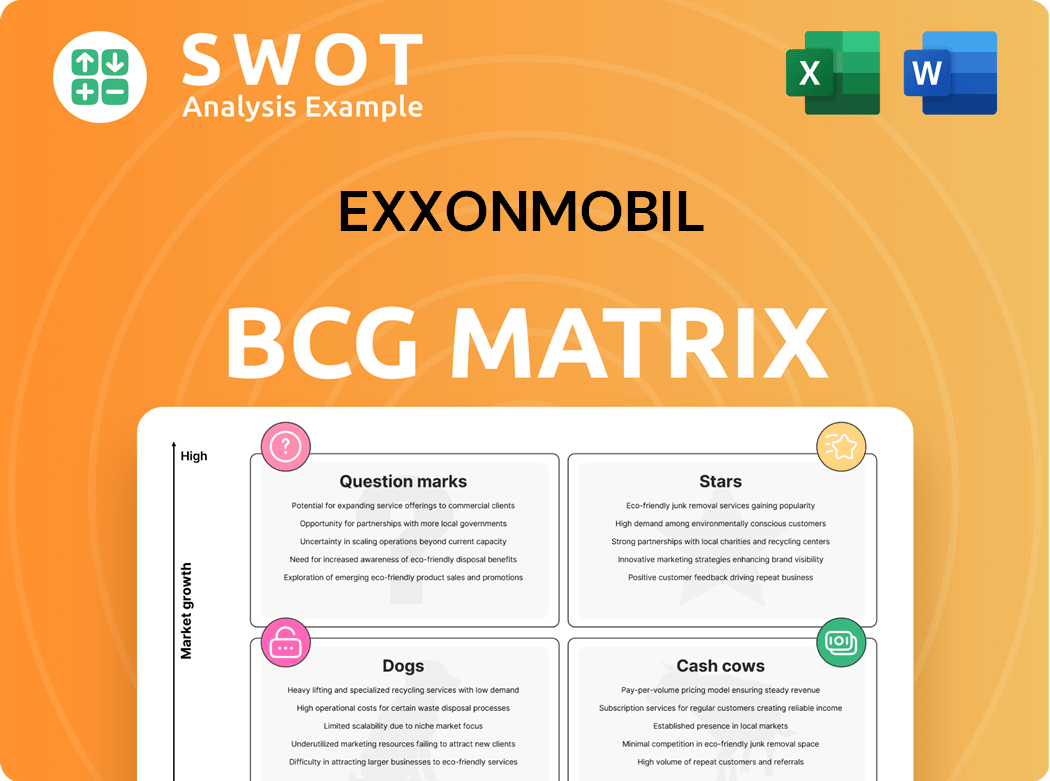

ExxonMobil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ExxonMobil Bundle

What is included in the product

Tailored analysis for ExxonMobil's portfolio, with strategic insights for each quadrant.

Printable summary optimized for A4 and mobile PDFs, enabling concise discussions about strategic investments.

Full Transparency, Always

ExxonMobil BCG Matrix

The preview displays the identical ExxonMobil BCG Matrix you'll receive after buying. This is the complete, fully editable report—no hidden content, just strategic insights, ready to implement. Designed for professional application, it’s yours instantly upon purchase.

BCG Matrix Template

ExxonMobil's BCG Matrix unveils its diverse portfolio, from high-growth ventures to established cash generators. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for strategic resource allocation. Explore which areas drive revenue and which may need restructuring. Analyze market share and growth potential across each quadrant. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ExxonMobil's Permian Basin operations are a major growth driver, significantly expanded by the late 2024 Pioneer Resources acquisition. This expansion, alongside tech investments like AI for remote monitoring, boosts efficiency. In Q3 2024, Permian production was about 650,000 barrels of oil equivalent per day.

ExxonMobil's Guyana projects are booming, with production reaching record levels and accounting for a major part of its upstream earnings. The Stabroek Block success, including the upcoming Whiptail Project, reinforces ExxonMobil's leadership in offshore oil. These projects are incredibly cost-effective, boosting overall profits. In Q1 2024, Guyana production hit 645,000 barrels per day.

ExxonMobil's Chemical Products division is a "Star" within its BCG matrix. This segment experienced robust earnings growth, fueled by better margins and high-value product sales. ExxonMobil benefits from lower ethane feed costs, especially in North America. Despite market challenges, the division shows resilience and growth potential; in 2024, it contributed significantly to overall revenue.

Low Carbon Solutions

ExxonMobil's Low Carbon Solutions, a "Star" in its BCG Matrix, focuses on growth areas like carbon capture and storage (CCS), hydrogen, and lithium. The company is investing heavily, dependent on favorable policies. Large-scale hydrogen and CCS projects aim to meet rising low-emission energy demands. ExxonMobil plans to spend about $17 billion on lower-emission projects through 2027.

