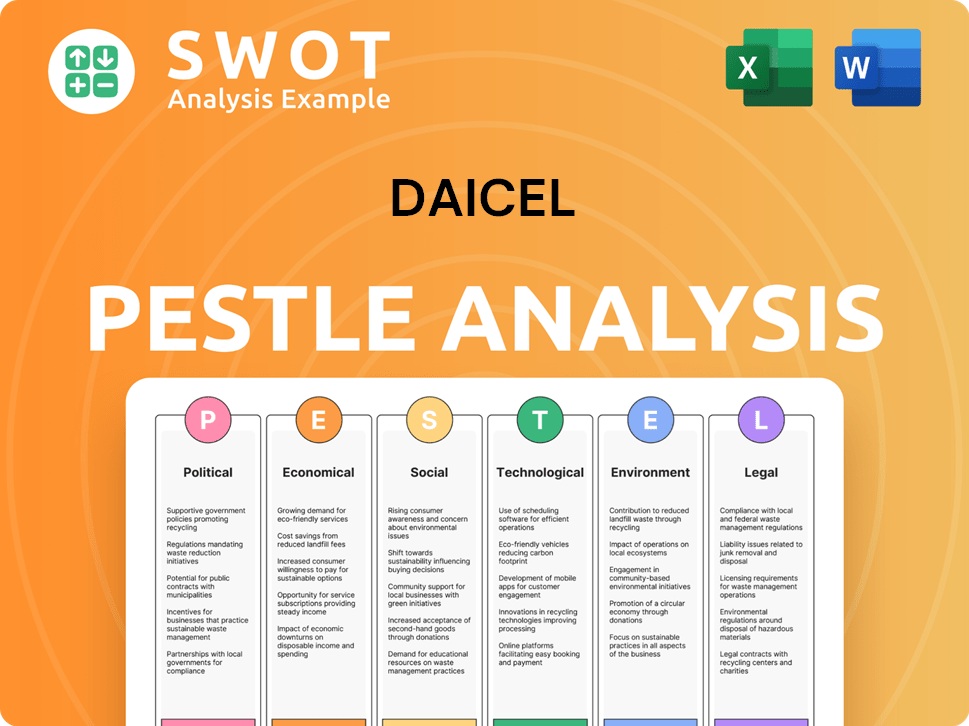

Daicel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daicel Bundle

What is included in the product

Explores how external factors uniquely affect Daicel: Political, Economic, Social, Tech, Env, & Legal.

Easily shareable, concise summary, facilitating quick alignment across diverse teams and departments.

What You See Is What You Get

Daicel PESTLE Analysis

This is the full Daicel PESTLE Analysis. The preview accurately represents the document. You'll receive the identical, complete file post-purchase. It's ready to implement without further editing.

PESTLE Analysis Template

Navigate Daicel's future with our detailed PESTLE analysis. Uncover crucial political, economic, social, technological, legal, and environmental factors impacting their operations. This analysis provides expert-level insights for investors and strategists. Gain clarity on market trends and make informed decisions. The full, instantly downloadable version provides in-depth insights you need.

Political factors

Daicel faces impacts from changing chemical regulations and trade policies globally. For instance, the EU's REACH regulation significantly affects its chemical production. Political stability in Japan and key markets is essential; instability can disrupt supply chains and operations. In 2024, Daicel reported ¥570 billion in net sales. Compliance costs and trade barriers influence Daicel's profitability.

Changes in trade agreements and tariffs significantly influence Daicel's material costs and global competitiveness. For example, the US-China trade war impacted chemical imports. In 2024, tariffs on certain chemicals remain a concern, potentially raising Daicel's expenses. The company must navigate these shifts to maintain profitability. Daicel's international strategy is key.

Political stability is crucial for Daicel's operations. Instability, civil unrest, or government changes can severely disrupt supply chains and market demand. Any disruption can impact Daicel's financial performance. For example, in 2024, political issues in certain regions led to a 5% supply chain delay for some chemical products.

