Euronet Worldwide Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronet Worldwide Bundle

What is included in the product

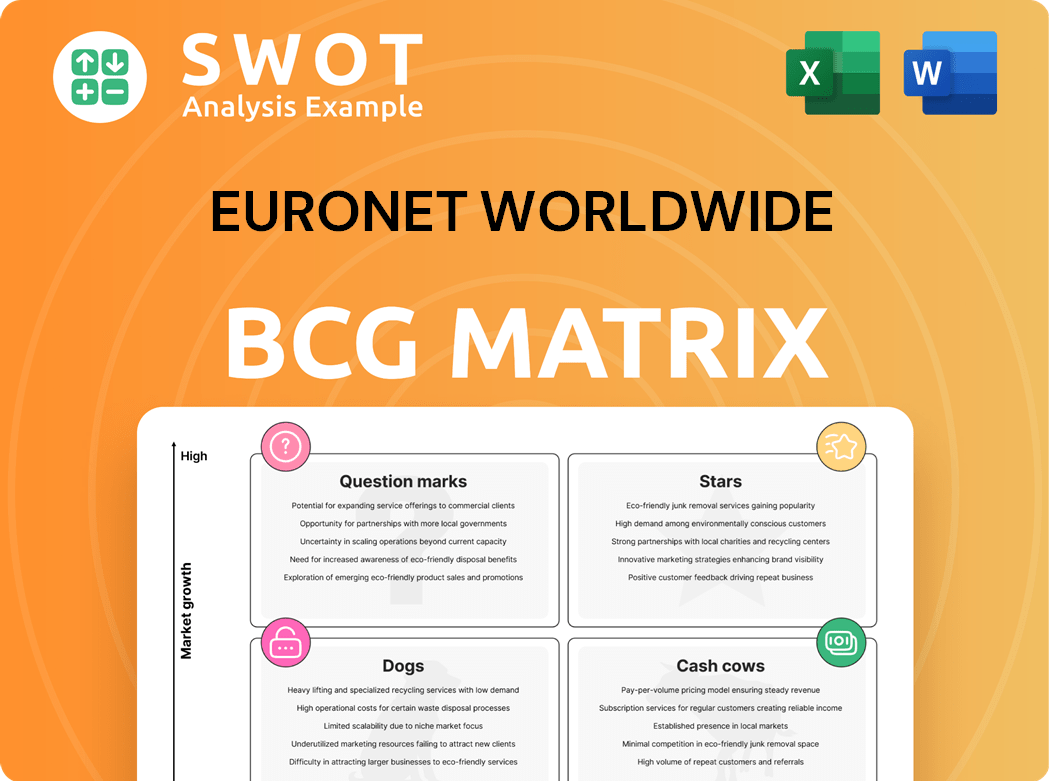

Euronet's BCG Matrix analysis for its product portfolio to guide investment, hold, or divest decisions.

Export-ready design for quick drag-and-drop into PowerPoint allows rapid updates for quarterly reports.

Delivered as Shown

Euronet Worldwide BCG Matrix

The Euronet Worldwide BCG Matrix preview mirrors the complete report you'll receive upon purchase. It is ready to assist with strategic planning, offering a deep dive into market positioning and investment strategies. No content changes occur; it's ready for immediate application.

BCG Matrix Template

Euronet Worldwide's financial services landscape is complex, ripe for strategic analysis. This preview offers a glimpse into its potential market positioning using the BCG Matrix framework. Understand where products are thriving (Stars), generating steady cash (Cash Cows), underperforming (Dogs), or require investment (Question Marks).

This initial look at the company's strategy only scratches the surface. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Euronet's digital money transfer services, like Ria and Xe, are experiencing robust growth. This is fueled by the rise of digital payments and market expansion. In Q4 2024, digital transactions surged by 33%, a substantial portion of overall volume. This segment is a star within Euronet's portfolio.

Euronet's EFT Processing, a Star in its BCG Matrix, thrives on rebounding international travel. This fuels ATM transactions and merchant services, with expansions boosting growth. In Q4 2024, this segment showed double-digit growth across all key areas. The EFT segment's success is also due to the growth in merchant acquiring and market expansion.

Euronet's Dandelion platform is a "Star" in the BCG Matrix, indicating high market share in a high-growth market. This global real-time payments platform allows banks and fintechs to bypass traditional systems, facilitating transactions across 195 countries and 117 currencies. Euronet sees a market opportunity nearly 20 times the size of the remittance market. In 2024, the platform's expansion continues, capitalizing on the increasing demand for efficient cross-border payment solutions.

Ren Payments Platform

Ren Payments Platform is a modern, end-to-end payment solution. It supports real-time payments and new methods like QR codes. This platform attracts partnerships and fosters innovation. Ren is designed for flexibility, supporting fintech growth. Euronet's 2024 revenue was over $3.2 billion.

- Real-time payment support.

