ePlus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ePlus Bundle

What is included in the product

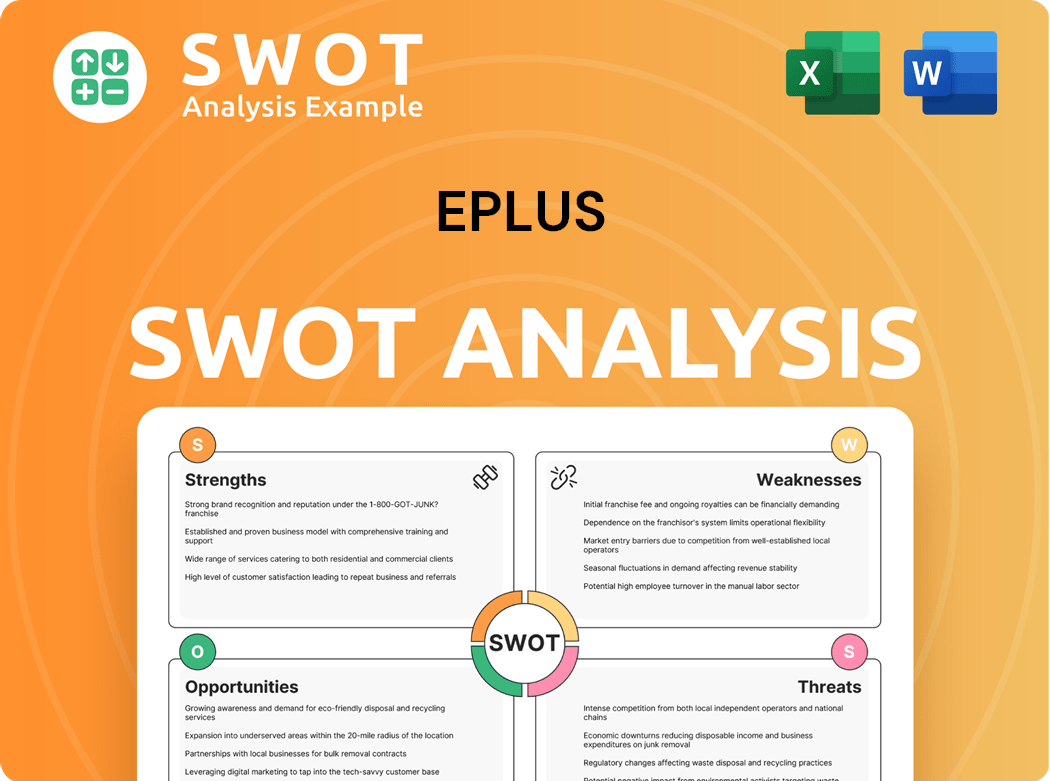

Analyzes ePlus’s competitive position through key internal and external factors.

Facilitates clear SWOT strategy communication with a simple format.

Preview Before You Purchase

ePlus SWOT Analysis

You're viewing an authentic excerpt from the ePlus SWOT analysis. The file displayed here is exactly what you'll download after your purchase. It provides the complete insights. This is not a demo, but the full document. Get it all after purchase!

SWOT Analysis Template

The ePlus SWOT analysis preview provides a glimpse into their strengths, like their solid service offerings. However, it barely scratches the surface. Weaknesses, opportunities like market expansion, and threats such as competition are thoroughly examined in the full report. Gain critical financial context. Don't miss out on key insights; unlock the full SWOT analysis for detailed strategy and informed decision-making!

Strengths

ePlus showcases a strong liquidity position, holding substantial cash and short-term investments. This financial health offers flexibility for growth, acquisitions, and economic resilience. The company's ready capital access enables seizing opportunities and innovation investments. In Q1 2024, ePlus reported $320.7 million in cash and equivalents.

ePlus excels by concentrating on high-growth IT sectors like AI and cybersecurity. Investing in these areas allows ePlus to meet rising client demands with innovative solutions. In 2024, the global cybersecurity market is projected to reach $202.5 billion, highlighting the potential. This focus keeps ePlus competitive.

ePlus is strategically focusing on service revenue, which is growing substantially year-over-year. This shift is creating a more stable, recurring income source. The company's ability to adapt to evolving customer demands is highlighted by this growth. As of 2024, service revenue accounted for a significant portion of the total revenue, demonstrating the effectiveness of this transition.

