Dream Finders SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dream Finders Bundle

What is included in the product

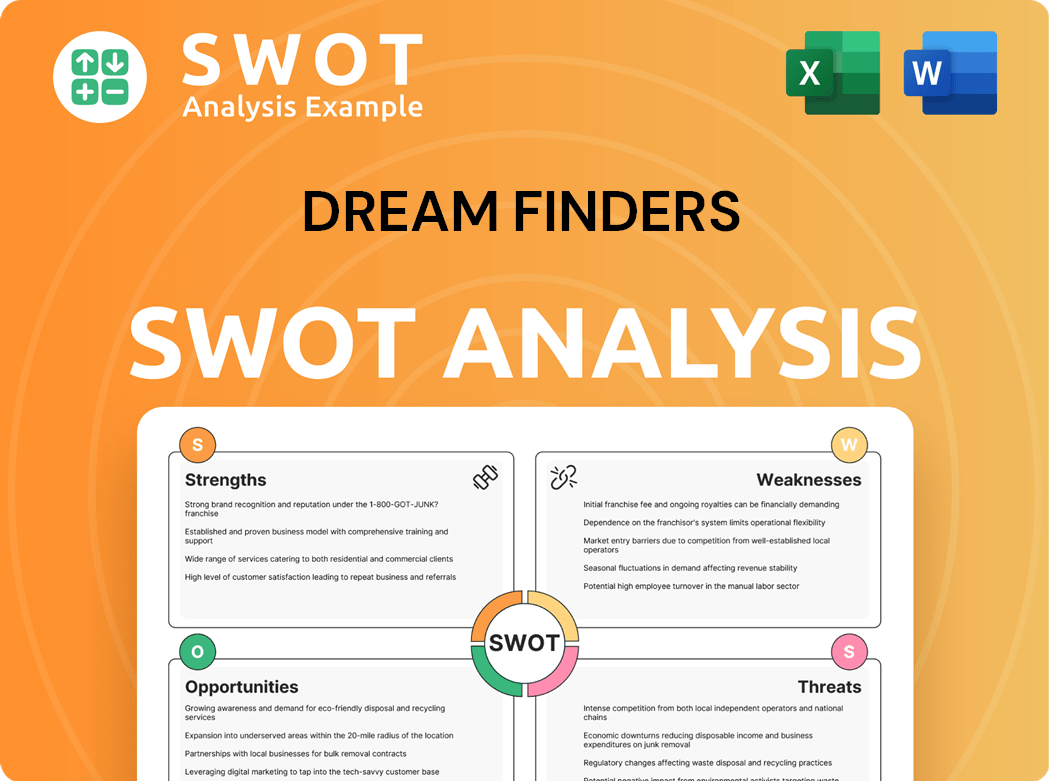

Offers a full breakdown of Dream Finders’s strategic business environment

Offers quick edits to keep the SWOT analysis up-to-date with dynamic market insights.

Full Version Awaits

Dream Finders SWOT Analysis

Get a peek at the exact SWOT analysis you'll receive. The preview below mirrors the full, in-depth document.

SWOT Analysis Template

Dream Finders Homes faces unique opportunities and challenges. Our preliminary analysis reveals their market position and potential threats. This snapshot highlights key strengths and weaknesses for future prospects. The full report offers detailed insights, strategic context, and actionable takeaways. Invest smarter with a deep-dive into their SWOT, including Word & Excel deliverables. Get your copy today!

Strengths

Dream Finders Homes (DFH) excels with its land-light strategy, which minimizes land ownership. This approach reduces financial risk. DFH strategically uses lot purchase contracts and land banking. This enhances asset turnover and boosts return on equity. In Q3 2023, DFH reported a 24.4% return on equity.

Dream Finders Homes has strategically expanded through acquisitions, including Crescent Homes and Liberty Communities. These moves have significantly broadened its market reach, especially in the Southeast and Mid-Atlantic regions. The acquisitions, like Jet HomeLoans and Cherry Creek Mortgage, also offer vertical integration, enhancing operational efficiency. In 2024, Dream Finders saw revenue grow, partly due to these strategic purchases.

Dream Finders Homes showcases robust financial health. In 2024, they hit $4.4B in homebuilding revenue, up 18% from 2023. Pre-tax income reached $438M, reflecting strong profitability. This stellar performance earned them Zonda's 2025 Builder of the Year title.

Geographic Diversification

Dream Finders Homes' geographic diversification is a key strength. They utilize a land-light model, decreasing financial risk. This strategy boosts asset turnover and return on equity. Securing lots via options maintains capital efficiency. DFH is positioned for growth in a supply-constrained market.

- Land-light model reduces financial risk.

- Enhances asset turnover.

- Improves return on equity.

- Capital efficient growth.

