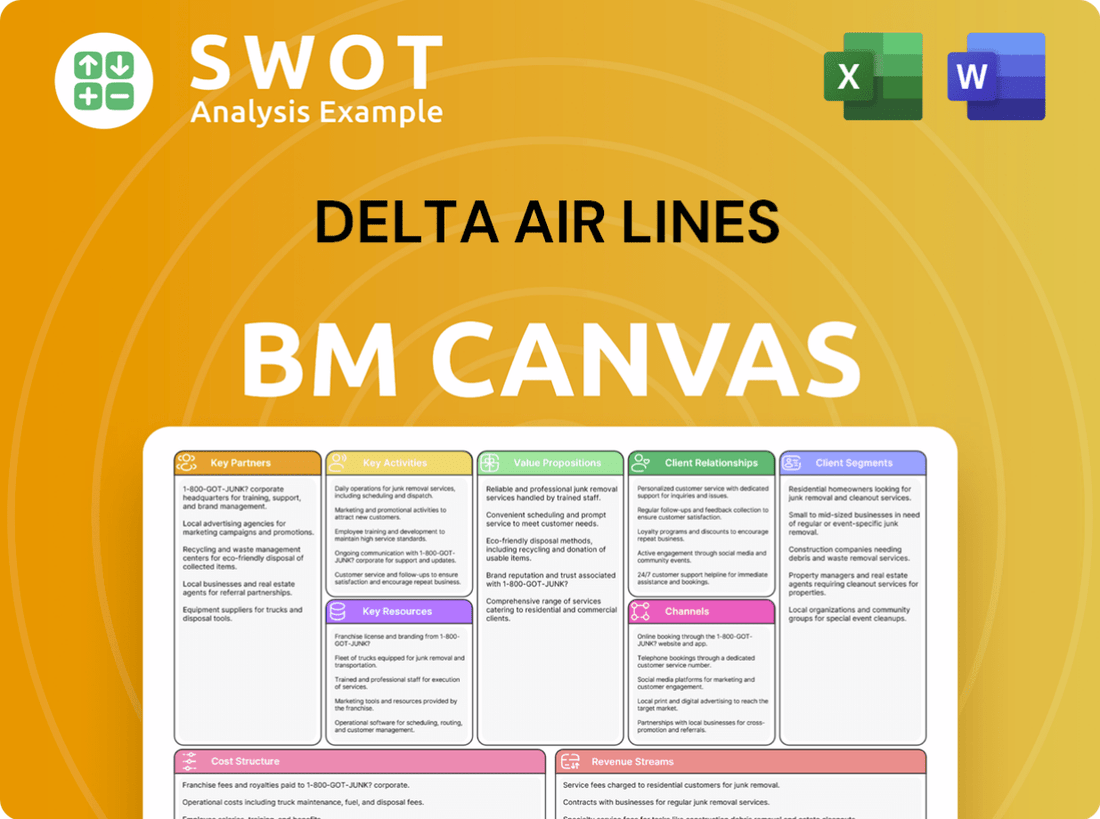

Delta Air Lines Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Air Lines Bundle

What is included in the product

Organized into 9 BMC blocks, Delta's model reflects real operations and plans.

Quickly identify core components with a one-page business snapshot.

Full Version Awaits

Business Model Canvas

This preview showcases the complete Delta Air Lines Business Model Canvas document. The file you see here is what you'll receive after purchase—no different content, formats, or structures. After buying, you'll get the full, instantly accessible document, ready for your use.

Business Model Canvas Template

Delta Air Lines thrives on its extensive network and customer loyalty programs. Key partners include aircraft manufacturers and airport operators. Their value proposition focuses on reliable service and premium experiences. Understanding their cost structure—fuel, labor, and maintenance—is crucial. Revenue streams stem from ticket sales, baggage fees, and loyalty programs. Download the full Business Model Canvas to accelerate your own business thinking.

