EMCOR Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMCOR Group Bundle

What is included in the product

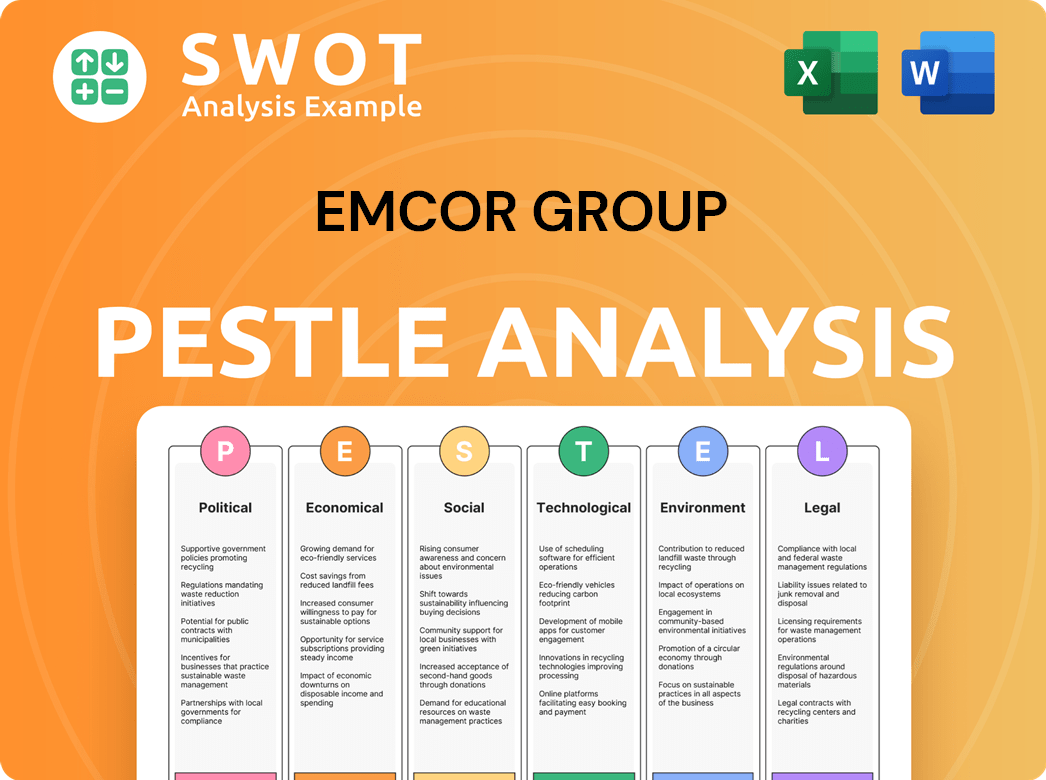

Evaluates EMCOR Group through six dimensions: Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version perfect for incorporating into presentations or group planning.

What You See Is What You Get

EMCOR Group PESTLE Analysis

The EMCOR Group PESTLE analysis previewed here accurately represents the document you will receive.

Its content, organization, and analysis of the company's external environment are all intact.

Upon purchase, you’ll instantly download this same detailed and comprehensive assessment.

This ready-to-use file is perfect for gaining insights.

Enjoy!

PESTLE Analysis Template

Explore how EMCOR Group is impacted by external forces with our PESTLE analysis. We dissect the political landscape and economic trends affecting their operations. Analyze social factors and technological advancements shaping their strategy. Gain valuable insights into environmental considerations and legal frameworks influencing EMCOR. Equip yourself with actionable intelligence to strengthen your own strategic plans. Download the full analysis now for a comprehensive market view!

Political factors

Government infrastructure spending, fueled by initiatives like the Bipartisan Infrastructure Law, significantly impacts EMCOR. The law allocates substantial funds to infrastructure projects, directly boosting demand for EMCOR's services in mechanical, electrical construction, and energy infrastructure. For example, the Bipartisan Infrastructure Law is set to provide $550 billion in new infrastructure investments over five years. This influx of capital creates numerous opportunities for EMCOR to secure contracts and expand its project portfolio. This investment is expected to boost the construction sector's growth by 2-3% annually through 2025.

