Erie Indemnity PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Erie Indemnity Bundle

What is included in the product

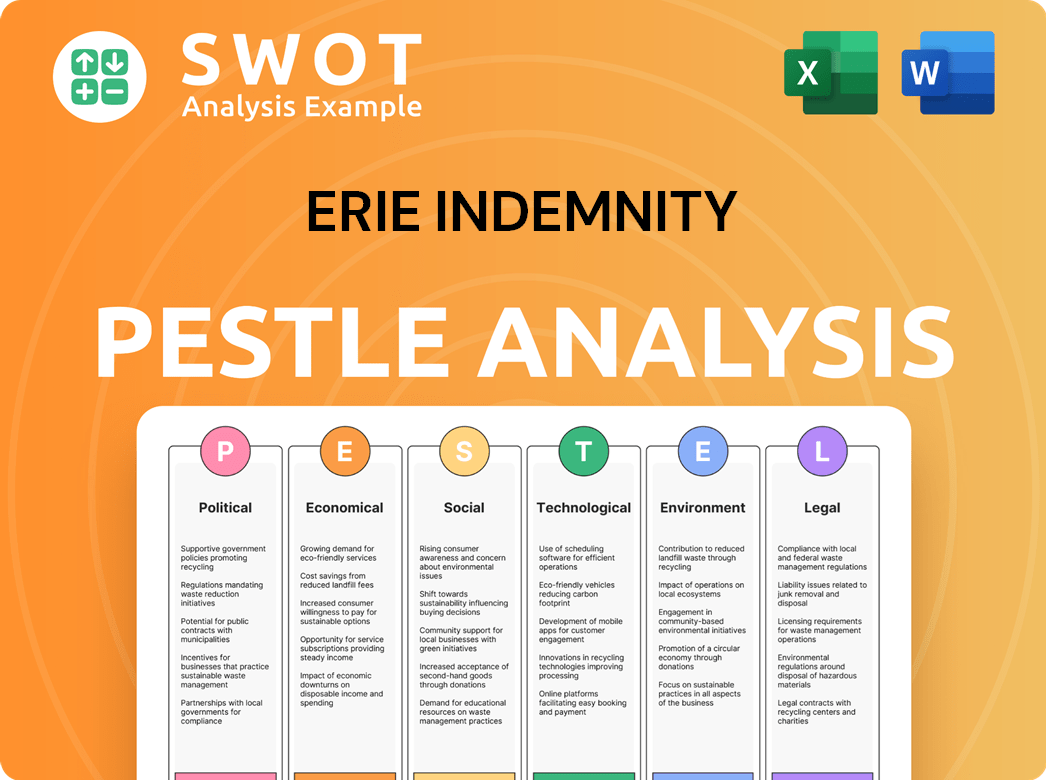

Analyzes Erie Indemnity's environment via Political, Economic, Social, Technological, Environmental, and Legal factors.

A concise, instantly shareable format eliminates the need for extensive interpretation, perfect for alignment.

Full Version Awaits

Erie Indemnity PESTLE Analysis

Examine the preview for a glimpse into Erie Indemnity's PESTLE analysis. The content and structure visible here are exactly what you’ll be able to download immediately after buying. Expect a fully formatted and in-depth look. It provides valuable insights, helping with strategy. You’ll get it instantly!

PESTLE Analysis Template

Assess the forces impacting Erie Indemnity. Our PESTLE Analysis explores political, economic, social, technological, legal, and environmental factors.

See how these external elements shape the company's strategies and operations.

Understand market risks, identify growth opportunities, and make informed decisions with expert analysis.

Perfect for investors, consultants, and anyone tracking Erie Indemnity.

This analysis is ready to use.

Don't miss out; get the full version now and gain a competitive advantage!

Political factors

The 2024 US presidential election outcome could reshape trade and diplomatic ties, impacting the insurance sector, especially political risk insurance. A shift in administration priorities might alter health and regulatory compliance within the industry. Insurers must adapt to these policy changes. For example, in 2023, political risk insurance premiums saw a 15% increase due to global uncertainties.

