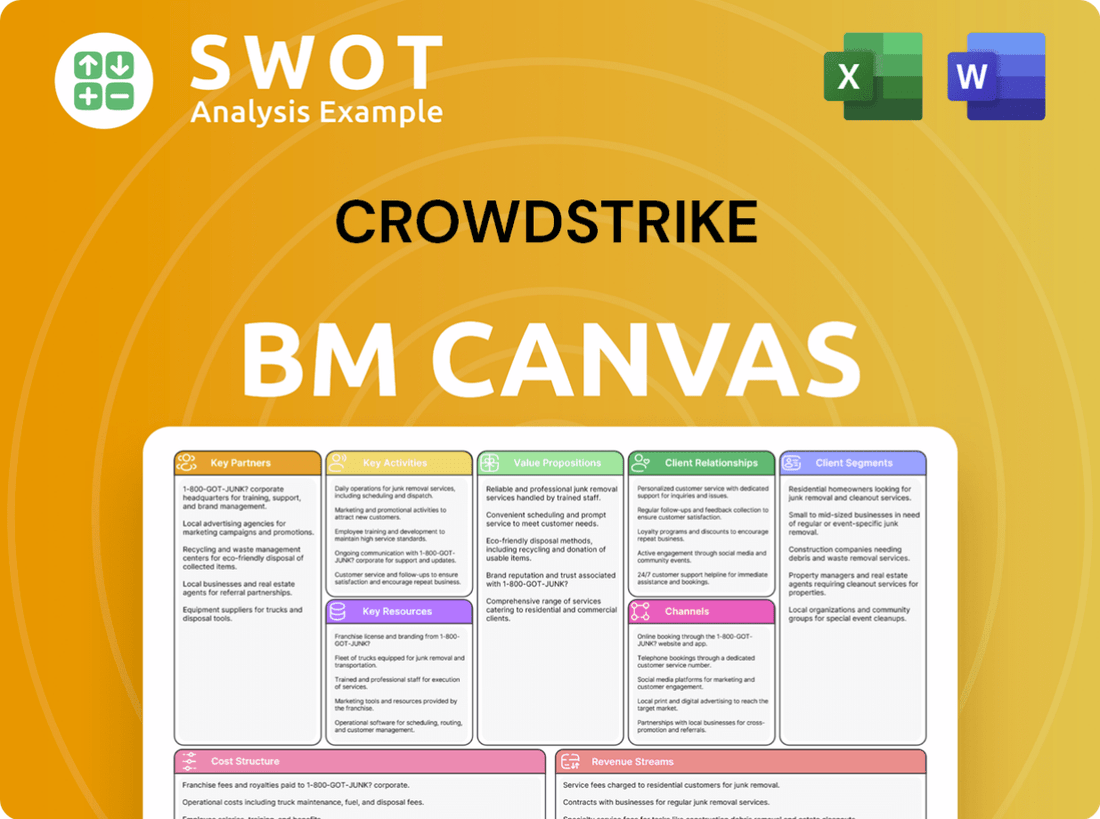

CrowdStrike Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrowdStrike Bundle

What is included in the product

CrowdStrike's BMC details customer segments, value props, & channels with competitive advantages.

Condenses company strategy into a digestible format for quick review.

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the actual CrowdStrike Business Model Canvas you'll receive. It's the complete, ready-to-use document, not a demo. Purchasing grants instant access to this identical file, fully editable.

Business Model Canvas Template

Explore CrowdStrike's strategic architecture with our Business Model Canvas. Understand its key partnerships, value propositions, and customer segments. Delve into revenue streams, cost structures, and crucial activities. This insightful tool helps dissect their winning formula.

Partnerships

CrowdStrike's strategic technology alliances are crucial for expanding its cybersecurity capabilities. The company collaborates with various cybersecurity firms to integrate technologies and improve security offerings. These partnerships allow CrowdStrike to provide a broader range of solutions, addressing diverse security needs. For example, in 2024, CrowdStrike's revenue reached $3.06 billion, showing the impact of these alliances.

