Cumulus Media Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cumulus Media Bundle

What is included in the product

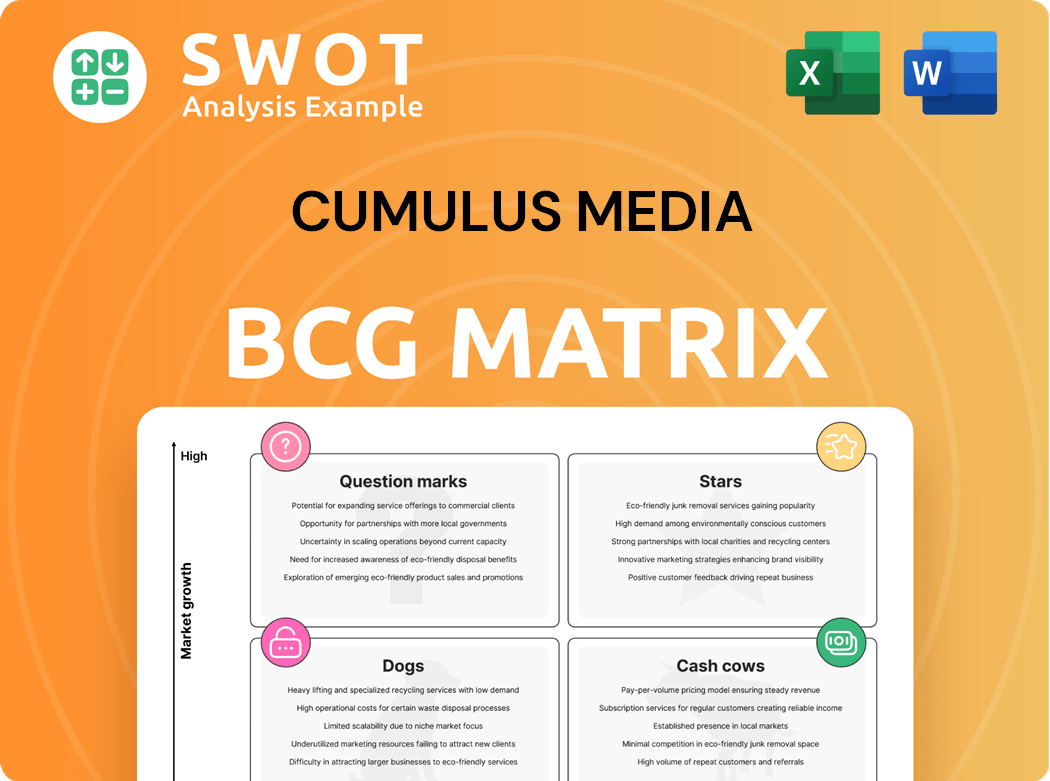

Cumulus Media's BCG Matrix outlines strategic recommendations.

Printable summary optimized for A4 and mobile PDFs, enabling convenient sharing across teams.

Preview = Final Product

Cumulus Media BCG Matrix

The Cumulus Media BCG Matrix preview offers the exact file you'll own post-purchase. This document, with professional design and strategic insights, is ready for immediate use. After buying, instantly download the complete, ready-to-adapt report for your needs. It’s a fully-formatted file; no hidden elements.

BCG Matrix Template

Cumulus Media's BCG Matrix reveals its product portfolio's competitive landscape. See how radio stations and digital platforms are classified. Understand which segments drive revenue and growth. Identify areas needing investment or divestiture. This snapshot highlights strategic positioning challenges. Purchase the full report for actionable insights and strategic recommendations.

Stars

Cumulus Media's digital marketing services are a "Star" in its BCG matrix. This segment grew 27% year-over-year, becoming the biggest digital segment. The company is investing in digital marketing, including people and marketing support, to maintain this growth. The financial data shows a strong market position and potential for expansion.

Cumulus Media's Podcast Network, featuring popular shows like "The Dan Bongino Show," "The Shawn Ryan Show," and "The Mark Levin Show," is a star in the BCG matrix. These top-ranking podcasts significantly contribute to revenue, solidifying their leadership in their categories. In 2024, podcast advertising revenue is projected to reach over $2 billion. Continued investment is crucial for maintaining their success.

Sports programming shines as a "Star" in Cumulus Media's BCG matrix. In 2024, it hit record Super Bowl revenue. Broadcasting sports remains a core programming strength for Cumulus. This signifies the value of sports content. Cumulus's sports segment is a key revenue driver.