Government policies drive the clean energy transition, influencing demand for renewable infrastructure. The Inflation Reduction Act boosts clean energy projects via incentives. This increases investment in solar, wind, and battery storage. EMCOR's role in energy infrastructure aligns with policy-driven trends. For instance, the US solar market is projected to reach $37.7 billion by 2024, reflecting these shifts.

Changes in trade policies and tariffs significantly impact EMCOR. For instance, tariffs on steel could raise costs. In 2024, the U.S. imposed tariffs on certain imported steel, potentially increasing EMCOR's expenses. This could affect project profitability and demand, as seen in the construction sector's fluctuations.

Regulatory Environment

EMCOR Group faces political factors impacting its operations, particularly concerning the regulatory environment. Regulations significantly shape construction and facilities services, influencing project execution. Compliance, especially with prevailing wage laws and apprenticeship mandates tied to federal funds, is critical for companies like EMCOR. In 2024, the U.S. government allocated $1.2 trillion for infrastructure, directly impacting EMCOR's projects.

- Construction spending increased by 11% in 2024.

- Federal funding mandates adherence to labor standards.

- Environmental regulations drive sustainable practices.

- Compliance costs affect project profitability.

Political Stability and Government Spending Priorities

Political stability significantly influences EMCOR Group's operational landscape. Government spending priorities, particularly infrastructure, directly affect project availability. Stable environments with infrastructure focus create consistent demand for EMCOR's services. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated significant funds for infrastructure, which continues to boost projects.

- U.S. infrastructure spending is projected to reach $1.2 trillion over several years.

- EMCOR's government client sector accounts for a notable portion of its revenue.

- Political shifts can alter funding allocations, impacting project pipelines.

- Stable policies encourage long-term investments in infrastructure.

Government policies drive EMCOR's growth through infrastructure spending. The Bipartisan Infrastructure Law's $550 billion boost fuels EMCOR's project portfolio. Construction spending rose 11% in 2024, supported by federal mandates and environmental regulations. Political stability encourages investments; US infrastructure spending is set at $1.2T.

| Political Factor | Impact on EMCOR | 2024/2025 Data |

|---|---|---|

| Infrastructure Spending | Increases Project Demand | $550B Infrastructure Law (US) |

| Clean Energy Policies | Boosts Renewable Projects | US Solar Market: $37.7B (2024) |

| Trade Policies | Affects Costs and Profitability | Tariffs on Steel (2024) |

Economic factors

Overall economic growth significantly impacts EMCOR Group. Strong economic performance, as seen in the U.S. with a GDP growth of 3.3% in Q4 2023, boosts construction and facility service demands. This growth fuels business expansion, increasing the need for new and maintained infrastructure. Conversely, slowdowns, like the projected global growth decline to 2.9% in 2024, could curb EMCOR's opportunities.

The construction market in 2024 and 2025 shows mixed signals. Non-residential building and civil engineering are growing, offering chances for EMCOR. Sectors like manufacturing and data centers are expanding, while residential construction faces challenges. The Dodge Momentum Index rose 6% in March 2024, showing positive signs.

Interest rates significantly influence EMCOR's financing costs and client investment decisions. As of early 2024, the Federal Reserve maintained a target range of 5.25% to 5.50% for the federal funds rate, impacting borrowing expenses. Higher rates can curb new construction, potentially affecting EMCOR's project pipeline. Conversely, lower rates could stimulate construction activity.

Material and Labor Costs

Material and labor costs are pivotal economic factors for EMCOR Group. The price of construction materials and the availability and cost of skilled labor directly impact project profitability. Rising material costs and labor shortages can squeeze profit margins, affecting project bidding and selection decisions. The Producer Price Index (PPI) for construction materials saw fluctuations in 2024, with specific increases in steel and concrete. Labor costs also varied by region, with certain areas experiencing higher wage demands due to skilled worker scarcity.

- PPI for construction materials showed a 2-4% increase in Q4 2024.

- Labor costs in the Northeast US increased by 3-5% due to high demand.

