Dream Finders Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Finders Bundle

What is included in the product

Analyzes Dream Finders' competitive position, exploring market dynamics and potential threats.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview the Actual Deliverable

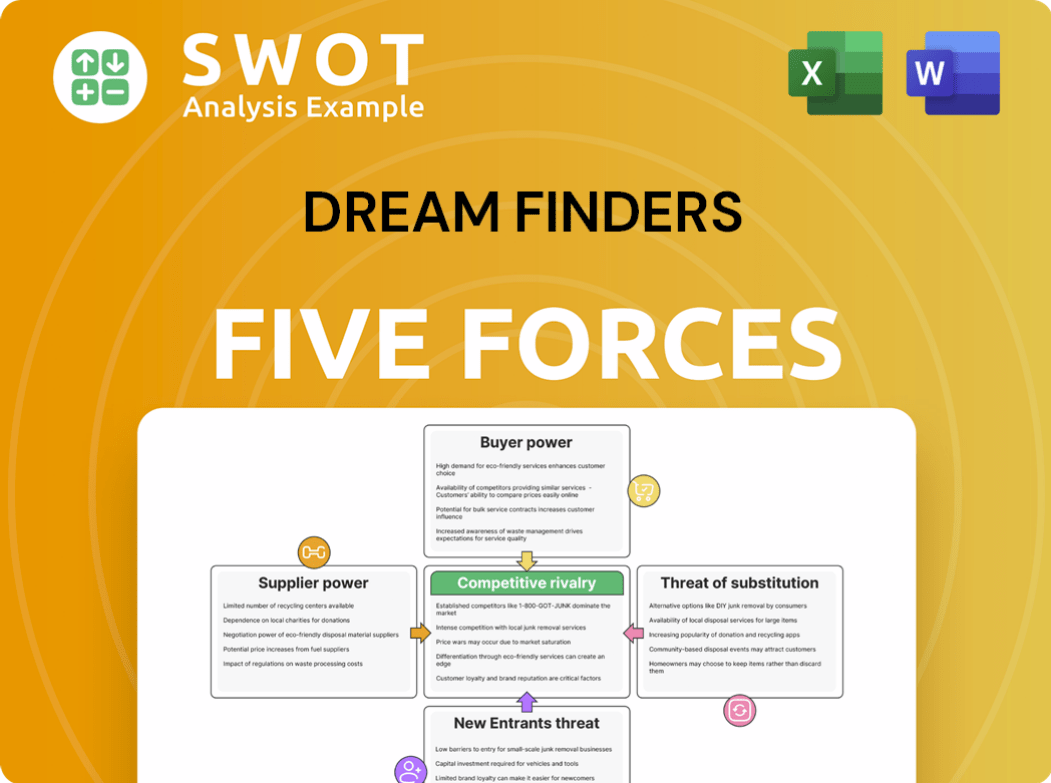

Dream Finders Porter's Five Forces Analysis

This is the complete, ready-to-use analysis file. This preview showcases Dream Finders Homes Porter's Five Forces analysis, which examines industry competition, buyer power, and more. You'll receive the same thorough, professionally formatted document instantly after purchase. The analysis reveals key insights into the company's competitive landscape and strategic positioning. The document you're previewing is exactly what you'll download.

Porter's Five Forces Analysis Template

Dream Finders faces moderate rivalry in the homebuilding market, influenced by both national and local competitors. Buyer power is significant, driven by choices and price sensitivity. Supplier power, especially for materials, poses a moderate threat. The threat of new entrants is substantial due to manageable barriers. Finally, substitute threats (existing homes) are also a factor.

Ready to move beyond the basics? Get a full strategic breakdown of Dream Finders’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Dream Finders benefits from a fragmented supplier base. This structure limits the influence of individual suppliers. For example, in 2024, the top 10 suppliers accounted for a relatively small percentage of Dream Finders' total costs. This lessens the potential for suppliers to dictate terms or pricing. This dynamic helps Dream Finders maintain control over its cost structure and profitability, as seen in the company's 2024 financial reports.

Dream Finders benefits from standardized building materials, like lumber and concrete, which are often commodities. This means they can easily switch suppliers. For example, in 2024, lumber prices fluctuated, but Dream Finders could seek better deals elsewhere. This competition among suppliers limits their ability to raise prices. This keeps costs lower for Dream Finders.

