Datadog PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datadog Bundle

What is included in the product

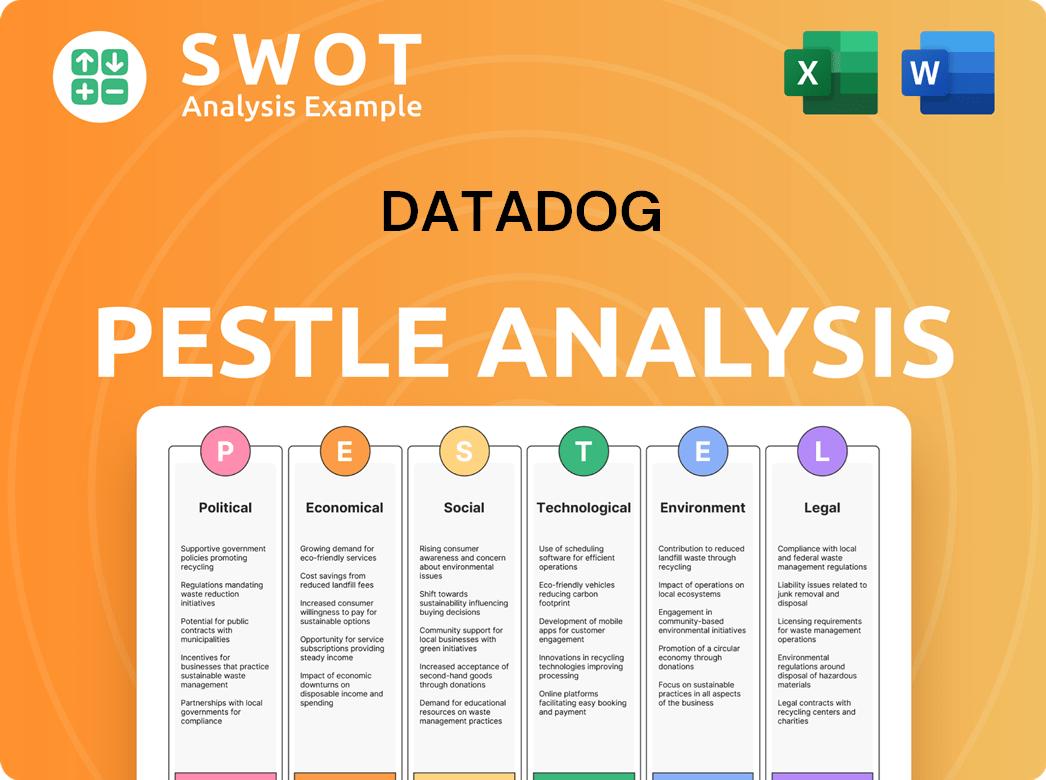

Examines external forces shaping Datadog via Political, Economic, Social, Technological, Environmental & Legal.

Provides a concise version of a Datadog PESTLE Analysis ready for inclusion in reports or presentations.

Preview Before You Purchase

Datadog PESTLE Analysis

Everything you see in this preview is included in the Datadog PESTLE analysis you'll download. No surprises—it's the exact document. The format and content are identical.

PESTLE Analysis Template

Understand Datadog's market through a lens of external factors. Our PESTLE analysis examines political, economic, social, technological, legal, and environmental influences. Discover opportunities and threats facing Datadog within the industry. Strengthen your strategic planning and risk management capabilities with our insights. The full PESTLE report offers in-depth analysis and actionable recommendations. Purchase the complete analysis today!

Political factors

Governments worldwide are tightening cybersecurity mandates. Datadog aids compliance with standards like FedRAMP High. In 2024, the global cybersecurity market is projected to reach $217.9 billion. Datadog's solutions help meet evolving government demands. This includes robust monitoring for sensitive data.

Data privacy laws like GDPR and CCPA are constantly changing, affecting cloud providers like Datadog. Compliance is crucial for global operations. For example, the EU's GDPR can lead to fines up to 4% of annual global turnover. Staying compliant helps Datadog avoid hefty penalties and maintain customer trust. In 2024, the global data privacy software market is projected to reach $8.7 billion.

The US tech sector faces a complex regulatory landscape. The Federal Trade Commission (FTC) and Securities and Exchange Commission (SEC) set rules. These rules impact cloud monitoring and compliance. Datadog must comply with data protection laws. In 2024, penalties for non-compliance could reach millions.

Geopolitical Tensions

Geopolitical tensions present significant challenges for Datadog. Conflicts and instability globally can disrupt cloud infrastructure expansion. In 2024, the global cloud computing market was valued at $670.8 billion. These tensions can lead to technology restrictions and data localization mandates. Datadog, with its international presence, faces operational risks from these geopolitical factors.

- Cloud computing market expected to reach $1.6 trillion by 2030.

