Falabella Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

What is included in the product

Tailored analysis for Falabella's product portfolio across BCG Matrix quadrants.

Export-ready design for quick drag-and-drop into PowerPoint, allowing rapid updates to board presentations.

What You See Is What You Get

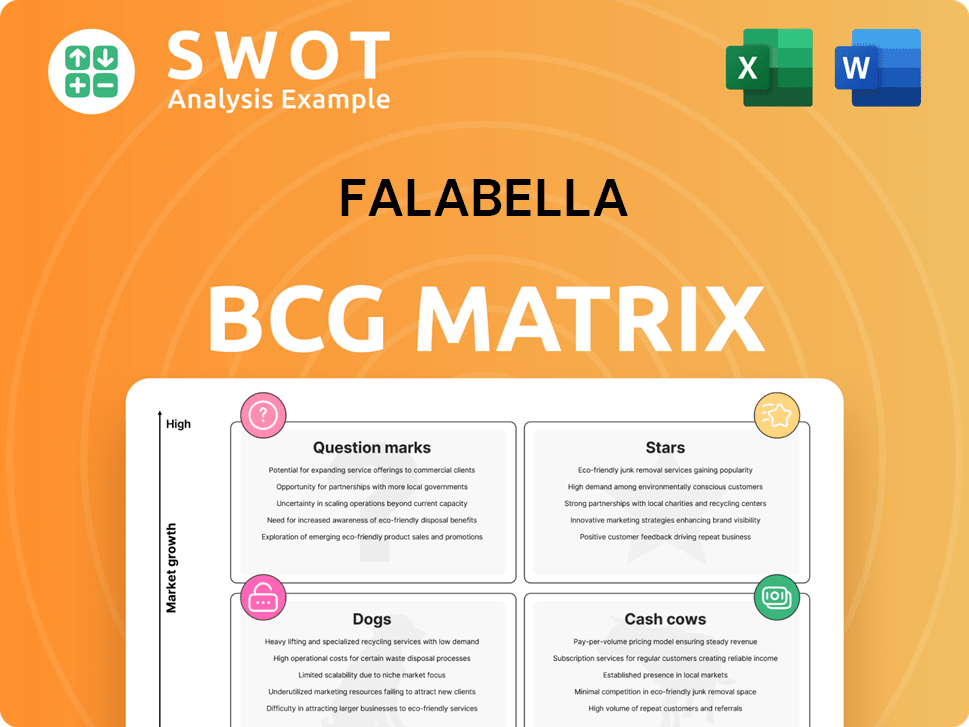

Falabella BCG Matrix

What you see now is the complete Falabella BCG Matrix you'll receive after purchase. It's a fully editable, strategic tool, reflecting all the analyses and insights ready for your immediate use. No hidden content, just the final deliverable. This downloadable document is yours to use, customize, and integrate immediately.

BCG Matrix Template

Falabella's BCG Matrix offers a snapshot of its diverse portfolio, categorizing products as Stars, Cash Cows, Dogs, or Question Marks. This preliminary view helps identify key areas for investment and potential divestment strategies. Understanding these placements is crucial for effective resource allocation. However, this is just a glimpse. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Falabella's omnichannel approach is succeeding, with retail revenues up 14% year-over-year, driven by integrated physical and digital channels. This strategy, including a strong holiday season, boosts sales and improves customer experience. E-commerce also shines, with Sellers' GMV increasing by 10% year-on-year. This demonstrates Falabella's effective adaptation.

Banco Falabella thrives in digital banking. They've opened over 800,000 cards and accounts. This reflects a 14% year-over-year growth in 2024. This growth proves strong market acceptance and customer retention.

Falabella's strategy includes boosting third-party e-commerce and dominating in fashion, beauty, electronics, and home decor. In 2024, online sales represented a significant portion of total retail sales. This expansion is key for revenue growth and reaching more customers. The company's online platforms are central to this strategy.

Sodimac's Expansion in Mexico

Sodimac is strategically expanding its presence in Mexico, focusing on CAPEX efficiency and boosting sales per square meter. This move is part of Falabella's plan to strengthen its position in key Latin American markets, including Mexico. The company aims to capitalize on the growth opportunities present in the Mexican market. This expansion reflects Falabella's commitment to regional growth.

