Delta Air Lines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Air Lines Bundle

What is included in the product

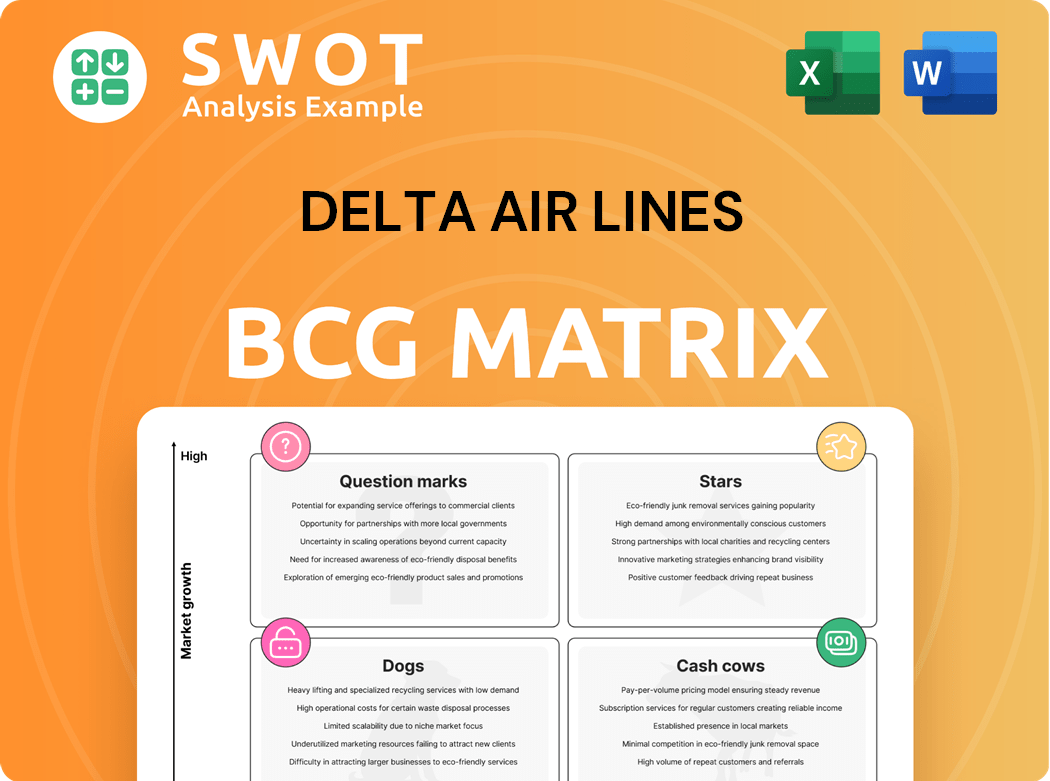

Delta Air Lines' BCG Matrix analysis spotlights investment strategies across its diverse business units.

Clean, distraction-free view optimized for C-level presentation, providing concise strategic insights.

Delivered as Shown

Delta Air Lines BCG Matrix

The BCG Matrix preview is the identical document you'll receive after purchase. Get a fully formed, ready-to-use report for strategic planning.

BCG Matrix Template

Delta Air Lines navigates a complex market with its diverse services. Understanding its position through the BCG Matrix is crucial for investors and stakeholders. This framework categorizes Delta's offerings as Stars, Cash Cows, Dogs, or Question Marks. This provides an overview of where the company should invest. The matrix helps identify growth drivers and potential weaknesses.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Delta's strong international routes are stars, especially those recovering post-pandemic. These routes generate significant revenue and hold a strong market position. In 2024, international passenger revenue increased, reflecting high demand. Sustained investment, including fleet upgrades, is key to maintaining their star status.

Delta's SkyMiles, a key asset, boasts a vast, engaged membership. This loyalty program boosts retention and offers valuable marketing data. SkyMiles' revenue hit $6.8 billion in 2023, a 20% rise. Enhancements are crucial for sustained appeal and revenue gains.

Delta's premium cabins, like Delta One and First Class, serve high-value clients. These services have higher margins, boosting profitability. In 2024, Delta's premium revenue increased by 15%. Investments in lounges and amenities are key. This helps maintain a competitive advantage in the premium market.

Strategic Airline Alliances

Delta Air Lines strategically forms alliances to broaden its network and enhance customer travel. Partnerships, like SkyTeam, offer benefits such as boosted passenger numbers and reduced costs. These alliances are essential for Delta's global competitiveness, with SkyTeam carrying over 630 million passengers in 2023. Actively managing these partnerships is crucial.