Diversified Business Model

ePlus's diversified business model is a strength. They hold a robust liquidity position with cash and short-term investments. This financial health enables growth and acquisitions. Ready capital access allows them to invest in innovation and opportunities. ePlus's financial strategy is solid.

- In Q1 2024, ePlus reported $289.8 million in cash and cash equivalents.

- This financial strength supports strategic moves.

- They can pursue growth, acquisitions, and innovation.

Partner Network

ePlus's robust partner network is a key strength, enabling access to a wide array of technologies and solutions. This network supports ePlus's strategic focus on high-growth areas like AI and cybersecurity. These partnerships allow ePlus to offer cutting-edge services, boosting its market competitiveness. In 2024, ePlus reported significant revenue growth in these sectors, underscoring the value of its partner ecosystem.

- Access to diverse tech solutions.

- Supports focus on AI and cybersecurity.

- Enhances market competitiveness.

- Drives revenue growth in key sectors.

ePlus's financial strength, marked by strong liquidity and cash reserves, allows strategic growth and investment flexibility. Focus on high-growth sectors, like AI and cybersecurity, boosts its competitive edge and meets rising client needs. A diverse business model with significant service revenue increases income stability and adaptation.

| Strength | Details | 2024 Data |

|---|---|---|

| Financial Health | Strong cash, short-term investments | $320.7M cash in Q1 2024 |

| High-Growth Focus | AI, cybersecurity investment | Cybersecurity market: $202.5B |

| Service Revenue | Growing and stable income | Significant portion of total revenue |

Weaknesses

ePlus's revenue growth has slowed recently, a key weakness. In fiscal year 2024, ePlus reported a 6.5% increase in net sales, a deceleration compared to prior periods. This slowdown could stem from stiffer competition or shifts in the IT market. Overcoming this requires strategic initiatives to boost sales.

ePlus faces decreasing profitability, with net income showing declines recently. This trend may stem from rising operating costs or pricing issues. For instance, in Q3 2024, gross profit decreased. Boosting profitability is key for better financial results and shareholder value.

ePlus heavily relies on the US market for revenue. This concentration, as of 2024, makes it vulnerable to US economic shifts. For instance, a US recession could severely impact ePlus's earnings. Expanding internationally, like in Canada or Mexico, could spread this risk and provide stability.

Impact of Subscription Models

ePlus faces revenue growth challenges, potentially due to competition or market shifts. The company's revenue growth rate slowed in 2024. Addressing this is vital for sustaining its market position and growth targets.

- Revenue growth slowdown in 2024.

- Increased market competition.

Stock Price Decline

ePlus has faced a stock price decline due to decreasing profitability. The company's net income has been under pressure recently. This could be caused by rising operating costs or pricing issues. Boosting profitability is crucial for ePlus to improve its financial health.

- Net income decreased in the last quarters.

- Operating expenses increased.

- Pricing pressures impact margins.

- Profitability is key for stock performance.

ePlus struggles with slower revenue growth and higher market competition, as seen in the 6.5% sales increase in fiscal year 2024, impacting its market position. Profitability is declining, evidenced by recent net income decreases and Q3 2024 gross profit declines, influenced by rising costs and pricing pressures. ePlus heavily relies on the U.S. market, which makes it sensitive to economic changes; expanding internationally could help.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Slowing Revenue Growth | Market Position | 6.5% sales increase |

| Decreasing Profitability | Financial Health | Net income decline |

| US Market Concentration | Economic Sensitivity | Vulnerable to US shifts |

Opportunities

The global IT services market presents a significant growth opportunity for ePlus. In 2024, the IT services market was valued at over $1.4 trillion. ePlus can increase its revenue by capitalizing on this growth. Expanding into new geographic markets and offering innovative services can further enhance this opportunity.

The cloud computing market's growth presents opportunities for ePlus. They can offer cloud solutions and services to clients. Leveraging expertise in migration, management, and security services is key. This expansion can significantly boost ePlus's revenue. In 2024, the global cloud computing market is projected to reach $678.8 billion.

The acquisition of PEAK Resources Inc. expands ePlus's professional services. This integration allows ePlus to offer a wider range of services, boosting its market position. In Q4 2023, ePlus reported a 10.7% increase in services revenue, indicating growth potential. Successfully integrating PEAK is key to capitalizing on this opportunity.

