DNV GL Group AS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNV GL Group AS Bundle

What is included in the product

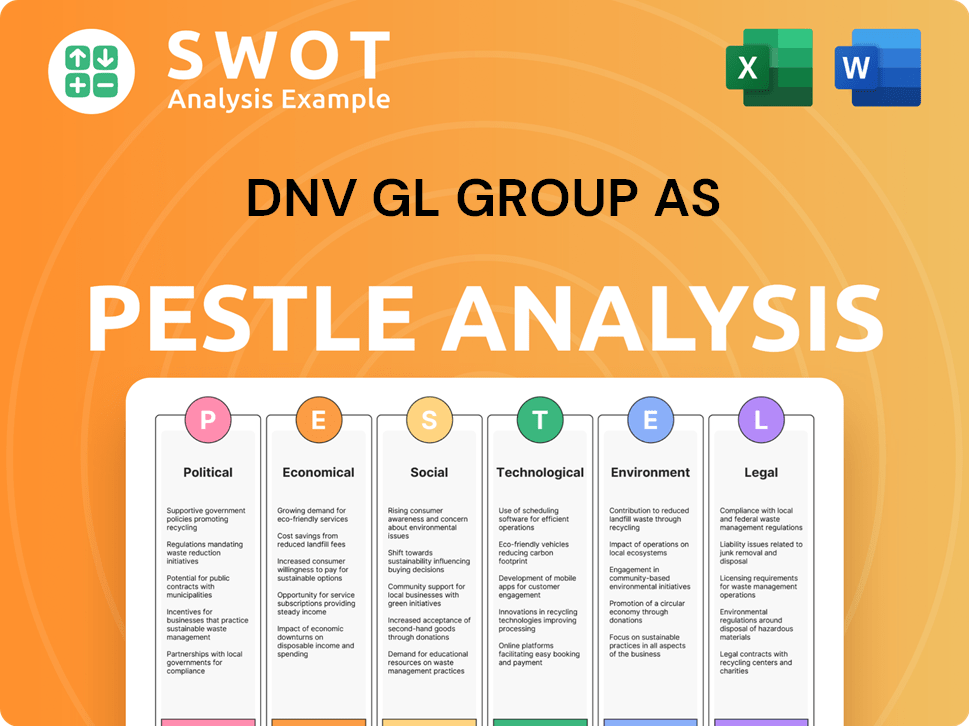

Assesses DNV GL Group AS's macro-environment across six factors: Political, Economic, etc. to identify impacts and implications.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

DNV GL Group AS PESTLE Analysis

This is the complete DNV GL Group AS PESTLE Analysis you will receive after purchase.

The content, layout, and all data points shown in this preview will be in your downloadable file.

Get the finished product, immediately—ready to use, no extra steps!

Everything displayed here is fully functional after checkout.

PESTLE Analysis Template

Understand the external forces impacting DNV GL Group AS. Our PESTLE analysis breaks down crucial political, economic, social, technological, legal, and environmental factors. It reveals potential opportunities and threats affecting the company. This analysis helps inform strategic planning and risk mitigation. Access the full PESTLE analysis today to empower your decision-making!

Political factors

DNV GL Group AS faces geopolitical risks due to its global presence. The war in Ukraine and the conflict in Gaza affect operations. These conflicts can disrupt supply chains and increase operational costs. According to a 2024 report, political instability has caused a 15% increase in project delays.

DNV faces constant shifts in global regulations, especially in maritime and energy. Environmental protection and safety regulations are key. For example, the IMO's 2020 sulfur cap impacted shipping. DNV must adapt to these changes to stay compliant and competitive. Staying ahead is crucial.

Trade sanctions and protectionism pose risks to DNV's global operations and clients. For instance, in 2024, the US imposed sanctions on entities involved in Russian oil projects, potentially affecting DNV's certification services. These measures can disrupt supply chains and increase costs, impacting DNV's profitability. The World Bank projects global trade growth at 2.5% in 2024, a slowdown influenced by protectionist policies. DNV must navigate these complexities to maintain its market position.

