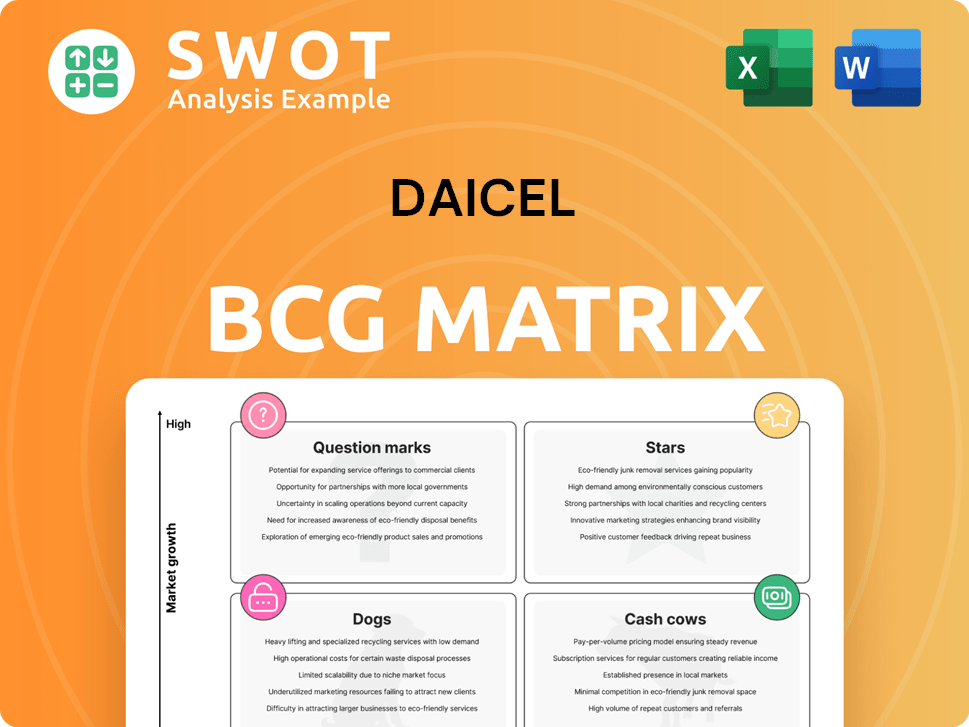

Daicel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daicel Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Prioritize resources, reduce uncertainty. Daicel BCG Matrix provides concise business unit overviews for strategic alignment.

Delivered as Shown

Daicel BCG Matrix

The Daicel BCG Matrix preview is identical to the purchased document. Get immediate access to the full, professional report upon purchase—ready for in-depth analysis. No hidden content, only strategic insights. Download and use it right away.

BCG Matrix Template

Daicel's product portfolio is complex. The BCG Matrix helps clarify market positions: Stars, Cash Cows, Dogs, and Question Marks. This snapshot shows how products compete. Understanding these placements is key to strategic planning. Learn how to optimize resource allocation. Purchase the full BCG Matrix for in-depth analysis and recommendations.

Stars

Daicel's high-performance polymers, especially those in electronics and autos, are stars. They likely lead in growing markets, needing continuous investment. The Asia-Pacific region's rising demand boosts their star power. In 2024, Daicel's revenue from high-performance materials grew by 7%.

Airbag inflators have been a key revenue source for Daicel. With automotive safety regulations tightening and a rising market, this segment probably holds a solid market share. Continuous innovation is vital; in 2024, the global airbag market was valued at approximately $9.5 billion. R&D investment is vital to maintain this position.

Daicel's specialty chemicals for electronics, including those for semiconductors and displays, fit the "Stars" category. The electronics market's constant evolution, demanding innovation, supports Daicel's R&D focus. These products probably require significant investment to maintain market share. In 2024, the global semiconductor market is valued at over $500 billion, indicating growth.

Cellulose Acetate (Specialized Applications)

Cellulose acetate, despite being a mature product, can shine as a star in specialized applications. These niche markets, such as high-end textiles, offer higher profit margins and growth potential, compared to traditional uses. For Daicel, strategic investments here can secure a competitive edge, particularly if they focus on sustainable production methods, addressing the growing demand for eco-friendly materials. In 2024, the global market for cellulose acetate is estimated at $2.5 billion, with specialized applications growing at 5-7% annually.

- Market Size: The global cellulose acetate market was valued at $2.5 billion in 2024.

- Growth Rate: Specialized applications are growing at 5-7% annually.

- Profitability: Niche markets offer higher profit margins.

- Strategic Focus: Sustainable production methods are key.

