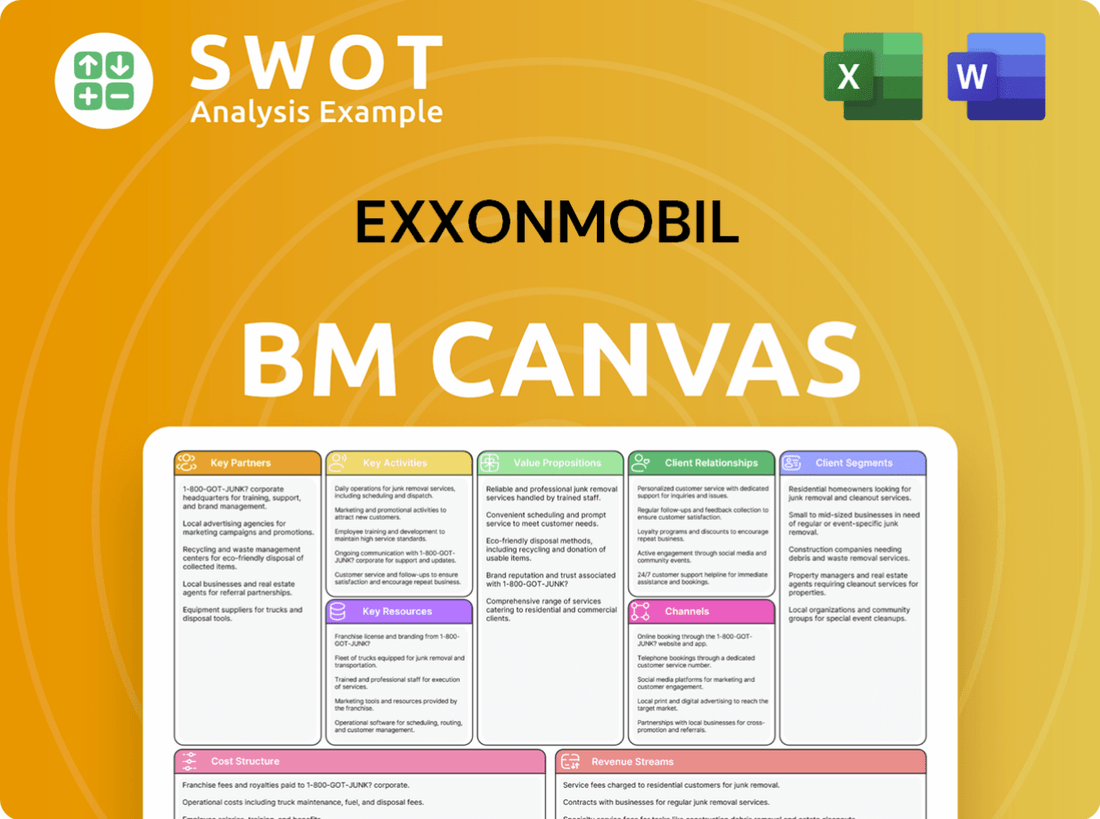

ExxonMobil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ExxonMobil Bundle

What is included in the product

A comprehensive model reflecting ExxonMobil's operations, covering customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Full Document Unlocks After Purchase

Business Model Canvas

This preview shows the actual ExxonMobil Business Model Canvas document. It's not a sample, but the complete file you'll get. Purchase grants immediate access to the same ready-to-use, editable document.

Business Model Canvas Template

Explore the strategic framework that powers ExxonMobil's global dominance. This condensed Business Model Canvas reveals key value propositions, customer segments, and revenue streams. Analyze core activities like exploration and refining, plus vital partnerships for supply chain efficiency. Understand cost structures and how ExxonMobil maintains profitability in a fluctuating market. Download the full Business Model Canvas for in-depth insights and strategic advantages.

Partnerships

ExxonMobil collaborates with tech firms to boost efficiency. These partnerships drive innovation, like AI for drilling. This helps them adopt cutting-edge tech. In 2024, ExxonMobil invested \$200 million in tech partnerships, improving operational costs by 5%.

Joint ventures are vital for ExxonMobil, enabling risk and capital sharing in massive projects. These partnerships open doors to new markets and resources. Collaborating with energy firms uses combined expertise and infrastructure. For example, in 2024, ExxonMobil partnered with QatarEnergy on the Golden Pass LNG project.

