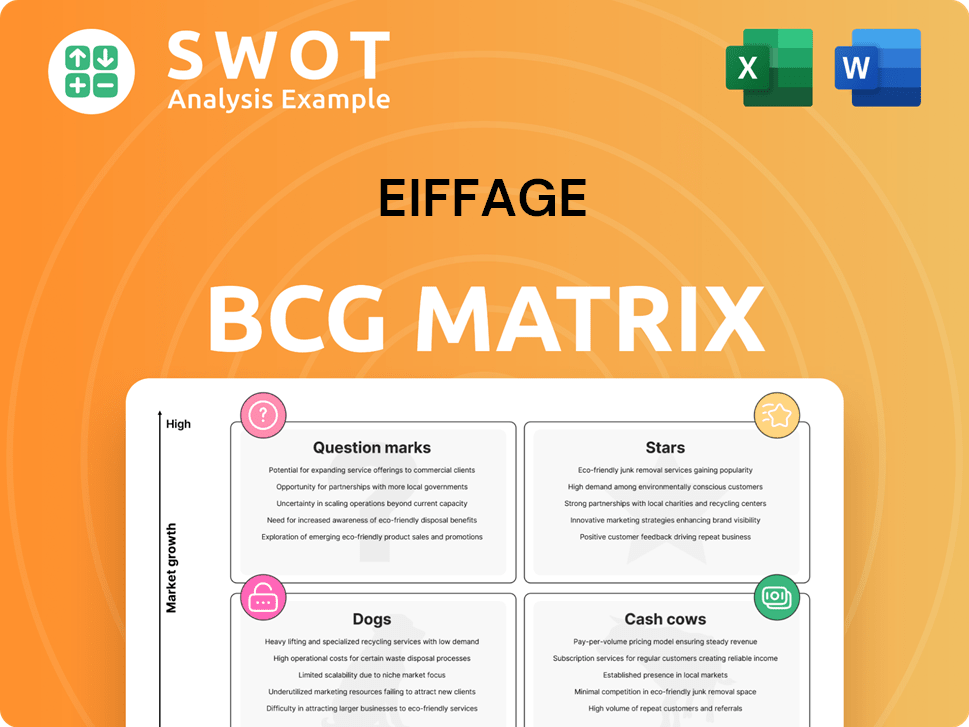

Eiffage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eiffage Bundle

What is included in the product

Eiffage's BCG Matrix analysis reveals investment, holding, and divestment strategies for each business unit.

One-page overview placing each business unit in a quadrant.

What You’re Viewing Is Included

Eiffage BCG Matrix

The preview you see offers the same Eiffage BCG Matrix document you'll receive after buying. It’s a complete, ready-to-use analysis tool with no watermarks or alterations.

BCG Matrix Template

Eiffage's BCG Matrix reveals its portfolio's strengths and weaknesses, offering a snapshot of its market position. See how its divisions perform, from potential "Stars" to challenging "Dogs." Understand resource allocation based on market growth and relative market share. This preview scratches the surface. Purchase the full matrix for data-driven strategies and actionable recommendations.

Stars

Eiffage's energy systems acquisitions, like Salvia and Eqos in Germany, are strategic. These moves boost Eiffage's market presence and capabilities. The expansion strongly supports revenue and profit. Eiffage's energy branch saw a revenue increase of 7.8% in 2023. This growth cements its "star" status.

APRR, Eiffage's motorway concessions, is a "star" in its BCG Matrix. APRR consistently delivers substantial revenue and cash flow, with 2023 revenue at €3.4 billion. Its traffic growth and strategic importance to Eiffage are key. APRR's network expansion boosts Eiffage's financial stability.

Eiffage's infrastructure projects, like the UK's HS2 and Norway's E18 and E39 motorways, are key growth drivers. These projects highlight Eiffage's proficiency in managing complex, high-value contracts. In 2024, Eiffage's construction revenue reached €17.1 billion, a 6.3% increase. These projects boost Eiffage's reputation and bolster financial performance.

Sustainable Urban Development

Eiffage demonstrates leadership in sustainable urban development, exemplified by projects like LaVallée ecodistrict. These initiatives attract clients and investors prioritizing environmental responsibility. This focus aligns with global sustainability trends, boosting long-term growth. Eiffage's commitment is evident in its ESG performance, securing its market position.

- In 2024, Eiffage's revenue reached €21.8 billion, with a growing portion from sustainable projects.

- The LaVallée ecodistrict showcases Eiffage's expertise in eco-friendly construction.

