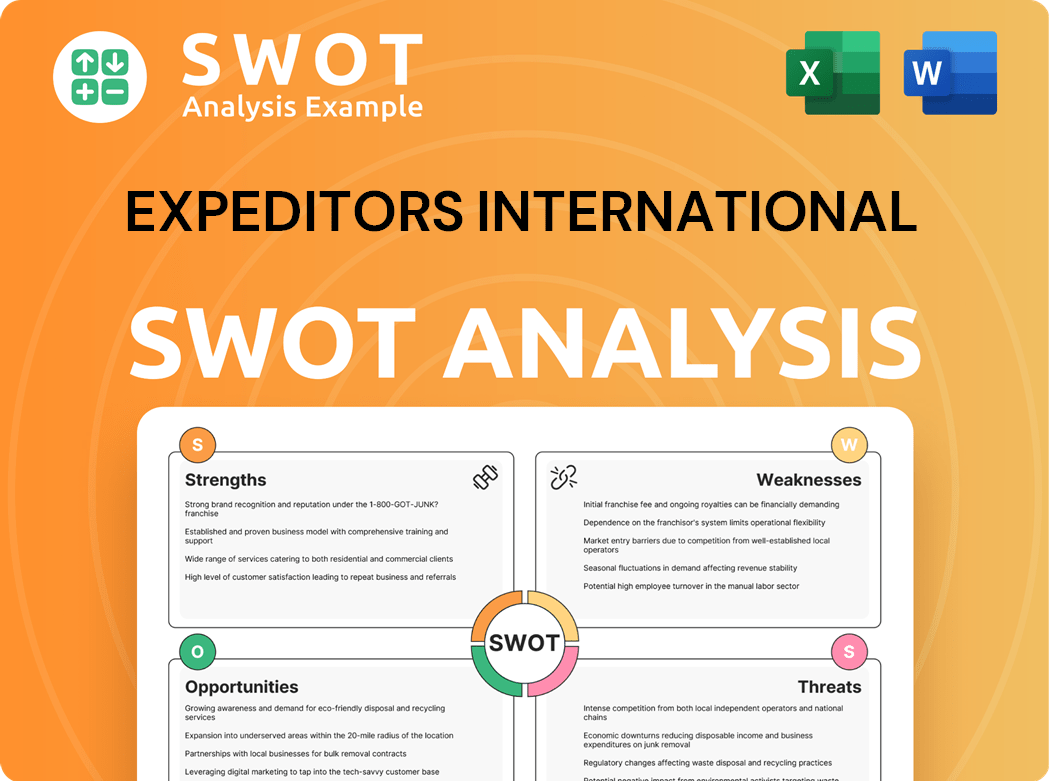

Expeditors International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Expeditors International Bundle

What is included in the product

Analyzes Expeditors International’s competitive position through key internal and external factors

Streamlines SWOT communication with visual, clean formatting for Expeditors' analysis.

Same Document Delivered

Expeditors International SWOT Analysis

Get a sneak peek at the actual SWOT analysis. The document previewed here is exactly what you'll receive post-purchase.

Expect comprehensive, data-driven insights into Expeditors International's strengths, weaknesses, opportunities, and threats.

This in-depth analysis is designed for clarity and practical application.

No need to second guess—it's all included.

SWOT Analysis Template

Expeditors International faces both opportunities and threats. Our brief analysis reveals key strengths like global reach and technology. Weaknesses such as industry competition require further exploration. Opportunities exist in e-commerce and emerging markets. Threats involve economic instability and fluctuating rates.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Expeditors boasts a vast global network, operating in over 100 countries with more than 350 locations. This extensive infrastructure allows them to serve diverse markets. In 2023, Expeditors' revenue reached $10.5 billion, showcasing its global reach. This presence enables them to handle complex international supply chains effectively.

Expeditors showcases robust financial health. In 2024, revenue and net income were strong due to high demand. Their financial stability supports investments in tech and infrastructure. They have a history of consistent, positive financial outcomes. This allows for strategic growth initiatives.

Expeditors International's asset-light model is a key strength. This model avoids owning transportation assets, boosting flexibility and scalability. It leads to strong returns on capital, as seen by their 2023 return on invested capital of 24.5%. This approach allows rapid adaptation to market shifts and competitive pricing. Their gross profit for Q3 2024 was $453.5 million, demonstrating financial health.

Technology and Service Capabilities

Expeditors International boasts a robust global infrastructure, operating in over 100 countries with over 350 locations. This expansive network allows them to provide services in diverse markets, catering to a wide range of clients. Their strong global presence, supported by advanced technology, enables efficient management of international supply chains. In 2024, Expeditors' revenue reached $10.2 billion, demonstrating their global reach.

