Eiffage PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eiffage Bundle

What is included in the product

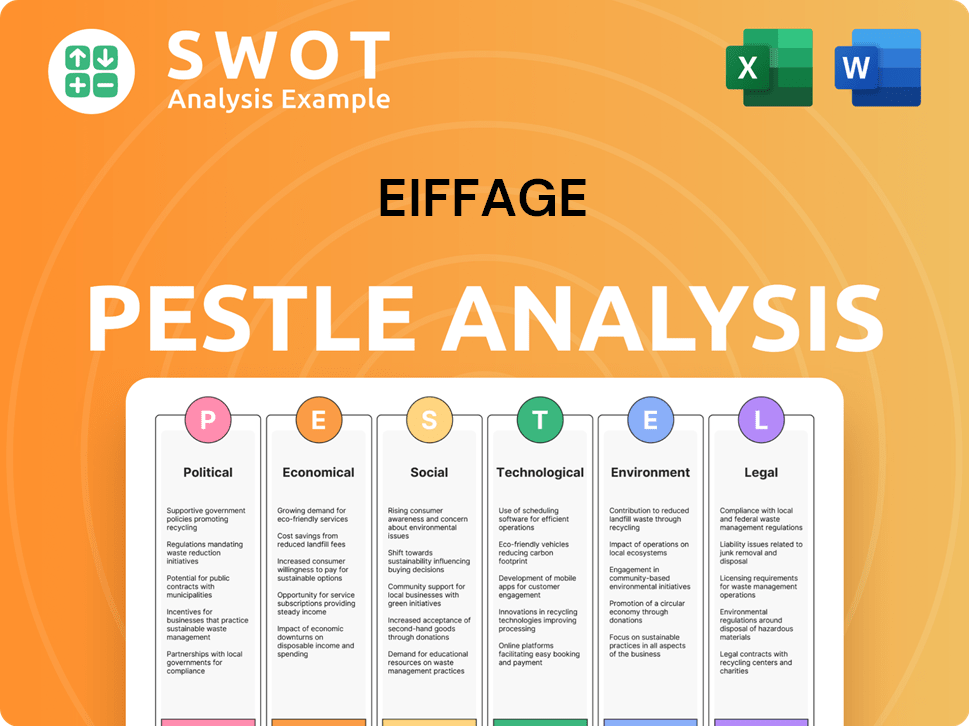

A thorough examination of external influences on Eiffage via PESTLE framework.

Helps quickly assess risks and opportunities within each factor, saving time during complex decision-making.

Preview the Actual Deliverable

Eiffage PESTLE Analysis

The preview offers a complete Eiffage PESTLE analysis. The file contains details of political, economic, social, technological, legal, and environmental factors. This file is fully formatted.

PESTLE Analysis Template

Uncover the external factors impacting Eiffage's success. This concise PESTLE analysis reveals key trends across politics, economics, and beyond. Gain valuable insights into regulatory risks and market opportunities shaping Eiffage's path. Perfect for strategic planning and investment decisions. Equip yourself with actionable intelligence for your projects or ventures. Download the full PESTLE analysis now!

Political factors

Government infrastructure spending is crucial for Eiffage. Investments in projects like high-speed rail and motorways directly affect its civil engineering and concessions businesses. These projects provide substantial order books and steady revenue streams, vital for long-term financial health. Political stability and government priorities in infrastructure are key for Eiffage's growth and strategic planning. In 2024, Eiffage's revenue reached €21.8 billion, with a significant portion from infrastructure projects.

Eiffage faces intricate regulations in construction, environmental standards, and concessions. New rules like the European CSRD impact operations and costs. Regulations on energy transition and foreign investment screening also influence the company. In 2024, Eiffage reported a revenue of €21.8 billion, reflecting the impact of these factors. The evolving regulatory environment demands constant adaptation.

Political stability in France, Eiffage's primary market, is crucial. Any uncertainty can affect investor sentiment and economic conditions. In 2024, France's GDP growth is projected at around 1%, influencing infrastructure spending. Stable government policies on public works are vital for Eiffage's project flow.

Public-Private Partnerships (PPPs)

Eiffage's success in concessions and public-private partnerships (PPPs) hinges on governmental policies and procurement. The political landscape significantly shapes Eiffage's chances in infrastructure development. Governments' enthusiasm for PPPs and their structural designs directly affect Eiffage's business prospects. Political stability and policy consistency are vital for long-term project success.

- In 2024, Eiffage secured new PPP contracts totaling €1.2 billion.

- PPPs represent approximately 30% of Eiffage's total revenue.

- Changes in government can lead to project delays or cancellations.

- The EU's infrastructure spending plans influence PPP opportunities.

