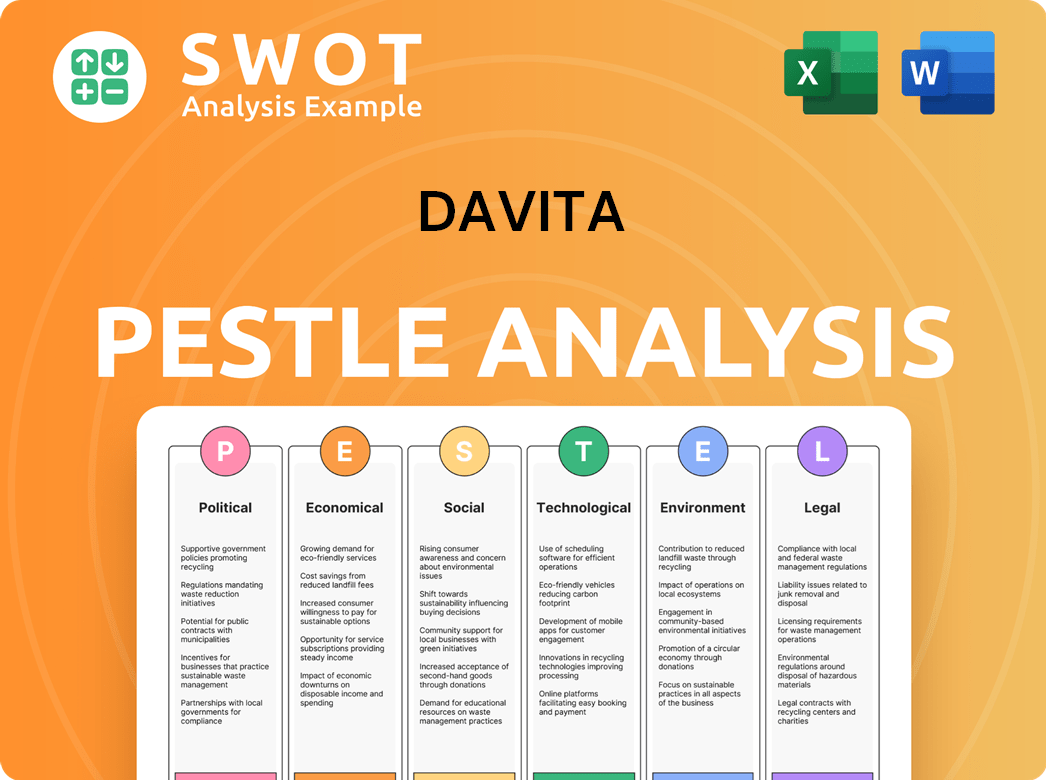

DaVita PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DaVita Bundle

What is included in the product

DaVita's PESTLE analysis dissects external macro factors impacting the company. It offers reliable evaluations, supported by data and market trends.

Allows for modifications and additions specific to DaVita's changing environment, offering personalized insights.

Preview the Actual Deliverable

DaVita PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This DaVita PESTLE analysis is designed for easy understanding and application. Each section, from Political to Environmental factors, is clearly presented. Download it instantly and leverage the insights provided. You will receive exactly what you see.

PESTLE Analysis Template

Discover how DaVita thrives amidst external pressures with our PESTLE Analysis.

We delve into political, economic, social, technological, legal, and environmental factors impacting its strategy.

Uncover market dynamics, navigate risks, and capitalize on opportunities.

Gain actionable intelligence to inform strategic decisions and investment analysis.

This in-depth analysis provides a comprehensive view of DaVita’s operating environment.

Don't miss out! Download the complete PESTLE analysis now!

Political factors

Government healthcare policies, especially for Medicare and Medicaid, heavily influence DaVita's financials. CMS updates to the ESRD PPS, including oral-only drug inclusion, are critical. These updates directly affect dialysis service reimbursement rates. For 2024, the ESRD PPS base rate is around $260, impacting DaVita's revenue.

