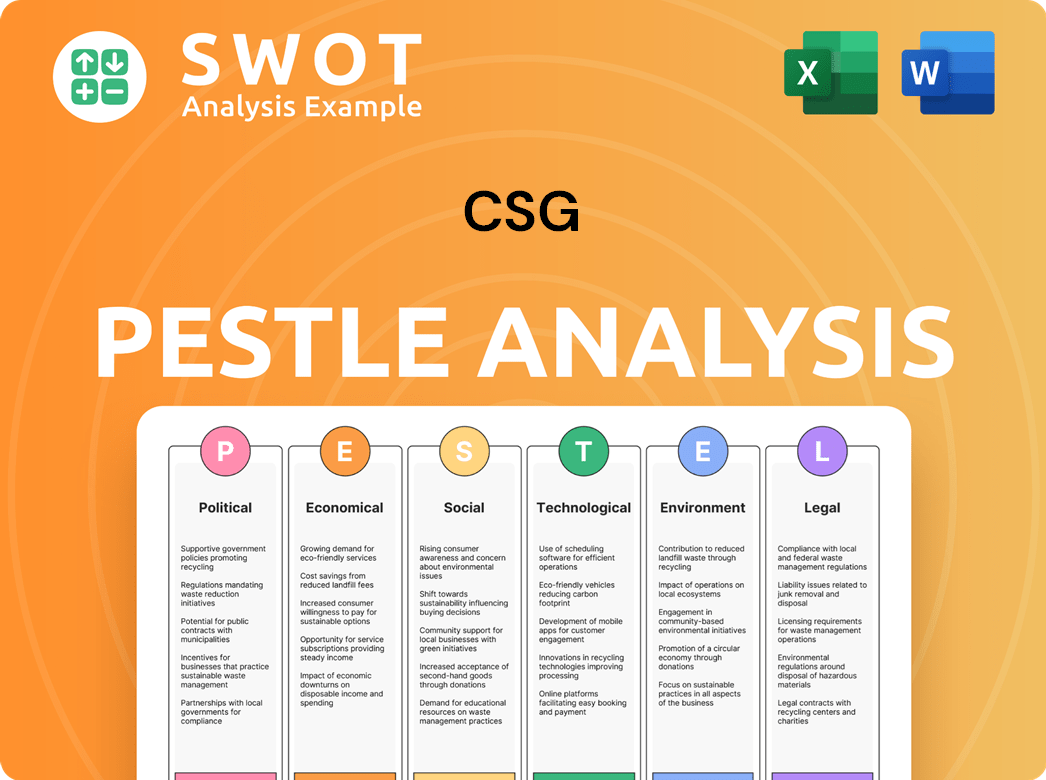

CSG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSG Bundle

What is included in the product

Uncovers CSG's macro-environmental landscape through Political, Economic, etc. lenses, offering tailored insights.

Helps you spot risks and opportunities in one document for faster, more efficient strategic decision-making.

What You See Is What You Get

CSG PESTLE Analysis

See exactly what you'll receive! The CSG PESTLE Analysis preview displays the complete document.

The layout, information, and structure shown is identical to the final product.

This is the ready-to-use file you'll get immediately upon purchase—fully prepared.

What you see here is the actual analysis you'll own and use.

PESTLE Analysis Template

Navigate CSG's landscape with our PESTLE Analysis, offering crucial insights into external factors. Uncover how political, economic, social, technological, legal, and environmental forces shape their trajectory. This analysis helps you grasp market dynamics and anticipate challenges and opportunities. Access the complete breakdown and equip yourself with actionable strategies for success.

Political factors

Governments globally are intensifying their oversight of the telecom sector, focusing on data privacy, network security, and market competition. These regulations directly influence how CSG's clients function, affecting demand for CSG's BSS solutions. Compliance with regulations, such as GDPR and the EU AI Act, is essential. The global telecom market is projected to reach $1.9 trillion by 2025, highlighting the sector's significance and regulatory impact.