- EMCOR's gross profit margins were impacted by 1-2% due to rising costs.

Investment in Energy Transition

The global push towards energy transition, especially renewable energy, significantly boosts economic prospects. This shift leads to increased investment in projects that require specialized services. EMCOR Group benefits from this as it provides essential services in this growing sector. The U.S. Department of Energy projects a 30% increase in renewable energy consumption by 2025.

- Investment in renewable energy infrastructure is projected to reach $1.3 trillion globally by 2025.

- EMCOR's involvement in these projects supports job creation and economic growth.

Economic conditions heavily influence EMCOR Group's performance. Growth in areas like manufacturing and data centers drives construction demand, as seen with the Dodge Momentum Index's 6% rise in March 2024.

Interest rates impact financing and project investments; the Federal Reserve held rates between 5.25% and 5.50% in early 2024.

Material and labor costs are critical, with the PPI for construction materials up 2-4% in Q4 2024, and labor costs rising 3-5% in the Northeast.

The renewable energy sector offers significant opportunities, projected to reach $1.3 trillion in global investment by 2025, which directly benefits EMCOR Group.

| Economic Factor | Impact on EMCOR | Data Point (2024-2025) |

|---|---|---|

| GDP Growth | Influences construction demand | U.S. GDP growth of 3.3% in Q4 2023; global growth projected at 2.9% in 2024 |

| Interest Rates | Affects borrowing costs and client investments | Federal Funds Rate: 5.25% - 5.50% in early 2024 |

| Material & Labor Costs | Impacts project profitability | PPI for construction materials up 2-4% (Q4 2024); Labor cost in Northeast increased 3-5% |

| Renewable Energy | Creates specialized service demand | Global investment projected to $1.3 trillion by 2025; US energy sector growth up 30% |

Sociological factors

EMCOR Group faces workforce challenges. The construction and facilities services sectors highly depend on skilled labor. Labor shortages impact project timelines and costs. Attracting and retaining tradespeople is an ongoing issue. In 2024, the construction industry faced a 4.6% job vacancy rate, reflecting skill gaps.

Urbanization and population growth fuel demand for new construction and infrastructure. This creates a steady need for services like those offered by EMCOR. The U.S. population grew to over 333 million in 2024, with urban areas expanding. Spending on infrastructure is projected to increase, creating opportunities for EMCOR.

The evolution of workplace dynamics, including remote work and flexible spaces, impacts facilities services demand. This shift changes focus from traditional office maintenance. In 2024, approximately 60% of companies plan to offer hybrid work models. This impacts services like IT support and space management. Changing dynamics require EMCOR to adapt its offerings.

Focus on Health and Safety

Societal focus on health and safety significantly shapes EMCOR Group's operations. This emphasis necessitates strict adherence to safety regulations and investments in worker well-being. Compliance costs are rising, impacting project expenses and operational strategies. For instance, in 2024, the construction industry saw a 10% increase in safety-related spending.

- EMCOR's safety training programs increased by 15% in 2024.

- Safety-related technology investments grew by 12% in 2024.

- Compliance costs rose 8% due to stricter regulations.

- Worker safety incidents decreased by 7% in 2024.

Community Impact and Social Responsibility

EMCOR Group faces increasing pressure to demonstrate social responsibility. This impacts project approvals and community relations. For example, in 2024, 78% of consumers preferred brands committed to social causes. Workforce development initiatives are also key. Companies investing in such programs see higher employee retention rates.

- Project approvals are often influenced by community perception.

- Strong community relations are crucial for operational success.

- Workforce development boosts local economies.

- Socially responsible companies often have a better public image.

Societal demands heavily influence EMCOR's operations. Health and safety remain paramount, necessitating robust investments, evidenced by a 10% rise in construction safety spending in 2024. Public image hinges on social responsibility, as 78% of consumers favored brands with social commitments, impacting project approvals and community relations.

| Factor | Impact | Data |

|---|---|---|

| Safety Focus | Increased costs and training | 10% rise in safety spending (2024) |

| Social Responsibility | Improved reputation and approvals | 78% consumer preference for socially conscious brands (2024) |

| Workforce | High retention | Workforce development retention higher rates |

Technological factors

The surge in digital tech adoption, including BIM and data analytics, reshapes construction and facilities management. These tools boost project oversight and operational efficiency. For example, the global BIM market is projected to reach $18.5 billion by 2025, indicating growth potential. EMCOR can leverage these technologies to optimize project delivery and enhance client services.

