Dollar Tree Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar Tree Bundle

What is included in the product

Evaluates control by suppliers/buyers, and influence on Dollar Tree's pricing and profitability.

Instantly compare the five forces visually using a color-coded rating scale for easy understanding.

What You See Is What You Get

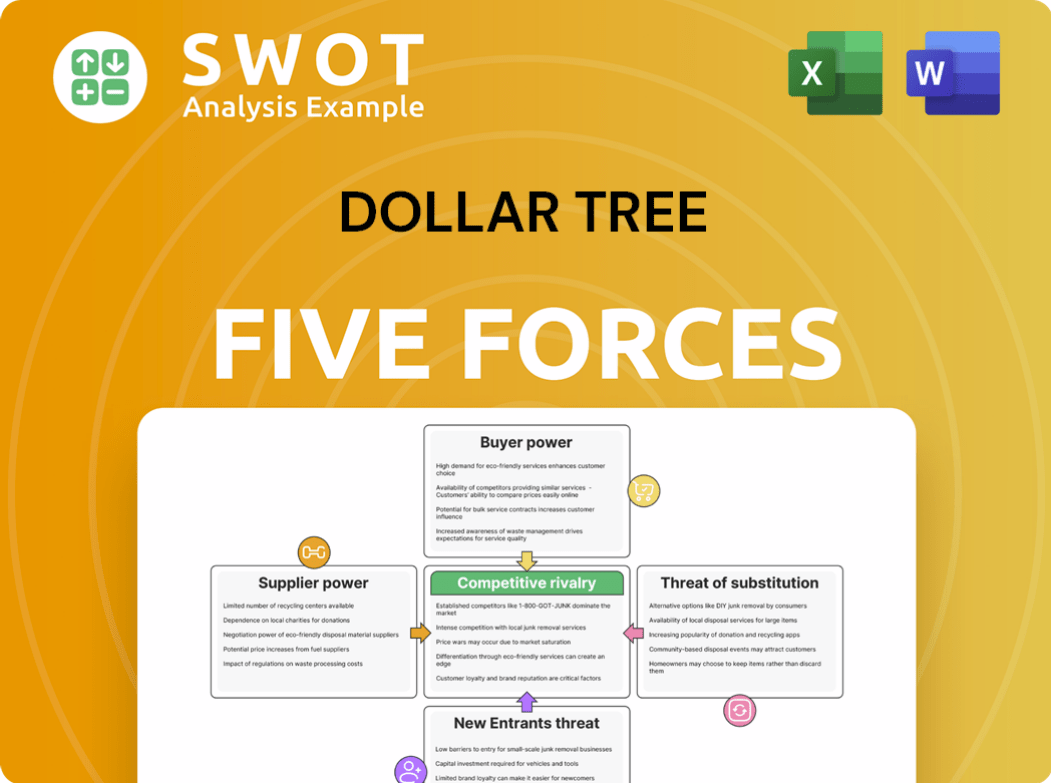

Dollar Tree Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This Dollar Tree Porter's Five Forces analysis assesses competitive rivalry, bargaining power of suppliers, and buyers, the threat of substitutes and new entrants. It details Dollar Tree's market position and challenges using the five forces framework. You'll receive a fully formatted and in-depth look at the discount retail giant.

Porter's Five Forces Analysis Template

Dollar Tree faces moderate competition, with buyers wielding some power due to numerous retail options. Suppliers, however, hold limited leverage, with diversified sourcing. The threat of new entrants is relatively low due to established brand recognition and economies of scale. Substitute products, primarily other discount retailers, pose a constant threat. Rivalry among existing competitors is high, driving price wars and margin pressures.

The complete report reveals the real forces shaping Dollar Tree’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dollar Tree's bargaining power with suppliers is generally strong due to its extensive network of approximately 13,000 suppliers. However, a substantial 70% of these suppliers are based in Asia, with a significant portion in China, as of 2024. This concentration grants some leverage to these suppliers, especially if they provide unique products. To counter this, Dollar Tree actively diversifies its sourcing, including suppliers in North America and Europe.

Dollar Tree's massive purchasing volume, hitting approximately $5.3 billion annually, significantly strengthens its bargaining power. This allows the retailer to dictate favorable terms and pricing with suppliers. They leverage bulk orders, often negotiating contracts for 500,000 to 1,000,000 units per product category. This advantageous position helps mitigate the influence of concentrated suppliers, ensuring competitive costs.

