FedEx PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FedEx Bundle

What is included in the product

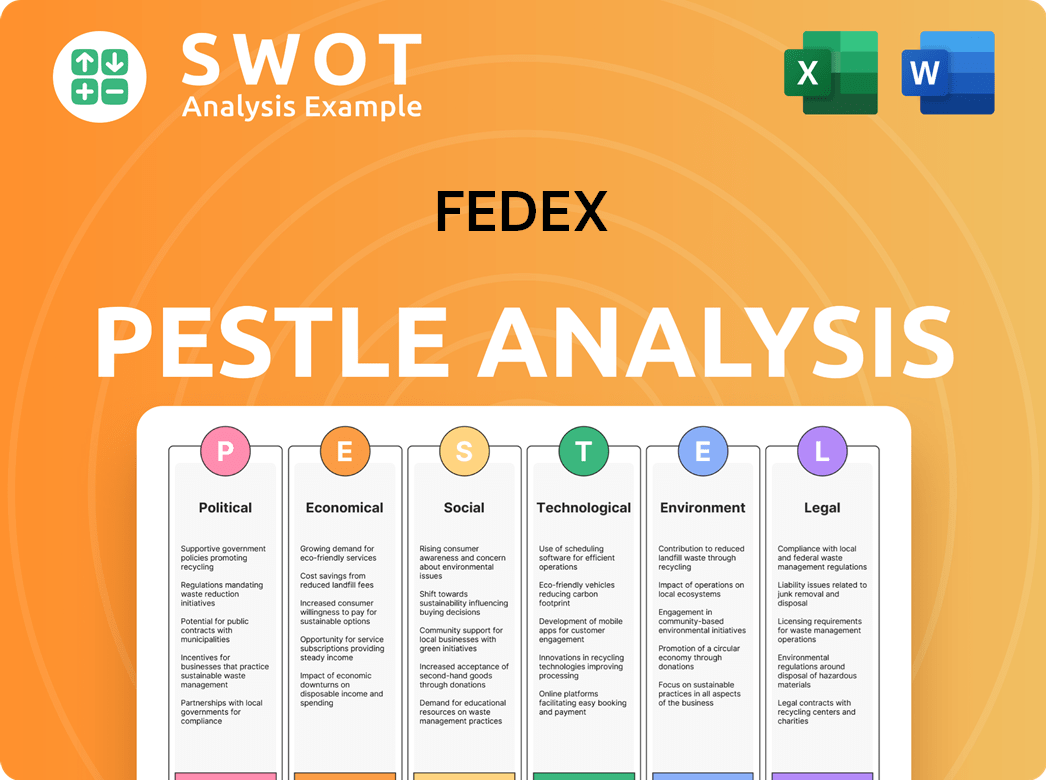

Examines how macro factors influence FedEx across Political, Economic, Social, Tech, Env, & Legal dimensions.

Aids in brainstorming solutions with impactful examples in a bullet-point-ready format.

Same Document Delivered

FedEx PESTLE Analysis

This is the complete FedEx PESTLE Analysis, previewed in its entirety. What you're seeing is the identical, finished document available instantly after purchase. No hidden elements or different versions. Every detail shown here is included in the downloadable file. Ready to download, and ready for your use.

PESTLE Analysis Template

Discover how FedEx navigates a complex global landscape with our detailed PESTLE Analysis. We explore the political influences, economic shifts, social trends, technological advancements, legal frameworks, and environmental factors affecting FedEx's operations. From international regulations to sustainability pressures, we break down key external forces. This analysis helps you understand risks and opportunities impacting the company's strategic outlook. Enhance your business acumen, make smarter investment decisions. Get the full, in-depth analysis instantly.

Political factors

FedEx's global operations are highly sensitive to government regulations and trade policies. International trade policies, tariffs, and customs regulations directly influence shipping volumes and strategies. For instance, US-China trade tensions continue to impact FedEx. The company actively lobbies policymakers. In 2024, FedEx's revenue was approximately $87.6 billion.