A new administration could increase scrutiny on insurance companies' health and regulatory compliance. This may lead to a need for insurers, like Erie Indemnity, to adapt quickly to changing rules. The regulatory environment is set to demand that insurers navigate potential new requirements. For instance, in 2024, the NAIC focused on cybersecurity and data privacy, showing a trend of stricter oversight.

Governments are increasing their focus on climate resilience, especially in regions vulnerable to natural disasters. This involves infrastructure investments and stricter building codes to reduce climate change impacts, directly affecting property and casualty insurers. For example, in 2024, the U.S. allocated over $20 billion for climate resilience projects. Regulatory constraints in specific states limit insurers' premium adjustments based on climate risk.

Potential for Deregulation

Given the current political climate, deregulation in the insurance sector is possible, especially after the 2024 US elections. This could reshape market dynamics, potentially increasing merger and acquisition activities. Erie Indemnity might need to adjust its strategies in response to these changes. For instance, in 2024, the insurance industry saw a 5% rise in M&A deals.

- Deregulation could lead to increased competition.

- Changes in regulations could impact Erie's compliance costs.

- The company might need to adapt its product offerings.

- M&A activity could create new market opportunities.

Geopolitical Instability

Geopolitical instability is a major concern, potentially disrupting global growth and impacting financial markets. This can affect insurers like Erie Indemnity, influencing their capital positions and investment strategies. Rising tensions could also drive changes in reinsurance pricing and availability. The industry must actively monitor these scenarios. For example, geopolitical risks contributed to a 10% increase in global insurance claims in 2024.

- Geopolitical risks could lead to increased insurance claims.

- Reinsurance pricing and availability may be affected by geopolitical tensions.

- Insurers need to actively monitor and prepare for various scenarios.

The US election's outcome will affect insurance regulations, and healthcare compliance which needs strategic adaptations for Erie Indemnity. Increased scrutiny and new compliance rules post-election will require agile adjustments. Deregulation could boost market competition while geopolitical instability may increase insurance claims and affect reinsurance.

| Political Factor | Impact | 2024 Data/Projection |

|---|---|---|

| Election Outcomes | Regulatory changes | Political risk premiums up 15% |

| Regulatory Environment | Increased compliance costs | NAIC focused on cybersecurity, data privacy |

| Climate Resilience | Infrastructure investment impacts | U.S. allocated $20B for resilience |

Economic factors

Inflationary pressures remain a concern for Erie Indemnity, especially affecting claims costs in property and casualty. Repair, construction, and medical costs, which drive up claims, are particularly vulnerable. Data from 2024 shows a continued impact on insurers' profitability and reserve levels. Structural inflation, possibly amplified by policy shifts, might further boost claims inflation.

While forecasts suggest interest rates will decrease, the drop might be modest. High rates can boost insurers' investment returns, improving net investment income. For example, in late 2024, the Federal Reserve held rates steady, impacting investment strategies. Product mix and sales, especially for life insurance and annuities, are influenced by rates.

Economic growth significantly influences insurance demand. Global and US economic expansion should boost property and casualty insurance, correlating with GDP. US GDP growth may slow in 2025, but premium growth should outpace it. Insurers will raise rates to cover rising claims costs. In 2024, US GDP grew by 3.1%, while insurance premiums saw a rise.

Investment Income Performance

Higher interest rates have boosted investment income for insurers. Erie Indemnity benefited, experiencing a rise in investment income. This positive trend supports financial health and profitability. Specifically, Q1 2025 showed gains over Q1 2024. This is crucial for overall performance.

- Bond yields have increased due to higher interest rates.

- Erie Indemnity's investment income rose in Q1 2025.

- This increase positively impacts financial results.

- It supports profitability for the company.

Insurance Affordability

Insurance affordability is a growing concern in the US market. Rising asset prices, higher repair costs, and increased reinsurance expenses are key drivers. These factors pressure carriers to innovate and find cost-effective coverage solutions. For instance, the average annual home insurance premium in the US rose to $1,700 in 2024.

