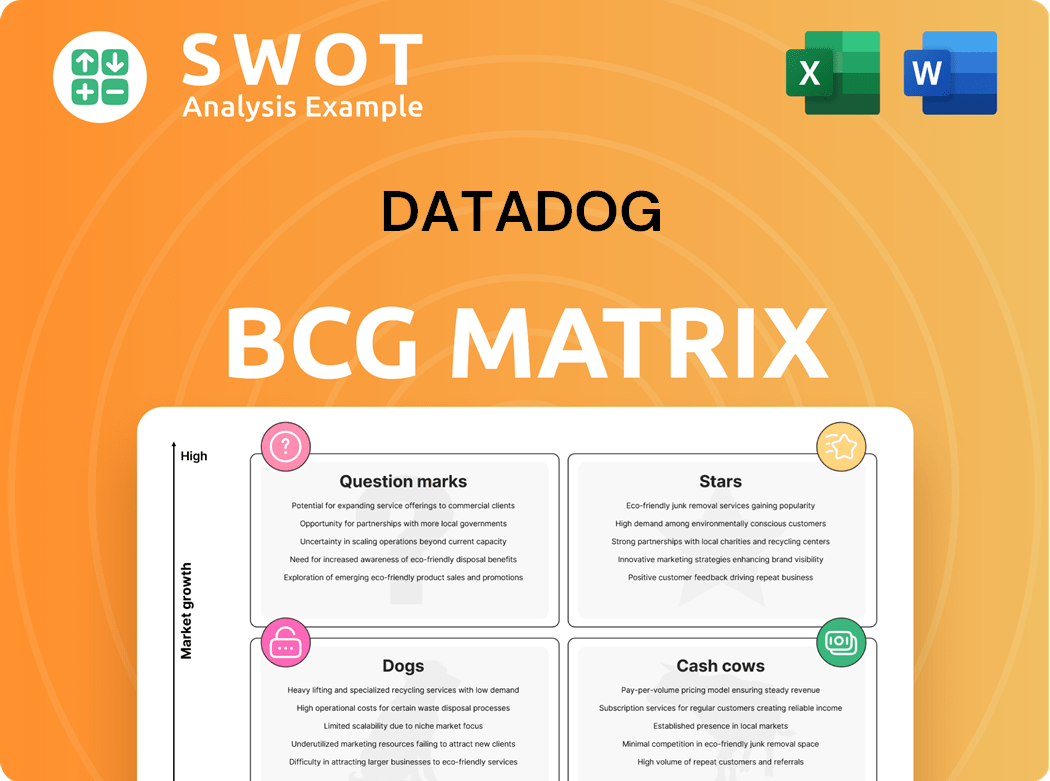

Datadog Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datadog Bundle

What is included in the product

Strategic evaluation of Datadog's offerings using the BCG Matrix framework. Identifies investment priorities.

Quickly visualize performance with a color-coded quadrant matrix.

Delivered as Shown

Datadog BCG Matrix

The Datadog BCG Matrix you're previewing is the complete report you'll receive. It's the finalized, ready-to-use version, offering strategic insights with no hidden content or watermarks.

BCG Matrix Template

Datadog's product landscape, visualized through a BCG Matrix, offers a strategic snapshot of its offerings. Stars shine with high growth and market share, while Cash Cows generate strong revenue. Question Marks present growth potential, and Dogs face market challenges. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Datadog's cloud monitoring platform is a "Star" in its BCG Matrix, excelling in the high-growth cloud observability market. Its comprehensive suite includes infrastructure, application, and log management. In 2024, Datadog reported a revenue of $2.25 billion, reflecting its strong market position. Continuous innovation is key to maintaining this leadership.

Datadog's APM, a star, shines brightly. APM is essential for modern apps and microservices. The APM market is expected to reach $7.5 billion by 2024. AI integration can boost Datadog's market share.

Datadog's log management is a star, vital for troubleshooting. High data volumes fuel growth, positioning it strongly. AI-powered log analytics could boost adoption. In Q3 2024, Datadog's revenue grew 25% year-over-year, showing strong performance.

Cloud Security Platform

Datadog's cloud security platform is a rising star, reflecting the growing need for robust cloud security. The demand for cloud security solutions is increasing due to rising cyber threats and compliance needs. Datadog's platform is well-positioned to capitalize on this growth. Investing in innovative security features and threat intelligence is crucial for sustained success.