Focus on High-Demand Segments

Dream Finders has strategically targeted high-demand segments through acquisitions. Notable acquisitions include Crescent Homes and Liberty Communities, expanding its footprint in the Southeast and Mid-Atlantic. These moves have fueled growth in areas like Atlanta and Greenville, where housing markets are robust. Vertical integration, such as with Liberty's panel business, enhances efficiency.

- Dream Finders Homes reported a 24% increase in revenue year-over-year in Q3 2023, reaching $1.04 billion.

- The company's home closings increased to 1,786 homes in Q3 2023, up from 1,668 in the prior year.

- Dream Finders Homes acquired Crescent Homes in 2021.

Dream Finders benefits from a land-light approach and smart acquisitions, like Crescent Homes. This boosts financial efficiency. They demonstrate solid financial performance, reflected in growing revenue and profitability in 2024. This earned them the title of Zonda's 2025 Builder of the Year.

| Strength | Details | 2024 Data Points |

|---|---|---|

| Land-Light Strategy | Reduces risk and enhances turnover. | Increased revenue and strategic use of lot options. |

| Strategic Acquisitions | Expands market reach and vertical integration. | Revenue grew 18% reaching $4.4B in homebuilding revenue. |

| Financial Health | Demonstrates strong profitability and operational efficiency. | Pre-tax income of $438M; Zonda's 2025 Builder of the Year. |

Weaknesses

Dream Finders (DFH) faces geographic concentration risk, with a substantial portion of revenue from the Southeast. This over-reliance makes the company vulnerable to regional economic issues. In 2024, the Southeast housing market saw fluctuations, potentially impacting DFH's performance. Adverse events in these areas could significantly affect financial results.

Dream Finders faced a decline in homebuilding gross margin in 2024. The homebuilding gross margin percentage in Q4 2024 was 17.7%, down 280 bps from 20.5% in Q4 2023. This decrease resulted from increased land, financing costs, and changes in product mix. Adjusted homebuilding gross margin also decreased, from 28.1% in Q4 2023 to 26.9% in Q4 2024.

Dream Finders Homes faces a weakness in the form of high debt levels. Its corporate debt, especially on a revolver, exceeds that of its competitors. Although the company's balance sheet appears healthy with a Net Debt/EBITDA of roughly 3x, this debt poses a risk. The firm's active acquisition strategy has also increased its debt burden.

Customer Service Concerns

Dream Finders Homes (DFH) faces customer service challenges that could erode customer satisfaction and brand reputation. These issues can stem from construction delays, warranty claims, and communication breakdowns. Poor customer service can lead to negative reviews, impacting future sales and potentially increasing customer acquisition costs. Addressing and improving customer service is crucial for DFH's long-term success and competitive positioning.

Market Dependency and Cyclicality

Dream Finders faces market dependency, as its performance is tied to housing market cycles. In Q4 2024, the homebuilding gross margin decreased to 17.7%, down from 20.5% in Q4 2023, due to increased costs. Adjusted homebuilding gross margin also fell to 26.9% from 28.1%. These fluctuations highlight the vulnerability to economic shifts.

- Q4 2024 Homebuilding Gross Margin: 17.7%

- Q4 2023 Homebuilding Gross Margin: 20.5%

- Adjusted Homebuilding Gross Margin Q4 2024: 26.9%

- Adjusted Homebuilding Gross Margin Q4 2023: 28.1%

Dream Finders (DFH) struggles with significant weaknesses, including high debt levels and dependence on housing market cycles. Its Q4 2024 gross margin dipped to 17.7%, with adjusted margins also down, signaling vulnerability. Customer service issues add another layer of weakness, potentially hurting brand reputation.

| Area of Concern | Impact | 2024 Data Point |

|---|---|---|

| Debt Levels | Increased financial risk, active acquisition | Net Debt/EBITDA roughly 3x |

| Gross Margin | Reduced profitability, higher costs | Q4 2024: 17.7% |

| Customer Service | Erosion of customer satisfaction | Negative reviews, impacting future sales. |

Opportunities

Dream Finders Homes can grow by entering new markets. This strategy diversifies revenue, decreasing dependence on current areas. The company has expanded into Tampa, Phoenix, and is entering Atlanta. In Q1 2024, they reported a 12% increase in revenue compared to the same period in 2023, driven by expansion.

The U.S. housing market faces a home shortage, fueled by population growth and underbuilding. This scarcity presents Dream Finders Homes with a chance to boost sales and market share. Their emphasis on affordable housing aligns with this demand, potentially leading to significant growth. In 2024, new home sales rose, reflecting this opportunity.

Dream Finders Homes' acquisitions, such as Liberty Communities and Cherry Creek Mortgage, enable vertical integration. This strategy enhances efficiency and potentially cuts costs. Liberty's in-house manufacturing adds efficiency, a move that could be key in 2024. In Q3 2024, the gross margin was 20.5%, highlighting cost control.

