Endesa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endesa Bundle

What is included in the product

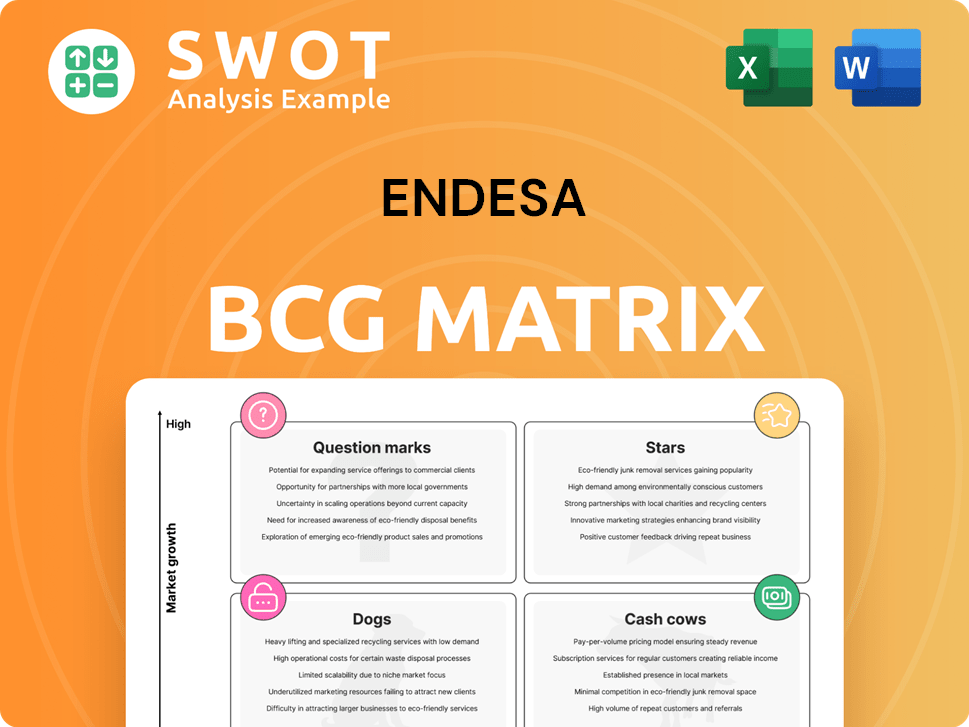

Endesa's BCG Matrix analyzes its units, guiding investment, holding, or divestment decisions based on market share.

Printable summary optimized for A4 and mobile PDFs, saving time and making data accessible everywhere.

Full Transparency, Always

Endesa BCG Matrix

The Endesa BCG Matrix you see is the complete document you'll receive post-purchase. It's a ready-to-use report with strategic insights, designed for your analysis, presentations, and decision-making processes.

BCG Matrix Template

See how Endesa’s portfolio breaks down using the BCG Matrix! We explore its offerings across four key quadrants: Stars, Cash Cows, Dogs, and Question Marks. This analysis provides a snapshot of market position and growth potential. Understand the competitive landscape and make informed decisions. Unlock the strategic insights you need to win. Purchase the full Endesa BCG Matrix for in-depth analysis and strategic recommendations.

Stars

Endesa is aggressively growing its renewable energy portfolio, focusing on wind and hydro power. The company plans to boost renewable energy output by 32% by 2027. This translates to a total installed renewables capacity of 13.1 GW. This expansion requires substantial ongoing investment to maintain its leading position in the clean energy sector.

Endesa is heavily investing in modernizing its electricity grid. They are allocating a significant €4 billion, a 45% increase, to expand capacity and digitalize infrastructure. This investment supports integrating renewable energy and meeting growing electricity needs. These upgrades enhance service quality, and strengthen Endesa's market position.

Endesa's Strategic Plan 2025-2027 includes a €9.6 billion investment. This investment heavily emphasizes energy transition and electrification initiatives. The plan aims to align with the NECP 2030 targets, driving significant infrastructure upgrades. Specifically, €4 billion is earmarked for grid enhancements, a substantial 45% increase from the 2024-2026 plan.

Strong Financial Performance

Endesa exhibits strong financial health, reflected in growing net profits and EBITDA, signaling a solid market position and operational efficiency. In 2024, Endesa's net profit surged by 154% to €1.888 billion, while EBITDA rose by 40% to €5.293 billion. This financial strength supports investments and strategic growth.