Growing Demand for AI and Security Solutions

The rising demand for AI and security solutions presents a major opportunity for ePlus. The global IT services market is growing, allowing ePlus to expand and increase revenue. In 2024, the cybersecurity market is projected to reach $267.0 billion. Expanding services and entering new markets can further boost this opportunity.

- Cybersecurity market projected to reach $267.0 billion in 2024.

- Opportunities exist for ePlus to capitalize on market growth.

- Expanding into new geographic markets and offering innovative services.

Digital Transformation Initiatives

ePlus has significant opportunities in digital transformation. The cloud computing market is booming, with a projected value of over $800 billion in 2024. ePlus can capitalize on this by offering cloud solutions and services. Their expertise in cloud migration, management, and security positions them well for growth.

- Cloud market projected to exceed $800B in 2024.

- ePlus can provide cloud-based solutions.

- Offers cloud migration and security.

- Expected revenue growth from cloud services.

ePlus can tap into the expanding IT services market, valued at $1.4 trillion in 2024. Cloud computing, with a projected $800 billion value in 2024, offers another significant avenue. They should expand by providing AI and security solutions, eyeing the $267 billion cybersecurity market by 2024.

| Opportunity | Market Size (2024) | ePlus Strategy |

|---|---|---|

| IT Services | $1.4 Trillion | Expand Service Offerings |

| Cloud Computing | $800 Billion+ | Provide Cloud Solutions |

| Cybersecurity | $267 Billion | AI & Security Services |

Threats

ePlus faces fierce competition in the IT solutions market. This includes established firms and new entrants, all vying for market share. Intense rivalry can lead to price wars, potentially squeezing ePlus's profit margins. For instance, in 2024, the IT services sector saw a 7% decrease in average project prices due to competition. Differentiating services is vital for ePlus.

ePlus's reliance on vendors poses a significant threat. Supply chain issues or vendor changes could disrupt operations. In 2024, vendor disruptions impacted many tech companies. Diversifying vendors is key to mitigating this risk. ePlus needs to consider proprietary solutions.

The escalating intricacy of IT infrastructure and solutions presents a significant hurdle for ePlus and its clientele. To stay ahead, organizations need specialized knowledge to navigate their IT ecosystems effectively. ePlus must consistently allocate resources to training, with IT spending projected to reach $5.06 trillion globally in 2024, reflecting the need for expert management. In 2023, ePlus reported a 10.2% decrease in gross profit, highlighting the impact of complex IT projects.

Economic Downturns

Economic downturns pose a significant threat to ePlus, potentially reducing corporate IT spending. During economic slowdowns, businesses often cut costs, which can lead to decreased demand for ePlus's IT solutions and services. The IT services market, valued at $1.4 trillion in 2023, is sensitive to economic fluctuations. ePlus must navigate these challenges to maintain financial stability.

- Reduced IT spending during economic downturns.

- Potential impact on revenue and profitability.

- Need for cost management and strategic adjustments.

- Market volatility and uncertainty.

Cybersecurity

Cybersecurity threats are a significant concern for ePlus. They depend on vendors for products and services, creating vulnerabilities. Supply chain disruptions or shifts in vendor relationships could harm ePlus's operations. Mitigating this requires diversifying vendors and developing proprietary solutions. In 2024, the global cybersecurity market reached $223.8 billion, highlighting the scale of this threat.

- Vendor dependence poses a risk.

- Supply chain issues can disrupt operations.

- Diversification and proprietary solutions are key.

- The cybersecurity market is a multi-billion dollar industry.

ePlus faces market competition, including price pressures, which are challenges. Vendor dependency poses operational risks. The increasing complexity of IT and economic fluctuations also present difficulties for the company. Cyber threats and market volatility further threaten ePlus's performance. In 2024, the IT services market saw an overall impact due to these pressures.

| Threat | Description | Impact in 2024 |

|---|---|---|

| Competition | Intense rivalry in IT solutions. | 7% decrease in average project prices. |

| Vendor Dependency | Reliance on vendors for services. | Potential operational disruptions. |

| Cybersecurity | Exposure to digital security threats. | Global market value of $223.8 billion. |

SWOT Analysis Data Sources

This SWOT analysis leverages ePlus' financial reports, industry benchmarks, market research, and expert analysis for a data-backed overview.