- SkyTeam alliance members include Aeromexico, Air France, and Korean Air.

- Delta's alliance strategy aims for global reach and improved service.

- Alliances help optimize routes and share resources.

- In 2023, Delta's revenue reached $50.5 billion.

Cargo Transportation Services

Delta's cargo transportation services represent a "Star" within the BCG Matrix, showing high growth and high market share. This segment benefits from the expansion of e-commerce and global trade. Leveraging Delta's existing infrastructure diversifies revenue streams.

- In 2024, Delta Cargo saw a revenue increase, reflecting the growing demand for air freight.

- Investments in cargo capacity and logistics are vital for sustaining this growth.

- Delta's cargo operations contribute significantly to overall profitability.

Delta Cargo, identified as a "Star," shows high growth and a substantial market share within the BCG Matrix. This segment profits from e-commerce and expanding global trade. Delta's infrastructure also helps to diversify revenue streams effectively.

| Metric | 2023 Data | 2024 Data (Projected) |

|---|---|---|

| Cargo Revenue | $1.1 billion | $1.3 billion |

| Cargo Growth | 8% | 10% |

| Market Share | 12% | 13% |

Cash Cows

Delta's well-trodden domestic US routes are cash cows. These established routes, linking major cities, see steady demand. With mature markets, investment needs are lower. In 2024, Delta's domestic load factor was around 85%, showing strong demand. Focus is on efficiency and happy customers to boost profits.

Delta's Maintenance, Repair, and Overhaul (MRO) services are a cash cow, providing consistent revenue. Delta's MRO services generate a stable income stream by using its technical expertise. The company retains clients by maintaining high service quality and competitive pricing. In 2024, Delta's MRO revenue was approximately $1.5 billion.

Delta Air Lines leverages ancillary revenue streams, including baggage fees and seat upgrades, to boost profitability. These streams, with minimal investment, offer high margins. In Q3 2024, Delta's total revenue reached $15.5 billion, with ancillary revenue playing a key role. Focus on optimizing pricing and enhancing customer experience is crucial for maximizing these revenue streams.

Hub and Spoke Network

Delta Air Lines' hub-and-spoke network is a cash cow, connecting many smaller cities to major hubs, ensuring efficient passenger flow and maximizing aircraft use. This well-established network offers a competitive advantage, consistently generating substantial revenue. Delta focuses on optimizing network scheduling and managing hub operations efficiently. The airline's revenue in 2024 reached $59.58 billion.

- Delta operates hubs in cities like Atlanta, Detroit, and Minneapolis.

- The network's efficiency drives strong profitability.

- Hub operations generate consistent, reliable income.

- This model supports Delta's financial stability.

Brand Reputation

Delta Air Lines' robust brand reputation is a significant cash cow, fueled by its reliability and customer service. This strong image, cultivated through years of consistent performance and marketing, draws in and keeps customers loyal. Delta's commitment to maintaining high operational standards is crucial for sustaining its brand value. In 2024, Delta's customer satisfaction scores remained high, reflecting its brand strength.

- Delta's brand value is estimated at billions of dollars.

- Customer loyalty programs contribute significantly to revenue.

- Marketing investments support brand image.

- Operational excellence enhances brand perception.

Delta's frequent flyer program, SkyMiles, is a cash cow, providing consistent revenue through partnerships and miles redemption. SkyMiles fosters customer loyalty, driving repeat business. Delta's partnerships with companies like American Express generate significant revenue. In 2024, SkyMiles revenue was approximately $7 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | SkyMiles Program | ~$7 billion |

| Loyalty | SkyMiles Members | ~100 million |

| Partnerships | Amex, Others | Significant Revenue |

Dogs

Older, less fuel-efficient aircraft in Delta's fleet represent "dogs" due to high operating costs and lower appeal. These planes, demanding more maintenance, drag down profitability. Delta's strategy involves phasing them out. In 2024, Delta aimed to retire some older Boeing 757s and 767s.

Routes with consistently low demand and profitability are classified as dogs. These routes drain resources without significant revenue contribution. For instance, in 2024, Delta might evaluate routes with less than 60% load factor. Careful assessment and potential discontinuation of these routes are crucial to optimize profitability. Consider routes that consistently underperform, impacting the overall financial performance.

Aircraft with outdated in-flight entertainment systems are considered dogs, especially on long routes. These systems worsen the passenger experience, impacting satisfaction. Delta invested $4 billion from 2017-2024 to upgrade its cabins, including entertainment. This upgrade is essential to stay competitive in 2024.