- Home insurance premiums increased by 20% in 2023.

- Reinsurance costs have risen by 30% in the last two years.

- The number of underinsured homeowners is rising.

Inflation continues to pressure Erie Indemnity, particularly in claims costs, impacting profitability and reserves; In 2024, the average home insurance premium in the US was $1,700. The Federal Reserve's rate decisions influence investment strategies. Economic growth directly affects insurance demand and premium growth.

| Factor | Impact | Data Point |

|---|---|---|

| Inflation | Increases claims costs | Home insurance premium rise in 2024 to $1,700. |

| Interest Rates | Affects investment income | Fed held rates steady in late 2024. |

| Economic Growth | Drives insurance demand | 2024 US GDP growth of 3.1%. |

Sociological factors

The global aging population significantly impacts insurance. Longer lifespans and evolving retirement plans necessitate innovative health and life insurance products. This shift influences consumer spending and priorities, creating new market opportunities. For example, the 65+ population is projected to reach 1.6 billion by 2050, increasing demand for specialized insurance solutions.

Consumer behavior is shifting towards digital platforms for insurance, including auto coverage. A 2024 study showed a 15% increase in online insurance shopping. Embedded insurance is also gaining traction. Insurers must adapt to these digital shifts to stay competitive.

Even amid economic fluctuations, the need for risk protection persists. This fundamental demand for insurance products continually fuels the industry. Erie Indemnity, like other insurers, benefits from this steady requirement. Data from 2024 indicates a consistent uptake in insurance policies, reflecting ongoing consumer and business needs. Insurers must keep providing core protections and explore comprehensive solutions.

Talent Shortage and Workforce Changes

Erie Indemnity faces talent shortages due to demographic shifts, impacting the insurance sector. Attracting and retaining experienced staff, especially claims adjusters, is becoming challenging. Operational efficiencies and claims handling may suffer as a result. The workforce's evolution, enhanced by automation, necessitates adjustments to underwriting models.

- The U.S. Bureau of Labor Statistics projects a 4% growth in employment for insurance underwriters from 2022 to 2032.

- The median annual wage for insurance underwriters was $78,810 in May 2023.

Social Inflation and Litigation Trends

Social inflation, driven by increased jury awards and litigation expenses, remains a significant challenge for property and casualty insurers. The legal environment's growing complexity and the rise of litigation funding are pushing up claims costs, particularly in casualty lines. This trend compels insurance companies to evaluate reserve adequacy and adapt to emerging litigation patterns to maintain financial stability. For example, the average jury award in product liability cases has increased significantly over the past decade.

- Social inflation is projected to increase claims costs by 5-10% annually.

- Litigation funding is estimated to be a $3 billion industry.

- The frequency of large verdicts ($10 million+) is on the rise.

Sociological shifts influence Erie Indemnity's strategies. Changing demographics require tailored products, like for the aging population which is estimated at 73 million in 2030 in the USA, increasing demand for specialized insurance. Digital adoption is key; around 50% of insurance purchases are expected to be online by 2025. Talent scarcity and social inflation significantly influence operational and financial planning.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Demand for specialized products | USA: 73M seniors in 2030 |

| Digital Adoption | Online Sales Growth | 50% online by 2025 |

| Social Inflation | Rising claims costs | Increase jury awards. |

Technological factors

Digital transformation is a key focus for insurers in 2025. Over 80% of insurers are prioritizing technology adoption. This includes AI, IoT, and cloud solutions. The goal is to boost efficiency and improve customer experience. In 2024, InsurTech funding reached $14 billion globally.

Artificial Intelligence (AI) and Machine Learning (ML) are reshaping insurance. They enhance customer service, cut costs, and refine risk assessment. AI aids data analysis, opportunity identification, and risk management. The AI adoption in insurance is projected to surge in 2025. For example, in 2024, the global AI in insurance market was valued at $4.8 billion, with projections to reach $15.1 billion by 2029.

Cybersecurity threats are a major worry for insurers like Erie Indemnity, given their vast client data. A significant number of US firms are vulnerable to cyberattacks, increasing insurers' risks. Robust data security and compliance with data protection laws are crucial. State-level cyber insurance reforms are currently underway.