- Partnerships with various financial entities.

- Scalable design for fintech growth.

- Contributes to Euronet's revenue.

Strategic ATM Expansion

Euronet Worldwide's strategic ATM expansion is a "Stars" initiative, fueling growth. The company's Independent ATM network (IAD) is growing globally, including in Belgium and Mexico. This expansion includes new ATM deployments and partnerships with financial institutions.

Euronet's IAD presence now covers 38 countries, showing strong growth potential. This expansion strategy is critical for revenue growth and market share. The IAD segment brought in $1.03 billion in revenue in 2023, a 14% increase year-over-year.

- Geographic Expansion: Increased presence in key markets like Mexico and Belgium.

- Revenue Growth: IAD segment revenue increased by 14% in 2023.

- Network Size: Operates in 38 countries across multiple continents.

- Strategic Partnerships: Formed alliances with financial institutions to boost ATM deployment.

Euronet Worldwide's "Stars" consistently demonstrate high growth and market share, signifying strong performance. The digital money transfer services and EFT processing experienced double-digit growth in Q4 2024. These segments, along with Dandelion, are crucial for Euronet's revenue.

| Segment | Q4 2024 Growth | Key Features |

|---|---|---|

| Digital Money Transfer | 33% transaction growth | Global reach, digital payments |

| EFT Processing | Double-digit growth | ATM transactions, merchant services |

| Dandelion Platform | Expanding | Real-time payments, global reach |

Cash Cows

Euronet's ATM network is a cash cow in Europe. They make steady money from transaction fees. In 2024, Euronet had 49,945 active ATMs. This was a 6% increase from 2023, showing growth. They also offer services like DCC, boosting revenue.

Euronet's epay, distributing prepaid mobile airtime and digital content, is a Cash Cow. It ensures stable revenue via POS terminals. Partnerships with retailers and operators are beneficial. In 2024, epay's revenue rose to $1,150.5 million, up 6%.

Euronet's card issuing services, including debit, credit, and prepaid card programs, are a steady revenue stream for financial institutions. In 2024, the card services segment brought in a significant portion of Euronet's revenue. Banks use these services to quickly enter the card market. Euronet’s speed-to-market card solutions help banks build their card issuing reputations and secure market share.

Merchant Acquiring Services

Euronet's merchant acquiring services are a "Cash Cow" in its BCG Matrix, offering comprehensive solutions for banks and merchants. These services streamline transaction acceptance, promoting business expansion with low initial costs. Euronet's focus on user experience enhancement optimizes transactions. For 2023, Euronet's Merchant Acquiring segment saw a revenue of $608.7 million, marking a 17% increase year-over-year.

- Revenue Growth: The Merchant Acquiring segment's revenue grew by 17% in 2023.

- Comprehensive Solutions: Offers complete solutions for banks, simplifying vendor management.

- Low Investment: Facilitates rapid expansion with minimal upfront investment.

- User Experience: Focuses on improving user experience.

Dynamic Currency Conversion (DCC)

Euronet's Dynamic Currency Conversion (DCC) is a cash cow, enabling international travelers to pay in their home currency. DCC generates consistent revenue through transactions at ATMs and POS terminals. Euronet's global presence and partnerships ensure widespread DCC availability. In 2024, Euronet processed over 2.1 billion transactions.

- DCC provides direct and recurring revenue.

- Offered at ATMs and POS terminals.

- Euronet has a global ATM network.

- 2.1 billion transactions were processed in 2024.

Euronet's ATM network, epay, card issuing, merchant acquiring, and DCC services are cash cows. They generate stable revenue streams. In 2024, epay's revenue was $1,150.5 million, up 6%. Merchant Acquiring grew 17% in 2023.

| Service | Revenue Driver | 2024 Data/Growth |

|---|---|---|

| ATM Network | Transaction Fees | 49,945 ATMs, 6% growth |

| epay | Digital Content | $1,150.5M, 6% growth |

| Card Services | Card Programs | Significant Revenue |

| Merchant Acq. | Transaction Processing | 17% YoY growth (2023) |

| DCC | Currency Conversion | 2.1B transactions |

Dogs

Some of Euronet's legacy prepaid services could be "dogs" in its BCG matrix. These services might face tough competition and changing customer habits. They may have slow growth and need costly fixes that don't boost profits much. Areas with less digital use and more cash could see slower prepaid service growth. Euronet's 2023 annual report showed these services were underperforming.

Underperforming regional payment networks within Euronet's portfolio likely face challenges like limited geographical reach and outdated tech. These networks, with low market share and growth, demand substantial investment. For example, in 2024, some regional networks showed revenue stagnation. Strategic divestiture might be considered.

Euronet's outdated tech infrastructure, classified as a "dog," hinders efficiency and boosts maintenance costs. For example, in 2024, legacy systems may increase operational expenses by 10-15%. The company is modernizing with solutions like the Ren Payments Platform. This shift aims to cut costs and boost performance. Modernization efforts can reduce infrastructure-related expenses by 20% within two years.

