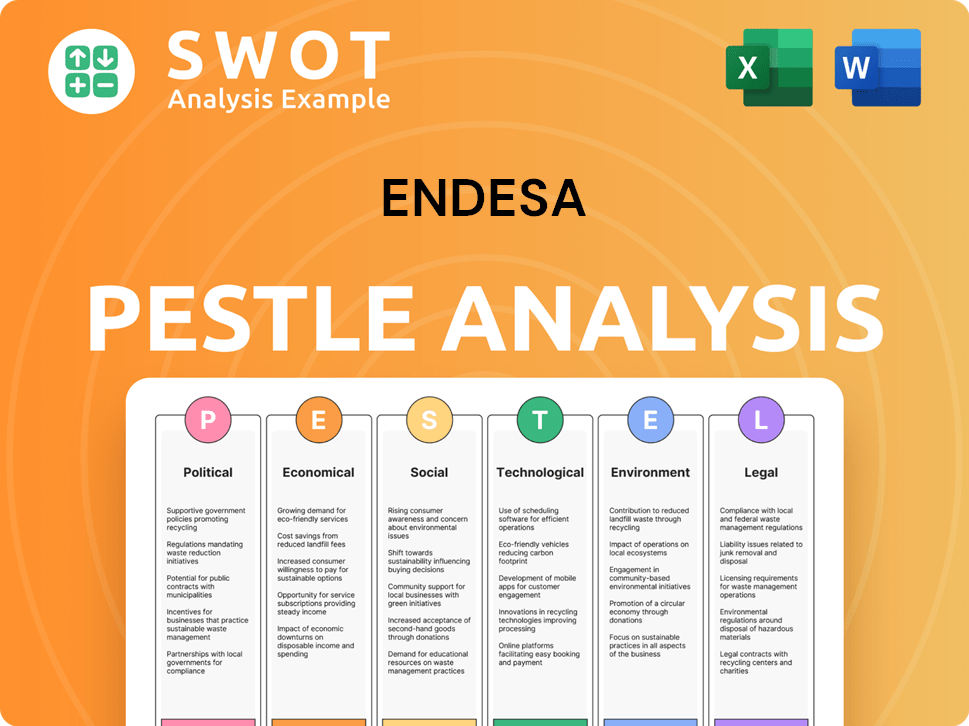

Endesa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Endesa Bundle

What is included in the product

Explores Endesa's external influences across six PESTLE dimensions.

Provides insights to identify and understand risks for better, proactive strategic decision-making.

Preview Before You Purchase

Endesa PESTLE Analysis

What you see is what you get! This preview is the Endesa PESTLE Analysis you'll download after purchasing. It’s fully formatted and professionally presented.

PESTLE Analysis Template

Explore Endesa's future with our in-depth PESTLE Analysis! Uncover the external forces shaping their strategies, from regulations to social trends. This analysis provides a comprehensive overview of the industry's key drivers and challenges. Understand Endesa's position within this dynamic landscape. Equip yourself with essential market intelligence, download the full report now.

Political factors

Endesa's strategies hinge on government energy policies in Spain, Portugal, and Latin America. These policies, like the Spanish NECP for 2030, set targets for renewable energy and decarbonization. Spain aims for 74% renewables in electricity by 2030. This influences Endesa's investments and operations significantly.

Endesa's operations are significantly influenced by regulatory frameworks across its markets. Electricity distribution tariffs, market liberalization, and environmental compliance are key. For example, changes to the regulated asset base and allowed returns in Spain impact profitability. In 2024, regulatory adjustments in Spain affected Endesa's financial planning. These shifts can influence investment decisions.

Political stability in Spain and Latin America is crucial for Endesa. Changes in energy policies or tax implementations, like Spain's temporary levy on energy companies, directly affect Endesa. For instance, in 2024, Spain's government discussed further energy sector regulations. These shifts create operational and investment risks. The company must navigate these uncertainties to maintain its financial health and operational continuity.

International Agreements and Targets

Endesa's strategic direction is significantly influenced by international accords and sustainability objectives, like the Paris Agreement and EU emissions reduction targets. These international frameworks push Endesa toward greener technologies and sustainable practices. The company has pledged to cut its CO2 emissions by 80% by 2030. Endesa plans to install 3,000 MW of renewable capacity between 2024 and 2026.

- Paris Agreement: Sets global goals for climate action.

- EU Targets: Mandates for renewable energy and emissions cuts.

- Endesa's Goal: 80% CO2 reduction by 2030.

- Investment: 3,000 MW renewable capacity by 2026.

