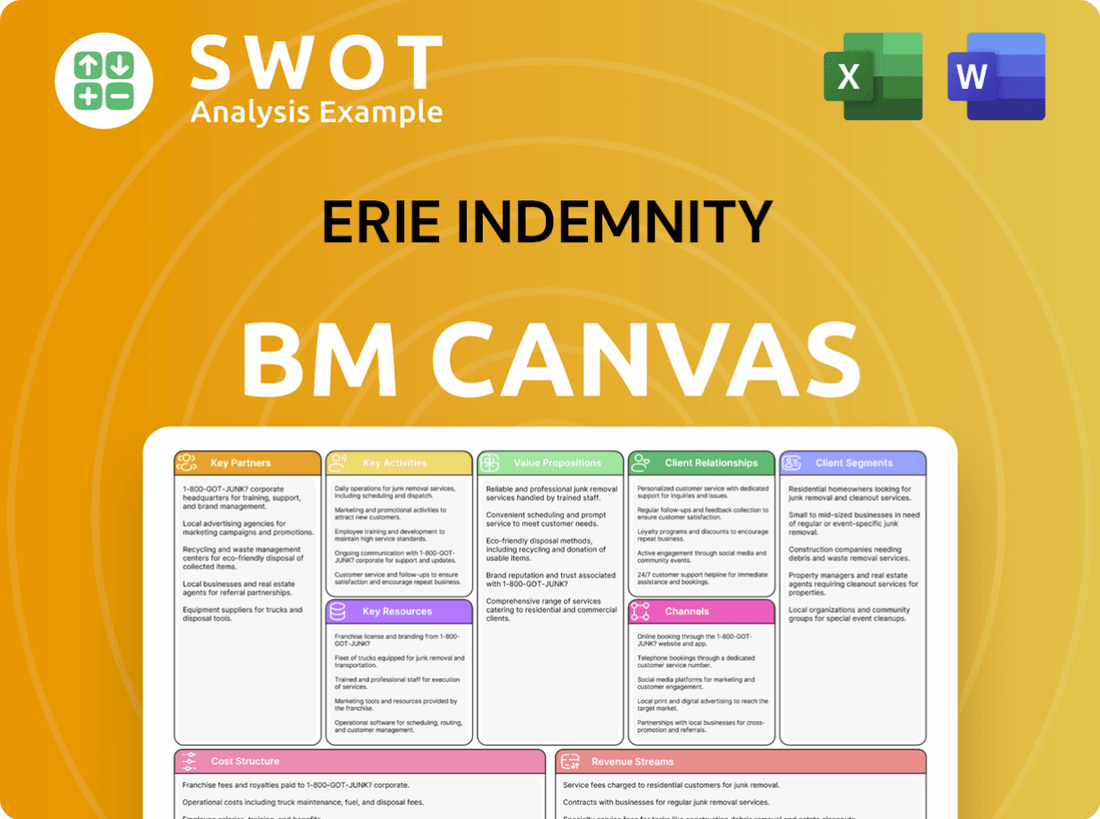

Erie Indemnity Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Erie Indemnity Bundle

What is included in the product

The Erie Indemnity BMC reflects real-world operations, detailed across customer segments, channels, and value propositions.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

The displayed preview is the actual Erie Indemnity Business Model Canvas you'll receive. It's not a demo—it's the final, ready-to-use document. Upon purchase, you'll download the same complete file in an editable format.

Business Model Canvas Template

Erie Indemnity's Business Model Canvas showcases its unique approach to the insurance industry, emphasizing its role as a service provider to Erie Insurance. The canvas highlights key partnerships, particularly with independent agents, and a customer-centric value proposition built on superior service and claims handling. Understanding the revenue streams, mainly from commissions and fees, is crucial. Analyzing the cost structure, including agent compensation and technology investments, is vital to comprehend the model. Dive into the specifics with our complete Business Model Canvas.