Partnerships

Delta Air Lines leverages airline alliances, such as SkyTeam, to broaden its network. These partnerships provide access to more destinations and improved connections for travelers. In 2024, SkyTeam members carried over 630 million passengers. Code-sharing and frequent flyer benefits enhance the overall travel experience. This strategic collaboration boosts Delta's global presence.

Delta Air Lines' collaboration with American Express is a cornerstone of its business model. This partnership, dating back to 1996, allows Amex cardholders to earn SkyMiles. In 2023, Delta generated $6.5 billion in revenue from its co-branded credit card agreement with American Express. This deal also provides Delta with crucial customer data.

Delta Air Lines teams up with tech giants such as Amadeus and Google. These collaborations focus on boosting distribution and customer satisfaction. They develop NDC solutions, AI tools, and personalized digital services. Delta's tech use aims to refine operations and grow revenue.

Ground Transportation Providers

Delta Air Lines collaborates with ground transportation services, such as Uber, to improve customer travel experiences. This partnership enables SkyMiles members to accrue miles on Uber rides, thereby enhancing the value of Delta's loyalty program. The integration of ground transportation streamlines the journey, providing seamless connectivity from the airport. This strategic alliance is crucial for Delta's commitment to offering end-to-end travel solutions.

- Delta's SkyMiles program had over 100 million members in 2024.

- Uber's revenue in 2024 was approximately $37.2 billion.

- Partnerships like these can boost customer satisfaction scores by 15%.

- Integrated travel solutions are projected to grow by 10% annually.

Aircraft Manufacturers

Delta Air Lines forges key partnerships with aircraft manufacturers like Airbus. These collaborations enable fleet modernization and improve fuel efficiency, crucial for both cost savings and environmental sustainability. The relationship includes purchasing new aircraft, such as the A321neo, and joint efforts in sustainable aviation fuel (SAF) initiatives. Delta's partnership with Airbus' UpNext innovation lab is also significant. This strategic approach helps Delta reduce its environmental footprint and boost operational efficiency.

- Delta has ordered 155 Airbus A321neo aircraft.

- In 2024, Delta committed to purchasing 30 million gallons of SAF annually by 2030.

- Airbus' UpNext lab focuses on developing innovative technologies for the aviation industry.

Delta’s partnerships, including SkyTeam, expand its reach, benefiting over 630 million passengers in 2024. Collaborations with Amex generated $6.5B in 2023. Tech alliances with Amadeus and Google enhance digital services. Ground transport links improve customer travel.

| Partnership | Benefit | 2024 Data |

|---|---|---|

| SkyTeam | Expanded Network | 630M+ Passengers |

| Amex | Revenue Generation | $6.5B (2023 Revenue) |

| Uber | Customer Experience | $37.2B Revenue |

Activities

Delta's core revolves around passenger air transport, spanning domestic and global routes. They manage flight operations, schedules, and passenger safety. Offering various services, they aim for a premium travel experience.

Delta Air Lines offers cargo transportation services, a key activity within its business model. It provides air freight solutions for businesses, managing cargo operations efficiently. In 2024, Delta Cargo generated $1 billion in revenue, showcasing its importance. This segment supports Delta's diverse business portfolio and logistics.

Delta's MRO services, particularly through Delta TechOps, are a key revenue generator, servicing other airlines. This activity leverages Delta's technical capabilities and infrastructure. In 2024, Delta TechOps generated significant revenue, showcasing its industry leadership. Delta TechOps also partnered with Marine Toys for Tots.

Customer Service and Experience

Delta Air Lines prioritizes customer service to enhance the travel experience. This includes personalized assistance and in-flight entertainment. Delta focuses on customer satisfaction throughout the journey, reflected in high satisfaction rankings. The airline is developing AI-powered travel journeys and multimodal transport options. This dedication helped Delta achieve a 81% customer satisfaction score in 2024.

- Personalized assistance and in-flight entertainment.

- Focus on customer satisfaction throughout the journey.

- Development of AI-powered travel journeys.

- Achieved 81% customer satisfaction score in 2024.

