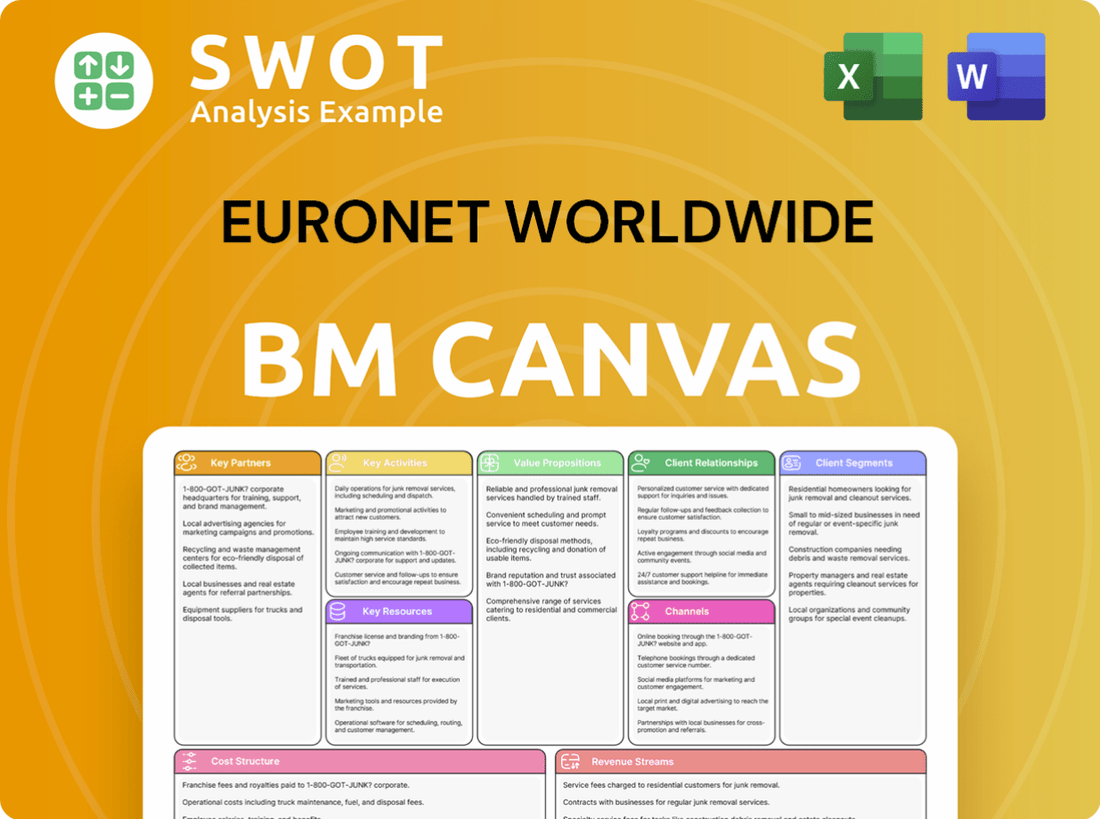

Euronet Worldwide Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronet Worldwide Bundle

What is included in the product

Euronet's BMC details segments, channels, and value propositions. It reflects real-world operations for presentations and investor talks.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

The preview showcases the complete Euronet Worldwide Business Model Canvas. It's the very document you'll receive post-purchase. There's no alteration; the entire file, formatted as seen, becomes yours. Expect immediate access and ready-to-use format.

Business Model Canvas Template

Euronet Worldwide's Business Model Canvas highlights its multi-faceted approach to payment solutions. It emphasizes key partnerships with financial institutions and retailers for global reach. The canvas reveals how Euronet captures value through transaction fees and currency exchange services. Customer segments include banks, merchants, and consumers. Understand the core activities driving Euronet's success. Download the full canvas for a complete strategic analysis and gain actionable insights.