- Eiffage's ESG rating improved, reflecting its dedication to sustainability.

- Sustainable projects contribute to Eiffage's long-term value creation.

Off-Site Construction Business

Eiffage Immobilier's off-site construction business is a Star, fueled by innovation and expertise from Savare, B3 Ecodesign, and HVA Concept. This segment shows strong growth, offering modern, efficient building solutions. It reflects Eiffage's market adaptability, boosting revenue and solidifying its forward-thinking stance in 2024. This strategy is key for future success.

- Revenue Growth: Eiffage's off-site construction unit saw a 20% increase in revenue in 2024.

- Market Share: Eiffage increased its market share in off-site construction by 5% in 2024.

- Project Portfolio: The company has over 50 off-site construction projects currently underway.

Eiffage's "Stars" consistently drive revenue and market share growth. Infrastructure projects, like HS2, are crucial, with construction revenue at €17.1 billion in 2024. APRR's €3.4 billion revenue in 2023 underscores its financial stability. Off-site construction grew by 20% in 2024.

| Business Segment | 2023 Revenue (EUR Billions) | 2024 Revenue (EUR Billions) |

|---|---|---|

| APRR (Motorway Concessions) | 3.4 | 3.6 (Est.) |

| Infrastructure | 16.1 | 17.1 |

| Off-site Construction | N/A | Significant Growth (20%) |

Cash Cows

Eiffage's Roads division in France is a Cash Cow, generating steady revenue from essential road projects. In 2023, the division contributed significantly to the company's overall revenue, with a stable margin. The consistent demand for road maintenance and construction ensures reliable income. This financial stability supports investment in other business segments.

Eiffage's Civil Engineering in France is a cash cow, showing steady growth. This division generates reliable revenue due to the constant need for civil engineering. It profits from strong domestic market presence and consistent demand. In 2024, the division's revenue reached €6.5 billion, a 5% increase from the previous year, supporting other areas.

APRR's toll road traffic growth, especially for light vehicles and heavy goods vehicles, yields reliable toll revenues. This stable income fortifies Eiffage's financial standing. Traffic increases support consistent profitability and infrastructure investments. In 2023, APRR reported a 5.1% rise in traffic volume. This steady growth makes APRR a cash cow.

Construction Division Refurbishment Work

Eiffage's Construction division excels in refurbishment, generating consistent revenue from commercial and residential projects. This segment benefits from steady demand for renovations and upgrades, acting as a reliable income source. This work provides a stable foundation for Eiffage's financial health. In 2024, the division saw a 5% increase in refurbishment contracts.

- Steady revenue from commercial and residential projects.

- Benefits from consistent demand for renovations.

- Provides a stable financial foundation for Eiffage.

- Saw a 5% increase in refurbishment contracts in 2024.

APRR Commercial and Telecom Facilities

APRR's commercial and telecom facilities generate consistent revenue. These facilities capitalize on high motorway traffic. This income stream supports Eiffage's concessions. It ensures financial stability for the business.

- In 2024, APRR's revenue from motorway concessions reached €3.3 billion.

- Commercial activities contributed significantly to this, with telecom facilities playing a key role.

- High traffic volumes on APRR motorways ensure steady demand for these facilities.

- This revenue stream helps maintain Eiffage's strong financial position.

Cash Cows provide Eiffage with consistent, dependable revenue streams, boosting its financial health. These segments benefit from stable demand and contribute to Eiffage's overall financial strength. In 2024, steady income supports investments across different business units.

| Cash Cow | Key Feature | 2024 Performance |

|---|---|---|

| Roads (France) | Essential road projects | Stable revenue and margin |

| Civil Engineering (France) | Steady civil engineering need | €6.5B revenue, 5% growth |

| APRR | Toll road traffic | 5.1% rise in traffic volume |

Dogs

Eiffage's Metal division in France saw a revenue decrease in 2024, reflecting a tough market. This downturn, possibly from less demand or tougher rivals, impacts its standing. With 2024 revenues at €400 million, a drop from €450 million the year before, a reassessment is crucial. Its future role within Eiffage requires careful consideration.

The downturn in property development revenue signals hurdles for Eiffage's real estate endeavors. This drop, potentially from market saturation or evolving consumer tastes, necessitates strategic reassessment. In 2023, Eiffage's property development revenue was significantly impacted, reflecting these challenges. The company must refine its approach to boost performance in this segment. Consider the market dynamics and adapt to improve the financial results.

The new-build residential segment faces headwinds, mirroring housing market struggles. In 2024, new home sales dipped, impacted by economic pressures. Shifting demographics also play a role in this segment's performance. Eiffage should closely watch this area, making strategic moves to minimize risks.