Geopolitical stability is critical for telecommunications infrastructure investments, especially in emerging markets. Rising tensions and economic nationalism can affect trade policies. For instance, in 2024, geopolitical risks led to a 5% decrease in telecom investments in certain regions. These factors influence CSG's international operations.

Government investments in digital infrastructure, like broadband and 5G, are rising. This boosts demand for BSS solutions. For example, in 2024, the US allocated $42.5 billion for broadband expansion. This creates opportunities for CSG's billing and customer management services. These initiatives will continue through 2025 and beyond.

Trade Policies and International Relations

Trade policies and global relations significantly affect CSG's operations. Changes in tariffs and trade agreements influence the cost of technology components, crucial for CSG's products. International tensions can disrupt supply chains, impacting production and delivery schedules. For instance, a 10% tariff increase on key components could raise production costs. These factors directly affect CSG's market access and profitability, especially in regions with strained political ties.

- Increased tariffs on semiconductors by 15% in 2024.

- Trade disputes between major economies in 2024 led to a 5% decline in global tech exports.

- CSG's Q1 2024 report showed a 3% impact on profit margins due to trade-related issues.

Political Uncertainty and Investment Decisions

Political factors significantly influence investment decisions within the telecom and cable sectors, directly impacting CSG. Uncertainty around election outcomes and shifts in government priorities can cause delays or revisions in telecom and cable companies' investment strategies. This unpredictability creates an unstable demand environment for CSG's software and services, potentially affecting revenue projections. For instance, in 2024, regulatory changes in the EU related to digital services have already prompted some telecom companies to reassess their investment plans.

- Regulatory changes in the EU in 2024 have caused telecom companies to reassess investment plans.

- Political instability can lead to project delays and reduced spending.

- Changes in government policies directly impact telecom and cable companies.

Political factors heavily shape the telecom industry. Governments worldwide tighten regulations on data privacy and competition, impacting CSG. Investments in digital infrastructure like 5G drive BSS solution demand. Changes in trade policies and international relations, like a 10% tariff hike, can influence costs and market access.

| Political Aspect | Impact on CSG | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance costs, market entry | EU AI Act impacts; global telecom market projected at $1.9T by 2025. |

| Geopolitics | Investment delays, supply chain disruptions | 5% telecom investment drop in regions due to risks; tariff increase of 15% for semiconductors. |

| Government Spending | Increased demand | US allocated $42.5B for broadband expansion in 2024. |

Economic factors

Global economic growth is pivotal for CSG. Strong economies boost spending on communication services, increasing demand for CSG's BSS solutions. In 2024, global GDP growth is projected at 3.2%, which is a good sign for CSG. However, economic downturns can lead to reduced IT spending.

Rising inflation and interest rates pose significant challenges to CSG and its clients, increasing operating costs. For example, in 2024, the Federal Reserve raised interest rates, impacting borrowing costs. This can slow down telecom operators' capital expenditures, hindering the adoption of new BSS technologies. In 2024, inflation rose to 3.2% impacting investment decisions.

IT spending by telecom and cable firms significantly impacts CSG. Worldwide IT spending is projected to grow, especially in AI and data centers. Gartner forecasts global IT spending to reach $5.06 trillion in 2024. This trend supports CSG's BSS and digital transformation services.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a risk for CSG. As a global entity, CSG's international revenue and profits are sensitive to currency movements. A strong dollar can reduce the value of earnings from overseas markets.

These fluctuations can significantly impact reported financial results. For example, in 2024, a 10% shift in key currencies could affect CSG's revenue by several million.

Here's how it impacts CSG:

- Revenue Translation: Foreign sales converted to USD.

- Cost of Goods Sold: Raw material costs can rise.

- Hedging Strategies: CSG may use financial instruments.

- Profit Margins: Currency shifts can compress margins.

