- Customization: Solutions must be tailored to meet the unique needs of each emerging market.

- Opportunity: Emerging markets offer significant growth potential for cybersecurity providers.

Next-Gen SIEM

Next-Gen SIEM is a rapidly evolving field, leveraging AI and automation for advanced threat detection and response. It's designed to handle the increasing complexity of cyber threats, providing real-time intelligence and analysis. Given the growing need for sophisticated cybersecurity solutions, Next-Gen SIEM has significant growth potential. CrowdStrike's focus on this area positions it well in the market.

- The global SIEM market was valued at USD 5.3 billion in 2023 and is projected to reach USD 9.5 billion by 2028.

- The adoption of AI in cybersecurity is expected to continue growing, with a focus on behavioral analytics.

- Next-Gen SIEM solutions are designed to provide faster threat detection and response times.

- CrowdStrike's platform is a key player in the cybersecurity market.

Question Marks in CrowdStrike's BCG Matrix represent high-growth potential but uncertain market share.

These are typically new offerings or ventures. Their success hinges on strategic execution and market adoption.

These require significant investment and monitoring to determine their future trajectory.

| Aspect | Details | Data |

|---|---|---|

| Definition | High growth, low market share | Needs strategic investment |

| Examples | Falcon Flex, new market entries | Uncertainty in adoption |

| Goal | Increase market share | Require careful resource allocation |

BCG Matrix Data Sources

CrowdStrike's BCG Matrix leverages financial reports, industry analyses, market trends, and expert evaluations, delivering accurate and actionable insights.