Focus on Energy Security and Transition Policies

Governments worldwide are intensely focused on energy security and the shift towards cleaner energy, creating a complex landscape for companies like DNV. DNV, which serves both traditional and renewable energy sectors, must navigate these shifts. The International Energy Agency (IEA) projects that global investment in renewable energy will reach $3.7 trillion annually by 2030. This represents a significant opportunity for DNV to provide expertise.

- Increased demand for services related to renewable energy project certification and risk assessment.

- Potential for policy changes, like subsidies or regulations that favor renewable energy.

- Geopolitical risks tied to energy security and supply chain disruptions.

International Cooperation and Agreements

International agreements, like the IMO's regulations, directly shape DNV's services. These collaborations drive demand for DNV's assurance and risk management services. For example, the EU's Green Deal and related initiatives create opportunities. DNV's involvement in climate-related projects is increasing. The company's focus aligns with global sustainability goals.

- IMO regulations: DNV helps to ensure compliance.

- EU Green Deal: A key driver for DNV's services.

- Climate-related projects: DNV's involvement is growing.

- Sustainability goals: DNV's focus aligns with these.

Political instability globally increases DNV's operational costs and project delays, with a 15% rise reported in 2024 due to conflicts. Trade sanctions and protectionism, as seen with US sanctions in 2024, disrupt DNV's services, impacting profitability amid slowing global trade, projected at 2.5% growth.

Government policies driving energy security and cleaner energy transitions, such as EU Green Deal, offer DNV opportunities to grow its services by assisting in areas like risk management, assurance and certification. These geopolitical and policy landscapes directly influence DNV's services.

| Aspect | Impact on DNV | Data |

|---|---|---|

| Geopolitical Risks | Increased costs, supply chain disruptions, project delays | 15% increase in project delays in 2024 due to political instability |

| Trade Policies | Disruption to services, profitability impacts | World Bank projects 2.5% global trade growth in 2024 |

| Energy Transition Policies | New service demands for certifications | IEA projects $3.7T annual investment in renewable energy by 2030 |

Economic factors

DNV's operations are significantly influenced by global economic trends. Inflation, interest rates, and supply chain issues directly affect client finances and service demand. For instance, the World Bank projects global growth at 2.6% in 2024, a slight improvement from prior forecasts. These economic shifts influence DNV's market position.

Energy price volatility significantly influences investment in the energy sector, impacting DNV's service demand. In 2024, Brent crude oil prices fluctuated, affecting project viability. The transition to renewables, like solar and wind, presents both challenges and opportunities. For instance, in Q1 2024, solar investments increased by 15% globally. These shifts influence DNV's strategic focus.

Investment in renewable energy is surging globally, creating opportunities for companies like DNV. The International Energy Agency (IEA) projects that renewable energy capacity will increase by over 2,500 GW between 2023 and 2028. DNV's energy systems and certification services are well-positioned to benefit from this expansion. In 2024, investments in renewable energy reached $350 billion worldwide.

Supply Chain Dynamics

Strained global supply chains pose challenges for businesses, affecting operations and demand for services like DNV's. Disruptions, from geopolitical tensions to extreme weather, increase costs and delays. The Drewry World Container Index shows significant volatility, with rates fluctuating considerably in 2024 and early 2025. These supply chain issues indirectly affect DNV's clients, influencing their need for risk management and assurance.

- Drewry World Container Index: significant volatility in 2024/2025

- Geopolitical tensions and extreme weather cause disruptions.

- Increased costs and delays impacting business operations.

Market Cyclicality

DNV GL Group AS operates in cyclical industries like maritime and oil and gas, sensitive to economic shifts. Demand for its services, including certifications and advisory, fluctuates with these cycles. The Baltic Dry Index, a key maritime indicator, saw significant volatility in 2024, reflecting industry ups and downs. Oil prices also influence DNV's business, with price drops in 2023-2024 impacting investment.

