Expeditors International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Expeditors International Bundle

What is included in the product

Tailored analysis for Expeditors' product portfolio, covering all BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing of strategic insights.

Delivered as Shown

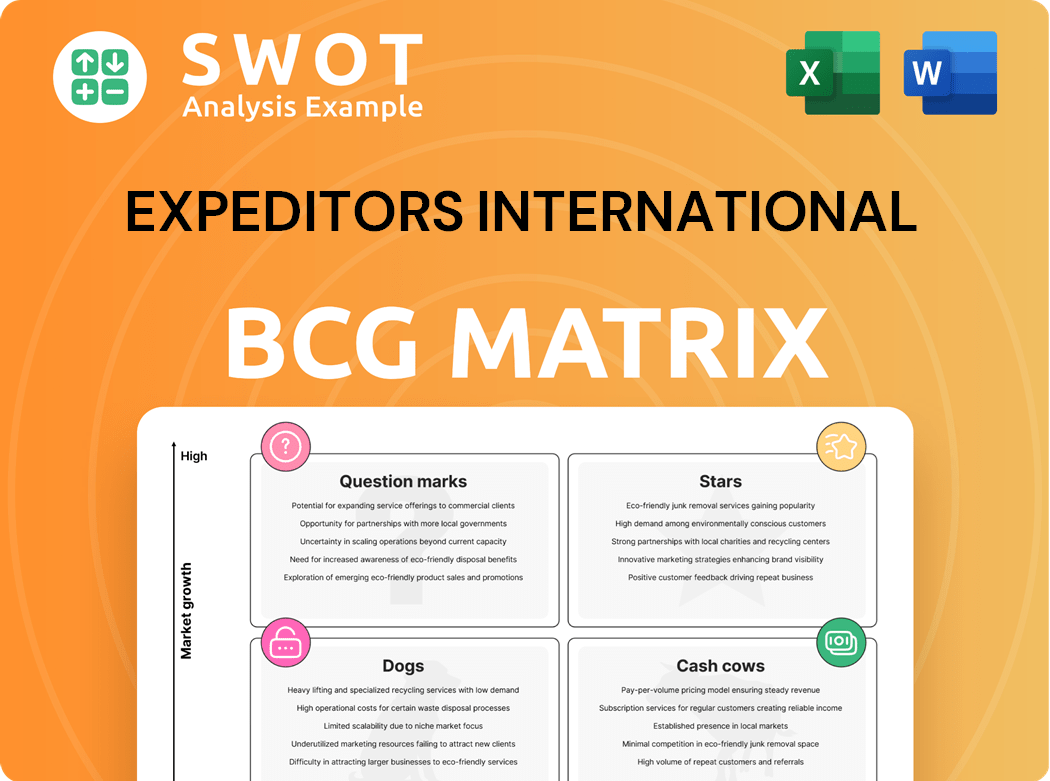

Expeditors International BCG Matrix

The BCG Matrix displayed here mirrors the document you'll download after purchase, ready for your immediate strategic review. This fully formatted report offers in-depth insights, with no hidden content or post-purchase adjustments needed. It's a professional-grade analysis tool, instantly usable across your organization. This is the complete, ready-to-implement Expeditors International BCG Matrix.

BCG Matrix Template

Expeditors International navigates the global logistics landscape. Their portfolio likely features diverse services and regional operations. A BCG Matrix helps assess each offering's potential. Identifying Stars, Cash Cows, Dogs, and Question Marks is crucial. This framework guides investment and resource allocation decisions. Gain a clear view of where Expeditors’ offerings stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Expeditors' Q4 2024 financial performance was impressive. They reported a 54% increase in EPS, reaching $1.68. Net earnings also rose significantly, by 49% to $236 million. This indicates strong profitability and effective adaptation to market changes.

Air freight services are a star for Expeditors International. In 2024, these services generated about 34% of total revenue, fueled by Asian demand and e-commerce. Q4 2024 saw an 11% rise in airfreight tonnage, highlighting their market strength. This positions air freight for growth, potentially becoming a cash cow.

Expeditors thrived in ocean freight, boosted by Red Sea issues and longer trips. Ocean container volume rose 14% in Q4 2024, boosting revenue. This shows their ability to handle disruptions. In Q4 2024, the ocean freight segment saw a revenue increase, reflecting their adaptability. Expeditors' performance reflects its strong operational capabilities amidst global challenges.