Geopolitical events like conflicts and instability can disrupt FedEx's global operations. For instance, the Russia-Ukraine war significantly impacted FedEx's service, with operations suspended in both countries. The company constantly monitors regions for potential disruptions. In 2024, FedEx's international revenue accounted for a substantial portion of its total revenue, making it sensitive to global political risks.

FedEx heavily relies on government contracts, particularly with the U.S. Postal Service. These contracts significantly contribute to revenue streams. In 2024, FedEx secured a multi-year contract extension with USPS. Fluctuations in contract terms or new awards directly affect financial performance and strategic planning. For example, in Q1 2024, government contracts accounted for 15% of FedEx's total revenue.

Labor Laws and Regulations

Labor laws and regulations, including those on employee classification and unionization, significantly impact FedEx's operations. Navigating diverse labor standards across various regions is essential for cost management and compliance. For instance, in 2024, FedEx faced increased scrutiny regarding employee classification, leading to potential adjustments in how it manages its workforce. These regulations influence FedEx's ability to manage its workforce effectively and control costs.

- Compliance costs can vary significantly based on location and specific labor laws.

- Unionization efforts could potentially impact wage structures and operational flexibility.

- Employee classification challenges might lead to legal disputes and financial penalties.

Political Advocacy and Lobbying

FedEx strategically engages in political advocacy, using lobbying and contributions to shape policies affecting its operations. This includes influencing transport, environmental, and tax regulations to create a beneficial environment. In 2023, FedEx spent approximately $14.3 million on lobbying efforts. Their political action committee (PAC) contributed over $1 million to federal candidates. These efforts aim to support FedEx's business interests.

- 2023 Lobbying Spend: $14.3 million.

- PAC Contributions: Over $1 million.

Political factors heavily affect FedEx. Trade policies, like US-China tensions, and geopolitical events such as the Russia-Ukraine war influence its operations and revenue. Labor laws and government contracts, including USPS, also have significant financial impacts. In 2024, FedEx’s total revenue was roughly $87.6 billion.

| Factor | Impact | Example (2024/2025) |

|---|---|---|

| Trade Policies | Affects shipping volumes | US-China trade, tariffs. |

| Geopolitical Events | Disrupts global ops | Russia-Ukraine war suspended services. |

| Government Contracts | Significant revenue stream | USPS contract extension. |

Economic factors

FedEx's success is significantly linked to global economic health. Inflation and interest rates impact consumer and business spending, influencing package volumes. For instance, in 2024, a slight global economic slowdown affected shipping demand. Economic downturns can reduce the need for transportation services.

Fuel price volatility directly impacts FedEx's operational costs. The company relies heavily on fuel for its extensive air and ground fleet. In Q1 2024, fuel expenses rose, prompting fuel surcharges to offset costs. FedEx invests in fuel-efficient tech to mitigate price fluctuations.

E-commerce continues to surge, boosting FedEx's delivery services. Online retail sales are projected to reach $7.3 trillion globally in 2024, a 10.4% increase from 2023. FedEx is adjusting its infrastructure to handle this expanding market. The company's focus includes optimizing delivery routes and expanding capacity, evident in its Q1 2024 earnings report showing a 3% rise in overall revenue due to e-commerce.

Currency Exchange Rates

FedEx faces currency exchange rate risks due to its global operations. These fluctuations affect the translation of revenues and costs across different regions. For instance, a stronger US dollar can reduce the value of international sales. In fiscal year 2024, currency impacts negatively affected FedEx's revenue.

- In Q1 2024, currency negatively impacted FedEx's revenue by $100 million.

- The Euro's depreciation against the USD is a key concern.

- Hedging strategies are used to mitigate risks.

Supply Chain Disruptions

Supply chain disruptions pose a significant risk to FedEx. These disruptions, stemming from economic shifts or geopolitical events, directly influence the movement of goods. This impacts FedEx's operational efficiency and profitability, potentially increasing costs and delaying deliveries. FedEx's ability to navigate these challenges is crucial for maintaining its market position.

- In Q1 2024, FedEx experienced a 5% decrease in international priority package volume.

