DigiKey Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigiKey Bundle

What is included in the product

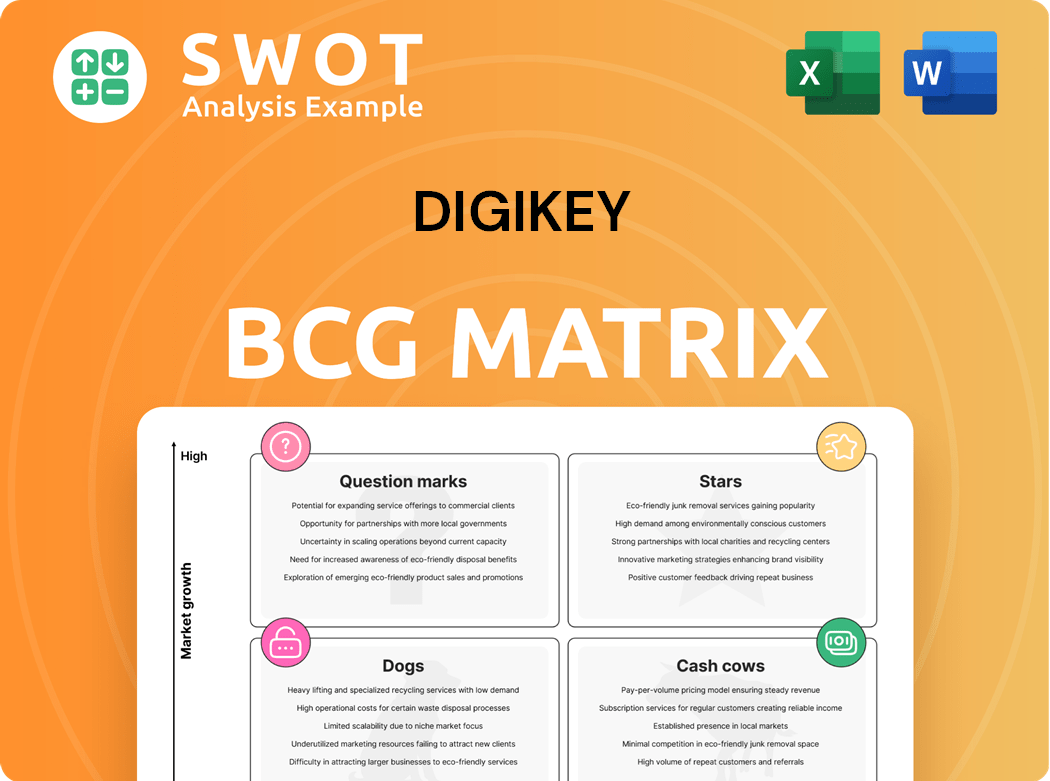

DigiKey's BCG Matrix: strategic insights for its product portfolio across quadrants, guiding investment, holding, and divestment decisions.

DigiKey BCG Matrix alleviates analysis paralysis with a clear, one-page overview.

Delivered as Shown

DigiKey BCG Matrix

The preview is the DigiKey BCG Matrix document you'll receive after buying. It's the complete, ready-to-use analysis for understanding market positioning and making strategic decisions. This isn't a demo; it's the fully functional report delivered directly to you. Expect immediate download access to this professional document, no edits needed.

BCG Matrix Template

Uncover DigiKey's product portfolio through the lens of the BCG Matrix. See which products are market stars, generating substantial revenue. Identify cash cows that provide consistent profits. Recognize the dogs to decide if they should be divested. The Matrix is a valuable tool for strategic planning. Get the full BCG Matrix to unlock data-backed recommendations for optimized resource allocation and sharper decision-making.

Stars

DigiKey's vast inventory, featuring over 15.9 million components from 3,000+ manufacturers, positions it as a "Star." This extensive portfolio caters to diverse customer needs, making it a primary source for engineers and procurement specialists. DigiKey's strategy includes consistently adding new products, which helps it to maintain its strong market position. In 2024, DigiKey's robust product range contributed significantly to its revenue growth.

DigiKey's online platform is central to its business, reflecting its "Strong Online Presence" status. The company has consistently enhanced its website, including user experience. This digital focus enables DigiKey to serve a global customer base. In 2024, DigiKey's website traffic and online sales saw significant growth, with online orders accounting for over 90% of total sales.

DigiKey's commitment to exceptional customer service is a core strength, supporting its high-service distribution model. They offer digital solutions to engineers and designers, ensuring a smooth experience. This customer-centric approach boosts loyalty and positive word-of-mouth. In 2024, DigiKey saw a 15% increase in customer satisfaction scores.

