DigiKey PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DigiKey Bundle

What is included in the product

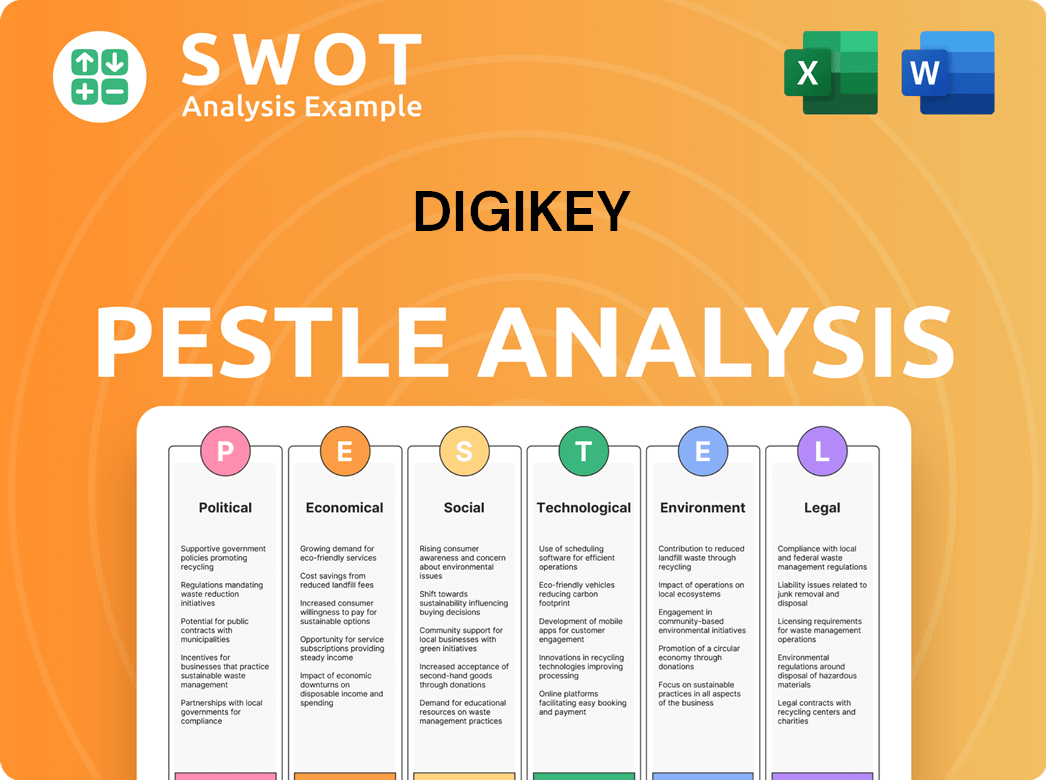

This DigiKey PESTLE analysis assesses external factors affecting the company across Political, Economic, etc., dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

DigiKey PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This DigiKey PESTLE Analysis provides a comprehensive look at relevant factors. It analyzes the political, economic, social, technological, legal, and environmental aspects. Get instant access to this valuable resource after purchasing.

PESTLE Analysis Template

Navigating the complex electronics market? Our DigiKey PESTLE analysis offers critical insights.

Uncover how external forces like technology, economics, and politics impact DigiKey's growth.

Gain a clear understanding of market risks and opportunities facing DigiKey.

Perfect for strategic planning, investment analysis, and competitive research.

Get the full picture now with our downloadable, in-depth report.

Make data-driven decisions with confidence.

Download your copy and optimize your market strategy today!

Political factors

Ongoing geopolitical instability, like the conflicts in Ukraine and the Middle East, impacts the electronic component supply chain. Trade tensions, especially between the U.S. and China, lead to tariffs and export controls. The U.S. imposed tariffs on $370 billion of Chinese goods in 2024. These issues necessitate diversifying suppliers and potentially reshoring production.

Governments worldwide are bolstering domestic manufacturing through incentives, aiming for supply chain resilience. The CHIPS Act in the U.S. offers substantial funding for semiconductor production, with over $52 billion allocated. Policy shifts due to changing administrations can introduce new regulations, impacting economic stability and supply chains. These changes influence DigiKey's operational costs and market access. For example, in 2024, the EU introduced new rules about AI.

Stricter export controls and sanctions, especially those targeting Russia, significantly impact the semiconductor industry. These restrictions limit access to essential raw materials and components, raising production costs. For DigiKey, such controls mean fewer supplier options and potential delays in sourcing vital parts. In 2024, the semiconductor industry faced a 20% increase in material costs due to these factors.

