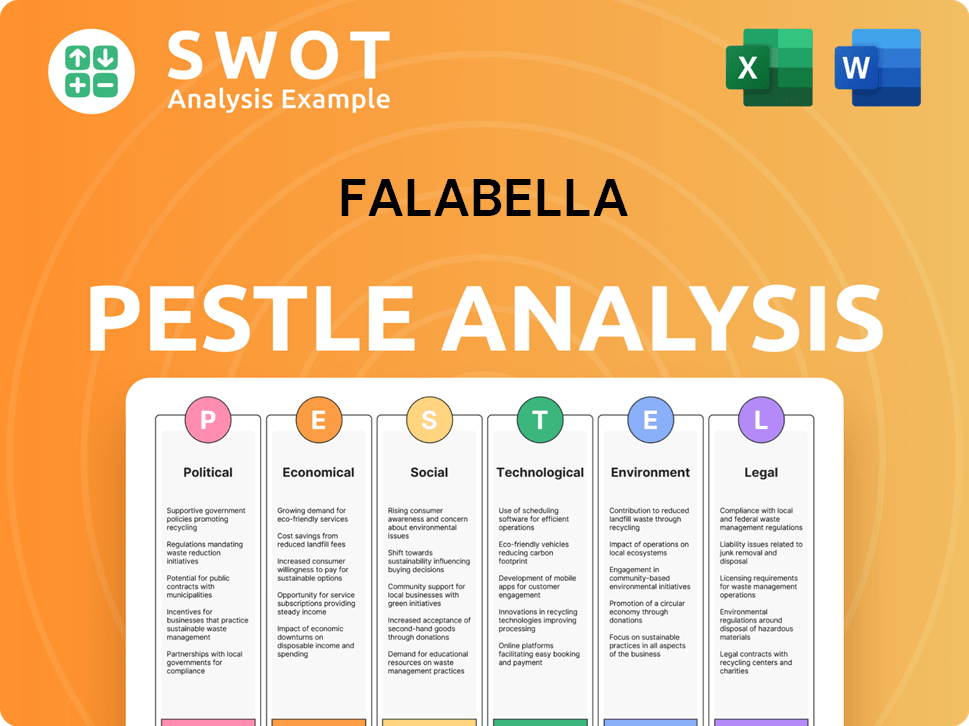

Falabella PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Falabella Bundle

What is included in the product

Assesses external factors impacting Falabella across six dimensions. Offers reliable, insightful evaluations backed by data.

Easily shareable summary format ideal for quick alignment across teams or departments.

Full Version Awaits

Falabella PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Falabella PESTLE Analysis examines crucial factors. You'll download the complete document with all sections. Access it instantly after purchase, ready for analysis.

PESTLE Analysis Template

Navigate Falabella's complex landscape with our PESTLE analysis. Discover how political shifts, economic factors, social trends, technological advancements, legal constraints, and environmental concerns influence Falabella's operations. Uncover key opportunities and potential risks impacting their business. Download the complete analysis for expert-level insights and data-driven strategies to elevate your market understanding. Get it now!

Political factors

Falabella's operations span Latin America, where political stability varies. Countries like Chile, with a GCI score of 68.6 in 2024, offer greater stability compared to others. Political instability can affect regulations and trade. In 2024, political risk insurance costs increased for businesses in less stable regions. Navigating these landscapes is key for Falabella's success.

Government regulations significantly shape Falabella's operations across retail, finance, and real estate. Consumer protection laws, labor regulations, and tax policies directly influence profitability. For instance, changes in import duties or sales tax, as seen in Chile in 2024, could alter pricing strategies. Moreover, foreign investment policies impact Falabella's expansion plans, especially in markets like Peru and Colombia.

Falabella's operations are significantly impacted by trade agreements and tariffs. For instance, Chile, where Falabella has a strong presence, has numerous free trade agreements, potentially lowering import costs. Conversely, rising tariffs, like those seen in some regions, could increase the prices of imported goods. In 2024, Chile's trade balance showed a surplus of $8.2 billion, reflecting its trade relationships.

Political Risk and Geopolitical Events

Geopolitical events and political risks, especially in Latin America, pose challenges for Falabella. Elections, government changes, and regional tensions can create uncertainty. These factors can impact consumer confidence and the economic climate. For example, Chile's political landscape is subject to change, potentially impacting business.

- Political instability can lead to currency fluctuations.

- Changes in trade policies can affect Falabella's supply chains.

- Social unrest may disrupt operations and sales.

Government Support and Investment Incentives

Government support and investment incentives play a crucial role for Falabella. Initiatives designed to boost economic growth and aid specific sectors can directly benefit the company. These incentives may cover job creation, infrastructure improvements, and technology adoption, potentially reducing operational costs and increasing profitability. For instance, in 2024, Chile, where Falabella has significant operations, saw a 5% increase in government spending on infrastructure projects.

