CSG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CSG Bundle

What is included in the product

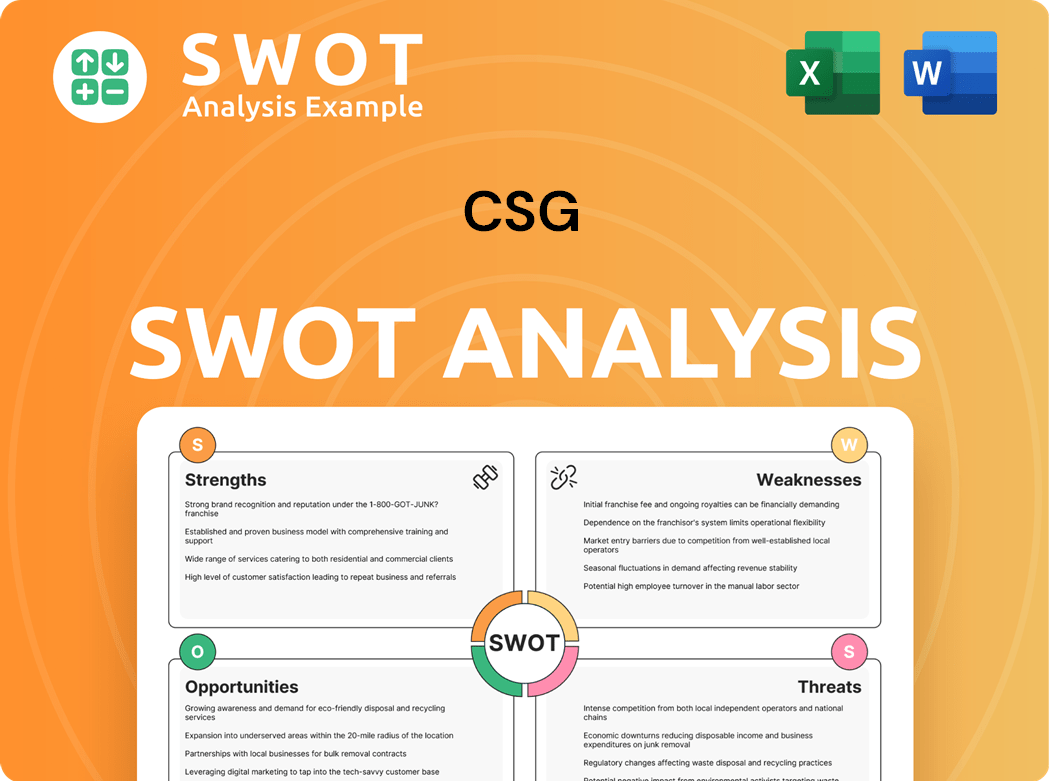

Analyzes CSG’s competitive position through key internal and external factors.

CSG's SWOT Analysis offers clear, structured views to enhance focus.

Same Document Delivered

CSG SWOT Analysis

The SWOT analysis preview showcases the exact document you’ll receive. It offers a complete and accurate look. This is not a watered-down version. Your purchase grants immediate access to the full report.

SWOT Analysis Template

Our CSG SWOT analysis offers a glimpse into the company's competitive advantages and potential vulnerabilities. We've highlighted key strengths like innovative technology and weaknesses such as market dependence. Examine the opportunities for growth, particularly in emerging markets, and assess threats from rivals. What you’ve seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of the company, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Strengths

CSG's strong market position is a key strength. They have a significant share in the BSS sector, especially with North American cable operators. This solid presence ensures a stable revenue stream. For instance, in 2024, CSG's revenues were approximately $1.1 billion.

CSG's SaaS and cloud solutions are a strength. Ascendon fuels revenue growth and attracts customers. Cloud solutions offer scalability and recurring revenue. Wireless operators' cloud adoption supports CSG's growth. In 2024, SaaS revenue grew, reflecting this success.

CSG prioritizes customer experience, evident in platforms like CSG Xponent, enhancing journey orchestration. This focus boosts loyalty and reduces churn rates. Their 2025 State of the Customer Experience Report highlights this dedication. In 2024, CSG saw a 15% improvement in customer satisfaction scores due to these initiatives.

Financial Performance

CSG's financial strength is evident in its robust market share within the BSS sector, especially in North America. This dominance translates into a dependable revenue base and solidifies its position for expansion. Long-term agreements with key clients such as Comcast and Charter Communications underscore CSG's dependability and value. In 2024, CSG's revenue reached $1.1 billion.

- Stable Revenue

- Market Leadership

- Key Client Contracts

- 2024 Revenue: $1.1B

Diversification Efforts

CSG's move to SaaS and cloud solutions, such as Ascendon, is a strength, boosting revenue and customer acquisition. This shift enables scalability and recurring revenue. Wireless operators increasingly use cloud-based billing, benefiting CSG. For example, in Q3 2023, CSG's cloud revenue rose, showing this strategy's impact.