Relationship with Governments and Regulatory Bodies

Maintaining a strong relationship with governments and regulatory bodies is crucial for Endesa's operations. This involves active engagement in discussions about regulatory changes and advocating for policies that support the company's goals. Compliance with all relevant laws and regulations is also a key priority. For example, in 2024, Endesa invested heavily in ensuring compliance with new EU energy regulations, allocating over €500 million for grid modernization to meet these standards.

- €500M: Investment in grid modernization for regulatory compliance (2024).

- Ongoing dialogue with the Spanish government regarding renewable energy targets.

- Continuous monitoring of EU energy policy updates.

- Regular audits to ensure compliance with environmental regulations.

Political factors shape Endesa’s strategies, with government policies like the Spanish NECP 2030 influencing renewable energy targets, such as Spain aiming for 74% renewables in electricity by 2030. Regulatory frameworks, like changes in distribution tariffs and environmental compliance, significantly affect Endesa's profitability. Political stability and government actions, like the energy tax discussions in 2024, also introduce operational risks.

| Policy Influence | Impact | Examples (2024-2025) |

|---|---|---|

| Energy Transition Laws | Investment decisions; profitability | Spain's 2030 targets; EU energy regulations. |

| Regulatory Changes | Operational costs; compliance | €500M spent on grid modernization. |

| Government Stability | Risk assessment | Tax implementations affecting financial planning. |

Economic factors

Fluctuations in wholesale and retail electricity and gas prices significantly affect Endesa's financial performance. The normalization of energy markets in 2024, compared to the volatility of 2022 and 2023, positively influenced Endesa's net profit. In Q1 2024, Endesa reported a net profit of €553 million, reflecting improved market conditions. The European energy crisis and subsequent price corrections continue to shape Endesa's strategic decisions.

Endesa's strategic plan prioritizes large investments in grid upgrades and renewable energy projects. Securing financing at good rates and managing debt are key for investment execution. In Q1 2024, Endesa's net debt was €8.9 billion. Successfully managing debt is vital for their financial health and future growth.

Customer demand for electricity and gas, crucial for Endesa, is influenced by economic trends and consumer behavior. Market competition in the liberalized sector impacts Endesa's sales and market share. Endesa strives to expand its customer base and retain valuable clients. In 2024, Endesa's customer base grew by 2%, reflecting its strategic focus.

Inflation and Interest Rates

Inflation and interest rates are crucial macroeconomic factors affecting Endesa. Higher inflation can increase operating costs, potentially squeezing profit margins. Elevated interest rates can raise financing expenses, impacting profitability and investment decisions. These factors can offset growth in EBITDA, as seen in recent financial reports.

- In 2024, the Eurozone's inflation rate fluctuated, impacting Endesa's operational costs.

- Interest rate hikes by the ECB directly influence Endesa's borrowing costs.

- Rising financial expenses can offset growth in EBITDA.

Economic Growth and Development

Economic growth is crucial for Endesa, particularly in Spain, Portugal, and Latin America. Spain's GDP growth was 2.5% in 2023, with forecasts of around 2% for 2024. Portugal saw a 2.3% GDP increase in 2023. These figures influence energy demand. Development boosts electricity needs, requiring grid upgrades.

- Spain's 2023 GDP: 2.5%

- Portugal's 2023 GDP: 2.3%

- Forecast for Spain in 2024: ~2%

Economic factors such as inflation, interest rates, and GDP growth heavily impact Endesa's performance. Eurozone inflation in 2024 affects operational costs, while ECB interest rate hikes influence borrowing. GDP growth in Spain and Portugal directly affects energy demand.

| Indicator | 2023 | 2024 (Forecast/Recent) |

|---|---|---|

| Spain GDP Growth | 2.5% | ~2% |

| Portugal GDP Growth | 2.3% | - |

| Eurozone Inflation | - | Fluctuating |

Sociological factors

Public opinion on energy sources significantly impacts Endesa. Positive views on renewables are crucial, with a 2024 survey showing 75% support for solar. Environmental impact concerns influence project approvals; Endesa's focus on green initiatives, like investing €1.5 billion in renewables in 2024-2025, is key for acceptance. Social acceptance of infrastructure is vital for project success.

Endesa's workforce and labor relations are critical. The company invests in employee training, adapting to technological changes. A key challenge is managing the social impact of phasing out coal. In 2024, Endesa employed around 9,500 people, reflecting its commitment to workforce development.

Endesa actively engages with local communities, fostering shared value and socio-economic development. It supports initiatives in areas impacted by thermal plant closures. In 2024, Endesa invested €15 million in community projects. These efforts aim to mitigate the impact of plant closures and promote local economic growth.