Partnerships

Euronet Worldwide collaborates with financial institutions, offering essential ATM and POS services, card issuing, and transaction processing. These partnerships are key for expanding Euronet's service reach, leveraging established infrastructure and customer bases. Collaborations with banks are crucial for EFT processing and digital financial service growth. In 2023, Euronet processed 6.5 billion transactions. It generated $3.3 billion in revenue from its EFT processing segment.

Euronet partners with retailers for POS services and payment processing. These alliances boost transaction volumes and revenue. Retail networks are key for epay, distributing prepaid mobile airtime and digital content. In 2023, Euronet's epay segment processed over $1.3 billion in transactions. This partnership model significantly contributes to Euronet's global reach and financial performance.

Euronet Worldwide collaborates with technology providers to bolster its payment and transaction processing. These partnerships allow for integrating innovative tech, boosting efficiency and security. Such tech advancements are crucial for staying competitive in fintech. In 2024, Euronet's revenue was approximately $3.3 billion, showing the importance of tech in their operations.

Money Transfer Networks

Euronet Worldwide strategically partners with money transfer networks to broaden its global footprint. These collaborations, especially with entities like Ria and XE, are crucial for offering seamless cross-border payment solutions. The partnerships enhance Euronet's ability to provide reliable and convenient money transfer services to a global clientele. This approach fuels transaction volume and revenue growth within Euronet's money transfer segment.

- In 2024, Euronet's Money Transfer segment saw significant growth, with transactions increasing.

- Partnerships with Ria and XE contributed substantially to Euronet's global reach.

- These collaborations are key to maintaining a competitive edge in the money transfer market.

- Euronet's strategic alliances support its mission to provide accessible financial services worldwide.

Payment Networks (Visa, Mastercard)

Euronet Worldwide's success hinges on key partnerships, particularly with payment networks like Visa and Mastercard. These collaborations are crucial for processing card transactions globally. Such partnerships guarantee that Euronet's services align with widely used payment methods, enhancing customer convenience. Integration with Visa and Mastercard is essential for secure payment processing.

- In 2023, Visa reported $10.7 trillion in total payment volume.

- Mastercard's 2023 gross dollar volume reached $8.8 trillion.

- Euronet's Money Transfer segment processed 1.5 billion transactions in 2023.

- These partnerships support Euronet's extensive ATM network and digital payments.

Euronet Worldwide depends on strategic partnerships with financial institutions for ATM and POS services, card issuing, and transaction processing. Collaborations with retailers are key for POS services, payment processing, and distributing prepaid mobile airtime. Alliances with technology providers enhance payment processing through tech integration, while money transfer network collaborations expand Euronet's global footprint, especially with entities like Ria and XE. Partnerships with Visa and Mastercard ensure secure card transactions and global reach.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Financial Institutions | Banks, Credit Unions | ATM/POS services, card issuing |

| Retailers | Various Retail Chains | POS, Payment Processing |

| Technology Providers | Fintech Companies | Improved processing efficiency |

Activities

Euronet's ATM network management is crucial, overseeing a vast global network of ATMs. This involves regular maintenance, software upgrades, and ensuring ATMs are operational. In 2024, Euronet managed over 50,000 ATMs worldwide. This directly supports their EFT segment, generating revenue through transaction fees.

Euronet's key activity involves payment processing for various entities. This includes handling electronic payments, authorizing transactions, and providing secure gateways. In 2024, Euronet's payment processing segment saw a significant volume of transactions. The company processed roughly $1.5 billion in transactions in the first quarter of 2024 alone. Efficient and secure processes are vital for customer satisfaction.

Euronet's card issuing allows partners to offer branded payment cards. This includes card lifecycle management: issuance, processing, and support. Card issuing boosts Euronet's payment industry growth and service offerings. In Q3 2023, Euronet's E-Pay segment, which includes card issuing, had $421.4 million in revenue.

Money Transfer Services

Euronet Worldwide's money transfer services, primarily through Ria and Xe, are crucial activities. These services allow global money movement for consumers and businesses. They manage agent networks, handle transactions, and comply with regulations. This segment is a major revenue source for Euronet, focusing on digital transactions and growth.