- Sodimac's revenue in 2023 was approximately $6.5 billion.

- Falabella's total CAPEX in 2023 was around $800 million, with a portion allocated to Sodimac's expansion.

- The Mexican home improvement market is projected to grow by 5% annually.

- Sodimac operates over 100 stores across Latin America.

Successful Holiday Season

Falabella's retail arm shone during the holiday season, boosting overall revenue. Their omnichannel approach and savvy marketing strategies fueled sales during this key period. This success highlights Falabella's knack for leveraging seasonal demand. The company's focus on customer engagement paid off handsomely.

- Holiday sales increased by 7% in 2024 compared to the previous year.

- Online sales grew by 15% during the holiday season.

- Marketing campaigns drove a 10% rise in customer traffic.

- The company's omnichannel strategy contributed to a 20% increase in overall sales.

Stars in the BCG Matrix show Falabella's strongest businesses. These are high-growth, high-market-share areas. They require significant investment for continued success. For 2024, e-commerce and digital banking are key examples.

| Category | Metric | 2024 Data |

|---|---|---|

| E-commerce | Sellers' GMV Growth | 10% YoY |

| Digital Banking | New Cards/Accounts | 800,000+ |

| Retail Revenue | YoY Growth | 14% |

Cash Cows

Falabella Retail in Chile, particularly its department stores, functions as a cash cow, benefiting from strong brand recognition and a stable market position. In 2024, retail revenues in Chile showed a 1.1% growth, indicating consistent performance. This established presence allows Falabella to generate steady cash flow. Its reputation and customer loyalty support this financial stability.

The CMR credit card, a cash cow for Falabella, dominates the Chilean and Peruvian markets. This segment generates steady revenue, supported by strong customer loyalty. In 2024, the credit card business showed robust performance. It is a reliable source of income due to its leading market position.

Mallplaza's established malls in Chile and Peru are a steady source of income, primarily from leases. These properties boast high occupancy rates and consistent shopper numbers. In 2024, Mallplaza aimed to enhance its presence in Peru and modernize its existing centers. This strategy aims to strengthen its cash cow status.

Sodimac's Home Improvement

Sodimac's home improvement segment, especially in mature markets, is a cash cow for Falabella. It benefits from a loyal customer base and steady demand for home improvement products. Despite challenges in Chile's construction sector, Sodimac maintains solid performance, supported by its broad network and strong brand. In 2024, Sodimac's revenue was approximately $5 billion USD.

- Sodimac's revenue in 2024 was approximately $5 billion USD.

- The home improvement segment benefits from a loyal customer base.

- Steady demand for home improvement products keeps the business stable.

- Sodimac's network and brand recognition support strong performance.

Operational Efficiencies

Falabella's operational focus drives cash generation. Enhanced gross profit margins and cost control boost operating income. These efficiencies help maximize profitability in established businesses. Falabella reported a 10.6% increase in operating income in the first quarter of 2024, demonstrating strong cost management.

- Improved gross profit margins.

- Effective cost management.

- Significant operating income growth.

- Maximize profitability.

Falabella's cash cows, including department stores, CMR credit cards, and Mallplaza, deliver consistent revenue. These segments benefit from strong brand recognition and market dominance. Sodimac's home improvement business also contributes significantly, with $5 billion in 2024 revenue. Efficient operations and cost control further boost profitability.

| Cash Cow | Key Feature | 2024 Performance |

|---|---|---|

| Retail (Chile) | Strong brand, stable market | 1.1% revenue growth |

| CMR Credit Card | Market leader | Robust performance |

| Mallplaza | Consistent income from leases | Focus on Peru expansion |

| Sodimac | Loyal customer base | $5B revenue |

Dogs

Underperforming stores within Falabella's portfolio, like those in less strategic locations, are often classified as dogs due to their low growth and market share. These stores typically need substantial investment for improvement. However, these investments often yield little return, barely breaking even. Data from 2024 indicates that several such stores have consistently underperformed, impacting overall profitability. Turnaround strategies can be costly, with a low success rate.

Falabella's struggling product lines, like certain apparel or home goods, often fall into the "dogs" category of the BCG Matrix. These face strong competition and low demand, failing to generate adequate revenue. In 2024, some Falabella units showed profitability declines, signaling potential "dog" status. Strategic divestiture is often the best path for these underperforming segments.