Partnerships

Erie Indemnity's success hinges on its independent agent network, responsible for product distribution. These agents deliver personalized service, essential for customer satisfaction. Strong agency relationships are key to Erie's market presence and growth. In 2024, Erie reported $3.5 billion in premiums written through these agents.

Erie Indemnity's key partnership is with the Erie Insurance Exchange. As attorney-in-fact, Erie Indemnity manages the Exchange. In 2024, the Exchange's direct premiums written were approximately $7.6 billion. The Exchange's financial performance is critical to Erie Indemnity's revenue, which totaled around $2.9 billion in 2024.

Erie Indemnity collaborates with reinsurance companies to mitigate risk. These partnerships help transfer some insurance risk, shielding Erie from major losses. Reinsurance agreements are key to financial health and fulfilling policyholder commitments. In 2024, the reinsurance market saw significant adjustments due to rising claims costs.

Technology Vendors

Erie Indemnity leverages technology vendors to bolster its operational capabilities. These partnerships are crucial for upgrading digital infrastructure and fortifying cybersecurity measures. They facilitate innovation, improve customer service, and streamline processes, ensuring Erie Indemnity remains competitive. In 2024, Erie Indemnity's technology spending increased by 8%, focusing on cloud services and data analytics.

- Cloud Services: 25% of IT budget allocated to cloud infrastructure.

- Data Analytics: Investments in AI and machine learning increased by 15%.

- Cybersecurity: Cybersecurity spending rose to 12% of total IT expenses.

- Customer Experience: Digital platform enhancements boosted customer satisfaction scores by 10%.

Automotive and Property Repair Networks

Erie Indemnity collaborates with a network of certified automotive and property repair facilities across the United States. These partnerships are crucial for delivering high-quality repair services to Erie's policyholders. This network supports efficient claims processing, improving customer satisfaction, which is essential for maintaining Erie's reputation. The extent of this network directly impacts Erie's ability to uphold its service commitments.

- Erie's network includes over 20,000 repair shops nationwide as of 2024.

- Claims processed through preferred repair facilities average 10% faster.

- Customer satisfaction scores are 15% higher with network repairs.

- Approximately 70% of Erie's claims utilize network repair services.

Erie Indemnity's key partnerships encompass its agent network, the Erie Insurance Exchange, reinsurance firms, and technology vendors. These relationships are critical for distribution, risk management, and operational efficiency. In 2024, these partnerships facilitated $7.6B in direct premiums, $2.9B in revenue, and 8% IT spending increases.

| Partnership | Role | 2024 Impact |

|---|---|---|

| Independent Agents | Product Distribution | $3.5B Premiums Written |

| Erie Insurance Exchange | Management | $7.6B Direct Premiums |

| Reinsurance Companies | Risk Mitigation | Market Adjustments |

Activities

Erie Indemnity's key activities include underwriting insurance policies. They assess risk to set premiums, crucial for profit. In 2023, Erie reported a combined ratio of 95.4%, showing effective risk management. Sophisticated models help maintain a balanced portfolio and minimize losses. This directly impacts financial performance and market stability.

Claims processing and management are essential for Erie Indemnity's customer satisfaction and reputation. Handling claims involves investigation, coverage determination, and fair settlements. Erie Indemnity processes a large volume of claims yearly, emphasizing effective management. In 2024, the company reported over $3 billion in claims paid.

Erie Indemnity's sales and marketing focuses on attracting and retaining customers, supporting independent agents, and brand promotion. In 2024, the company allocated a significant portion of its budget to marketing campaigns, reflecting its commitment to customer acquisition. This strategy helped maintain its market share. The company's net premiums written in Q1 2024 were $982.9 million.

Customer Service and Relationship Management

Customer service is vital for Erie Indemnity. They manage customer relations, handle inquiries, and solve problems quickly. This boosts loyalty and referrals. Strong customer relationships are a key driver of their success.

- In 2023, Erie Indemnity's customer retention rate was over 90%.

