Cumulus Media Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cumulus Media Bundle

What is included in the product

Analyzes Cumulus Media's market position, assessing competitive forces for strategic insights.

Easily identify and mitigate competitive threats with a color-coded impact rating.

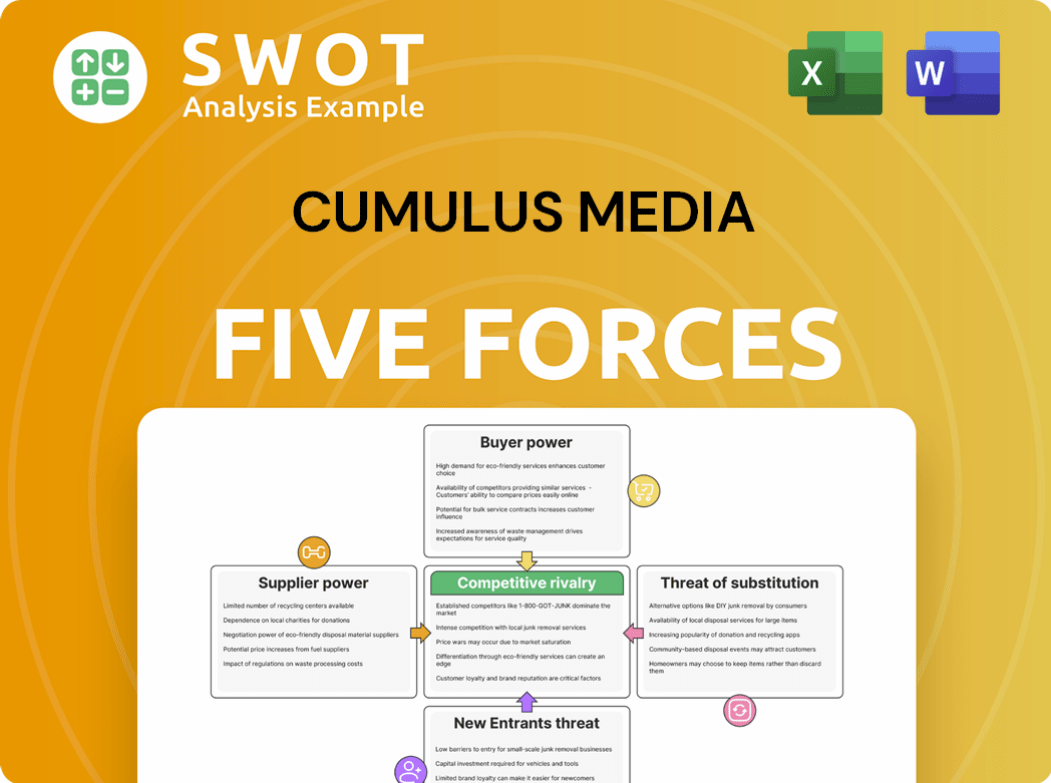

Preview the Actual Deliverable

Cumulus Media Porter's Five Forces Analysis

This preview provides a complete Porter's Five Forces analysis of Cumulus Media. It examines industry rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. The strategic insights are fully elaborated within this version. You'll get the complete, ready-to-use document, instantly after purchase. The document you see is your deliverable.

Porter's Five Forces Analysis Template

Cumulus Media faces intense competition, particularly from digital platforms and evolving consumer habits. Bargaining power of buyers is moderate, influenced by content availability and listener choice. Threat of substitutes is high, with streaming services and podcasts vying for audience share. Supplier power is moderate, depending on content providers and talent. New entrants pose a threat, especially from well-funded digital media players.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cumulus Media’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cumulus Media's bargaining power of suppliers is moderate, primarily content creators. In 2024, Cumulus spent $250 million on programming, including talent fees. Top-tier talent can negotiate for higher pay. The large pool of creators limits individual influence. This balances costs and programming decisions.

Syndication partners, offering national content, have some bargaining power over Cumulus. If Cumulus depends on specific partners for popular content, these partners can negotiate better terms. In 2024, Cumulus's revenue was approximately $837.8 million, showing the importance of content. Alternative content sources impact the degree of this power.

Technology and equipment providers, including broadcasting equipment and software vendors, wield moderate bargaining power. The availability of multiple vendors constrains their influence over pricing and terms. In 2024, Cumulus Media's capital expenditures reflect this dynamic. The company invested $18.4 million in capital expenditures in Q1 2024. Standardized tech solutions further reduce dependence on specific suppliers.