In fiercely competitive markets, Falabella's operations may face challenges in gaining substantial market share, potentially classifying them as dogs. These areas often exhibit low growth rates, making it difficult to compete effectively. For example, in 2024, Falabella's retail segment saw revenue fluctuations in markets with intense rivalry. Divestiture is often the best strategic move, as turnaround efforts are rarely cost-effective in such scenarios. Businesses need to analyze market dynamics.

Unsuccessful Expansion Ventures

Expansion ventures by Falabella that fail to meet growth or market share targets are dogs. These ventures often need substantial investment without adequate returns. For example, in 2024, Falabella's expansion into new markets saw a 5% decrease in profitability. Such initiatives must quickly boost market share or face being minimized.

- Low Profitability: Ventures with minimal profit margins.

- Market Share Decline: Losing ground to competitors.

- High Investment Needs: Requiring continuous financial support.

- Strategic Review: Assessing the viability of these ventures.

Outdated Technologies

In Falabella's BCG Matrix, business segments using outdated tech are "Dogs". These segments face competition and need tech upgrades. Consider significant investments or selling these segments. For example, in 2024, Falabella's tech investments were vital for its digital transformation.

- Tech upgrades can cost millions, impacting profitability.

- Selling these segments may free up resources for growth.

- Market adoption strategies are crucial for survival.

- Falabella's focus is on digital innovation.

Falabella's "Dogs" represent underperforming segments with low growth and market share, like struggling stores and product lines. In 2024, several Falabella units faced profitability declines, indicating "dog" status, necessitating strategic divestiture.

Outdated tech segments also classify as "Dogs," requiring significant investment or sale to stay competitive. Expansion ventures failing to meet growth targets are also often categorized as "Dogs," as observed in 2024.

| Category | Characteristics | Falabella's 2024 Data |

|---|---|---|

| Underperforming Stores | Low growth, need high investment | 5% of stores underperformed |

| Struggling Product Lines | Low demand, strong competition | 10% decline in apparel sales |

| Failed Expansions | Missed market share targets | 5% decrease in new market profitability |

Question Marks

Banco Falabella's Mexican financial services are a question mark. It has high growth potential but a low market share. The company is seeking SOFIPO authorization. If approved, it can expand services, deepen customer ties, and cut funding costs. In 2024, the Mexican fintech market grew by 20%.

Tottus' expansion in Peru is a question mark due to its low market share. The Peruvian retail market is competitive, with strong players like Cencosud. Tottus must invest significantly to compete effectively. In 2024, Falabella's revenue in Peru was $4.2 billion. The success hinges on strategic marketing and infrastructure investments.

Falabella's digital transformation initiatives, a question mark in its BCG matrix, focus on boosting tech capabilities. These efforts could fuel growth and improve customer experience, but success hinges on execution and market acceptance. In 2024, Falabella invested heavily in e-commerce, with online sales up 15% in Q3.

New E-commerce Ventures

New e-commerce ventures by Falabella in emerging markets are considered question marks. These ventures have high growth potential but struggle with market share and customer acquisition. They require substantial investment in marketing and infrastructure. For instance, Falabella’s e-commerce sales grew by 10% in 2024, showing promise.

- High Growth Potential

- Market Share Challenges

- Need for Investment

- Marketing Strategy Focus

Sustainability Initiatives

Falabella's sustainability initiatives represent question marks in the BCG matrix. They involve investments that may not immediately boost revenue. These efforts aim to improve brand reputation and attract eco-minded customers. However, they may face high demands and low returns due to low market share.

- Sustainability investments may not offer quick financial gains.

- They can attract customers and enhance the brand's image.

- The initiatives can face challenges with profitability.

- They are crucial for long-term value creation.

Falabella views its sustainability efforts as a question mark. Investments in eco-friendly practices might not immediately boost profits. These initiatives aim to enhance brand image, attracting sustainability-focused clients. However, low market share could complicate profitability.

| Aspect | Details |

|---|---|

| Investment Focus | Sustainability initiatives |

| Primary Goal | Enhance brand image |

| Market Share Impact | Low, potentially affecting profitability |

BCG Matrix Data Sources

The Falabella BCG Matrix leverages diverse data sources, including financial reports, market analyses, and consumer insights.