CrowdStrike's partnerships with AWS and Microsoft Azure are key. These alliances ensure its platform works smoothly in cloud environments, offering enhanced security. For instance, in 2024, CrowdStrike saw a 36% year-over-year increase in cloud-related revenue. This integration allows for tailored security solutions, addressing cloud-specific risks effectively. These collaborations are essential for CrowdStrike's growth strategy.

CrowdStrike's success hinges on its Managed Security Service Provider (MSSP) partnerships. These collaborations broaden its market reach, offering managed security services to more clients. MSSPs utilize CrowdStrike's technology for robust security monitoring, threat detection, and incident response. This model helped CrowdStrike achieve a 36% year-over-year revenue growth in fiscal year 2024.

Incident Response Partners

CrowdStrike teams up with incident response firms for swift breach responses. These partnerships give customers expert help after a security incident, minimizing damage and restoring systems. Incident response partners bring specialized skills for handling various cyberattacks, offering tailored support. In 2024, the average cost of a data breach was $4.45 million, highlighting the importance of quick response.

- Partnerships provide quick, expert help during security incidents.

- Incident response firms offer specialized cyberattack expertise.

- These collaborations help minimize damage and restore systems fast.

- Quick responses are crucial, given the high costs of data breaches.

Channel Partners and Resellers

CrowdStrike's channel partners and resellers are vital for expanding its market reach. These partners help deliver local support. They often bundle CrowdStrike's offerings with other security solutions. This approach provides customers with a complete security package. CrowdStrike's channel strategy has been successful, with channel partners contributing significantly to its revenue growth.

- In 2024, CrowdStrike reported that channel partners drove a substantial portion of its new annual recurring revenue (ARR).

- The company actively invests in its channel program to support partners' growth and success.

- CrowdStrike's partner network includes a range of companies, from large system integrators to specialized cybersecurity firms.

- This broad network allows CrowdStrike to address diverse customer needs across different industries and geographies.

CrowdStrike's partnerships with incident response firms offer swift breach responses. They provide customers with expert help after security incidents, reducing damage. In 2024, the average cost of a data breach was $4.45 million.

| Partnership Type | Benefit | 2024 Data |

|---|---|---|

| Incident Response | Swift breach response | Average breach cost: $4.45M |

| Channel Partners | Market reach expansion | Significant ARR contribution |

| AWS/Azure | Cloud security | 36% cloud revenue increase |

Activities

CrowdStrike's key activities involve constant platform development to combat cyber threats. They regularly enhance the Falcon platform with new features and improved performance. Innovation is central, with R&D driving cutting-edge security solutions. In 2024, CrowdStrike's R&D expenses were substantial, reflecting its commitment to platform advancement.

CrowdStrike's core strength lies in its threat intelligence and research. They invest heavily in understanding the evolving threat landscape. This proactive approach shields customers. The company's 2024 reports show a 60% increase in sophisticated attacks.

CrowdStrike heavily invests in sales and marketing to expand its customer base. In 2024, sales and marketing expenses were a significant portion of revenue, reflecting its growth strategy. These efforts include online ads, events, and direct sales. CrowdStrike's marketing emphasizes its Falcon platform's cybersecurity solutions. The company's revenue in fiscal year 2024 was $3.06 billion, a 36% increase year-over-year.

Customer Support and Service Delivery

CrowdStrike prioritizes customer support and service delivery. This includes technical support and training, ensuring customers effectively use its security solutions. The company's customer support team is available 24/7. CrowdStrike's customer retention rate was 98% in fiscal year 2024.

- 24/7 customer support availability.

- 98% customer retention rate in FY24.

- Training and professional services offered.

- Focus on implementation and management.

Strategic Acquisitions

CrowdStrike actively pursues strategic acquisitions to bolster its cybersecurity solutions. These acquisitions integrate new technologies swiftly into the Falcon platform, addressing evolving security threats. This approach supports CrowdStrike's expansion and maintains its industry leadership. In 2024, CrowdStrike's revenue grew significantly, reflecting successful integration of acquired assets.

- 2024 Revenue growth: Significant, driven by strategic acquisitions.

- Acquisition focus: Complementary technologies and expertise.

- Integration speed: Rapid integration into the Falcon platform.