Energy Affordability and Consumer Behavior

Energy affordability significantly affects households and businesses, creating social and political pressures. This can lead to regulatory scrutiny for energy providers like Endesa. Consumer choices, such as embracing electric vehicles, reshape Endesa's operations. These shifts demand strategic adaptation to maintain market relevance and financial health.

- In 2024, approximately 15% of European households struggled with energy poverty.

- EV adoption increased by 20% in 2024 across key European markets.

- Decentralized energy production grew by 10% in Spain in 2024.

Demographic Trends

Demographic shifts significantly affect Endesa's operations. Population growth or decline, and aging trends in areas like Spain and Portugal, alter energy consumption. For example, Spain's population grew slightly in 2024, impacting electricity demand. These changes dictate infrastructure needs and investment strategies. Understanding these shifts is crucial for Endesa's long-term planning.

- Spain's population: 47.5 million in 2024.

- Portugal's population: 10.3 million in 2024.

- Aging population trends influence energy usage patterns.

Public support for renewable energy sources remains critical, with positive views driving investments; 75% support solar power in 2024. Workforce development, adapting to technological changes, is essential for Endesa's operations, focusing on social impact. Endesa invested €15M in community projects in 2024, supporting socio-economic growth in regions impacted by plant closures.

| Aspect | Details | Data (2024) |

|---|---|---|

| Renewables Support | Public preference | 75% support for solar |

| Community Investment | Project funding | €15 million |

| Energy Poverty | Household struggle | 15% of households in Europe |

Technological factors

Endesa heavily invests in renewable energy tech. Solar, wind, and hydroelectric power are key. In 2024, Endesa aims to boost renewable capacity. They plan to add over 3 GW of new renewable capacity by the end of 2025. This is part of their decarbonization goals.

Endesa is heavily investing in smart grids, a key part of its strategy. Digitalizing infrastructure and implementing advanced grid management systems are essential. These advancements help integrate renewable energy sources. In 2024, Endesa allocated €1.5 billion to grid digitalization. This boosts service quality and network resilience.

Energy storage solutions are crucial for Endesa. Battery storage helps manage the irregular nature of renewables, ensuring grid stability. Investments in energy storage are rising; the global market is projected to reach $15.7 billion in 2024. This growth supports Endesa's transition to cleaner energy sources.

Electrification of Energy Consumption

Technological advancements are significantly boosting the electrification of energy consumption, a core element of Endesa's expansion strategy. Electric vehicles (EVs), heat pumps, and other electric technologies are pivotal. Endesa is investing heavily in these areas, aiming to capitalize on the shift towards electric solutions. For instance, the European EV market saw about 1.5 million registrations in 2024.

- EV sales are expected to continue rising, with projections estimating over 2 million registrations in 2025 across Europe.

- Heat pump installations are also climbing, with a growth rate of approximately 20% in 2024 in the EU.

- Endesa plans to increase its charging infrastructure by 30% by the end of 2025.

Data Analytics and Artificial Intelligence

Endesa heavily invests in data analytics and AI to boost operational efficiency. These technologies are used to optimize energy generation and distribution. Furthermore, they help forecast demand and improve predictive maintenance. This allows for better resource allocation and reduced downtime. For instance, in 2024, Endesa allocated €150 million for digital transformation projects.

- €150 million allocated for digital transformation in 2024.

- AI used for predictive maintenance, reducing downtime by 15% in 2024.

- Data analytics improves grid efficiency by 10% in 2024.

Endesa focuses heavily on renewables, aiming to add over 3 GW of capacity by 2025, supporting decarbonization. Smart grid investments reached €1.5 billion in 2024, enhancing digitalization. They also utilize data analytics for efficiency and are boosting charging infrastructure.

| Technology Focus | 2024 Data | 2025 Outlook |

|---|---|---|

| Renewable Capacity Additions | Over 1 GW | Aiming for over 3 GW |

| Grid Digitalization Investment | €1.5 Billion | Further investments planned |

| EV Registrations (Europe) | 1.5 million | Projected over 2 million |

Legal factors

Endesa faces intricate energy sector regulations across its operational countries, impacting generation, distribution, retail, and pricing. Strict adherence to these laws is crucial for Endesa's operations. For instance, the European Union's regulations, which affect Endesa, aim for a 40% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. Moreover, Endesa must navigate evolving policies like the EU's Emissions Trading System (ETS), impacting its financial performance.

Endesa faces stringent environmental laws. These include emissions limits and waste management rules. Biodiversity protection is also crucial. For instance, EU's 2024 policies aim at reducing emissions. Compliance costs are a key factor in investment.

