DaVita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

What is included in the product

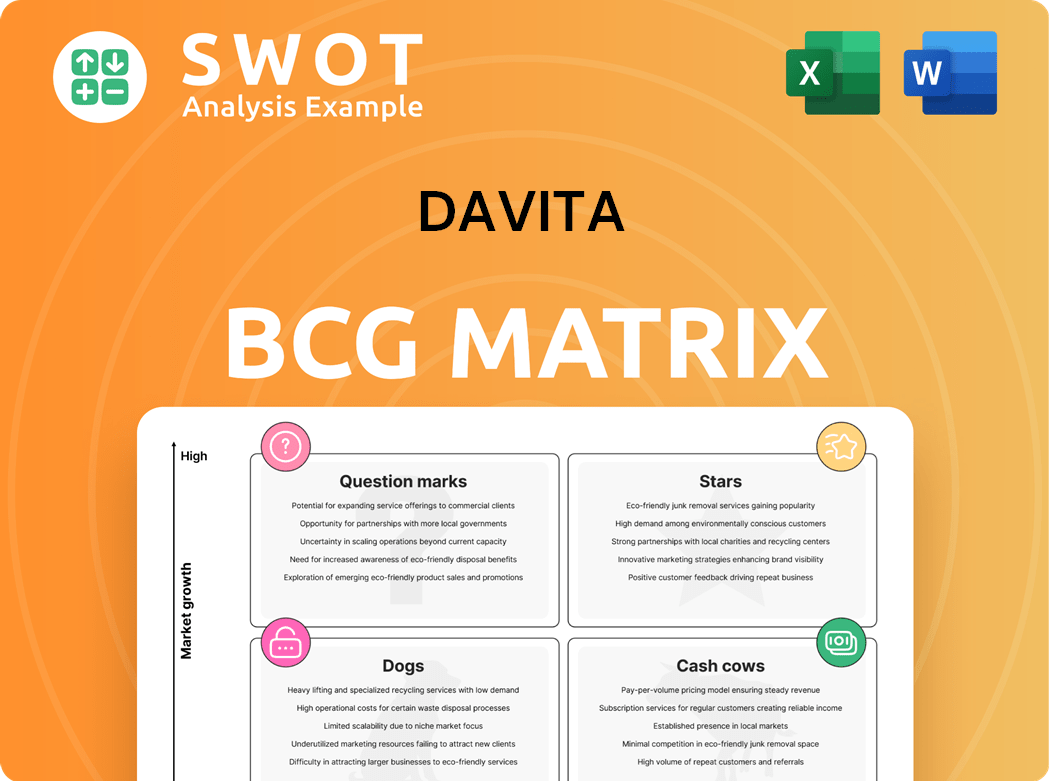

DaVita's BCG Matrix explores its business units using the four quadrants for strategic decisions.

Color-coded quadrants highlight growth opportunities, quickly revealing pain points.

Delivered as Shown

DaVita BCG Matrix

The DaVita BCG Matrix preview mirrors the final, downloadable document. It's the complete, ready-to-use report, providing strategic insights and market analysis with no hidden content.

BCG Matrix Template

Explore DaVita's strategic landscape through its BCG Matrix, a vital tool for understanding its product portfolio's potential. We've analyzed its offerings, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This overview offers a glimpse into their market positioning and growth prospects. Want a comprehensive view? Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

DaVita's Integrated Kidney Care (IKC) programs show strong growth prospects and expanding market share, focusing on value-based care. These programs manage chronic kidney disease (CKD) patients comprehensively, aiming to cut costs and enhance outcomes. As of December 31, 2024, DaVita had around 70,400 patients in risk-based integrated care, accounting for about $5.5 billion in yearly medical spending. Further investment and IKC growth could cement DaVita's leadership in complete kidney care.

DaVita's international expansion, especially in Latin America, is a key growth driver. Acquisitions in Brazil, Colombia, Chile, and Ecuador boost its global presence. These moves broaden DaVita's patient reach significantly. DaVita's commitment to sustainability is evident, with global operations aiming for 100% renewable energy.

DaVita's home dialysis services are a star due to the rising patient preference and industry trends. In 2024, 15% of DaVita patients chose home dialysis. This led to a double-digit growth in home dialysis treatments. Home dialysis is cost-effective and boosts patient well-being, fueling its expansion.

Transplant Support Programs

DaVita's transplant support programs represent a significant area of growth and positive impact. In 2024, nearly 8,200 DaVita patients received a kidney transplant, a record for the company. These programs are designed to improve patient outcomes and reduce the need for long-term dialysis.