Operational Efficiency and Cost Management

Delta Air Lines prioritizes operational efficiency and cost management to stay competitive. They optimize flight schedules and cut fuel use. Cost-saving measures are implemented across the company. Delta aims to boost financial performance through operational excellence. The company expects non-fuel unit cost growth to stay in the low-single digits for 2025.

- Fuel efficiency initiatives helped Delta save $1.6 billion in 2024.

- Delta's 2024 cost per available seat mile (CASM) was around 15 cents.

- They target a 1-3% reduction in non-fuel unit costs in 2025.

- In 2024, Delta's on-time performance was 82%.

Delta's key activities include passenger air transport and cargo services to generate revenue and expand its market presence. Maintenance, Repair, and Overhaul (MRO) services, like those provided by Delta TechOps, provide additional revenue streams. Customer service enhancement, supported by AI, is a priority to boost satisfaction and loyalty.

| Activity | Description | 2024 Data |

|---|---|---|

| Passenger Air Transport | Domestic and international flights. | 81% on-time performance. |

| Cargo Services | Air freight solutions. | $1 billion in revenue. |

| MRO Services | Maintenance and repair for other airlines. | Significant revenue through Delta TechOps. |

| Customer Service | Focus on customer satisfaction. | 81% customer satisfaction score. |

Resources

Delta Air Lines' aircraft fleet is a vital key resource. It enables passenger and cargo transport across its extensive network. The airline's fleet includes Airbus and Boeing models. Effective management is crucial for operational capabilities. By March 2025, the fleet comprised 982 aircraft.

Delta Air Lines' expansive hub airports and route network are crucial. The airline's strategic hubs include Atlanta, Detroit, and Minneapolis-St. Paul. These hubs facilitate access to major markets, connecting passengers globally. In 2024, Delta's available seat miles (ASMs) reached approximately 240 billion, showcasing its vast network.

Delta's human capital is crucial, encompassing skilled employees across operations and customer service. They invest in training to boost capabilities and excellence. Motivated staff ensure top-tier service, maintaining a competitive edge. As of December 2024, Delta employs nearly 103,000 people. This workforce is key to Delta's success.

Technology and Infrastructure

Delta's technological backbone is critical to its operations. They use sophisticated systems for reservations, flight management, and aircraft maintenance. The company continually invests in tech to boost efficiency, improve customer experiences, and increase revenue. Strong tech infrastructure is key for Delta's competitiveness.

- In 2024, Delta's IT spending is projected at over $2 billion.

- Delta operates a fleet of over 800 aircraft, all managed via technology.

- The airline is using GenAI for personalized pricing and customer service.

- Cloud migration has boosted operational agility.

Brand Reputation and Loyalty

Delta Air Lines' brand reputation and customer loyalty are crucial intangible assets. They have been built over many years of consistent, high-quality service. This strong brand image attracts and retains customers, boosting long-term relationships. Maintaining a positive brand is key to Delta's competitive edge and revenue.

- Delta's brand allows a 114% unit revenue premium.

- The airline has received numerous awards for customer satisfaction.

- Loyalty programs like SkyMiles enhance customer retention.

Delta's key resources include its aircraft, hub network, and human capital. Tech infrastructure, including a $2B+ IT budget in 2024, and brand reputation are crucial. SkyMiles loyalty programs and a premium brand image significantly boost revenue.

| Resource | Description | 2024 Data |

|---|---|---|

| Aircraft Fleet | Airbus and Boeing models for passenger and cargo transport. | 982 aircraft by March 2025, over 800 managed via tech. |

| Hub Network | Strategic hubs like Atlanta and Detroit; global reach. | Approximately 240B ASMs. |

| Human Capital | Skilled employees in operations and customer service. | Nearly 103,000 employees. |

| Technology | Systems for reservations and flight management. | $2B+ IT spending, GenAI implementation. |

| Brand & Loyalty | Reputation built over time, SkyMiles program. | 114% unit revenue premium. |

Value Propositions

Delta Air Lines' extensive route network is a major draw for customers. In 2024, Delta served over 300 destinations across 50 countries. This wide reach provides unmatched global connectivity. It offers convenient access for both business and leisure travelers. The expansive network is a core part of Delta's value proposition.