- CCS projects could capture millions of metric tons of CO2 annually.

- Hydrogen production is targeted for industrial use and transportation.

- Lithium investments support electric vehicle battery materials.

- Investments are strategically aligned with global emission reduction goals.

LNG Projects

ExxonMobil's LNG projects, such as Golden Pass and Qatar North Field East, are set to boost its global LNG presence. The company aims to significantly increase its LNG sales by 2030, showing strong investment in the market. These projects provide access to various markets, supporting the company's financial growth.

- ExxonMobil's LNG production reached 8.2 million metric tons in Q4 2023.

- Golden Pass LNG terminal is expected to begin operations in 2024.

- Qatar North Field East expansion is a major project for ExxonMobil.

- ExxonMobil plans to increase LNG sales volume by 40% by 2030.

ExxonMobil's LNG projects are "Stars," focused on growth. Golden Pass is set to launch, increasing global presence. LNG sales are targeted to rise by 40% by 2030. They support financial expansion.

| Project | Status | Sales Growth Target |

|---|---|---|

| Golden Pass LNG | Operational in 2024 | |

| LNG Sales | Increasing | 40% by 2030 |

| Production (Q4 2023) | 8.2 MMT |

Cash Cows

ExxonMobil's mature upstream operations, excluding high-growth areas, are cash cows. These assets, with established infrastructure, generate steady cash. In 2024, these operations still contribute significantly to overall revenue, ensuring financial stability. The focus is on cost management to maximize returns from these stable assets.

ExxonMobil's Energy Products division, encompassing refining and marketing, is a significant cash cow. Although refining margins faced pressure in 2024, this segment continues to be a core component. The company generated $3.5 billion in cash flow from operations in Q4 2023. Infrastructure investments should boost future cash flow.

ExxonMobil's Specialty Products, like performance chemicals and lubricants, consistently generate earnings. These products boast strong margins and cost savings. In 2024, this segment contributed significantly to overall revenue. Innovation and partnerships are key to maintaining this cash flow.

Signature Polymers

ExxonMobil's Signature Polymers initiative consolidates its polyolefin offerings. This move aims to boost customer relationships and streamline product choices, which could drive sales. Focusing on recyclability and downgauging in packaging caters to eco-minded consumers. ExxonMobil's chemical segment saw revenues of $48.8 billion in 2023. Signature Polymers could contribute positively to this segment.

- Customer-centric approach to product selection.

- Emphasis on sustainability and eco-friendly solutions.

- Potential for increased revenue within the chemical segment.

- Alignment with market trends towards recyclability.

Global Operations Network

ExxonMobil's global operations network is a key cash cow. It generates diverse revenue streams across different markets. This global presence enables ExxonMobil to leverage regional supply and demand. The network provides a stable cash flow. In 2024, ExxonMobil's international upstream operations contributed significantly to its overall earnings.

- Diverse Revenue Streams: Operations worldwide.

- Regional Dynamics: Capitalizes on market specifics.

- Stable Cash Flow: Reliable financial base.

- 2024 Impact: Significant contribution to earnings.

ExxonMobil's core segments function as cash cows, generating consistent profits. Refining and specialty products boost revenue significantly, as seen in 2024 figures. Global operations, with diverse revenue streams, offer stable cash flow.

| Segment | 2024 Revenue | Cash Flow (Q4 2023) |

|---|---|---|

| Energy Products | Significant | $3.5B (Operations) |

| Specialty Products | Significant | N/A |

| Global Operations | Diverse | Stable |

Dogs

Mature or declining assets in ExxonMobil's portfolio, like certain older oil and gas fields, fit the "Dogs" category. These assets often face high operational expenses and increasingly stringent regulations, reducing their profitability. For example, in 2024, ExxonMobil faced rising costs in mature fields. Divestiture or decommissioning becomes crucial for enhancing overall portfolio performance, as seen with some asset sales in 2024.

Operations facing significant regulatory hurdles, like ExxonMobil's Santa Ynez Unit assets in California, which were divested in 2023 due to regulatory challenges, can be considered "Dogs". These assets use resources without generating enough returns. The Santa Ynez Unit had faced years of delays and increased costs due to regulatory issues. Strategic decisions are crucial to avoid further losses.

ExxonMobil's commodity chemicals, like basic plastics, face low margins due to intense competition. These products, such as ethylene and propylene, often see profit challenges. In 2024, these chemicals had margins around 5-10%, influenced by global supply and demand. Without strategic moves, they may remain a "dog".