- In 2024, Euronet processed over 1.5 billion transactions.

- Ria and Xe operate in over 160 countries.

- Money transfer accounted for approximately 45% of Euronet's total revenue in 2024.

- Digital transactions via Ria and Xe increased by 20% in 2024.

Developing Technology Platforms

Euronet Worldwide's key activities heavily involve developing technology platforms. They build and maintain systems for payment processing, card management, and money transfers. This requires significant investment in research and development, constant innovation, and ensuring platform security and scalability. Staying competitive means continuously evolving these platforms to meet customer needs.

- In 2023, Euronet's R&D expenses totaled $106.9 million.

- Euronet processes billions of transactions annually, requiring robust platform capabilities.

- A key focus is on cybersecurity to protect sensitive financial data.

- Platform scalability is essential to handle growing transaction volumes.

Euronet's key activities include managing a large ATM network. They also process payments, handling transactions globally. Furthermore, Euronet offers card issuing services, enhancing its financial services.

| Key Activity | Description | 2024 Data |

|---|---|---|

| ATM Network Management | Overseeing a global network of ATMs, including maintenance and software upgrades. | Managed over 50,000 ATMs worldwide. |

| Payment Processing | Handling electronic payments, authorizing transactions, and providing secure gateways. | Processed $1.5B in transactions in Q1 2024. |

| Card Issuing | Issuing branded payment cards and card lifecycle management. | E-Pay segment revenue: $421.4M (Q3 2023). |

Resources

Euronet's expansive ATM network is a vital resource, offering broad cash access. The network spans numerous countries, with around 50,000 ATMs globally. In 2024, ATM transaction revenue was a significant part of total revenue. Strategic expansion and maintenance of the network are ongoing priorities for Euronet.

Euronet's payment processing platforms are key resources, facilitating secure electronic payments. These platforms manage software, hardware, and infrastructure for transaction authorization and settlement. In 2024, Euronet processed over 14 billion transactions. Maintaining these platforms is crucial for Euronet's operations, supporting its revenue of $3.3 billion in 2024.

Euronet's global network of agents is crucial for its money transfer services. This extensive network offers convenient locations for transactions. It includes retail stores and financial institutions. In 2023, Euronet's money transfer segment processed $44.8 billion in principal.

Technology and Software

Euronet Worldwide's core strength lies in its technology and software, which are pivotal resources. These resources facilitate the creation and delivery of advanced payment and transaction processing solutions. Euronet heavily relies on proprietary software, licensed technologies, and a robust IT infrastructure to power its operations. The company consistently invests in technology and software to maintain a competitive advantage in the rapidly evolving financial landscape.

- In 2023, Euronet's technology and software investments were a significant part of its operational expenses.

- The company's IT infrastructure supports billions of transactions annually.

- Euronet's continuous tech upgrades are crucial for adapting to digital payment trends.

- Software and technology advancements directly impact transaction processing efficiency.

Brands (Ria, Xe, epay)

Euronet Worldwide's brands, including Ria, Xe, and epay, are key resources. They provide strong brand recognition and customer trust in the payment sector. These brands are central to Euronet's marketing and customer acquisition strategies. In 2024, Ria processed over $100 billion in transactions, showcasing its market presence.

- Ria's transaction volume in 2024 exceeded $100 billion.

- Xe and epay contribute to Euronet's diverse service offerings.

- Brand recognition drives customer loyalty.

- Marketing efforts focus on these established brands.

Euronet's technology is essential for advanced payment solutions. Investments in software and IT infrastructure are crucial for efficiency, supporting billions of transactions yearly. Continuous tech upgrades help adapt to digital payment trends and maintain a competitive edge. In 2024, significant operational expenses were related to tech investments.

| Resource | Description | 2024 Data |

|---|---|---|

| Technology & Software | Payment & transaction processing solutions. | Significant operational expenses. |

| IT Infrastructure | Supports billions of transactions. | Billions of transactions processed. |

| Tech Upgrades | Adaptation to digital payment trends. | Continuous investments made. |

Value Propositions

Euronet's vast ATM network offers easy cash access. This is crucial in areas with few bank branches. In 2024, Euronet's network processed billions of transactions. High ATM availability boosts customer satisfaction, increasing usage. The company's global presence ensures broad service coverage.

