Northfield Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northfield Bank Bundle

What is included in the product

Tailored analysis for Northfield Bank's product portfolio.

Clean, distraction-free view optimized for C-level presentation, summarizing performance and strategies.

Delivered as Shown

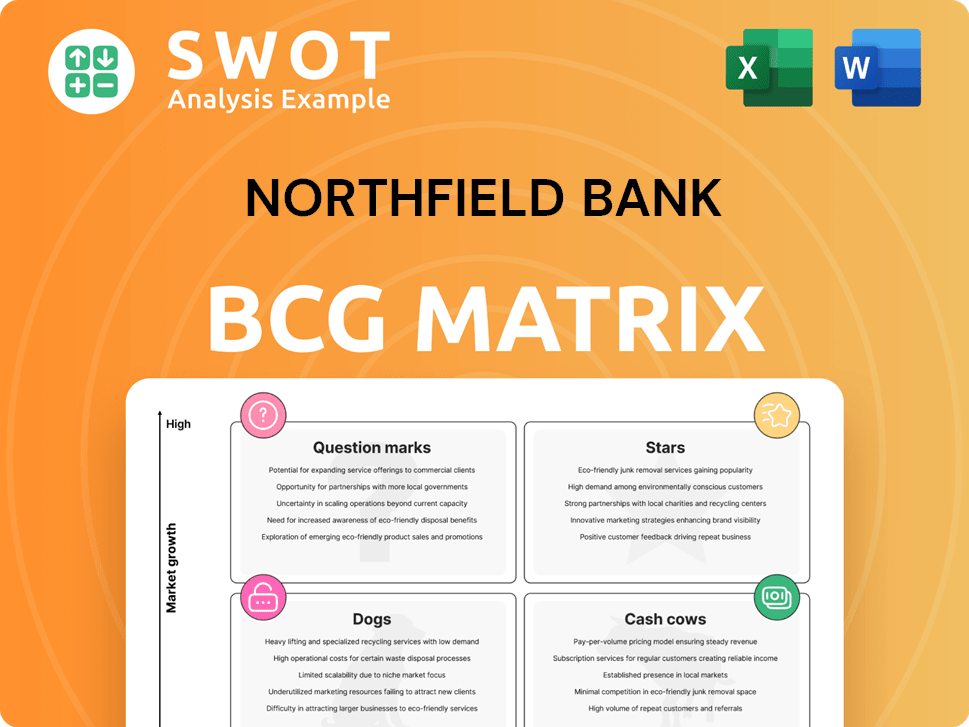

Northfield Bank BCG Matrix

The Northfield Bank BCG Matrix preview mirrors the downloadable document you receive. Expect no changes: it's a fully functional, purchase-ready report for strategic insights. This is the exact analysis tool you'll get, instantly available post-purchase for impactful decisions. Access the complete, professionally designed matrix ready for immediate application and presentation.

BCG Matrix Template

Northfield Bank’s BCG Matrix shows a snapshot of its product portfolio. This analysis reveals strengths, weaknesses, and growth opportunities. Understand where products fit—Stars, Cash Cows, Dogs, or Question Marks. This preliminary view provides valuable strategic context.

Dive deeper into the full BCG Matrix report and gain a clear view of Northfield Bank's product positions. Get quadrant-by-quadrant insights and strategic recommendations. Purchase now for a complete breakdown and actionable insights.

Stars

Northfield Bank's strong net interest margin (NIM) is a key strength. The NIM reached 2.38% in Q1 2025. This is up from 2.03% in Q1 2024. The 35 basis points rise reflects better asset yield and cost control.

Northfield Bank excels in cost management. In 2024, they focused on lowering funding costs. This strategy boosted net interest income. The net interest margin improved too. It's vital for profit and market standing.

In early 2024, Northfield Bank utilized the Bank Term Funding Program (BTFP), borrowing $300 million from the Federal Reserve at attractive rates. They strategically invested these funds at higher yields. This decision substantially increased their earnings, demonstrating their financial acumen. This maneuver aligns with a proactive financial strategy.

Robust Liquidity Position

Northfield Bank's robust liquidity is a key strength, positioning it well in the market. The bank holds around $1.12 billion in unpledged available-for-sale securities, providing a significant financial cushion. Furthermore, it has approximately $547 million in loans ready for pledge, offering additional financial flexibility. These resources enable Northfield Bank to confidently meet its financial commitments and pursue strategic opportunities effectively.