Dream Finders benefits from multiple suppliers for materials, enhancing its negotiating power. This competition ensures Dream Finders can secure favorable pricing and terms. Suppliers, to retain Dream Finders' business, must remain competitive in their offerings. In 2024, Dream Finders utilized this leverage to reduce construction costs by approximately 3%.

Dream Finders' scale matters

Dream Finders, as a major homebuilder, holds considerable sway with suppliers due to its substantial purchasing volume. The company's expanding operations and growing revenues, reaching $4.4 billion in 2024, strengthen its negotiation position. This scale allows Dream Finders to secure favorable terms, impacting supplier profitability. This strategic advantage is key in the competitive homebuilding market.

- Increased purchasing power helps Dream Finders negotiate better prices.

- Revenue growth supports stronger supplier relationships.

- Favorable terms improve Dream Finders' profit margins.

Land-light strategy impacts

Dream Finders' land-light strategy, which uses options contracts, decreases the need for substantial upfront material purchases, possibly weakening supplier power. This approach supports a strong liquidity position. In 2024, Dream Finders reported a gross margin of 22.6%, reflecting efficient cost management. The land-light model aids in maintaining financial flexibility in a volatile market. The utilization of options contracts helps shield against rapid material price hikes.

- Options contracts offer price certainty.

- Reduced immediate material needs.

- Maintains a strong liquidity position.

- Helps in cost management.

Dream Finders has strong bargaining power over suppliers due to a fragmented supply base and standardized materials. The company's large purchasing volume and land-light strategy also help. In 2024, Dream Finders reported a gross margin of 22.6%, showcasing efficient cost management and leveraging its strong position.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Fragmentation | Reduces supplier influence | Top 10 suppliers <5% of costs |

| Standardized Materials | Easy switching, price competition | Lumber price fluctuations |

| Purchasing Power | Favorable pricing | Revenue of $4.4 billion |

Customers Bargaining Power

Homebuyers, particularly those in the entry-level and first-time move-up segments, tend to be highly price-sensitive, which increases their bargaining power. High interest rates and affordability challenges exacerbate this sensitivity. In 2024, the average 30-year fixed mortgage rate fluctuated, affecting buyer affordability. As of late 2024, rates were around 7%, making price a critical factor for buyers.

Customers wield considerable power due to abundant housing options. They can choose from competitors like Taylor Morrison or Lennar. In 2024, existing home sales represented a substantial market share. Renting also provides a viable alternative, amplifying consumer influence.

Dream Finders' customer bargaining power is moderate due to limited customization. The company's ability to offer personalized homes is restricted. According to a 2024 report, most new home buyers seek some level of customization, but Dream Finders may not fully satisfy this demand. This can lead to price sensitivity among buyers. In 2024, the average cost of a newly built home was about $490,000.

Incentives boost power

Dream Finders faces customer bargaining power, as seen in their use of sales incentives and move-in-ready homes to attract buyers, indicating customer influence over terms. Cancellation rates, though improving, still show buyers' ability to choose alternatives. This dynamic suggests that customers can negotiate for better deals. The company's strategies respond to this power.

- Sales incentives: Used to attract buyers.

- Move-in-ready homes: Offered to meet customer demands.

- Cancellation rates: Reflect buyer's options.

Mortgage financing influence

Dream Finders Homes (DFH) provides mortgage financing via subsidiaries like Jet HomeLoans, potentially influencing customer choices. While this offers an advantage, buyers retain power by exploring external financing options. The 2024 acquisition of Cherry Creek Mortgage further integrates this service. However, customers can always shop around for better rates. The bargaining power of customers remains, though somewhat mitigated by in-house financial services.

- Jet HomeLoans and Cherry Creek Mortgage integration.

- Buyers' ability to seek external financing.

- Influence versus control over buyer decisions.

- 2024 acquisition data.