Data and Analytics Providers

Data and analytics providers are becoming increasingly vital for Cumulus Media's digital expansion. These providers furnish crucial insights into audience behavior and advertising performance. Their influence is rising as data-driven strategies become more essential. However, Cumulus can lessen this impact through internal analytics development or by using multiple providers. In 2024, the digital advertising market is projected to reach $279 billion, highlighting the significance of data-driven decisions.

- Digital ad spending is expected to grow, emphasizing data's role.

- Cumulus can build its analytics teams or diversify data sources.

- Data insights help in optimizing ad campaigns for better results.

Music Licensing Entities

Music licensing entities, such as ASCAP and BMI, wield substantial bargaining power, crucial for Cumulus Media. They control the rights to copyrighted music, a necessity for Cumulus's radio content. License costs significantly impact Cumulus's profitability, a non-negotiable expense for content delivery. Collective bargaining and industry negotiations help manage these costs.

- In 2024, ASCAP distributed over $1.6 billion in royalties, reflecting their financial influence.

- BMI reported distributing $1.58 billion in royalties in fiscal year 2024, highlighting their substantial industry role.

- Cumulus Media's content costs, including licensing, accounted for a significant portion of its operating expenses.

- Industry-wide negotiations between radio groups and licensing entities aim to stabilize royalty rates.

Cumulus Media encounters varied supplier bargaining power.

Content creators and syndication partners hold moderate power, influencing costs and content availability. Music licensing entities, like ASCAP and BMI, have considerable bargaining power. They control essential copyrighted music.

| Supplier Type | Bargaining Power | Impact on Cumulus |

|---|---|---|

| Content Creators | Moderate | Talent costs, programming decisions |

| Syndication Partners | Moderate | Content availability, contract terms |

| Music Licensing | High | Royalty expenses, content costs |

Customers Bargaining Power

Advertisers are crucial customers for Cumulus Media, wielding significant bargaining power. They can easily move their ad budgets to other media if Cumulus' prices are too high or its audience reach isn't effective. In 2024, digital advertising spending is projected to reach $275 billion, highlighting alternative options. Cumulus must offer competitive rates and showcase the value of its advertising solutions to keep advertisers.

Listeners, though non-paying, heavily influence Cumulus' advertising revenue through their listening choices. Declining listenership directly impacts advertising rates and overall revenue. Cumulus' Q3 2023 revenue was $218.9 million, a decrease from $229.3 million in Q3 2022, highlighting the importance of audience engagement. This decrease demonstrates the substantial customer power.

Users of Cumulus Media's digital platforms, including streaming services and podcast apps, hold bargaining power by deciding whether to engage with the platform. User experience, content quality, and pricing significantly affect user retention and expansion, which directly impacts digital advertising revenue. In 2024, digital advertising revenue is projected to reach $238 billion in the U.S. alone. This emphasizes the importance of user satisfaction in maintaining and growing revenue streams. Cumulus' success hinges on its ability to satisfy digital platform users.

Affiliate Stations' Influence

For Cumulus Media, affiliate stations function as customers for syndicated content, holding significant bargaining power. These stations can select competing syndicated programs, directly influencing Cumulus' audience reach and advertising revenue. This dynamic necessitates a focus on content quality and strong affiliate relationships to maintain competitiveness. In 2023, Cumulus generated $865.9 million in net revenue, underscoring the financial stakes of these relationships.

- Affiliate Choice

- Revenue Impact

- Content Quality

- Relationship Building

Digital Marketing Clients

Clients of Cumulus Media's digital marketing services possess bargaining power. This power stems from the measurable performance and effectiveness of the services provided. If the return on investment (ROI) doesn't meet expectations, clients can easily shift to competing agencies or build their own in-house teams. Cumulus must continually demonstrate ROI to retain clients. Tailored solutions are key.

- In 2024, the digital marketing industry is projected to reach $874.1 billion.

- The average customer acquisition cost (CAC) for digital marketing services can range from $50 to $1,000+ depending on the industry.

- Churn rates for digital marketing agencies vary, but can be as high as 30% annually.

- Demonstrating a positive ROI is key, with clients expecting a return of 5:1 or higher.