DaVita faces a complex regulatory environment, including healthcare, privacy (like HIPAA), and fraud laws. Changes in regulations and their enforcement can greatly affect DaVita's operations and reputation. Legal challenges and government probes pose risks. In 2023, DaVita's legal and compliance expenses totaled $220 million.

Political healthcare reforms, like Medicare expansions or drug price talks, impact dialysis providers. Legislation ensuring insurance compliance with Medicare rules is crucial. In 2024, debates focused on drug pricing and access. These discussions directly affect DaVita's operations and financial outcomes. The company closely monitors political shifts for strategic planning.

Government Spending on Healthcare

Government healthcare spending, especially via Medicare and Medicaid, is pivotal for DaVita's financial health. In 2024, Medicare spending is projected at $970 billion, and Medicaid at $800 billion. These figures directly impact the reimbursement rates DaVita receives for its dialysis services, with ESRD-specific allocations being a key component. Fluctuations in these allocations can significantly affect DaVita's profitability and strategic planning.

- Medicare spending is projected at $970 billion in 2024.

- Medicaid spending is projected at $800 billion in 2024.

- ESRD-specific allocations directly affect DaVita.

Advocacy and Lobbying Efforts

DaVita actively lobbies to influence healthcare policies impacting the kidney care industry. Their efforts focus on shaping regulations like the ESRD Quality Incentive Program and payment models. They also advocate for telehealth reimbursement policies for dialysis services. In 2023, DaVita spent $1.9 million on lobbying. These actions aim to mitigate the impact of policy changes.

- Lobbying Spending: $1.9 million in 2023.

- Policy Focus: ESRD Quality Incentive Program, payment models, telehealth.

- Goal: Influence regulations to benefit kidney care services.

Political factors significantly affect DaVita through government policies on healthcare and reimbursement rates. Medicare and Medicaid spending projections for 2024 are substantial. DaVita actively lobbies to influence related regulations.

| Factor | Impact | Data (2024) |

|---|---|---|

| Government Policies | Direct impact on financials | ESRD PPS base rate around $260 |

| Regulations | Influence on operations and reputation | Legal and compliance expenses $220M (2023) |

| Healthcare Spending | Impact reimbursement | Medicare: $970B, Medicaid: $800B (projected) |

Economic factors

Overall healthcare spending in the US is projected to grow. National health expenditures are expected to increase, impacting dialysis providers like DaVita. Inflation and rising drug costs drive up medical expenses. For 2024, national health spending is estimated at $4.9 trillion, or $14,696 per person. This impacts DaVita's costs.

DaVita's financial health hinges on Medicare and commercial reimbursement rates. Medicare, a major revenue source, is subject to government policies. Commercial insurers offer higher but potentially volatile rates. In 2024, reimbursement adjustments significantly impacted DaVita's earnings. For instance, Medicare accounted for 60% of revenue, while commercial insurance provided 25%.

DaVita confronts escalating operational costs, particularly in labor and due to supply chain issues. Inflation significantly impacts healthcare, potentially reducing profit margins. To counter this, DaVita must enhance operational efficiency. For example, in 2024, the U.S. healthcare inflation rate was around 3.5%.

Patient Volume and Treatment Growth

DaVita's financial success is significantly linked to patient volume and treatment growth, which are sensitive to economic shifts. The demand for dialysis is influenced by factors such as mortality rates, transplant rates, and the prevalence of chronic kidney disease. Lower-than-projected treatment volumes can hamper long-term growth and affect facility and staff utilization.

- In 2024, DaVita reported a slight increase in dialysis treatments, reflecting stable demand.

- Transplant rates and mortality rates directly influence the patient pool.

- Economic downturns can affect patient access to care.

- Facility utilization is a key financial metric.