- Focus on patient outcomes and reducing dialysis needs.

- DaVita facilitated nearly 8,200 kidney transplants in 2024.

- Aligned with value-based care models.

Strategic Partnerships

DaVita's strategic partnerships shine brightly, positioning them as stars in the BCG matrix. Their collaboration with Google Cloud is a prime example, focusing on a new clinical operating system for kidney care. This partnership could improve patient outcomes and operational efficiency. Furthermore, DaVita's alliance with the American Diabetes Association reinforces their commitment to preventing chronic diseases like diabetes and kidney disease. These collaborations enhance DaVita's market position and growth potential.

- Google Cloud partnership targets a $120 billion market for kidney care services.

- The American Diabetes Association collaboration aims to impact the 37 million Americans with diabetes.

- DaVita's revenue in 2024 was approximately $12 billion, showing strong growth potential.

DaVita's strategic partnerships are stars, notably their collaboration with Google Cloud to target the $120 billion kidney care market. This partnership aims to improve patient outcomes and operational efficiency. DaVita's 2024 revenue was roughly $12 billion, showcasing significant growth potential.

| Aspect | Details |

|---|---|

| Partnership Focus | Google Cloud for kidney care, American Diabetes Association |

| Market Impact | $120B kidney care, 37M Americans with diabetes |

| 2024 Revenue | Approximately $12 billion |

Cash Cows

DaVita's U.S. dialysis services are a cash cow, generating reliable revenue because dialysis is crucial. DaVita holds a substantial market share, over 36%, securing a steady patient base. In Q4 2024, patient service revenues hit $2.881 billion, up from $2.765 billion in Q4 2023.

DaVita's outpatient dialysis centers are cash cows, providing consistent revenue. In 2024, DaVita operated 3,166 centers, with 2,657 in the U.S. These centers served about 281,100 patients. This large patient base ensures a stable, predictable cash flow for the company.

DaVita's Medicare and government reimbursements are a financial cornerstone. In 2023, 67% of revenue came from these sources, ensuring a steady cash flow. This government-backed revenue stream offers stability. Even though commercial payers have higher margins, government funding provides a solid base.

Scale Advantages in Drug Acquisition

DaVita's substantial scale enables favorable drug acquisition costs, boosting its cash flow. This advantage allows DaVita to purchase drugs at lower prices, increasing profit margins per treatment. This cost efficiency is critical, especially given changes in phosphate binder reimbursement policies. DaVita's strong financial performance highlights its ability to manage costs effectively. In 2024, DaVita reported a revenue of $12.07 billion.

- Lower drug costs enhance profitability.

- Scale translates to better negotiation power.

- Cost advantages are crucial for treatments.

- Financial performance is a key indicator.

Share Repurchase Program

DaVita's share repurchase program demonstrates financial strength and a focus on shareholder value. In 2024, the company repurchased 9.8 million shares, showcasing confidence in its future. This strategy boosts stock value and enhances returns for investors. Repurchases often indicate that a company believes its stock is undervalued.

- Share repurchases reduce the number of outstanding shares.

- This can increase earnings per share (EPS).

- It can also signal confidence from management.

- Shareholders benefit from potential price appreciation.

DaVita's dialysis services are cash cows due to stable revenue. They have a dominant market share, with over 36% in the U.S. This ensures a consistent patient base and predictable cash flow.

| Metric | 2024 Data | Details |

|---|---|---|

| U.S. Dialysis Centers | 2,657 | Outpatient centers |

| Q4 2024 Revenue | $2.881B | Patient service |

| 2024 Total Revenue | $12.07B | Annual Revenue |

Dogs

The closure of underperforming dialysis centers classifies as a 'dog' within DaVita's business portfolio, as shown in their BCG Matrix. These closures aim to reduce costs; however, they might decrease patient volume if not managed efficiently. During Q4 2024, DaVita shut down 5 U.S. dialysis centers. In Q3 2024, they recorded around $18.3 million in charges related to these closures.

A decline in U.S. dialysis treatment volumes is a worry, signaling possible market saturation or operational issues. This impacts revenue if not handled well. DaVita's recent report showed a drop in U.S. dialysis treatments, linked to reviews and closures. In Q4 2023, DaVita's U.S. dialysis treatments fell, affecting financial outcomes.