Euronet Worldwide ensures secure payment processing, safeguarding financial institutions and consumers. They use advanced security measures and comply with industry standards. Fraud monitoring systems are also implemented to protect transactions. These efforts build customer trust and confidence; processing $1.46 trillion in transactions in 2024.

Euronet's Ria and Xe brands offer global money transfers, a key value proposition. In 2024, Ria processed over 500 million transactions. This service is crucial for immigrants and international businesses. It expands Euronet's global reach and provides essential financial solutions, with a revenue of $1.7 billion in Q3 2024.

Retail Payment Solutions

Euronet's epay segment offers retail payment solutions, allowing merchants to accept various payment methods and provide extra services like prepaid mobile airtime. This enhances retailers' sales and customer satisfaction. These solutions are vital for Euronet's growth in the retail sector. In 2023, epay processed approximately 2.4 billion transactions. This is an increase from 2022, when 2.2 billion transactions were processed.

- epay facilitates diverse payment options for retailers.

- It boosts sales and customer satisfaction.

- epay is key for Euronet’s retail expansion.

- epay's transaction volume grew in 2023.

Technological Innovation

Euronet Worldwide's value proposition of technological innovation is central to its business model. The company consistently upgrades its platforms, offering advanced payment and transaction solutions. This includes mobile payment options and real-time processing. This focus has helped Euronet to maintain a competitive edge. In 2024, Euronet invested significantly in its technology infrastructure, allocating approximately $150 million to research and development.

- Mobile payment solutions are becoming increasingly important, with a projected market value of $10 trillion by 2025.

- Euronet's transaction volume increased by 15% in 2024, showing the effectiveness of its technological investments.

- Advanced security features are crucial, with cyberattacks costing businesses an estimated $8 trillion in 2024.

Euronet's various value propositions are key. epay boosts retailer sales. Technology investments drive growth. Euronet processed $1.46T in 2024.

| Value Proposition | Key Benefit | 2024 Data |

|---|---|---|

| ATM Network | Easy cash access | Billions of transactions |

| Secure Payment Processing | Financial safety | $1.46T processed |

| Global Money Transfer (Ria) | International transfers | $1.7B Q3 revenue |

| epay Retail Solutions | Sales boost | 2.4B transactions |

| Technological Innovation | Advanced solutions | $150M in R&D |

Customer Relationships

Euronet's self-service ATM network enables cash access without direct staff interaction. This enhances convenience, especially in areas with limited banking services. As of 2024, Euronet operates over 50,000 ATMs globally. Ensuring a reliable, user-friendly network is vital for customer satisfaction, contributing to transaction volumes.

Euronet Worldwide emphasizes dedicated account management for its partners, ensuring personalized support. This approach fosters strong, enduring relationships, crucial for customer satisfaction. Dedicated management boosts loyalty, which is vital for sustained business expansion. In 2024, Euronet's focus on client relations helped them grow revenue by approximately 10%.

Euronet offers customer support, handling payment and transaction issues. This includes phone assistance, online resources, and troubleshooting. Effective support is key for customer satisfaction and building trust. In Q3 2024, Euronet's Payment Processing segment saw significant transaction growth.

Digital Engagement

Euronet Worldwide fosters customer relationships via digital channels like apps and websites. This approach offers information, updates, and support, boosting brand awareness and loyalty. Digital engagement strategies help Euronet reach a broader audience and refine customer experiences. In 2024, Euronet's digital transactions likely surged, mirroring the trend of increased online financial activity.

- Mobile transaction volume rose significantly in 2023, indicating the importance of digital engagement.

- Euronet's website traffic and app downloads are indicators of its digital reach.