- Tax breaks for companies investing in sustainable practices.

- Subsidies for job creation in retail and related sectors.

- Grants for adopting e-commerce and digital technologies.

- Streamlined regulations for international trade and investment.

Political stability across Latin America influences Falabella's operations, with countries like Chile offering more stability than others, impacting trade and regulations.

Government regulations such as consumer protection laws, taxes, and foreign investment policies shape Falabella's profitability and expansion strategies, exemplified by tax changes in Chile.

Trade agreements and geopolitical events significantly affect Falabella's supply chains and economic climate, impacting costs and consumer confidence, demonstrated by Chile's trade surplus in 2024 and government support.

| Factor | Impact | Example (2024) |

|---|---|---|

| Political Stability | Influences business risk & investment | Chile's GCI score of 68.6 |

| Government Regulations | Affects profitability, expansion | Chile tax adjustments |

| Trade Agreements | Impacts costs, supply chains | Chile trade surplus $8.2B |

Economic factors

Economic growth in Latin America, where Falabella operates, significantly impacts consumer spending. GDP growth, employment, and disposable income directly influence demand. For example, in 2024, Chile's GDP growth was projected at around 2%, impacting consumer behavior. Stronger economies typically boost Falabella's sales and profitability. In 2025, forecasts suggest moderate growth, influencing strategic decisions.

Inflation poses a challenge, diminishing consumer spending power and raising Falabella's expenses. Currency swings, especially against the USD, affect import expenses and the worth of foreign earnings. In 2024, Chile's inflation rate hovered around 7.5%, which impacted retail prices. Currency volatility can significantly alter profit margins.

Central bank interest rate decisions directly influence Falabella's borrowing costs and customer credit terms. As of early 2024, Chile's central bank maintained a restrictive monetary policy with interest rates at 6.5%. This impacts Falabella's investment capital. Higher rates can curb consumer spending, especially on credit-financed goods. This could lead to reduced sales in 2024/2025.

Unemployment Rates

Unemployment significantly impacts consumer behavior and spending patterns, crucial for Falabella's performance. Elevated unemployment can decrease the customer base and reduce demand for discretionary items across its diverse business segments. In Chile, unemployment in late 2024 hovered around 8.5%, reflecting economic instability that affects consumer spending. This figure is projected to slightly decrease to 8.0% by the end of 2025.

- Chile's unemployment rate in Q4 2024: approximately 8.5%.

- Projected unemployment rate in Chile by the end of 2025: around 8.0%.

Income Distribution and Inequality

Income distribution is crucial for Falabella, influencing consumer purchasing power. High inequality can shrink markets, while a growing middle class expands opportunities. Chile's Gini coefficient, a measure of inequality, was around 0.44 in 2023, indicating moderate inequality. This impacts demand for Falabella's diverse offerings. A rising middle class fuels demand for higher-end goods.

- Chile's Gini coefficient: ~0.44 (2023)

- Impact: Consumer spending patterns

- Opportunity: Growth in middle class

Economic growth, consumer spending, and GDP significantly affect Falabella. Chile's 2024 GDP grew about 2%, influencing sales. Moderate growth forecasts for 2025 will shape strategies. Inflation, such as Chile's 7.5% rate in 2024, and currency volatility, impact consumer spending.

| Economic Factor | Impact on Falabella | 2024 Data |

|---|---|---|

| GDP Growth (Chile) | Influences Sales, Consumer spending | ~2% |

| Inflation Rate (Chile) | Affects Prices, Spending Power | ~7.5% |

| Unemployment (Chile) | Impacts Demand, Consumer Base | ~8.5% (Q4 2024) |

Sociological factors

Latin America's population dynamics significantly shape Falabella's market. The region's population is projected to reach approximately 668 million by 2025, with continued urbanization. A youthful demographic fuels demand for fashion and tech, while the aging population boosts health and home goods sales. Urbanization necessitates robust physical and e-commerce strategies.

Consumer preferences are constantly evolving. In 2024, there's a strong focus on sustainability and ethical sourcing. For instance, 60% of consumers globally prefer brands with sustainable practices. Falabella needs to adjust its product lines to meet this demand. Also, convenience is key; online sales grew by 15% in Q1 2024, highlighting the need for a robust e-commerce presence.

Falabella's success hinges on navigating diverse cultural norms in Latin America. Consumer preferences and behaviors differ significantly across countries like Chile, Peru, and Colombia. For instance, in 2024, e-commerce adoption rates varied, impacting online sales strategies. Building trust and adapting marketing to local values are crucial for brand loyalty and market penetration.