Medical Device Components

Daicel's medical device components segment is emerging as a potential star within its portfolio. This is driven by strategic investments like PharmaJet and the establishment of Daicel Medical Ltd. The healthcare industry's robust growth, fueled by an aging population and technological advancements, offers significant opportunities. Success depends on effective R&D and strategic market penetration to capitalize on rising demand.

- Daicel's medical business revenue in FY2024 was approximately ¥80 billion.

- The global medical device market is projected to reach $613 billion by 2024.

- Daicel Medical Ltd. focuses on developing and manufacturing medical devices.

- PharmaJet investment supports needle-free drug delivery.

Daicel's "Stars" represent high-growth, high-share business units, like high-performance polymers and airbag inflators. These segments require substantial investment to maintain their market positions. The medical device components, fueled by investments like PharmaJet, are also emerging stars. In 2024, global airbag market was $9.5B.

| Segment | Market Status | 2024 Financial Data |

|---|---|---|

| High-Performance Polymers | Leading market share | Revenue grew by 7% |

| Airbag Inflators | Solid market share | Global market valued at $9.5B |

| Medical Devices | Emerging star | FY2024 Revenue: ¥80B |

Cash Cows

Cellulose acetate tow, crucial for cigarette filters, is a stable market. Daicel, a key player, likely holds a significant market share. With limited growth, this segment generates consistent cash flow. Minimal investment is needed, classifying it as a cash cow. Daicel's revenue from this segment was approximately $1.2 billion in 2024.

Daicel's 1,3-butylene glycol, especially pharmaceutical grade, likely functions as a cash cow. The healthcare sector's consistent demand and Daicel's strong Asia Pacific presence support stable cash flow. In 2024, the global butylene glycol market was valued at approximately $600 million. Investment in sustainable practices could boost its profitability further.

Triacetin, a versatile compound used in cosmetics, pharmaceuticals, and industrial applications, positions itself as a potential cash cow for Daicel. Its established market presence and consistent demand translate to reliable revenue streams, requiring minimal investment in new innovations. Daicel's commitment to eco-friendly manufacturing enhances its profitability. In 2024, the global triacetin market was valued at approximately $150 million, with Daicel holding a significant market share, indicating strong financial stability.

Engineering Plastics (Commodity)

Engineering plastics, used in automotive and electronics, are cash cows for Daicel. They benefit from economies of scale and customer loyalty, despite market competition. Maintaining profitability requires a focus on operational efficiency and cost control. Daicel's net sales for the fiscal year 2023 were ¥729.4 billion.

- Market competition requires Daicel to focus on cost management.

- Daicel's customer relationships are a key advantage.

- Engineering plastics are a stable revenue source.

- Operational efficiency is crucial for profitability.

Organic Chemicals (Base Chemicals)

Daicel's base organic chemicals, like acetic acid, are cash cows. These chemicals are vital in multiple sectors, ensuring consistent demand. Daicel's established market position and cost-efficient production support profitability. In 2024, the global acetic acid market was valued at approximately $2.8 billion. Daicel's operational efficiency allows it to maintain strong profit margins.

- Steady Demand: Essential chemicals guarantee consistent sales.

- Market Position: Daicel has a strong presence in the market.

- Cost-Effective: Efficient production leads to higher profitability.

- Financial Data: The acetic acid market was worth $2.8 billion in 2024.

Cash cows are stable, high-market-share businesses in slow-growing markets.

Daicel's product lines like cellulose acetate tow, 1,3-butylene glycol, and triacetin fit this profile. They generate reliable cash with minimal new investment.

Engineering plastics and base organic chemicals also act as cash cows due to Daicel's strong market position and efficient production.

| Product | Market Value (2024) | Daicel's Role |

|---|---|---|

| Cellulose Acetate Tow | $1.2B | Key Player |

| 1,3-Butylene Glycol | $600M | Strong presence in Asia Pacific |

| Triacetin | $150M | Significant Market Share |

Dogs

Daicel's 2024 withdrawal from organic semiconductors signals underperformance, aligning with a 'dog' classification in the BCG matrix. This segment likely faced low growth and market share challenges. Daicel's inability to gain a competitive edge led to the strategic divestment. The move reflects a decision to allocate resources away from underperforming areas.

Commodity pyrotechnic devices, facing cheaper rivals or safety concerns, fit the "dogs" category in Daicel's BCG Matrix. These items, with low market share and growth, may warrant reduction or elimination. In 2024, Daicel's revenue from less profitable segments decreased by approximately 7%, reflecting strategic shifts. Focus would be on higher-margin specialized pyrotechnic applications.