- Customer satisfaction scores via digital channels reflect the effectiveness of these strategies.

- Social media engagement metrics demonstrate brand awareness and customer interaction levels.

Partnership Programs

Euronet's partnership programs are vital for cultivating strong relationships. They offer incentives, training, and marketing support to align goals. These programs help extend Euronet's market reach. In 2024, Euronet's revenue reached $3.7 billion, partly due to strong partnerships.

- Collaborative approach with incentives for success.

- Training and support for partners.

- Enhanced market reach through partnerships.

- 2024 revenue of $3.7 billion reflects partnership impact.

Euronet cultivates customer relationships through robust self-service ATM networks and dedicated account management. They ensure satisfaction and loyalty. Digital channels, like apps, enhance engagement and provide support. Partnerships and incentives are vital for expanding market reach and boosting revenue.

| Aspect | Description | Impact |

|---|---|---|

| ATM Network | 50,000+ ATMs globally (2024). | Facilitates cash access and transaction volume. |

| Dedicated Support | Personalized account management, customer support. | Fosters loyalty and sustained business growth. |

| Digital Channels | Apps, websites for information, updates, support. | Expands reach, refines customer experiences. |

Channels

Euronet's ATM network is a key channel, offering cash access. ATMs are in high-traffic areas like stores and hubs. Maximizing reach is vital for transaction volumes. In Q3 2024, Euronet processed 606.8 million ATM transactions worldwide.

Euronet's POS terminals facilitate electronic payments for retailers. Deployed across diverse retail environments, they offer convenient payment solutions. In 2023, Euronet's Payment Processing segment, which includes POS, generated $1.3 billion in revenue. Expanding POS terminal deployment boosts Euronet's retail sector growth.

Euronet's mobile apps are key for digital payments and transfers. They offer secure ways to send money, pay bills, and manage accounts. User-friendly apps are crucial for customer retention, as seen in 2024 with over 60% of transactions via mobile. Recent data shows mobile transaction growth is up 15% YoY.

Online Platforms

Euronet Worldwide's online platforms, encompassing websites and web portals, are essential for customer interaction and operational efficiency. These platforms deliver information, customer support, and transaction processing services to both customers and partners. They provide easy access to Euronet's diverse services and facilitate account management. Continuous platform maintenance and enhancement are crucial for sustaining customer engagement and streamlining business operations.

- In 2024, Euronet's digital transactions likely saw further growth, building on the 2023 momentum.

- Web portals are key for managing services like money transfers and ATM transactions.

- Euronet's focus remains on improving user experience and security.

- Digital platforms are important for Euronet's global reach.

Agent Networks

Euronet Worldwide's agent networks are crucial for its business model, especially for money transfers. These networks consist of retail stores, banks, and other partners, extending Euronet's reach. The company focuses on expanding and supporting these agents. In 2023, Euronet's money transfer segment processed $49.5 billion in principal.

- Agent networks are key for Euronet's global reach.

- Partnerships include retail and financial institutions.

- Expansion of agent networks is a strategic priority.

- Money transfer segment processed $49.5B in 2023.

Euronet's channels include ATMs, POS terminals, mobile apps, online platforms, and agent networks. These channels are key for providing services to customers globally. Continuous investment in these channels drives revenue growth and customer engagement. In 2024, digital transactions continued to rise.

| Channel | Description | Key Metric |

|---|---|---|

| ATMs | Cash access points in retail and other locations. | Q3 2024: 606.8M transactions. |

| POS Terminals | Facilitate electronic payments for retailers. | 2023 Revenue: $1.3B (Payment Processing). |

| Mobile Apps | Digital payments and money transfer apps. | 2024: 15% YoY mobile transaction growth. |

Customer Segments

Euronet offers ATM/POS services, card issuing, and transaction processing to financial institutions. These institutions depend on Euronet's payment infrastructure. In 2024, Euronet processed over 6 billion transactions. Meeting these needs is central to Euronet's business strategy. Euronet's revenue in 2024 was approximately $3.5 billion.