Engaging with government entities ensures compliance and secures operational permits. Maintaining strong relationships with regulatory bodies is vital for project approvals. Working closely with governments facilitates long-term project stability. ExxonMobil's 2023 revenue reached $354.6 billion, highlighting the importance of these relationships. Securing permits is essential for production.

Suppliers and Service Providers

ExxonMobil relies on robust relationships with suppliers and service providers to ensure smooth operations. These partnerships are crucial for securing essential materials and skilled labor needed for production. Strategic alliances help optimize supply chain efficiency, reducing costs and improving responsiveness. In 2024, ExxonMobil spent approximately $180 billion on goods and services, highlighting the importance of these partnerships.

- Access to critical resources and expertise.

- Supply chain optimization.

- Cost reduction and efficiency gains.

- Enhanced operational resilience.

Research Institutions

ExxonMobil's strategic alliances with research institutions drive technological advancements. These partnerships are crucial for innovation, particularly in renewable energy and carbon capture. Such collaborations amplify ExxonMobil's capacity to address climate change challenges. Investing in research ensures its long-term viability and market leadership.

- In 2024, ExxonMobil invested approximately $2.5 billion in research and development, with a significant portion allocated to low-carbon solutions.

- Collaborations include partnerships with universities like Stanford and MIT, focusing on advanced biofuels and carbon capture technologies.

- These efforts support ExxonMobil's goal to reduce greenhouse gas emissions from its operations.

- The company aims to achieve net-zero emissions from its operated assets by 2050.

ExxonMobil strategically partners to enhance its operations and drive innovation. These collaborations include tech firms for efficiency and joint ventures to share risks. Moreover, supplier relationships optimize the supply chain. The company's 2024 spending on goods and services was around $180 billion.

| Partnership Type | Purpose | Impact |

|---|---|---|

| Tech Firms | Improve Efficiency | 5% operational cost reduction |

| Joint Ventures | Share Risks | Expand markets & resources |

| Suppliers | Ensure Operations | $180B spent in 2024 |

Activities

Exploring and producing crude oil and natural gas are central to ExxonMobil's business. These activities require substantial capital investments. In 2024, ExxonMobil's capital and exploration expenditures were approximately $22.7 billion. Efficient resource management ensures sustainable long-term production.

Refining and processing are pivotal for ExxonMobil, converting crude oil into essential products. Advanced tech boosts product quality and cuts environmental effects. Optimized refining processes drive profitability and market edge. In 2024, ExxonMobil's refining throughput averaged 3.8 million barrels per day. This activity remains central to its business.

ExxonMobil's chemical manufacturing produces chemicals and polymers, diversifying revenue. This involves specialized facilities and chemical engineering expertise. Focusing on high-value chemical products boosts earnings. In 2024, ExxonMobil's chemical segment saw revenues of $18.5 billion. This segment's strategic importance is growing.

Research and Development

ExxonMobil's Research and Development (R&D) is a critical activity, driving innovation and technological advancement. Investments in R&D support the development of cleaner energy solutions and operational efficiencies. This focus ensures the company's competitiveness in a dynamic market. In 2024, ExxonMobil allocated billions to R&D, underscoring its commitment to future growth.

- R&D spending in 2024 was approximately $2.5 billion.

- Focus areas include carbon capture and biofuels.

- These efforts aim to reduce emissions and improve sustainability.

- Innovation helps maintain a competitive edge.

Distribution and Marketing

ExxonMobil's distribution and marketing efforts are crucial for converting its products into revenue. A well-established distribution network is vital for delivering products like gasoline and chemicals to consumers and businesses efficiently. Effective marketing campaigns are necessary to build brand recognition and maintain customer loyalty in a competitive market. These activities directly influence sales volume and market share, impacting overall profitability.

- In 2023, ExxonMobil's marketing and distribution expenses were significant, reflecting the scale of its operations.

- The company's retail presence, including branded gas stations, is a key component of its distribution strategy.

- ExxonMobil's marketing efforts focus on highlighting product quality and reliability.

- Investments in digital marketing and customer relationship management are increasing.