Technology Investments

Expeditors' strategic tech investments are a key element of its "Stars" quadrant in a BCG matrix, driving operational excellence. The company's tech spending in 2023 reached $275 million. This focus boosts service capabilities and customer satisfaction. Expeditors uses digital platforms for shipment tracking, offering real-time insights.

- 2023 Tech spending: $275 million.

- Advanced digital platforms for shipment tracking.

- Focus on cybersecurity and operational efficiency.

- Supports competitive advantage and growth.

Adaptability to Market Disruption

Expeditors International demonstrates strong adaptability. Its asset-light model and global network allow it to navigate market volatility. The company finds solutions for customers during disruptions. Expeditors capitalizes on expansion opportunities. This adaptability reinforces its market leadership.

- In 2024, Expeditors' revenue was $8.9 billion, reflecting its ability to adjust to changing market dynamics.

- The company's Q4 2024 earnings showed resilience, with a focus on managing supply chain disruptions.

- Expeditors' adaptability is evident in its ability to handle events like the Red Sea crisis, ensuring service continuity.

- Expeditors' stock has demonstrated stability, reflecting investor confidence in its ability to adapt.

Expeditors' air freight is a Star due to high revenue and market growth. Their 2024 air freight services generated 34% of total revenue. Tech investments, with $275 million in 2023, boost operational excellence. This positions Expeditors for continued success.

| Metric | Q4 2024 | 2024 Total |

|---|---|---|

| Airfreight Tonnage Increase | 11% | - |

| Revenue (Adaptability) | - | $8.9 Billion |

| Tech Spending (2023) | - | $275 Million |

Cash Cows

Customs brokerage is a crucial cash cow for Expeditors, generating substantial revenue. In 2023, the company's customs brokerage and related services brought in a significant portion of its total revenue. Increased trade volumes translate to more fees from customs declarations and ancillary services. Expeditors leverages its global network and expertise, which is reflected in its consistent financial performance.

North Asia, a cash cow for Expeditors, is the largest export region, significantly contributing to revenue. Airfreight tonnage surged in 2024, fueled by tech and manufacturing shifts. This segment provides a reliable revenue stream. Expeditors' 2024 financial reports show North Asia's consistent profitability, reflecting market stability.

Expeditors International boasts a robust balance sheet, free of bank debt. Their strong financial health is reflected in consistent free cash flow generation. This financial strength allows them to pursue growth and return capital to shareholders. Expeditors' substantial cash reserves provide a cushion against economic downturns. In 2024, they reported over $1.5 billion in cash and short-term investments.

Share Repurchases and Dividends

Expeditors International, classified as a "Cash Cow" in the BCG Matrix, consistently rewards shareholders. In 2024, they returned $1.1 billion to shareholders via buybacks and dividends. This marks the third straight year of over $1 billion returned. It reflects financial stability and a shareholder-focused strategy.

- 2024 Shareholder Returns: $1.1 billion

- Consecutive Years of $1B+ Returns: 3

- Capital Allocation Strategy: Share Repurchases and Dividends

Established Global Network

Expeditors International's global network is a cash cow, operating in over 100 countries. Their established infrastructure and culture offer a strong competitive edge. This extensive network ensures reliable services worldwide, supporting consistent revenue. In 2024, Expeditors' net revenue was approximately $2.6 billion, demonstrating its financial strength.

- Global Presence: Offices in over 100 countries.

- Competitive Advantage: Well-established network and culture.

- Service Reliability: Efficient services to customers globally.

- Financial Strength: Approximately $2.6B net revenue in 2024.

Expeditors' airfreight services are a cash cow, especially in key trade lanes. The company's airfreight segment brought in significant revenue, with notable growth in 2024. Increased demand and efficient operations ensure consistent profitability.

| Key Performance Indicator | 2023 | 2024 (Projected) |

|---|---|---|

| Airfreight Revenue (USD Billion) | $1.7 | $1.9 |

| Gross Revenue (USD Billion) | $10.7 | $11.0 |

| Net Revenue (USD Billion) | $2.5 | $2.6 |

Dogs

Expeditors' reliance on skilled personnel exposes it to operational risks. Their business model depends on employee expertise and relationships. High turnover or talent attraction issues could hurt operations and service quality. In 2024, Expeditors reported roughly $10.6 billion in revenue. Employee-related expenses are a significant cost factor.

Expeditors International operates in a fiercely competitive global logistics market. The industry sees many firms fighting for dominance. New tech competitors and large companies challenge Expeditors. This intense rivalry impacts pricing and margins, affecting profits. In 2024, the logistics sector's revenue was around $11.4 trillion globally.