Social Trends and Consumer Behavior

Social trends significantly shape consumer behavior, with digital technology adoption, evolving family structures, and heightened environmental awareness at the forefront. These shifts influence purchasing habits and retailer expectations. Falabella's omnichannel approach directly addresses these changes, aiming to meet diverse consumer needs. For instance, in 2024, e-commerce sales in Latin America grew by 18%, reflecting increased digital shopping.

- Digital adoption drives online sales growth.

- Changing family structures influence product demand.

- Environmental consciousness impacts brand choices.

- Omnichannel strategies are crucial for retailers.

Education Levels and Awareness

Rising education levels are reshaping consumer behavior. Educated consumers often seek superior products and expect excellent service. This shift impacts brand perception and demand for transparency. Awareness of social and environmental issues is increasing, influencing purchasing choices.

- Chile's literacy rate is approximately 96%, reflecting a high level of educational attainment.

- Consumer demand for sustainable products is growing, with a 15% increase in eco-conscious purchases.

- Transparency reports by companies are up by 20% to meet consumer expectations.

Digital adoption fuels substantial online sales growth in Latin America. Family structure shifts change what consumers want, with sustainable and eco-friendly options gaining traction. Transparency in business, with eco-friendly product demand up by 15%

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Digital Adoption | Boosts online sales. | E-commerce sales growth in Latin America: 18% |

| Family Structures | Shapes product demand. | Rise in single-person households by 7%. |

| Eco-Consciousness | Influences brand choices. | 15% increase in eco-friendly purchases. |

Technological factors

E-commerce is booming in Latin America, reshaping retail. Falabella's digital investments are key. In 2024, e-commerce sales in LatAm hit $100B. Falabella.com's growth is vital for omnichannel success. Digital infrastructure is essential for staying competitive.

Falabella's e-commerce and digital services expansion relies on robust technological infrastructure. Reliable internet and mobile networks are crucial for seamless operations. Enhanced connectivity fuels growth opportunities, especially in underserved areas. In 2024, e-commerce sales represented 15% of Falabella's total revenue, highlighting the importance of digital infrastructure.

Technological factors significantly impact Falabella's operations. AI, data analytics, automation, and in-store tech are crucial. For example, in 2024, AI-driven personalization boosted sales by 15% in some retail sectors. These advancements enhance efficiency, personalize customer experiences, and streamline supply chains. Falabella's ability to adopt these technologies will be key.

Digital Payment Systems and Financial Technology (FinTech)

Digital payment systems and FinTech significantly influence Falabella. The company's financial services and transaction processes are directly impacted by these advancements. Embracing new payment technologies is crucial for enhancing customer convenience and security. Falabella must integrate these innovations to remain competitive. In 2024, mobile payments in Latin America are expected to reach $200 billion.

- Mobile payment adoption is rapidly growing across Latin America.

- FinTech solutions are reshaping how customers interact with financial services.

- Falabella's digital strategy must prioritize these technological shifts.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Falabella, given its extensive digital presence and customer data handling. The company needs strong security to combat cyber threats and adhere to data privacy rules, which is essential for maintaining customer trust. In 2024, global cybercrime costs reached $9.2 trillion, highlighting the urgency. Falabella's investments in data protection are crucial for avoiding financial and reputational damage.

- Cybersecurity spending is projected to exceed $10.2 billion by the end of 2025.

- Data breaches can cost companies millions; the average cost per breach in 2024 was $4.45 million.

- GDPR compliance fines can reach up to 4% of annual global turnover.

Technological factors heavily shape Falabella's trajectory. AI and data analytics are crucial for enhancing operations, with AI-driven personalization potentially boosting sales. Digital payments and cybersecurity also significantly impact Falabella's financial services and data handling.

Robust infrastructure, like mobile networks, is essential, while cybersecurity spending is set to exceed $10.2 billion by the end of 2025.

| Technology Area | Impact on Falabella | 2024/2025 Data Points |

|---|---|---|

| E-commerce | Essential for omnichannel success | LatAm e-commerce sales reached $100B (2024) |

| Digital Infrastructure | Supports digital services expansion | E-commerce represents 15% of total revenue (2024) |

| Cybersecurity | Critical for data protection | Global cybercrime costs $9.2T (2024), cybersecurity spending exceeds $10.2B (2025) |

Legal factors

Falabella must comply with consumer protection laws across its operating regions. These laws dictate clear pricing, product details, and return policies. For example, in Chile, consumer complaints increased by 15% in 2024, highlighting the need for robust compliance. Non-compliance can lead to fines and reputational damage.

Labor laws significantly influence Falabella's HR and expenses. They must adhere to varying regulations globally. This includes wages, hours, and benefits. For example, Chile's minimum wage was roughly $470 USD monthly in early 2024. Unionization also plays a role.

Falabella faces impacts from tax laws like corporate, sales, and import duties, influencing its financial results and pricing. Tax policy shifts can significantly affect its profitability and market competitiveness. In 2024, Chile's corporate tax rate is 27%, which affects Falabella. Sales taxes also vary by region, impacting consumer prices.