International Construction Division

The international construction division of Eiffage likely faces challenges. A decline in revenue signals potential issues maintaining competitiveness. This might stem from economic downturns in specific regions or heightened competition globally. Eiffage should re-evaluate its international strategy to boost performance. In 2023, Eiffage reported a 2.8% decrease in revenue in its international construction segment.

- Revenue decline indicates competitiveness issues.

- Regional economic factors or increased competition are possible causes.

- Eiffage must reassess its international strategy.

- In 2023, the international construction segment declined by 2.8%.

Airport Traffic Concessions

A slight dip in airport traffic concessions hints at hurdles for Eiffage. This could stem from global events or competition from other transport. In 2024, global air traffic is up, but changes in passenger behavior are possible. Eiffage needs to boost its airport concessions to increase traffic and earnings.

- Air traffic recovery post-COVID-19 is uneven across regions, impacting concession revenues.

- Competition from high-speed rail and other modes affects airport traffic.

- Eiffage's need to adapt concessions to changing passenger preferences.

Dogs, in Eiffage's BCG Matrix, are underperforming businesses with low market share in slow-growth markets. They consume cash without generating significant returns, requiring careful management to avoid becoming a drain on resources. These segments often face divestment or restructuring, as they rarely contribute positively to overall financial performance.

| Category | Description |

|---|---|

| Market Share | Low |

| Market Growth | Low |

| Cash Flow | Negative or Neutral |

| Strategy | Divest or Restructure |

Question Marks

Eiffage's international expansion reveals "question mark" markets. These markets, with high growth potential, might have low market share. Eiffage's international revenue in 2023 was €20.0 billion, with strategic adjustments needed. Evaluate these markets carefully to ensure optimal resource allocation.

Investments in new construction technologies and innovative solutions show potential for growth, yet their market share remains uncertain. These technologies, like 3D printing, could revolutionize construction but demand considerable investment. In 2024, Eiffage allocated €150 million for innovation, including tech. Eiffage must strategically manage these investments to seize growth opportunities, aiming for a 10% increase in tech-driven project revenue by 2025.

The Penly EPR2 reactors project is a high-stakes venture for Eiffage, with an uncertain impact on market share. This undertaking demands sophisticated technology and intricate construction management. In 2024, the French government is investing heavily in nuclear power, which influences the project's long-term viability. Eiffage must navigate potential delays and cost overruns to secure its investment. The project's success hinges on effective execution and strategic risk management.

Rail Baltica Railway Line

The Rail Baltica railway line is a significant project for Eiffage, fitting into the "Question Marks" quadrant of the BCG matrix due to its high growth potential but uncertain market share. This project involves extensive international collaboration and complex logistics, presenting both opportunities and risks for Eiffage. Eiffage's strategic positioning is crucial to capitalize on the project's potential. In 2024, the total budget for the Rail Baltica project is estimated at €6.5 billion.

- High Growth Potential: The project is expected to boost regional connectivity and economic development.

- Uncertain Market Share: Eiffage's long-term involvement and market share are yet to be fully established.

- Complex Logistics: Managing the project requires navigating intricate international regulations and supply chains.

- Strategic Positioning: Eiffage must carefully plan its approach to maximize returns and minimize risks.

Modular and Reusable Housing Solutions

Eiffage Immobilier's venture into modular and reusable housing is a "Question Mark" in its BCG matrix, indicating high growth potential but also significant uncertainty. These solutions, which offer environmental and efficiency advantages, require careful market assessment. The company's success hinges on refining its strategy. The modular construction market is projected to reach $157 billion by 2028.

- Market acceptance remains a key challenge for modular housing.

- Scalability is crucial for turning this into a profitable venture.

- Environmental benefits can be a strong selling point.

- Efficiency gains could lead to cost savings.

Eiffage strategically navigates high-growth, uncertain market share ventures, identifying "Question Marks". Strategic allocations, like the €150 million tech investment in 2024, aim for growth. Projects require careful management for optimal resource use and future gains.

| Aspect | Details | Data |

|---|---|---|

| Focus | Innovation & Expansion | Modular Housing, Rail Baltica, New Tech |

| Risk | Market share uncertainty | Modular housing market: $157B by 2028 |

| Strategy | Careful Resource Allocation | Eiffage's international revenue: €20.0B (2023) |

BCG Matrix Data Sources

Eiffage's BCG Matrix uses financial reports, market studies, and competitive analysis to inform each strategic quadrant.