ePlus Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ePlus Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Quickly visualize data with a clear layout. This ePlus BCG Matrix offers easy to share and print formats.

Delivered as Shown

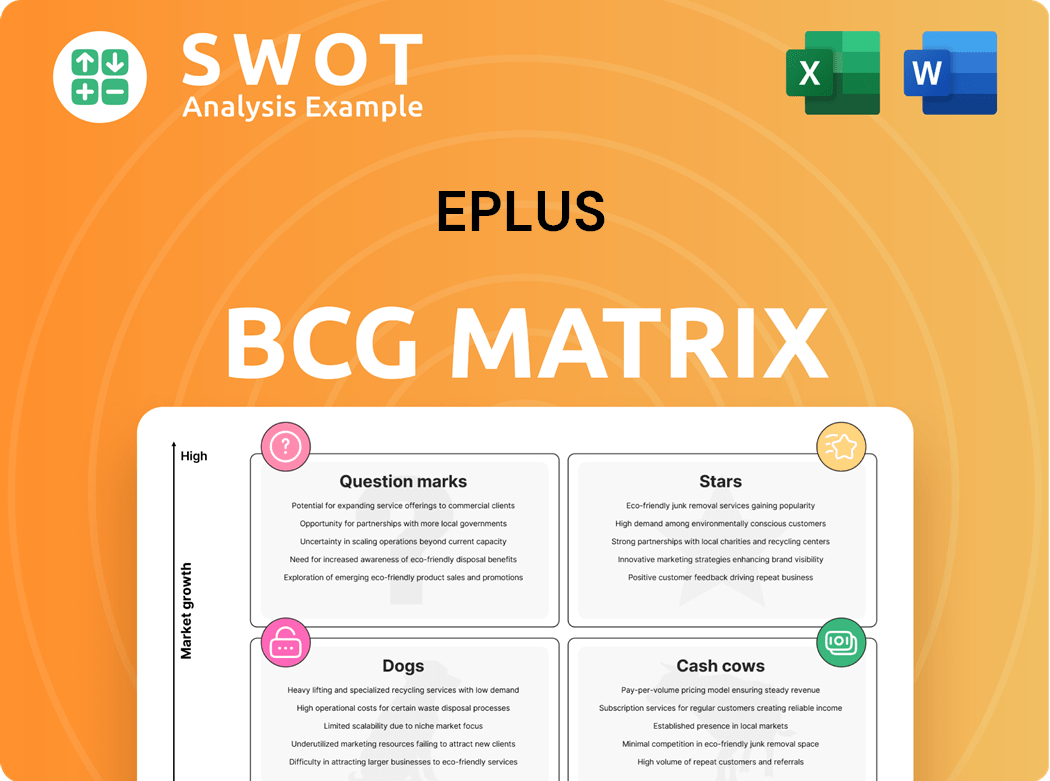

ePlus BCG Matrix

The BCG Matrix preview displays the identical document you'll download after purchase. This ready-to-use, comprehensive report provides strategic insights, delivered directly to your inbox, ensuring immediate application.

BCG Matrix Template

ePlus's BCG Matrix showcases its product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks.

This snapshot reveals key strengths and potential areas for improvement.

Understanding these quadrants is crucial for strategic decision-making and resource allocation.

This preview provides a glimpse into the company's market position.

Purchase the full BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

ePlus is heavily investing in AI and security, creating innovative solutions like AI Ignite and Secure GenAI. These programs directly address current customer demands and are poised to boost future financial performance. The focus on these areas aligns with a cybersecurity market that's projected to reach $345.4 billion by 2024.

ePlus's managed services are a rising star in its portfolio, showing strong growth. The company invests in customer-facing staff to boost market share. In fiscal year 2024, managed services revenue increased, signaling success. This expansion strategy positions ePlus for future gains.

ePlus is seeing significant growth in its cloud solutions, with gross billings on the rise. Cloud services revenue hit $109.6 million in 2023, a 22.7% increase from the previous year. This segment's market share expanded by 27.4%, signaling strong market positioning. This indicates ePlus is successfully capitalizing on cloud market opportunities.

Professional Services

ePlus's professional services are a star in its BCG matrix, significantly boosted by acquisitions like Bailiwick Services, LLC. This segment enhances ePlus's offerings, meeting customer needs for advanced tech. In fiscal year 2024, professional services revenue grew, indicating strong demand. This growth highlights ePlus's strategic expansion and commitment to innovation.

- Professional services revenue growth driven by strategic acquisitions.

- Enhances ePlus's service suite and customer value.

- Reflects a commitment to both organic and inorganic growth strategies.

- Aligns with demands for advanced technology solutions.