Underperforming Renewable Energy Investments

Underperforming renewable energy investments in ExxonMobil's portfolio can become "dogs" if they fail to deliver expected returns or face significant technological hurdles. These ventures may struggle due to shifting market dynamics or competition. Continuous assessment is essential to align these investments with ExxonMobil's strategic objectives. Non-performing projects necessitate a re-evaluation of their viability.

- ExxonMobil's Q3 2023 earnings showed a decrease in the company's renewable energy investments.

- The company is reevaluating its investments in biofuels and carbon capture projects.

- Technological challenges and market volatility continue to impact renewable projects.

- Strategic adjustments are needed to optimize returns and align with company goals.

Regions with High Political Risk

Operations in regions with high political risk for ExxonMobil, such as those in Sub-Saharan Africa and parts of the Middle East, are classified as "dogs" in the BCG Matrix. These areas may experience instability, impacting profitability. For example, in 2024, political unrest in Nigeria affected oil production. Mitigation strategies and diversification are crucial to manage these risks.

- Political instability can lead to operational disruptions.

- Unfavorable policy changes can reduce profitability.

- Risk mitigation includes diversification and local partnerships.

- ExxonMobil's 2024 investments in Guyana show diversification efforts.

In ExxonMobil's BCG Matrix, "Dogs" are mature or declining assets with high costs and low returns. These include older oil fields and commodity chemicals facing intense competition. Renewable energy projects underperforming or facing headwinds also fall into this category. Operations in regions with high political risk can also be classified as Dogs.

| Category | Examples | Impact |

|---|---|---|

| Mature Oil Fields | Older assets | High costs, low profits |

| Commodity Chemicals | Ethylene, propylene | Low margins (5-10% in 2024) |

| Renewable Energy | Biofuels, carbon capture | Underperformance & technological challenges |

Question Marks

ExxonMobil's lithium production initiative fits the 'Question Mark' quadrant of the BCG Matrix. The company is venturing into a new market with a potentially high growth rate but faces uncertainty. Success hinges on technological breakthroughs and robust market demand. In 2024, the lithium market saw fluctuating prices, impacting investment strategies.

Carbon Capture and Storage (CCS) projects are currently Question Marks for ExxonMobil. These projects are crucial to the Low Carbon Solutions segment, but their economic feasibility is still under development. The scalability and profitability of CCS remain uncertain, requiring successful demonstrations. For example, ExxonMobil's CCS project at LaBarge, Wyoming, has captured over 7 million metric tons of CO2 annually since 2010.

Similar to CCS, ExxonMobil's hydrogen production projects are in the early stages, requiring significant investment and facing market uncertainties. The demand for hydrogen as a clean energy source is growing, but the infrastructure is not yet fully developed. Strategic partnerships and technological advancements are crucial for these projects to become profitable. ExxonMobil is investing in hydrogen projects with a target to reduce emissions.

Advanced Recycling Technologies

ExxonMobil's ventures into advanced recycling technologies represent a "Question Mark" in its BCG matrix. These technologies aim to convert plastic waste into valuable products, offering a path to manage waste and generate new income. Yet, the financial feasibility and the ability to expand these technologies are still unclear. The company has allocated significant resources, with a 2024 budget of $100 million, but results are pending. Further innovation and development are crucial for success.

- Investment: $100 million in 2024.

- Goal: Transform plastic waste.

- Challenge: Scalability and profitability.

- Status: Early stages of development.

New Biofuel Initiatives

New biofuel initiatives represent **question marks** for ExxonMobil, reflecting high uncertainty and low market share. These projects aim to produce sustainable fuels, like those from algae and other renewable feedstocks. Success hinges on technological advancements, feedstock availability, and supportive regulations. Strategic partnerships and significant investments are critical for growth in this area.

- ExxonMobil is investing in biofuels to diversify its energy portfolio.

- The biofuel market is still developing, with potential for significant growth.

- Technological challenges and regulatory hurdles remain.

- Partnerships are key to scaling up biofuel production.

ExxonMobil's biofuel initiatives are classified as question marks. These ventures target the development of sustainable fuels, such as those derived from algae. The success of these initiatives depends on technological breakthroughs and supportive regulations.

| Aspect | Details |

|---|---|

| Market Share | Low, as the biofuel market is still developing. |

| Investment | Significant investments are ongoing. |

| Challenges | Technological and regulatory hurdles remain. |

| Partnerships | Strategic alliances are crucial for scaling. |

BCG Matrix Data Sources

ExxonMobil's BCG Matrix uses company financials, market reports, and industry analysis. This ensures data-backed assessments.