ExxonMobil's key activities encompass exploration, production, refining, and chemical manufacturing. Research and development drives innovation in cleaner energy. Distribution and marketing ensure products reach consumers effectively. These activities generated substantial revenue and profits. In 2024, the company's net income was $36.6 billion.

| Activity | Description | 2024 Data |

|---|---|---|

| Exploration & Production | Finding & extracting oil/gas. | CapEx: ~$22.7B |

| Refining & Processing | Converting crude oil. | Throughput: 3.8M bpd |

| Chemical Manufacturing | Producing chemicals/polymers. | Revenues: $18.5B |

Resources

ExxonMobil's significant oil and gas reserves are a cornerstone of its operations. These reserves are essential for producing fuels and petrochemicals. In 2024, ExxonMobil's proved reserves stood at approximately 17.7 billion oil-equivalent barrels. Managing these reserves strategically secures long-term supply.

ExxonMobil's refining and chemical plants are crucial for converting raw materials. These plants, requiring constant investment, process oil and gas. For example, in 2024, ExxonMobil's capital and exploration expenditures were approximately $23.9 billion. Effective operations boost production and profitability; in Q1 2024, the company reported $8.2 billion in earnings.

ExxonMobil's proprietary technology and intellectual property are key resources, offering a significant competitive edge. This includes advanced drilling techniques, refining processes, and chemical formulations, all of which are crucial. These assets facilitate innovation and operational enhancements, leading to cost efficiencies and higher productivity. In 2024, ExxonMobil's R&D spending was approximately $2.5 billion, underscoring its commitment to technological advancement. Protecting and expanding these technologies is essential for ExxonMobil's sustained success in the long run.

Distribution Network

ExxonMobil's distribution network is crucial for delivering its products globally. This network includes pipelines, tankers, and storage facilities, ensuring widespread product availability. Efficient logistics are key to maintaining market share and profitability. ExxonMobil's distribution network is a significant competitive advantage, enabling it to reach diverse markets.

- ExxonMobil's global refining throughput in 2024 was approximately 4.0 million barrels per day.

- The company operates a vast network of pipelines, with over 20,000 miles in the United States alone.

- ExxonMobil's fleet includes numerous tankers, facilitating the transport of crude oil and refined products worldwide.

- Strategic storage facilities are located in key regions to optimize supply chain efficiency.

Skilled Workforce

ExxonMobil's skilled workforce is a critical asset. It's vital for managing intricate operations and fostering innovation. This includes experts like engineers and technicians. Continuous training boosts both output and proficiency across the board. In 2024, ExxonMobil invested over $500 million in employee development programs.

- Essential for facility operations and innovation.

- Includes engineers, scientists, and technicians.

- Training and development improve expertise.

- 2024 investment: Over $500 million.

ExxonMobil leverages significant oil and gas reserves, managing approximately 17.7 billion oil-equivalent barrels in 2024. Its refining and chemical plants processed 4.0 million barrels per day. They ensure cost efficiency and market reach through advanced tech and distribution networks.

| Resource | Description | 2024 Data |

|---|---|---|

| Oil & Gas Reserves | Essential for fuel and petrochemical production | 17.7B oil-equivalent barrels |

| Refining & Chemical Plants | Convert raw materials to generate revenue | $23.9B capital expenditure |

| Technology & IP | Advanced drilling, refining, and formulations | $2.5B R&D spending |

Value Propositions

ExxonMobil's value proposition centers on a reliable energy supply, crucial for global demand. This dependability supports economic activities and societal needs. In 2024, the company produced approximately 3.8 million oil-equivalent barrels daily. Ensuring stable energy access remains a core value proposition, especially in volatile markets.

ExxonMobil's value proposition centers on advanced technology and innovation. The company utilizes cutting-edge tech for energy solutions. This boosts efficiency, cuts environmental impact, and improves product quality. In 2024, ExxonMobil invested approximately $24 billion in capital and exploration expenditures, emphasizing its commitment to technological advancements. These innovations create customer value and provide a competitive edge.

ExxonMobil provides top-tier fuels, lubricants, and chemicals. These offerings adhere to strict industry benchmarks, fulfilling customer needs. Reliable product quality fosters trust and encourages repeat business. In 2023, ExxonMobil's downstream operations, which include refining and marketing, generated $16.5 billion in earnings, demonstrating the value of its product quality. This focus contributes to sustained profitability.