Daicel's cellulose derivatives in commodity applications, facing intense competition and low margins, fit the 'dog' quadrant of the BCG Matrix. These products, lacking differentiation and growth prospects, are less strategically valuable. For example, in 2024, the global cellulose acetate market was valued at around $2.5 billion, with slow growth.

Adhesives (Low-Margin)

If Daicel's adhesive product lines have low margins and small market shares, they fit the "Dogs" category in the BCG matrix. The adhesives market is very competitive, making it tough to earn profits without a strong edge. These products might not bring in much money, and a strategic review is needed to decide what to do next.

- Daicel's 2024 revenue from adhesives might be low due to market competition.

- Low-margin products often struggle to compete.

- A strategic review could involve selling or restructuring these lines.

Certain Automotive Plastics (Legacy Products)

Legacy automotive plastics, like those used in older car models, are facing dwindling demand. These "dogs" in Daicel's portfolio may have limited growth. Minimal investment is needed to avoid losses. Daicel's focus is shifting to new, high-performance materials, reflecting a broader industry trend.

- Decline in demand for traditional automotive plastics is evident.

- Minimal investment is suggested for these products.

- Focus is on newer, more advanced materials.

- Industry trends show a shift towards high-performance plastics.

In Daicel's BCG matrix, "Dogs" are low-growth, low-share businesses. These segments, such as commodity products and those with tough competition, often underperform. Strategic moves include divesting or minimizing investment, like the 7% revenue decrease in 2024 from less profitable areas.

| Category | Characteristics | Daicel's Action |

|---|---|---|

| Commodity Products | Low growth, intense competition | Divest, reduce investment |

| Automotive Plastics | Declining demand, low growth | Minimal investment |

| Adhesives (Low Margin) | Competitive market, low share | Strategic review, restructure |

Question Marks

Daicel's nanodiamonds venture is a question mark in its BCG matrix. The market's high growth potential, fueled by uses in electronics and medicine, is attractive. However, Daicel's market share in this segment is currently uncertain. To transform this question mark into a star, Daicel must consider strategic investments and partnerships. The global nanodiamond market was valued at USD 21.2 million in 2023 and is projected to reach USD 39.8 million by 2028.

Daicel's medical device ventures, like Daicel Medical Ltd., are question marks. The industry boasts high growth; Global medical devices market was valued at $557.5 billion in 2023, and is projected to reach $800 billion by 2030. Success needs R&D, marketing, and partnerships. Daicel's market entry requires significant investment.

Daicel's biodegradable plastics initiative addresses rising environmental consciousness and market needs. The market is evolving, presenting both opportunities and challenges for Daicel. Securing partnerships and scaling production are vital for success. In 2024, the global biodegradable plastics market was valued at approximately $15 billion, with projections for significant growth.

Actranza Lab (Drug Delivery Device)

Actranza Lab, Daicel's drug delivery device, sits within the question mark quadrant of the BCG matrix. This means it operates in a high-growth market but has a low market share. The drug delivery systems market was valued at $286.7 billion in 2024. Daicel must invest heavily to increase its market presence.

- High-Growth Market: Drug delivery systems market.

- Low Market Share: Actranza Lab's market penetration is currently unknown.

- Investment Needs: Significant funding for clinical trials and commercialization.

- Potential Returns: High, if successful in gaining market share.

Pyro Fuses

Daicel's pyro fuse business, particularly for electric vehicles and renewable energy, is a question mark in its BCG matrix. The market for these fuses is expanding quickly. However, Daicel needs to improve its competitive standing to fully capitalize on this growth. Investments are crucial for success.

- Market growth in pyro fuses is driven by the EV and renewable energy sectors.

- Daicel must strengthen its position through strategic investments.

- These investments should focus on product development, manufacturing, and partnerships.

- Securing a larger market share is the ultimate goal.

Daicel's question marks include nanodiamonds, medical devices, and biodegradable plastics, all in high-growth markets. Success needs strategic investments and partnerships to increase market share. The drug delivery system market reached $286.7 billion in 2024; pyro fuses are crucial for EVs and renewable energy.

| Business Segment | Market Status | Daicel's Need |

|---|---|---|

| Nanodiamonds | High growth | Strategic investments |

| Medical Devices | Rapid growth | R&D, marketing |

| Biodegradable Plastics | Evolving market | Partnerships, scale |

BCG Matrix Data Sources

Daicel's BCG Matrix utilizes financial statements, market analyses, industry reports, and expert assessments for precise strategic recommendations.