Supply chain issues, like IV fluid shortages, can hurt DaVita's business. These problems drive up costs and decrease treatments. In Q4 2024, DaVita faced a $10-20 million hit from supply chain issues, showing its vulnerability. These disruptions remain a key concern.

Regulatory and Compliance Risks

DaVita faces significant regulatory and compliance risks within the healthcare industry. Non-compliance or shifts in regulations could severely impact its operations and image. Lawsuits and government probes add to these challenges, potentially leading to considerable financial repercussions. In 2024, healthcare compliance costs are estimated to have increased by 7%. These risks classify DaVita as a "Dog" in the BCG matrix.

- Compliance costs are a rising concern.

- Legal issues pose financial threats.

- Regulatory changes can disrupt operations.

- Reputational damage is a risk.

Elevated Mortality Rates

Elevated mortality rates among dialysis patients pose a significant challenge for DaVita. This impacts patient volume and revenue. Weak volume outlook for 2025 is expected. DaVita's same-store volumes turned negative in Q3 2024 due to higher mortality.

- Mortality rates are a key concern for DaVita's financial performance.

- Negative same-store volume growth was observed in Q3 2024.

- Weak volume outlook is projected for 2025.

- Patient volume and revenue are directly affected.

DaVita's "Dogs" include underperforming centers, facing closures and revenue declines. Supply chain issues, like IV fluid shortages, and increasing compliance costs, further burden DaVita. Elevated mortality rates and regulatory risks add to the challenges.

| Category | Impact | 2024 Data |

|---|---|---|

| Center Closures | Reduced Patient Volume | 5 U.S. centers closed in Q4 |

| Supply Chain | Increased Costs | $10-20M impact in Q4 |

| Mortality | Revenue Impact | Negative same-store volume in Q3 |

Question Marks

The transition of oral drugs to dialysis benefits, effective January 1, 2025, is a question mark. This change might bring in an extra $0 to $50 million in operating income, potentially boosting revenue. However, the true financial impact is still unknown, making it a key area to watch. DaVita's 2024 revenue was approximately $12.1 billion.

DaVita's Center Without Walls™ (CWOW) platform, developed with Google Cloud, is a question mark in the BCG matrix. It uses AI and analytics to improve clinical outcomes and operational efficiency. The platform's ability to cut costs and enhance patient care is still uncertain. In 2024, DaVita invested $150 million in digital health initiatives, including CWOW. Its financial impact is still under evaluation.

DaVita's VBC expansion is a question mark in its BCG matrix. As of November 2024, $5B was at risk, aiming for $10B. Success hinges on managing patient outcomes and costs effectively. This model has high growth potential but carries risks.

Expansion into New International Markets

DaVita's international expansion, particularly in new markets like Chile, Ecuador, and Japan, presents a complex mix of opportunities and challenges, fitting the question mark quadrant. While international growth can be a star, entering these markets requires substantial upfront investment and carries inherent uncertainties. Success hinges on effectively navigating local regulations, competitive landscapes, and unique market dynamics.

- DaVita's international revenue growth was approximately 10% in 2024, indicating expansion potential.

- Market entry costs, including regulatory compliance, can range from $5 million to $20 million per country.

- The dialysis market in Japan is valued at roughly $8 billion, offering a significant opportunity.

- Competition in these markets includes both established local providers and global players.

Home Dialysis Technological Innovations

Home dialysis technology innovations fit the question mark quadrant due to high investment needs and uncertain returns. While home dialysis can improve patient outcomes, its adoption faces hurdles. The substantial investment needed and potential regulatory challenges make its success uncertain. However, DaVita's focus on innovation could lead to significant gains.

- DaVita invested $500 million in dialysis technology in 2024.

- Home dialysis adoption rates are at 15% as of late 2024.

- Regulatory approvals for new technologies can take up to 2 years.

- Improved patient outcomes can lead to reduced healthcare costs.

DaVita's question marks in the BCG matrix represent high-potential ventures with uncertain outcomes. These include oral drug benefits, digital health initiatives like CWOW, and value-based care (VBC) expansion. Investments in these areas, though substantial, face risks.

| Initiative | 2024 Investment/Revenue | Uncertainty |

|---|---|---|

| Oral Drugs | $0-$50M (Operating Income) | Financial impact unclear |

| CWOW | $150M (Digital Health) | Cost reduction/patient care |

| VBC | $5B at Risk ($10B target) | Patient outcomes, cost control |

BCG Matrix Data Sources

This DaVita BCG Matrix uses public financial statements, healthcare market analyses, and industry benchmarks for strategic accuracy.