DNV GL Group AS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

What is included in the product

Analysis of DNV GL's portfolio using the BCG Matrix, with strategic recommendations.

Printable summary optimized for A4 and mobile PDFs, allowing easy sharing of strategic business unit positions.

Full Transparency, Always

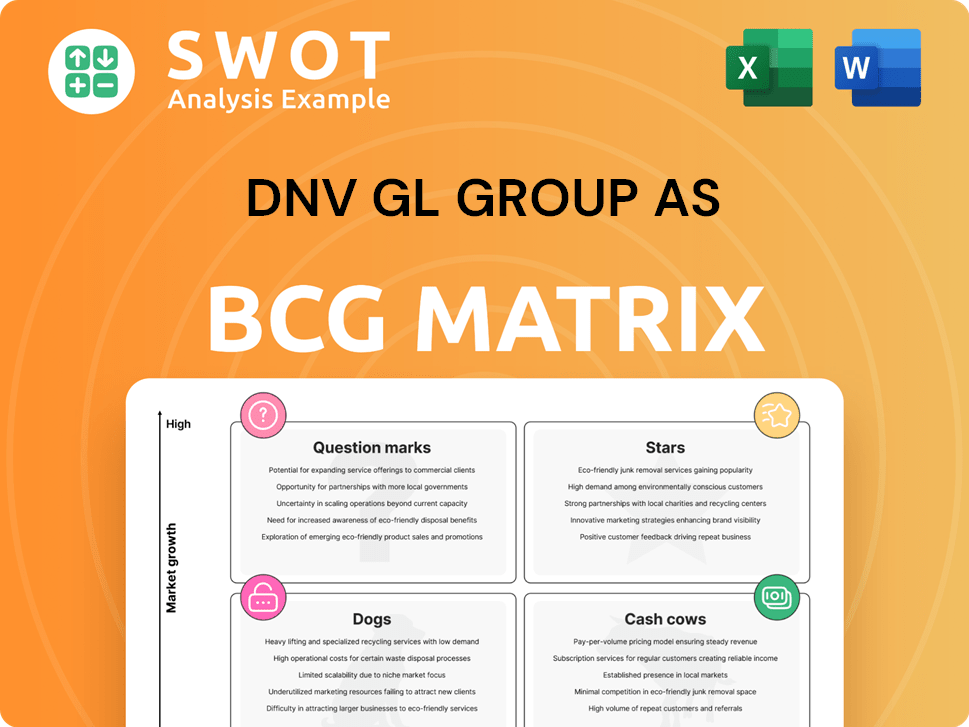

DNV GL Group AS BCG Matrix

The DNV GL Group AS BCG Matrix you see is identical to the file you'll receive upon purchase. This full report, ready for strategic assessment, is delivered instantly after checkout—no hidden extras. Expect a fully functional, professionally designed BCG Matrix, ready for implementation.

BCG Matrix Template

DNV GL Group AS faces a dynamic market. Their BCG Matrix reveals where each business unit falls—from high-growth Stars to resource-draining Dogs. Understanding these positions is key to strategic planning. This sneak peek offers a glimpse of their product portfolio’s health. Analyze market share and growth rates. Purchase the full report for actionable insights and confident decision-making.

Stars

DNV GL Group AS's maritime decarbonization efforts are a "Star" within the BCG Matrix, reflecting high growth and market share. DNV is pivotal in helping the maritime sector adopt alternative fuels, including LNG, methanol, and ammonia. Demand for DNV's expertise is surging as shipowners comply with tighter emission rules; The global LNG market was valued at $174.8 billion in 2023. DNV's classification standards are crucial for the industry's shift to sustainable technologies.

Cybersecurity solutions are in high demand, driven by digital technology's expansion across sectors. DNV Cyber was established in 2024, showcasing a dedication to safeguarding digital assets and infrastructure. DNV's integrated IT and OT security expertise positions it as a key player. The global cybersecurity market is projected to reach $345.7 billion in 2024, emphasizing DNV's strategic relevance.

DNV GL Group AS's "Digital Solutions and AI Assurance" is a "Star" in its BCG Matrix. In 2024, DNV significantly invested in AI R&D, securing projects like AI system security and maturity assessments. The AI assurance market, valued at $1.2 billion in 2023, is projected to reach $6.5 billion by 2028. This growth underscores the high demand for DNV's services.

Low-Carbon Energy Inspection Services

DNV Inspection is making a big push into low-carbon energy, including CCS, hydrogen, and ammonia projects. This area is becoming a major part of their business, with substantial sales growth. They are hiring more people to keep up with this expansion, showing a strong commitment. DNV's expertise in inspection is crucial for the safety of these emerging energy technologies.