Low-Margin Traditional Remittance Services

Traditional remittance services, facing stiff competition from digital platforms, often find themselves in the "dogs" quadrant of the BCG matrix. These services, such as those offered by Euronet Worldwide, may struggle with low-profit margins. Significant investments are often needed to enhance their profitability and stay competitive.

- Digital remittance services are expected to grow at a CAGR of 15% by 2024.

- Euronet's Money Transfer segment saw a revenue increase of 16% in Q3 2023, but faces margin pressures.

- The shift towards digital transactions puts pressure on traditional, cash-based models.

- Western Union's transaction volume decreased by 3% in Q3 2023, highlighting this trend.

POS Terminals in Declining Markets

In Euronet's BCG Matrix, POS terminals in areas with dropping cash use and rising mobile payments could be categorized as dogs. These terminals often see low transaction volumes, impacting revenue. By December 31, 2024, Euronet's POS terminals declined by 5%, reaching approximately 777,000. This indicates a potential struggle in competitive markets.

- Decreased POS Terminals: A 5% drop to roughly 777,000 by the end of 2024.

- Market Shift: Declining cash usage and increased mobile payments.

- Revenue Impact: Low transaction volumes potentially leading to minimal revenue.

- Competitive Pressure: Challenges in markets prioritizing digital transactions.

Euronet's "dogs" include underperforming prepaid services, with revenue stagnation in certain areas. Outdated tech infrastructure is another challenge, potentially increasing operational costs by 10-15% in 2024. Traditional remittance services also struggle against digital competitors, facing low margins.

| Category | Financial Data (2024) | Market Trends |

|---|---|---|

| Prepaid Services | Potential for slow growth in regions with less digital adoption. | Competition from digital platforms; changing customer habits. |

| Tech Infrastructure | Operational expenses may rise by 10-15%. | Need for modernization to cut costs. |

| Remittance Services | Low-profit margins; pressure from digital services. | Digital remittance CAGR of 15% by 2024. |

Question Marks

Euronet's LATAM expansion, starting with Mexico, is a question mark in its BCG Matrix. Success hinges on navigating diverse regulations and technology deployment. Euronet's independent ATMs in Mexico mark its LATAM market entry. In 2024, Euronet's revenue was around $3.5 billion, reflecting its global reach. However, the LATAM contribution is still emerging.

Euronet's Dandelion, a B2B2X platform, is categorized as a question mark in the BCG matrix. It aims to tap into a market potentially bigger than remittances. Success depends on forging key banking alliances and boosting transaction volumes. Dandelion enables swift payment expansion, bypassing traditional networks. In 2024, Euronet's total revenue was around $3.5 billion, reflecting the importance of such platforms.

Euronet's digital payment tech, like mobile wallets, are question marks in its BCG matrix. These have high growth potential but low market share, needing investment. Euronet is positioned to partner with central banks and fintechs. In 2024, digital payments are expected to surge.

ATM Network Participation Program

Euronet's ATM Network Participation program is categorized as a question mark in the BCG Matrix, reflecting high market growth potential but low market share. This program allows financial institutions to expand their footprint without major capital outlays. Success hinges on attracting more institutions and boosting transaction volumes. In 2024, Euronet's ATM transaction volume reached over 1.4 billion globally.

- Offers Financial Institutions access to Euronet's ATM network.

- Provides expertise in ATM management and strategic location selection.

- Enables rapid market expansion without significant capital investment.

- Success is tied to attracting new financial institutions and boosting transaction volumes.

Cardless Payout Services

Euronet's cardless payout services fall into the "Question Mark" category of the BCG matrix, indicating high potential but uncertain returns. These services, which allow cardless cash withdrawals, need substantial investment for growth. Euronet leverages its REN solution to add digital payment capabilities to ATMs. Despite the potential, cardless payouts face challenges in consumer adoption and market competition.

- Cardless transactions are growing; in 2024, mobile payments increased by 25% globally.

- Euronet's revenue in 2023 was approximately $3.2 billion, with cardless services contributing a small, but growing, percentage.

- Investment in ATM upgrades and marketing is critical for cardless payout success.

- Competition comes from established banks and fintech companies offering similar services.

Cardless payout services at Euronet are a question mark, representing high potential but uncertain returns. These services, enabling cardless cash withdrawals, demand significant investment. In 2024, mobile payments increased by 25% globally, while Euronet's 2023 revenue was around $3.2 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Mobile Payment Growth | Global increase in mobile payments | 25% |

| Euronet Revenue (2023) | Approximate total revenue | $3.2B |

| Cardless Contribution | Percentage of revenue from cardless services | Small, growing |

BCG Matrix Data Sources

This BCG Matrix leverages company filings, financial reports, market analyses, and industry expert opinions for strategic accuracy.