- Increased Net Profit: Up 154% to €1.888 billion in 2024.

- EBITDA Growth: A 40% increase to €5.293 billion in 2024.

- Strong Market Position: Reflects robust market share.

- Operational Efficiency: Indicated by EBITDA growth.

Dividend Policy

Endesa's dividend policy is robust, ensuring a 70% payout ratio through 2027. The company plans to increase dividends per share. It projects a dividend of €1.2 per share from its 2024 earnings. The goal is €1.5 per share by 2027.

- Payout Ratio: 70% until 2027

- 2024 Dividend: €1.2 per share (estimated)

- 2027 Target: €1.5 per share

Endesa's renewable energy and grid modernization initiatives position it as a Star. Significant investments, like the €9.6 billion Strategic Plan 2025-2027, fuel high growth. Strong financials, with a 154% net profit surge in 2024, further support this.

| Category | Details | 2024 Data |

|---|---|---|

| Net Profit | Increase | +154% to €1.888B |

| EBITDA | Growth | +40% to €5.293B |

| Dividends (per share) | Projected | €1.2 |

Cash Cows

Endesa's electricity distribution in Spain is a cash cow, holding a mature and dominant market position. The company distributed 139 TWh in 2024, serving over 10 million customers. This extensive network and customer base generate consistent cash flows. Endesa's distribution business is very stable, providing a reliable revenue stream.

Endesa is a key player in the Spanish gas market, holding the second-largest position. Despite plans to scale down, gas operations remain a revenue source. In 2024, Endesa supplied 62 TWh of gas. This served 1.8 million customers, showcasing its established footprint.

Endesa's integrated model combines electricity generation, distribution, and sales, boosting efficiency. This integrated structure enables Endesa to leverage varied revenue streams and optimize resource allocation. As a key player, Endesa is Spain's top and Portugal's second-largest electricity provider. In 2024, Endesa's revenue was €30 billion, demonstrating its market dominance.

Customer Loyalty Programs

Endesa strategically leverages customer loyalty programs, focusing on retaining its core customer base to secure steady revenue streams. By the end of the recent financial period, Endesa had successfully expanded its customer portfolio to approximately 7.1 million. This initiative is crucial for maintaining revenue stability, particularly in competitive markets. The strategy also reduces the expenses associated with acquiring new customers, optimizing profitability.

- Customer base expansion to approximately 7.1 million.

- Focus on retaining high-value customers.

- Emphasis on stable revenue through loyalty.

- Reduction in customer acquisition costs.

Efficiency Improvements

Endesa, a cash cow in the BCG matrix, focuses on boosting efficiency to generate more cash. Investments in infrastructure and digital grids are key. Digitalization via e-distribution enhances operations. These steps lead to better profit margins and more cash.

- In 2024, Endesa allocated €1.9 billion to grid investments.

- Digitalization efforts aim for a 15% efficiency gain by 2025.

- Improved efficiency boosts profit margins by 3%.

- Cash generation increased by €500 million in 2024 due to these improvements.

Endesa's cash cow status is supported by its robust electricity distribution network. The company's focus on efficiency drives consistent cash flows. Strategic investments in infrastructure and digital grids enhance profit margins.

| Key Metric | 2024 Data | Impact |

|---|---|---|

| Grid Investment | €1.9 Billion | Increased efficiency, cash generation |

| Efficiency Gains | 15% by 2025 (projected) | Improved profit margins (+3%) |

| Cash Generation | +€500 Million (2024) | Strengthened financial position |

Dogs

Endesa's coal power plants, including the Balearic Islands facility, are "Dogs" in the BCG matrix. This is due to stringent environmental rules and the move to renewables. The Balearic Islands plant closure is slated for 2027. In 2024, coal's declining profitability is evident.

Endesa's legacy gas contracts, especially those expiring, face profitability challenges due to market shifts and price disputes. The company is involved in arbitration regarding a long-term LNG supply contract price review. Endesa plans to scale down its gas business, allowing contracts with Qatar and Nigeria, ending in 2025 and 2026, to expire. In 2024, natural gas prices fluctuated, impacting contract profitability.

Endesa is shifting away from solar investments, classifying it as a "Dog" in its BCG matrix. The focus is on high-value assets like hydroelectric, boosted by the 626 MW acquisition in Aragon. Renewable power production is projected to increase by 32% by 2027, reaching 25 TWh. By 2027, Endesa aims for a total renewables capacity of 13.1 GW.