- Data localization policies are increasing worldwide.

- Geopolitical events can cause supply chain disruptions.

Government Adoption of Cloud Technologies

Government adoption of cloud technologies offers Datadog significant growth potential. As governments migrate to the cloud, the need for monitoring and security solutions increases. Datadog must comply with stringent government security standards. This creates opportunities and challenges.

- In 2024, the global government cloud market was valued at approximately $70 billion.

- By 2025, projections estimate this market to reach over $85 billion, showcasing substantial growth.

- The U.S. government alone spends billions annually on cloud services, driving demand for security solutions.

Political factors significantly affect Datadog's operations. Cybersecurity mandates and data privacy laws like GDPR, influence Datadog. Compliance is key to avoid hefty fines. In 2024, global cybersecurity market size reached $217.9B, data privacy software market, $8.7B.

| Political Factor | Impact on Datadog | Data/Stats (2024) |

|---|---|---|

| Cybersecurity Mandates | Drives need for robust security solutions. | Global cybersecurity market: $217.9 billion. |

| Data Privacy Laws | Compliance costs, risk of fines. | Data privacy software market: $8.7 billion. |

| Geopolitical Tensions | Supply chain & operational disruption. | Cloud market size: $670.8 billion. |

Economic factors

Macroeconomic uncertainty, fueled by inflation and rising interest rates, poses a risk to Datadog. Enterprises may cut IT spending, directly impacting demand for Datadog's services. Datadog's performance closely mirrors cloud infrastructure spending trends. In Q1 2024, Datadog's revenue grew 26%, reflecting this sensitivity. The Federal Reserve's actions and inflation data will be critical in 2024/2025.

The digital transformation trend fuels demand for cloud monitoring. Businesses shifting to cloud/hybrid environments need real-time visibility. This boosts demand for Datadog's platform. In Q1 2024, Datadog's revenue rose to $611.3 million, up 26% year-over-year, reflecting this growth. Datadog continues to capitalize on this trend.

Enterprise cloud spending is expected to rise, supporting Datadog. The move to cloud-native architectures boosts demand for its observability tools. Gartner forecasts global public cloud spending to reach nearly $679 billion in 2024, growing 20.7% from 2023. This growth creates significant opportunities for Datadog.

Competitive Landscape and Pricing Pressure

Datadog faces intense competition in the observability market, putting pressure on its pricing strategies. This includes rivals like Dynatrace and New Relic, as well as native monitoring tools from major cloud providers. Increased competition can squeeze Datadog's profit margins, potentially affecting its financial performance. For instance, in 2024, Datadog's gross margins were around 79%, which could be threatened by pricing wars.

- Competition from cloud providers like AWS, Azure, and GCP.

- Pricing pressure from other observability platforms.

- Potential impact on Datadog's market share and profitability.

- Datadog's gross margins were around 79% in 2024.

Cost Escalations

Datadog faces rising costs across its operations. Research and development, sales and marketing, and general and administrative expenses are all increasing. These escalations could squeeze profit margins. For instance, in Q1 2024, Datadog's operating expenses increased by 27% year-over-year.

- R&D expenses rose to $245 million in Q1 2024.

- Sales and marketing costs reached $216 million.

- General and administrative costs were $63 million.

Economic factors significantly influence Datadog's trajectory. Inflation and interest rates impact IT spending, directly affecting demand for its services. Cloud spending growth is crucial, with Gartner forecasting significant increases in 2024/2025. DataDog's revenue in Q1 2024 rose 26%.

| Factor | Impact | Data |

|---|---|---|

| Inflation/Interest Rates | Affect IT Spending | Fed actions critical in 2024/2025 |

| Cloud Spending | Boosts Demand | Gartner forecasts $679B in 2024, +20.7% YoY |

| Revenue Growth | Performance Indicator | Q1 2024 Revenue +26% YoY, reaching $611.3M |

Sociological factors

The surge in remote work, especially post-2020, has significantly impacted IT infrastructure. Datadog's services are vital because remote setups increase network complexity. A 2024 survey showed that 30% of employees worked remotely at least a few days a week. This shift boosts the need for advanced monitoring.

Attracting and retaining skilled employees is vital for Datadog's success in the tech sector. The company heavily relies on stock-based compensation. In Q1 2024, Datadog's stock-based compensation expenses were $136.4 million, a key element in its operational costs. This strategy aims to motivate and keep top talent.

Datadog's sociological landscape shows rising customer adoption of multi-product offerings. This trend reflects a shift towards unified observability and security solutions. In Q1 2024, Datadog reported that a significant portion of its customer base utilized multiple products. Customers are increasingly favoring integrated platforms for enhanced operational efficiency.