Political Stability in Key Manufacturing Regions

Political stability is vital for DigiKey's manufacturing operations. Areas like the Asia-Pacific region, central to electronics, face risks. Disruptions from tensions, such as those in the South China Sea, impact supply chains. Escalations between China and Taiwan could severely affect semiconductor and electronic product availability.

- Taiwan's semiconductor industry accounts for over 60% of global foundry revenue.

- China's electronics production accounts for nearly 30% of global output.

- The South China Sea is a critical shipping route for over $3 trillion in goods annually.

Cybersecurity as a Political Concern

Cybersecurity is increasingly a political concern, affecting businesses globally. Governments are enacting regulations to bolster supply chain security, like the EU's NIS2 Directive. International firms, including component distributors, face these changing cybersecurity demands. The global cybersecurity market is projected to reach $345.7 billion by 2025, underscoring its importance.

- NIS2 Directive aims to improve cybersecurity across the EU.

- Cybersecurity market growth reflects rising political and business concerns.

- Companies must adapt to stay compliant and secure.

Political factors significantly influence DigiKey's operations, from trade regulations to geopolitical tensions. Supply chains face disruptions from export controls and geopolitical hotspots. Governments worldwide invest heavily in domestic manufacturing to enhance resilience.

| Factor | Impact | Data |

|---|---|---|

| Trade Tensions | Tariffs, export controls | U.S. tariffs on Chinese goods: $370B (2024) |

| Geopolitical Instability | Supply chain disruptions | South China Sea: $3T goods/yr, Taiwan controls >60% global foundry revenue. |

| Government Policy | Incentives, regulations | U.S. CHIPS Act: $52B for semiconductors |

Economic factors

Global economic growth is projected to be stable, though with some deceleration. Elevated inflation and geopolitical risks persist, potentially dampening demand. The IMF forecasts global growth at 3.2% in 2024, slightly down from previous estimates. High inflation rates, still above central bank targets, add to economic uncertainty.

The global electronic components market is poised for substantial expansion, fueled by rising consumer electronics demand and the 5G rollout. The Internet of Things (IoT) and industrial automation further boost this growth. Market revenue is forecast to reach $782.7 billion in 2024. This trend creates opportunities for distributors.

Geopolitical events and trade restrictions continue to impact DigiKey, increasing transportation expenses. Companies now diversify supply chains, raising operational costs. For example, the Baltic Dry Index, a measure of shipping costs, saw fluctuations in 2024, reflecting these challenges. Excess inventory remains a concern; strategic inventory management is crucial, particularly in volatile sectors.

Impact of High-Demand Industries

High-demand industries like automotive, consumer electronics, and AI are boosting demand for electronic components. This surge can strain the supply chain, causing competition for scarce inventory. The automotive sector's chip demand is expected to reach $80 billion by 2025. Generative AI's growth further intensifies these pressures.

- Automotive chip demand projected to hit $80B by 2025.

- Consumer electronics and IoT also significantly increase demand.

- Supply chain bottlenecks and inventory competition are key issues.

Currency Fluctuations and Trade Tariffs

Currency fluctuations significantly affect DigiKey's operations. For instance, a stronger US dollar can make imported components cheaper, boosting profit margins, while a weaker dollar has the opposite effect. Trade tariffs, like those imposed on goods from China, directly raise costs. In 2024, the US trade deficit reached approximately $773.4 billion, influenced by currency values and tariffs. These factors require careful management to maintain profitability and competitiveness.

- US Dollar Index (DXY) volatility impacts import costs.

- Tariffs on electronic components increase expenses.

- Trade deficits and currency values are interconnected.

Economic stability faces deceleration, with persistent inflation and geopolitical risks. The IMF predicts 3.2% global growth in 2024. High inflation, impacting DigiKey's margins, and currency fluctuations demand careful management.

| Metric | Value | Year |

|---|---|---|

| Global Growth Forecast | 3.2% | 2024 |

| US Trade Deficit | $773.4B | 2024 |

| Automotive Chip Demand | $80B | 2025 (projected) |

Sociological factors

Consumer demand for electronics is significantly influenced by sociological trends. The rising use of smartphones and gadgets for entertainment and shopping boosts demand for components. AI-enabled devices, like smartphones, are set to increase consumer interest. Global smartphone shipments reached 1.17 billion units in 2023. In 2024, the trend is expected to continue.

Digital transformation and IoT are driving demand for electronic components. The global IoT market is projected to reach $2.46 trillion by 2029, fostering innovation. This expansion requires a diverse component selection. Increased connectivity fuels the need for advanced electronics. DigiKey benefits from these trends.

The rise of AI and the digital economy underscores the need for digital skills. This affects the electronics industry's workforce. The demand for digital literacy is surging. The global digital skills gap is widening. Data from 2024 shows a 20% increase in demand for digital skills.