Smart building tech and IoT are changing facilities management. These innovations boost energy efficiency and maintenance. In 2024, the global smart building market was valued at $80.6 billion. IoT adoption in buildings is expected to grow significantly by 2025.

EMCOR Group faces technological shifts with automation and robotics adoption. These technologies boost efficiency and safety in construction and facilities management. According to recent reports, the construction industry's robotics market is projected to reach $2.8 billion by 2025. Automation helps mitigate labor shortages, a key industry challenge.

Advancements in Construction Techniques

EMCOR Group must monitor innovations in construction. New techniques and materials can boost efficiency and sustainability, impacting project costs and timelines. For instance, the global smart construction market is projected to reach $25.2 billion by 2025. Staying informed helps EMCOR remain competitive. This includes adopting technologies like Building Information Modeling (BIM) and prefabricated construction, as these could cut project costs by 10-20%.

- Adoption of BIM for project planning and execution.

- Use of sustainable materials to meet green building standards.

- Implementation of modular construction for faster project delivery.

- Integration of AI for project management.

Data Security and Connectivity

EMCOR Group must prioritize robust data security measures and reliable connectivity given its reliance on digital technologies and connected systems. Protecting sensitive project and client data is crucial to maintain trust and avoid costly breaches. Cyberattacks on infrastructure firms have risen, with costs averaging $4.45 million per incident in 2023. This necessitates ongoing investment in cybersecurity.

- Cybersecurity spending is projected to reach $9.6 billion in 2024 for critical infrastructure.

- The average cost of a data breach in the US was $9.48 million in 2023.

- Ransomware attacks increased by 13% globally in 2023.

Technological advancements profoundly impact EMCOR Group. The construction robotics market is set to reach $2.8 billion by 2025, enhancing efficiency. Digital tools and IoT improve operational effectiveness. Cybersecurity, vital in this landscape, must be a focus; the average data breach cost in the U.S. was $9.48 million in 2023.

| Technology Area | Market Size/Growth (2024/2025) | EMCOR Impact |

|---|---|---|

| BIM Market | $18.5 billion (projected 2025) | Enhance project oversight, delivery. |

| Smart Building Market | $80.6 billion (2024) | Boost energy efficiency, maintenance. |

| Construction Robotics Market | $2.8 billion (projected 2025) | Increase efficiency, mitigate labor issues. |

Legal factors

EMCOR Group must adhere to stringent building codes and standards that vary by location. These regulations, such as those from the International Code Council, govern aspects like fire safety and energy efficiency. Compliance is crucial; in 2024, non-compliance led to significant project delays and fines for several construction firms. These codes are updated regularly; the 2024 updates emphasize sustainable building practices, which impacts EMCOR's material choices and project designs.

EMCOR Group's operations are heavily influenced by labor laws, especially in construction and facilities services. These laws dictate wages, working hours, and safety standards. Compliance is crucial and directly affects operational costs. For example, in 2024, the U.S. Department of Labor increased the federal minimum wage for federal contractors to $17.20 per hour. This increase affects labor expenses.

EMCOR Group operates within a legal landscape heavily influenced by contract law, which dictates project agreements. Proper management of contracts is vital for project success, with legal disputes potentially impacting financial outcomes. For instance, in 2024, contract disputes within the construction sector led to significant financial losses, with some firms facing penalties exceeding $10 million. These disputes often arise from unclear terms or unmet obligations.

Environmental Regulations

EMCOR Group must adhere to environmental regulations, impacting construction and facility operations. These regulations cover environmental protection, waste disposal, and emission standards. Compliance is crucial and influences project design and execution, potentially increasing costs. For instance, in 2024, the EPA's budget for environmental programs was approximately $9.6 billion. Non-compliance can lead to significant fines and project delays.