Customer Loyalty and Retention

Datadog's customer loyalty is a key strength, especially with major businesses. A high retention rate is seen, showing that customers are happy with the platform, which supports consistent income. Datadog's Q1 2024 earnings highlighted a dollar-based net retention rate above 115%, showing strong customer stickiness. This indicates a focus on customer satisfaction and successful product integration.

- High retention rates lead to predictable revenue streams and stable growth.

- Datadog's success relies on keeping its current customers happy.

- Customer loyalty signals that the platform is meeting customer needs.

Industry Collaboration and Partnerships

Datadog's success is significantly shaped by its collaborative efforts within the tech industry. Partnerships, like the one with Akamai, are crucial. These alliances improve platform capabilities, enhancing visibility and threat detection for users. Such collaborations often lead to broader market reach and increased adoption of Datadog's services. In 2024, Datadog expanded its partnerships to include integrations with several new platforms.

- Akamai partnership enhances threat detection.

- Expanded partnerships in 2024 increased market reach.

The rise of remote work drives IT infrastructure needs. Datadog's platform becomes crucial for remote setups, given increased network complexity. Customer adoption of multi-product offerings indicates a shift to integrated solutions for efficiency. Partnerships, like the one with Akamai, improve capabilities and market reach.

| Sociological Factor | Impact on Datadog | Supporting Data (2024-2025) |

|---|---|---|

| Remote Work | Increased demand for monitoring | 30% of employees worked remotely in 2024 |

| Customer Behavior | Shift to unified solutions | Significant usage of multiple products in Q1 2024 |

| Partnerships | Enhanced platform and reach | Partnerships with new platforms in 2024 |

Technological factors

The shift to cloud computing boosts demand for monitoring tools like Datadog. Cloud adoption grew, with 70% of businesses using cloud services in 2024. Datadog's revenue rose 25% year-over-year in Q1 2024, indicating strong market positioning. Observability is key for managing complex cloud environments.

Datadog is increasingly integrating AI and machine learning into its platform. This includes AI-driven anomaly detection, which helps identify unusual patterns in data, and automated incident response. This focus on AI enhances its monitoring capabilities, potentially increasing its customer base and revenue, which reached $2.25 billion in 2023. Furthermore, the incorporation of AI creates a strong competitive advantage in the market.

Datadog's product innovation fuels its growth. The company expands its platform with new features. This strategy meets evolving customer needs. Datadog's revenue in Q1 2024 was $611 million, up 26% year-over-year. The company's focus on innovation is evident.

Multi-Cloud and Hybrid Environments

Datadog's platform is engineered to be cloud-agnostic, supporting varied deployments. This includes on-premise, hybrid, IoT, and multi-cloud setups. This adaptability is critical for clients with diverse IT infrastructures. The multi-cloud market is expanding; it's projected to reach $1.6 trillion by 2025. Datadog's strategy aligns with this trend.

- Cloud-agnostic design enables broad customer reach.

- Supports various deployment environments.

- Multi-cloud market is rapidly growing.

- Strategic alignment with industry trends.

Emerging Technologies (e.g., LLM Observability)

Datadog is incorporating cutting-edge technologies like Large Language Model (LLM) Observability into its platform. This strategic move aims to enhance cloud and next-gen infrastructure utilization. The company's investments in AI and related technologies are expected to boost its market position. Datadog's focus on innovation is reflected in its financial performance.

- In Q4 2023, Datadog's revenue reached $589.7 million, a 25% increase year-over-year.

- Datadog's investments in R&D totaled $224.3 million in 2023, showing its commitment to innovation.

Technological advancements significantly influence Datadog. AI and ML integration enhances monitoring capabilities, reflected in strong revenue growth. The company's cloud-agnostic design and support for multi-cloud environments aligns with industry trends, like the projected $1.6T multi-cloud market by 2025.

| Technology Area | Datadog's Approach | Impact |

|---|---|---|

| Cloud Computing | Cloud-agnostic platform | Expands market reach |

| AI & ML | Anomaly detection, incident response | Enhances capabilities |

| Platform Expansion | New features and integrations | Drives growth |

Legal factors

Datadog must adhere to data protection laws like GDPR and CCPA, dictating how customer data is handled. These regulations are constantly changing, demanding continuous compliance efforts. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of a company's annual global turnover. In 2024, the average cost of a data breach hit $4.45 million globally.

The SEC's cybersecurity disclosure rules mandate that Datadog reveals its cybersecurity risks and incidents. Datadog complies with these regulations, managing its cybersecurity risks and reporting to stakeholders.

Datadog must adhere to industry-specific standards like FedRAMP, crucial for government clients. Compliance ensures data security and builds customer trust. In 2024, the cybersecurity market reached $223.8 billion, highlighting the importance of these standards. Maintaining compliance requires ongoing investment and audits.