Investment and Growth Opportunities

Economic factors present investment and growth opportunities for DaVita. Upward revisions to financial guidance are possible, alongside expansion of services and market share via strategic investments. International business expansion is also on the table. DaVita's strong financial health supports these initiatives. The company's free cash flow yield is a key indicator of its investment capacity.

- DaVita's revenue in 2024 was $12.1 billion.

- DaVita's 2024 adjusted operating income was $1.6 billion.

- DaVita's free cash flow yield in 2024 was approximately 7%.

DaVita faces economic pressures like healthcare inflation and Medicare policies influencing revenue. It relies on patient volume, mortality, and transplant rates affected by economic shifts. Strategic investments, international expansion, and a strong financial position can offer opportunities. In 2024, DaVita’s revenue reached $12.1 billion. Free cash flow yield was around 7% in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Healthcare Inflation | Rising operational costs. | U.S. healthcare inflation 3.5% |

| Reimbursement Rates | Influence revenue, profits. | Medicare 60%, Commercial 25% |

| Patient Volume | Key for growth. | Slight treatment increase |

Sociological factors

The rising prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) significantly impacts dialysis service demand. Factors like aging populations and chronic diseases, such as diabetes, contribute to increasing kidney care needs. In 2024, over 800,000 Americans had ESRD, with projections showing continued growth. This demographic shift directly influences the market for DaVita's services.

DaVita must understand patient demographics, which includes age, existing health conditions, and where patients live, to customize care effectively. Personalized healthcare is growing, requiring services that meet diverse patient needs, including those in underserved areas. For instance, in 2024, about 37 million U.S. adults have chronic kidney disease, highlighting the importance of tailored services. Communication strategies must consider these diverse groups.

DaVita's operations are significantly influenced by health equity, focusing on equal care access. They address disparities in kidney transplantation and community-based chronic kidney disease (CKD) education. In 2024, the US spent over $4.5 trillion on healthcare, highlighting the importance of equitable access. Initiatives like these improve outcomes across diverse populations.

Lifestyle and Behavioral Factors

Lifestyle and behavioral factors significantly influence kidney disease progression and treatment efficacy. DaVita's Kidney Smart program educates patients on managing Chronic Kidney Disease (CKD) and preparing for dialysis. Patient engagement and adherence to care plans are crucial for positive outcomes. The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) reports that lifestyle changes can slow CKD progression.

- Kidney Smart program has reached over 700,000 people.

- Adherence to treatment plans can improve patient survival rates by 15-20%.

- Dietary changes impact CKD progression by up to 30%.

Community Engagement and Support

DaVita's strong community focus is a key sociological element. They cultivate a culture of community engagement, emphasizing citizen leadership. This approach aims to improve health outcomes within the communities they serve. DaVita's social responsibility includes initiatives like supporting patient advocacy groups. For instance, in 2024, DaVita invested $15 million in community health programs.

- DaVita invested $15 million in community health programs in 2024.

- They support patient advocacy groups.

- DaVita focuses on community engagement.

Sociological factors greatly influence DaVita's market. Rising CKD cases and aging populations drive demand. Personalized healthcare, like tailored services, is growing. DaVita's health equity initiatives improve outcomes.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Demographics | Aging pop., chronic diseases increase demand. | 800K+ Americans with ESRD, 37M+ with CKD. |

| Healthcare Equity | Focus on equal care access. | $4.5T US healthcare spending in 2024. |

| Community Focus | Engagement & social responsibility. | $15M invested in health programs (2024). |

Technological factors

DaVita is significantly impacted by technological advancements in kidney care. Innovation in dialysis machines and related equipment is a core focus. The goal is to improve the patient treatment experience. This is also to improve patient outcomes. The dialysis devices market is expected to reach $10.7 billion by 2029.

DaVita leverages data analytics and AI to improve patient outcomes. They use these tools for population health management and personalized care. According to a 2024 report, AI-driven predictive models enhanced early disease detection by 15%. This also leads to clinical efficiency gains.