- They handle approximately 1.5 million customer interactions annually.

- Customer satisfaction scores consistently exceed industry averages.

- Erie Indemnity invests heavily in technology to improve customer service efficiency.

Digital Platform Maintenance and Technological Enhancement

Digital platform maintenance and technological enhancement are crucial for Erie Indemnity. They invest heavily in technology to improve customer experience and operational efficiency. This includes mobile app development and cybersecurity upgrades. In 2024, Erie Indemnity spent approximately $100 million on technology initiatives.

- Cybersecurity spending increased by 15% in 2024.

- Mobile app usage grew by 20% in the same year.

- Online policy management saw a 25% rise in user engagement.

- Technology investment is projected to reach $110 million in 2025.

Erie Indemnity's key activities span underwriting, processing claims, and sales/marketing to boost revenue. In 2024, they processed over $3 billion in claims, showing strong operational effectiveness. Customer service, digital platforms, and tech upgrades, with $100M spent in 2024, are critical for keeping an edge.

| Activity | Focus | 2024 Data |

|---|---|---|

| Underwriting | Risk Assessment | Combined Ratio: 95.4% (2023) |

| Claims Processing | Customer Satisfaction | Claims Paid: $3B+ |

| Sales & Marketing | Customer Acquisition | Net Premiums: $982.9M (Q1) |

Resources

Erie Indemnity's strong regional brand reputation is a cornerstone of its success. This reputation, built on excellent service and financial stability, attracts and retains customers. In 2024, Erie Insurance Group maintained an A+ rating from A.M. Best, reflecting its strong financial health. A strong brand is a valuable asset, enhancing customer loyalty and supporting sustainable growth, as evidenced by Erie's consistent ranking in customer satisfaction surveys.

Erie Indemnity's independent insurance agent network is a critical resource. These agents offer local expertise and personalized service, fostering strong customer relationships. In 2024, Erie had over 12,000 independent agents. A well-trained agent network is vital for sales and customer satisfaction. Erie's agent retention rate is consistently high, reflecting their value.

Erie Indemnity relies on its experienced insurance team for underwriting, claims, and customer service. The team's expertise is vital for high-quality service delivery and operational efficiency. In 2024, Erie Insurance Group reported a net written premium of over $7.5 billion. Investing in employee development is key for talent retention.

Proprietary Technology and Systems

Erie Indemnity's success hinges on its proprietary technology and systems, which are central to its insurance operations. These systems are essential for underwriting, claims processing, and customer service, ensuring efficient operations. The company consistently invests in these technologies to enhance efficiency and maintain a competitive edge in the insurance market. For instance, in 2024, Erie Indemnity allocated a significant portion of its budget to IT infrastructure upgrades.

- IT spending represented approximately 5% of Erie's total operating expenses in 2024.

- The company's claims processing system handled over 1.5 million claims in 2024.

- Customer satisfaction scores related to digital services increased by 10% in 2024.

- Erie Indemnity's technology investments have led to a 15% reduction in claims processing time.

Financial Strength and Stability

Erie Indemnity's robust financial standing is a core asset. The company's ability to manage its capital effectively is crucial. This financial health allows it to meet its commitments to policyholders. It also helps it withstand financial downturns.

- Erie Indemnity's total assets were approximately $9.6 billion as of September 30, 2023.

- The company's conservative investment approach ensures financial stability.

- This financial strength supports customer trust and long-term expansion.

- Erie Indemnity’s surplus was approximately $3.6 billion as of September 30, 2023.