Dollar Tree leverages a wide supplier network, averaging 50-100 suppliers per product category. This strategy reduces reliance on any single vendor, enhancing its negotiating position. The company's ability to swiftly replace suppliers, often within 30-45 days, further weakens supplier power. In 2024, Dollar Tree's cost of goods sold was approximately $21.7 billion, showing its significant purchasing volume and influence.

Supplier Switching Capabilities

Dollar Tree benefits from low supplier switching costs, estimated to be only 2-3% of its total merchandise procurement expenses. This low cost allows Dollar Tree to readily change suppliers. The company can typically replace a supplier within 30-45 days, minimizing inventory disruption, which weakens supplier bargaining power. This flexibility is crucial in maintaining competitive pricing.

- Switching costs are a low 2-3% of procurement expenses.

- Supplier replacement can occur in 30-45 days.

- This flexibility helps maintain competitive prices.

Global Sourcing Strategy

Dollar Tree's global sourcing strategy is a key element in its bargaining power with suppliers. They leverage international markets to secure favorable deals. This approach is crucial for maintaining low prices, which is central to their business model. By diversifying its supplier base, Dollar Tree reduces dependency and strengthens its negotiating position.

- In 2024, Dollar Tree sourced products from over 40 countries, underlining its broad supplier network.

- Approximately 70% of Dollar Tree's merchandise is sourced internationally.

- This strategy helps them maintain gross margins, even with inflationary pressures.

- They are focused on sourcing products via channels that deliver the lowest landed cost to maintain value continuity for their customers.

Dollar Tree's strong bargaining power stems from its extensive supplier network and massive purchasing volume, roughly $5.3 billion annually. They can dictate favorable terms and quickly replace suppliers, minimizing supplier influence. With low switching costs (2-3%) and global sourcing, Dollar Tree maintains competitive pricing, crucial for its value proposition.

| Factor | Details | Impact |

|---|---|---|

| Supplier Network | Approximately 13,000 suppliers; 70% in Asia, including China (2024). | Mixed: some supplier leverage, mitigated by diversification. |

| Purchasing Volume | Around $5.3B annually; bulk orders of 500K-1M units. | Strong bargaining power; favorable terms and pricing. |

| Switching Costs | Low, about 2-3% of procurement expenses. | Easy supplier replacement; maintains competitive pricing. |

Customers Bargaining Power

Dollar Tree's customers are notably price-sensitive, constantly seeking the best deals. Any price increase or quality dip can drive customers to rivals like Dollar General. In 2024, Dollar General reported a 5.8% sales increase, highlighting customer readiness to switch. This price awareness strengthens customer bargaining power.

Customers possess significant bargaining power due to low switching costs in the discount retail sector. This ease of switching allows customers to easily compare prices and promotions across different stores. The lack of loyalty, coupled with the prevalence of similar products, means customers often prioritize the best deals. In 2024, Dollar Tree's same-store sales increased by 3.0%, but this growth is always under pressure from competitors.

Dollar Tree's consistent pricing, notably the $1.25 model launched in 2022, limits customer bargaining power. This strategy fosters a perception of value, making individual price negotiations less likely. In Q4 2023, Dollar Tree's same-store sales increased by 3%. The simplicity of the pricing reinforces this dynamic.

Limited Differentiation

Customers wield considerable bargaining power due to limited product differentiation among discount retailers. This lack of distinct offerings means shoppers often prioritize price and convenience when deciding where to shop. Online e-commerce sites further amplify this power by providing access to similar low-cost goods, intensifying competition. In 2024, Dollar Tree's net sales reached approximately $7.4 billion in the first quarter alone, indicating significant customer activity and choice.

- Similar products across retailers heighten customer price sensitivity.

- Online platforms offer competitive pricing and wider selection.

- Customers can easily switch between stores based on deals.

- Customer loyalty is low due to the nature of discount shopping.

Availability of Alternatives

Dollar Tree faces strong customer bargaining power due to the availability of alternatives. Customers can easily switch to other dollar stores, online retailers, or big-box stores like Walmart and Target. Amazon's vast marketplace, with approximately 9.7 million third-party sellers in 2023, offers competitively priced alternatives. This competition compels Dollar Tree to maintain attractive pricing and product quality.

