Fortune Brands Innovations SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Innovations Bundle

What is included in the product

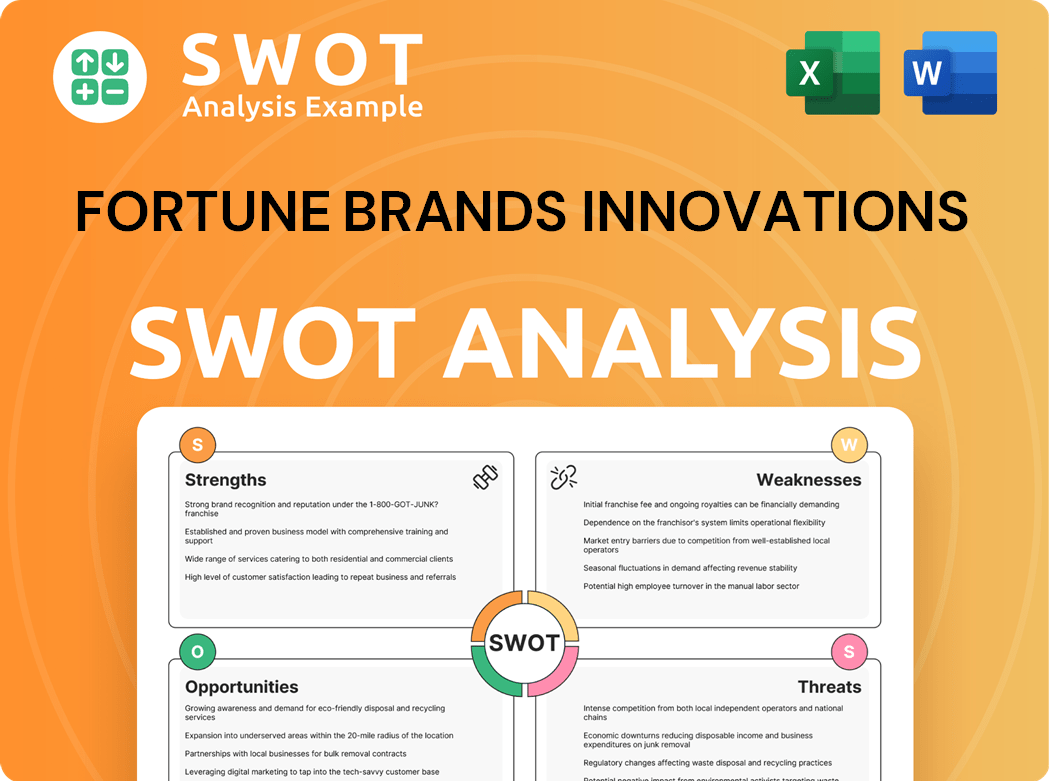

Outlines the strengths, weaknesses, opportunities, and threats of Fortune Brands Innovations.

Simplifies complex SWOT data into an at-a-glance view for immediate understanding.

Full Version Awaits

Fortune Brands Innovations SWOT Analysis

This is a live look at the actual SWOT analysis document you'll receive. It's the same professionally-crafted analysis ready for your use. Purchase provides full access to this in-depth document. Explore the complete SWOT analysis now!

SWOT Analysis Template

Fortune Brands Innovations' SWOT reveals crucial insights into its market position. We've analyzed strengths like innovative products and robust brands. Opportunities for growth and potential threats like supply chain issues are also explored. The snippet shows a fraction of the company's landscape. Unlock the full SWOT report with strategic insights & an editable spreadsheet.

Strengths

Fortune Brands Innovations benefits from a robust brand portfolio. This includes well-known names such as Moen and Master Lock. These brands hold strong market positions. This helps them maintain customer loyalty and pricing power. In 2023, Moen's sales contributed significantly to the company's overall revenue.

Fortune Brands Innovations excels with its focus on innovation and digital transformation, crucial for future growth. They're advancing digital and connected products. This strategy allows them to adapt to changing trends and customer demands. In 2024, the company invested heavily, with R&D spending at $150 million, reflecting their commitment.

Fortune Brands' lean and adaptable supply chain enables quick responses to market changes. This agility is crucial for cost management and operational efficiency. Strategic alignment of operations enhances profitability. In Q3 2024, they reported strong supply chain performance, improving margins. Their focus on high-profit segments is key.

Strong Financial Performance

Fortune Brands Innovations benefits from its strong financial performance, supported by its diverse brand portfolio. The company's brands, such as Moen and Master Lock, hold leading market positions, fostering customer loyalty and pricing power. In 2024, the company's net sales reached $4.0 billion, demonstrating its financial health. This robust performance stems from a strategic focus on premium brands.