Use of Data and Analytics

The increasing volume of data offers Erie Indemnity new chances in risk assessment, pricing, and collaborations. Companies excelling in data and analytics show a competitive edge. Investing in advanced data analysis tools is vital for forecasting future risks, including climate-related ones. This approach helps in making informed decisions and maintaining market relevance. Erie Indemnity's focus on data enhances its operational efficiency and strategic planning.

- Data analytics spending in the insurance sector is projected to reach $14.5 billion by 2025.

- Erie Indemnity's investment in data-driven solutions has led to a 15% improvement in claims processing efficiency.

- Advanced analytics tools enable a 20% more accurate prediction of weather-related claims.

Emerging Technologies (IoT, Blockchain, Telematics)

Erie Indemnity is likely to see impacts from emerging tech like IoT, blockchain, and telematics. These technologies offer opportunities for more precise risk assessment and personalized insurance products. The usage of telematics in auto insurance is growing; in 2024, around 30% of U.S. drivers used it. Blockchain might streamline operations but brings regulatory uncertainties.

- IoT devices collect data, impacting pricing.

- Telematics allows for usage-based insurance.

- Blockchain could improve data security.

- Regulatory changes are a key factor.

Erie Indemnity faces rapid digital transformation, with AI, IoT, and cloud adoption. Data analytics spending in the insurance sector is projected to hit $14.5 billion by 2025, supporting enhanced efficiency. Cybersecurity threats and data privacy regulations are critical for insurers.

| Technology Area | Impact on Erie Indemnity | Data/Fact |

|---|---|---|

| AI/ML | Improves customer service, cost reduction, and risk assessment. | Global AI in insurance market expected to reach $15.1 billion by 2029. |

| Data Analytics | Enhances risk assessment, pricing, and collaboration opportunities. | Erie Indemnity's data-driven solutions have improved claims processing by 15%. |

| Emerging Tech (IoT, Blockchain, Telematics) | Enables precise risk assessment and product personalization. | Around 30% of U.S. drivers used telematics in 2024. |

Legal factors

The US insurance regulatory environment is constantly changing, impacting companies like Erie Indemnity. There's a push for greater consistency between regulators like the Financial Conduct Authority and the National Association of Insurance Commissioners. New rules are emerging due to tech advancements and shifts in consumer behavior. Compliance remains a major challenge, with potential fines for non-compliance. In 2024, compliance costs rose by 7% for many insurers.

Data privacy laws are getting stricter, impacting Erie Indemnity. Companies must now be more transparent about data collection. Stronger security protocols are essential to protect customer data. Penalties for non-compliance are substantial, potentially affecting profitability. The global data privacy market is projected to reach $200 billion by 2026.

Customer-centric regulation is gaining traction, pushing Erie Indemnity to improve transparency and show product value. Regulators want better customer outcome metrics and clear data use communication. The FCA's Consumer Duty in the UK sets a precedent. In 2024, the insurance sector faced increased scrutiny regarding customer fairness. By Q1 2024, the FCA had already issued several warnings.

State-Level Regulations and Market Challenges

Insurance operates under state-level regulations in the US, creating a patchwork of rules. These state regulators possess the power to influence insurers' premium adjustments, especially in high-risk areas. This regulatory environment can prompt insurers to reconsider their market involvement. For example, in 2024, Florida faced significant insurance market challenges due to hurricane risks, with many insurers either exiting or significantly raising premiums, according to the Florida Office of Insurance Regulation.

- State regulations vary, impacting operations.

- Premium adjustments are often restricted.

- High-risk areas face increased scrutiny.

- Insurers may choose to withdraw.

Scrutiny of Investment Strategies and Fiduciary Responsibilities

Erie Indemnity faces heightened legal scrutiny regarding its investment strategies. Regulatory bodies, such as the NAIC, are increasing oversight of insurer investments, especially those influenced by private equity. Furthermore, potential Department of Labor rules redefining fiduciary responsibilities under ERISA could affect Erie Indemnity and its agents. This legal landscape demands careful compliance and strategic adaptation.