Strategic Investments in Growth Areas

DigiKey strategically focuses on high-growth sectors like automotive, AI, energy, industrial automation, and IoT. This proactive investment strategy keeps DigiKey ahead in a rapidly evolving market. By concentrating on these key areas, DigiKey is well-positioned to capitalize on expanding market opportunities. For example, the global automotive semiconductor market was valued at $60.9 billion in 2023, and is projected to reach $97.6 billion by 2030.

- Automotive: $60.9B in 2023, projected to $97.6B by 2030.

- AI: Rapid growth across various industries.

- Energy: Increasing demand for renewable solutions.

- Industrial Automation: Expanding due to Industry 4.0.

Global Leader in Commerce Distribution

DigiKey is a global leader in distributing electronic components and automation products, known for innovation and customer satisfaction. This solidifies its market position. DigiKey attracts and retains customers, boosting revenue and market share. In 2024, DigiKey's revenue reached $6.8 billion.

- Global Leader Status

- Innovation and Customer Focus

- Revenue Growth

- Market Share Expansion

DigiKey's "Stars" include vast inventory and robust online presence, driving revenue. Customer service boosts loyalty, reflected in high satisfaction. Strategic focus on high-growth sectors like automotive fuels expansion. In 2024, DigiKey's revenue reached $6.8B, showing market leadership.

| Key Feature | Impact | 2024 Data |

|---|---|---|

| Vast Inventory | Caters to diverse needs. | 15.9M+ components. |

| Online Platform | Global customer reach. | 90%+ sales online. |

| Customer Service | Drives loyalty. | 15% satisfaction increase. |

Cash Cows

DigiKey's global distribution network ensures timely delivery of electronic components worldwide, a key cash cow characteristic. The company's efficient logistics and supply chain management meet diverse customer demands effectively. This network provides a reliable revenue stream, contributing to its financial stability. DigiKey's 2024 revenue reached approximately $6.8 billion, reflecting the strength of its distribution.

DigiKey's high inventory turnover is key to its success. This allows them to quickly fulfill orders, reducing lead times for customers. High inventory turnover boosts cash flow efficiency. In 2024, DigiKey's revenue reached $6.5 billion, reflecting efficient inventory management.

DigiKey's success hinges on its robust supplier network, currently encompassing over 3,000 manufacturers. These relationships guarantee a steady stream of components, critical for fulfilling customer orders. Securing favorable pricing and terms through these partnerships is a significant factor in DigiKey's profitability, with 2024 revenue reaching $6.8 billion.

Efficient Operations

DigiKey's commitment to operational excellence is a key driver of its cash cow status. The company consistently invests in automation and process improvements to boost efficiency. These enhancements lead to lower costs and faster, more accurate order fulfillment, directly impacting profitability. Efficient operations are reflected in DigiKey's financial results.

- Automation investments have significantly reduced picking and packing times.

- DigiKey's operational efficiency contributes to its strong profit margins.

- The company's streamlined processes enhance customer satisfaction.

Predictive Web Search Functionality

DigiKey strategically invests in predictive web search functionality, a key element of its "Cash Cows" segment. This functionality ensures customers can swiftly locate desired components, streamlining their purchasing experience. It directly enhances customer satisfaction and boosts sales figures. In 2024, DigiKey's online sales accounted for a significant portion of its revenue, emphasizing the importance of user-friendly search features.

- Improved search accuracy leads to quicker order fulfillment.

- Enhanced customer satisfaction scores.

- Increase in online sales revenue.

- Optimized user experience on the website.

DigiKey's cash cow status is supported by its robust global distribution and efficient supply chain, which generated approximately $6.8 billion in revenue in 2024. High inventory turnover and a strong supplier network of over 3,000 manufacturers also contributed to DigiKey's profitability. The company invests in operational excellence and predictive web search for an enhanced customer experience.

| Feature | Description | Impact |

|---|---|---|

| Revenue (2024) | Approximately $6.8 billion | Strong financial performance |

| Inventory Turnover | High | Efficient cash flow |

| Supplier Network | Over 3,000 manufacturers | Reliable component supply |

Dogs

In DigiKey's BCG Matrix, commodity components often have low profit margins due to intense competition. These components might not drive substantial growth. For example, in 2024, DigiKey's focus was on optimizing the supply chain for these items. The goal is to maintain profitability despite lower margins, as seen in the Q3 2024 financial reports.

Obsolete inventory, or "Dogs," refers to components that are no longer in demand due to technological advancements. This can lead to significant financial burdens for DigiKey. In 2024, companies faced increased costs for managing and disposing of outdated inventory, with some reporting losses exceeding 10% of total inventory value. Effective strategies, like proactive obsolescence management, are crucial to minimize these losses.