Customers exhibit significant bargaining power due to price sensitivity and plentiful housing alternatives. High interest rates in 2024, averaging around 7%, amplified this influence. Dream Finders mitigates this through incentives and financial services. However, buyers retain the ability to seek better deals.

| Factor | Impact | 2024 Data |

|---|---|---|

| Interest Rates | Affect Affordability | ~7% average for 30-year fixed mortgage |

| Home Prices | Buyer Sensitivity | Avg. new home cost ~$490,000 |

| Competition | Choice Availability | Strong from companies like Lennar |

Rivalry Among Competitors

The homebuilding market is fiercely competitive, with numerous national and regional builders. Dream Finders faces competition across various geographic areas, impacting its market share. In 2024, the top 10 builders controlled about 30% of the market. This rivalry pressures pricing and innovation.

Dream Finders faces intense competition due to a fragmented market. National builders hold a substantial market share, but regional builders also significantly compete. This fragmentation, highlighted by the presence of many smaller players, increases rivalry. Data from 2024 shows that the top 10 builders account for only about 30% of the market share, indicating a competitive landscape. This competition can pressure margins.

In the homebuilding sector, competitive rivalry is intense, with companies vying on design, price, location, and features. Dream Finders, like its rivals, must continually innovate to stand out. For instance, in 2024, the company focused on expanding into new markets, a key differentiation strategy. This included offering unique design portfolios and targeting specific geographic areas.

Land-light advantage

Dream Finders' land-light strategy offers a competitive edge by decreasing capital tied to land. This approach enables faster reactions to market changes, reducing financial risks. Dream Finders can adjust to demand shifts without significant land holdings. This model supports quicker inventory turnover and potentially higher returns.

- In Q3 2023, Dream Finders reported a land-light strategy, with about 20% of its lots owned.

- This strategy helped Dream Finders achieve a gross margin of 23.9% in Q3 2023.

- The land-light model allows for greater flexibility in responding to fluctuating housing market conditions.

- The company's strategy is to maintain a low land inventory percentage, around 20-25%.

Acquisition strategy

Dream Finders' active acquisition strategy, like the purchases of Crescent Homes and Liberty Communities, significantly alters the competitive landscape. These acquisitions are aimed at boosting the customer base and sales volume. Dream Finders' strategy intensifies competition by rapidly expanding its market footprint and operational capabilities. This growth approach directly challenges competitors by increasing market share and resources.

- Acquisition of Crescent Homes expanded Dream Finders' presence in the Southeast.

- Liberty Communities acquisition further diversified its geographic reach.

- These moves support a 2024 revenue target of approximately $4 billion.

- The acquisitions increase the pressure on competitors to consolidate.

Competitive rivalry in homebuilding is high, with many national and regional players. Dream Finders competes on design, price, and location to differentiate itself. The top 10 builders held about 30% of the market in 2024, indicating a fragmented market and strong competition.

| Metric | Value (2024) | Impact |

|---|---|---|

| Top 10 Builders Market Share | ~30% | High Competition |

| Dream Finders Revenue Target | ~$4 Billion | Growth Driven Rivalry |

| Land-Light Strategy | ~20% Lots Owned | Flexibility |

SSubstitutes Threaten

The existing home market serves as a substantial substitute, providing diverse housing options and price levels for potential homebuyers. Existing home sales present significant competition to new home construction, impacting Dream Finders. In 2024, existing home sales totaled approximately 4.09 million units, indicating a substantial alternative to new builds. This volume of sales creates ongoing competitive pressure on Dream Finders.

Rental options, such as apartments, serve as direct substitutes for potential homebuyers, particularly those facing affordability challenges. The rental market offers a significant alternative, influencing demand for Dream Finders' homes. In 2024, the national average rent for a 1-bedroom apartment was around $1,500, while homeownership costs remained higher. This substitution effect is amplified by interest rate fluctuations. This makes renting an attractive option.

Prefabricated and modular homes present a growing threat to traditional homebuilders. These substitutes offer potential advantages, including lower costs and quicker construction. In 2024, the modular construction market was valued at $15.2 billion, and is projected to reach $25.2 billion by 2032, with a CAGR of 6.5%. This growth highlights the increasing appeal of these alternatives.

Renovation as alternative

The threat of substitutes for Dream Finders Homes includes the option for homeowners to renovate or expand their current homes instead of buying new ones. This is a viable alternative, especially as the real estate market fluctuates. Remodeling and renovation projects can fulfill the need for more space or updated features. This option competes directly with Dream Finders Homes' offerings.

