Dollar Tree SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar Tree Bundle

What is included in the product

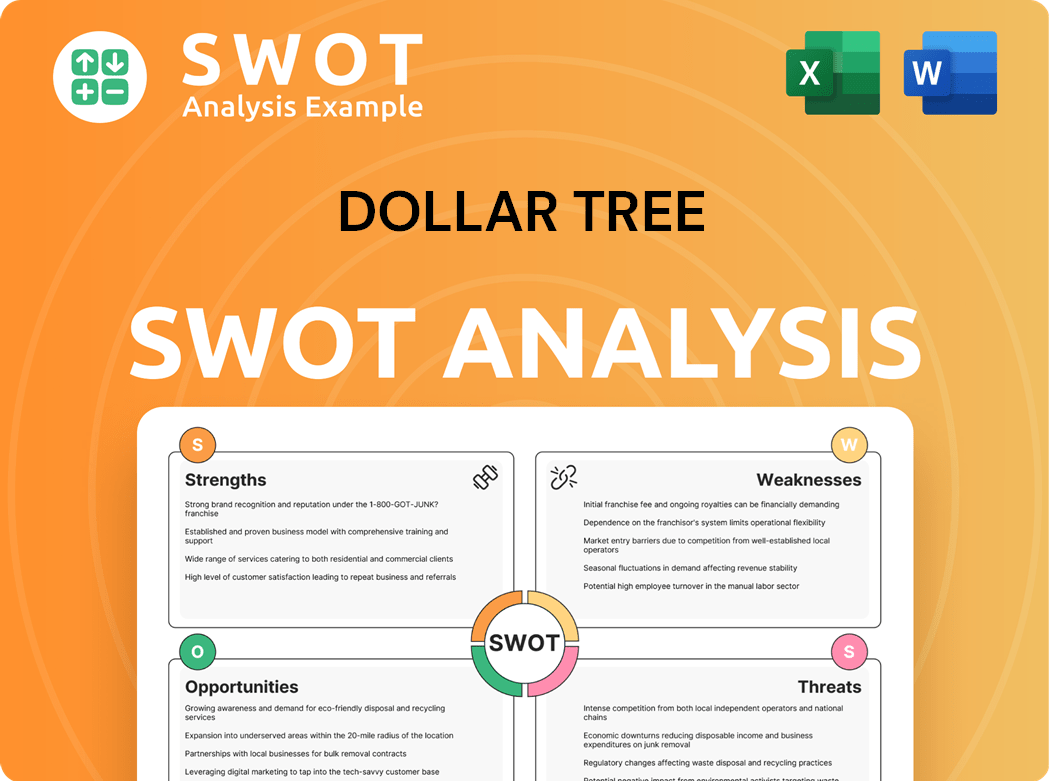

Outlines the strengths, weaknesses, opportunities, and threats of Dollar Tree.

Offers a concise summary, making complex Dollar Tree strategies easy to grasp.

Same Document Delivered

Dollar Tree SWOT Analysis

See a live preview of the Dollar Tree SWOT analysis. The exact content displayed below is what you'll receive instantly upon purchase.

There are no hidden snippets or edited sections. This document is the full, complete, professional SWOT analysis.

The whole, comprehensive report is accessible right after your order. It's ready to use!

SWOT Analysis Template

Dollar Tree, a titan in the discount retail sector, faces both compelling advantages and serious vulnerabilities. Our SWOT analysis reveals how Dollar Tree capitalizes on its vast store network and bargain prices. But it also highlights key threats like rising costs and intense competition. Exploring its opportunities to expand offerings further, or addressing the potential risks related to inflation?

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Dollar Tree benefits from established brand recognition, especially for its value. This recognition boosts customer loyalty, driving store traffic. The company's market presence reinforces its status as a budget-friendly choice. In 2024, Dollar Tree's revenue was approximately $7.6 billion. This reflects strong brand appeal.

Dollar Tree's expansive store network, with over 16,000 locations as of 2024, is a core strength. This vast presence allows them to reach a broad customer base across North America. Their widespread accessibility enhances customer convenience. This drives foot traffic and supports robust sales figures, with 2023 revenues reaching approximately $28.3 billion.

Dollar Tree’s broad product range, from food to home goods, attracts a wide customer base. This diverse assortment, including seasonal items and party supplies, positions it as a convenient shopping destination. In 2024, Dollar Tree's consumables sales reached $8.5 billion, demonstrating the appeal of its product variety. This wide selection boosts customer loyalty and encourages frequent visits, supporting strong sales.

Strategic Multi-Price Expansion

Dollar Tree's strategic multi-price expansion leverages its established brand recognition and customer loyalty. This expansion allows the company to cater to a broader range of consumer needs while maintaining its value-driven image. The move is designed to boost revenue and profitability by offering a wider selection of products at various price points. This strategy has shown promise, with some analysts predicting increased sales and market share.

