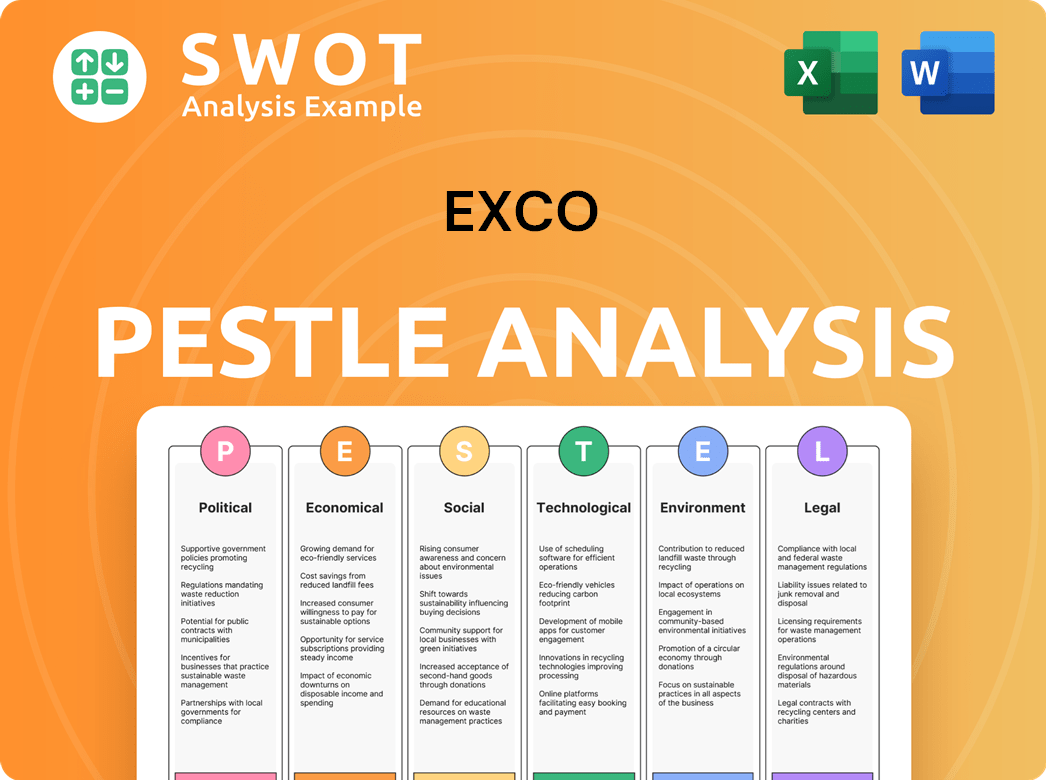

EXCO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXCO Bundle

What is included in the product

Assesses how external macro-factors impact the EXCO through PESTLE lenses: Political, Economic, etc.

Provides a concise version for easy integration into presentation slides and collaborative workshops.

Preview the Actual Deliverable

EXCO PESTLE Analysis

Explore the EXCO PESTLE Analysis now! The detailed preview accurately reflects the downloadable document.

See all the insights, categories, and formatted sections—what you see here is what you’ll receive.

Our promise: complete transparency. This is the finished document ready to use!

PESTLE Analysis Template

Analyze the forces impacting EXCO's performance with our PESTLE analysis. Understand the complex interplay of political, economic, social, technological, legal, and environmental factors. This analysis helps to inform strategic decisions, risk assessment, and opportunity identification. Our report delivers actionable insights, fully researched and professionally written. Get the full PESTLE Analysis for in-depth strategic advantages, right now.

Political factors

Government energy policy shifts, particularly after the US elections, could significantly affect oil and gas. Efforts to boost domestic production and ease permitting are likely. A focus on energy independence and lower costs might favor fossil fuels. In 2024, the U.S. produced 13.3 million barrels of crude oil per day. Executive actions and regulatory changes could be implemented, potentially impacting production levels and investment strategies.

Changes in the regulatory environment are anticipated for the oil and gas sector. This includes possible reversals of climate policies. There might be adjustments to rules about public land and offshore area development. A focus on natural gas for power generation could increase. For instance, in 2024, the U.S. government leased over 73 million acres for oil and gas.