- In 2024, U.S. homeowners spent over $470 billion on home improvements.

- Renovations can be seen as a more immediate solution compared to the longer process of buying and building a new home.

- Interest rates and economic conditions significantly influence the attractiveness of renovation versus new construction.

Delayed purchase decisions

The threat of substitute products, specifically delayed purchase decisions, can impact Dream Finders Homes. Potential buyers might postpone buying a new home and choose to stay in their current homes or with family. This decision can be influenced by expectations of falling prices or interest rates, making buyers wait for more favorable conditions. According to the National Association of Realtors, existing home sales decreased by 1.7% in November 2023, indicating a slowdown in the market.

- Market Slowdown: Existing home sales decreased by 1.7% in November 2023.

- Interest Rate Sensitivity: Higher interest rates can deter potential homebuyers.

- Price Expectations: Anticipation of price declines can lead to delayed purchases.

- Alternative Housing: Staying in current homes or with family are viable substitutes.

Substitutes like existing homes, rentals, and modular homes challenge Dream Finders. These alternatives offer competitive choices for potential homebuyers, affecting demand. In 2024, existing home sales were about 4.09 million units.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Existing Homes | Direct Competition | 4.09M sales |

| Rentals | Affordability Option | Avg. rent $1,500 (1-bed) |

| Modular Homes | Growing Alternative | $15.2B market |

Entrants Threaten

Entering the homebuilding market demands substantial capital, a significant barrier to new competitors. Acquiring land, constructing homes, and navigating regulations all necessitate considerable upfront investment. Interest rates in 2024, averaging around 7%, have increased the cost of borrowing, making it even harder for newcomers to compete. For example, in Q3 2024, the average cost of a new single-family home was approximately $436,700, reflecting the high capital needs.

Access to land is a significant hurdle for new home builders, particularly in prime areas. Developed lot costs and availability pose ongoing challenges. Dream Finders Homes faces competition for desirable land parcels. Land acquisition costs have risen, impacting profitability. In 2024, land and development costs accounted for a large portion of home prices.

Established brand advantages, like Dream Finders' recognition and customer trust, pose a significant hurdle for new entrants. Brand strength is a key competitive advantage, as demonstrated by Dream Finders' consistent revenue growth, reaching $3.4 billion in 2023. This makes it challenging for newcomers to build market share. New entrants face high costs to compete with established brands.

Regulatory hurdles exist

Regulatory hurdles significantly impact the homebuilding sector, presenting challenges for new entrants. Compliance with zoning laws, building codes, and environmental regulations increases complexity. These regulatory requirements often lead to higher initial costs and longer project timelines. In 2024, regulatory compliance costs added approximately 5-10% to overall project expenses.

- Zoning regulations vary widely by location, adding complexity.

- Building code compliance necessitates specific expertise.

- Environmental regulations demand costly assessments and mitigation.

- Permitting processes can delay project starts.

Economies of scale matter

Economies of scale significantly impact the threat of new entrants in the homebuilding industry. Larger builders, like Dream Finders, leverage their size to negotiate better prices on materials and labor, creating a cost advantage. This advantage makes it harder for smaller, new companies to compete on price. In 2024, the top 10 builders accounted for over 30% of the new home market, highlighting the scale advantage.

- Purchasing Power: Large builders secure lower prices.

- Construction Efficiencies: Scale allows for faster builds.

- Market Share: Top builders control a significant portion.

- Cost Advantage: Economies of scale reduce per-unit costs.

The threat of new entrants in the homebuilding market is moderate due to high barriers. Significant capital investment, including land acquisition and construction costs, creates a financial hurdle. Established brands and regulatory complexities further deter new competitors.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Needs | High Initial Costs | Avg. New Home Price: $436,700 (Q3) |

| Land Access | Competitive Market | Land & Dev. Costs: Major portion of home prices |

| Brand Recognition | Competitive Edge | Dream Finders Revenue (2023): $3.4B |

Porter's Five Forces Analysis Data Sources

Dream Finders' analysis uses SEC filings, industry reports, market research, and competitor analysis for data. It aims for an informed view of the market.