Strategic Government and Enterprise Contracts

ePlus's strategic government and enterprise contracts are a strong suit. In fiscal year 2023, ePlus achieved $187.3 million in secured contracts. A 35.6% renewal rate shows their continued success in these sectors. These contracts help ePlus grow and solidify its leadership in tech solutions.

- 2023 contracts totaled $187.3 million.

- The contract renewal rate was 35.6%.

- These contracts support future growth.

- ePlus is a leader in technology solutions.

ePlus's cloud solutions, managed services, and professional services, fueled by strategic acquisitions and customer-focused investments, are stars in its portfolio. In 2023, cloud services revenue surged to $109.6 million, a 22.7% increase. Professional services revenue also climbed in fiscal year 2024, reflecting strong demand and strategic growth. These segments drive ePlus's market expansion and innovation.

| Segment | 2023 Revenue | Growth Rate |

|---|---|---|

| Cloud Services | $109.6M | 22.7% |

| Managed Services | Increased | Strong |

| Professional Services | Increased | Strong |

Cash Cows

ePlus's networking solutions, a cash cow, hit $213.5M in revenue in 2024. Infrastructure services boasted an 18.4% profit margin. A high 87% repeat customer rate highlights stability. These solutions consistently deliver revenue, fueling the company's growth.

ePlus's recurring maintenance and support service contracts are a solid cash cow. In 2024, these contracts generated $156.2 million in annual recurring revenue. The average contract lasts 3.5 years, and the renewal rate is a high 94.6%. This ensures stable, predictable cash flow.

ePlus's financing solutions offer diverse financial arrangements like leases and loans. This segment generates stable revenue via transactional gains and portfolio earnings, contributing to consistent profitability. In Q1 2024, the financing segment's gross profit rose 16.9% to $15.8 million, showcasing its reliability. This growth highlights its importance as a cash cow within the BCG matrix.

Hardware Sales

ePlus's hardware sales represent a significant revenue stream, even with some recent demand fluctuations. The company's market position suggests segment stability. This segment's revenue provides the cash flow to fund other ventures. In 2024, hardware sales contributed to a large portion of ePlus's total revenue.

- Hardware sales still contribute significantly to ePlus's financial performance.

- The company maintains a solid market presence in hardware.

- Revenue generated supports other business operations.

- Hardware sales are a key component of the company's strategy.

Collaboration Solutions

ePlus's collaboration solutions, especially for enterprise clients, are a solid cash cow, consistently generating revenue. In 2024, the company saw strong growth in gross billings within this segment, demonstrating sustained demand. These solutions are mature and provide a reliable income stream for ePlus, ensuring financial stability.

- Consistent revenue from established solutions.

- Strong gross billings growth in 2024.

- Reliable income stream.

- High demand from enterprise clients.

ePlus's networking solutions are a cash cow, with $213.5M revenue in 2024. Recurring contracts generated $156.2M in ARR. Financing solutions had a 16.9% gross profit increase in Q1 2024. Hardware sales and collaboration solutions are also key contributors.

| Segment | 2024 Revenue/Metric | Key Feature |

|---|---|---|

| Networking Solutions | $213.5M Revenue | High repeat customer rate (87%) |

| Recurring Contracts | $156.2M ARR | 3.5-year average contract length |

| Financing Solutions | 16.9% Gross Profit (Q1) | Stable revenue via transactional gains |

| Hardware Sales | Significant contribution | Supports other operations |

| Collaboration Solutions | Strong gross billings | Enterprise client focus |

Dogs

ePlus's product sales dipped, signaling a 'dog' in its BCG Matrix. In Q3 2024, technology business net sales saw a minor decrease, and product sales fell notably. This hints at low growth and market share for some offerings. For example, in Q3 2024, product sales decreased by 8.8% year-over-year. This downturn necessitates strategic reassessment.

Demand for staff augmentation services has recently faced headwinds, particularly within the professional services arena. This downturn signals potential underperformance relative to other service offerings. Considering low growth and market share, these services could be categorized as a 'dog' in specific market segments. For instance, in 2024, a 7% decrease in demand was observed in certain sectors.

Certain legacy hardware products can become 'dogs' in the ePlus BCG Matrix, facing declining demand. These products often show low growth rates. For example, in 2024, older server models saw a market share decrease of 10% due to cloud adoption. Careful strategic evaluation and potential divestiture are important for financial health.

Low-Margin Product Sales to Enterprise Customers

ePlus saw lower product margins because they sold more to big enterprise clients at lower prices. These sales boosted revenue, but the profit might not be worth the effort. Low-margin product sales can become 'dogs' if they don't help much with profit.