- Numerous dollar stores provide direct alternatives.

- Online marketplaces, like Amazon, offer a wide selection of products.

- Large retailers (Walmart, Target) compete on price and convenience.

- Customers can readily compare prices and switch vendors.

Customers’ strong bargaining power stems from price sensitivity and easy switching. Dollar General's 5.8% sales increase in 2024 shows customers readily switch for better deals. Limited product differentiation and online options further empower consumers. Dollar Tree must maintain competitive pricing and quality.

| Factor | Impact | Data |

|---|---|---|

| Price Sensitivity | High | Customers seek best deals; switching is common. |

| Switching Costs | Low | Easy to compare prices at different stores. |

| Alternatives | Numerous | Dollar General, online retailers, and big-box stores. |

Rivalry Among Competitors

Dollar Tree faces fierce competition in discount retail. Competitors like Dollar General and Walmart constantly vie for market share. This rivalry pressures pricing and profit margins. In 2024, Dollar Tree's revenue reached approximately $30.6 billion, showing the stakes in this competitive landscape.

Market saturation significantly heightens rivalry in the dollar store sector. With more stores, competition for customers escalates, impacting sales and margins. The availability of commercial properties has surged by 9.2% since mid-2024, fueling this trend. This expansion makes it harder for each store to thrive independently. This intensifies the need for strategic differentiation.

Rivalry is intense, with competitors like Dollar General expanding and diversifying. Dollar General's project affects over 4,800 stores. These strategic moves force Dollar Tree to innovate to stay competitive. This includes improving customer experience and product offerings.

Price Wars

The discount retail sector's emphasis on low prices frequently ignites price wars, squeezing profit margins. Competitors like Dollar General and Family Dollar often match or lower prices, diminishing profitability across the board. In 2024, Dollar Tree's gross margin was about 20.5%, reflecting these pressures. Challenging consumer spending trends among lower-income households further complicate the landscape.

- Price wars are common in the discount retail sector.

- Competitors aggressively compete on price.

- Dollar Tree's gross margin was around 20.5% in 2024.

- Consumer spending trends add complexity.

Consolidation and Acquisitions

Consolidation and acquisitions significantly impact competitive rivalry within the dollar store industry. Larger entities, formed through mergers, wield greater influence and resources. This makes it tougher for smaller companies to keep up. Dollar General and Dollar Tree are the dominant players in the market.

- Dollar General and Dollar Tree control 60.9% of the dollar store market.

- Acquisitions can lead to increased market concentration.

- Larger companies have advantages in pricing and supply chains.

Rivalry is high, with price wars common. Gross margin was about 20.5% in 2024. Consolidation affects competition.

| Aspect | Details |

|---|---|

| Market Share | Dollar General and Dollar Tree control 60.9% of dollar store market |

| Revenue (2024) | Dollar Tree: $30.6 billion |

| Gross Margin (2024) | Dollar Tree: ~20.5% |

SSubstitutes Threaten

The availability of online retailers poses a significant threat to Dollar Tree. Amazon and Walmart.com offer many low-cost items, easily accessible from home. In 2023, Amazon's marketplace had 9.7 million third-party sellers, providing competitive alternatives. This online accessibility reduces the need for physical store visits, impacting Dollar Tree's market.

Big-box retailers, including Walmart and Target, represent a significant threat to Dollar Tree due to product similarities and competitive pricing. These stores offer a broad selection, functioning as a one-stop shop, which can divert customers. Walmart's e-commerce revenue reached $73.2 billion in 2022, intensifying the substitution risk. This competition pressures Dollar Tree to maintain its value proposition to retain customers.

Grocery stores and pharmacies pose a threat to Dollar Tree by offering similar products, like consumables and household items, providing convenient alternatives. These retailers often use loyalty programs and promotions to attract customers. Dollar Tree's expansion into groceries, with a focus on consumables, suggests a strategic response to maintain market share. For instance, Dollar General reported a 7.3% same-store sales increase in Q3 2023, indicating strong competition.

Other Discount Retailers

The threat of substitutes in the discount retail sector is significant, mainly due to the presence of competitors offering similar value. Retailers like Five Below and Ollie's Bargain Outlet compete directly with Dollar Tree by providing a variety of low-priced merchandise. These alternatives appeal to budget-conscious shoppers, potentially diverting customers away from Dollar Tree.