- Diverse Brand Portfolio: Includes Moen, House of Rohl, and Master Lock.

- Market Leadership: Brands hold strong positions in their categories.

- Financial Strength: Net sales of $4.0 billion in 2024.

- Pricing Power: Brand equity enables premium pricing.

Global Presence

Fortune Brands Innovations boasts a significant global presence, enhancing its market reach. The company prioritizes innovation and digital transformation, setting itself for growth. They have opportunities to expand digital and connected products. This strategic focus allows them to meet evolving customer needs effectively. For instance, in 2024, international sales accounted for approximately 20% of total revenue.

- Global sales provide diversification.

- Focus on innovation drives new product development.

- Digital transformation enhances customer experience.

- International presence minimizes risk.

Fortune Brands Innovations leverages a strong brand portfolio, featuring Moen and Master Lock. Market leadership enables premium pricing. The company showed financial health in 2024, with net sales hitting $4.0 billion. Strategic agility through global presence boosts market reach, improving sales in key areas.

| Strength | Description | 2024 Data |

|---|---|---|

| Brand Portfolio | Includes Moen, House of Rohl, Master Lock | $4.0B net sales |

| Market Leadership | Brands hold strong positions | R&D $150M in 2024 |

| Financial Strength | Robust performance | 20% international sales |

Weaknesses

Fortune Brands Innovations faces a notable weakness: its heavy reliance on the US market. In 2023, approximately 80% of its revenue originated from the USA. This concentration exposes the company to economic downturns and shifts in consumer behavior within this single market. The split into smaller businesses impacts the total revenue. Diversifying its geographic revenue streams could help to mitigate this risk.

Fortune Brands Innovations faces risks due to its strong link to the housing market. A slowdown in construction or remodeling can directly hit revenue and profits. In 2024, the housing market showed signs of cooling, which could affect the company. Diversifying into more stable areas might help cushion against these market swings.

Fortune Brands Innovations faced headwinds in China, particularly affecting its Water Innovations segment. Weakness in China's operations can impede growth and profitability. In 2024, the company reported a decline in sales in China. Overcoming these challenges is vital for market expansion.

Software Outages

Software outages can disrupt Fortune Brands' operations, potentially causing financial losses and damage to its reputation. A significant portion of Fortune Brands' revenue comes from the USA, making it susceptible to US economic downturns. Over-reliance on a single market increases risk. Diversifying its geographic revenue would reduce this vulnerability.

- In 2023, the US accounted for over 80% of Fortune Brands' sales.

- Software glitches have caused temporary shutdowns in other industries.

- Diversification could include expanding into European or Asian markets.

Fluctuating Profitability

Fortune Brands Innovations faces fluctuating profitability because its financial health is linked to the housing market, making it vulnerable to economic downturns. In 2024, housing starts decreased, potentially affecting the company's revenue. This dependence on housing can lead to unpredictable earnings. Diversifying into less volatile markets would help.

- 2024 saw a decline in new housing construction, impacting related industries.

- The company's financial performance is directly influenced by housing market trends.

- Diversification could provide stability against market fluctuations.

- Economic downturns in construction and remodeling could hurt profitability.

Fortune Brands Innovations has a significant dependence on the US market, with over 80% of sales originating there in 2023. The housing market's volatility poses risks; a decline in construction can directly affect revenues. Its China operations present challenges affecting the company's market expansion.

| Weakness | Impact | Data |

|---|---|---|

| US Market Dependency | Economic Vulnerability | 80% sales from US (2023) |

| Housing Market Risk | Profit Volatility | Housing starts down in 2024 |

| China Operations | Growth Challenges | Sales decline in 2024 |

Opportunities

The connected products market offers Fortune Brands Innovations substantial growth opportunities, especially in water management and security. This expansion can significantly boost revenue. By investing in and broadening its connected product range, Fortune Brands can capitalize on this trend. The global smart home market, including connected products, was valued at $85.8 billion in 2023 and is projected to reach $159.5 billion by 2029.

Fortune Brands can grow by offering commercial safety solutions. They can use Master Lock's name and LOTO knowledge. Connected LOTO is a big chance for them. This move can boost sales and spread out their income sources. In 2024, Master Lock's sales were solid, showing the potential for growth in safety solutions.

An improving housing construction market in the US presents opportunities for Fortune Brands. Increased sales of home products are expected. In 2024, U.S. housing starts rose, potentially boosting sales. Capitalizing on this trend can increase market share and revenue. For example, in March 2024, housing starts were at a seasonally adjusted annual rate of 1.5 million.

