DoubleVerify Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoubleVerify Bundle

What is included in the product

Analysis of DoubleVerify's products within the BCG Matrix. Strategic insights for each quadrant's investment needs.

Printable summary optimized for A4 and mobile PDFs, creating quick insights delivery.

What You See Is What You Get

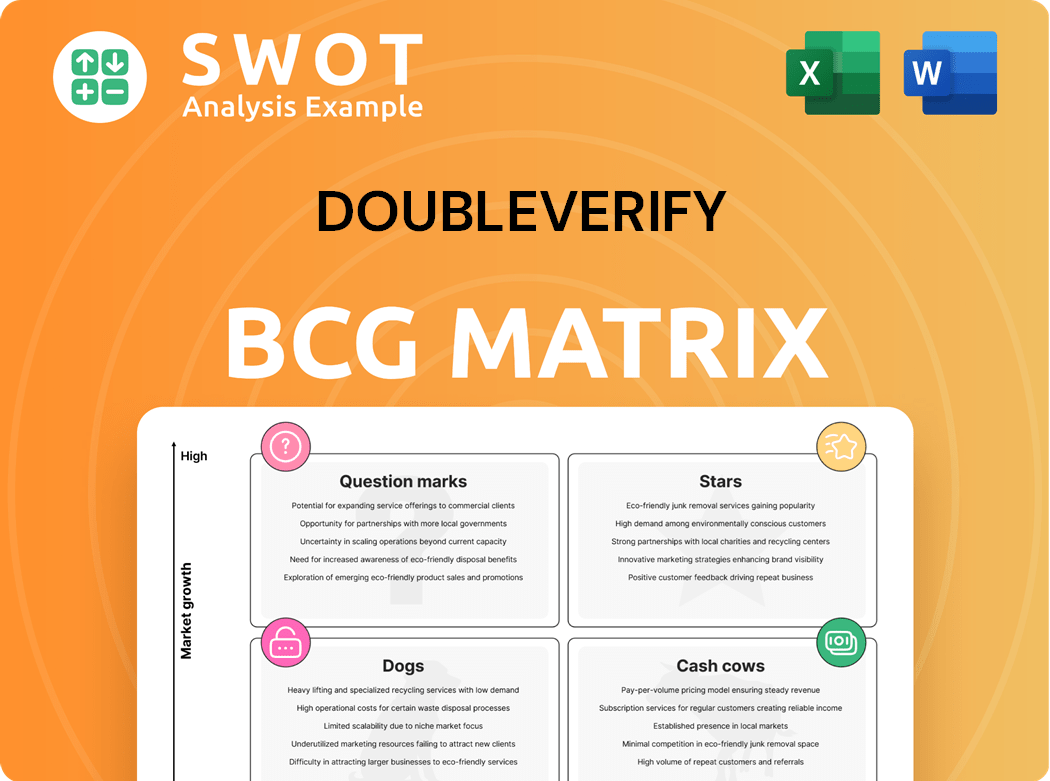

DoubleVerify BCG Matrix

The BCG Matrix preview mirrors the final report delivered post-purchase. Expect the complete, professional, and ready-to-use document designed for your strategic advantage, without any alterations.

BCG Matrix Template

DoubleVerify's BCG Matrix reveals its product portfolio's strategic landscape. Identifying Stars, Cash Cows, Question Marks, and Dogs unlocks growth strategies. This snapshot offers only a glimpse of their strategic product positioning. The complete BCG Matrix offers detailed quadrant analysis and actionable recommendations.

Stars

DoubleVerify's CTV measurement solutions are a star, enjoying high growth in the expanding connected TV market. CTV measurement rose 95% year-over-year in 2024, showcasing its market leadership. This segment benefits from ongoing investment and innovation. Continued growth is expected.

DoubleVerify's social media verification tools show strong potential, particularly on platforms like Meta and TikTok. Their partnerships with these platforms have grown, boosting social measurement revenue by 27% in 2024. This growth indicates a successful strategy in a rapidly expanding market. Future expansion and innovation in this area could further solidify their market position.

DoubleVerify's AI, like Universal Content Intelligence, boosts brand safety and performance. In 2024, AI drove 25% of DV's content-level avoidance. Keyword optimization is AI-powered. Ongoing AI investment ensures competitiveness.

Global Expansion

DoubleVerify's global expansion is a key growth driver, especially in EMEA and APAC. International measurement revenue saw a 22% increase in 2024. This expansion strategy allows them to serve clients worldwide, boosting market share.