- Five Below's net sales in Q3 2024 were $808.9 million, a 12.3% increase.

- Ollie's Bargain Outlet reported net sales of $518.9 million in Q3 2024, up 11.3%.

- Dollar General's same-store sales decreased by 0.1% in Q3 2024.

Private Label Brands

The growing popularity of private label brands poses a substitution threat to Dollar Tree. These store-brand products often provide similar quality at lower prices, appealing to budget-conscious consumers. Dollar Tree's move to broaden its price range and possibly sell Family Dollar reflects efforts to adapt. Family Dollar was acquired for $9 billion in 2015.

- Private label brands offer comparable quality at lower prices, attracting cost-conscious shoppers.

- Dollar Tree is adjusting by expanding its assortment and considering strategic shifts.

- Family Dollar acquisition for $9 billion in 2015.

Dollar Tree faces substitution threats from various retailers offering similar products at competitive prices. Online retailers and big-box stores provide convenient alternatives, while grocery stores and pharmacies also compete by offering similar goods. The proliferation of private label brands and discount stores like Five Below and Ollie's Bargain Outlet further intensifies the competition.

| Substitute | Q3 2024 Data | Key Impact |

|---|---|---|

| Five Below | Net Sales: $808.9M (+12.3%) | Direct competition in low-cost retail |

| Ollie's Bargain Outlet | Net Sales: $518.9M (+11.3%) | Offers similar value proposition |

| Dollar General | Same-store sales: -0.1% | Indicates market saturation, competitive environment |

Entrants Threaten

Dollar Tree's strong brand recognition presents a substantial hurdle for new entrants. The company's reputation for value and affordability is a significant advantage. Dollar Tree's brand recognition creates high market entry barriers. The company's revenue reached $27.5 billion in 2023, with a market cap of $24.3 billion.

Dollar Tree and Dollar General leverage substantial economies of scale. These giants secure advantageous supplier deals, boosting their efficiency. In 2024, Dollar General's revenue reached approximately $38.7 billion, underscoring its market dominance. This size enables them to offer lower prices, creating a barrier for new competitors. Suppliers, reliant on these retailers for significant revenue, provide competitive terms, further solidifying the incumbents' advantage.

Dollar Tree's robust distribution network acts as a significant barrier to new competitors. Their efficient supply chain ensures product availability, boosting customer satisfaction. This network includes strategically placed distribution centers for streamlined operations. In 2024, Dollar Tree operated over 16,000 stores across North America, demonstrating a vast distribution reach.

Initial Capital Requirements

The threat of new entrants to Dollar Tree is somewhat limited due to high initial capital requirements. Establishing a large-scale retail presence like Dollar Tree demands a significant financial commitment. This includes setting up stores, distribution networks, and supply chains, all of which are costly. Dollar Tree itself needed a substantial investment to achieve its current scale.

- Initial capital investment: $250 million to $500 million.

- Dollar Tree operates approximately 16,560 stores in the U.S. and Canada as of 2024.

- These figures highlight the financial barrier for new competitors.

Regulatory and Compliance Costs

Navigating regulatory and compliance requirements can be complex and costly, presenting a hurdle for new businesses. Compliance with laws adds to operational challenges and expenses. The retail industry has moderate entry barriers. However, Dollar General's extensive store network, brand recognition, and economies of scale act as barriers.

- Regulatory compliance includes labor laws, health and safety standards, and environmental regulations.

- These costs can be significant, especially for smaller entrants.

- Dollar Tree's established position and scale help manage these costs better.

- New entrants face higher per-unit costs due to compliance.

New entrants face substantial hurdles when challenging Dollar Tree. High capital needs, like the $250-$500 million needed initially, act as a significant barrier. Navigating regulations adds to costs, and Dollar Tree's scale offers a competitive advantage.

| Barrier | Description | Impact |

|---|---|---|

| Capital Needs | High startup costs | Limits new entrants |

| Regulatory Costs | Compliance expenses | Increases operational costs |

| Dollar Tree's Scale | Established network | Creates competitive advantage |

Porter's Five Forces Analysis Data Sources

The Dollar Tree analysis uses SEC filings, market research, and industry publications. This incorporates competitor analyses and economic data to gauge forces.