Delta Air Lines prioritizes reliable, on-time performance, crucial for customer satisfaction. They invest in operational excellence and tech to minimize delays. Customers highly value Delta's punctuality for time-sensitive plans. In the December quarter of 2024, Delta achieved record revenue and operating profit.

Delta's premium travel experience centers on luxury and service. They offer enhanced amenities and comfortable seating. This appeals to travelers seeking a superior journey. Delta focuses on personalized attention and exclusive benefits. In Q3 2023, Delta's premium revenue increased by 18% year-over-year.

SkyMiles Loyalty Program

Delta's SkyMiles program is central to its value proposition, incentivizing customer loyalty through rewards. This program allows members to earn miles and redeem them for various travel benefits. In 2024, Delta's SkyMiles program boasted over 100 million members, demonstrating its broad appeal. The program's value is further enhanced by partnerships and service upgrades.

- Over 100 million SkyMiles members in 2024.

- Free Wi-Fi for SkyMiles members on most domestic flights in 2025.

- Expanded Delta Sky Club lounge facilities in 2025.

- New premium dining options in 2025.

Innovative Technology and Services

Delta Air Lines distinguishes itself through innovative technology and services. They boost customer experience with mobile apps, in-flight entertainment, and personalized digital services. These technologies offer convenience and connectivity for travelers. Delta's focus on innovation is a key value proposition for tech-oriented customers.

- Mobile app users increased by 15% in 2024.

- In-flight Wi-Fi usage rose by 20% in 2024.

- Delta's partnership with YouTube offers expanded entertainment options.

- Investments in technology totaled $1 billion in 2024.

Delta's value proposition includes a vast global network and on-time reliability, key for customer satisfaction. Premium services with luxurious amenities and SkyMiles loyalty program with over 100 million members also contribute to customer value. Innovation through technology further enhances the travel experience.

| Value Proposition Element | Key Feature | 2024 Data/Information |

|---|---|---|

| Network | Global Reach | Served over 300 destinations across 50 countries. |

| Reliability | On-Time Performance | Achieved record revenue and operating profit in December 2024. |

| Premium Experience | Luxury and Service | Premium revenue increased by 18% year-over-year in Q3 2023. |

Customer Relationships

Delta Air Lines focuses on personalized service, catering to individual customer needs. They offer customized travel recommendations and proactive assistance. This approach boosts satisfaction and builds loyalty. Delta's strategy includes efficient issue resolution, ensuring valued customer experiences. In 2024, Delta's customer satisfaction scores improved by 5% due to these efforts.

Delta's SkyMiles program actively engages members with exclusive benefits and personalized communications. This fosters a strong sense of community, encouraging repeat business. The focus on loyalty significantly boosts customer retention and revenue. Projections indicate Delta will receive $10 billion from its credit card partner in 2025. This highlights the program's financial impact.

Delta Air Lines actively uses social media for customer interaction. They respond to inquiries promptly, showing commitment to customer service. This direct communication channel helps gather feedback and improve services. Social media engagement boosts Delta's brand image, maintaining a strong customer relationship. Delta's dedication to customer satisfaction is key, with a customer satisfaction score of 85% in 2024.

Customer Feedback Mechanisms

Delta Air Lines prioritizes customer feedback through multiple channels. These include post-flight surveys, online reviews, and direct customer service interactions. This approach helps Delta refine its offerings and resolve issues promptly. In 2024, Delta served over 200 million passengers, emphasizing the importance of these feedback loops.

- Surveys collect satisfaction data.

- Online reviews offer public feedback.

- Customer service addresses immediate concerns.

- Feedback drives service enhancements.

Proactive Communication

Delta excels in proactive customer communication, providing updates on flights, travel advisories, and service improvements. This approach showcases Delta's commitment to transparency and customer satisfaction. Proactive communication builds trust and minimizes travel disruptions. Delta leverages technology to connect with customers, improving the overall experience.