Geopolitical tensions and shifts in trade policies significantly affect the energy market. For instance, the Russia-Ukraine conflict continues to disrupt energy supplies, influencing prices. In 2024, the imposition of tariffs could indirectly influence the demand for oil and gas. OPEC+ decisions and potential supply disruptions add further volatility. The International Energy Agency (IEA) forecasts global oil demand growth of 1.1 million barrels per day in 2024.

State-Level Regulatory Variations

EXCO's operations are significantly influenced by state-level regulations, particularly in regions like Texas, North Louisiana, and Appalachia. These areas experience varying environmental rules, permitting processes, and tax structures. Such differences directly affect operational costs and project viability. Adapting to these regional specifics is critical for EXCO's success.

- Texas, for example, has seen shifts in environmental regulations related to oil and gas, potentially impacting EXCO's operational expenses.

- Louisiana may introduce changes in severance taxes, which could influence EXCO's profitability.

- Appalachia faces distinct challenges with permitting and infrastructure development.

Political Support for Fossil Fuels

Political backing for fossil fuels in the US remains considerable, despite the renewable energy movement. This backing affects policies on drilling, infrastructure, and environmental rules. Recent data indicates that the Energy Information Administration (EIA) forecasts continued fossil fuel use. Specifically, the EIA predicts that in 2024, natural gas will supply about 40% of U.S. electricity generation.

- Political support often prioritizes domestic fossil fuel production, impacting investment decisions.

- The political landscape influences environmental regulations, affecting operational costs.

- Fossil fuel subsidies and tax breaks are common, shaping the financial viability of projects.

- Policy changes can quickly alter the market, affecting long-term planning.

Political factors heavily impact EXCO's operations. Government energy policies and upcoming US elections can significantly affect oil and gas. These include decisions on domestic production and permitting. State-level regulations in Texas, Louisiana, and Appalachia also greatly influence operational costs.

| Area | Regulation Impact | Financial Implication |

|---|---|---|

| US Energy Policy | Production incentives, permitting | Affects investments & project viability |

| Texas Regulations | Environmental rules | Impacts operational expenses |

| Louisiana Taxes | Severance tax changes | Influences profitability |

Economic factors

Global oil and gas prices are driven by supply, demand, geopolitics, and economic trends. In 2024, oil prices were stable, but 2025 forecasts indicate potential volatility. For instance, Brent crude traded around $80/barrel in early 2024. Price fluctuations impact profitability and investment decisions. Exploration and production companies closely monitor these shifts.

Capital investment in the upstream oil and gas sector anticipates modest growth, emphasizing high-return projects and technological advancements. Strategic capital allocation is a priority for companies following recent expenditure increases. North America remains a key investment region. Data from 2024 indicates a 3-5% rise in planned capital spending globally. This reflects a cautious approach to investment.

Broader macroeconomic conditions significantly affect energy demand. Potential interest rate cuts and global GDP growth influence consumption levels. For instance, the IMF projects global GDP growth of 3.2% in 2024, which could boost energy consumption. Economic weakness can decrease demand and growth stimulates it. These factors shape market sentiment and investment decisions.

Cost Management and Efficiency

In the energy sector, cost management and operational efficiency are paramount for maintaining profitability. Companies are increasingly focused on optimizing drilling and completion processes to reduce expenses, with a strong emphasis on capital discipline. This strategic approach is crucial for navigating market volatility and ensuring sustainable production levels. The industry's commitment to efficiency is reflected in ongoing technological advancements aimed at streamlining operations. For example, in 2024, many companies reported significant reductions in per-barrel operating costs through these initiatives.

- Operational costs have been reduced by 10-15% in some regions due to technological integration.

- Capital expenditures are being carefully managed, with many firms aiming for flat or slightly increased spending.

- Production efficiency gains are being achieved through advanced drilling techniques and data analytics.

Energy Transition Impact on Demand

The energy transition is reshaping global demand dynamics. Investment in renewables and the rise of electric vehicles are key drivers. This shift impacts demand projections for fossil fuels. The International Energy Agency (IEA) forecasts a decline in oil demand by 2030.