- The company has invested heavily in supply chain resilience strategies.

- Geopolitical tensions continue to create uncertainty.

Economic factors heavily influence FedEx's financial performance. In 2024, fluctuations in inflation and interest rates continue to affect shipping volumes. E-commerce growth, with projections reaching $7.3 trillion globally in 2024, offers substantial opportunities for FedEx. Fuel prices and currency exchange rates present ongoing challenges, impacting operational costs and revenue.

| Factor | Impact | Data (2024) |

|---|---|---|

| Inflation/Interest Rates | Influence on spending, affecting shipping demand. | Moderate global slowdown, impacting package volume. |

| Fuel Prices | Direct impact on operational costs. | Q1 2024 fuel expenses rose; surcharges initiated. |

| E-commerce Growth | Boosts delivery service demand. | Online retail: $7.3T globally; 10.4% growth YOY. |

| Currency Exchange | Affects revenue from international sales. | Negative impact of $100M on revenue in Q1. |

| Supply Chain Disruptions | Impacts efficiency and profitability. | 5% decrease in international priority package volume in Q1 2024. |

Sociological factors

Consumer expectations are rapidly evolving, pushing FedEx to adapt. Demand for speed, convenience, and transparency in delivery services is at an all-time high. Real-time tracking and flexible delivery options are now standard, reflecting customer preferences. FedEx must invest in technology to meet these demands; in 2024, they invested $1.5 billion in tech.

FedEx's extensive global presence means managing a diverse workforce, creating sociological hurdles like labor negotiations and potential disruptions. Positive employee relations are critical for operational stability. In 2024, FedEx employed over 500,000 people worldwide. Labor costs significantly impact FedEx's financial performance; in fiscal year 2024, salaries and employee benefits totaled billions of dollars.

Changes in population demographics significantly impact FedEx. Urbanization increases demand for last-mile delivery, while aging populations might shift demand towards healthcare logistics. According to the UN, 68% of the world's population is projected to live in urban areas by 2050. Lifestyle changes, like e-commerce growth, further drive delivery service needs. In 2024, e-commerce sales reached $1.1 trillion in the U.S., underscoring this shift.

Social Responsibility and Community Engagement

FedEx actively engages in social responsibility and community initiatives, which significantly shapes its brand perception. Their involvement in disaster relief, such as delivering essential supplies, is a key aspect. Environmental conservation projects also bolster their image. These efforts align with growing consumer expectations for corporate social responsibility.

- FedEx has contributed over $50 million in cash and in-kind support to disaster relief efforts globally since 2001.

- The company aims to achieve carbon-neutral operations by 2040.

Work Culture and Employee Well-being

FedEx's work culture and employee well-being are key sociological factors. Positive morale and well-being boost productivity and retention. A 2024 survey showed FedEx's employee satisfaction at 78%. Addressing employee needs is crucial for operational success. Investing in well-being programs can reduce turnover, which was around 15% in 2024.

- Employee satisfaction rate: 78% (2024).

- Turnover rate: Approximately 15% (2024).

- Focus: Employee well-being initiatives.

Consumer demands for speed and transparency are central to FedEx's sociological environment, requiring ongoing technological investment. Global workforce diversity presents challenges like labor relations, impacting operational stability, with over 500,000 employees as of 2024. Demographic shifts, particularly urbanization and e-commerce growth, are key factors.

| Sociological Factor | Impact | Data/Example (2024) |

|---|---|---|

| Consumer Expectations | Demand for speed and transparency | $1.5B in tech investment. |

| Workforce & Demographics | Labor & urbanization effects | 500k+ employees; e-commerce sales $1.1T in US |

| Social Responsibility | Brand perception, customer loyalty | $50M+ in disaster relief |

Technological factors

FedEx is ramping up automation and robotics in its operations. This includes AI-driven robotic arms and autonomous systems to boost efficiency. In 2024, FedEx invested \$2 billion in automation tech. This is aimed at cutting costs and improving safety. The goal is to optimize sorting and loading processes.