- EMEA growth reached 25% in 2024.

- APAC experienced an 18% revenue increase in 2024.

- Global presence enhances client service capabilities.

Supply-Side Platform (SSP) Revenue

DoubleVerify's supply-side platform (SSP) revenue is growing rapidly, showing strong market share. SSP revenue increased by 34% in 2024, reflecting growth in existing and new platform integrations. This growth is fueled by strategic integrations, boosting capabilities and reach. These integrations allow for more comprehensive coverage and better performance.

- 34% revenue increase in 2024.

- Driven by existing and new integrations.

- Strategic platform integrations.

- Enhanced capabilities and reach.

DoubleVerify's CTV measurement, social media verification, AI, global expansion, and SSP are its Stars. These segments exhibit high growth rates and strong market positions. Revenue increases in 2024 highlight their success. Investments and strategic initiatives support sustained growth.

| Segment | 2024 Revenue Growth | Key Drivers |

|---|---|---|

| CTV Measurement | 95% | Market expansion, investment |

| Social Media | 27% | Platform partnerships |

| SSP | 34% | Platform integrations |

Cash Cows

DoubleVerify's brand safety solutions are cash cows, holding a strong market position in a stable market. They provide consistent revenue by safeguarding brand reputation for advertisers. In 2024, the digital ad spend reached $287 billion, highlighting the need for solutions like DoubleVerify's to combat ad fraud and ensure viewability. Their services address key industry challenges.

DoubleVerify's ad fraud detection is a cash cow, generating consistent revenue. The need for fraud prevention in digital advertising is constant, making it a reliable service. Their platform uses advanced algorithms to offer up-to-date data, critical for advertisers. In 2024, ad fraud cost advertisers billions, highlighting the importance of verification tools.

DoubleVerify's viewability measurement is crucial for advertisers, ensuring ads are seen by actual viewers. This service boosts digital ad campaign quality and effectiveness. In 2024, DoubleVerify reported a 95% viewability rate for ads on premium platforms, a key performance indicator. Viewability helps maximize campaign impact and improve results.

Large Enterprise Clients

DoubleVerify's strong ties with significant brands and advertising agencies create a reliable revenue source. They serve major clients, including Kenvue, Diageo, and Home Depot. These relationships ensure steady demand for DoubleVerify's services. In 2024, DoubleVerify's revenue reached $600 million, showcasing their solid client base.

- Stable Revenue: Consistent income from established clients.

- Key Clients: Kenvue, Diageo, and Home Depot among others.

- Service Demand: Ensures sustained requirement for core services.

- Financial Performance: $600 million revenue in 2024.

Gross Revenue Retention

DoubleVerify's "Cash Cows" status is significantly bolstered by its high gross revenue retention. This rate is a strong indicator of customer loyalty and dependable revenue streams. In Q4 2024, DoubleVerify reported a Gross Revenue Retention rate exceeding 95%, showcasing its ability to retain clients. This high retention underscores the value and dependability of DoubleVerify's offerings in the market.

- Q4 2024 Gross Revenue Retention rate over 95%

- Demonstrates strong customer loyalty

- Highlights consistent revenue from existing clients

- Reflects value and reliability of DoubleVerify's solutions

DoubleVerify's "Cash Cows" status shows strong market position and steady revenue from brand safety and fraud detection. Their services are crucial, especially with 2024 digital ad spend reaching $287 billion. They retain clients, with a Q4 2024 Gross Revenue Retention rate above 95%.

| Feature | Details | 2024 Data |

|---|---|---|

| Core Services | Brand safety, ad fraud detection, viewability | Essential for digital ad campaigns |

| Revenue | Generated through services | $600 million |

| Client Retention | Customer loyalty | Over 95% Gross Revenue Retention (Q4) |

Dogs

Legacy desktop display ad verification services, classified as "dogs" in DoubleVerify's BCG matrix, face declining demand. Desktop display ad spending is projected to decrease, with mobile ad spending reaching $360 billion in 2024. This shift impacts the relevance of services focused solely on this format. Focusing on newer formats is crucial for growth.

Regional markets showing low growth and market share are "dogs." In 2024, underperforming regions saw limited ROI. Reducing investment in these areas boosts efficiency. Strategic resource allocation is vital for better results.

Basic keyword blocking, a part of DoubleVerify's BCG Matrix, may not be as effective. These tools can limit advertiser reach. In 2024, advertisers spent $200 billion on digital ads. Improving keyword capabilities is key.