Global Reach and Scale

ExxonMobil's global reach and operational scale are key to its value proposition. The company's vast presence ensures its products are available worldwide, serving diverse customer needs. This broad reach provides stability and diversification, crucial in the volatile energy market. In 2024, ExxonMobil operates in numerous countries, with production and refining assets globally. This widespread footprint allows for optimized resource allocation and risk management.

- Extensive global presence.

- Serves diverse markets.

- Provides operational stability.

- Facilitates resource optimization.

Commitment to Sustainability

ExxonMobil's value proposition now prominently features a commitment to sustainability. This shift includes significant investments in carbon capture technologies, renewable energy projects, and biofuel development. Such initiatives attract environmentally conscious customers and investors, enhancing the company's appeal in a changing market. In 2024, ExxonMobil allocated billions to lower-emission projects. This strategic move is vital for long-term value creation.

- Investment: Over $17 billion in low-carbon solutions by 2027.

- Carbon Capture: Plans to capture 20 million metric tons of CO2 annually by 2030.

- Renewables: Expanding renewable energy portfolio, including biofuels.

- Market: Appeals to ESG-focused investors and customers.

ExxonMobil's value propositions include reliable energy, advanced tech, and superior products. Its global footprint and commitment to sustainability boost its appeal. In 2024, ExxonMobil invested in low-carbon solutions.

| Value Proposition | Description | 2024 Highlights |

|---|---|---|

| Reliable Energy Supply | Ensures consistent energy to meet global needs. | Produced ~3.8M oil-equivalent barrels/day. |

| Advanced Technology | Utilizes cutting-edge tech for efficiency & quality. | Invested ~$24B in capital & exploration. |

| Superior Products | Offers top-tier fuels, lubricants, and chemicals. | Downstream operations earned $16.5B in 2023. |

Customer Relationships

ExxonMobil's direct sales target industrial clients, offering technical support. Tailored solutions boost customer satisfaction, crucial in the energy sector. Direct engagement cultivates lasting relationships, vital for repeat business. In 2024, ExxonMobil's B2B sales accounted for a significant portion of its $330 billion revenue. This strategy ensures customer loyalty.

ExxonMobil's branded retail outlets, primarily gas stations and service centers, ensure convenient fuel and lubricant access. These locations provide a consistent customer experience, reinforcing brand recognition. In 2024, ExxonMobil operated approximately 20,000 retail sites globally. This strong presence boosts customer loyalty.

ExxonMobil utilizes digital platforms, offering detailed product information and online ordering. This online engagement boosts accessibility and convenience for customers globally. Digital tools streamline transactions, improving customer service efficiency. In 2024, ExxonMobil's digital initiatives saw a 15% increase in online service usage.

Customer Loyalty Programs

ExxonMobil's customer loyalty programs are designed to foster strong relationships with its consumers and increase sales. These programs reward repeat customers through various incentives. They provide discounts, special promotions, and personalized offers. Loyalty initiatives are crucial for retaining customers and boosting revenue.

- ExxonMobil's loyalty program, Speedpass+, offers rewards and convenience.

- In 2024, such programs contributed significantly to customer retention rates.

- These efforts enhanced the customer experience and improved brand loyalty.

- Loyalty programs drive sales by incentivizing repeat purchases.

Technical Partnerships

ExxonMobil's technical partnerships involve collaborative projects with customers to drive innovation in products and services. These collaborations are designed to meet specific customer needs and solve challenges in the energy sector. Joint development efforts boost product value and increase customer satisfaction, which is essential for maintaining strong relationships. For example, in 2024, ExxonMobil invested $23.2 billion in capital and exploration expenditures, demonstrating a commitment to these strategic partnerships.

- Collaboration with customers on technical projects and product development.

- Partnerships address specific customer needs and challenges.

- Joint development enhances product value and customer satisfaction.

- ExxonMobil's 2024 capital expenditures were $23.2 billion.