Telemedicine and remote patient monitoring are key technological factors for DaVita. They use digital tools for virtual provider-patient interactions. This approach enhances care accessibility, especially for home dialysis patients. Wearable tech and smart sensors enable continuous health monitoring. The global telemedicine market is projected to reach $175.5 billion by 2026.

Electronic Health Records (EHR) and Integrated Platforms

DaVita's adoption of renal-specific EHR systems and platforms like Center Without Walls streamlines workflows and care coordination. This integration allows the aggregation of patient data across millions of treatments, supporting data-driven healthcare. This enhances the potential for personalized and preventive care strategies. In 2024, the EHR market is valued at over $30 billion globally, with continuous growth expected.

- EHR market is expected to reach $38 billion by 2025.

- DaVita treats approximately 250,000 patients in over 3,000 dialysis centers.

- Cloud-based platforms improve data accessibility and security.

Training and Simulation Technologies

DaVita leverages technology for advanced training. The metaverse is used for virtual training of dialysis technicians, offering a safe space to practice procedures. This boosts confidence and efficiency. In 2024, the global medical simulation market was valued at $2.4 billion, growing at a CAGR of 13%.

- Virtual reality (VR) and augmented reality (AR) simulations are increasingly used.

- This reduces costs associated with traditional training methods.

- Improved training leads to better patient outcomes.

- DaVita's investment in these technologies reflects a commitment to quality.

DaVita embraces tech in kidney care, focusing on innovation like dialysis machines, a $10.7B market by 2029. They use data analytics and AI for personalized care and early disease detection, boosting clinical efficiency. Telemedicine and EHR systems, including cloud-based platforms, enhance care accessibility.

| Technology Focus | Impact | Data |

|---|---|---|

| Dialysis Machines | Patient treatment improvement | Market: $10.7B by 2029 |

| AI & Data Analytics | Enhanced disease detection and efficiency | 15% improvement, EHR market $38B by 2025 |

| Telemedicine & EHR | Improved care accessibility and data handling | Telemedicine market $175.5B by 2026 |

Legal factors

DaVita faces strict healthcare regulations, including Medicare and Medicaid rules, impacting billing and patient care. Compliance is crucial, and changes in regulations can greatly affect DaVita's finances. In 2024, DaVita's revenue from U.S. dialysis and related lab services was approximately $11.9 billion. Any shifts in these regulations could affect this revenue stream.

DaVita must strictly adhere to fraud and abuse laws, including the Anti-Kickback Statute and Stark Law. Non-compliance can trigger legal issues, investigations, and penalties. In 2024, healthcare fraud cost the U.S. billions. The HHS recovered $1.8 billion in healthcare fraud cases in fiscal year 2024, highlighting the significance of compliance.

DaVita must strictly adhere to HIPAA to protect patient data. Breaches can lead to hefty fines; in 2024, penalties can reach millions. Effective cybersecurity is essential to avoid legal issues and maintain trust. Non-compliance can severely harm DaVita's reputation and financial standing. Legal adherence ensures patient privacy and supports operational integrity.

Antitrust Matters and Market Competition

DaVita's operations face legal scrutiny regarding antitrust matters and market competition. Acquisitions and mergers within the dialysis sector require regulatory approval to ensure fair competition. The competitive landscape, dominated by major players, can result in legal challenges, influencing market share and strategic decisions. For instance, the Federal Trade Commission (FTC) has actively investigated and challenged mergers in healthcare.

- FTC actions: The FTC has blocked mergers between dialysis providers.

- Market concentration: High market concentration can lead to antitrust concerns.

- Legal challenges: Competitors may file lawsuits alleging anti-competitive practices.

Employment and Labor Laws

DaVita, as a large employer, is subject to a complex web of employment and labor laws. These laws, which cover areas like minimum wage, overtime, and worker safety, can significantly affect its operational expenses. For example, increases in the federal minimum wage, last updated in 2009, could raise DaVita's labor costs. Any labor disputes or unionization efforts could further disrupt operations and impact profitability.