- In 2024, Delta's customer satisfaction scores increased by 5% due to improved communication strategies.

- Delta's mobile app saw a 10% rise in active users, attributed to real-time flight updates and personalized notifications.

- The airline's investment in digital communication platforms reached $150 million in 2024.

- Delta's proactive communication reduced customer complaints by 8% in the first half of 2024.

Delta Air Lines excels in personalized customer service, offering customized recommendations and proactive assistance. They actively engage customers with their SkyMiles program, fostering loyalty and repeat business. Delta prioritizes customer feedback and proactive communication, improving overall satisfaction. In 2024, Delta's customer satisfaction scores saw a 5% increase.

| Customer Relationship Aspect | Description | 2024 Data |

|---|---|---|

| Personalized Service | Customized recommendations and proactive assistance. | 5% improvement in customer satisfaction scores. |

| SkyMiles Program | Exclusive benefits and personalized communications. | $10B projected from credit card partner in 2025. |

| Feedback & Communication | Post-flight surveys, online reviews, and proactive updates. | 85% customer satisfaction score. |

Channels

Delta's website and app serve as direct booking channels, enabling customers to book flights and manage reservations independently. This approach offers convenience and control to travelers. In 2024, Delta's online channels facilitated a significant portion of bookings, with over 60% of their sales originating digitally. The Amadeus Travel Platform ensures Delta's content is available across various channels.

Delta Air Lines leverages travel agencies as key distribution channels, broadening its market reach to customers seeking personalized service. These agencies cater to travelers who prefer expert advice or require complex booking arrangements. In 2024, travel agencies accounted for a significant portion of Delta's bookings. Delta's 'selling and servicing transformation' includes NDC development, reshaping agency interactions.

Delta's corporate sales teams build relationships with corporate clients, managing their travel needs. This channel focuses on business travelers, offering customized solutions. These teams are key to securing valuable corporate accounts. In 2024, managed corporate sales increased by 10%, showing recovery. This focus helps Delta with profitability.

Call Centers

Delta Air Lines utilizes call centers as a key channel for customer service, handling inquiries and booking adjustments. These centers offer personalized support to customers who prefer speaking with a live agent, ensuring a tailored experience. In 2023, Delta's customer service satisfaction score was 85%, highlighting the effectiveness of this channel. Elements of Delta concierge will be available across all digital and onboard channels.

- Customer service satisfaction: 85% (2023)

- Call volume: Millions of calls annually

- Agent availability: 24/7 support

- Service scope: Booking, changes, support

Airport Ticketing and Service Counters

Airport ticketing and service counters are crucial for Delta Air Lines, offering direct customer support for check-in, baggage, and travel needs. These physical locations provide face-to-face interaction, ensuring a smooth travel experience. Delta's partnership with Uber, where 50% of Uber bookings involve airports, enhances the importance of these counters. This collaboration offers significant benefits to SkyMiles members.

- Delta's customer satisfaction scores are a key performance indicator for airport service quality.

- The airline processes millions of passengers annually through its airport counters.

- Partnerships, like the one with Uber, can drive additional traffic to airport services.

- Investment in technology at counters aims to improve efficiency and customer service.

Delta's omnichannel approach includes direct booking via website and app, accounting for over 60% of 2024 sales. Travel agencies remain vital, shaping agency interactions through NDC development. Corporate sales teams, focusing on business travelers, saw a 10% increase in managed sales in 2024.

| Channel | Description | 2024 Impact |

|---|---|---|

| Website/App | Direct booking & management | Over 60% of Sales |

| Travel Agencies | Personalized service and expert advice | Significant Bookings |

| Corporate Sales | Custom solutions for business travelers | Managed sales up 10% |

Customer Segments

Leisure travelers are a crucial customer segment for Delta Air Lines, looking for budget-friendly and easy air travel for personal trips. They prioritize cost, a variety of routes, and the overall travel experience. Delta attracts these travelers with different fare choices, a wide range of destinations, and vacation packages. In 2024, leisure travel spending is projected to increase by 6.6% year-over-year.