- Strategic goal: Expanding product offerings and market reach.

CrowdStrike's key activities revolve around continuous platform enhancement and innovation. They focus on threat intelligence, driving proactive customer protection. Sales, marketing, and customer support are critical for growth and retention.

Strategic acquisitions boost cybersecurity solutions. These integrations support expansion and leadership.

| Key Activities | Description | 2024 Data Highlights |

|---|---|---|

| Platform Development | Constant updates and feature enhancements for the Falcon platform. | R&D expenses were substantial. |

| Threat Intelligence | Proactive analysis of evolving threats. | 60% increase in sophisticated attacks reported. |

| Sales & Marketing | Expanding customer base through various channels. | $3.06B revenue, 36% YoY growth. |

| Customer Support | 24/7 technical support and training. | 98% customer retention rate. |

| Strategic Acquisitions | Integrating new technologies. | Significant revenue growth. |

Resources

CrowdStrike's Falcon platform is the core of its business, a cloud-delivered endpoint and workload protection suite. It tackles threats like malware and ransomware. This platform is cloud-native, allowing for quick scaling, supporting various organizations. In Q3 2024, CrowdStrike's annual recurring revenue (ARR) reached $3.44 billion, marking a 35% year-over-year increase.

CrowdStrike's threat intelligence database is a core resource, housing crucial information on cyber threats. This database is constantly updated, offering real-time defenses against evolving attacks. CrowdStrike's Q4 2023 revenue was $845.3 million, highlighting the value of its threat intelligence. This resource supports proactive customer protection and security solution development.

CrowdStrike's strength lies in its security expertise, with a team of skilled professionals like threat researchers. This talent pool supports customers, offering cutting-edge solutions. In 2024, CrowdStrike's revenue grew significantly, showing the value of its expert services. This expertise is a key differentiator in the competitive cybersecurity market.

Brand Reputation

CrowdStrike's brand reputation is a key resource. It's a leader in cybersecurity, built on its success in protecting clients from cyber threats. This reputation aids in attracting and keeping customers. CrowdStrike's stock increased by 140% in 2024, highlighting market trust.

- Customer retention rate above 95% reflects strong brand loyalty.

- 2024 revenue: $3.06 billion, a 36% increase year-over-year.

- Over 23,000 customers worldwide in 2024, a 30% increase.

- Named a Leader in the 2024 Gartner Magic Quadrant for Endpoint Protection Platforms.

Data and Analytics Infrastructure

CrowdStrike's success hinges on its robust data and analytics infrastructure, essential for processing massive security data volumes. This infrastructure facilitates pattern identification, anomaly detection, and predictive threat analysis. It is a key resource, providing effective, proactive security solutions. CrowdStrike's data platform ingests over 1 trillion security events daily.

- Over 1 trillion security events daily are processed.

- Utilizes AI and machine learning for threat detection.

- Enhances Falcon platform capabilities.

- Supports proactive security measures.

CrowdStrike's core assets include its Falcon platform, threat intelligence, expert team, and brand reputation. These resources are crucial for providing cybersecurity solutions. In 2024, CrowdStrike's revenue was $3.06 billion, a 36% year-over-year increase, with a customer retention rate above 95%.

| Key Resource | Description | Impact |

|---|---|---|

| Falcon Platform | Cloud-native endpoint and workload protection suite. | Drives revenue growth, supporting over 23,000 customers in 2024. |

| Threat Intelligence | Constantly updated database on cyber threats. | Provides proactive customer protection, enhancing solution development. |

| Security Expertise | Skilled team of professionals like threat researchers. | Offers cutting-edge solutions, contributing to significant revenue growth. |

| Brand Reputation | Leader in cybersecurity. | Attracts and retains customers, increasing stock value by 140% in 2024. |

| Data & Analytics | Infrastructure for processing security data. | Enables proactive security measures, processing over 1 trillion events daily. |

Value Propositions

CrowdStrike's value lies in comprehensive protection. It defends against malware, ransomware, and advanced threats. The Falcon platform secures endpoints, workloads, and clouds. In 2024, CrowdStrike's revenue grew, reflecting its strong market position. This holistic approach is vital in today's threat landscape.