- In fiscal year 2024, ePlus reported a gross profit margin of 24.5%, which is slightly down from 25.3% in 2023, indicating pressure on margins.

- The company's sales to enterprise customers, though increasing overall revenue, may have contributed to this margin compression.

- If the profitability from these sales is too low, they might be reclassified as "dogs" in the BCG matrix.

Solutions Facing Supply Chain Issues

Supply chain issues, like those causing order delays, are "dogs." These problems can increase costs and hurt customer satisfaction. They often lower profitability due to inefficiencies. Effective strategies are vital to manage and reduce these supply chain challenges.

- According to a 2024 report, 60% of businesses faced supply chain disruptions.

- Delays can cause a 10-15% decrease in customer satisfaction.

- Increased costs due to supply chain issues can reduce profit margins by up to 8%.

- Mitigation strategies include diversifying suppliers and using technology.

In the ePlus BCG Matrix, 'dogs' are products or services with low market share and growth. This category includes items like declining product sales, certain staff augmentation services, and legacy hardware. Supply chain problems and low-margin sales to enterprise clients also fit this definition. Strategic responses, such as divestiture or focused improvements, are essential.

| Category | Financial Impact (2024) | Strategic Implication |

|---|---|---|

| Product Sales Decline | -8.8% YoY decrease in Q3 | Reassess market fit |

| Staff Augmentation | 7% demand decrease | Evaluate service portfolio |

| Legacy Hardware | 10% market share drop | Consider divestiture |

Question Marks

ePlus's AI Ignite program and discovery services are generating significant customer interest, yet they contribute minimally to current revenue. These services, while promising high growth, currently hold a low market share within the competitive tech landscape. To achieve star status, significant investment is needed, with potential gains mirroring the 20% growth in the overall IT services market in 2024.

ePlus's Secure GenAI Accelerator, a recent offering, is positioned as a Question Mark in the BCG Matrix. This means it has high growth potential but currently holds a low market share. To succeed, ePlus must strategically invest in this product to boost adoption. Its future hinges on effective market penetration, potentially transforming it into a Star if successful, or a Dog if it fails. The company's 2024 revenue was $2.1 billion, with significant investment allocated to innovative solutions like this one.

ePlus's Juniper Mist managed services are a Question Mark in its BCG Matrix. The market share is uncertain, though the market for managed services is growing. ePlus needs to invest and market this service. In 2024, the managed services market was valued at $282.7 billion.

Digital Transformation Services

Digital transformation services at ePlus are categorized as a "Question Mark" in the BCG Matrix. They are experiencing increased market penetration, yet their revenue contribution remains relatively modest compared to the company's overall performance. These services present substantial growth opportunities but require strategic investments to significantly expand market share. Focusing on targeted marketing and specific strategic investments could elevate these services to "Star" status, boosting ePlus's financial outlook.

- Revenue from digital transformation services is growing, though its overall percentage is still small.

- Investments in these services are crucial for capturing a larger market share.

- Targeted marketing can improve visibility and attract new clients.

- Strategic planning is essential to leverage the growth potential of these services.

EV Charging and Digital Signage Services

Following the acquisition of Bailiwick Services, ePlus entered the digital signage and EV charging markets. These services represent a "Question Mark" in the BCG matrix. They have high growth potential but currently low market share for ePlus.

Strategic investments and partnerships are vital to transform these services into "Stars." ePlus aims to capitalize on the increasing demand for digital signage solutions and the expansion of EV infrastructure.

The EV charging market is expected to grow substantially, with projections indicating significant expansion in the coming years. Digital signage is also experiencing rapid growth, driven by technological advancements and increasing demand from various sectors.

ePlus must focus on building its presence and market share in these areas. This includes investing in sales, marketing, and service capabilities to capture opportunities.

- EV charging infrastructure market is projected to reach $47.2 billion by 2028.

- Digital signage market is estimated to reach $31.7 billion by 2028.

- ePlus acquired Bailiwick Services to expand its professional services.

Question Marks within ePlus's portfolio represent high-growth, low-share opportunities, demanding strategic investment. These services, like digital transformation and Juniper Mist, require focused marketing and investment. The EV charging market is anticipated to reach $47.2 billion by 2028, illustrating significant potential.

| Service | Status | Strategic Need |

|---|---|---|

| Secure GenAI Accelerator | Question Mark | Boost adoption through strategic investments |

| Juniper Mist Managed Services | Question Mark | Investment, Marketing |

| Digital Transformation | Question Mark | Targeted Marketing, Investment |

| Digital Signage/EV Charging | Question Mark | Expand presence, market share |

BCG Matrix Data Sources

ePlus BCG Matrix leverages financial data, market analysis, and industry reports for comprehensive and insightful quadrant placement.