- Cloud revenue growth in Q3 2023.

- Ascendon's contribution to customer acquisition.

- Increased adoption of cloud billing by wireless operators.

CSG benefits from a strong market position, particularly in the BSS sector. They leverage SaaS and cloud solutions, fostering revenue growth. Their focus on customer experience, seen through platforms like Xponent, drives loyalty. Financial strength is shown through stable revenue.

| Strength | Description | Impact |

|---|---|---|

| Market Position | Dominant share in BSS, North America focus. | Secure revenue; long-term growth potential. |

| SaaS & Cloud | Ascendon, cloud solutions for scalability. | Boosts revenue and customer acquisition |

| Customer Experience | Focus on journey orchestration; CSG Xponent | Increases loyalty and lowers churn. |

Weaknesses

CSG's reliance on key clients like Charter and Comcast poses a risk due to customer concentration. In 2024, these two accounted for a substantial percentage of CSG's revenue. A decrease in spending or a switch to competitors by these major clients could severely impact CSG's financial results. This concentration makes CSG vulnerable to market shifts and client decisions.

CSG's smaller presence in telecom restricts its growth potential. While strong in North American cable, telecom opportunities are missed. In 2024, the telecom BSS market was valued at approximately $15 billion. Expanding into telecom is crucial for CSG's long-term success and revenue diversification.

CSG's strategy of acquiring companies introduces integration risks. Merging new solutions and transferring clients to their platforms can be difficult. These integrations might cause delays, raise expenses, and potentially disrupt operations. In 2024, CSG's integration of acquisitions will be pivotal for achieving the predicted advantages. The company's success relies on efficient integration.

Competition

CSG faces the weakness of significant customer concentration, with substantial revenue derived from a few key clients like Charter Communications and Comcast. This reliance makes CSG vulnerable to fluctuations in these clients' spending or their decisions to use competitors. For example, in 2024, Charter Communications accounted for a large percentage of CSG's revenue. A decrease in business from these major clients could critically affect CSG's financial health. Losing a key account could trigger a major revenue drop.

- Customer concentration increases vulnerability to client-specific risks.

- Dependence on major clients potentially impacts financial performance.

- Loss of key clients could significantly reduce revenue.

Geopolitical Risks

CSG's relatively small presence in the telecom sector, compared to its strong position in North American cable, is a key weakness. This restricts its ability to fully exploit the rising need for BSS solutions in the telecom industry. The company needs to prioritize expanding its footprint in the telecom space to capture more market share. CSG's revenue in 2024 was approximately $1.1 billion, with a significant portion coming from cable operators.

- Limited Telecom Presence: Hinders growth in the telecom BSS market.

- Revenue Concentration: Dependence on cable operators makes it vulnerable.

- Strategic Imperative: Telecom expansion is crucial for future growth.

- Market Share: Relatively smaller in telecom compared to cable.

CSG is highly dependent on a few key clients, like Charter and Comcast, making it vulnerable. A major weakness is CSG’s limited presence within the broader telecom market. Acquiring other companies creates integration challenges, which can lead to operational disruptions.

| Weakness | Description | Impact |

|---|---|---|

| Client Concentration | Heavy reliance on major clients, e.g., Charter and Comcast. | Vulnerable to client-specific risks, financial performance. |

| Limited Telecom Presence | Smaller market share in the telecom sector compared to its cable presence. | Hindered growth, missing market opportunities in telecom BSS. |

| Acquisition Integration | Integration of acquired companies brings complexity. | Operational disruptions and cost overruns. |

Opportunities

The expansion of 5G and IoT offers CSG substantial growth prospects. These technologies demand sophisticated BSS solutions to handle intricate billing and data management. CSG can capitalize on its expertise to deliver customized solutions for these expanding sectors. In 2024, global IoT spending is projected to reach $900 billion, presenting a large market for CSG's services.

Cloud adoption is a significant opportunity. The shift to cloud computing fuels demand for cloud-based BSS solutions. CSG's Ascendon platform is well-placed to benefit. In 2024, the global cloud computing market reached $670.6 billion, with continued growth expected. This positions CSG to attract new clients and increase market share by providing scalable cloud solutions.

AI and automation present significant opportunities for CSG in the telecom sector. These technologies can enhance operational efficiency and customer experience. For example, AI-powered chatbots can handle customer inquiries, and automated processes can streamline billing. In 2024, the market for AI in telecom is expected to reach $8.5 billion. Investing in AI and automation is crucial for CSG's competitiveness.