- In Q3 2023, Dollar Tree reported a 5.4% increase in same-store sales.

- The multi-price strategy aims to increase the average transaction value.

- Dollar Tree operates over 16,000 stores across North America.

- The company plans to expand its higher-priced offerings.

Strong Financial Position

Dollar Tree's robust financial standing is a key strength. The company's substantial revenue, reaching $7.6 billion in Q1 2024, reflects its solid market position. This financial health supports investments in store improvements and expansion. It also enables Dollar Tree to navigate economic fluctuations effectively.

- Revenue: $7.6 billion (Q1 2024)

- Gross profit: $2.3 billion (Q1 2024)

- Cash and cash equivalents: $1.06 billion (Q1 2024)

Dollar Tree excels due to strong brand recognition, attracting loyal customers. Its vast store network ensures broad reach, enhancing convenience and sales. The wide product range boosts customer visits and supports sales figures.

| Strength | Details | Data (2024) |

|---|---|---|

| Brand Recognition | Value perception drives customer loyalty. | $7.6B Revenue (Q1) |

| Store Network | Over 16,000 stores. | Consumables sales: $8.5B |

| Product Range | Diverse items attract a wide audience. | Same-store sales up 5.4% (Q3 2023) |

Weaknesses

Dollar Tree's fixed-price model, a core part of its identity, presents vulnerabilities. This strategy restricts its ability to adjust to market changes. High inflation, for instance, can squeeze margins. In Q4 2023, Dollar Tree reported a gross margin of 21.6%, down from 23.4% the previous year.

Dollar Tree struggles with the perception that its products are of lower quality due to its pricing strategy. Consumers might assume items are inferior compared to those at higher-priced stores. This perception can deter customers, impacting sales and brand image. To combat this, Dollar Tree must balance affordability with improved product quality and perceived value. In 2024, Dollar Tree's same-store sales increased, but consumer perception of quality remains a key challenge.

Dollar Tree faces inventory management hurdles due to its extensive store network and varied product range. Inefficient inventory practices can result in stockouts or excess inventory, impacting profitability. The company's gross profit margin in Q3 2023 was 39.9%, down from 40.6% in the prior year, potentially linked to inventory issues. Advanced systems are essential to enhance inventory tracking.

Dependence on Imports

Dollar Tree's reliance on imports presents a significant weakness, particularly given its low-price strategy. This dependence can restrict its ability to adapt to market changes and rising costs. Maintaining profitability within a fixed-price model demands rigorous cost control and efficient supply chains. Disruptions to the supply chain or increased operating expenses can severely affect profit margins.

- In 2024, Dollar Tree reported a 10.3% increase in cost of goods sold, highlighting the impact of import costs.

- Approximately 60% of Dollar Tree's merchandise is sourced from overseas.

- Supply chain issues, such as those experienced in 2021-2022, significantly increased freight costs.

Integration Issues with Family Dollar

Dollar Tree's acquisition of Family Dollar presents integration challenges, especially concerning brand perception. Family Dollar's existing reputation for lower-quality products can negatively impact the combined entity. Overcoming this involves improving product perception while maintaining affordability. This is crucial, as Dollar Tree's 2024 Q1 sales decreased slightly to $7.63 billion, reflecting integration difficulties.

- Perception of lower product quality.

- Need to enhance product value.

- Maintaining affordability is key.

- Focus on quality and value.

Dollar Tree's fixed prices limit market flexibility. Perceived lower product quality can deter shoppers. Inventory management struggles impact profitability. Reliance on imports exposes it to risks. Family Dollar's integration brings brand challenges.

| Weakness | Impact | Data (2024) |

|---|---|---|

| Fixed Pricing | Margin Squeeze | Q4 GM 21.6% (vs 23.4%) |

| Product Perception | Deters Customers | Same-store sales increase. |

| Inventory Issues | Profit Impact | Q3 GP margin 39.9% (vs 40.6%) |

| Import Reliance | Cost Vulnerability | COGS up 10.3% |

| Family Dollar | Integration Issues | Q1 Sales $7.63B |

Opportunities

Dollar Tree can tap into new markets, like urban areas and underserved communities, for growth. Focusing on these segments with tailored products can boost sales and market share. Expanding into rural areas also offers potential, providing affordable options where they're limited. In 2024, Dollar Tree's expansion strategy aims to open hundreds of new stores, including in these key areas.

Dollar Tree can significantly boost growth by enhancing its e-commerce capabilities. A user-friendly online platform and convenient delivery can attract new customers. Integrating online and offline channels enhances the shopping experience and boosts loyalty. In Q4 2023, online sales were 2.7% of total revenue. This presents a huge growth opportunity.