Strategic Partnerships

Fortune Brands Innovations (FBI) can leverage strategic partnerships to capitalize on the growing connected products market, especially in water management and security. This expansion can drive substantial revenue growth, as the smart home market continues to expand. Investing in and broadening its connected product offerings allows FBI to seize this opportunity. For instance, the global smart home market is projected to reach $195 billion by 2025.

- Connected products market growth offers revenue potential.

- FBI can expand offerings in water management and security.

- Smart home market expected to reach $195B by 2025.

Margin Improvements Through Efficiency

Fortune Brands Innovations can enhance profitability by improving operational efficiency. The company can achieve this through streamlined processes and cost-cutting measures. This strategy could lead to higher profit margins. For instance, in 2024, the company focused on reducing manufacturing costs.

- Focus on Operational Excellence: Implementing lean manufacturing.

- Supply Chain Optimization: Negotiating better deals with suppliers.

- Technology Integration: Automating processes.

- Cost Reduction: Lowering overhead expenses.

Fortune Brands Innovations (FBI) can seize growth through the connected products market, projected to hit $195 billion by 2025. They can expand in water management and security to boost revenues. Commercial safety solutions offer additional profit opportunities with Master Lock.

| Opportunity | Strategic Action | Supporting Data (2024) |

|---|---|---|

| Connected Products | Expand water/security offerings | Smart home market value is estimated at $159.5B by 2029. |

| Commercial Safety | Leverage Master Lock expertise | Master Lock showed solid sales potential in 2024. |

| US Housing Market | Capitalize on rising housing starts | U.S. housing starts rose, reaching 1.5 million in March 2024. |

Threats

Stringent regulations, particularly in health and safety, pose a significant threat. Compliance costs can rise, impacting profitability, as seen with increased spending on safety measures. These regulations can also create barriers to entry, potentially limiting market expansion. Adapting to these changes is vital; failure to do so could affect market share, as observed when companies struggle with new standards. For instance, in 2024, regulatory fines in similar industries have reached millions due to non-compliance.

Fortune Brands Innovations contends with intense competition from both domestic and international entities, some offering more affordable alternatives. This heightened competition from local competitors, providing cheaper products, poses a threat to its market share. To stay ahead, the company must distinguish its offerings through innovation and robust brand positioning. In 2024, the global home and building products market was valued at approximately $750 billion, highlighting the scale of competition.

Fortune Brands Innovations faces growing cybersecurity threats, potentially leading to data breaches and reputational damage. Such threats could erode consumer trust and harm business relationships. In 2024, cyberattacks cost businesses globally an average of $4.5 million each. Investing in strong cybersecurity and incident response plans is essential to protect against these risks.

Supply Chain Disruptions

Fortune Brands Innovations faces supply chain disruptions, including stringent regulations that can increase costs and create barriers. Health and safety regulations are particularly impactful, requiring constant adaptation. Compliance demands can strain resources, potentially affecting profitability. Staying informed and agile is essential to mitigate these risks and maintain a competitive edge.

- In 2024, supply chain disruptions increased operating costs by 5% for some companies.

- Compliance costs related to health and safety regulations have risen by 7% annually since 2020.

- Companies that proactively manage supply chain risks experience a 10% higher profit margin.

Economic Downturns

Economic downturns pose a significant threat to Fortune Brands Innovations, especially given the competitive landscape. The company battles with local and global competitors. Cheaper products from local players can erode Fortune Brands' market share. Differentiating through innovation and brand strength is crucial to mitigate these risks.

- In 2024, the housing market slowdown impacted home improvement product sales.

- Rising inflation and interest rates can reduce consumer spending on discretionary items.

- Economic uncertainty can delay or cancel renovation projects, affecting demand.

Fortune Brands Innovations confronts stringent regulations and rising compliance costs. Cybersecurity threats and supply chain disruptions add further challenges, potentially increasing operational expenses. These factors require robust risk management strategies. Economic downturns also pose a risk, influencing consumer spending and market share. The company must proactively address these threats.

| Threat | Impact | Data (2024) |

|---|---|---|

| Regulatory | Increased costs/Barriers | Compliance costs up 7% annually |

| Competition | Market share erosion | Home products market: $750B |

| Cybersecurity | Data breaches/Reputational damage | Avg. cost of attacks: $4.5M |

SWOT Analysis Data Sources

The analysis uses financial data, market research, expert opinions, and industry publications for a data-backed SWOT assessment.