Customers hold significant bargaining power, influencing Cumulus Media's financial performance. Advertisers can shift budgets if prices are high. Listeners' choices impact advertising rates. Digital platform users influence revenue.

| Customer Type | Bargaining Power Source | Impact on Cumulus |

|---|---|---|

| Advertisers | Budget mobility; digital alternatives | Price and audience reach must be competitive |

| Listeners | Listening choices | Affects advertising revenue |

| Digital Platform Users | Engagement decisions; quality/pricing | Impacts digital ad revenue |

Rivalry Among Competitors

The radio broadcasting market is fiercely competitive. Cumulus Media competes with iHeartMedia and Audacy. In 2024, Cumulus reported a revenue of $869.8 million. Differentiating through unique content and effective ad strategies is crucial for survival.

The podcasting industry is fiercely competitive. Cumulus Media's Westwood One faces Spotify, Apple Podcasts, and iHeartMedia. Spotify had 615 million monthly active users in Q4 2023. Success hinges on content quality, marketing, and partnerships.

The digital audio streaming market is fiercely competitive, featuring giants like Spotify, Apple Music, and Amazon Music. Cumulus Media, despite not being a direct streaming provider, competes for listeners' attention. In 2024, Spotify held about 31% of the U.S. streaming market share. Integrating digital and traditional offerings is crucial for Cumulus's success. Podcasts are a key area of competition as well.

Advertising Market Clashes

The advertising market is highly competitive, with Cumulus Media facing intense rivalry from various platforms. Traditional media like radio compete with digital giants such as Google and Meta for ad revenue. Cumulus must highlight its unique strengths to advertisers.

- In 2024, digital ad spending is projected to reach $320 billion, surpassing traditional media.

- Radio advertising revenue in the U.S. was approximately $14 billion in 2023.

- Social media platforms like Facebook and Instagram are significant competitors, attracting large ad budgets.

- Cumulus must offer competitive pricing and demonstrate strong ROI to secure ad contracts.

Local Market Skirmishes

Cumulus Media faces intense competition in local radio markets. Stations vie with other radio broadcasters, local newspapers, and digital platforms for ad revenue. This dynamic requires strong local presence and community engagement. Tailored advertising strategies are crucial for attracting clients in this environment. Cumulus's 2024 revenue was approximately $780 million, reflecting the competitive pressures.

- Local radio ad spending in 2024 was around $13.7 billion.

- Digital ad revenue growth continues to outpace radio, around 10% annually.

- Cumulus operates about 400 radio stations.

- Newspaper ad revenue continues to decline, about 15% annually.

Cumulus Media faces intense rivalry across its markets.

Competition is fierce in radio, podcasting, digital, and advertising sectors.

Digital ad spending is rising, with radio facing pressures. Cumulus's success relies on differentiation and strategic focus.

| Market | Competitors | 2024 Data |

|---|---|---|

| Radio | iHeartMedia, Audacy | Cumulus Rev: $869.8M |

| Podcasting | Spotify, Apple | Spotify: 615M users (Q4 2023) |

| Digital Audio | Spotify, Apple Music | Spotify: 31% U.S. share |

SSubstitutes Threaten

Streaming services pose a substantial threat to Cumulus Media. Spotify and Apple Music provide on-demand music and personalized playlists, drawing listeners away from traditional radio. In 2024, streaming services accounted for over 80% of music consumption in the U.S. compared to traditional radio. This shift impacts Cumulus's advertising revenue and audience share.

Podcasts offer diverse content, from news to education, acting as radio substitutes. The growing popularity of podcasts and easy access threaten radio listenership. In 2024, podcast ad revenue is projected to reach $2.5 billion, reflecting their increasing market share. Cumulus Media must adapt to this shift to retain its audience.

Satellite radio, like SiriusXM, is a notable substitute due to its ad-free music and specialized content. The subscription model offers a different value proposition than free, ad-supported traditional radio. SiriusXM had about 34 million subscribers in 2024, showing its market presence. This poses a threat to Cumulus Media as it competes for listener attention and advertising revenue.

Audiobooks for Storytelling

Audiobooks present a formidable substitute for Cumulus Media's storytelling content, potentially drawing audiences away from radio. The on-demand accessibility of audiobooks, allowing listeners to engage with stories at their convenience, is a significant appeal. This shift is evident in the audiobook market's growth, with revenues reaching $1.8 billion in 2023, up from $1.5 billion in 2022. This growth suggests a widening audience base seeking alternatives to traditional radio formats.

- Audiobook revenue in 2023: $1.8 billion.

- Audiobook revenue in 2022: $1.5 billion.

- Growth year-over-year: 20%.