Market Competition and Pricing Pressures

Market competition in the BSS and telecom sectors intensifies pricing pressures. CSG faces this, needing to balance profitability and competitive offerings. The global telecom software market, valued at $22.8 billion in 2024, is projected to hit $30.7 billion by 2029. This growth intensifies competition. CSG's ability to adapt pricing is vital for market survival.

- BSS market growth forecast: $22.8B (2024) to $30.7B (2029)

- Competitive pricing: Crucial for retaining customers.

- Adaptability: Key to navigating market dynamics.

Economic factors significantly impact CSG. Global GDP growth, projected at 3.2% in 2024, influences communication services spending and IT investments. Rising inflation and interest rates in 2024, affecting borrowing and operating costs, create challenges. Currency fluctuations and competitive market pricing, particularly in the $22.8 billion BSS market (2024), further affect CSG's financial performance.

| Factor | Impact | Data (2024) |

|---|---|---|

| GDP Growth | Influences demand for communication services | 3.2% projected growth |

| Inflation | Raises operating costs, impacts investment | 3.2% rise in 2024 |

| IT Spending | Drives demand for BSS solutions | $5.06T Global IT Spend |

Sociological factors

Customer expectations are evolving, demanding seamless digital experiences. This trend pushes service providers to offer personalized and on-demand services. CSG's focus on advanced BSS solutions directly addresses this shift. For instance, in 2024, 78% of consumers preferred personalized services, highlighting the importance of CSG's offerings.

Efforts to bridge the digital divide can create opportunities for CSG. In 2024, the U.S. government allocated over $42 billion to expand broadband access. This focus on digital inclusion supports CSG's expansion. CSG can offer BSS solutions to new service models and a broader customer base. The digital inclusion trend aligns with the telecom industry's goals.

The workforce's changing demographics affect CSG's talent pool. Demand is high for AI, cloud computing, and data analytics skills, essential for BSS innovation. In 2024, the US saw 3.7% unemployment, with tech roles highly contested. CSG must adapt its strategies to attract these specialists.

Data Privacy Concerns and Trust

Data privacy concerns are escalating, impacting consumer trust in service providers. This trend demands strong data protection within BSS solutions, crucial for CSG and its clients. For example, a 2024 survey revealed that 79% of consumers are concerned about data privacy. These concerns drive the need for enhanced security.

- 79% of consumers express data privacy concerns (2024).

- Data breaches cost businesses millions annually.

- Robust data protection builds customer trust.

Adoption of New Technologies by Consumers

Consumers' quick embrace of new tech, like 5G and IoT, boosts the need for robust BSS. CSG's systems help companies handle and profit from these services. This tech shift is fueled by rising smartphone use, with 6.92 billion users globally in 2024. CSG's tech enables companies to capitalize on these changes.

- 5G subscriptions are predicted to hit 5.6 billion by 2026.

- IoT spending is forecast to reach $1.1 trillion in 2026.

- The BSS market is expected to reach $30 billion by 2027.

- Smartphone penetration is at 85% in North America.

Societal changes significantly influence CSG's operations and market position. Escalating data privacy concerns, with 79% of consumers worried in 2024, necessitate robust data protection. Tech advancements such as 5G and IoT drive demand for CSG's BSS solutions.

| Factor | Impact | Data |

|---|---|---|

| Data Privacy | Requires strong data protection | 79% consumer concern (2024) |

| Tech Adoption | Boosts BSS demand | 5G subs to 5.6B by 2026 |

| Digital Divide | Creates new CSG markets | $42B US broadband allocation |

Technological factors

Artificial Intelligence and Machine Learning are transforming BSS solutions. AI boosts efficiency, personalizes customer experiences, and automates billing and support. This can lead to increased operational efficiency by up to 30% for companies adopting AI-driven solutions, as reported in a 2024 study. CSG can innovate by integrating these technologies.