ExxonMobil’s customer relationships are built on direct sales, retail, digital platforms, loyalty programs, and technical partnerships. These channels provide tailored solutions and foster strong, long-term connections. In 2024, customer-focused strategies drove significant revenue and customer retention. The firm's investment in these areas has a large impact.

| Customer Relationship Type | Description | 2024 Impact |

|---|---|---|

| Direct Sales (B2B) | Targeted industrial clients, technical support. | Significant portion of $330B revenue. |

| Retail Outlets | Gas stations & service centers, brand recognition. | ~20,000 global retail sites. |

| Digital Platforms | Product info and online ordering. | 15% increase in online service usage. |

| Loyalty Programs | Speedpass+, rewards, and incentives. | Enhanced customer retention. |

| Technical Partnerships | Joint projects, product development. | $23.2B in capital and exploration. |

Channels

ExxonMobil's Direct Sales Force involves a dedicated team managing major industrial client relationships. This direct channel offers personalized service and customized solutions. Direct sales guarantee effective communication and customer support. In 2024, ExxonMobil's revenues were approximately $338.6 billion, highlighting the importance of channels like direct sales. This approach allows tailored offerings, boosting customer satisfaction and loyalty.

Branded gas stations are key for ExxonMobil, serving consumers directly with fuel and convenience items. They are the main touchpoint for individual customers, crucial for market reach. In 2024, ExxonMobil operated over 20,000 retail sites globally. A robust retail network boosts brand visibility and solidifies market presence.

ExxonMobil utilizes distributors and wholesalers to reach a broad customer base, including smaller retailers and industrial clients. This indirect channel is vital for efficient market reach. In 2024, ExxonMobil's strategic partnerships with distributors contributed significantly to its global sales, with over $300 billion in revenue. These partnerships enhance market penetration and distribution efficiency, especially in regions where direct operations are limited. The company's robust distribution network is a key component of its business model.

Online Sales Platforms

ExxonMobil utilizes online sales platforms, such as its website and partnerships with e-commerce sites, to offer product information and facilitate online ordering. Digital channels enhance accessibility and convenience, expanding the company's reach to a wider customer base. Online sales complement traditional distribution channels, providing an additional avenue for revenue generation. In 2024, the e-commerce sector continued to grow, with online sales accounting for a significant percentage of total retail sales globally.

- E-commerce sales growth in 2024 is projected to be significant, with an estimated increase of over 10% in many regions.

- ExxonMobil's online sales likely contribute to this growth, particularly in areas where its products are easily distributed.

- The company's digital strategy includes providing detailed product information and streamlining the online purchasing process.

- Digital channels offer ExxonMobil opportunities for targeted marketing and customer engagement.

Partnerships with Automotive Companies

ExxonMobil's collaborations with automotive companies are crucial. These partnerships guarantee their products' recommendation and easy availability. This strategic move boosts brand credibility and market reach significantly. OEM alliances are key to driving product adoption and raising customer awareness. In 2024, ExxonMobil expanded its partnerships, contributing to a 3% increase in market share.

- Product placement in new car models.

- Joint marketing campaigns.

- Enhanced customer loyalty programs.

- Increased brand visibility.

ExxonMobil leverages multiple channels, including direct sales, branded gas stations, and distributors, to reach customers. Digital platforms and e-commerce are also part of the company's strategy, growing in importance. Strategic partnerships with automotive companies expand market reach and promote product adoption.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Team managing major industrial client relationships. | $338.6B in revenue |

| Branded Gas Stations | Retail sites selling fuel and convenience items. | 20,000+ retail sites globally |

| Distributors/Wholesalers | Reach smaller retailers and industrial clients. | Strategic partnerships contributed significantly to global sales |

| Online Sales | Website and e-commerce platforms. | E-commerce growth increased by 10%+ |

| OEM Partnerships | Collaborations with automotive companies | Contributed to a 3% increase in market share |

Customer Segments

Individual consumers represent a key customer segment for ExxonMobil, particularly through retail gas stations. This segment, comprising everyday drivers, is heavily influenced by factors like fuel prices, convenience, and brand recognition. In 2024, ExxonMobil's retail operations generated billions in revenue. Focusing on consumer needs is critical for maintaining a competitive edge and driving sales.

Commercial transportation customers, including trucking, airlines, and shipping, depend on ExxonMobil for fuels and lubricants. These clients prioritize reliability, performance, and cost-efficiency. In 2024, the global transportation sector consumed significant amounts of energy products. ExxonMobil's robust supply chain is essential to meet this segment's high demands. The company's fuel sales in 2023 totaled $200 billion.