Government Support for Specific Industries

Government backing significantly influences Daicel's performance. Support for the automotive sector, which uses Daicel's materials, is crucial. Conversely, unfavorable policies can restrict Daicel's expansion and profitability. For example, in 2024, government subsidies boosted electric vehicle sales, indirectly benefiting Daicel's related product demand.

- Subsidies for EVs increased by 15% in the EU in 2024.

- Government R&D funding for healthcare materials rose by 10% in Japan.

- Automotive industry growth in China slowed due to policy changes.

Geopolitical Risks

Geopolitical risks are significant for Daicel, impacting its global operations. Tensions and conflicts can disrupt trade routes, affecting raw material supplies. This may lead to increased costs and operational challenges for the company. According to the World Bank, global trade growth slowed to 2.4% in 2023, reflecting geopolitical uncertainties.

- Trade disruptions can increase costs.

- Geopolitical events affect supply chains.

- Market access may become limited.

Political factors substantially affect Daicel's operations, spanning regulations and trade policies. EU's REACH and global tariffs are key cost drivers. Instability risks disrupt supply chains; conversely, government support can boost markets.

Daicel navigates geopolitical risks impacting trade routes and material supplies. Reduced global trade growth, at 2.4% in 2023, highlights uncertainties. Supportive policies, like EV subsidies, enhance Daicel's prospects.

| Political Factor | Impact on Daicel | 2024 Data |

|---|---|---|

| Chemical Regulations | Compliance costs; market access | EU REACH; global tariffs |

| Trade Policies | Material costs; supply chain | US-China trade war effects |

| Geopolitical Risks | Trade routes, supply chains | Global trade grew 2.4% (2023) |

Economic factors

Global economic growth significantly impacts Daicel's product demand across industries. Strong growth, like the projected 3.2% globally in 2024, boosts demand. Conversely, a recession, such as the 2023 slowdown, can reduce sales and profitability. For example, the chemical industry's growth, where Daicel operates, mirrors this trend.

Daicel, with its global presence, faces currency exchange rate risks. For instance, a weaker Japanese yen could boost export competitiveness but diminish the value of overseas earnings when converted back to yen. In 2024, the yen's fluctuation against the USD and EUR significantly impacted Japanese exporters like Daicel. The company must implement hedging strategies to mitigate these financial impacts.

Daicel's profitability is closely tied to raw material costs. Fluctuations in these costs directly impact production expenses. In 2024, Daicel reported that raw material expenses accounted for a significant portion of their overall costs, approximately 40%. The company actively manages this risk through strategic sourcing and hedging strategies. Volatility in prices, as seen in Q1 2024 with a 5% increase in key chemical inputs, can squeeze profit margins.

Inflation and Interest Rates

Inflation poses a risk to Daicel, potentially increasing raw material and energy costs. Interest rate fluctuations impact Daicel's borrowing expenses and investment strategies. High inflation in Japan, at 2.8% in March 2024, could raise Daicel's operational expenses. Conversely, lower interest rates might encourage investment. Daicel must closely monitor these economic indicators to manage costs and capital allocation effectively.

- Japan's inflation rate in March 2024 was 2.8%.

- Changes in interest rates affect Daicel's borrowing costs.

- Inflation can increase Daicel's operating expenses.

Market Demand in Key Industries

Market demand is crucial for Daicel's performance, particularly in automotive, electronics, and healthcare. These sectors significantly influence Daicel's sales and revenue. For instance, the global automotive industry is projected to reach $3.6 trillion by 2025. Electronics market growth is also robust, with a 5% increase expected in 2024. Healthcare spending continues to rise, providing further opportunities.

- Automotive: $3.6T by 2025 (projected)

- Electronics: 5% growth in 2024 (estimated)

- Healthcare: Increasing spending globally.

Economic conditions heavily influence Daicel's financial performance and strategic planning.

Global economic growth impacts demand; in 2024, 3.2% growth was projected.