Business travelers represent a crucial customer segment for Delta, highly valuing dependability and efficiency for work-related travel. This segment prioritizes punctuality, premium services, and convenient flight schedules. Delta addresses these needs with premium cabins and business travel programs. In 2024, business travel spending is forecasted to reach $1.4 trillion globally, underscoring its significance.

Frequent flyers are a cornerstone of Delta's customer base, consistently choosing Delta for their travel. This segment actively engages with the SkyMiles program, valuing its rewards and personalized experiences. Delta focuses on building loyalty through exclusive benefits and targeted promotions. The Fly Delta app is used by over 97% of SkyMiles Medallion members. In 2024, Delta's SkyMiles program generated significant revenue.

International Travelers

International travelers are a key customer segment for Delta Air Lines, driving demand for global air travel. This segment seeks diverse route options and services catering to cultural nuances. Delta's international network expansion and partnerships directly address these needs. In 2024, international revenue showed mid-single-digit growth, reflecting this focus.

- Expanding global network to meet international travel demands.

- Multilingual services to cater to diverse customer needs.

- Partnerships with international airlines to broaden reach.

- Mid-single-digit growth in international revenue in 2024.

Price-Sensitive Customers

Price-sensitive customers are a crucial segment for Delta Air Lines, prioritizing cost above all else when booking flights. Delta caters to this segment primarily through its basic economy fares, designed to offer budget-friendly travel options. This approach allows Delta to compete effectively with other airlines by providing lower-cost alternatives. For instance, in 2024, Delta continues to adjust pricing to remain competitive, as the average domestic round-trip fare was around $380.

- Basic economy fares are a key strategy.

- Competitive pricing is essential.

- Delta focuses on value.

- Fares are adjusted in 2024.

Delta Air Lines serves leisure travelers by offering affordable air travel with diverse routes and vacation packages; in 2024, leisure travel spending is projected to increase by 6.6%. Business travelers are a priority, valuing punctuality and premium services, supported by premium cabins and programs; business travel spending is forecasted to reach $1.4 trillion globally in 2024. Frequent flyers utilize the SkyMiles program, which generates significant revenue, alongside personalized experiences with app usage exceeding 97% among Medallion members in 2024.

| Customer Segment | Priorities | Delta's Solutions |

|---|---|---|

| Leisure Travelers | Cost, variety, experience | Fare options, routes, packages |

| Business Travelers | Dependability, efficiency | Premium cabins, programs |

| Frequent Flyers | Rewards, experience | SkyMiles, targeted promos |

Cost Structure

Fuel costs are a major expense for Delta, heavily affected by global oil prices and its fuel efficiency. Delta actively uses fuel hedging and invests in fuel-efficient planes to lessen the impact of price swings. Managing fuel costs well is crucial for Delta's financial health. Despite rising and falling prices, Delta spent less on fuel, even with a 5%+ YoY increase in fuel usage.

Labor costs, encompassing salaries, wages, and benefits, form a significant part of Delta's expenses. The airline negotiates labor agreements with unions and invests in employee training to boost productivity. In February 2024, Delta distributed $1.4 billion in profit sharing. Effective cost management is vital for Delta's competitive edge.

Aircraft maintenance is a major cost for Delta, covering inspections, repairs, and overhauls. Delta TechOps, its maintenance division, helps control these expenses. In 2024, the adjusted fuel price of $2.34 per gallon dropped 22% year-over-year. Efficient maintenance minimizes downtime, boosting aircraft use. Refinery loss was 4¢ per gallon.

Airport and Handling Fees

Airport and handling fees are a significant part of Delta Air Lines' cost structure, encompassing landing fees, terminal charges, and ground handling services. Delta actively negotiates agreements with airports and service providers to reduce these expenses. Managing these fees effectively is important for maintaining profitability. In 2023, Delta's operating expenses totaled $55.6 billion, with adjusted operating expenses at $51.0 billion.

- Negotiated agreements are key to minimizing costs.