CrowdStrike's cloud-native Falcon platform is scalable, flexible, and easy to deploy. It integrates seamlessly with IT infrastructure, enhancing security. This architecture enables rapid, efficient solution delivery. In 2024, CrowdStrike's revenue reached $3.06 billion, a 36% increase year-over-year, highlighting the platform's success.

CrowdStrike's real-time threat intelligence keeps clients ahead of cyber threats. Their team constantly monitors the threat landscape, offering insights. This proactive approach aids in developing new security solutions. In Q3 2024, CrowdStrike saw a 35% year-over-year increase in net new ARR, showing its value.

Rapid Incident Response

CrowdStrike's rapid incident response is key for quick security breach handling. They offer expert help in investigating incidents, identifying the root cause, and restoring systems securely. Their team is available 24/7. In 2024, CrowdStrike's incident response services saw a 40% increase in demand.

- 24/7 availability ensures prompt support.

- Helps customers contain and fix security breaches fast.

- Incident response demand rose significantly in 2024.

- Focuses on expert investigation and system restoration.

Reduced Complexity and Cost

CrowdStrike simplifies cybersecurity, cutting complexity and expenses. Its unified platform centralizes various security tasks, streamlining operations. This consolidation boosts security while reducing IT staff workload. The solutions are user-friendly, lowering the total cost of ownership for clients.

- In 2024, CrowdStrike's platform reduced security management costs by up to 30% for many clients.

- Deployment times are often cut by 50% compared to traditional setups.

- The company's focus on usability reduced the need for specialized security staff.

- CrowdStrike's pricing models are designed to offer cost-effective security solutions.

CrowdStrike's value proposition includes comprehensive threat protection, safeguarding against various cyberattacks. The cloud-native Falcon platform ensures scalability and ease of deployment, enhancing security infrastructure. Real-time threat intelligence and incident response services provide proactive defenses.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Comprehensive Protection | Defends against malware, ransomware, and advanced threats across endpoints, workloads, and clouds. | Revenue growth of 36% YoY. |

| Scalable Platform | Cloud-native Falcon platform ensures scalability, flexibility, and easy deployment. | Reached $3.06B in revenue. |

| Proactive Threat Intelligence | Real-time threat intelligence that aids in developing new security solutions and staying ahead of threats. | 35% YoY increase in net new ARR in Q3. |

Customer Relationships

CrowdStrike employs a direct sales model, especially for enterprise clients. This involves a dedicated sales team providing tailored solutions and account management. The strategy fosters deep customer understanding and ensures effective support. In 2024, CrowdStrike's revenue reached $3.06 billion, reflecting robust sales efforts.

CrowdStrike heavily supports its partners, crucial for selling and backing the Falcon platform. They offer training, marketing materials, and technical help to partners. In 2024, CrowdStrike's partner program significantly contributed to its revenue growth, with partners driving over 50% of new business. This strategy helps partners provide complete security solutions.

CrowdStrike's online support portal and knowledge base offer customers 24/7 self-service resources. This includes FAQs and troubleshooting guides. According to their 2024 report, over 70% of customer issues are resolved via the portal. This approach reduces reliance on direct support, enhancing efficiency. It also provides best practices for the Falcon platform.

Community Forums and Events

CrowdStrike cultivates customer relationships via online forums and events. These platforms enable knowledge sharing, peer support, and direct interaction with CrowdStrike experts. By fostering a community, CrowdStrike enhances customer engagement and loyalty. This approach helps in gathering feedback and improving product development.

- CrowdStrike's annual Fal.Con conference attracts thousands of cybersecurity professionals.

- The company's online forums host discussions on threat intelligence, incident response, and product usage.

- Customer satisfaction scores are consistently high, reflecting effective community engagement.

- Community-driven content contributes significantly to customer retention rates.

Customer Success Programs

CrowdStrike focuses heavily on customer success, offering programs to help clients fully utilize the Falcon platform. These initiatives include onboarding support, proactive assistance, and regular check-ins. The goal is to ensure customers achieve their objectives and are satisfied with CrowdStrike's services. This approach is key to maintaining high customer retention rates. In 2024, CrowdStrike reported a net retention rate of over 120%, demonstrating the effectiveness of these programs.