Data analytics and AI are pivotal for FedEx. They boost logistics, optimize routes, and predict demand. FedEx uses AI to estimate delivery times and streamline shipping. In 2024, FedEx invested heavily in AI-driven automation, increasing package processing efficiency by 15%.

FedEx is investing heavily in digital transformation, focusing on e-commerce. This involves developing platforms to streamline the customer journey. In 2024, e-commerce represented a significant portion of FedEx's revenue, with digital solutions being key. The company aims to improve the online shipping experience. FedEx's digital initiatives include enhanced tracking and integrated services.

Tracking and Visibility Technologies

Advanced tracking technologies, including sensor-based devices and mobile app features, are crucial for FedEx. These tools offer real-time shipment data, boosting delivery security and speed. FedEx's investment in tech is evident, with a 2024 budget of $6 billion for technology and infrastructure. This includes improvements to their SenseAware ID, enhancing visibility.

- Real-time tracking provides updates every few seconds.

- Mobile app features offer proactive notifications.

- Sensor-based logistics devices improve package monitoring.

- FedEx aims to increase automation by 20% by 2025.

Sustainable Technologies

FedEx's investment in sustainable technologies is a critical technological factor. This includes electric vehicles and alternative fuels, driven by environmental concerns and regulations. The company is actively transitioning its fleet to reduce its carbon footprint. FedEx has committed to achieving carbon-neutral operations globally by 2040.

- FedEx aims to electrify its pickup and delivery fleet by 2040.

- The company is investing in alternative fuels like sustainable aviation fuel (SAF).

- In 2024, FedEx announced it had deployed over 6,000 electric vehicles.

Technological advancements are pivotal for FedEx, focusing on automation, AI, and digital transformation. They invest heavily in robotics and data analytics, aiming to cut costs and boost efficiency. By 2024, e-commerce had become a key revenue stream for FedEx due to digital solutions and advanced tracking tech.

FedEx prioritizes sustainable technologies, including electric vehicles and alternative fuels, to reduce its carbon footprint. They aim to electrify their pickup and delivery fleet by 2040. By 2024, FedEx has deployed over 6,000 electric vehicles as part of their sustainability efforts.

Digital innovation improves the customer experience with enhanced tracking and services. The company invested \$6 billion in tech and infrastructure in 2024, showing strong investment into improving real-time shipment updates.

| Technology | Focus | 2024 Data |

|---|---|---|

| Automation | Robotics & AI | \$2B Investment |

| Digital | E-commerce platforms | Key Revenue Source |

| Sustainability | Electric Vehicles | 6,000+ EVs Deployed |

Legal factors

FedEx operates under stringent transportation and aviation regulations globally. These rules cover air, ground, and international shipping, impacting operations. Compliance with safety standards, licensing, and operational rules is essential. In 2024, FedEx faced increased scrutiny regarding its aviation practices, leading to some adjustments. The company's legal team navigates these complex requirements to maintain operational integrity.

FedEx must navigate a complex web of international trade laws, customs regulations, and import/export restrictions. These legal requirements vary significantly across the countries where FedEx operates, creating operational hurdles. Any shifts in these international trade laws can directly affect FedEx's cross-border activities and associated expenses. For instance, in 2024, changes to tariffs between the U.S. and China impacted FedEx's shipping costs by approximately 3%.

Labor laws are crucial for FedEx, particularly concerning collective bargaining and worker classification. Legal battles and operational shifts can arise from these factors. FedEx faced lawsuits in 2024 over misclassifying drivers, costing the company. In 2025, compliance with evolving labor standards is vital for risk management.

Data Privacy and Security Regulations

FedEx must adhere to stringent data privacy laws globally, particularly GDPR in Europe and other regional regulations. This is crucial due to the extensive customer and shipment data it manages. Data security is a paramount legal and operational need for FedEx. Non-compliance can result in significant fines and reputational damage.

- GDPR violations can lead to fines up to 4% of annual global turnover.

- Cybersecurity breaches cost companies an average of $4.45 million in 2023.