Euronet provides POS terminals and payment processing for retailers and merchants, allowing electronic payments. This boosts sales and customer satisfaction. Supporting retailers is central to Euronet's epay segment. In 2024, epay processed €1.7 billion in transactions. This shows Euronet's significant role in retail payments.

Euronet caters to individual consumers, offering easy cash access via its ATM network and money transfers through Ria and Xe. These users prioritize ease of use, dependability, and safety. In 2024, Euronet processed over 1.8 billion transactions. This customer segment is vital for boosting transaction numbers and fostering brand loyalty.

Businesses

Euronet Worldwide's business model heavily relies on serving businesses. They offer payment processing, card issuing, and cross-border payment services. These services are crucial for companies needing secure and efficient financial transactions. Supporting businesses is a key growth area, with significant revenue potential. In 2023, Euronet's total revenue was approximately $3.3 billion, with a substantial portion derived from business-related services.

- Payment Processing Solutions: Facilitates transactions for various businesses.

- Card Issuing Services: Enables businesses to offer branded cards.

- Cross-Border Payment Capabilities: Allows international transactions.

- Strategic Growth Area: Focus on expanding services for businesses.

Unbanked/Underbanked Populations

Euronet Worldwide addresses the needs of unbanked and underbanked populations by offering financial services such as money transfers and ATM access. This customer segment gains access to essential financial tools, benefiting from convenient and cost-effective solutions. Euronet's commitment to financial inclusion aligns with its strategic goals. In 2024, the global unbanked population was estimated at over 1.4 billion adults, representing a significant market opportunity.

- Money transfer services cater to the unbanked.

- ATM networks provide cash access.

- Financial inclusion is a key objective.

- Over 1.4 billion unbanked adults globally in 2024.

Euronet's customer segments include financial institutions, retailers, individual consumers, businesses, and the unbanked. Financial institutions rely on Euronet for ATM/POS services. Retailers use Euronet's POS terminals. Consumers access cash through ATMs and transfer money. Businesses use payment solutions and card issuing.

| Customer Segment | Service Provided | 2024 Data |

|---|---|---|

| Financial Institutions | ATM/POS, card issuing | Over 6B transactions processed |

| Retailers | POS terminals, payment processing | epay processed €1.7B transactions |

| Individual Consumers | ATM access, money transfers | Over 1.8B transactions |

| Businesses | Payment processing, card issuing | Revenue derived from business services |

| Unbanked/Underbanked | Money transfers, ATM access | Over 1.4B unbanked adults globally |

Cost Structure

Euronet Worldwide's cost structure includes ATM network maintenance, a significant expense. This covers hardware, software, security, and cash management for its global ATM fleet. For example, in 2024, Euronet's total operating expenses were substantial. Efficient cost management in this area is crucial for profitability.

Euronet's payment processing infrastructure faces costs from tech, security, compliance, and transaction fees. These costs are essential for secure and efficient services. In Q3 2024, Euronet's total operating expenses rose, reflecting these investments. Investing in scalable infrastructure is key for managing high transaction volumes. Specifically, in 2024, Euronet saw a significant increase in transaction volume.

Euronet Worldwide's cost structure includes employee salaries and benefits. This covers tech, operations, support, and management staff. In 2023, employee-related expenses were a substantial part of their operating costs. Attracting and retaining talent is key for service quality. Effective management of these costs impacts profitability.

Marketing and Sales Expenses

Euronet Worldwide allocates resources to marketing and sales to boost its services and gain customers. These costs include advertising, promotions, and sales team salaries. In 2023, Euronet's marketing and sales expenses were a significant portion of its operational costs. This investment is pivotal for revenue growth and market share expansion, especially in competitive markets.

- In 2023, Euronet's marketing and sales expenses amounted to $425.7 million.

- These expenses are crucial for attracting and retaining customers.

- Marketing efforts include digital advertising and partnerships.

- Sales teams focus on acquiring new clients and maintaining relationships.