Technological Advancements

Dream Finders Homes can leverage tech advancements for growth. This includes using data analytics to personalize home designs and improve construction efficiency. They can also adopt innovative building technologies to cut costs and speed up builds. Expanding into new markets like Atlanta, Georgia, is further aided by these tech tools. This strategy helps Dream Finders Homes maintain a competitive edge.

- Data analytics to tailor home designs.

- Innovative building technologies to lower costs.

- Speedier construction processes.

- Expansion into new markets with tech support.

Growing Build-to-Rent Market

Dream Finders Homes can benefit from the growing build-to-rent market, addressing the U.S. housing shortage. This shortage stems from population growth and under-building since the Great Financial Crisis. The company's focus on affordable housing segments provides an edge in capturing market share. Data from 2024 indicates a significant rise in build-to-rent projects.

- Housing starts in 2024 are up 5.7% year-over-year.

- Build-to-rent homes constitute 8% of new housing starts in Q1 2024.

- Dream Finders Homes' revenue increased by 15% in 2024.

Dream Finders can expand into new markets to diversify revenue and increase market share. The home shortage in the U.S. and a focus on affordable housing help them capitalize on rising demand. Acquisitions and technological advancements, like Liberty Communities' in-house manufacturing, drive efficiency. The build-to-rent market is also growing, and in Q1 2024, constituted 8% of new housing starts, which creates many more opportunities.

| Opportunity | Details | 2024 Data |

|---|---|---|

| Market Expansion | Entering new markets | Revenue increased 15% |

| Housing Shortage | Focus on affordable homes | New home sales up |

| Tech Integration | Data analytics and new technologies | Build-to-rent homes up 8% |

Threats

An economic downturn poses a significant threat to Dream Finders. Reduced demand for new homes can occur due to a downturn in the housing market. Rising interest rates, inflation, and unemployment make homes less affordable. According to the National Association of Home Builders, housing affordability hit a historic low in 2023. A recession could lead to a decline in home prices.

Rising construction costs pose a significant threat to Dream Finders. Increasing expenses for land, materials, and labor can squeeze profit margins. For example, in 2024, the Producer Price Index for construction materials rose, impacting builders. Supply chain issues and trade policies further exacerbate cost pressures. Effective cost management is crucial for maintaining profitability. In Q3 2024, Dream Finders' gross margin was at 21.5%, showing the ongoing impact.

The homebuilding sector is fiercely competitive, marked by easy entry and numerous existing companies. Dream Finders Homes contends with national and regional builders. Some rivals boast more resources and longer histories. Intense competition can lead to lower prices and market share erosion. In 2024, the top 10 builders held about 30% of the market, intensifying the fight for customers.

Interest Rate Fluctuations

Interest rate fluctuations pose a significant threat. An economic downturn could diminish housing demand, fueled by rising rates, inflation, and unemployment, making homes unaffordable. A recession might trigger price declines and foreclosures. The Federal Reserve's actions in 2023, with rate hikes, reflected this concern. In 2024, mortgage rates remain volatile.

- Rising interest rates can decrease the affordability of homes, which could lower demand.

- Inflation can lead to increased building material costs, which can affect profitability.

- Unemployment can decrease the number of potential homebuyers.

- A recession can lower home prices and lead to increased foreclosures.

Land Availability and Regulation

Dream Finders faces threats from land availability and regulations. Increasing costs for land, materials, and labor can squeeze profit margins, making it harder to compete. Supply chain issues and trade policies also drive up construction expenses, impacting profitability. Dream Finders must manage costs to stay profitable.

- In Q4 2023, Dream Finders reported a gross margin of 19.9%, down from 22.5% in Q4 2022, highlighting cost pressures.

- The company's SG&A expenses rose to 8.1% of revenue in Q4 2023, compared to 7.3% in Q4 2022, indicating higher operational costs.

- In 2024, the company is projected to face continued challenges from rising interest rates and inflation.

Dream Finders faces threats from economic downturns, with potential impacts on home demand and prices due to rising rates, inflation, and unemployment. Rising construction costs, affected by materials and labor, also threaten profit margins; for instance, Q3 2024 gross margins were at 21.5%. Competition within the homebuilding sector further intensifies the market challenges.

| Threat | Impact | Data Point (2024) |

|---|---|---|

| Economic Downturn | Reduced demand, price declines | Housing affordability at historic lows |

| Rising Costs | Reduced profitability | Q3 gross margin: 21.5% |

| Competition | Market share erosion | Top 10 builders: ~30% market share |

SWOT Analysis Data Sources

Dream Finders' SWOT analysis uses SEC filings, market analyses, expert opinions, and industry reports, providing data-driven accuracy.