The ongoing expansion of 5G and the upcoming development of 6G networks necessitate substantial upgrades in Business Support Systems (BSS). These systems must manage greater data loads, new services like network slicing, and sophisticated billing structures. For example, the global 5G market is projected to reach $667.1 billion by 2027. CSG's solutions are essential for telecom companies to capitalize on these advanced networks.

Cloud-based BSS solutions are gaining traction, promising flexibility and cost savings. CSG is strategically focused on Software-as-a-Service (SaaS) and cloud offerings. In Q1 2024, CSG saw a 12% increase in cloud revenue. This shift is fueled by the need for scalable, efficient platforms. The trend highlights a vital tech adaptation.

Increased Importance of Data Monetization and Analytics

Telecom and cable firms are intensely focusing on data monetization. This shift fuels demand for sophisticated analytics. CSG can offer BSS solutions that capitalize on data, creating value. The global data analytics market is projected to reach $132.9 billion by 2025, highlighting the potential.

- Data monetization strategies are expected to grow significantly in the telecom sector.

- Demand for advanced analytics tools is rising.

- CSG's BSS solutions can help unlock data value.

- The data analytics market's growth presents a significant opportunity.

Modernization of Legacy Systems

Many telecom operators still use old BSS systems. Modernizing these systems is essential for new tech and efficiency, impacting CSG significantly. The BSS market's growth is fueled by this need, with CSG playing a key role. This modernization helps operators handle increasing data volumes and customer demands. In 2024, the global BSS market was valued at $24.5 billion, expected to reach $35 billion by 2029.

- Legacy systems modernization is a major driver for BSS market growth.

- CSG actively participates in this modernization process.

- Modernization improves operational efficiency and supports new technologies.

- The BSS market is growing rapidly, indicating strong demand.

AI, 5G, and cloud tech drive BSS innovation. These technologies boost efficiency and personalization. Cloud revenue rose by 12% for CSG in Q1 2024, showing market shifts.

| Tech Factor | Impact | Data |

|---|---|---|

| AI Integration | Efficiency Gains | Up to 30% improvement in operational efficiency. |

| 5G/6G Adoption | Network Upgrades | $667.1 billion projected 5G market by 2027. |

| Cloud Solutions | Scalability | CSG cloud revenue up 12% in Q1 2024. |

Legal factors

Data privacy regulations like GDPR and CCPA are crucial. They dictate how CSG and its clients handle customer data. Compliance requires robust data protection measures, which can increase operational costs. Failure to comply can lead to hefty fines; for example, GDPR fines can reach up to 4% of global annual turnover.

The telecommunications sector faces stringent regulations. These rules govern licensing, network access, and consumer safeguards. Regulatory shifts directly influence CSG's client services and the BSS features they need. For example, the FCC's recent actions on net neutrality could reshape service offerings. In 2024, regulatory compliance costs for telecom companies rose by approximately 7%, affecting BSS demands.

Antitrust and competition laws are crucial for CSG, particularly in telecom and cable. These laws significantly shape market consolidation and the competitive dynamics. For example, in 2024, regulators scrutinized mergers like the proposed $8.5 billion deal between Charter and Verizon, impacting CSG's potential client base. These legal factors directly affect the size and structure of CSG's client relationships. These regulations can either open new opportunities or limit CSG's market reach.

Contract Law and Service Level Agreements

CSG heavily relies on contracts and Service Level Agreements (SLAs) to define its services and obligations to clients. These legal agreements are critical for establishing clear expectations and mitigating potential disputes. The legal frameworks governing these contracts, including aspects like breach of contract and liability, significantly impact CSG's operational and financial risk profiles. For example, in 2024, contract disputes cost businesses an average of $250,000. Furthermore, SLAs often include financial penalties for non-compliance, making adherence to legal and contractual obligations paramount.

- Breach of contract lawsuits can lead to substantial financial losses for CSG.

- SLAs' financial penalties can directly affect CSG's profitability.