Endesa is subject to competition law to foster fair market practices. The company has taken steps to comply. In 2024, Endesa faced scrutiny for market dominance. It received certification for competition law compliance. The EU's market regulation impacts Endesa's strategies.

Data Protection and Privacy Laws

Endesa must strictly adhere to data protection and privacy laws due to its extensive customer data management. The company's regulatory compliance model ensures adherence to evolving standards. This is vital, especially with the increasing focus on data privacy. Failure to comply can lead to significant fines and reputational damage. In 2024, the EU's GDPR saw increased enforcement, with fines reaching billions of euros.

- GDPR compliance is crucial for Endesa's operations in Europe.

- Endesa must continually update its data protection practices.

- Data breaches can result in significant financial penalties.

- Customer trust relies on robust data protection.

Labor Laws and Regulations

Endesa must comply with diverse labor laws across its operating countries, impacting employee relations. These laws dictate working conditions, employee rights, and collective bargaining processes. For instance, in Spain, Endesa's primary market, labor costs represent a significant operational expense. In 2024, Endesa's workforce in Spain totaled approximately 9,000 employees. Compliance is crucial to avoid legal issues and maintain positive labor relations.

- Spain's labor costs account for a large portion of Endesa's operational expenses.

- Endesa employed roughly 9,000 people in Spain in 2024.

- Compliance with labor laws is necessary for positive employee relations.

Endesa navigates strict legal frameworks impacting its operations across various sectors, including energy and environmental regulations. EU's emissions targets aim at a 40% reduction by 2030. Compliance with labor laws is vital; in Spain, about 9,000 employees are employed by Endesa as of 2024.

| Regulatory Area | Key Impact | 2024 Data/Examples |

|---|---|---|

| Energy Regulations | Generation, distribution, retail, and pricing | EU emissions reduction targets, affecting operational costs. |

| Environmental Laws | Emissions limits, waste management, and biodiversity protection. | Increased focus on sustainable practices; EU policies drive investment in renewables. |

| Competition Law | Fair market practices, preventing market dominance. | Ongoing scrutiny of Endesa's market activities to ensure competitiveness. |

Environmental factors

Climate change is a key environmental factor for Endesa. The company aims to cut CO2 emissions and reach zero emissions by 2040, supporting global climate goals. Endesa invested €2.5 billion in renewables in 2023. The EU aims to cut emissions by 55% by 2030.

Endesa is significantly increasing its renewable energy capacity, focusing on wind, solar, and hydro to reduce its carbon footprint. The company's investments in renewable projects align with Spain's goal to generate 48% of its electricity from renewables by 2030. In 2024, Endesa's renewable energy capacity reached 10.4 GW.

Endesa's activities, including infrastructure development, affect biodiversity and ecosystems. The company focuses on no net loss of biodiversity. In 2024, Endesa invested €150 million in environmental protection. Endesa integrates biodiversity assessments into its projects.

Water Management

Water management is crucial for Endesa, especially concerning hydroelectric power. The company focuses on efficient water usage across its operations. They are implementing strategies to optimize water consumption, considering water scarcity risks. In 2024, Endesa invested €15 million in water management projects.

- Hydroelectric plants depend on water availability.

- Endesa aims to reduce water footprint.

- Investments focus on sustainable water practices.

Environmental Impact Assessments

Environmental Impact Assessments (EIAs) are crucial for Endesa's new energy projects, evaluating and minimizing environmental effects. These assessments often include biodiversity impact studies. In 2024, Endesa invested significantly in environmental protection, with approximately €500 million allocated to environmental projects and remediation. Endesa's commitment to EIAs reflects its dedication to sustainable practices.

- €500 million invested in environmental projects in 2024.

- EIAs are mandatory for new projects.

- Biodiversity impact assessments are included.

Endesa prioritizes cutting CO2, aiming for zero emissions by 2040, aligning with EU goals. The company significantly boosts renewable capacity with €2.5B invested in renewables in 2023. Biodiversity protection and efficient water use are key focuses, with €150M and €15M respectively invested in related projects in 2024.

| Environmental Aspect | Endesa's Initiatives | 2024 Data |

|---|---|---|

| CO2 Reduction | Transition to renewables, emissions targets | Zero emissions by 2040 goal |

| Renewable Energy | Investments in wind, solar, and hydro | 10.4 GW capacity reached |

| Biodiversity | No net loss strategy, assessments | €150M invested in protection |

PESTLE Analysis Data Sources

Our Endesa PESTLE Analysis uses government reports, industry data, financial publications, and regulatory updates.