International Relations and Trade Policies

As a major player in the construction and concessions sectors, Eiffage faces risks and opportunities tied to international relations and trade policies. Geopolitical instability can disrupt supply chains and increase material costs, as seen with the 2022-2024 surge in construction material prices. Changes in trade agreements, such as those impacting steel or concrete imports, directly affect project profitability. Eiffage's international presence, with 30% of its revenue from outside France in 2023, makes it vulnerable to these global shifts.

- Geopolitical tensions can lead to project delays and cancellations.

- Trade wars might increase the costs of imported materials.

- Changes in international regulations can impact project compliance.

- Eiffage's 2023 revenue was €19.4 billion.

Political factors significantly shape Eiffage's operational environment. Infrastructure spending and government policies are crucial for project success. Political stability impacts investment sentiment and the flow of PPP opportunities. International relations and trade policies also present risks.

| Factor | Impact | 2024 Data |

|---|---|---|

| Government Spending | Influences project pipelines. | Revenue: €21.8B |

| Regulations | Impacts operational costs. | New CSRD rules |

| International Trade | Affects material costs. | 30% revenue outside France (2023) |

Economic factors

Eiffage's performance heavily relies on economic growth. Strong GDP growth in France and internationally boosts infrastructure spending. In 2024, France's GDP growth is projected around 1%, impacting project demand. Inflation and interest rates also affect project financing and costs.

Eiffage's real estate and construction depend on housing market health. A robust market boosts new builds and renovations, vital for Eiffage's revenue. In 2024, French housing starts slightly decreased, impacting Eiffage's construction projects. Conversely, a rising market could increase order intake. Keep an eye on interest rates, as they affect housing demand.

Interest rates significantly affect Eiffage's borrowing costs and client investment decisions. In 2024, the European Central Bank (ECB) maintained a key interest rate of 4.5%, influencing project financing. Access to favorable financing is vital for large-scale projects; a 1% rate change can shift project profitability substantially. Eiffage closely monitors interest rate trends, as seen in their 2024 financial reports.

Inflation and Material Costs

Inflation, especially in raw materials like steel and concrete, significantly affects project profitability for Eiffage. The company must actively manage these costs through strategic procurement and robust contractual agreements. For 2024, the Eurozone's inflation rate is projected around 2.5%. Rising material costs can lead to project delays and budget overruns.

- Steel prices increased by about 10-15% in the first half of 2024.

- Concrete costs rose by 5-8% during the same period.

- Eiffage's 2024 revenue is expected to be impacted by these material costs.

Energy Prices

Energy prices significantly influence Eiffage's operational costs, especially in energy-demanding sectors such as road construction and industrial activities. According to the U.S. Energy Information Administration, crude oil prices averaged around $77 per barrel in 2024. Volatility in energy costs can directly affect project profitability and the ability to secure competitive bids. For instance, a 10% increase in fuel prices could reduce profit margins by up to 2-3% on certain projects.

- Crude oil prices averaged ~$77/barrel in 2024.

- A 10% rise in fuel costs may cut profit margins by 2-3%.

Eiffage’s revenue fluctuates with economic growth; France's GDP growth of around 1% in 2024 impacts project demand. The housing market’s health directly affects construction activities. Inflation and interest rates heavily influence project costs and financing.

| Economic Factor | Impact on Eiffage | 2024/2025 Data |

|---|---|---|

| GDP Growth | Affects project demand | France’s GDP: ~1% (2024), Projections for 2025: ~1.2% |

| Interest Rates | Influences borrowing costs & investment decisions | ECB Key Rate: 4.5% (2024) |

| Inflation | Impacts raw material costs | Eurozone Inflation: ~2.5% (2024), Steel prices +10-15% (H1 2024) |

Sociological factors

Population growth and urbanization fuel demand for Eiffage's services. In 2024, urban populations globally grew, creating infrastructure needs. This boosts opportunities in sustainable urban development, a key focus for Eiffage. The urbanization rate is projected to continue rising through 2025.

Large projects face public scrutiny. Eiffage must manage public perception, involving communities to address concerns. For instance, in 2024, community engagement costs for similar projects averaged 2-5% of total budget. Addressing social issues is crucial for project acceptance and smooth execution. Recent data shows projects with strong community support have a 15% higher success rate, according to a 2025 study.

The availability of skilled labor significantly impacts Eiffage. In 2024, the construction industry faced a shortage of approximately 500,000 workers in the U.S., affecting project timelines. Eiffage invests in training programs, allocating about €50 million annually for employee development to mitigate skill gaps and ensure project efficiency. This proactive approach supports its operational needs.