Industrial enterprises, including manufacturing plants and power facilities, are key customers for ExxonMobil. These entities demand substantial volumes of energy and chemical products, driving significant revenue. They prioritize a consistent supply, technical expertise, and tailored solutions to meet their operational needs. ExxonMobil's ability to fulfill these requirements fosters long-term partnerships, crucial for sustained growth. In 2024, ExxonMobil's B2B sales accounted for over 60% of its total revenue.

Government and Military

Government and military entities form a crucial customer segment for ExxonMobil, relying on the company for dependable energy products. These sectors demand stringent quality control and security measures, reflecting their critical operational needs. Securing government contracts not only ensures stable revenue but also enhances ExxonMobil's reputation. For example, in 2024, ExxonMobil secured several contracts to supply fuel to military bases worldwide.

- Stable Revenue: Government contracts offer predictable income streams.

- High Standards: Compliance with stringent quality and security protocols is essential.

- Strategic Importance: Energy supply is vital for government and military operations.

- Reputational Benefit: Government partnerships enhance prestige.

Chemical and Plastics Manufacturers

Chemical and plastics manufacturers are key customers, using ExxonMobil's products as raw materials. They prioritize consistent quality and a reliable supply chain, essential for their production processes. This segment includes companies producing plastics, synthetic rubber, and various chemical compounds. Serving this sector diversifies ExxonMobil's revenue streams and reduces market concentration risks. In 2024, the global chemical market was valued at approximately $5.7 trillion.

- Demand for plastics is projected to grow, increasing the need for raw materials.

- ExxonMobil's chemical segment contributed significantly to its overall revenue.

- The company invests in R&D to meet the evolving needs of this customer segment.

- Supply reliability is crucial for manufacturers to maintain production schedules.

ExxonMobil targets diverse customers. This includes everyday drivers at gas stations. Commercial transport, such as airlines, depend on them too. Industrial enterprises and governments are also key clients. The chemical industry relies on ExxonMobil's raw materials.

| Customer Segment | Description | Key Needs |

|---|---|---|

| Individual Consumers | Everyday drivers at retail gas stations. | Fuel prices, convenience, brand recognition. |

| Commercial Transportation | Trucking, airlines, shipping. | Reliability, performance, cost-efficiency. |

| Industrial Enterprises | Manufacturing plants, power facilities. | Consistent supply, technical expertise. |

| Government & Military | Government and military entities. | Quality control, security, reliable supply. |

| Chemical & Plastics Manufacturers | Companies producing plastics, rubber. | Consistent quality, reliable supply chain. |

Cost Structure

ExxonMobil's exploration and production (E&P) costs cover finding and extracting oil and gas. These costs include geological surveys, drilling, and building infrastructure. In 2024, ExxonMobil's capital and exploration expenditures were approximately $22.7 billion. Efficient E&P operations are vital for minimizing costs and maximizing resource use.

ExxonMobil's refining and manufacturing costs are substantial, encompassing energy, labor, and equipment upkeep. In 2024, the company's capital and exploration expenditures were approximately $23.5 billion. Optimizing operations is crucial for controlling these costs and boosting profitability. For example, in Q4 2023, ExxonMobil's chemical segment earnings were $449 million, reflecting these operational impacts. Efficient management is key.

ExxonMobil's distribution and logistics costs are substantial, reflecting the global scale of its operations. These costs cover transporting oil and gas products to customers. In 2024, the company invested heavily in logistics, with transport expenses reaching billions. Efficient logistics are crucial for minimizing costs and ensuring timely delivery.

Research and Development Expenses

ExxonMobil's cost structure includes significant Research and Development (R&D) expenses, critical for innovation and competitiveness. These investments cover new technologies, renewable energy, and product development, fueling long-term growth. Strategic R&D spending is vital for sustainability, especially in a changing energy landscape. In 2024, ExxonMobil allocated billions to R&D, focusing on low-emission solutions.

- 2024 R&D spending is in billions of USD.

- Focus on low-emission technologies.

- Supports long-term growth strategies.

- Drives competitive advantage.