Solutions Lacking AI Integration

Verification solutions without AI face tough competition. They risk falling behind as the industry evolves. DoubleVerify uses AI to boost ad campaign effectiveness. Staying current demands tech investments.

- Ad fraud losses are projected to reach $100 billion globally in 2023.

- AI-driven fraud detection can reduce ad fraud by up to 80%.

- DoubleVerify's revenue increased 18% in 2023.

- The company invested $75 million in R&D in 2023.

Point Solutions Facing Consolidation

Point solutions in ad verification face potential decline, becoming "dogs" as the market consolidates. Clients prefer comprehensive platforms, shifting away from niche offerings. DoubleVerify aims to differentiate itself, avoiding direct competition on similar products. Broader solutions could foster stronger strategic partnerships with key industry players.

- Consolidation in ad tech is evident, with mergers and acquisitions increasing by 15% in 2024.

- Demand for integrated platforms grew by 20% in Q3 2024, signaling a move away from point solutions.

- DoubleVerify's revenue from integrated solutions rose by 22% in 2024, reflecting strategic focus.

- The market share of point solutions decreased by 8% in 2024, indicating a shift.

In DoubleVerify's BCG matrix, "dogs" represent areas with low growth and market share. Legacy desktop display ad verification, facing declining demand, falls into this category. Basic keyword blocking and point solutions also struggle, especially against AI-driven and integrated platforms.

| Category | Description | 2024 Data |

|---|---|---|

| Desktop Display Ads | Declining demand, classified as "dogs." | Mobile ad spending reached $360B. |

| Regional Markets | Low growth and market share. | Limited ROI in underperforming regions. |

| Keyword Blocking | Basic tools with limited effectiveness. | Advertisers spent $200B on digital ads. |

Question Marks

DoubleVerify's Scibids acquisition is a question mark in its BCG Matrix, targeting high growth in performance marketing. The goal is to reach $100 million in revenue from Scibids by 2028. This move aims to capture a larger share of the mid-market accounts. DoubleVerify's expansion indicates a strategic shift into a new arena.

DoubleVerify's mid-market advertiser acquisition is a "question mark," a new segment. The Rockerbox acquisition aims to boost value for these advertisers. Success hinges on integration and targeted strategies. In Q3 2023, DV's revenue was $120.8 million, highlighting the stakes. Effective strategies are key for growth.

DoubleVerify's RMN verification services are in a growth phase, though their market share is still emerging. Retail Media Networks (RMNs) are expanding, yet viewability is a concern. In 2024, viewability on RMNs was 8% lower than DoubleVerify's benchmark. Success hinges on tackling these challenges and proving value.

Attention Measurement

Attention measurement's role in digital advertising is expanding, yet DoubleVerify's market share remains unclear. A 2024 survey showed 47% of media buyers plan to widely use attention metrics. Investing in research and development is key for DoubleVerify to remain competitive. This strategic move will likely define its future position.

- Growing adoption of attention metrics.

- Uncertainty in DoubleVerify's market share.

- 47% of media buyers to use attention metrics in 2024.

- Importance of R&D for competitiveness.

Advanced CTV Features

Advanced CTV features, such as video-level transparency and open measurement, currently represent question marks within the DoubleVerify BCG Matrix. These features need wider industry adoption to become fully effective. The CTV industry is still working towards achieving the same level of data granularity as other platforms. However, with video-level suitability data gaining traction among advertisers, DoubleVerify anticipates broader availability beginning in 2024.

- CTV advertising spend in the US is projected to reach $30.2 billion in 2024.

- Video-level suitability data helps advertisers ensure their ads appear alongside appropriate content.

- Open measurement allows for third-party verification of ad viewability and measurement.

- Industry adoption rates directly impact the effectiveness of advanced CTV features.

DoubleVerify's "Question Marks" highlight areas of high growth potential, but with uncertain market positions. These include Scibids, mid-market advertiser acquisition, and RMN verification services. Investment in R&D and strategic integration are crucial for success. The CTV segment, projected to reach $30.2B in 2024, is a key focus.

| Category | Focus Area | Key Challenge |

|---|---|---|

| Scibids | Performance Marketing | Achieving $100M revenue by 2028 |

| Mid-Market | Advertiser Acquisition | Successful integration and strategy |

| RMN | Verification Services | Boosting viewability; RMNs' growth |

| CTV | Advanced Features | Industry adoption and data granularity |

BCG Matrix Data Sources

The DoubleVerify BCG Matrix leverages multiple sources. These include market data, ad campaign results, competitive analysis, and industry reports.