Expeditors faces headwinds from escalating trade restrictions. In 2024, tariffs and geopolitical tensions significantly disrupted global trade flows. These disruptions could decrease trade volumes, impacting Expeditors' earnings. The company's adaptability is crucial given these challenges.

IT System Disruptions

Expeditors' "Dogs" quadrant includes IT system disruptions. They are susceptible to tech failures, as a major cyberattack or system failure could hinder service. A 2022 cyberattack underscored this vulnerability. In 2024, the company's IT spending was approximately $200 million, aiming for enhanced cybersecurity.

- Cybersecurity is a growing concern for logistics companies globally.

- Expeditors' IT infrastructure is critical for its operations.

- The 2022 cyberattack caused significant operational disruptions.

- Ongoing investment in IT aims to mitigate future risks.

Market Normalization

Expeditors International's "Dogs" segment in its BCG Matrix highlights the risk of market normalization. The recent surge in earnings, driven by global freight market disruptions, faces headwinds. As supply chains stabilize and demand potentially softens, the company's pricing power may diminish.

- Freight rates have decreased from their peak in 2022, impacting margins.

- Normalization could lead to lower revenue growth compared to the exceptional performance in 2021-2023.

- Expeditors' stock performance in 2024 might reflect these challenges.

Expeditors' "Dogs" in the BCG Matrix face challenges from IT disruptions and market normalization. Cybersecurity threats pose risks, impacting operations. The company is adjusting to declining freight rates and potential lower revenue growth. In 2024, IT spending was $200 million, addressing vulnerabilities.

| Aspect | Details |

|---|---|

| IT Disruptions | Cyberattacks, system failures |

| Market Normalization | Declining freight rates, lower revenue |

| 2024 IT Spending | Approx. $200M |

Question Marks

Expeditors International's expansion into emerging markets, such as South Asia and Latin America, is a key area for growth. These regions show rising demand for logistics services due to economic development. In 2024, Asia-Pacific's logistics market was valued at over $2.5 trillion, indicating substantial opportunity. Strategic investment in these areas could boost future revenue.

E-commerce's surge offers Expeditors a chance to create special logistics. They can use air/ocean freight skills for e-commerce. This could greatly boost sales. In 2024, e-commerce sales hit $1.1 trillion in the U.S., a 7.5% rise. Expeditors can tap this growth.

Expeditors should invest in AI-powered logistics and blockchain to boost efficiency. These technologies enhance tracking and optimize routes. This innovation differentiates Expeditors. In 2024, the global supply chain tech market is valued at over $20 billion.

Value-Added Warehousing and Distribution

Value-added warehousing and distribution represents a strategic area for Expeditors International, fitting the "Question Mark" quadrant of the BCG matrix. Expanding these services creates new revenue streams. This move strengthens customer relationships and boosts profitability. In 2024, the logistics sector saw significant growth, with warehousing and distribution contributing substantially.

- Order fulfillment services can boost revenue by 15-20%.

- Inventory management reduces storage costs by 10-12%.

- Final-mile delivery enhances customer satisfaction.

- The global warehousing market is valued at over $400 billion.

Strategic Acquisitions

Strategic acquisitions are a key aspect of Expeditors International's growth strategy, allowing it to broaden its service offerings and market footprint. These acquisitions often involve smaller logistics providers or companies with specialized services, enabling Expeditors to enhance its capabilities. This approach provides access to new technologies, a broader customer base, and expansion into new geographic regions, which are essential for sustained growth. Expeditors focuses on the careful selection and integration of these acquisitions to drive long-term value.

- Acquisitions enable Expeditors to expand into new markets and enhance its service offerings.

- The company strategically targets logistics providers with specialized services.

- Careful integration of acquired companies is crucial for realizing long-term growth.

- Access to new technologies and customer bases is a key benefit of acquisitions.

Value-added warehousing and distribution fit the "Question Mark" category, focusing on growth. Expeditors aims to expand services, creating new income. The logistics sector's growth in 2024, particularly in warehousing, supports this strategy.

| Service | Benefit | 2024 Data |

|---|---|---|

| Order Fulfillment | Revenue increase | 15-20% boost |

| Inventory Management | Cost reduction | 10-12% savings |

| Warehousing Market | Global value | Over $400B |

BCG Matrix Data Sources

The Expeditors BCG Matrix uses financial reports, market analyses, and industry publications. Data also includes competitor analysis and growth forecasts.