Dollar Tree can boost profits by developing private label products, giving it control over quality, pricing, and branding. Private labels often have higher profit margins than national brands. In 2024, Dollar Tree's focus on private brands and global sourcing continues to be a key strategy. This approach strengthens their competitive edge and builds customer loyalty. Dollar Tree's private label sales are expected to increase, as per recent reports.

Strategic Partnerships

Dollar Tree can forge strategic partnerships to tap into new markets. Focusing on urban and underserved areas can significantly boost revenue. Tailoring products to these segments is key for growth. Rural expansion also offers a chance to serve communities lacking retail options.

- In 2024, Dollar Tree's expansion plans include adding hundreds of new stores.

- Partnerships could involve collaborations with local businesses or community organizations.

- This approach is designed to increase market share and cater to diverse customer needs.

- Such moves are crucial for Dollar Tree's continued financial growth.

Value-Added Services

Dollar Tree can significantly boost its revenue by enhancing its online presence and e-commerce capabilities. A user-friendly online platform and convenient delivery options are key to attracting new customers and driving online sales. Integrating online and offline channels can improve the shopping experience and customer loyalty. In Q4 2023, online sales accounted for 2.7% of Dollar Tree's total revenue, signaling substantial growth potential.

- Online sales grew 14.9% in Q4 2023.

- Dollar Tree plans to expand its digital footprint.

- Investments in technology are ongoing.

- Focus on click-and-collect services.

Dollar Tree can seize opportunities by entering new markets. This involves focusing on urban and underserved communities. Enhanced e-commerce and private labels boost profitability. Partnerships and a strong digital presence drive revenue, especially online, which was up 14.9% in Q4 2023.

| Opportunity | Details | Impact |

|---|---|---|

| Market Expansion | New stores, rural & urban focus. | Increased sales, market share gains. |

| E-commerce Enhancement | User-friendly online, click-and-collect. | Higher online revenue (2.7% in Q4 2023), customer reach. |

| Private Labels | Control over quality & branding. | Increased profit margins, customer loyalty. |

Threats

Dollar Tree faces fierce competition in the retail sector. Competitors like Dollar General and Walmart aggressively target the same budget-conscious shoppers. This intense rivalry squeezes pricing and profitability. Successful differentiation through unique products and service is vital for survival.

Economic downturns pose a threat by curbing consumer spending, especially on non-essential items. Despite Dollar Tree's appeal during economic hardships, sustained instability could hurt sales. The company must adapt its offerings. In 2024, inflation and economic uncertainty challenged retailers. Dollar Tree's CEO noted bargain hunting in March 2025.

Fluctuating supply chain costs pose a threat to Dollar Tree's profitability. Increased expenses in transportation, raw materials, and labor can squeeze margins. For instance, in Q3 2023, Dollar Tree's gross profit margin decreased to 29.9%. Rising fuel prices and potential tariffs also contribute to these costs.

Changing Consumer Preferences

Dollar Tree faces intense competition within the retail sector, including from Dollar General and Walmart, affecting pricing strategies. These competitors directly challenge Dollar Tree's market share, especially in attracting value-conscious consumers. Maintaining profitability amid this rivalry requires careful management of costs and differentiation. Adapting to evolving consumer demands and preferences is essential for long-term success.

- Dollar General's 2024 revenue reached approximately $40 billion, highlighting the competitive pressure.

- Walmart's expansive e-commerce presence intensifies the competition for online sales.

- Dollar Tree's Q3 2023 sales increased 3.4% to $7.32 billion.

Tariffs and Trade Restrictions

Tariffs and trade restrictions pose risks, potentially increasing the cost of imported goods. This can squeeze Dollar Tree's margins, especially if they can't fully pass costs to consumers. Economic downturns and recessions could also dent consumer spending. In Q4 2024, Dollar Tree reported a same-store sales decrease of 1.7%. Adapting to economic shifts is crucial for survival.

- Increased import costs.

- Potential margin squeeze.

- Reduced consumer spending.

- Need for strategic adaptation.

Dollar Tree battles intense rivalry from Dollar General and Walmart, which is seen in their financial outcomes.

Economic downturns threaten consumer spending, and the firm needs strategies to weather financial uncertainty.

Supply chain issues and trade restrictions potentially lift prices. A recent report showed a decrease in Q4 2024's same-store sales.

| Threats | Impact | Data |

|---|---|---|

| Intense Competition | Pricing Pressures | Dollar General: ~$40B revenue (2024) |

| Economic Downturns | Reduced Spending | Q4 2024 same-store sales: -1.7% |

| Supply Chain Issues | Margin Squeeze | Q3 2023 Gross Margin: 29.9% |

SWOT Analysis Data Sources

This SWOT leverages reliable financial reports, market analysis, and expert perspectives for accuracy and strategic depth.