- In 2024, DNV saw a 20% increase in demand for inspection services in the hydrogen sector.

- DNV's low-carbon energy projects now contribute over 30% to the company's total revenue.

- The company plans to add 500 new employees in 2024 to support the growth of these services.

- DNV is investing $100 million in 2024 to develop new inspection technologies.

Business Assurance Services

DNV's Business Assurance Services, within the DNV GL Group AS, are a "Star" in the BCG Matrix, showing robust growth. This segment benefits from rising demand for certification and training, especially in sustainability and digital transformation. DNV is expanding its services to include areas like information security, innovation, and AI governance. In 2023, DNV reported a 12% increase in revenue for this sector.

- Revenue growth driven by certifications and training.

- Focus on sustainability, digitalization, and AI.

- Services include information security and AI governance.

- 2023 sector revenue increase of 12%.

DNV's "Stars" in the BCG matrix exhibit high growth and market share.

Key "Stars" include cybersecurity, digital solutions, and low-carbon energy projects.

These segments benefit from significant investment and revenue growth, reflecting their strategic importance.

| Star Category | Market Growth (2024) | DNV Revenue Growth (2023-2024) |

|---|---|---|

| Cybersecurity | Projected to $345.7B | N/A (Established in 2024) |

| Digital Solutions/AI | AI assurance market at $1.2B (2023) | Significant investment in AI R&D |

| Low-Carbon Energy | Hydrogen sector inspection services up 20% | Over 30% of total revenue |

Cash Cows

DNV GL Group AS, with its Maritime Classification Services, is a cash cow in the BCG matrix. In 2024, DNV classified 29% of new ships, demonstrating its strong market position. This service line generates consistent revenue thanks to its established reputation.

DNV's risk management services are a cash cow, fueled by its assurance services. The core business generates substantial revenue, especially within sectors needing risk mitigation. DNV's purpose is to safeguard life, property, and the environment, underpinning the value it provides. In 2024, DNV's revenue reached €2.7 billion, with risk management a key contributor.

DNV's Energy Systems, a Cash Cow, has a strong history in oil and gas. It still generates revenue from traditional energy. DNV is using its expertise to support the shift to renewable energy. In 2024, DNV's revenue was $3.1 billion, with 30% from energy transition services.

Inspection Services

DNV's inspection services are a cash cow for the DNV GL Group AS. These services, covering factory, in-service, and vendor inspections, provide consistent revenue. DNV Inspection is expanding in low-carbon energy, using its expertise to support new energy projects. DNV's financial reports from 2024 show a steady income from these established services, essential for infrastructure safety.

- Revenue from inspection services in 2024 remained stable, contributing significantly to overall earnings.

- DNV's expansion into low-carbon energy is projected to increase revenue streams in the coming years.

- The demand for inspection services is consistently high due to regulatory and safety requirements.

- DNV's long-standing reputation enhances its ability to secure and retain major contracts.

Software Solutions

DNV's software solutions are crucial as industries digitize. These products boost asset management, efficiency, and compliance. DNV addresses the rising need for digital services, keeping its offerings competitive. In 2024, the digital solutions segment significantly contributed to DNV's revenue, reflecting its cash cow status. The company's focus on software ensures continued value for clients.

- Digital transformation drives demand for DNV's software.

- Solutions improve asset management and operational efficiency.

- Focus on compliance is a key feature of the software.

- Digital solutions were a major revenue contributor in 2024.

DNV's Maritime Classification Services are cash cows, classifying 29% of new ships in 2024, ensuring consistent revenue. Risk management services, a key cash cow, saw 2024 revenue reach €2.7 billion, thanks to assurance services. DNV’s Energy Systems generated $3.1 billion in 2024, with 30% from energy transition.

| Service Area | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| Maritime | N/A | Market leader |

| Risk Management | €2.7 Billion | Risk mitigation |

| Energy Systems | $3.1 Billion | Energy Transition |

Dogs

Traditional oil and gas services within DNV face challenges due to the renewable energy shift. Demand for these services may decline as the energy transition gains pace. DNV is diversifying to counter this, though 2024 data shows a continued reliance on fossil fuels, with approximately 30% of global energy still from oil and gas. This highlights the need for strategic adaptation.

Services lacking digital integration face challenges in today's market. DNV must digitize services to boost efficiency and customer satisfaction. Firms slow to adapt risk losing market share. Digital transformation spending is up; in 2024, it hit $2.8 trillion globally. The lack of digital adoption can impact the firm's competitiveness.

Geographically isolated services within DNV GL Group AS, categorized as "Dogs" in a BCG matrix, face significant risks. These services, concentrated in specific regions, are vulnerable to local economic downturns or regulatory shifts. DNV must diversify its geographic presence to mitigate these risks effectively. Services unable to adapt to new markets risk limited growth; for instance, a 2024 report showed a 10% decline in revenue for geographically-tied services.