Social Media Audio Platforms

Social media audio platforms, like Twitter Spaces and Clubhouse, are direct substitutes for Cumulus Media's talk shows. These platforms provide live audio, offering real-time engagement that attracts listeners. This interactive format competes with traditional radio, potentially drawing audiences away. The increasing popularity of these platforms poses a threat to Cumulus Media's market share.

- In 2024, Twitter saw 2.9 million daily active users on Spaces.

- Clubhouse had 10 million weekly active users in early 2024.

- Cumulus Media's revenue in Q3 2024 was $223.9 million, potentially impacted by this shift.

Cumulus Media faces intense competition from substitutes. Streaming services, like Spotify and Apple Music, capture over 80% of music consumption, diverting listeners. Podcasts and satellite radio also offer alternative content, impacting Cumulus' audience and ad revenue. Audiobooks and social media audio platforms further challenge Cumulus Media's market share.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Streaming Services | High | 80%+ music consumption |

| Podcasts | Medium | $2.5B ad revenue projected |

| Satellite Radio | Medium | 34M SiriusXM subscribers |

| Audiobooks | Medium | $1.8B revenue (2023) |

| Social Media Audio | Low | Twitter Spaces: 2.9M daily users |

Entrants Threaten

Independent podcasters represent a growing threat due to low barriers to entry. They compete directly for listeners and ad dollars, intensifying market competition. In 2024, the podcasting market is projected to reach $2.5 billion in ad revenue, up from $2.2 billion in 2023. This increase puts pressure on established players like Cumulus Media's Westwood One. Westwood One's revenue in 2023 was $350 million, showing the impact of new entrants.

Digital radio startups pose a threat to Cumulus Media, potentially disrupting the traditional radio market. They can introduce new technologies and business models, offering unique listening experiences. For instance, in 2024, the podcasting market, a form of digital audio, generated over $2 billion in advertising revenue, showcasing the attractiveness of digital audio. These startups can target specific audiences, as seen with niche podcast networks, drawing listeners away from established broadcasters. The rise of platforms like Spotify and Apple Music, which offer personalized radio features, further intensifies this competition.

The threat of new entrants looms as streaming services broaden their content. Spotify and Apple Music, with their massive user bases, could easily integrate live radio features. This expansion intensifies competition for Cumulus Media. In 2024, Spotify reported 615 million monthly active users, highlighting their potential market reach.

Tech Giant Investments

The threat of new entrants, particularly tech giants, poses a significant risk to Cumulus Media. Companies like Amazon and Google have the potential to invest heavily in audio content and distribution, potentially disrupting the radio and podcasting markets. This could significantly alter the competitive landscape, intensifying pressure on traditional players like Cumulus.

- Amazon's ad revenue grew to $47.4 billion in 2023, indicating its expanding presence in the digital advertising space, including audio.

- Google's parent company, Alphabet, reported $237.5 billion in ad revenue for 2023, showing its substantial financial resources to invest in audio platforms.

- Spotify, a major player in audio streaming, had 615 million monthly active users in Q4 2023, demonstrating the scale of audience these platforms command.

Niche Content Platforms

The threat of new entrants in the radio broadcasting industry, particularly for a company like Cumulus Media, is real. Niche content platforms, focusing on specific genres or formats, pose a challenge. These platforms can attract listeners and advertisers away from Cumulus's broader offerings. This is especially true if these new entrants offer unique content or better user experiences.

- Pandora, Spotify, and iHeartRadio are major competitors.

- Cumulus Media's revenue in 2023 was approximately $866.7 million.

- Digital audio advertising is growing rapidly, with projections showing continued expansion.

- New entrants can quickly gain traction by capitalizing on unmet audience needs.

New entrants threaten Cumulus Media's market share. Independent podcasters and digital radio startups intensify competition for listeners and ad revenue. Tech giants like Amazon and Google possess significant resources.

| Factor | Details | Impact on Cumulus Media |

|---|---|---|

| Podcasting Market Growth (2024) | $2.5 billion ad revenue | Increased competition for ad dollars. |

| Westwood One Revenue (2023) | $350 million | Indicates vulnerability to new entrants. |

| Spotify Monthly Active Users (Q4 2023) | 615 million | Highlights the scale of digital audio platforms. |

Porter's Five Forces Analysis Data Sources

Our Porter's analysis uses SEC filings, market share data, industry reports, and financial statements for a comprehensive evaluation. Competitive landscape informed by investor relations, and competitor information.