Changing Consumer Behavior and Expectations

Consumer behavior is shifting, with increasing focus on product origin, ethical sourcing, and sustainability. This trend pressures supply chain companies, including distributors, to boost transparency and traceability. A 2024 survey showed that 70% of consumers prioritize ethical sourcing. DigiKey, like other distributors, must adapt to meet these evolving expectations. Failure to adapt could lead to loss of market share.

- 70% of consumers prioritize ethical sourcing in 2024.

- Growing demand for supply chain transparency.

- Distributors must adapt to evolving consumer expectations.

Impact of Remote Work and Digital Lifestyles

The COVID-19 pandemic significantly accelerated remote work and digital lifestyles. This shift has driven increased demand for personal electronics. DigiKey benefits from this trend, as people buy components for home offices and entertainment. The market continues to evolve, shaped by these societal changes.

- Global remote work is expected to involve 32.6% of the workforce by the end of 2024.

- The global consumer electronics market is projected to reach $878.8 billion in 2024.

- Increased demand for components is visible in DigiKey's sales growth.

Societal trends profoundly impact electronics demand, with smartphones driving component needs; 1.17 billion units shipped in 2023. Digital transformation and the IoT boom fuels innovation, projected at $2.46T by 2029. Ethical sourcing is key, as 70% of consumers prioritize it in 2024.

| Trend | Impact | Data (2024) |

|---|---|---|

| Smartphones & Gadgets | Increased component demand | Continued growth, AI integration. |

| IoT Expansion | Drives component needs | $2.46T market projection. |

| Ethical Sourcing | Influences consumer choice | 70% consumers prioritize. |

Technological factors

Significant advancements in semiconductor tech, especially WBG materials like GaN and SiC, are fueling innovation. These materials enable more efficient and high-performance components. The global SiC power semiconductor market is projected to reach $4.5 billion by 2025. These advancements are crucial for DigiKey's offerings.

The integration of AI and automation is reshaping supply chains, optimizing inventory and logistics. AI's influence extends to electronic component design and manufacturing. For instance, in 2024, AI-driven automation reduced operational costs by 15% for some electronics manufacturers. This trend is expected to continue through 2025.

The widespread deployment of 5G technology globally fuels demand for electronic components. This expansion is a primary driver of market growth, with 5G subscriptions expected to reach 5.9 billion by 2029, according to Ericsson. DigiKey benefits from increased demand for components essential to 5G infrastructure.

Growth of Electric Vehicles and Charging Infrastructure

The electric vehicle (EV) market's expansion and the build-out of charging infrastructure are boosting demand for power electronics and related components. This area is poised for significant growth. The global EV market is projected to reach $823.75 billion by 2030. DigiKey benefits from supplying components for this expanding sector.

- EV sales in 2024 are expected to increase by over 20% globally.

- Investments in charging infrastructure are forecast to exceed $50 billion by 2025.

- Demand for power semiconductors in EVs is growing at 25% annually.

Digitalization of Supply Chains

The digitalization of supply chains is transforming operations. DigiKey, like others, leverages blockchain for enhanced traceability and IoT for real-time monitoring. Data analytics further boosts efficiency and agility within their global network. This shift is supported by significant market growth. In 2024, the global supply chain management market was valued at $21.8 billion. It is expected to reach $37.4 billion by 2029.

- Blockchain adoption in supply chain is projected to grow by 40% annually.

- IoT spending in supply chain logistics reached $11.3 billion in 2024.

- Companies using data analytics in their supply chain see a 15% reduction in operational costs.

Technological advancements drive innovation in semiconductors and electronic components, crucial for DigiKey. AI and automation are reshaping supply chains. The expansion of 5G and the EV market fuel demand.

| Technology Trend | Impact on DigiKey | Data Point (2024/2025) |

|---|---|---|

| Semiconductor Advancements | Demand for advanced components | SiC power semiconductor market: $4.5B by 2025 |

| AI and Automation | Supply chain optimization | AI reduced costs by 15% for some manufacturers in 2024 |

| 5G Expansion | Increased component demand | 5G subscriptions expected to reach 5.9B by 2029 |

| EV Market Growth | Demand for power electronics | EV market projected to reach $823.75B by 2030 |

Legal factors

The General Product Safety Regulation (GPSR) in the EU mandates product safety. DigiKey must ensure components meet these standards. Non-compliance can lead to significant penalties. In 2024, the EU intensified enforcement, increasing scrutiny. This directly affects DigiKey's compliance costs.

Environmental regulations are intensifying, especially concerning electronic waste and sustainable product designs. DigiKey, as a distributor, must adapt its product offerings and processes to comply with these evolving standards. The WEEE directive and ecodesign rules impact product design, manufacturing, and disposal. Failure to comply could result in penalties and reputational damage.