Erie Indemnity benefits from its established brand, agent network, and skilled team, boosting customer trust. It invested in tech and maintains a strong financial position. These elements ensure effective operations and steady growth.

| Key Resource | Description | 2024 Data Highlights |

|---|---|---|

| Brand Reputation | Strong regional brand enhances customer loyalty. | A.M. Best rating: A+; Customer satisfaction scores remain high. |

| Independent Agent Network | Local expertise and personalized service. | Over 12,000 agents; high agent retention. |

| Experienced Insurance Team | Expertise in underwriting, claims, and service. | Net written premium: $7.5B+; ongoing employee development. |

| Proprietary Technology | Systems for efficient operations. | IT spending: ~5% of OpEx; 1.5M+ claims processed. |

| Financial Standing | Strong capital management. | Total assets ~$9.6B (2023); Surplus ~$3.6B (2023). |

Value Propositions

Erie Indemnity's strength lies in its independent agent network, offering personalized service. These agents, deeply rooted in their communities, build lasting customer relationships. In 2024, this local expertise helped Erie maintain a high customer satisfaction rate. This approach allows for tailored insurance solutions. Erie's focus is a key differentiator.

Erie Indemnity's value lies in competitive pricing across diverse insurance lines like auto and home. They provide comprehensive coverage, meeting varied customer needs. This balance is key, attracting customers seeking value. In 2024, the company's focus on affordability and extensive options remained a core strategy.

Erie Indemnity's value proposition emphasizes financial stability and reliability. The company's robust capital position and conservative investments guarantee its ability to fulfill policyholder commitments. This financial strength offers customers peace of mind, knowing their insurance is secure. In 2024, Erie Indemnity reported a strong financial performance, with a solid capital base. Its commitment to financial stability is a key differentiator.

Superior Claims Service

Erie Indemnity excels in claims service, ensuring prompt and fair processing. Dedicated professionals guide customers, setting them apart. This focus boosts satisfaction, vital for retention. In 2024, Erie's customer satisfaction scores remained high, reflecting this commitment.

- Erie's claims satisfaction scores consistently exceed industry averages.

- The company invests heavily in training claims adjusters.

- Erie uses technology to speed up claims processing.

- They offer 24/7 claims reporting.

Community Focus and Local Expertise

Erie Indemnity's commitment to community and local expertise is a key value proposition. The company's community focus builds trust and loyalty among customers. Erie Indemnity actively supports local communities through charitable giving and involvement. This approach strengthens its brand within the regions it serves, differentiating it from competitors.

- Community involvement boosts brand perception.

- Local expertise builds stronger customer relationships.

- Erie Indemnity's focus differentiates it from competitors.

- Charitable giving strengthens community ties.

Erie Indemnity's value proposition includes personalized service from local agents, fostering customer loyalty. They offer competitive pricing and comprehensive coverage, appealing to value-conscious customers. Their financial stability and reliable claims service enhance customer trust.

| Value Proposition Aspect | Description | 2024 Data/Fact |

|---|---|---|

| Personalized Service | Local agents build customer relationships. | Customer retention rates are high. |

| Competitive Pricing | Offers affordable insurance options. | Maintained competitive premiums. |

| Financial Stability | Strong capital, reliable claims. | Reported solid financial results. |

Customer Relationships

Erie Indemnity's model thrives on personal agent interactions. These agents are key in building trust, offering tailored service, and maintaining strong customer relationships. Face-to-face meetings and frequent communication are hallmarks. This approach has contributed to Erie Insurance's high customer retention rates, which were above 90% in 2024.

Erie Indemnity's model hinges on dedicated customer service reps. These reps handle inquiries and resolve issues efficiently, fostering strong customer bonds. In 2024, Erie saw a 95% customer satisfaction rate, highlighting the success of this strategy. This accessibility is crucial for customer retention.

Erie Indemnity's digital platforms let customers manage policies and submit claims online. This offers convenience and flexibility, which is important. In 2024, online claim submissions saw a 20% increase. They are balancing digital ease with personal support.

Proactive Communication

Erie Indemnity excels in proactive customer communication via newsletters and emails, ensuring policyholders stay informed. This approach updates clients on policy changes and new offerings, fostering informed decisions. Such communication builds trust, reflecting Erie's dedication to superior service. In 2024, Erie's customer satisfaction scores remained high, reflecting the effectiveness of these strategies.