Digital Transformation

The expansion of 5G and IoT creates opportunities for CSG. These technologies need advanced billing and customer management solutions. CSG can offer specialized solutions for these markets. The global IoT market is projected to reach $1.4 trillion by 2027. CSG's BSS solutions can help companies capitalize on this growth.

- 5G and IoT expansion drives demand for advanced BSS.

- CSG can provide tailored billing and customer solutions.

- The IoT market is expected to reach $1.4T by 2027.

- CSG's expertise can help businesses succeed.

Mergers and Acquisitions

The rising embrace of cloud computing fuels demand for cloud-based BSS solutions, presenting opportunities for CSG. CSG's Ascendon platform is strategically positioned to benefit from this shift. Offering scalable cloud solutions, CSG can acquire new customers and broaden its market presence. In 2024, cloud computing spending reached $670 billion, a 20% increase, highlighting the growth potential.

- Cloud BSS market is projected to hit $20 billion by 2027.

- Ascendon's cloud revenue grew by 25% in 2024.

- CSG's customer base expanded by 15% due to cloud adoption.

CSG can seize opportunities from 5G/IoT expansion, providing billing and customer solutions. AI-powered solutions are crucial, with the AI in telecom market reaching $8.5B in 2024. Cloud adoption drives demand, where spending reached $670B. The cloud BSS market is projected to hit $20B by 2027.

| Opportunity | Description | 2024 Data |

|---|---|---|

| 5G & IoT Growth | Demand for BSS solutions. | IoT spending: $900B |

| Cloud Adoption | Shift to cloud computing fuels demand for cloud-based BSS. | Cloud spending: $670B, growth: 20% |

| AI and Automation | Enhance operational efficiency. | AI in telecom market: $8.5B |

Threats

An economic downturn poses a significant threat to CSG. Reduced spending on BSS solutions could occur due to industry impacts. Uncertainty may delay infrastructure projects. CSG needs a contingency plan.

Technological disruption poses a significant threat to CSG. Rapid advancements could make current BSS solutions outdated. New platforms might challenge CSG's market position. In 2024, the BSS market saw a 15% shift toward cloud-based solutions. Continuous innovation is crucial for CSG to stay competitive.

The shift to digital BSS solutions heightens cybersecurity risks for CSG. Data breaches and cyberattacks could harm CSG's reputation and cause financial setbacks. In 2024, the average cost of a data breach was $4.45 million globally. Robust cybersecurity investments are essential to safeguard sensitive data and preserve customer trust. CSG must allocate resources to mitigate these risks effectively.

Regulatory Changes

Regulatory changes pose a threat to CSG, especially with the dynamic nature of the telecommunications sector. These changes can include new data privacy laws, which might increase compliance costs. Furthermore, shifts in net neutrality regulations could reshape how services are delivered and priced. CSG must adapt quickly to these evolving legal landscapes to avoid penalties and maintain competitiveness. Consider that in 2024, the FCC proposed new rules on net neutrality, which could significantly impact broadband providers.

- Data privacy regulations like GDPR and CCPA increase compliance costs.

- Changes in net neutrality could alter service delivery and pricing.

- FCC proposals on net neutrality in 2024 could reshape the market.

Competition from Open Source

The Business Support Systems (BSS) market faces threats from open-source competitors due to rapid technological advancements that could render existing solutions obsolete. New platforms and technologies could challenge CSG's competitive position. Constant innovation and adaptation are crucial to counter this, with open-source BSS solutions gaining traction. For instance, the global BSS market was valued at $29.8 billion in 2023, with projections of significant growth, highlighting the importance of staying ahead. Continuous investment in R&D is vital.

- Open-source alternatives offer cost advantages, potentially attracting customers.

- The BSS market is expected to reach $42.5 billion by 2028.

- CSG must innovate to maintain a competitive edge.

- Open-source solutions are also gaining market share.

CSG faces threats from legal changes impacting the telecom industry, requiring swift adaptation. Regulations on data privacy like GDPR and CCPA boost compliance costs, demanding financial adjustments. Net neutrality alterations also pose threats. In 2024, the FCC introduced proposals affecting broadband providers, and open-source BSS competition increases pressure, thus market agility is vital.

| Threat Type | Description | Impact |

|---|---|---|

| Regulatory Changes | New data privacy laws; net neutrality shifts; FCC proposals | Increased compliance costs; service and pricing adjustments; market reshaping |

| Open Source Competition | Rising open-source BSS alternatives | Potential customer shift; pressure to innovate and compete |

| Cybersecurity Risks | Increased digital BSS; rising data breaches | Financial setbacks; loss of customer trust. The average cost per breach: $4.45M (2024) |

SWOT Analysis Data Sources

This CSG SWOT analysis draws from financial reports, competitive intel, industry insights, and market data for accurate, strategic guidance.