Potential Legal Issues from Security Breaches

Datadog, despite its stance on limited data privacy risk exposure, faces potential legal challenges from security breaches. These breaches could trigger lawsuits and regulatory actions, especially under data protection laws like GDPR or CCPA. The company's significant investment in cybersecurity, with estimated spending of $100 million in 2024, highlights its commitment to mitigating these risks. Failure to prevent or swiftly respond to security incidents may result in substantial penalties and reputational damage.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA violations can incur penalties up to $7,500 per record.

- Datadog's revenue for 2024 is projected at $2.4 billion.

Contractual Obligations and Service Level Agreements

Datadog operates under contractual obligations and Service Level Agreements (SLAs) that define service terms and performance standards. These legally binding agreements are crucial for maintaining customer trust and ensuring service reliability. Breaching these contracts can lead to legal repercussions, including financial penalties or damage to Datadog's reputation. For instance, in 2024, the average settlement for SLA breaches in the SaaS industry was around $150,000, highlighting the potential financial impact.

- Contractual breaches can lead to financial penalties.

- SLAs are essential for customer satisfaction.

- Legal compliance is critical for business continuity.

- Reputational damage can result from non-compliance.

Legal factors significantly impact Datadog's operations. Compliance with data protection laws, such as GDPR and CCPA, is critical, with potential fines reaching up to 4% of global revenue or $7,500 per record violation, respectively. In 2024, Datadog's cybersecurity spending reached around $100 million. Contracts and SLAs define service standards; breaches can result in penalties, such as a $150,000 average settlement for SaaS SLA breaches in 2024.

| Legal Aspect | Impact | Example/Data (2024) |

|---|---|---|

| Data Protection (GDPR/CCPA) | Fines, Compliance Costs | GDPR Fines: Up to 4% global revenue; CCPA: $7,500/record |

| Cybersecurity Regulations | Disclosure Requirements, Incident Response | SEC Cybersecurity Disclosure Rules; Cybersecurity Market: $223.8B |

| Contractual Obligations (SLAs) | Service Reliability, Customer Trust | SaaS SLA Breach Settlement: ~$150,000 |

Environmental factors

Cloud infrastructure's energy use is an environmental concern. Datadog's impact links to its cloud providers' energy consumption. In 2024, data centers globally consumed about 2% of the world's electricity. The energy intensity of cloud services is a key factor. Datadog's PESTLE analysis must consider these factors.

Datadog is dedicated to lowering its carbon footprint, focusing on optimizing data center efficiency. They actively work on improving Power Usage Effectiveness (PUE). This strategy helps reduce energy consumption. In 2024, the company invested $10 million in green initiatives.

Customer demand for sustainable tech is growing. Companies like Datadog, focusing on efficient operations, attract eco-conscious clients. According to a 2024 study, 60% of consumers favor sustainable brands. This trend impacts tech purchasing decisions. Datadog's green initiatives can boost its market appeal.

Adoption of Green Technology

The shift toward green technology significantly influences cloud infrastructure. Datadog benefits from supporting energy-efficient technologies like Arm-based instances. This aligns with reducing environmental impact, a growing priority for investors. Consider that in 2024, the global green technology and sustainability market reached $366.6 billion. It's expected to hit $614.8 billion by 2029.

- Arm-based servers offer up to 40% better energy efficiency compared to x86 servers.

- Datadog helps monitor and optimize the performance of these energy-efficient technologies.

- The cloud computing market is projected to grow, emphasizing the need for sustainable practices.

ESG Reporting and Stakeholder Focus

Datadog faces growing pressure regarding Environmental, Social, and Governance (ESG) factors from various stakeholders. Investors are increasingly integrating ESG criteria into their investment decisions, with ESG assets projected to reach $50 trillion by 2025. Datadog is actively assessing and refining its ESG strategies to meet these evolving expectations. This includes enhancing transparency and disclosure around environmental impact, social responsibility, and corporate governance practices.

- ESG assets are expected to reach $50 trillion by 2025.

- Datadog is working on improving its ESG practices.

Datadog's environmental impact hinges on cloud energy consumption. They aim to cut their carbon footprint by optimizing data centers. Sustainable tech's market is booming, influencing their strategies.

| Aspect | Details | Impact |

|---|---|---|

| Energy Use | Data centers use about 2% of world electricity | Datadog's carbon footprint is a concern |

| Efficiency Efforts | Focus on Power Usage Effectiveness (PUE) | Helps reduce energy consumption, investment in green initiatives in 2024 $10 million |

| Market Trends | 60% consumers favor sustainable brands | Green initiatives boost Datadog's market appeal, the global green technology and sustainability market in 2024 reached $366.6B |

PESTLE Analysis Data Sources

Datadog's PESTLE leverages financial data from reputable sources, like company reports, and market research from top analytics firms. The political and regulatory environment relies on government resources and industry publications.