- In 2024, the cloud security market is projected to reach $77.3 billion.

- Datadog's security revenue grew significantly in 2023.

- The company continues to invest heavily in R&D, with a focus on security.

- The cloud security market is expected to grow at a CAGR of 12% from 2024 to 2030.

AI-Driven Innovations

Datadog's integration of AI and machine learning is a significant star. This includes AI-driven anomaly detection and predictive analytics. These tools help customers proactively manage their systems. AI innovation is vital for Datadog's growth. For 2024, Datadog reported a 25% increase in revenue, showing its strong performance.

- AI-powered monitoring enhances customer experience.

- Predictive analytics improve system reliability.

- Continued AI investment fuels competitive advantage.

- Revenue growth reflects AI's impact.

Datadog’s various platforms consistently rank as stars, demonstrating strong performance and high growth potential. Cloud security, in particular, is a rising star, reflecting the $77.3 billion market in 2024. AI integration also boosts its market position and customer experience.

| Platform | Market | Key Feature |

|---|---|---|

| Cloud Monitoring | High Growth | Infrastructure, Application, Log Management |

| APM | $7.5B by 2024 | Modern apps & microservices |

| Log Management | High Data Volumes | Troubleshooting & AI Analytics |

| Cloud Security | $77.3B in 2024 | Threat intelligence & Compliance |

Cash Cows

Datadog's infrastructure monitoring is a cash cow, given its mature market. This segment provides consistent revenue. In Q1 2024, Datadog's revenue grew 26% to $611 million. This cash flow supports other areas. Datadog has a strong, established customer base.

Server monitoring is a Datadog cash cow, offering consistent revenue. It has a large user base, ensuring steady income. Enhancing efficiency in this area boosts cash flow. Datadog's revenue in 2024 was approximately $2.25 billion, showcasing its financial stability.

Database monitoring is a cash cow for Datadog, a core service generating steady revenue. It offers key insights into database performance. In 2024, the database monitoring market was valued at approximately $5 billion, reflecting its importance. Investments in this area can boost efficiency and cash flow.

Network Monitoring

Network monitoring, a key component of Datadog's offerings, is a cash cow. This segment provides Datadog with a steady revenue stream due to its established market position and consistent demand from businesses. Datadog can maintain its financial stability by focusing on small improvements to its network monitoring solutions. This approach ensures continued cash generation.

- Datadog's 2024 revenue increased by approximately 26% year-over-year.

- Network monitoring tools are critical for IT operations in 2024, driving consistent demand.

- Datadog's market share in the network monitoring space is substantial, ensuring revenue stability.

- Incremental improvements in network monitoring features are key to retaining customers.

Existing Customer Base

Datadog's substantial, devoted customer base is a key cash cow. It facilitates high-margin revenue through cross-selling and upselling, reducing acquisition expenses. Customer relationship nurturing and excellent support are crucial for maximizing this cash cow's potential. In Q3 2023, Datadog's revenue surged to $548 million, showcasing this strategy's efficacy.

- Customer Retention Rate: Datadog consistently maintains a high customer retention rate, often exceeding 90%, demonstrating the strength of its existing customer base.

- Upselling Success: A significant portion of Datadog's revenue growth comes from upselling additional products and features to its existing customers.

- Cross-selling Opportunities: Datadog leverages its diverse product suite to cross-sell various monitoring and security solutions to its existing customer base.

Datadog's cash cows are vital for revenue generation. They provide stability through their established markets and customer bases. Datadog's solid financial health, with 2024 revenue around $2.25 billion, relies on these segments.

| Cash Cow | Market Position | Revenue Contribution (2024 est.) |

|---|---|---|

| Infrastructure Monitoring | Mature, stable | Significant |

| Server Monitoring | Established | High, consistent |

| Network Monitoring | Key segment | Steady |

Dogs

Legacy on-premise solutions in Datadog's portfolio are likely "Dogs". These solutions face decreasing demand as cloud adoption rises. The company should consider reducing investments or divesting from these areas. In 2024, Datadog's revenue growth slowed, reflecting this shift.

Datadog's BCG Matrix highlights unsuccessful product experiments. Any features that haven't gained traction should be recognized. Turnaround plans are often ineffective. Reallocating resources is crucial for success. In 2024, Datadog's revenue grew, but focusing on successful products is vital.