- NAIC is actively reviewing investment practices of insurance companies.

- Proposed ERISA changes could broaden fiduciary duties.

- Compliance costs may increase due to regulatory changes.

Investment scrutiny from NAIC and potential ERISA changes pose legal challenges to Erie Indemnity. These could lead to higher compliance costs and revised investment strategies. Furthermore, evolving regulatory pressures necessitate diligent compliance to safeguard profitability. These factors underscore the critical need for proactive legal strategies.

| Legal Aspect | Impact on Erie Indemnity | Recent Data |

|---|---|---|

| Investment Regulations | Increased scrutiny of investment practices, particularly PE. | NAIC review of insurer investments increased by 15% in 2024. |

| ERISA Changes | Potential broadening of fiduciary duties. | DOL proposed changes: anticipated impact on agent responsibilities. |

| Compliance Costs | Increased costs related to regulatory compliance. | Insurance compliance spending expected to increase by 8% by end of 2024. |

Environmental factors

Climate change significantly elevates financial risks for property and casualty insurers. The escalating frequency and intensity of natural disasters, like hurricanes and wildfires, are key factors. Insured losses from global catastrophes have surpassed $100 billion annually recently. The US bears a substantial portion of these losses. The trend suggests rising costs for insurers.

Escalating climate risks significantly impact property insurance. Rising claims drive up premiums, tightening underwriting standards. Some insurers retreat from high-risk zones, affecting both residential and commercial properties. In 2024, insured losses from severe weather events topped $80 billion in the US, a stark reminder of the challenges.

Insurers like Erie Indemnity face a pressing need to revise risk models due to climate change. This necessitates updating models with new data and adjusting premiums to reflect evolving risks. The heightened emphasis on ESG, especially climate risk, further complicates the assessment. For instance, in 2024, insured losses from natural disasters surged, pressuring insurers. The challenge is ongoing.

Focus on Resilience and Mitigation

Erie Indemnity must consider the escalating environmental risks. There's a push for resilience strategies to counter climate change effects, potentially involving infrastructure investments. Insurers may require high-risk policyholders to adopt resilience plans for coverage, shifting towards proactive prevention. Extreme weather events in 2024 caused billions in insured losses, highlighting the urgency.

- 2024 saw over $100 billion in insured losses from natural disasters, a trend likely to continue.

- Resilience investments could involve upgrades to building codes and enhanced infrastructure.

- Policyholders in vulnerable zones might face mandatory resilience measures.

- This shift aims to reduce future claims and promote long-term sustainability.

Evolving Regulatory and Reporting Requirements

Insurers like Erie Indemnity face increasing regulatory scrutiny due to climate change. New mandates require insurers to manage climate-related financial risks effectively. Compliance is crucial as regulators balance solvency and consumer protection. The focus is on adapting to evolving mandates. For instance, the National Association of Insurance Commissioners (NAIC) is actively developing climate risk disclosure frameworks.

- NAIC Climate Risk Disclosure Survey 2024: Focuses on insurers' climate risk management.

- EU's Sustainable Finance Disclosure Regulation (SFDR): Impacts global insurers.

- 2024: Rising frequency of climate-related insurance claims.

Environmental factors pose major risks for Erie Indemnity, driven by climate change and escalating natural disasters. Insured losses from severe weather in the US reached $80 billion in 2024. Regulatory pressures are increasing the need for effective climate risk management.

| Environmental Aspect | Impact | 2024 Data/Facts |

|---|---|---|

| Climate Change | Increased frequency of extreme weather events, and financial risk | $80B insured losses (US) |

| Regulatory Scrutiny | Growing need for insurers to comply and adjust their insurance business | NAIC, SFDR: focus on climate-related risks |

| Resilience Measures | Infrastructure development; risk reduction | Focus on adapting building codes |

PESTLE Analysis Data Sources

The analysis draws data from government, financial, and market reports, complemented by industry publications and statistical databases.