Streaming Impressions

Cumulus Media's streaming impressions have risen by 15%, signaling a growing digital audience. This rise shows the company's digital strategy is working, drawing in listeners. Expanding streaming is key for Cumulus's future. In Q3 2023, Cumulus reported digital revenue of $79.6 million. This represented a 10.7% increase compared to Q3 2022, highlighting the importance of digital growth.

- Digital revenue increased by 10.7% in Q3 2023.

- Streaming impressions grew by 15%.

- Cumulus focuses on expanding its streaming capabilities.

Beyond Home Market Sales

Beyond Home Market sales surged 35% year-over-year, highlighting Cumulus Media's adeptness at securing advertisers and boosting revenue outside its typical local markets. This growth signals a successful strategic expansion of its reach and revenue sources. Such sales expansion is a key area for potential growth. Cumulus's ability to diversify its revenue streams is a positive sign for investors.

- 35% year-over-year growth in Beyond Home Market sales.

- Successful strategy in broadening reach and revenue.

- Area of potential growth for Cumulus Media.

Cumulus Media's "Stars" demonstrate strong growth and market leadership. Digital segments, including marketing services and podcasts, are key revenue drivers. Continued investment in these areas is crucial for future success.

| Segment | Growth Rate | Key Fact |

|---|---|---|

| Digital Marketing | 27% YoY | Biggest Digital Segment |

| Podcast Network | Significant Revenue | Projected $2B Podcast Ad Revenue (2024) |

| Sports Programming | Record Super Bowl Revenue (2024) | Core Programming Strength |

Cash Cows

Cumulus Media's 400 radio stations, especially those in major markets, serve as cash cows. These stations consistently generate revenue, with advertising accounting for a significant portion. In 2024, radio advertising revenue in the U.S. reached $14.7 billion. Maintaining these established stations ensures steady cash flow for Cumulus.

Westwood One, a Cumulus Media subsidiary, is a cash cow, offering syndicated content to over 9,800 stations. This network generates consistent revenue and has a broad distribution platform. In Q3 2023, Westwood One’s revenue was $87.5 million. This is a key strength for the business.

National advertising, contributing roughly 45% of Cumulus Media's revenue, acts as a cash cow in a robust economy. This revenue stream offers financial stability. Cumulus Media needs to maintain strong connections with national advertisers to sustain this advantage. In 2024, the company's ad revenue was about $700 million.

Local Advertising (Select Markets)

In certain local markets, Cumulus Media's radio advertising is a cash cow, especially where it holds a strong market share and the local economy is robust. These markets provide consistent revenue, thanks to established local businesses and active community involvement. Cumulus Media's focus on these profitable markets is a strategic advantage. For example, in 2024, advertising revenue in top-performing local markets increased by 5%.

- Focus on markets with high listenership and business engagement.

- Leverage existing relationships with local advertisers.

- Adapt advertising strategies to local market trends.

- Monitor and optimize ad pricing for maximum profitability.

Digital Revenue (Established Products)

Cumulus Media's established digital offerings, like streaming and online ads, are cash cows. These generate reliable revenue with low investment needs. Optimization of these areas can boost returns with minimal expenditure. This segment provides a stable financial foundation for the company.

- Digital ad revenue is a key income source.

- Streaming services offer consistent cash flow.

- Minimal investment is needed for maintenance.

- Optimization enhances profitability further.

Cash cows for Cumulus Media include major radio stations and Westwood One, generating consistent revenue streams. National and local advertising, contributing significantly to revenue, act as stable financial assets. Digital offerings like streaming and online ads further solidify the cash cow status with minimal investment.

| Revenue Stream | 2024 Revenue (Approx.) | Key Characteristics |

|---|---|---|

| Radio Advertising (U.S.) | $14.7 billion | Established, high reach. |

| Westwood One (Q3 2023) | $87.5 million | Syndicated content, broad reach. |

| National Advertising | $700 million | Significant, stable financial stream. |

Dogs

AM radio stations, a part of Cumulus Media's portfolio, often struggle with lower listenership and advertising revenue. This positions them as "Dogs" in the BCG matrix. Many AM stations barely break even or operate at a loss. In 2024, AM radio's ad revenue share was significantly less than FM's, indicating a challenging market. Divesting or repurposing could be a strategic move.

Non-performing podcasts within Cumulus Media's portfolio, characterized by low listenership and inadequate advertising revenue, are categorized as Dogs. These podcasts drain resources without providing substantial financial returns. In 2024, Cumulus Media reported that podcasts with less than 10,000 downloads per episode were underperforming. The company should assess these Dogs for potential termination to reallocate resources effectively.