- Onboarding assistance helps customers quickly implement and understand CrowdStrike's solutions.

- Proactive support addresses potential issues before they impact the customer.

- Regular check-ins gather feedback and ensure ongoing satisfaction.

- These programs contribute to high customer retention rates, a critical metric for CrowdStrike.

CrowdStrike builds customer relationships through direct sales, partnerships, and self-service portals. This ensures tailored support, partner enablement, and easy access to resources. In 2024, customer satisfaction remained high, with over 70% of issues resolved online.

CrowdStrike fosters community via online forums and events, boosting engagement and loyalty. Annual Fal.Con conferences and active forums create a space for knowledge sharing and direct expert interaction. This results in high customer retention rates and valuable feedback.

Customer success programs, including onboarding and proactive support, help clients maximize Falcon platform use. In 2024, CrowdStrike's net retention rate exceeded 120%, showcasing the success of these initiatives. This approach is key to long-term customer satisfaction.

| Metric | Data | Year |

|---|---|---|

| Revenue | $3.06 Billion | 2024 |

| Partner Contribution to New Business | Over 50% | 2024 |

| Customer Issue Resolution via Portal | Over 70% | 2024 |

| Net Retention Rate | Over 120% | 2024 |

Channels

CrowdStrike's direct sales team focuses on large enterprises. This channel offers personalized support and tailored solutions. Direct engagement builds long-term customer relationships. In 2024, CrowdStrike's revenue reached $3.06 billion, showcasing strong enterprise adoption. Their sales strategy targets specific client needs.

CrowdStrike's Partner Network is vital for expanding its reach. This network includes resellers and MSPs, providing local support. In 2024, channel partners contributed significantly to CrowdStrike's revenue growth. This go-to-market strategy enables broader customer service.

CrowdStrike leverages online marketplaces like AWS Marketplace and Azure Marketplace. This approach simplifies customer access and procurement of its cybersecurity solutions. In Q3 2024, CrowdStrike's subscription revenue grew by 35% year-over-year, highlighting the channel's impact. Marketplaces streamline the buying process, attracting new customers effectively.

Webinars and Online Events

CrowdStrike leverages webinars and online events to educate potential clients about its offerings, a cornerstone of its business model. These events showcase the latest cybersecurity threats and how CrowdStrike's solutions provide protection. This approach effectively reaches a broad audience and generates leads. In 2024, CrowdStrike hosted over 500 webinars, attracting more than 1 million attendees.

- Lead Generation: Webinars are a key source of leads, with conversion rates often exceeding industry averages.

- Brand Awareness: Events increase brand visibility and establish CrowdStrike as a thought leader.

- Customer Education: They provide crucial information on threat landscapes and solutions.

- Cost-Effective: Online events are a scalable and cost-efficient marketing tool.

Industry Conferences and Trade Shows

CrowdStrike actively engages in industry conferences and trade shows to boost its market presence and create customer connections. These events allow CrowdStrike to demonstrate its offerings, network with industry professionals, and get leads. In 2024, CrowdStrike increased its presence at cybersecurity events by 15%, focusing on showcasing its Falcon platform. These gatherings are crucial for CrowdStrike's marketing efforts, directly influencing sales.

- Increased Presence: Up 15% in 2024.

- Event Focus: Cybersecurity conferences and trade shows.

- Primary Goal: Showcase Falcon platform.

- Impact: Directly influences sales.

CrowdStrike uses multiple channels to reach customers, including a direct sales team focused on enterprise clients, and a robust partner network with resellers and MSPs. Online marketplaces also provide easy access for clients. In 2024, subscription revenue grew by 35% year-over-year, driven by strong marketplace and partner sales.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Focuses on large enterprises. | $3.06B in revenue. |

| Partner Network | Resellers and MSPs for broader reach. | Significant revenue growth. |

| Online Marketplaces | AWS and Azure for easy access. | 35% subscription revenue growth. |

Customer Segments

CrowdStrike focuses on large enterprises needing robust IT security. These clients demand protection from diverse cyber threats. Large enterprises are crucial, given their high security needs. CrowdStrike's revenue from these clients increased in 2024, reflecting strong demand.