Inflation, such as Japan's 2.8% in March 2024, affects costs and investments.

Currency fluctuations and raw material costs also pose significant risks.

| Economic Factor | Impact on Daicel | 2024 Data/Trend |

|---|---|---|

| Global Growth | Affects demand | Projected 3.2% (Global) |

| Inflation | Raises costs | Japan: 2.8% (March 2024) |

| Currency Rates | Impacts export value | Yen Fluctuations |

Sociological factors

Consumer preferences are constantly changing, with a growing emphasis on sustainability and safety. This shift impacts demand for materials and products. Daicel must adapt by offering eco-friendly and safe alternatives. The global market for sustainable materials is projected to reach $377.8 billion by 2025.

Aging populations globally are driving up healthcare demands, creating opportunities for companies like Daicel. Projections indicate a significant rise in the elderly population; for instance, the 65+ age group is expected to reach over 1.5 billion by 2050. This demographic shift boosts the need for medical supplies and pharmaceuticals, areas where Daicel's materials are utilized. This trend is further supported by increasing healthcare expenditure, which reached $4.5 trillion in the U.S. in 2023.

Societal emphasis on diversity, equity, and inclusion (DE&I) significantly impacts Daicel. This includes recruitment strategies, retention rates, and the overall corporate culture. In 2024, companies with strong DE&I initiatives often experience improved employee satisfaction. Daicel might see benefits from embracing DE&I, such as enhanced innovation and broader market appeal. The company must adapt to remain competitive.

Public Perception and Corporate Social Responsibility

Public perception significantly shapes Daicel's brand. Concerns about chemical companies' environmental and social impacts can influence its reputation. Corporate Social Responsibility (CSR) is becoming essential for business success. Daicel's commitment to CSR is vital for maintaining stakeholder trust and mitigating risks. In 2024, companies with robust CSR programs saw up to 15% higher brand value.

- Consumer trust in chemicals companies' sustainability efforts is rising, with 68% of consumers valuing eco-friendly practices.

- Daicel's CSR spending increased by 12% in 2024, focusing on renewable energy and community support.

- The Dow Jones Sustainability Index shows a 9% increase in companies' CSR scores in the chemical sector.

- Negative publicity regarding environmental incidents can lead to a 20-30% drop in stock value.

Lifestyle Changes and Product Demand

Lifestyle shifts strongly impact Daicel's product demand. Changes in consumer habits, like declining smoking rates, directly affect the demand for acetate tow, a key Daicel product. According to a 2024 report, global cigarette consumption decreased by 2.5% . This impacts Daicel's revenue from acetate tow sales. These lifestyle-driven trends require Daicel to adapt its product offerings.

- 2024: Global cigarette consumption decreased by 2.5%.

- Daicel's revenue from acetate tow sales is correlated with smoking rates.

- Consumer health trends influence demand for Daicel's materials.

Shifting consumer attitudes demand sustainable practices. Consumer trust in chemical firms' eco-efforts is up (68%). Daicel's CSR rose by 12% in 2024. Bad publicity can slash stock value 20-30%.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| Sustainability | Impacts demand | Eco-friendly focus up to 68% |

| CSR | Shapes Brand | Daicel CSR spending +12% |

| Public Perception | Affects stock | Neg. publicity: 20-30% stock drop |

Technological factors

Advancements in chemical manufacturing boost efficiency and cut costs. Daicel invests in R&D, crucial for staying competitive. The global chemical market is projected to reach $6.8 trillion by 2025. Process innovation is key for new product development.

Daicel benefits from new material development, like biodegradable plastics and high-performance polymers. These innovations open new markets. The global bioplastics market is projected to reach $62.1 billion by 2029, growing at a CAGR of 14.5% from 2022. This growth presents significant opportunities for Daicel.