Niche monitoring tools or integrations with low adoption are "Dogs". These consume resources without significant returns. For example, Datadog's revenue grew 25% in Q4 2023, focusing on core offerings. Evaluating these tools for potential divestiture is wise. In 2024, streamlining the product portfolio is key for efficiency.

Areas Where Datadog Lacks Competitive Advantage

In segments with intense competition and no clear edge, Datadog's offerings could be seen as "Dogs" in a BCG matrix. Battling rivals without a distinct advantage diminishes the likelihood of success. Datadog's stock performance in 2024 reflected this, with periods of stagnation in competitive markets. Prioritizing strengths and unique aspects is essential for sustained growth.

- Market competition in certain areas may lead to price wars.

- Lack of differentiation could affect market share.

- Focusing on core strengths is vital.

- Datadog's stock volatility reflects these challenges.

Products with Declining Market Demand

In the Datadog BCG Matrix, "Dogs" represent products in declining markets. These offerings often involve technologies nearing obsolescence, making further investment unwise. A strategic pivot involves reallocating resources toward growth areas. For example, the market for traditional software licenses shrank by 10% in 2024.

- Declining market segments mean reduced investment returns.

- Outdated technologies drive obsolescence.

- Shifting to emerging technologies is key.

- Market decline necessitates resource reallocation.

Datadog's "Dogs" include niche tools or offerings in declining markets. These generate low returns and may be obsolete. Resource reallocation toward growth areas is essential, as seen by the 10% drop in traditional software licenses in 2024.

| Category | Characteristics | Action |

|---|---|---|

| Market Position | Declining or niche, intense competition. | Divest or reduce investment. |

| Technology | Outdated or low adoption. | Reallocate resources. |

| Financial Impact | Low ROI, consumes resources. | Focus on core strengths. |

Question Marks

Datadog's LLM Observability, a question mark in its BCG Matrix, monitors generative AI apps. The AI observability market is new but promising rapid growth. Datadog invested $20M in R&D in Q3 2024. It aims to capture this high-potential, emerging market. Significant future investments are needed to maintain a leading position.

Datadog's Kubernetes Active Remediation, automating Kubernetes troubleshooting, fits the question mark category in the BCG Matrix. The Kubernetes management tools market is booming, projected to reach $7.3 billion by 2024. Intense competition demands focused investment. Success hinges on effective market adoption strategies and product development.

Datadog's Cloud SIEM is a question mark in its BCG Matrix, given its recent entry into the crowded security market. The demand for cloud security is soaring; the global market is projected to reach $98.9 billion in 2024. Datadog must differentiate itself from giants like Splunk. Strategic investments are vital for growth.

Serverless Monitoring

Serverless monitoring is a question mark for Datadog within the BCG Matrix. The serverless market is growing rapidly, yet monitoring these environments presents its own set of challenges. Datadog needs to invest strategically and innovate to gain a significant market share in this area. For instance, in 2024, the serverless computing market was valued at approximately $7.6 billion.

- Market growth: The serverless computing market is projected to reach $28.6 billion by 2029.

- Challenges: Monitoring serverless environments requires specialized tools and strategies.

- Investment: Targeted investments are needed to capture market share.

- Innovation: Datadog must innovate to stay competitive.

Product Analytics

Datadog's product analytics capabilities fit the "Question Mark" quadrant. The demand for product usage insights is on the rise, driven by businesses seeking better customer understanding. However, Datadog contends with specialized analytics platforms, creating a competitive landscape. Success hinges on focused development and tight integration with Datadog's core platform.

- Growth in product analytics market is projected to reach $20.5 billion by 2029.

- Datadog's revenue in 2023 was $2.26 billion.

- Competition includes companies like Amplitude and Mixpanel.

- Integration with core platform is crucial for user adoption.

Datadog's product analytics, a question mark in its BCG Matrix, targets rising demand for product insights. The product analytics market, with a projected $20.5B value by 2029, presents opportunities. Datadog must focus on integrating its product analytics with its core platform to compete with specialized players.

| Aspect | Details |

|---|---|

| Market Growth | Product analytics market projected to $20.5B by 2029. |

| Competitive Landscape | Competes with Amplitude, Mixpanel. |

| Revenue | Datadog's 2023 revenue: $2.26B. |

BCG Matrix Data Sources

Datadog's BCG Matrix uses performance data and market analysis including financial reports and sector trends, all carefully vetted.