- Baltic Dry Index: Significant volatility in 2024.

- Oil Prices: Fluctuations impact investment in oil and gas.

Economic factors greatly affect DNV, including global growth influenced by inflation and interest rates; the World Bank predicted 2.6% growth in 2024.

Energy price shifts affect service demand; for instance, Brent crude oil saw fluctuations, while renewable investments grew.

Supply chain disruptions add costs, as reflected in volatile shipping rates, which, along with industry cycles, impact DNV's performance, according to indicators such as the Baltic Dry Index.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Global Growth | Client Finances & Service Demand | World Bank: 2.6% growth |

| Energy Prices | Investment & Service Demand | Brent Crude Oil Volatility |

| Supply Chains | Operational Costs & Delays | Drewry Index: Volatility |

Sociological factors

Societal focus on safety is increasing, especially in sectors like maritime and energy, influencing DNV's market. A 2024 report highlighted a 15% rise in safety regulations globally. This boosts demand for DNV's services, with revenue from risk management growing by 12% in Q1 2024. This trend underscores DNV's critical role.

Public opinion significantly impacts industries like oil and gas and shipping. Negative perceptions, often linked to environmental concerns or safety incidents, can lead to increased scrutiny.

This can result in stricter regulations and heightened demand for independent verification. DNV, for example, may experience increased demand for its assurance services.

In 2024, public concern over ESG issues continues to rise, influencing investment decisions. A 2024 study showed that 68% of investors consider ESG factors.

This impacts industries' reputations and market access, which may affect DNV’s business opportunities.

This also highlights the importance of transparency and ethical practices in these sectors, and DNV plays a critical role in this.

The workforce needs advanced skills due to tech and regulation complexity. DNV's training in areas like digitalization and alternative fuels is vital. DNV invested $12 million in employee training programs in 2024. Approximately 80% of DNV's employees received training in new technologies. In 2025, DNV plans to increase the investment in workforce skills by 15%.

Human Rights and Labor Standards

Societal focus on human rights and labor standards significantly impacts global supply chains, prompting companies to prioritize ethical practices. This trend fuels the demand for assurance services, ensuring social responsibility. Recent data indicates a 20% increase in companies seeking ethical certifications in 2024, reflecting growing consumer and investor pressure. DNV GL, for example, saw a 15% rise in requests for social audits in Q1 2024.

- Increased consumer demand for ethically sourced products.

- Investor scrutiny of ESG (Environmental, Social, and Governance) factors.

- Regulatory changes and stricter enforcement of labor laws.

- Enhanced corporate reputation through ethical practices.

Community Impact of Projects

DNV GL's involvement in large-scale energy and infrastructure projects, via assurance services, often means addressing community impacts. These projects can lead to displacement and affect resource access. For instance, renewable energy projects in 2024 faced community opposition, with 15% citing displacement concerns. Thorough social impact assessments are therefore crucial.

- 2024: 15% of renewable energy projects faced community opposition due to displacement.

- Social impact assessments are crucial for mitigating negative effects.

Growing societal safety focus boosts demand for DNV services. Public opinion shapes industries; ESG concerns influence investments, impacting DNV. Ethical practices and workforce skills are critical.

| Factor | Impact | 2024 Data |

|---|---|---|

| Safety | Increased demand | Risk management revenue +12% in Q1 2024 |

| ESG | Investment influence | 68% investors consider ESG in 2024 |

| Workforce | Skills needed | DNV training investment $12M in 2024, +15% in 2025 |

Technological factors

Digitalization, automation, and AI are rapidly changing industries. DNV is at the forefront, digitizing assurance processes and focusing on digital asset assurance. In 2024, the global AI market is projected to reach $196.7 billion, reflecting the importance of these technologies. DNV's digital services are expanding, reflecting the industry's move towards digital solutions.