- $1.12 billion in unpledged available-for-sale securities.

- $547 million in loans available for pledge.

- Ability to meet financial obligations.

- Capacity to capitalize on opportunities.

Successful Share Repurchase Programs

Northfield Bancorp's share repurchase programs highlight its strategic capital management. In 2024, the company repurchased shares, indicating confidence in its valuation. A $5 million program was completed, and a new $10 million plan was approved in April 2025. These initiatives aim to boost shareholder returns.

- Completed a $5 million share repurchase program.

- Approved a new $10 million share repurchase plan in April 2025.

- Share repurchases signal confidence in stock valuation.

Northfield Bank's "Stars" likely include its strong net interest margin (NIM) and effective cost management. In Q1 2024, the NIM was 2.03%, which improved to 2.38% by Q1 2025. Strategic moves like the BTFP boosted earnings in 2024.

| Key Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Net Interest Margin (NIM) | 2.03% | 2.38% |

| BTFP Borrowing (2024) | $300 million | N/A |

| Share Repurchase (2024) | $5 million | $10 million (approved) |

Cash Cows

Northfield Bank's core deposits have been consistently growing, especially in low-cost transaction accounts. In Q1 2025, deposits, excluding brokered ones, rose by $133.6 million, showing a 13.8% annualized growth. This growth is driven by new municipal and commercial ties. These deposits are key, enhancing the bank's financial stability.

Northfield Bank's strong asset quality is highlighted by its non-performing loans (NPLs) to total loans ratio. As of March 31, 2024, the bank reported an NPL ratio of 0.48%. This indicates the bank's ability to manage risk effectively. Low NPLs are essential for financial health and investor trust.

Northfield Bank's new residential mortgage program, a "Cash Cow" in the BCG matrix, aids homeownership. This program broadens Northfield's offerings, aligning with community needs. The bank strengthens customer relationships. In 2024, mortgage rates fluctuated, impacting home buying decisions. Northfield's focus on local markets could stabilize returns.

Community-Oriented Banking

Northfield Bank's "Cash Cows" segment, Community-Oriented Banking, thrives on its strong local presence. Their strategy centers on serving local consumers and businesses effectively. This approach fosters customer loyalty, critical for consistent revenue. In 2024, Northfield Bank's focus on community banking showed stable performance.

- Community banking emphasizes local relationships.

- This strategy builds customer loyalty over time.

- Northfield Bank maintained strong asset quality.

Strategic Branch Expansion

Northfield Bank's strategic move to open a branch in Elizabeth, New Jersey, in December 2024, highlights its dedication to growth. This modern branch, located in the new Vintage City, aims to improve customer accessibility. Expanding its physical branches supports Northfield Bank's goal to strengthen its market position. The bank's total assets reached $5.34 billion as of September 30, 2024.

- New branch in Elizabeth, NJ, opened in December 2024.

- Focus on customer convenience and accessibility.

- Supports overall growth strategy.

- Total assets: $5.34 billion (as of Sept. 30, 2024).

Northfield Bank's "Cash Cows" strategy centers on its strong local presence and community-oriented banking. This approach, vital for consistent revenue, focuses on serving local consumers and businesses. In 2024, the bank's commitment to community banking demonstrated stable performance.

| Metric | Data |

|---|---|

| Total Assets (Sept. 30, 2024) | $5.34 billion |

| NPL Ratio (March 31, 2024) | 0.48% |

| Deposit Growth (Q1 2025) | $133.6 million |

Dogs

Northfield Bank saw a decrease in multifamily loans, with a $29.6 million drop in Q1 2025. This could signal a strategic pivot, potentially influenced by regulations or market conditions. In 2024, multifamily loan origination volume decreased 15% across the U.S. Tracking this shift is key to grasping the bank's portfolio adjustments.

Northfield Bank's "Dogs" quadrant includes commercial and industrial loans, which decreased by $1.3 million in Q1 2025. This decline is a concern, potentially signaling decreased demand or tighter lending standards. For example, in 2024, many banks faced similar challenges due to economic uncertainties. Understanding the cause is key for future lending adjustments.

Northfield Bank saw its non-interest income drop by 10.6% due to lower gains from trading securities. This reflects the inherent risks involved in trading activities. To mitigate such volatility, diversifying income sources is crucial, especially in 2024's uncertain market. Effective management of these trading activities is vital for stable revenue streams, as shown by recent financial reports.