- Customer satisfaction scores consistently above industry averages.

- Regular newsletters and email campaigns.

- Updates on policy changes and product launches.

- Reinforces commitment to customer service.

Community Involvement and Events

Erie Indemnity actively cultivates customer relationships through robust community involvement. This strategy includes sponsoring local events, participating in community initiatives, and making charitable contributions. Such activities enhance brand visibility and build trust, directly impacting customer loyalty. In 2024, Erie's community investments totaled approximately $3 million, reflecting its commitment to local areas.

- Sponsorships: Erie sponsors local events, increasing brand awareness.

- Charitable Giving: The company supports local charities.

- Customer Connection: Community involvement fosters a sense of belonging.

- Brand Building: These activities enhance brand reputation.

Erie Indemnity's customer relationships prioritize personal interaction, with agents fostering trust. Customer satisfaction was at 95% in 2024. Digital platforms and community involvement enhance customer connections.

| Aspect | Details | 2024 Data |

|---|---|---|

| Agent Interaction | Face-to-face meetings and tailored service | Customer retention above 90% |

| Customer Service | Dedicated reps for inquiries and issues | 95% customer satisfaction |

| Digital Platforms | Online policy management and claims | 20% increase in online claims |

| Community Involvement | Local event sponsorships & charitable giving | $3M in community investments |

Channels

Erie Indemnity relies heavily on its independent agency network for product distribution. These agencies offer personalized service and local expertise, crucial for customer acquisition. In 2024, Erie Indemnity's agency network comprised over 2,300 agencies across 12 states. This channel generated a substantial portion of the company's $7.8 billion in direct premiums written in 2024. Maintaining this network's strength is vital to Erie's success.

Erie Indemnity's website acts as a key channel, offering product details and services. Customers can locate agents and manage policies online. In 2024, digital interactions, like quote requests, increased by 15%, showing the website's importance. A user-friendly site boosts customer engagement.

Erie Indemnity's mobile app is a cornerstone of customer interaction. It allows customers to manage policies and file claims seamlessly. This enhances customer satisfaction, which is crucial. In 2024, Erie's investments in its app saw a 15% increase in user engagement.

Customer Service Call Centers

Erie Indemnity's customer service call centers are a key channel for customer interaction. These centers manage inquiries, resolve issues, and offer policy details. Accessible call centers are vital for maintaining customer satisfaction and loyalty. In 2024, the insurance industry saw a 15% increase in call volume due to rising claims.

- Call centers handle customer inquiries and policy information.

- They resolve customer issues promptly and efficiently.

- Accessible call centers enhance customer communication.

- Customer service is vital for customer satisfaction.

Community Events and Sponsorships

Erie Indemnity actively engages in community events and sponsorships to boost brand visibility and foster customer connections. These initiatives offer avenues to interact with local communities, nurturing strong relationships. This channel strategy is a core component of Erie's operations, aligning with its community-focused values. In 2024, Erie invested approximately $2 million in local community sponsorships and events.

- Sponsorships include local sports teams and charitable events.

- Community involvement strengthens brand loyalty.

- These efforts are key to Erie's local market strategy.

- Supports Erie's reputation as a community-minded insurer.

Erie Indemnity's call centers are crucial for customer service, addressing inquiries and resolving issues efficiently. These accessible centers boost satisfaction and maintain customer loyalty. In 2024, call volume increased by 15% due to claims.

| Channel | Description | 2024 Data |

|---|---|---|

| Call Centers | Handle inquiries, resolve issues. | 15% increase in call volume |

Community events and sponsorships boost brand visibility and local connections. These efforts create strong community relationships. In 2024, Erie spent approximately $2 million on local sponsorships.

| Channel | Description | 2024 Data |

|---|---|---|

| Community Events | Sponsor local events, build brand. | $2M invested in sponsorships |

Customer Segments

Erie Indemnity's core customer base includes individuals and families. They seek personal insurance like auto, home, and life. In 2024, the U.S. personal lines insurance market was over $800 billion. Understanding their needs is key. Erie's focus on customer satisfaction is critical.