Tax Laws and Litigation

Tax laws and litigation significantly impact FedEx's financials. Changes in corporate tax regulations across various countries can directly affect profitability. FedEx must also manage potential litigation risks tied to its tax strategies. For instance, in fiscal year 2024, FedEx's effective tax rate was approximately 23.5%.

- Tax law changes can alter FedEx's tax liabilities.

- Litigation can result in significant financial penalties.

- Tax planning is crucial for minimizing tax burdens.

- Compliance with international tax laws is essential.

FedEx confronts a maze of transportation and aviation rules internationally. Global trade regulations and cross-border activities present major hurdles, with tariff changes in 2024 affecting shipping costs by roughly 3%. Data privacy laws, especially GDPR, are critical due to significant fines for non-compliance. Labor law battles concerning worker classification also persist.

| Legal Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| Data Privacy | Fines & Reputation Damage | Average breach cost $4.45M (2023), GDPR fines up to 4% of turnover |

| International Trade | Operational Costs & Compliance | Tariff changes, 3% impact on shipping costs |

| Labor Laws | Lawsuits & Operational Shifts | Ongoing legal disputes related to misclassification. |

Environmental factors

Climate change and carbon emissions are key environmental factors for FedEx. The company aims for carbon-neutral operations by 2040. FedEx invests in reducing its environmental impact. In 2024, FedEx Express introduced electric vehicles in several locations. FedEx continues to explore sustainable aviation fuel (SAF) options.

Stringent vehicle emission standards globally push FedEx to adopt cleaner vehicles. The company aims to electrify its pickup and delivery fleet by 2040. FedEx plans to invest over $2 billion in electric vehicles by 2025. This shift impacts operational costs and infrastructure needs. It also enhances the company's sustainability profile.

FedEx actively manages waste from packaging and operations, focusing on reducing environmental impact. In 2024, FedEx recycled over 1.3 million tons of materials globally. The company invests in recycling programs to minimize waste and promote sustainability. They aim to increase recycling rates and reduce landfill waste.

Sustainable Packaging

FedEx is responding to the rising consumer and regulatory pressure for sustainable practices by focusing on eco-friendly packaging. The company is actively researching and implementing packaging alternatives to reduce environmental impact. This includes using recycled materials and optimizing package sizes to minimize waste. In 2024, FedEx aims to increase the use of sustainable packaging by 10%.

- By 2025, FedEx plans to have 100% reusable, recyclable, or compostable packaging for its services.

- FedEx's investment in sustainable packaging solutions is projected at $50 million by the end of 2024.

- The company is also collaborating with suppliers to innovate packaging materials.

Environmental Disasters and Extreme Weather

Extreme weather events and natural disasters pose significant risks to FedEx's global operations. These events can disrupt delivery schedules and damage critical infrastructure, potentially leading to service delays and increased operational costs. Climate change, which may exacerbate these occurrences, presents a growing challenge for the company. FedEx must continuously adapt its strategies to mitigate these environmental risks.

- In 2023, the U.S. alone experienced 28 separate billion-dollar weather and climate disasters.

- Increased frequency of extreme weather can disrupt FedEx's supply chains.

- Physical damage to hubs and transportation networks.

- Insurance and recovery costs.

Environmental factors heavily influence FedEx's operations. Carbon neutrality by 2040, electric vehicle investments, and sustainable aviation fuel (SAF) are crucial. Waste management, eco-friendly packaging, and resilience to extreme weather also define their environmental strategy. The company has earmarked $50 million for sustainable packaging solutions by the close of 2024.

| Environmental Factor | FedEx Initiatives | Data/Targets |

|---|---|---|

| Carbon Emissions | Carbon-neutral operations by 2040 | Reduce emissions, SAF exploration |

| Vehicle Emissions | Electrify fleet by 2040 | $2B investment in EVs by 2025 |

| Waste Management | Recycling programs | 1.3M+ tons of materials recycled (2024) |

PESTLE Analysis Data Sources

Our FedEx PESTLE Analysis uses industry reports, government data, economic indicators, and company filings to create its assessments.