Unprofitable Regional Partnerships

Unprofitable regional partnerships at Delta Air Lines, which don't bring in enough passengers, fall into the "dogs" category. These partnerships drain resources and hurt the network's efficiency. Delta needs to think about whether to keep these partnerships or end them. For instance, in 2024, regional carrier SkyWest, which partners with Delta, saw its stock price fluctuate, indicating financial pressures.

- SkyWest's stock experienced volatility in 2024.

- Unprofitable routes strain Delta's resources.

- Inefficient partnerships hurt the network's performance.

- Delta should re-evaluate these regional deals.

Niche Cargo Services with Declining Demand

Specific niche cargo services facing declining demand and profitability fit the "Dog" category for Delta Air Lines. These services consume resources without significantly boosting revenue. For example, in 2024, Delta's cargo revenue decreased by 10% due to reduced demand in certain specialized areas. The airline may consider discontinuing these services to improve overall financial performance.

- Declining demand and profitability characterize these services.

- They tie up resources without substantial revenue generation.

- Careful evaluation and potential discontinuation are advised.

- Delta's cargo revenue decreased in 2024, indicating a problem.

Delta's "Dogs" include older aircraft and underperforming routes, straining resources. Outdated in-flight entertainment and unprofitable partnerships also fall into this category. In 2024, Delta aimed to improve financial performance by focusing on these areas.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Older Aircraft | High operating costs, low appeal | Boeing 757/767 retirements |

| Underperforming Routes | Low demand, low profitability | Routes with <60% load factor |

| Outdated Systems | Poor passenger experience | Ongoing cabin upgrades |

Question Marks

New international routes for Delta Air Lines, especially in emerging markets, are question marks due to uncertain demand. These routes offer high growth potential but also high risk. Aggressive marketing is essential to boost awareness. Delta's international revenue increased by 24% in 2024.

Delta Air Lines' forays into innovative digital services, including personalized travel tools and AI support, place them in the question mark quadrant of the BCG matrix. These initiatives aim to boost customer experience and create new revenue channels. In 2024, Delta invested $1.5 billion in technology and digital platforms. Success hinges on monitoring and refining these services.

Delta's SAF investments are question marks. SAF can cut emissions, but high costs and limited supply are hurdles. Delta invested $2.5 million in SAF in 2023. SAF use rose 60% in 2024, yet represents a small portion of total fuel consumption. Policy support is crucial for SAF's future.

Partnerships with Electric Vertical Take-Off and Landing (eVTOL) Companies

Partnerships with eVTOL companies fall under the "Question Marks" category for Delta Air Lines' BCG Matrix. These ventures are high-growth, high-risk opportunities. Regulatory hurdles and public acceptance of eVTOLs are still developing, creating uncertainty. Delta needs to carefully assess potential partners and market dynamics. The eVTOL market is projected to reach $12.9 billion by 2030.

- High Growth Potential: The eVTOL market could reshape short-distance travel.

- Regulatory Risks: FAA approvals and safety standards are crucial.

- Market Uncertainty: Consumer adoption and demand are yet to be fully realized.

- Strategic Partnerships: Collaboration is key to mitigate risks and leverage expertise.

Expansion into New Cargo Markets

Venturing into new cargo markets, especially those demanding specialized handling, positions Delta Air Lines as a question mark in the BCG matrix. These markets promise high growth, but demand substantial investments in infrastructure and specialized skills. Successful expansion hinges on comprehensive market research and forming strategic partnerships to navigate complexities. Delta's cargo revenue in 2023 was a significant portion of its overall revenue, indicating the importance of this segment [3].

- High Growth Potential: New cargo markets offer opportunities for substantial revenue increases.

- Investment Needs: Requires significant capital for infrastructure, such as specialized storage and handling equipment.

- Strategic Partnerships: Collaboration is crucial to navigate logistical and regulatory complexities.

- Market Research: Thorough analysis is essential to understand demand and tailor services.

Delta's cargo expansion is a question mark due to high growth prospects in specialized markets. These markets demand investments in infrastructure and skills. Strategic partnerships and market research are key. In 2024, cargo revenue increased by 10%.

| Aspect | Details | 2024 Data |

|---|---|---|

| Growth Potential | New cargo markets offer substantial revenue increases. | Cargo revenue grew by 10% |

| Investment Needs | Requires capital for infrastructure. | Significant capital investment |

| Strategic Partnerships | Collaboration for logistical complexities. | Partnerships being formed |

BCG Matrix Data Sources

Our Delta BCG Matrix relies on financial data, market trends, and competitive analysis from industry reports and expert opinions.