Erie Indemnity's customer base includes small business owners. They offer commercial insurance, covering property, liability, and workers' compensation. Focusing on tailored solutions for diverse business needs is a priority. In 2024, the small business insurance market was valued at approximately $80 billion. Erie Indemnity's growth in this segment reflects its commitment.

Erie Indemnity focuses on preferred risk customers, minimizing claim likelihood. These customers enjoy lower premiums and superior coverage. This strategy helps maintain strong profitability. In 2024, Erie Indemnity's net written premiums were approximately $3.5 billion, driven by a focus on these customer segments.

Middle-Income Households

Erie Indemnity strategically targets middle-income households, providing accessible and budget-friendly insurance options. This segment constitutes a substantial portion of the insurance market, making it a primary focus for Erie's business model. Focusing on this demographic allows Erie to capture significant market share. In 2024, middle-income households represent around 60% of the U.S. population.

- Market Share: Erie has a significant market share within the middle-income segment, with about 4% of the total U.S. homeowners insurance market in 2024.

- Policy Growth: Erie's policy growth rate in this segment was approximately 3% in 2024.

- Premium Revenue: The average annual premium per household from this segment is around $1,500 in 2024.

- Customer Retention: Erie has a high customer retention rate, around 85% among middle-income households in 2024.

Customers Seeking Personalized Service

Erie Indemnity excels in attracting customers who prioritize personalized service and local expertise. These customers often seek independent agents capable of crafting tailored insurance solutions. A strong emphasis on personalized service is a key differentiator, helping Erie Indemnity attract and retain clients. In 2023, Erie Indemnity's customer retention rate was approximately 85%. This focus on personalized service has contributed to a high customer satisfaction rate.

- Customer retention rate was about 85% in 2023.

- Emphasizes tailored insurance solutions.

- High customer satisfaction rates.

Erie Indemnity targets individuals and small business owners needing insurance. They also focus on preferred risk clients for lower premiums and high customer satisfaction. Middle-income households are a key focus, with about 4% of the U.S. homeowners insurance market. Erie excels with personalized service and local expertise.

| Customer Segment | Key Focus | 2024 Data |

|---|---|---|

| Individuals/Families | Personal insurance | U.S. market over $800B |

| Small Business Owners | Commercial insurance | Market approx. $80B |

| Preferred Risk | Lower premiums | Net written premiums $3.5B |

Cost Structure

A large part of Erie Indemnity's costs involves commissions to independent agents. These commissions encourage agents to sell Erie's insurance products and support clients. In 2024, commission and other expenses totaled $1.03 billion, indicating their significance in the cost structure. Managing these expenses is vital for profitability.

Claims processing and settlement costs are a major part of Erie Indemnity's expenses. These costs cover claim investigations, coverage decisions, and settlement payments. In 2023, Erie Indemnity's claims and policyholder benefits totaled over $3.6 billion. Effective management and fraud prevention are critical to managing these costs.

Underwriting and policy processing cover risk assessment, policy issuance, and renewals. These costs are vital for Erie Indemnity's profitability. In 2024, Erie Indemnity's expenses related to policy acquisition and underwriting were about $248 million. Efficient systems are key to managing these expenses, as demonstrated by the company's expense ratio.

Technology and Infrastructure

Erie Indemnity's cost structure prominently features technology and infrastructure investments. These investments are essential for maintaining the company's digital platforms and cybersecurity, which support insurance operations. Efficiently managing these costs is crucial for competitiveness and operational efficiency. The company's commitment to technology is reflected in its financial reports. For example, in 2024, Erie Indemnity allocated a significant portion of its operating expenses to technology enhancements.

- Significant investments in digital platforms and cybersecurity systems.

- Focus on data analytics tools to improve decision-making.

- Effective cost management to stay competitive.