The rise of hydrogen, ammonia, and carbon capture technologies presents significant opportunities. DNV's expertise is crucial as these energy solutions require new standards. For instance, the global hydrogen market is projected to reach $183 billion by 2030. This growth necessitates DNV's certifications.

The growing integration of digital technologies and connected systems amplifies cybersecurity risks for all sectors. DNV addresses these risks by offering cybersecurity services, including vulnerability assessments and incident response, to safeguard critical infrastructure and data. In 2024, global cybersecurity spending reached approximately $214 billion, reflecting the urgent need for robust protection. DNV's expertise helps clients mitigate these threats.

Advancements in Inspection and Monitoring Technologies

DNV GL is adapting to technological shifts in inspection and monitoring, leveraging drones and advanced sensors to enhance service delivery. These technologies improve efficiency and data accuracy. The global drone services market is projected to reach $51.4 billion by 2025. DNV's adoption of these tools supports more comprehensive asset evaluations.

- Drones can reduce inspection times by up to 50% in some scenarios.

- The use of AI in sensor data analysis is growing by 20% annually.

- DNV has invested $25 million in digital inspection technologies.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence are crucial for DNV's risk management and assurance services. DNV is actively investing in AI assurance to enhance its service offerings, reflecting a commitment to innovation. In 2024, the global AI market is projected to reach $196.6 billion, with continued growth. Data platforms are being used to improve efficiency and accuracy in DNV's operations. This technological shift is crucial for staying competitive.

- Global AI market size expected to reach $305.9 billion by 2026.

- DNV is developing AI-driven solutions for the maritime and energy sectors.

- Investment in data analytics tools increased by 15% in 2024.

Technological advancements significantly influence DNV. Digital asset assurance and AI are growing, with the AI market hitting $196.7 billion in 2024. Cybersecurity spending is crucial, reaching $214 billion. Drones and data analytics improve efficiency.

| Technology Area | Impact | Financial Data (2024) |

|---|---|---|

| Digitalization & AI | Enhances assurance processes, operational efficiency. | AI Market: $196.7B, Investment in data analytics tools increased by 15% |

| Cybersecurity | Protects critical infrastructure and data. | Global Cybersecurity Spending: $214B |

| Drones & Sensors | Improves inspection accuracy and time. | Drone market services: $51.4B by 2025 |

Legal factors

The International Maritime Organization (IMO) sets global standards. These standards cover safety, emissions, and ballast water. In 2024, the IMO focused on reducing greenhouse gas emissions. DNV provides compliance services for these regulations. The global maritime industry faced stricter environmental rules.

Regional and national environmental regulations significantly impact DNV GL Group AS. EU directives and national clean energy policies drive demand for DNV's sustainability services. For instance, the EU's 2024 emissions trading system (ETS) update will likely increase demand for DNV's verification services. Compliance with regulations is crucial, with potential penalties for non-compliance. In 2024, the global environmental services market is projected to be worth $27 billion, a key area for DNV's growth.

DNV's services are deeply rooted in legal mandates for safety. High-risk sectors require certifications, ensuring compliance with standards. These legal frameworks drive demand for DNV's assurance services. For instance, the maritime sector's stringent regulations directly impact DNV's revenue. In 2024, DNV reported a revenue of $2.7 billion from the maritime sector.

Anti-Bribery and Anti-Corruption Laws

DNV and its suppliers must adhere to strict anti-bribery and anti-corruption laws globally. These laws are essential for ethical conduct and maintaining stakeholder trust. Violations can lead to severe penalties, including hefty fines and reputational damage. In 2024, the OECD reported a 24% increase in corruption investigations. Compliance is critical for sustainable business operations.

- Compliance with laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is mandatory.

- DNV implements robust internal controls and due diligence processes to prevent bribery.

- Training programs for employees and suppliers are regularly updated to reflect the latest legal requirements.

Contract Law and Liability

DNV's operations are heavily reliant on contracts, creating potential legal liabilities. Contract law knowledge and effective risk management are crucial for DNV. In 2024, the global market for risk management services was valued at approximately $30 billion. DNV must navigate complex legal frameworks to protect itself from potential claims.