Services with High Labor Intensity

Services with high labor intensity, like some inspection or certification processes, can be "Dogs" in the DNV GL BCG matrix due to potential cost issues. These services might face inefficiencies, especially compared to more automated solutions. DNV should seek automation to boost productivity and reduce costs, especially with labor costs rising globally; for example, Norway's labor costs were up 5.2% in Q4 2023. Scalability is another challenge; labor-intensive services may struggle to meet increasing demand.

- Labor costs can significantly impact profitability for labor-intensive services, as seen in sectors like construction, where labor typically accounts for 30-40% of project costs.

- Automation can reduce labor costs by 20-50% in some industries, improving scalability and profitability.

- Services that cannot scale face limitations in market share growth, potentially leading to decreased revenue.

- DNV's focus on automation aligns with industry trends, with the global automation market projected to reach $214 billion by 2025.

Services with Limited Sustainability Focus

Services lacking a sustainability focus in DNV's portfolio, classified as "Dogs," face challenges. As of 2024, companies increasingly prioritize Environmental, Social, and Governance (ESG) factors, potentially reducing demand for non-ESG aligned services. DNV needs to adapt by embedding sustainability across its services to stay competitive. Those not aligning with the UN Sustainable Development Goals risk obsolescence.

- ESG-focused investments reached $40.5 trillion globally in 2022, signaling market shift.

- DNV's competitors are actively integrating sustainability into service offerings.

- Services not meeting ESG standards could see decreased client interest.

- Aligning with SDGs can open new market opportunities for DNV.

Geographically-isolated services, particularly those tied to specific regions, represent "Dogs" for DNV. These services struggle against local economic downturns or regulatory changes, emphasizing the need for broader geographic diversification. A 2024 study revealed a 10% revenue drop for such services. Limited scalability and market adaptability pose major threats.

| Aspect | Impact | Data |

|---|---|---|

| Geographic Concentration | High risk from local events | 10% revenue decrease (2024 study) |

| Market Adaptability | Limits growth potential | - |

| Diversification Needs | Mitigate risks | - |

Question Marks

DNV GL Group AS is venturing into digital health, marking a new growth area. Applying its risk management expertise, DNV aims to ensure the safety of digital health tech. The digital health market is projected to reach $604 billion by 2024. DNV's expansion could position it as a key player in this growing sector.

DNV GL's floating spaceports service notation places it in the question mark quadrant of the BCG matrix. This notation sets standards for launch and recovery, a niche market with high growth potential. DNV leverages its maritime and offshore expertise to support this new venture. The global spaceport market was valued at $4.8 billion in 2024 and is projected to reach $7.2 billion by 2029.

DNV is focusing on AI to secure maritime supply chains, addressing increasing digital reliance. Their AI and machine learning enhance detection and response, a critical need. DNV's solutions have the potential to become a key differentiator in this evolving sector.

Carbon Capture and Storage (CCS) Certification

DNV GL Group AS sees Carbon Capture and Storage (CCS) as a "Question Mark" in its BCG matrix. DNV is expanding its certification services, especially in sustainability, including CCS. This reflects CCS's current uncertainty but potential for high growth. DNV's risk management expertise is crucial for safe CCS deployment.

- DNV aims to certify 20 CCS projects by 2024.

- The global CCS market is projected to reach $6.5 billion by 2024.

- DNV's revenue from sustainability services grew by 15% in 2023.

Alternative Fuel Infrastructure Certification

DNV GL Group AS can leverage its expertise in maritime and energy to certify alternative fuel infrastructure. This is crucial as the maritime industry shifts towards fuels like hydrogen and carbon capture. DNV is actively involved in developing new class notations for these areas. This focus aligns with growing demand for sustainable solutions.

- DNV provides services for gas-fueled vessels, hydrogen, and carbon capture.

- The market for alternative marine fuels is expanding.

- DNV's involvement ensures safety and compliance in new fuel technologies.

- New class notations are being developed to support this transition.

DNV GL views Carbon Capture and Storage (CCS) as a "Question Mark," focusing on certification to support its growth. The global CCS market reached $6.5 billion in 2024, with DNV aiming to certify 20 projects. This expansion leverages their expertise in risk management.

| Project | Market Value (2024) | DNV's Goal |

|---|---|---|

| CCS | $6.5 Billion | Certify 20 Projects |

| Sustainability Services Revenue Growth (2023) | 15% | |

BCG Matrix Data Sources

Our DNV GL BCG Matrix draws from diverse sources: market data, financial reports, competitor analysis, and expert sector evaluations for trustworthy insights.