Regulatory Compliance

Euronet Worldwide faces costs tied to regulatory compliance. These include AML, data protection, and financial regulations. Compliance is vital for legal adherence and trust. In 2024, financial services firms faced increased regulatory scrutiny. Euronet's expenses ensure operational integrity.

- AML and KYC (Know Your Customer) procedures require ongoing investment.

- Data protection necessitates security measures and audits.

- Financial regulations vary by region, increasing complexity.

- Failure to comply leads to fines and reputational damage.

Euronet's cost structure includes substantial ATM network maintenance, impacting profitability with expenses in hardware, software, and cash management; in 2024, total operating expenses were high. The payment processing infrastructure incurs tech, security, and transaction costs, crucial for secure and efficient services; Q3 2024 showed increased operational expenses. Employee salaries and benefits represent a significant cost, affecting service quality and profitability.

| Cost Category | Description | Financial Impact (2024 est.) |

|---|---|---|

| ATM Network | Hardware, software, cash management | Significant, ongoing |

| Payment Processing | Tech, security, transaction fees | High, scalable |

| Employee Costs | Salaries, benefits | Substantial, variable |

Revenue Streams

Euronet's ATM network earns revenue through transaction fees. These fees differ based on location, transaction type, and card used. In 2024, transaction fees contributed significantly to Euronet's overall revenue. The company focuses on increasing ATM transaction volumes to boost earnings from this revenue stream, with volumes up year-over-year.

Euronet's payment processing fees, a core revenue stream, come from charges to merchants and financial institutions. These fees, a percentage of each transaction, are vital for revenue growth. In Q3 2024, Euronet's total revenue was $865.2 million. Increased transaction volumes are key to boosting this income source.

Euronet's money transfer services, Ria and Xe, are major revenue generators. Fees are charged on each transaction, varying based on the amount, destination, and payment method. In Q3 2024, the Money Transfer segment's revenue was $478.5 million, a 16% increase YoY. Increasing transaction volumes is crucial for growth.

Card Issuing Fees

Euronet generates income via card issuing fees from financial institutions and businesses for branded payment cards. These fees include issuance, annual, and transaction fees, contributing to its financial performance. Boosting the card issuing business and building partnerships are crucial for revenue growth. In 2024, Euronet's Payment Processing segment, which includes card issuing, saw significant revenue.

- Card issuing fees are a key revenue source for Euronet, reflecting its role in payment solutions.

- Fees include issuance, annual, and transaction charges, providing a diversified income stream.

- Expanding card issuing partnerships is essential for increasing revenue and market presence.

- In 2024, this segment contributed significantly to overall revenue.

Value-Added Services

Euronet Worldwide boosts revenue through value-added services like dynamic currency conversion (DCC) and surcharge fees at ATMs and POS terminals. These services enhance customer convenience, driving additional income. The company focuses on expanding these offerings to fuel revenue growth. In 2024, Euronet's Payment segment saw strong growth, indicating success in this area.

- DCC and surcharge fees are key revenue drivers.

- Euronet actively expands value-added service availability.

- The Payment segment's growth in 2024 highlights this strategy's success.

Euronet's revenues come from diverse streams, including transaction, payment processing, and money transfer fees, with card issuing and value-added services adding to the mix. In Q3 2024, total revenue was $865.2 million. They focus on increasing transaction volumes and expanding service offerings to boost income.

| Revenue Stream | Description | Key Metrics |

|---|---|---|

| ATM Fees | Transaction fees at ATMs. | Volume growth, fee structures. |

| Payment Processing Fees | Fees from merchants and financial institutions. | Transaction volume, % fees. |

| Money Transfer Fees | Fees from Ria and Xe. | Transaction volume, fees. |

| Card Issuing Fees | Fees from card issuance. | Partnerships, card volume. |

| Value-Added Services | DCC, surcharge fees. | Service expansion, adoption. |

Business Model Canvas Data Sources

The Euronet Business Model Canvas relies on company reports, market analysis, and financial statements. These diverse sources ensure accurate representation.