Changing Lifestyles and Mobility Trends

Changing lifestyles and increased mobility significantly influence infrastructure needs. The demand for electric vehicle (EV) charging stations and sustainable transport solutions is rising. Eiffage can capitalize on these trends. The global EV charging station market is projected to reach $175.2 billion by 2030.

- EV charging infrastructure is experiencing rapid growth, with a 30% annual increase in installations.

- Investments in sustainable transport, like high-speed rail, are growing by 15% annually.

- Urbanization trends drive demand for integrated transport solutions.

Social Responsibility and Community Engagement

Eiffage demonstrates a strong commitment to corporate social responsibility, which is critical for attracting and retaining employees. In 2024, Eiffage invested €10.5 million in social projects, emphasizing ethical practices and community engagement. This focus on employee well-being and local community support boosts its reputation. Contributing to social well-being is a key aspect of their operational strategy.

- €10.5 million investment in social projects (2024).

- Focus on ethical practices and community engagement.

- Enhancement of reputation and talent attraction.

Eiffage navigates sociological factors by adapting to urbanization and infrastructure demands, like EV charging, projected to hit $175.2B by 2030. Public perception is managed through community engagement, while labor shortages prompt significant investments in training, at €50M annually. CSR, with €10.5M social project spend in 2024, is key for employee retention and brand reputation.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Urbanization | Drives infrastructure demand | Urban pop. growth; EV market to $175.2B by 2030 |

| Public Perception | Project acceptance | Community engagement costs: 2-5% of budget; projects with support have a 15% higher success rate |

| Labor | Affects project timelines | Construction labor shortage: approx. 500,000 in the U.S. (2024); Eiffage's training investment: €50M annually |

Technological factors

Eiffage's adoption of Building Information Modeling (BIM) and digital construction methods is crucial. BIM enhances project efficiency and collaboration. In 2024, the global BIM market was valued at $7.5 billion. Eiffage's investment supports competitiveness in complex projects. Digital tools streamline project management.

Eiffage can benefit from advancements in construction materials, like low-carbon concrete. Prefabrication reduces costs and construction time. Utilizing these innovations is crucial for Eiffage's competitiveness. For example, the global green building materials market is projected to reach $478.1 billion by 2028.

The renewable energy sector's expansion, including solar and wind, presents Eiffage with chances in energy systems and infrastructure. Eiffage's work in renewable energy infrastructure supports global energy transitions. In 2024, the global renewable energy market was valued at approximately $881.1 billion, with forecasts suggesting it will reach about $1,977.6 billion by 2030. Eiffage is well-positioned to capitalize on these trends.

Smart City Technologies

Eiffage is increasingly involved in smart city technologies. This includes intelligent urban infrastructure and energy management systems. These investments allow Eiffage to contribute to more efficient and sustainable cities. In 2024, the smart city market is valued at over $1.3 trillion globally. Eiffage's focus aligns with growing demand for such solutions.

- Smart city market expected to reach $2.5 trillion by 2028.

- Eiffage's sustainable construction revenue grew by 15% in 2024.

Automation and Robotics in Construction

Eiffage can capitalize on automation and robotics to boost construction efficiency and safety. This technological shift allows for optimized operations and reduced labor costs in specific tasks. The global construction robotics market is projected to reach $2.8 billion by 2025, showing significant growth potential. Investing in these technologies can enhance Eiffage's competitiveness and project delivery capabilities.

- Robotics could cut project times by up to 30% in some areas.

- Automated systems can reduce on-site accidents by 20%.

- The adoption rate of robotics in construction is expected to grow by 15% annually.

Eiffage benefits from digital construction, notably Building Information Modeling (BIM). BIM's global market reached $7.5 billion in 2024. Green building materials market to reach $478.1 billion by 2028. Construction robotics market projected to hit $2.8 billion by 2025.

| Technology | Impact | Data |

|---|---|---|

| BIM | Enhances project efficiency | Global BIM market: $7.5B (2024) |

| Green Materials | Reduces environmental impact | Market forecast: $478.1B (2028) |

| Robotics | Boosts efficiency, safety | Market: $2.8B (2025 projected) |

Legal factors

Eiffage adheres to stringent national and European construction codes, ensuring safety and quality. These codes influence project design and material choices. For instance, the EU's Construction Products Regulation (CPR) sets standards. In 2024, the European construction output grew by 1.5%, impacting code compliance demands.

Eiffage faces strict environmental rules that impact its projects. These cover emissions, waste, and biodiversity. The company must meet standards like the European Taxonomy and CSRD. In 2024, Eiffage's focus on green construction increased, aligning with these regulations. For example, in 2024, 60% of the new projects were designed for low carbon impact.