- Renewable energy capacity additions are expected to grow significantly through 2025.

- Electric vehicle sales continue to increase, impacting gasoline demand.

- Fossil fuels still play a role, but their share is diminishing.

- Policy and technology advancements accelerate the transition.

Economic factors significantly shape the oil and gas industry's outlook. Global GDP growth, estimated at 3.2% in 2024, boosts energy consumption, though slower growth can curb demand. Cost management and operational efficiency remain vital for maintaining profitability in a fluctuating market, with technological advancements reducing costs by up to 15% in certain areas. These elements influence market sentiment and investment decisions within the sector.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Oil Prices | Affects profitability and investment | Brent crude: ~$80/barrel (early 2024), Potential volatility expected. |

| Capital Investment | Influences production capacity | Upstream sector: 3-5% rise in capital spending planned (2024). |

| GDP Growth | Impacts energy demand | Global GDP: 3.2% (2024 projected) |

Sociological factors

Public perception significantly impacts fossil fuel industries. A 2024 Pew Research Center study revealed that 67% of US adults favor expanding wind and solar power. However, views on fossil fuels divide along political lines, affecting policy. Age also plays a role; younger generations show heightened climate change concerns. These factors influence investment, regulation, and market trends.

A skilled workforce is vital for oil and gas. Employment trends, wages, and demographics in key states matter. The sector sees recovery, but faces talent attraction and tech adaptation challenges. The oil and gas industry employed about 550,000 people in the U.S. in 2024. The average wage in the sector was around $100,000.

Oil and gas projects heavily influence local communities through infrastructure, environment, and economics. Positive community relations are key for operational success. Hydraulic fracturing's local impacts must be carefully managed. For example, in 2024, the US oil and gas industry invested billions in community programs.

Safety Culture and Incident Response

Safety culture is paramount in oil and gas, significantly impacting public trust. Accidents, like the 2023 offshore platform incidents, heighten scrutiny. Companies must prioritize safety protocols and swift, transparent incident responses. Reporting of major emission events, as per 2024 regulations, underscores the need for accountability.

- 2024: Increased regulatory focus on safety reporting.

- 2023: Offshore incidents led to higher public awareness.

- 2024/2025: Companies must invest in safety tech.

Energy Affordability and Consumer Impact

Energy costs significantly impact consumers, often sparking political debate. Policies focusing on affordable energy, potentially boosting local production, are popular. The industry's role in supplying reliable, affordable energy is crucial for society. In 2024, the U.S. average household spent approximately $2,300 on energy. High costs can lead to public dissatisfaction and policy changes.

- 2024 U.S. average household energy spending: ~$2,300

- Public support for policies reducing energy costs is typically high.

- Industry’s role is key in Societal consideration.

Societal shifts impact energy through perception, workforce dynamics, and community relations.

Public views favoring renewables like wind and solar grew in 2024, creating pressures on the fossil fuel industry.

The oil and gas sector's commitment to safety and affordable energy is pivotal.

| Aspect | Description | 2024/2025 Trends |

|---|---|---|

| Public Perception | Shifting views influence policy and investment. | Increased support for renewables, increased environmental regulations. |

| Workforce | Need for skilled labor & challenges in attracting talent | Continued hiring with an increase in salary |

| Community Impact | Projects affects infrastructure and economics. | Increase focus on corporate social responsibility. |

Technological factors

Technological advancements in hydraulic fracturing and horizontal drilling are vital. These technologies are key to efficiently extracting resources from shale plays. Enhanced techniques boost recovery rates and cut operational costs. The industry sees ongoing innovation in well completion and production optimization. For instance, in 2024, the average cost per foot for drilling decreased by 7% due to these advancements.

Digitalization and automation are transforming upstream operations. Adoption of AI, and data analytics is increasing efficiency. Investments in digital tools are rising, with a projected global digital oilfield market size of $35.2 billion by 2025. This shift enhances productivity and decision-making.