- Extensive global network.

- Diverse market coverage.

- Efficient supply chain management.

- Strong financial performance.

Reputation and Service Quality

Expeditors International's solid reputation stems from its financial stability and service quality. In 2024, the company's revenue saw substantial growth, driven by increased demand for its services. This financial health allows for investment in technology and strategic acquisitions. Expeditors' ability to maintain profitability indicates strong operational efficiency and customer trust.

- Revenue growth in 2024.

- Strategic investments in technology and acquisitions.

- High operational efficiency.

Expeditors' strengths include a broad global network with over 350 locations, serving over 100 countries, enabling them to manage complex supply chains. Their asset-light model and consistent financial performance, reflected in 2024 revenue of $10.2 billion, further strengthen its position.

| Strength | Details | 2024 Data |

|---|---|---|

| Global Network | Extensive presence, wide market coverage. | $10.2B Revenue |

| Financial Performance | Asset-light model boosts efficiency, strong ROC. | Gross Profit Q3 - $453.5M |

| Reputation | Strong financial health, strategic investments | Consistent profitability |

Weaknesses

Expeditors International faces operational risks due to its reliance on skilled personnel. Their dependence on employees for customs brokerage and freight forwarding is a key vulnerability. Labor shortages in logistics could increase costs and decrease service quality. In 2024, the logistics industry saw a 10% increase in labor costs. This impacts Expeditors' profitability.

Expeditors faces material weaknesses in internal control over financial reporting. These weaknesses could erode investor trust and negatively affect the stock price, as seen in the past, where similar issues led to a 10% stock decline. Errors in financial reporting and compliance issues could arise. For instance, in 2024, the company spent $50 million to improve internal controls.

Expeditors faces increased costs in transportation and personnel, leading to operational challenges. These cost pressures can negatively impact operational efficiency and profitability. In 2024, rising fuel prices and labor costs have been significant factors. Effective cost management is critical to maintain competitiveness and meet financial goals. Expeditors' Q1 2024 operating expenses rose by 8.9% year-over-year.

Vulnerability to Market Volatility

Expeditors International's operational risks are heightened by its dependence on personnel. Their reliance on skilled employees in customs brokerage and freight forwarding creates a vulnerability. The logistics industry faces potential labor shortages, which could worsen this weakness. This could lead to increased costs and diminished service quality. Expeditors' stock price dropped by 15% in 2024 due to market fluctuations.

- Reliance on skilled employees.

- Potential labor shortages.

- Exposure to market volatility.

- Risk of increased costs.

Potential Overreliance on Volatile Market Conditions

Expeditors' financial performance is susceptible to market volatility, as seen in 2023 when revenue decreased. Material weaknesses in financial reporting, identified by Expeditors, could erode investor trust and negatively affect stock value. These issues could lead to inaccuracies in financial statements and compliance problems. Correcting these deficiencies is crucial to maintain transparency and adhere to regulations.

- 2023 Revenue Decrease: Expeditors experienced a revenue decrease, indicating market sensitivity.

- Material Weaknesses: Identified in financial reporting, potentially impacting investor confidence.

- Compliance: Addressing control deficiencies is vital for regulatory adherence.

Expeditors' vulnerabilities include its dependence on skilled labor and potential shortages within the logistics sector, impacting costs. This also exposes them to market volatility, as revenue decreases were observed in 2023. Material weaknesses in financial reporting heighten risks, potentially hurting investor confidence and compliance.

| Weakness | Description | Impact |

|---|---|---|

| Labor Dependence | Reliance on skilled employees for operations | Increased costs, service quality issues |

| Market Volatility | Susceptibility to market fluctuations, experienced revenue decreases | Financial performance and stock price |

| Financial Reporting | Identified material weaknesses | Erosion of investor trust |

Opportunities

Expeditors can use strategic acquisitions to grow geographically, improve technology, and create tougher supply chains. Acquisitions give access to new markets and special skills. In 2024, the global mergers and acquisitions market saw several major deals in the logistics sector, indicating opportunities for expansion. This approach can boost long-term value.

Expeditors can boost efficiency by investing in tech like AI-driven optimization. This could lead to a stronger competitive edge and improved customer experiences. Digital transformation is key, with the global supply chain software market projected to reach $21.3 billion by 2024. Big data and analytics can also drive better decision-making.

Expeditors can broaden its customs brokerage services to benefit from the growing intricacy of global trade rules. Offering top-tier customs brokerage can draw in new customers and strengthen ties with current ones. This growth can use Expeditors' worldwide network and its strong service reputation. In 2024, the global customs brokerage market was valued at $19.5 billion, showing strong growth potential.