Administrative and Operational Overheads

ExxonMobil's cost structure includes administrative and operational overheads, essential for daily operations. These encompass salaries, office costs, and compliance expenses. In 2024, ExxonMobil's administrative and selling expenses totaled approximately $5.4 billion. Efficient overhead management directly impacts profitability, a key focus for the company.

- Administrative expenses cover salaries and office costs.

- Operational overheads include regulatory compliance.

- Efficient management boosts profitability.

- In 2024, the expenses were around $5.4B.

ExxonMobil's cost structure includes R&D investments focused on low-emission tech, supporting long-term growth, with billions allocated in 2024. This fuels its competitive edge in a shifting energy market, aligning with strategic objectives. This spending is vital for sustainability and adaptability.

| Cost Category | Description | 2024 Data (Approx.) |

|---|---|---|

| R&D | Low-emission tech, product development. | Billions USD |

| Admin/Selling | Salaries, office costs, compliance. | $5.4 billion USD |

| Exploration/Capital | Drilling, infrastructure. | $22.7 billion USD |

Revenue Streams

ExxonMobil's core revenue comes from selling crude oil and natural gas. This revenue stream heavily relies on fluctuating market prices and production levels. In 2024, crude oil prices averaged around $80 per barrel, influencing ExxonMobil's earnings. Effective production and sales strategies are key for maximizing profits, with natural gas contributing significantly.

ExxonMobil's sale of refined products, like gasoline and jet fuel, generates substantial revenue. In 2024, refining contributed a significant portion of total earnings. Refining margins and sales volumes directly impact this revenue stream. Efficient operations and strategic marketing are crucial for driving sales. For example, in Q3 2024, ExxonMobil's refining & marketing segment reported strong earnings.

ExxonMobil generates revenue through the sale of chemical products, including plastics and polymers, diversifying its income streams. This segment's profitability is influenced by market demand, raw material costs, and production efficiencies. In 2024, the chemicals segment contributed significantly to overall revenue. Expanding the chemical product portfolio allows ExxonMobil to tap into growing markets and increase its earnings potential.

Lubricants and Specialty Products Sales

Sales from premium lubricants and specialty products are a crucial revenue stream for ExxonMobil. These offerings, designed for specific applications, provide higher profit margins compared to commodity products. The focus on specialty products boosts profitability and strengthens brand recognition within the industry. In 2024, ExxonMobil's chemical segment, which includes specialty products, saw revenues of $5.3 billion in Q1, reflecting strong demand and pricing.

- High-Margin Products: Specialty products offer superior profitability.

- Targeted Customer Needs: Lubricants cater to unique industrial requirements.

- Enhanced Brand Value: Specialization boosts market positioning.

- Financial Impact: Chemical segment contributed significantly to revenue.

Licensing and Technology Fees

ExxonMobil generates revenue through licensing its proprietary technologies and offering technical services. This strategy capitalizes on the company's extensive expertise and intellectual property developed over decades. Technology licensing allows ExxonMobil to diversify its income streams beyond core operations. It also supports innovation by fostering the adoption of its technologies in various applications.

- Licensing revenue contributed to ExxonMobil's overall financial performance in 2024.

- These licensing agreements cover various technologies, including refining processes and chemical production.

- The company's technical services include engineering support and operational consulting.

- ExxonMobil continues to invest in research and development to enhance its technology portfolio.

ExxonMobil's revenue streams include oil and gas sales, significantly influenced by market prices. Refining operations, like gasoline production, are a major source of income, with margins impacting earnings. Chemical product sales, such as plastics, diversify revenue, bolstered by market demand. Licensing of technology and services further contributes to revenue.

| Revenue Stream | Description | 2024 Data (Approx.) |

|---|---|---|

| Crude Oil & Natural Gas | Sales of crude oil and natural gas. | Avg. price ~$80/barrel; Significant contribution to total revenue. |

| Refined Products | Sales of gasoline, jet fuel, etc. | Refining contributed significantly to total earnings; Strong Q3 earnings. |

| Chemical Products | Sales of plastics, polymers, etc. | $5.3B in Q1 revenue from the chemical segment. |

Business Model Canvas Data Sources

The ExxonMobil Business Model Canvas relies on financial statements, market reports, and competitive analyses for reliable data.