Some DigiKey product lines struggle with low-profit margins, possibly due to intense market competition. These lines may drag down overall profitability, as seen in 2024 where some electronics components faced margin pressures. DigiKey should analyze these underperforming lines. Divesting or optimizing could boost financial results. In 2024, DigiKey's net sales were over $6 billion.

Products with Declining Demand

Products in the "Dogs" quadrant of DigiKey's BCG matrix face declining demand. This often stems from tech shifts or changing customer needs, making sales challenging. Identifying these components is critical to avoid inventory pile-up. DigiKey must proactively manage these items to minimize losses and free up resources.

- Obsolete components can lead to significant losses if not addressed promptly.

- Market analysis and forecasting are key to spotting declining demand early.

- Strategies include price reductions, promotions, or liquidating inventory.

- In 2024, managing obsolete inventory costs averaged 5-10% of total inventory value for electronics distributors.

Components Facing Intense Competition

In the "Dogs" quadrant of DigiKey's BCG Matrix, some components face fierce competition, sparking price wars and shrinking profit margins. These products may lack a lasting competitive edge in the market. For instance, in 2024, the average profit margin in the electronic components distribution market was around 10%, a figure that can be further reduced by price wars. To counter this, DigiKey must differentiate itself, possibly through value-added services or by targeting specialized markets.

- Intense competition erodes profit margins.

- Products lack a sustainable competitive advantage.

- Differentiation through value-added services is crucial.

- Focusing on niche markets can be beneficial.

Dogs in DigiKey's BCG Matrix represent obsolete or declining products. These items suffer from low demand and intense competition, squeezing profit margins. In 2024, obsolete inventory management cost electronics distributors 5-10% of total inventory value. DigiKey must manage Dogs proactively to minimize losses.

| Issue | Impact | Strategy |

|---|---|---|

| Declining Demand | Reduced Sales, Inventory Pile-up | Proactive Obsolescence Management |

| Intense Competition | Shrinking Margins, Price Wars | Differentiation, Niche Markets |

| Obsolete Inventory | Financial Losses, Tied-up Capital | Price Reductions, Liquidation |

Question Marks

Emerging tech components, including AI, quantum computing, and IoT devices, offer high growth potential for DigiKey. These markets are fast-changing, requiring strategic investments. In 2024, global IoT spending reached $212 billion. DigiKey should prioritize capturing market share in these areas.

New supplier partnerships introduce innovative products, boosting DigiKey's portfolio. These alliances need marketing investments for product awareness. DigiKey must meticulously assess and cultivate these partnerships. In 2024, DigiKey expanded its supplier base by 15%, adding cutting-edge tech. This strategy aims for a 10% revenue increase through new product lines.

DigiKey's Marketplace allows for a wider array of products and services. This expansion demands investment in platform upgrades and marketing to draw in new customers. As of Q3 2024, DigiKey reported a 15% increase in marketplace sales. Strategic expansion is crucial to leverage this growth, as the electronics components market is projected to reach $200 billion by 2025.

Solutions for Electric and Hybrid Vehicles

Solutions for electric and hybrid vehicles are a high-growth area, aligning with DigiKey's strategic focus. This sector demands specialized expertise and significant investment in product development and marketing. DigiKey must enhance its market presence to capitalize on the expanding EV market, projected to reach substantial growth by 2024. The EV market is expected to reach $802.8 billion by 2027.

- EV sales increased significantly in 2024, with projections for continued growth.

- Investment in EV-related components is crucial for market share gains.

- DigiKey's focus should include specific EV component solutions.

- Marketing efforts should target the EV sector's specific needs.

Advanced Automation and Control Products

Advanced automation and control products are key for boosting industrial efficiency, a trend that's consistently growing. This area requires significant investment in product development and technical support. DigiKey can gain from the rising demand by offering complete automation solutions. The global industrial automation market was valued at $207.7 billion in 2023.

- Market growth is driven by the need for improved productivity and reduced operational costs.

- Investments in R&D are crucial to stay competitive in the rapidly evolving automation landscape.

- Focusing on comprehensive solutions can help DigiKey capture a larger market share.

Question Marks are high-growth, low-share areas, requiring strategic investment. DigiKey should focus on emerging tech, new partnerships, and market expansion.

| Category | Strategy | 2024 Data |

|---|---|---|

| Emerging Tech | Invest in AI, IoT, quantum computing | IoT spending: $212B |

| New Partnerships | Cultivate alliances, marketing | Supplier base up 15% |

| Marketplace Expansion | Platform upgrades, marketing | Marketplace sales up 15% |

BCG Matrix Data Sources

The DigiKey BCG Matrix leverages data from financial filings, market reports, and competitor analysis for a data-driven strategy.