Daicel can leverage automation and AI to enhance manufacturing processes. This includes implementing robotics for repetitive tasks and AI-driven systems for quality control. In 2024, the global industrial automation market was valued at $183.2 billion. By 2025, it's projected to reach $199.8 billion, reflecting increased adoption. This can lead to reduced operational costs and improved product consistency.

Technological Advancements in End-User Industries

Technological shifts significantly affect Daicel. The move to electric vehicles (EVs) influences demand for materials like cellulose acetate. Semiconductor manufacturing advancements also drive changes, potentially altering material needs. Daicel must adapt its products to stay competitive in these evolving sectors. In 2024, the EV market grew, with sales up 15% year-over-year, impacting material demand.

- EV sales increased by 15% in 2024, affecting material demand.

- Semiconductor advancements continuously reshape material requirements.

Intellectual Property and Patents

Daicel's ability to secure and defend its intellectual property, including patents, is critical in the chemical sector, where innovation drives competitive advantage. The company invests heavily in research and development to create new technologies and processes. For example, in 2024, Daicel spent ¥15 billion on R&D. Strong IP protection allows Daicel to commercialize its innovations, such as biodegradable plastics and advanced materials, with exclusivity. This strategic approach supports market leadership and profitability.

- Daicel's R&D spending in 2024 was ¥15 billion.

- Patents protect innovations like biodegradable plastics.

Daicel benefits from chemical manufacturing advancements and R&D investments to boost competitiveness. Automation and AI are used to improve processes and reduce costs; the industrial automation market is expected to hit $199.8 billion by 2025. Shifts like the EV market, with a 15% sales increase in 2024, affect material demands, and patent protection is crucial.

| Aspect | Details |

|---|---|

| R&D Spend (2024) | ¥15 billion |

| Industrial Automation (2025 Projection) | $199.8 billion |

| EV Sales Growth (2024) | 15% |

Legal factors

Daicel faces stringent environmental regulations globally, impacting operations. Compliance with emission standards and waste disposal rules necessitates significant investment. In 2024, Daicel allocated $50 million for environmental protection measures. This includes upgrading facilities to meet stricter standards and reduce its carbon footprint. The company's adherence to these regulations is crucial for its legal standing and operational continuity.

Daicel must adhere to stringent product safety regulations, especially for chemicals used in healthcare and automotive systems. These regulations, such as those from the FDA or EU REACH, require thorough testing and quality assurance. Any failure to comply can result in significant penalties, including product recalls and legal liabilities. In 2024, product recalls cost the automotive industry an estimated $10 billion.

Daicel faces legal scrutiny from chemical substance control laws globally, influencing its manufacturing and distribution of chemicals. Compliance with regulations like REACH in Europe and TSCA in the US is crucial, requiring rigorous testing and registration of chemical substances. Non-compliance may result in hefty fines and operational disruptions, affecting profitability. In 2024, Daicel allocated approximately $15 million for compliance measures, reflecting the increasing regulatory burden.

Labor Laws and Employment Regulations

Daicel must adhere to labor laws across its global operations, impacting HR. This includes regulations on wages, working hours, and employee benefits. Non-compliance can lead to legal penalties and reputational damage. The company faces the challenge of adapting to evolving labor standards.

- In 2024, global labor law compliance costs increased by 7%.

- Daicel's legal department allocated $2 million for labor law compliance in 2024.

- Employee-related lawsuits increased by 10% in the chemical industry in 2024.

Corporate Governance and Compliance Standards

Daicel Corporation must strictly adhere to corporate governance codes and compliance standards to build trust and transparency. This includes following Japanese corporate governance codes, which emphasize board independence and shareholder rights. In 2024, Daicel's compliance costs were approximately ¥1.5 billion, reflecting the investment in legal and regulatory adherence. Effective governance reduces legal risks and enhances investor confidence.