Data protection laws, such as GDPR, and cybersecurity legislation are evolving. These laws affect how businesses like DigiKey manage customer data and secure their digital platforms. Compliance is crucial. The global cybersecurity market is projected to reach $345.7 billion by 2026. E-commerce must adhere to these standards to avoid penalties and maintain customer trust.

Trade Regulations and Tariffs

Trade regulations and tariffs significantly influence DigiKey's operations. Recent shifts in international trade rules, including updated tariffs and customs demands, impact the costs and logistics of importing and exporting electronic components. Compliance with these changing regulations is crucial. For instance, the U.S. imposed tariffs on $360 billion worth of goods from China, affecting the electronics industry.

- Tariff rates on certain electronic components may increase, raising costs.

- Compliance with new customs procedures adds to operational expenses.

- Trade disputes can disrupt supply chains and increase lead times.

- Staying informed about trade agreements is essential.

Supply Chain Due Diligence Regulations

Supply chain due diligence is increasingly crucial. New regulations mandate responsible sourcing and transparency, especially for high-revenue battery producers. This focus on ethical sourcing may expand to other electronic components. Companies must adapt to these evolving legal standards. The EU's Corporate Sustainability Due Diligence Directive (CSDDD) is a key example, affecting many businesses.

- Battery producers with substantial revenue face stringent supply chain due diligence.

- The trend toward responsible sourcing could broaden to other electronic components.

- EU's CSDDD is a significant regulation impacting many companies.

Legal factors require DigiKey to adapt. This includes adhering to GPSR in the EU and environmental standards like WEEE. Cybersecurity and data protection, plus evolving trade rules and tariffs, affect its operations. In 2024, the global cybersecurity market hit $345.7B.

| Area | Impact | Example |

|---|---|---|

| Product Safety | GPSR compliance | EU enforcement of standards. |

| Environment | WEEE compliance | Focus on e-waste and ecodesign. |

| Data Security | GDPR & cybersecurity | Global cyber market worth $345.7B by 2026. |

Environmental factors

The Ecodesign for Sustainable Products Regulation (ESPR) is driving demand for durable, reliable, and repairable electronics components. This shift is part of the EU's Green Deal, aiming for circular economy by 2050. In 2024, the global market for green electronics is projected to reach $800 billion, growing annually.

Regulations on electronic waste (WEEE) are tightening globally. The EU's WEEE Directive sets recovery targets, with 85% of collected e-waste to be prepared for reuse/recycling by 2024. In 2023, China generated ~15 million metric tons of e-waste. Companies must manage end-of-life electronics responsibly, facing potential fines for non-compliance.

The electronics supply chain faces growing environmental scrutiny. Companies must now measure and disclose their environmental impact. Regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) are driving these changes. The global e-waste volume reached 53.6 million metric tons in 2019, a figure that continues to rise.

Climate Change and Extreme Weather

Climate change and extreme weather pose significant risks to DigiKey's operations. Rising temperatures and severe weather events can disrupt supply chains, impacting transportation and manufacturing. Building resilient supply chains is essential to mitigate these risks. The World Economic Forum estimates climate-related losses could reach $8.5 trillion by 2050.

- 2023 saw record-breaking extreme weather events globally.

- Supply chain disruptions cost businesses billions annually.

- Investing in climate resilience is becoming a priority.

- DigiKey may face increased insurance costs.

Emphasis on Sustainable and Green Electronics

The electronics industry faces mounting pressure to adopt sustainable practices. Consumer demand for eco-friendly products is increasing, alongside stricter environmental regulations globally. This shift impacts DigiKey's product development, requiring a focus on energy-efficient components and materials with recycled content. For instance, the global green electronics market is projected to reach $614.5 billion by 2025.

- Increasing demand for sustainable electronics.

- Regulatory pressures driving eco-friendly practices.

- Impact on product development and sourcing.

- Market growth: $614.5B by 2025.

Environmental regulations, such as the ESPR and WEEE, strongly influence the electronics market. Businesses must now address electronic waste management and report their environmental impacts. The global green electronics market is predicted to hit $614.5 billion by 2025, showcasing the sector's growth.

| Factor | Impact | Data Point |

|---|---|---|

| E-waste | Waste management costs rise. | China generated 15M metric tons of e-waste (2023). |

| Climate change | Supply chain issues. | Climate-related losses could reach $8.5T by 2050. |

| Sustainable Practices | Product changes, market growth. | Green electronics market $614.5B by 2025. |

PESTLE Analysis Data Sources

DigiKey's PESTLE utilizes data from market analysis, regulatory documents, and industry reports. Each analysis draws on verified information regarding the political, economic, social, tech, legal, and environmental landscape.