- DaVita has over 70,000 employees.

- Compliance with the Affordable Care Act (ACA) adds to labor costs.

- Unionization could impact labor negotiations and costs.

DaVita navigates strict healthcare laws, including those from Medicare and Medicaid, influencing billing. The Anti-Kickback Statute and Stark Law require stringent compliance to avoid legal repercussions. Data privacy under HIPAA and antitrust matters further shape DaVita's legal landscape, impacting operational costs.

| Legal Area | Regulation | Impact on DaVita |

|---|---|---|

| Healthcare | Medicare, Medicaid, HIPAA | Compliance costs, risk of penalties |

| Fraud & Abuse | Anti-Kickback Statute, Stark Law | Legal investigations, potential fines |

| Employment | Labor laws, minimum wage | Operational expenses, potential disputes |

Environmental factors

DaVita integrates environmental stewardship into its ESG commitments, targeting a smaller carbon footprint. These efforts support broader sustainability goals in healthcare.

Dialysis centers, such as DaVita, produce significant medical waste, including used dialyzers and contaminated supplies. Effective waste management and disposal are crucial environmental factors. Proper handling and disposal help comply with regulations and minimize environmental impact. In 2023, the global medical waste management market was valued at $14.5 billion. The market is expected to reach $20.2 billion by 2028.

Dialysis centers like DaVita have considerable energy needs. In 2024, DaVita aimed to power its global operations with 100% renewable energy. This commitment is part of a broader initiative to reduce its environmental impact. The company's focus includes reducing carbon emissions.

Water Usage in Dialysis

Water is crucial for dialysis, with substantial amounts used in treatments, posing an environmental challenge. DaVita can mitigate this impact by adopting water conservation strategies and efficient practices. This includes recycling water and using advanced filtration systems to minimize water consumption. Addressing water usage is increasingly important due to rising water scarcity concerns globally. In 2024, the healthcare sector's water footprint was under scrutiny, making these efforts even more relevant.

- Water usage in dialysis treatments is significant, driving environmental considerations.

- Implementing water conservation measures can reduce water consumption.

- Adopting efficient practices, such as water recycling, is crucial.

- Water scarcity concerns underscore the importance of these efforts.

Supply Chain Environmental Impact

DaVita's supply chain has an indirect environmental impact, primarily from sourcing and transporting medical supplies and equipment. This includes the carbon footprint associated with manufacturing and delivering items like dialysis machines, medications, and other consumables. Addressing this footprint supports DaVita's sustainability initiatives and aligns with broader environmental goals. In 2024, healthcare supply chains faced increased scrutiny regarding their environmental impact, with companies exploring greener alternatives.

- Carbon emissions from transportation and manufacturing remain a key concern.

- Sustainable sourcing practices are gaining importance.

- DaVita likely assesses its supply chain's environmental impact to improve sustainability.

- Regulatory pressures for environmental reporting continue to increase.

DaVita tackles significant medical waste and energy demands as part of its environmental strategy. Focusing on water conservation through recycling and filtration is also essential. Supply chain impacts, specifically carbon emissions from transport, are further considered for sustainability. In 2023, global medical waste management reached $14.5B; by 2028, it's projected at $20.2B.

| Environmental Aspect | DaVita's Approach | Data/Impact |

|---|---|---|

| Medical Waste | Effective management and disposal. | $14.5B (2023) medical waste mkt. |

| Energy | Commitment to renewable energy. | Aiming for 100% renewable use in 2024. |

| Water Usage | Conservation strategies and recycling. | Healthcare water footprint under scrutiny in 2024. |

PESTLE Analysis Data Sources

DaVita's PESTLE analysis utilizes diverse data sources including government publications, financial reports, healthcare industry analyses, and academic research.