- EPA's budget for environmental programs was around $9.6 billion in 2024.

- Compliance costs can impact project budgets.

- Non-compliance may result in penalties.

Licensing and Permitting

EMCOR Group, like all construction and facilities management companies, must secure licenses and permits. These are essential for legal operation. Efficiently managing the permitting process is key to avoiding project delays. Delays can be costly. Regulatory compliance is critical.

- In 2024, construction spending reached $1.97 trillion in the U.S., highlighting the scale of projects needing permits.

- Permitting timelines can vary significantly; some projects face delays of several months.

- EMCOR's ability to navigate these processes directly impacts project profitability.

EMCOR must comply with varying building codes, which include those emphasizing sustainable practices. Labor laws, especially concerning wages and safety, significantly affect operational costs; in 2024, the federal minimum wage for contractors increased to $17.20 per hour. Contract law, essential for project agreements, impacts financial outcomes. Non-compliance with regulations leads to delays and penalties.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Building Codes | Project Design, Costs | 2024 Updates: Sustainable building emphasis |

| Labor Laws | Operational Costs | Federal minimum wage for contractors: $17.20 per hour (2024) |

| Contract Law | Financial Outcomes | Construction disputes led to significant losses |

Environmental factors

Sustainability and green building practices are significantly impacting the construction and facilities management industries. Clients now prioritize energy-efficient designs and renewable materials. For instance, in 2024, the green building market was valued at $367.1 billion. This trend drives demand for eco-friendly operations. In 2025, the market is expected to reach $400 billion.

Climate change intensifies extreme weather, affecting construction and infrastructure. The National Oceanic and Atmospheric Administration (NOAA) reported that 2023 saw 28 separate billion-dollar weather disasters in the U.S. Building resilience is key. EMCOR's focus on sustainable solutions aligns with these needs.

Stricter regulations and client desires for better energy use in buildings and industrial sites boost demand for energy management services. This is crucial for EMCOR. In 2024, the global energy efficiency services market was valued at $31.4 billion, with expected growth. EMCOR's services align well with this trend. The company's focus on energy-saving systems positions it favorably.

Waste Management and Recycling

EMCOR Group faces growing pressure from environmental regulations and a rising focus on sustainability, particularly in waste management and recycling. Construction sites and facilities must adhere to stricter waste reduction strategies. This includes proper handling of materials and waste disposal. In 2024, the global waste management market was valued at $2.1 trillion, with continued growth expected.

- Compliance with waste management regulations is essential to avoid penalties.

- Implementing recycling programs can reduce costs and improve environmental performance.

- Sustainable practices enhance EMCOR's reputation and attract environmentally conscious clients.

Renewable Energy Development

EMCOR Group benefits from the surge in renewable energy projects. The expansion of solar and wind farms fuels demand for their construction and maintenance services. This trend is supported by government incentives and growing environmental awareness. The global renewable energy market is projected to reach \$1.977 trillion by 2029, according to a report by Fortune Business Insights.

- The U.S. solar market is expected to grow by 24% in 2024.

- Wind energy capacity additions are also increasing, creating more opportunities.

- EMCOR's expertise in electrical and mechanical systems is crucial for these projects.

Environmental factors strongly influence EMCOR's business. Green building and sustainable practices drive demand; the green building market was valued at $367.1B in 2024. Extreme weather events, amplified by climate change, necessitate resilient infrastructure. Stricter regulations and demand for energy efficiency in construction fuel energy management services; the energy efficiency market was worth $31.4B in 2024.

| Environmental Factor | Impact on EMCOR | Data/Statistics (2024) |

|---|---|---|

| Sustainability & Green Building | Increased demand for eco-friendly operations | Green building market valued at $367.1 billion |

| Climate Change & Extreme Weather | Need for resilient infrastructure solutions | 28 billion-dollar weather disasters in the U.S. |

| Energy Efficiency Regulations | Demand for energy management services | Global energy efficiency services market at $31.4 billion |

PESTLE Analysis Data Sources

The EMCOR Group PESTLE Analysis draws data from financial reports, governmental publications, industry research, and legal databases.