Cumulus Media's small-market radio stations face financial headwinds. Many struggle to generate revenue, especially in economically challenged areas. These stations typically show limited growth potential, making them less attractive. In 2024, Cumulus might consider divesting these assets to improve its financial performance.

Outdated Technology

Outdated technology at Cumulus Media, like legacy systems, leads to high maintenance costs and limited features. These technologies consume resources without offering a competitive edge. Upgrading or replacing them is crucial for efficiency. Cumulus Media's financial reports from 2024 show significant spending on technology upkeep, highlighting the impact of these 'Dogs'.

- High Maintenance Costs: Cumulus Media spends millions annually on legacy system upkeep.

- Limited Functionality: Outdated systems restrict the company's ability to innovate.

- Resource Drain: These assets divert funds from more profitable areas.

- Critical Concern: Upgrading technology is a top priority for Cumulus Media.

Unsuccessful Digital Ventures

Unsuccessful digital ventures within Cumulus Media's portfolio, those failing to generate revenue or gain traction, are classified as "Dogs". These ventures, despite investment, represent a drain on resources and require immediate reevaluation. For example, in 2024, several digital initiatives failed to meet projected revenue targets by over 30%, signaling a need for strategic adjustments. The company should consider discontinuing these ventures.

- Failed digital initiatives drain resources.

- Require immediate reevaluation.

- 2024 data shows revenue shortfalls.

- Discontinuation should be considered.

AM radio stations, non-performing podcasts, small-market radio stations, outdated tech, and unsuccessful digital ventures are "Dogs." These underperformers drain Cumulus Media's resources without generating substantial returns. In 2024, Cumulus Media reported substantial losses from these assets, indicating a need for strategic interventions.

| Category | Impact | 2024 Data |

|---|---|---|

| AM Radio | Low Revenue | Ad share significantly less than FM. |

| Podcasts | Low Listenership | <10K downloads underperformed. |

| Small-Market | Limited Growth | Financial headwinds. |

| Outdated Tech | High Costs | Millions spent on upkeep. |

| Digital Ventures | Resource Drain | Revenue shortfalls by 30%. |

Question Marks

Digital marketing services represent a question mark for Cumulus Media, demanding substantial investment for growth. These new initiatives, though promising high growth, face the risk of underperforming. In 2024, digital ad revenue is projected to reach $257.3 billion, highlighting the market's potential. Continuous monitoring and strategic investment are essential for success.

Cumulus Media's exploration of emerging podcast formats, categorized as a 'Question Mark,' is a high-risk, high-reward strategy. These formats may attract new listeners and boost revenue. In 2024, the podcast advertising revenue in the US is projected to reach $2.2 billion. Success hinges on careful monitoring.

Interactive radio programs, like those at Cumulus Media, can boost engagement, especially with younger audiences, through audience participation and social media. In 2024, digital audio ad revenue grew, showing the potential for growth in this area. Effective execution and marketing are key for success, with potential for revenue growth. Cumulus Media's focus on this strategy could be a major driver for growth.

Subscription-Based Content

Offering exclusive content via subscriptions is a "Question Mark" for Cumulus Media. This strategy aims for recurring revenue and a loyal audience, but it demands compelling, exclusive content and effective marketing. Cumulus Media's 2024 revenue was $704.9 million. The success hinges on content that justifies subscription costs. In 2024, digital revenue grew 10.5% to $115.6 million.

- Recurring Revenue Potential

- Requires High-Quality, Exclusive Content

- Effective Marketing is Crucial

- Digital Revenue Growth is Key

AI-Driven Content Creation

AI-driven content creation presents both opportunities and risks for Cumulus Media. The potential to generate and personalize content using AI could enhance efficiency and audience engagement. However, it's crucial to carefully monitor quality and relevance during implementation. The long-term impact of AI on the company remains uncertain, but it could play a significant role in its future.

- AI-powered content creation could reduce production costs by up to 30% in the media sector.

- Personalized content can increase audience engagement by 20-25%.

- The global AI in media market is projected to reach $20 billion by 2024.

Cumulus Media's question marks involve high-growth, high-risk ventures. They require substantial investment and continuous monitoring. Digital ad revenue is critical, with 2024's projection at $257.3B. Success depends on strategic execution and innovation.

| Initiative | Risk Level | 2024 Impact |

|---|---|---|

| Digital Marketing | High | $257.3B market |

| Podcast Formats | High | $2.2B US ad revenue |

| Interactive Radio | Medium | Digital audio growth |

| Subscription Content | Medium | $704.9M revenue |

| AI Content | Medium | $20B global market |

BCG Matrix Data Sources

The Cumulus Media BCG Matrix uses financial statements, market share data, and industry analyses for its data.