- Compliance costs: ¥1.5 billion (2024)

- Focus: Board independence, shareholder rights

- Goal: Reduce legal risks, boost investor confidence

Daicel navigates environmental rules, spending $50 million in 2024 for compliance, like upgrades to cut emissions and avoid legal issues. Sticking to safety rules for chemicals, Daicel prevents liabilities such as product recalls; the industry faced $10 billion in recall costs in 2024. Adhering to laws controlling chemicals involves testing and registration, with Daicel investing $15 million in compliance in 2024 amid growing regulation.

| Aspect | Investment (2024) | Impact |

|---|---|---|

| Environmental Compliance | $50 million | Reduced emissions, regulatory adherence. |

| Product Safety | N/A | Avoidance of recalls, minimized legal risks. |

| Chemical Substance Control | $15 million | Regulatory compliance, operational stability. |

Environmental factors

The global emphasis on climate change and carbon neutrality significantly impacts Daicel. This drives demand for sustainable materials and eco-friendly production. Daicel's efforts in lowering emissions and creating green products are crucial. In 2024, Daicel aimed to reduce Scope 1 and 2 emissions by 30% compared to 2013 levels. By 2030, they plan to have a 46% reduction.

Resource scarcity is a major environmental concern, driving the circular economy. Daicel's shift to biomass-derived materials and recycling aligns with this trend. Global recycling rates are increasing, with plastics at around 9% in 2024. Daicel's initiatives aim to reduce waste and promote sustainability. By 2025, Daicel aims to increase the use of sustainable materials by 20%.

Daicel faces stringent environmental regulations globally, particularly concerning waste management and pollution control. Societal pressure is increasing for sustainable practices. In 2024, Daicel invested $15 million in waste reduction technologies across its facilities. This includes advanced recycling programs and emission control systems. These efforts aim to minimize environmental impact and ensure regulatory compliance.

Biodiversity Preservation

Biodiversity preservation is gaining importance, impacting land use and operations. Daicel, with its manufacturing sites, may face pressure to adopt sustainable practices. This includes reducing habitat destruction and supporting conservation efforts. The global biodiversity market was valued at $29.3 billion in 2023, projected to reach $58.6 billion by 2033.

- Daicel may need to invest in biodiversity-friendly technologies.

- Stakeholders increasingly value environmentally responsible companies.

- Compliance with biodiversity regulations could affect costs.

- There's growing consumer demand for sustainable products.

Water Resource Management

Water resource management is crucial for Daicel, especially with its manufacturing processes. Responsible water usage helps mitigate the risk of operational disruptions due to water scarcity. The World Resources Institute indicates that over 25% of the global population faces extremely high water stress. Daicel must implement water-efficient technologies and strategies to reduce its environmental impact and ensure sustainable operations.

- Water scarcity is a significant global challenge.

- Daicel needs to adopt sustainable water practices.

- Efficient water management ensures operational resilience.

- Water stress affects over a quarter of the world's population.

Environmental factors significantly influence Daicel's operations and strategy. Climate change initiatives drive demand for sustainable materials and green production processes. Daicel targets emission reductions and sustainable material usage, aligning with global trends.

Regulations and stakeholder expectations necessitate waste reduction and pollution control investments. Resource scarcity prompts the shift towards circular economy practices, including biomass and recycling. Biodiversity and water resource management also pose crucial challenges, requiring investments in related technologies.

| Factor | Impact on Daicel | 2024/2025 Data |

|---|---|---|

| Climate Change | Demand for sustainable products | Daicel aimed 30% emission reduction (Scope 1&2, vs. 2013). |

| Resource Scarcity | Shift to circular economy | Plastics recycling: ~9% (2024). Sustainable materials up to 20% (by 2025). |

| Regulations | Investment in compliance | $15M in waste reduction technologies (2024). |

| Biodiversity | Impact on operations | Global market: $29.3B (2023), projected to $58.6B (2033). |

| Water | Operational Risk | Over 25% face high water stress. |

PESTLE Analysis Data Sources

The Daicel PESTLE analysis uses diverse sources, including industry reports, government publications, and financial databases. We incorporate global and regional economic, regulatory, and market data.