High CRE Concentration Risks

Northfield Bank faces significant risks due to its high concentration in commercial real estate (CRE) loans. These loans constitute 424% of its risk-based capital, surpassing the well-capitalized standards. The bank's focus on office and multifamily loans in the New York/New Jersey areas adds to the risk. Declining occupancy rates in these markets could negatively impact profit margins.

- CRE loans are 424% of risk-based capital, exceeding well-capitalized thresholds.

- Overexposure to office and multifamily loans in NY/NJ markets is a concern.

- Declining occupancy rates could pressure margins.

Increased Credit Loss Provisions

Northfield Bank's "Dogs" category saw credit loss provisions surge to $2.6 million. This increase was driven by $2.8 million in net charge-offs, mainly from small business unsecured commercial loans. The rise in charge-offs highlights the need for vigilant monitoring to prevent further financial setbacks. Maintaining strong credit quality is critical for the bank's profitability.

- Credit loss provisions reached $2.6M.

- Net charge-offs totaled $2.8M.

- Focus on small business loans.

- Credit quality needs close attention.

Northfield Bank's "Dogs" include commercial and industrial loans, declining by $1.3 million in Q1 2025. This downturn signals potential issues like reduced demand. In 2024, many banks faced similar challenges due to economic uncertainties.

| Category | Q1 2025 Change | 2024 Context |

|---|---|---|

| Commercial & Industrial Loans | -$1.3M | Economic uncertainties, lower demand |

| Credit Loss Provisions | +$2.6M | Net charge-offs of $2.8M |

| Focus Area | Small business loans | Need for vigilant monitoring |

Question Marks

Northfield Bank's home equity and construction loans suggest growth potential. In 2024, home equity lines of credit (HELOCs) saw increased demand. Construction and land loans could diversify the bank's portfolio.

Northfield Bank's new residential mortgage program is a question mark in its BCG matrix. Launching a mortgage program needs a lot of investment to compete. The program's success hinges on effective marketing and pricing. The bank will monitor performance to decide future investment or divestment. In 2024, mortgage rates fluctuated, impacting market share.

Northfield Bank's expansion into new geographies, like Elizabeth, NJ, positions them as a question mark in the BCG matrix. Success hinges on customer acquisition and local integration. In 2024, Northfield Bank's asset growth was around 5%, reflecting these expansion efforts. Targeted marketing is vital for these new branches.

Digital Banking Enhancements

Northfield Bank's digital banking enhancements are in the "Question Mark" quadrant of the BCG Matrix. These initiatives, including online and mobile service upgrades, involve substantial investment with potentially variable returns. Success hinges on user uptake and enhanced customer satisfaction; for instance, in 2024, digital banking adoption rates across U.S. banks ranged from 60% to 80%, according to a recent study by the Federal Reserve. Continuous evaluation and adjustment are vital to optimize these digital efforts.

- Investment in digital banking services can reach millions of dollars.

- User adoption rates are critical for determining the success of digital banking enhancements.

- Customer satisfaction is a key indicator of the effectiveness of digital initiatives.

- Adaptation is essential to keep up with changing customer expectations.

Small Business Unsecured Loans

Northfield Bank's move into small business unsecured loans, categorized as a "Question Mark" in the BCG Matrix, represents a strategic decision with both opportunities and challenges. While this segment aims to diversify the bank's portfolio, it also faces increased scrutiny due to higher charge-offs. This area needs careful management and continuous monitoring to reduce credit risks and ensure it remains profitable. The potential for substantial growth is offset by the risk of significant losses.

- Increased allocation to small business unsecured loans could lead to higher charge-offs.

- Careful management and monitoring are essential to mitigate credit risks.

- The segment has the potential for high growth but also faces significant losses.

- Northfield Bank must balance growth opportunities with risk management.

Northfield Bank's investments in digital and unsecured loans place them as "Question Marks." These initiatives require substantial investment but carry uncertain returns. Success depends on high user adoption and solid risk management. The bank monitors performance for future decisions.

| Area | Consideration | Impact |

|---|---|---|

| Digital Banking | Adoption Rates | 60-80% adoption in 2024 (US banks) |

| Small Business Loans | Charge-off Risk | Higher risk, requires monitoring |

| Expansion | Asset Growth | Around 5% growth in 2024 |

BCG Matrix Data Sources

The Northfield Bank BCG Matrix uses comprehensive sources, including financial statements, market share analysis, and industry reports for accuracy.