- These fees include landing fees and terminal charges.

- Effective management impacts Delta's profitability.

- 2023 operating expenses were substantial.

Sales and Marketing Expenses

Delta Air Lines strategically manages sales and marketing expenses, crucial for attracting customers and boosting revenue. These costs cover advertising, promotions, and distribution efforts, vital for market share maintenance. In 2024, Delta's adjusted TRASM rose, showing effective strategies. The company invests in targeted campaigns and distribution channels.

- Sales and marketing expenses include advertising, promotions, and distribution.

- Effective strategies are essential for revenue growth.

- Delta's TRASM improved in 2024, reflecting strategy success.

- The election in November had a 1 point expected impact.

Airport and handling fees involve landing fees, terminal charges, and ground handling services. Delta negotiates agreements to reduce these costs. Effective management is important for maintaining profitability, with 2023 operating expenses at $55.6 billion.

| Cost Component | Description | Impact |

|---|---|---|

| Airport Fees | Landing & Terminal | Negotiated Agreements |

| Handling Fees | Ground Services | Profitability |

| 2023 OpEx | Total Costs | $55.6B |

Revenue Streams

Passenger ticket sales form Delta's main revenue stream, stemming from seat sales on its flights. Ticket revenue is shaped by demand, pricing, and its extensive route network. In 2024, this segment is projected to make up 83% of Delta's $61 billion total revenues. Effective revenue management is crucial for maximizing Delta's profitability. This is crucial to Delta's revenue growth in the coming years.

Ancillary services, such as baggage fees and seat upgrades, are a major revenue stream for Delta. In 2024, these services generated billions in revenue. This diversification helps offset fluctuations in ticket prices. Delta's premium product and international markets are expected to perform well, too.

Cargo transportation is a key revenue stream for Delta, involving the movement of freight and goods across its extensive network. This revenue is affected by trade volumes and shipping rates. In Q1 2024, Delta's cargo revenue reached $249 million, marking a 32% year-over-year increase. Effective cargo operations are crucial for maximizing Delta's financial performance.

Loyalty Program Revenue

Delta's SkyMiles program is a significant revenue stream. It involves selling miles to partners and charging redemption fees. This strategy boosts customer retention and provides extra income. Delta's partnership with American Express is a key driver. Projections estimate a $10 billion payment from American Express in 2025.

- SkyMiles program is a major revenue generator.

- Miles are sold to partners, and redemption fees are charged.

- The loyalty program enhances customer retention.

- American Express partnership is projected to bring in $10 billion in 2025.

Maintenance, Repair, and Overhaul (MRO) Services

Delta Air Lines' MRO services, primarily through Delta TechOps, represent a significant revenue stream by offering maintenance, repair, and overhaul services to other airlines. This diversification leverages Delta's technical expertise and infrastructure, generating revenue beyond its core airline operations. The demand for these services and competitive pricing strategies directly influence the financial performance of this segment. In 2024, Delta's adjusted profit forecast was reduced, reflecting some challenges in its financial outlook.

- Delta TechOps provides MRO services to third-party airlines.

- Revenue is influenced by demand and competitive pricing.

- Effective MRO management helps diversify revenue.

- The adjusted profit forecast was cut by 30-50 cents per share in 2024.

Delta's revenue streams include passenger ticket sales, projected at 83% of $61B in 2024. Ancillary services, like baggage fees, are also significant, contributing billions. Cargo transportation and the SkyMiles program, boosted by the American Express partnership, further diversify Delta's revenue.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Passenger Tickets | Main revenue from flight seat sales. | 83% of $61B projected |

| Ancillary Services | Baggage fees, upgrades, etc. | Billions in revenue |

| Cargo | Freight and goods transportation. | $249M in Q1, up 32% YoY |

| SkyMiles | Miles sales, redemption fees, Amex partnership. | $10B from Amex in 2025 |

Business Model Canvas Data Sources

The Delta Air Lines Business Model Canvas leverages financial reports, market analyses, and customer data. These elements ensure realistic strategic planning.