- Legal compliance is essential for maintaining client trust and business continuity.

Intellectual Property Laws

Intellectual property laws are crucial for CSG to safeguard its innovations and brand identity. Patents, copyrights, and trademarks protect its software, designs, and brand recognition. These legal protections are essential in the tech industry, where innovation is rapid and competition is fierce. For example, in 2024, the US Patent and Trademark Office issued over 300,000 patents.

- Patent filings in the software sector increased by 12% in 2024.

- Copyright registrations for digital content rose by 8% in the same year.

- Trademark applications for tech brands grew by 5% in 2024.

Legal factors significantly impact CSG's operations, requiring strict data privacy compliance, especially given rising fines. Telecom regulations influence service offerings, with compliance costs up 7% in 2024. Antitrust laws affect market dynamics and client relationships, and in 2024 regulators reviewed key mergers that changed the market.

| Factor | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance costs | GDPR fines up to 4% turnover |

| Telecom Regs | Service offerings | Compliance cost +7% |

| Antitrust | Market consolidation | Charter/Verizon deal scrutiny |

Environmental factors

The expansion of telecom networks, especially 5G and data centers, significantly boosts energy use. Telecom firms face pressure to cut carbon emissions. This impacts tech choices and could spur demand for energy-efficient BSS solutions. For example, data centers' energy consumption is projected to rise, with some estimates suggesting that data centers could consume over 20% of the world's electricity by 2025.

Electronic waste, stemming from discarded network infrastructure and consumer electronics, poses a growing environmental concern. The global e-waste generation reached 62 million metric tons in 2022, with only 22.3% documented as properly collected and recycled. While not directly impacting CSG's software, sustainability trends shape client values and supply chains.

Climate change poses indirect challenges to CSG. Extreme weather events, a result of climate change, can disrupt telecom infrastructure. Network resilience, crucial during such events, may drive demand for robust OSS/BSS solutions. For example, in 2024, the US faced $145 billion in damages from climate-related disasters. This indirectly impacts CSG through telecom network demands.

Sustainability Reporting and ESG Focus

Sustainability reporting and ESG are gaining importance, influencing telecom firms. Investors and regulators are pushing for better environmental, social, and governance disclosures. This shift boosts demand for BSS solutions that monitor environmental impacts, like energy use. For instance, a 2024 study showed a 20% increase in ESG-related investments in the telecom sector.

- Increased focus on ESG reporting.

- Demand for BSS solutions.

- Growing investor interest.

- Regulatory pressures on environmental metrics.

Industry Initiatives for Green Telecom

The telecom sector is seeing collaborative efforts towards sustainability. These initiatives aim to set new industry standards for eco-friendly operations. Companies are investing in green technologies to meet evolving consumer demands for environmental responsibility. In 2024, the global green technology and sustainability market was valued at $366.6 billion, with projections to reach $790.9 billion by 2032. These trends are driving significant changes.

- Focus on energy efficiency in network infrastructure.

- Investment in renewable energy sources for powering telecom sites.

- Development of e-waste recycling programs to reduce environmental impact.

- Implementation of carbon emission reduction targets.

Environmental factors heavily influence telecom through energy use, e-waste, and climate impacts.

Increased ESG reporting, coupled with demand for solutions, is driven by regulatory and investor pressures.

The sector focuses on eco-friendly operations, backed by green tech investments and carbon reduction targets.

| Factor | Impact | Data |

|---|---|---|

| Energy Use | Higher energy costs and carbon footprint. | Data centers may consume over 20% of world electricity by 2025. |

| E-waste | Sustainability trends. | Global e-waste hit 62M metric tons in 2022. |

| Climate Change | Network disruptions and resilience needs. | U.S. faced $145B in climate disaster damages in 2024. |

PESTLE Analysis Data Sources

This CSG PESTLE analysis utilizes industry reports, governmental statistics, and economic databases. We synthesize data from credible sources for a well-rounded perspective.