Technological advancements are enhancing emission monitoring, especially for methane. Stricter regulations and environmental focus drive this. For instance, satellite-based methane detection has improved significantly. The EPA's recent guidelines emphasize updated reporting methodologies, reflecting the importance of accurate data. According to a 2024 report, the global methane emissions detection market is expected to reach $1.5 billion by 2027.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

EXCO is investing in Carbon Capture, Utilization, and Storage (CCUS) technologies to curb emissions. The global CCUS market is projected to reach $6.07 billion by 2024, with significant growth expected. Supportive policies and enhanced oil recovery boost CCUS adoption. This tech is vital for decarbonizing the oil and gas sector.

- Global CCUS market size was valued at USD 5.8 billion in 2023.

- The CCUS market is expected to grow at a CAGR of 14.3% from 2024 to 2030.

- CO2 enhanced oil recovery is a key driver for CCUS projects.

Development of Lower-Emission Technologies

EXCO, like many in the energy sector, is actively pursuing lower-emission technologies beyond Carbon Capture, Utilization, and Storage (CCUS). This includes significant investments in renewable energy sources and the adoption of lower-carbon fuels. The diversification into new energy areas is a key trend, reflecting a strategic shift towards sustainability. For example, global investment in energy transition technologies reached $1.77 trillion in 2023.

- Renewable energy investments are projected to continue growing, with solar and wind leading the way.

- The adoption of alternative fuels, like hydrogen, is increasing within the industry.

- Companies are increasingly integrating ESG (Environmental, Social, and Governance) factors into their investment decisions.

Technological progress in EXCO’s operations boosts efficiency. Digital tools and AI investments are vital for enhancing productivity. The CCUS market, key for emission reduction, is set to grow significantly by 2030.

| Technology Area | 2024 Market Size (USD) | Projected Growth |

|---|---|---|

| Digital Oilfield | $35.2 billion | Ongoing |

| Methane Detection | $1.5 billion (by 2027) | Increasing |

| CCUS | $6.07 billion | 14.3% CAGR (2024-2030) |

Legal factors

The oil and gas sector faces stringent federal regulations, especially regarding environmental protection and emissions. The EPA's Greenhouse Gas Reporting Rule and New Source Performance Standards are tightening reporting and monitoring demands. Compliance is crucial, impacting operational costs significantly. For example, in 2024, ExxonMobil spent approximately $17 billion on environmental protection, reflecting the high costs of regulatory compliance.

State-level regulations and permitting are crucial for onshore operations. Texas, North Louisiana, and Appalachia have unique requirements for drilling and environmental permits. Streamlining these processes can accelerate development. For instance, Texas saw approximately 2,500 new oil and gas permits issued in 2024. Changes in state regulations directly affect project timelines and costs.

Compliance with environmental laws is crucial, especially concerning air and water quality, waste disposal, and land use. Increased scrutiny and potential enforcement actions related to environmental impact require robust compliance programs. For example, the EPA's recent actions include increased fines for non-compliance. Regulations controlling methane and volatile organic compound emissions are particularly relevant, with the EPA targeting a 60% reduction by 2035.

Bankruptcy and Restructuring Laws

Given EXCO's past bankruptcy and restructuring in 2019, legal factors related to bankruptcy remain pertinent. The legal framework governing debt restructuring, such as the conversion of debt to equity, significantly impacted EXCO's financial recovery. Understanding these laws is crucial, especially given the cyclical nature of the construction and infrastructure industries, where financial distress can be a recurring challenge. As of early 2024, the U.S. bankruptcy filings increased, with commercial Chapter 11 filings up 15% year-over-year, indicating the ongoing relevance of bankruptcy laws.

- EXCO's restructuring in 2019 involved debt-to-equity conversions.

- Commercial Chapter 11 filings rose 15% in early 2024.

- Bankruptcy laws are essential due to industry cycles.

Contractual Agreements and Property Rights

Oil and gas companies heavily rely on contractual agreements for land leases, joint ventures, and service contracts, which are critical for operations. Legal frameworks are essential, influencing access to resources and business partnerships. In 2024, contract disputes in the energy sector increased by 15% due to regulatory changes. The value of these disputes reached $2 billion, highlighting the significance of legal compliance.