Data Privacy and Security Regulations

Falabella must navigate increasingly strict data privacy and security regulations. These rules dictate how customer data is collected, stored, and used. Non-compliance can lead to hefty legal penalties and damage customer trust. The company must invest in robust data management practices to stay compliant. In 2024, data breaches cost companies an average of $4.45 million globally.

- GDPR and CCPA compliance are crucial.

- Cybersecurity investments are essential.

- Data protection training is vital.

- Regular audits and updates are needed.

Regulations on Financial Services

Falabella's financial services arm must adhere to banking and credit regulations in every operating country. These include capital adequacy, lending rules, and consumer credit safeguards, crucial for business legality. Failure to comply can lead to significant penalties and operational setbacks. Compliance is an ongoing process requiring continuous monitoring and adaptation. For example, in 2024, Chilean banks faced increased scrutiny regarding consumer loan practices.

- Chilean banks' capital adequacy ratios, as of late 2024, are around 15-16%, reflecting regulatory pressures.

- Consumer credit regulations in Peru, updated in 2024, impact Falabella's lending practices.

- Falabella's compliance costs in Argentina have risen by 10% due to new regulations in 2024.

Legal factors significantly shape Falabella's operations.

Consumer protection laws in Chile saw a 15% rise in complaints in 2024.

Data privacy and security are critical, with global data breaches costing $4.45 million in 2024.

Financial services must follow strict banking regulations.

| Regulation Type | Impact Area | 2024 Data Point |

|---|---|---|

| Consumer Protection | Pricing, Returns | Chile Complaints +15% |

| Data Privacy | Data Handling | Breach Cost: $4.45M |

| Banking | Credit Lending | Chile Bank Ratios: 15-16% |

Environmental factors

Climate change intensifies extreme weather, like floods and droughts, potentially disrupting Falabella's operations. These events can damage infrastructure and disrupt supply chains. For example, the 2023 floods in Chile caused significant logistical challenges. Such occurrences can also shift consumer behavior, impacting sales and profitability; in 2024, extreme weather events cost the retail sector billions. These pose financial risks.

Falabella faces growing pressure from environmental regulations. These rules cover waste, energy, and emissions. For example, Chile's carbon tax could raise costs. In 2024, the company invested in eco-friendly initiatives. Adapting to sustainability is crucial for the company's future.

Resource scarcity, like water and energy, poses operational and cost challenges for Falabella. Efficient resource management and renewable energy adoption are vital. For instance, in 2024, energy costs rose by 12% impacting retail margins. Sustainable practices are crucial for long-term viability.

Waste Management and Circular Economy

Regulations and consumer expectations are pushing Falabella towards better waste management. This involves recycling and embracing circular economy principles. Sustainable practices are key for environmental responsibility. Falabella's efforts align with rising consumer demand for eco-friendly options. This impacts product design and packaging choices.

- Chile's Extended Producer Responsibility (EPR) law, effective from 2023, mandates companies to manage and finance the collection and recycling of specific products, like packaging.

- Falabella has invested in initiatives to reduce packaging waste, aiming for 100% recyclable or reusable packaging by 2025.

- Consumer surveys indicate a 70% preference for brands with strong sustainability practices in 2024, influencing Falabella's strategies.

Environmental Reputation and Stakeholder Pressure

Falabella's environmental actions significantly influence its brand image and ties with customers, investors, and communities. A strong focus on sustainability can boost brand loyalty and draw in eco-minded consumers and investors. In 2024, companies with strong ESG (Environmental, Social, and Governance) scores saw increased investor interest and better financial performance. Falabella's dedication to environmental responsibility is vital for long-term success.

- In 2024, ESG-focused funds saw inflows of over $1 trillion globally, highlighting the growing importance of sustainability.

- Companies with better ESG ratings often have lower cost of capital, improving profitability.

Extreme weather, exacerbated by climate change, threatens Falabella's operations, with floods in Chile costing the retail sector billions in 2024.

Environmental regulations and consumer demands drive Falabella's sustainability efforts, impacting packaging and resource management.

Sustainability enhances brand image, boosting investor interest as ESG-focused funds saw $1 trillion inflows globally in 2024.

| Aspect | Impact | Data |

|---|---|---|

| Climate Risks | Disrupted Operations | Extreme weather caused billions in losses for retail in 2024. |

| Regulations | Increased Costs | Chile's carbon tax & EPR laws; recycling mandates since 2023. |

| Consumer Pressure | Shifts in Strategy | 70% preference for sustainable brands in 2024. |

PESTLE Analysis Data Sources

Falabella's PESTLE leverages economic databases, policy updates, industry reports, and government publications for credible insights.