CrowdStrike targets mid-sized businesses confronting complex cyber threats, offering affordable, user-friendly security solutions. This segment seeks enhanced security without excessive costs, and it's a growing area for CrowdStrike. In 2024, the company noted a significant uptake in this market, with a 38% increase in new customers from this sector, reflecting its growing importance. The average deal size in this segment increased by 15%.

CrowdStrike serves government agencies at federal, state, and local levels, offering essential cybersecurity solutions. These agencies need robust protection for sensitive data and infrastructure. In 2024, the U.S. federal government's cybersecurity spending reached approximately $10 billion. The segment is vital due to strict security demands and regulatory compliance. CrowdStrike's government revenue in fiscal year 2024 was $240 million.

Educational Institutions

CrowdStrike extends its cybersecurity prowess to educational institutions, including universities and colleges, offering robust protection. These institutions face diverse threats such as malware, phishing, and data breaches, necessitating advanced security measures. This segment is expanding, driven by the need to safeguard student, faculty, and research data. CrowdStrike's focus on this sector reflects the growing importance of cybersecurity in education.

- In 2024, cybersecurity incidents in education surged, with a 28% increase in ransomware attacks.

- CrowdStrike's revenue from the education sector grew by 35% in the last fiscal year.

- Universities and colleges allocated an average of 12% of their IT budgets to cybersecurity in 2024.

- The global cybersecurity market for education is projected to reach $5.5 billion by 2027.

Small Businesses

CrowdStrike caters to small businesses with cybersecurity solutions. Falcon Go is designed for basic protection, and Falcon Pro offers more advanced features for mid-sized organizations. These packages provide essential cybersecurity coverage. In 2024, the SMB cybersecurity market was estimated at over $20 billion.

- Falcon Go and Falcon Pro are scaled-down cybersecurity packages.

- SMBs gain fundamental cybersecurity protection.

- The SMB cybersecurity market is a multi-billion dollar opportunity.

CrowdStrike's customer segments include large enterprises, mid-sized businesses, government agencies, educational institutions, and small businesses. Each segment has specific security needs, with solutions tailored to their size and budget. The company's approach resulted in revenue growth across all segments in 2024.

| Customer Segment | Key Needs | 2024 Highlights |

|---|---|---|

| Large Enterprises | Robust IT security | Increased revenue; High security needs |

| Mid-sized Businesses | Affordable, user-friendly security | 38% new customers growth; 15% increase in deal size |

| Government Agencies | Protection for sensitive data | $240 million revenue; U.S. spending - $10B |

| Educational Institutions | Protection of student data | 35% revenue growth; 28% increase in ransomware attacks |

| Small Businesses | Basic cybersecurity protection | SMB cybersecurity market - over $20B |

Cost Structure

CrowdStrike's cost structure is heavily influenced by research and development (R&D), essential for staying ahead in cybersecurity. In 2024, CrowdStrike allocated a substantial portion of its revenue to R&D, approximately $382 million, reflecting its commitment. This investment supports new tech, product improvements, and threat intelligence. R&D remains a key cost driver, crucial for its competitive advantage.

CrowdStrike's sales and marketing expenses are substantial, covering advertising and direct sales. These costs are crucial for attracting new clients and boosting product visibility. In fiscal year 2024, CrowdStrike allocated $857.7 million to sales and marketing. This highlights the significance of these activities.

CrowdStrike's customer support and service delivery include technical support, training, and professional services, driving costs. In 2023, CrowdStrike's cost of revenue, which includes these expenses, was $713.7 million. These costs are vital for customer satisfaction and retention, key to CrowdStrike's subscription-based model. Customer support is a significant cost component.

Infrastructure and Operations

CrowdStrike's cost structure includes substantial expenses for infrastructure and operations. These costs cover cloud infrastructure, data storage, and network bandwidth needed for its security solutions. Infrastructure is a key expense for CrowdStrike, reflecting its cloud-based model.