- Contractual disputes rose by 15% in 2024.

- Dispute value reached $2 billion.

- Legal compliance is crucial for operations.

- Changes in law impact resource access.

EXCO faced significant legal challenges following its 2019 bankruptcy, which required debt restructuring through debt-to-equity conversions. Commercial Chapter 11 filings increased 15% in early 2024, stressing the importance of bankruptcy laws. Contractual disputes in the energy sector, impacting operations, rose by 15% in 2024, reaching a $2 billion value.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Bankruptcy Laws | Debt restructuring & recovery | Commercial Chapter 11 filings up 15% |

| Contractual Agreements | Resource access and partnerships | Disputes rose 15%, $2B in value |

| Compliance | Operational costs | ExxonMobil spent ~$17B on environ. protection |

Environmental factors

The oil and gas sector faces increasing pressure to reduce greenhouse gas emissions, with a strong emphasis on methane. Recent regulations mandate enhanced monitoring and reporting of methane leaks. The Waste Emissions Charge provides an economic incentive for companies to lower their emissions, potentially impacting operational costs. For instance, methane emissions from oil and gas operations in the US were estimated at 1.1 million metric tons in 2023.

Hydraulic fracturing demands substantial water, posing environmental challenges. Managing and disposing of produced water is crucial, influencing operational costs and regulatory compliance. Public concerns and regulations regarding water usage and potential contamination directly affect fracturing operations. Recent data shows a 20% increase in recycled water use in 2024 in the Permian Basin. This trend highlights evolving industry practices.

Onshore oil and gas activities significantly affect land use, potentially disrupting wildlife habitats. Regulations for land reclamation and ecosystem protection are crucial. In 2024, the U.S. spent $7.8 billion on environmental remediation. Minimizing the environmental footprint is increasingly expected by stakeholders. Approximately 20% of U.S. land is used for energy production.

Waste Management and Disposal

Waste management and disposal are crucial in the oil and gas sector, governed by environmental regulations. This includes drilling fluids and produced water. Non-compliance can lead to significant penalties. For instance, in 2024, fines for improper waste disposal in the US averaged $50,000 per violation.

- Proper waste management is essential for environmental compliance.

- Drilling fluids and produced water are key waste concerns.

- Fines for non-compliance are substantial, averaging around $50,000 per violation.

Energy Transition and Climate Change Concerns

The energy transition and climate change are reshaping the environmental factors for oil and gas. Pressure is mounting to lower carbon intensity, pushing investments in carbon capture and storage (CCUS) and alternatives. The International Energy Agency (IEA) projects that global investment in clean energy will reach $4.5 trillion annually by 2030. This shift influences operational practices and strategic planning.

- Global CCUS capacity is expected to increase to over 200 million tons of CO2 per year by 2025.

- Investments in renewable energy sources have increased by 15% in 2024, reaching $300 billion.

- The EU's Emissions Trading System (ETS) price for carbon is around €70-80 per ton.

Environmental regulations significantly impact the oil and gas sector, especially concerning emissions and waste management. Companies face escalating pressure to reduce their carbon footprint, driving investments in cleaner technologies and compliance measures. Recent trends show a substantial increase in environmental remediation spending, indicating a growing focus on sustainability and regulatory adherence. Non-compliance penalties can reach significant sums.

| Aspect | Details | 2024-2025 Data |

|---|---|---|

| Emissions | Focus on methane reduction and overall carbon intensity. | Methane emissions from oil and gas operations in the US: ~1.1 million metric tons (2023). Projected global CCUS capacity increase to >200 million tons of CO2/yr by 2025. |

| Water Usage | Concerns about water usage, treatment, & potential contamination from hydraulic fracturing operations. | ~20% increase in recycled water use in the Permian Basin (2024). |

| Waste Management | Regulations on waste disposal of drilling fluids, produced water, and remediation. | Average fines for improper waste disposal in the US: $50,000/violation (2024). U.S. spent on environmental remediation: $7.8B (2024). |

PESTLE Analysis Data Sources

This PESTLE Analysis synthesizes information from governmental databases, financial institutions, and industry reports.