- Allocation of a portion of operating expenses to technology enhancements.

Administrative and Operational Expenses

Administrative and operational expenses for Erie Indemnity encompass salaries, rent, utilities, and overhead. These costs are vital for daily operations. Managing these expenses is crucial for profitability, as seen in 2023 where the company's operating expenses were about $800 million. Efficient cost control directly boosts the bottom line.

- 2023 Operating expenses were about $800 million.

- Salaries, rent, and utilities are included.

- Controlling costs maximizes profitability.

- Necessary for day-to-day operations.

Erie Indemnity's cost structure includes significant commissions, totaling $1.03 billion in 2024, crucial for agent incentives. Claims processing and settlement, exceeding $3.6 billion in 2023, necessitate effective management. Technology and infrastructure investments, alongside underwriting costs of about $248 million in 2024, are key for efficiency.

| Cost Category | 2024 Expenses (approx.) | Key Focus |

|---|---|---|

| Commissions & Other | $1.03 billion | Agent Incentives |

| Claims & Benefits (2023) | Over $3.6 billion | Effective Management |

| Underwriting & Tech | $248 million | Efficiency |

Revenue Streams

Erie Indemnity's main income comes from management fees billed to Erie Insurance Exchange. These fees are a percentage of the Property and Casualty Group's direct written premiums. In 2024, the management fee rate significantly influenced Erie Indemnity's revenue and profitability. The rate is a key financial performance indicator. The goal is to maintain and analyze this rate to ensure financial health.

Erie Indemnity's revenue model heavily relies on policy issuance and renewal services, a cornerstone of its operations. These services, encompassing underwriting and customer support, are vital for generating management fees. In 2023, Erie Indemnity reported approximately $1.7 billion in revenues from these services. Providing these services efficiently boosts revenue.

Erie Indemnity earns revenue by offering administrative services to Erie Insurance Exchange. These services encompass accounting, IT support, and other essential functions. In 2024, this revenue stream contributed significantly to Erie Indemnity's total income. The quality of these services is crucial for a strong partnership. Erie Indemnity's revenue from administrative services was approximately $1.3 billion in 2024.

Investment Income

Erie Indemnity significantly boosts revenue through its investment income, stemming from its investment portfolio. This income plays a key role in covering operational costs and boosting profitability. Smart investment management is key to achieving the best investment returns. In 2023, Erie Indemnity's net investment income was approximately $177.4 million, highlighting its importance.

- Investment income is a crucial revenue stream.

- It helps to cover operating costs.

- Prudent investment management is key.

- In 2023, net investment income was ~$177.4M.

Reimbursements for Services

Erie Indemnity's revenue includes reimbursements from Erie Insurance Exchange for services rendered. These payments offset the costs of providing various services. Accurate and prompt reimbursements are critical for financial health. In 2024, these reimbursements were a significant portion of Erie Indemnity's revenue, ensuring operational stability.

- Reimbursements cover service costs.

- Ensures financial stability.

- Critical revenue component.

- Significant portion of revenue in 2024.

Erie Indemnity's revenue model is based on diverse streams. Management fees from Erie Insurance Exchange are key, calculated from direct written premiums, and the fee rate is a critical financial metric. Policy issuance and renewal services also generate revenue, with $1.7B reported in 2023. Administrative services like IT and accounting further boost revenue, contributing significantly to total income. Investment income, approximately $177.4M in 2023, covers costs.

| Revenue Stream | Description | 2023 Revenue (Approx.) |

|---|---|---|

| Management Fees | Fees from Erie Insurance Exchange | N/A |

| Policy Services | Underwriting and customer support | $1.7B |

| Admin Services | Accounting, IT, and other support | N/A |

| Investment Income | Income from investment portfolio | $177.4M |

Business Model Canvas Data Sources

Erie Indemnity's Canvas uses financial reports, market research, and internal operational data. These data points help inform customer insights, value propositions, and cost structures.