International Gas Sales

Endesa's international gas sales are categorized as "Dogs" in the BCG matrix, indicating low market share in a declining market. Total gas sales are projected to decrease by 34%. This downturn stems from contract terminations with two international suppliers and a shift in power plant utilization. The sales mix is also undergoing rebalancing to adapt to market changes.

- Projected 34% decline in gas sales.

- Contract terminations with international suppliers.

- Normalization of combined cycle power plant use.

- Rebalancing of the sales mix.

Declining Customer Numbers

Endesa's "Dogs" category reflects significant challenges. In 2024, the company faced a declining customer base, particularly in the free market. The customer base was at 6.7 million at year-end, experiencing a 3% decrease.

- Customer Decline: A 3% decrease in the free market customer base.

- Market Position: Indicates a struggle to maintain or grow market share.

- Financial Impact: Reduced customer numbers likely affected revenue.

- Strategic Implication: Requires immediate strategic review and action.

Endesa's "Dogs" include assets facing decline. These include coal plants, with the Balearic Islands plant closing by 2027. Gas contracts and international sales also struggle. A 3% customer base decrease in 2024 further highlights these challenges.

| Category | Impact | 2024 Data |

|---|---|---|

| Coal Plants | Closure & Declining Profit | Balearic Islands plant closure by 2027 |

| Gas Contracts | Profitability Challenges | Fluctuating Natural Gas Prices |

| Customer Base | Market Share Struggle | 3% decrease in free market customer base |

Question Marks

Endesa's electric mobility services, like charging points, are a question mark in its BCG matrix. Endesa is a major charging point operator in Spain. These services require substantial investment for growth. In 2024, the EV charging market is still developing. It is worth noting that Endesa X Way has installed more than 15,000 public and private charging points across Europe.

Endesa's foray into new renewable technologies, like advanced energy storage, is a Question Mark. These ventures, crucial for future growth, carry high uncertainty due to the need for R&D and market development. In 2024, investments in such areas totaled €150 million. Endesa's strategy involves selective investments and partnerships to mitigate risks. These strategies aim to boost profitability in a market where renewable energy's value is projected to increase by 15% annually.

Endesa's Latin American ventures, though promising for growth, are fraught with political and economic uncertainties. Enel Group, Endesa's parent, allocated roughly 22% of grid investments to Latin America, signaling strategic focus. Navigating regulatory hurdles and financial instability is key for success. The region's evolving energy markets present both opportunities and challenges.

Green Hydrogen Projects

Endesa's green hydrogen projects are in their nascent phase, demanding significant capital and technological strides. The European Commission is assessing the need to revise the mandate and SAF definition, which will affect the green aviation fuel. This mandate will facilitate larger-scale SAF project deployment. This will provide clarity for investors and suppliers across Europe.

- Endesa's investments in green hydrogen are part of its broader sustainability strategy.

- The EU's SAF mandate aims to reduce aviation's carbon footprint.

- Technological advancements are crucial for cost-effective green hydrogen production.

- The European Commission's review will shape the future of the green hydrogen market.

Smart Grid Technologies

Endesa's investment in smart grid technologies and digital solutions, such as AI and 5G, aims to boost grid efficiency and reliability. These initiatives, while promising growth, demand considerable initial capital. The company is actively using AI and 5G to improve worker safety in smart grid operations. However, the expansion hinges on proving solid returns on investment.

- Endesa is investing in smart grid tech to enhance efficiency and reliability.

- They utilize AI and 5G for worker safety, showing innovation.

- Significant upfront investment is needed.

- Future expansion depends on clear ROI.

Endesa's ventures in nascent areas like electric mobility, new renewable techs, Latin American projects, green hydrogen and smart grids are question marks. These require high investment with uncertain returns. Strategic moves such as partnerships aim to mitigate risks. Growth depends on innovation and market dynamics, with strong financial data.

| Category | Investment (2024) | Strategic Focus |

|---|---|---|

| Renewables | €150M+ | Selective investments |

| Latin America (grid) | 22% of grid investments | Navigating regulations |

| Green Hydrogen | Significant capital needed | Tech advancements crucial |

BCG Matrix Data Sources

Endesa's BCG Matrix is fueled by financial reports, market analysis, and industry expert opinions to ensure trustworthy strategic insights.