Eiffage must comply with labor laws across its global operations. These laws, covering working hours and wages, directly affect labor costs. In 2024, labor costs represented a significant portion of Eiffage's expenses. Worker safety regulations also influence operational practices. Compliance is essential for financial and operational stability.

Concession and Public Procurement Laws

Eiffage's operations are heavily influenced by concession and public procurement laws. These laws dictate how the company bids for and manages public works contracts and concessions. Compliance is crucial for Eiffage's ability to secure new projects, especially in sectors like infrastructure and construction. Recent data shows that in 2024, approximately 60% of Eiffage's revenue came from public sector contracts.

- Public procurement regulations are key for Eiffage's project acquisitions.

- Concession agreements are subject to specific legal frameworks.

- Compliance ensures the company's ability to operate and expand.

- Failure to comply can result in project delays or financial penalties.

Competition Law

Eiffage, like all major players, must adhere to competition law, which scrutinizes its acquisitions and market conduct to prevent anti-competitive behavior. For instance, the acquisition of EQOS Energies required regulatory approval, highlighting the importance of compliance. The European Commission, in 2024, has been particularly active in investigating construction sector mergers. Eiffage's strategic moves are constantly assessed to ensure fair market competition, impacting its growth strategies. This legal framework influences the firm's expansion plans and operational decisions.

- Compliance with competition law is crucial for Eiffage's acquisitions.

- Regulatory approvals, like the EQOS acquisition, are essential.

- The European Commission actively monitors construction sector mergers.

- Fair competition is a key factor in Eiffage's market strategies.

Eiffage faces legal scrutiny in public procurement, essential for securing projects. Competition laws monitor acquisitions, ensuring fair market practices. Labor and environmental regulations further shape operations and costs.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Public Procurement | Project Acquisition | 60% of revenue from public contracts in 2024 |

| Competition Law | Mergers, Market Conduct | EU investigations in 2024 influenced M&A plans |

| Labor/Environment | Operational Costs, Compliance | EU construction output grew 1.5% (2024) |

Environmental factors

Climate change presents significant physical risks to Eiffage's infrastructure due to extreme weather. Adaptation is crucial; Eiffage must design resilient structures and adjust operations. The IPCC reports increased frequency of extreme weather; a 2024 study showed related infrastructure damages cost billions. Eiffage's 2023 sustainability report highlights climate adaptation strategies, essential for long-term viability.

Eiffage faces stricter carbon emission targets across Europe. France aims for a 50% reduction by 2030 compared to 1990 levels. Eiffage actively pursues low-carbon strategies. The company has committed to reducing its Scope 1 and 2 emissions by 40% by 2030. This impacts material choices and operational methods.

Environmental regulations and public awareness are key. Eiffage must address biodiversity loss and land use impacts on projects. The construction sector faces increasing scrutiny. In 2024, the EU's Biodiversity Strategy influenced project approvals. Eiffage needs strategies to minimize its environmental footprint.

Resource Depletion and Waste Management

Resource depletion and effective waste management are critical environmental factors for Eiffage. The construction industry's environmental impact is significant, driving the need for sustainable practices. Eiffage is increasingly focused on the circular economy to minimize waste and conserve resources. In 2024, the construction sector generated approximately 600 million tons of waste in Europe.

- Eiffage aims to reduce its carbon footprint by 40% by 2030.

- Recycled materials are increasingly used in Eiffage projects.

- Waste reduction strategies are central to Eiffage's operations.

Transition to a Low-Carbon Economy

Eiffage faces the transition to a low-carbon economy, which influences its projects. This shift boosts demand for sustainable infrastructure and renewable energy solutions. Eiffage is adapting to capitalize on these opportunities. In 2024, the global green building market was valued at $367.6 billion.

- Renewable energy investments increased by 17% in 2024.

- Eiffage's focus is on sustainable building projects.

- The company is expanding its renewable energy portfolio.

Eiffage confronts climate risks requiring infrastructure resilience and adaptation. They must meet strict emission targets with sustainable strategies. Environmental regulations and public awareness necessitate reduced environmental impact, including biodiversity preservation. Eiffage emphasizes resource conservation and waste reduction, adapting to the low-carbon economy and leveraging the growing green building market.

| Factor | Impact | 2024 Data/Trend |

|---|---|---|

| Climate Change | Physical Risks & Adaptation | Infrastructure damage costs billions |

| Carbon Emissions | Stricter Targets | France aiming for a 50% reduction by 2030 (vs 1990) |

| Environmental Regulations | Project Approvals | EU Biodiversity Strategy impacted approvals in 2024 |

PESTLE Analysis Data Sources

Eiffage's PESTLE is built on global economic databases, industry reports, government portals and EU/France legislation.