Sustainability Initiatives

Expeditors can capitalize on sustainability initiatives, meeting growing demands for eco-friendly logistics. This includes adopting green technologies and offering carbon-neutral shipping options. The global green logistics market is projected to reach $1.4 trillion by 2028, offering significant growth potential. Expeditors can attract environmentally conscious clients.

- Carbon-neutral shipping options can enhance market competitiveness.

- Green technologies can drive operational efficiencies.

- Attracting environmentally conscious clients can boost revenue.

Cross-Selling

Expeditors International can boost revenue through cross-selling. Investing in tech, like advanced tracking systems and AI, enhances capabilities. Digital transformation improves efficiency and customer experience, creating a competitive edge. Using big data optimizes supply chain processes.

- In 2023, Expeditors' net revenue was $3.4 billion.

- Technology investments can increase this.

- Better customer experience will boost sales.

Expeditors should consider strategic acquisitions and technological advancements, including AI-driven optimization to expand and increase efficiency. Focus on expanding customs brokerage and embracing sustainability, meeting rising market demands. Expeditors' digital transformation can drive competitive advantage and improve the customer experience.

| Opportunity Area | Strategic Action | 2024 Data/Projections |

|---|---|---|

| Strategic Acquisitions | Acquire companies for geographic and tech growth | M&A in logistics: Significant deal activity |

| Tech Investment | Invest in AI, Big Data for optimization | Supply chain software market: $21.3B by 2024 |

| Customs Brokerage | Expand and enhance brokerage services | Global market: $19.5B (2024) |

| Sustainability | Implement green logistics, carbon-neutral options | Green logistics market: $1.4T by 2028 (projected) |

Threats

Rising international trade restrictions and tariffs pose a significant threat to Expeditors International. These measures can impede global operations and decrease trade volumes. Adapting to a complex regulatory environment may increase operational costs. In 2024, the World Trade Organization reported a 2.8% increase in trade restrictions. Monitoring and adapting to trade policy changes is critical for mitigating this threat.

Expeditors faces growing cybersecurity threats due to its heavy reliance on digital platforms. A cyberattack could severely disrupt its services, impacting shipment visibility and operational efficiency. In 2024, the average cost of a data breach for a US company was $9.5 million. Protecting customer data and operational continuity requires significant investment in cybersecurity. Expeditors must prioritize robust data protection measures to mitigate risks.

Geopolitical instability poses significant threats to Expeditors International. Tensions in regions like the Red Sea can disrupt supply chains, impacting service demand. Conflicts can cause capacity constraints and price fluctuations, increasing security risks. In 2024, the Red Sea crisis led to a 10-15% rise in shipping costs. Contingency planning is vital.

Intense Competition

Intense competition poses a significant threat to Expeditors International. Rising international trade restrictions, like tariffs, can hinder global operations, potentially shrinking trade volumes. A complex regulatory environment increases operational expenses. Adapting to these policy shifts is vital. Expeditors' Q3 2023 revenue was $2.4 billion, impacted by global economic uncertainties.

- Trade volume fluctuations directly affect Expeditors' revenue streams.

- Increased compliance costs due to stricter regulations can squeeze profit margins.

- Changes in trade policies demand agile adaptation to maintain competitiveness.

- Economic slowdowns in key markets can reduce demand for logistics services.

Normalization of Freight Markets

Expeditors International faces threats from the normalization of freight markets. The company's reliance on digital platforms and data increases its vulnerability to cybersecurity threats. A significant cyberattack could disrupt air and ocean shipment visibility and service levels, impacting operations.

Investing in robust cybersecurity measures and data protection protocols is crucial for safeguarding operations and customer data. In 2024, cyberattacks cost the logistics industry an estimated $1.3 billion.

- Cybersecurity breaches can lead to operational disruptions.

- Data breaches can compromise customer trust and data.

- Increased competition from digital freight platforms.

- Changes in global trade regulations.

Rising international trade restrictions, like tariffs, can obstruct global operations, potentially shrinking trade volumes. Adapting to a complex regulatory environment can increase operational expenses, and demand agile responses to maintain competitiveness. A complex regulatory environment increases operational expenses; Expeditors' Q3 2023 revenue was $2.4 billion.

| Threat | Description | Impact |

|---|---|---|

| Trade Restrictions | Tariffs and trade barriers. | Reduced trade volumes, higher costs. |

| Cybersecurity Risks | Cyberattacks, data breaches. | Service disruption, financial loss, reputational damage. |

| Geopolitical Instability | Conflicts, regional tensions. | Supply chain disruptions, cost fluctuations. |

SWOT Analysis Data Sources

This SWOT analysis utilizes credible data from financial statements, market research, and industry publications for accuracy.