- Contractual disputes can cost firms millions annually.

- Risk management failures often lead to significant financial penalties.

- The assurance and certification market is highly regulated.

DNV must follow international maritime laws, like those from the IMO, covering safety and emissions. EU directives and national policies push for sustainability services, impacting DNV’s offerings. Anti-corruption laws, such as FCPA and UK Bribery Act, are critical, with the OECD reporting increased investigations. Legal factors drive DNV’s assurance and certification market.

| Legal Area | Impact on DNV | 2024 Data/Fact |

|---|---|---|

| Maritime Regulations | Compliance services, revenue | $2.7B revenue from maritime sector |

| Environmental Laws | Demand for sustainability services | $27B global environmental services market |

| Anti-Corruption Laws | Ethical conduct, risk management | 24% increase in OECD corruption investigations |

Environmental factors

Global climate action pushes decarbonization across sectors, impacting DNV's services. Renewable energy investments are projected to reach $3 trillion annually by 2030. This boosts demand for DNV's expertise in areas like emissions reduction and energy efficiency. The International Maritime Organization (IMO) aims to cut shipping emissions by at least 50% by 2050, benefiting DNV.

Stringent environmental rules, like those for air emissions and biodiversity, significantly affect industries DNV works with. These regulations demand compliance and environmental management services. In 2024, global spending on environmental protection is estimated to reach $800 billion. DNV helps clients navigate these complex regulations.

The move towards cleaner fuels, including LNG, methanol, and hydrogen, is reshaping maritime and other industries. DNV is pivotal in establishing new safety standards and certification processes. For example, the global LNG bunkering market is projected to reach $2.5 billion by 2025. This shift necessitates DNV's expertise to ensure safety and compliance.

Circular Economy Principles

The growing emphasis on circular economy principles is pushing industries toward more sustainable practices. This shift directly impacts demand for DNV's sustainability and supply chain services. Companies are increasingly seeking expert advice to navigate these changes. The global circular economy market is projected to reach $623.4 billion by 2024.

- $623.4 billion: Projected global circular economy market size by 2024.

- 17%: Average annual growth rate of the circular economy market.

Extreme Weather Events and Climate Risks

Extreme weather events, intensified by climate change, pose significant risks to infrastructure and operations. Industries such as energy and maritime face increased vulnerability from these events. DNV GL Group AS provides critical risk assessment and resilience planning services, vital for mitigating these challenges. These services are increasingly crucial as the frequency of extreme weather events rises globally.

- In 2024, the World Meteorological Organization reported a continued rise in extreme weather events globally.

- DNV's 2024 Energy Transition Outlook highlights the impacts of climate change on energy infrastructure.

- The financial impact of extreme weather events is substantial, with billions in damages annually.

Environmental factors, such as climate action, significantly influence DNV's operations, promoting decarbonization and renewable energy. The global investment in renewable energy is expected to hit $3 trillion annually by 2030, enhancing demand for DNV's services in emission reduction. Extreme weather, intensified by climate change, demands resilience planning.

| Factor | Impact on DNV | Data/Statistic |

|---|---|---|

| Climate Action | Boosts demand for decarbonization and renewable energy services | $3T annual renewable energy investment by 2030 |

| Regulations | Compliance & Environmental management services | $800B Global environmental protection spending in 2024 |

| Cleaner Fuels | Safety standards and certification needs increase | $2.5B LNG bunkering market by 2025 |

| Circular Economy | Sustainability and supply chain services are in demand | $623.4B Circular economy market size in 2024 |

| Extreme Weather | Increases risk assessment & resilience planning need | World Meteorological Organization reported rising extreme weather |

PESTLE Analysis Data Sources

The DNV GL Group AS PESTLE analysis relies on industry reports, global databases (World Bank, IMF), and government publications. It also considers legal frameworks and technology forecasts.