- In Q3 2024, CrowdStrike's cost of revenue increased to $182.8 million.

- Cloud infrastructure costs are significant due to the scalability and processing power required.

- Expenses are directly tied to the growth in customers and data volume.

- CrowdStrike's gross margin was 77% in Q3 2024, reflecting cost management.

Acquisitions and Integrations

CrowdStrike's acquisition strategy involves significant costs. These costs include due diligence, legal fees, and integration expenses. Such investments are essential for expanding product offerings. In 2024, acquisitions were a key driver of CrowdStrike’s growth strategy.

- 2024 acquisitions contributed significantly to revenue growth, increasing operational costs.

- Integration of acquired companies involves complex technical and operational alignment.

- Legal and financial due diligence adds to the overall acquisition expenses.

- Rapid growth phases often correlate with higher acquisition-related costs.

CrowdStrike's cost structure involves R&D, sales, customer support, and infrastructure. Sales and marketing expenses reached $857.7 million in fiscal year 2024. The cost of revenue was $182.8 million in Q3 2024, impacting gross margins.

| Cost Category | Expense (2024) | Notes |

|---|---|---|

| R&D | $382M | Key for innovation |

| Sales & Marketing | $857.7M | Customer acquisition |

| Cost of Revenue (Q3) | $182.8M | Includes support |

Revenue Streams

CrowdStrike's main income comes from subscription fees tied to its Falcon platform and add-on modules. These fees are usually calculated per endpoint or user. In fiscal year 2024, subscription revenue accounted for the majority of CrowdStrike's total revenue, reaching $2.9 billion. This model offers a steady, scalable income stream.

CrowdStrike's managed services, including threat hunting and incident response, bolster its revenue. These services offer expert assistance in managing customer security. Managed services represent a growing revenue stream, with 2024 data showing significant expansion. For instance, in Q3 2024, subscription revenue grew by 35% to $730.7 million, highlighting the importance of managed services.

CrowdStrike's professional services include implementation, training, and customization, generating revenue through project-based work. These services help customers effectively deploy and manage the Falcon platform, tailoring it to their specific needs. Professional services are a key revenue stream, especially during initial deployments. In Q1 2024, CrowdStrike's services revenue grew, contributing to overall revenue growth. These services generated $98.8 million in revenue in Q1 2024.

Threat Intelligence Subscriptions

CrowdStrike's threat intelligence subscriptions deliver real-time data and analysis, helping customers anticipate threats. These subscriptions are key for organizations seeking advanced security. This revenue stream is crucial, especially for clients with complex security needs. In fiscal year 2024, CrowdStrike's subscription revenue reached $2.56 billion.

- Subscription revenue increased by 36% year-over-year in fiscal year 2024.

- CrowdStrike's annual recurring revenue (ARR) rose to $3.65 billion in fiscal year 2024.

- The company's gross margin for subscriptions was 79% in fiscal year 2024.

Incident Response Retainers

CrowdStrike's incident response retainers are a key revenue stream, offering customers guaranteed access to immediate support during security breaches. These retainers provide peace of mind by ensuring expert assistance is available when needed most. This proactive approach helps minimize downtime and data loss, which is critical in today's threat landscape. CrowdStrike's financial reports for 2024 likely reflect the strong demand for these services, given the increasing frequency and sophistication of cyberattacks.

- Guaranteed access to incident response services.

- Helps minimize downtime and data loss.

- Reflects strong demand for these services.

- Proactive approach to cybersecurity.

CrowdStrike's revenue model hinges on subscription fees from its Falcon platform and add-on modules, which generated $2.9 billion in fiscal year 2024. Managed and professional services also boost income, with subscription revenue up 35% in Q3 2024. Threat intelligence subscriptions and incident response retainers are vital, driving growth in a competitive cybersecurity market.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Subscriptions | Falcon platform & modules | $2.9B |

| Managed Services | Threat hunting, incident response | Significant growth in 2024 |

| Professional Services | Implementation, training | $98.8M (Q1 2024) |

Business Model Canvas Data Sources

The CrowdStrike Business Model Canvas uses financial statements, industry reports, and competitive analysis for accurate strategic modeling.