Ferrovial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferrovial Bundle

What is included in the product

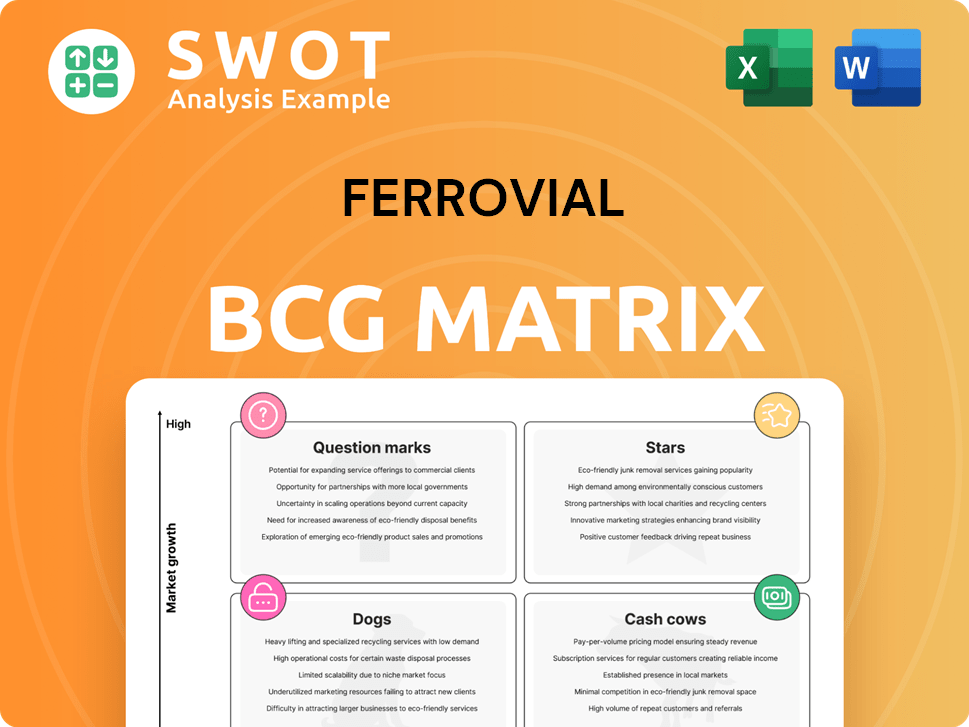

Ferrovial's businesses are analyzed across the BCG Matrix, revealing investment, hold, or divest strategies.

Easily switch color palettes for brand alignment, ensuring consistent visual identity for Ferrovial's BCG Matrix.

Full Transparency, Always

Ferrovial BCG Matrix

The BCG Matrix preview here is identical to your purchase. It's a complete, fully formatted Ferrovial report, ready for strategic planning. No hidden extras or alterations, it's immediately ready to use. You'll receive the same professional document, immediately downloadable after checkout. This gives you a clear view of the quality you'll get.

BCG Matrix Template

Uncover Ferrovial's strategic landscape with a glimpse into its BCG Matrix analysis. This preview highlights key product placements – Stars, Cash Cows, Dogs, and Question Marks. See how each business unit competes in the market. Get the full version for data-driven strategies, actionable insights, and confident decision-making.

Stars

Ferrovial's North American toll roads, including the NTE and LBJ Expressways, are cash cows. Revenue per transaction growth is robust, exceeding inflation. These assets provide substantial dividends, boosting overall revenue. Continued investment in this area supports Ferrovial's North American expansion strategy; in 2024, the NTE and LBJ Expressways generated significant revenue.

The Construction division at Ferrovial has significantly improved profitability, exceeding its annual goals and boasting a record order book. This division holds a strong presence in key markets like North America, Poland, and Spain. Technology adoption, including AI and automation, boosts efficiency and safety. In 2024, Ferrovial's Construction revenue reached €8.7 billion.

The New Terminal One (NTO) at JFK International Airport is a cornerstone project for Ferrovial, slated to open in 2026. This massive infrastructure investment promises substantial revenue growth, aligning with Ferrovial's strategic goals. With significant construction progress and airline agreements, NTO is poised for high market share gains. The project's budget is estimated at $9.5 billion.

Digital Infrastructure Division

Ferrovial's Digital Infrastructure Division, a Star in its BCG Matrix, concentrates on data center projects, utilizing the company's engineering and value creation skills. This division is poised for substantial expansion, capitalizing on the escalating need for data centers and Ferrovial's strong performance record. Investments in digital infrastructure support the growing trends of electrification and digitalization. Ferrovial's strategic focus on digital infrastructure is evident in its commitment to expanding its presence in the data center market. The division's growth aligns with the company's broader strategic goals.

- Ferrovial's revenue in 2023 was €8.5 billion.

- The global data center market is projected to reach $517.1 billion by 2030.

- Ferrovial has been investing in data center projects across Europe and North America.

Sustainable Infrastructure Projects

Ferrovial is deeply invested in sustainable infrastructure, which positions it well in the market. This includes renewable energy initiatives, such as the solar photovoltaic plant in Leon County, Texas. These projects align with global environmental regulations and trends, fostering long-term growth prospects. Sustainability efforts attract environmentally conscious investors and partners.

- Ferrovial's revenue from its environmental services segment was €289 million in 2023.

- The company has increased its investment in green projects by 15% in the past year.

- Ferrovial aims to reduce its carbon footprint by 30% by 2030.

- The Leon County solar plant has a capacity of 150 MW.

Ferrovial's Digital Infrastructure division represents a Star, indicating high growth and market share potential. It leverages the company's expertise in engineering and value creation for data center projects. This division benefits from the escalating demand for data centers. Strategic investments support electrification and digitalization trends.

| Metric | Details | Data |

|---|---|---|

| Market Growth | Global data center market | Projected to reach $517.1B by 2030 |

| Ferrovial's Focus | Data center projects | Investment across Europe/North America |

| Strategic Alignment | Trends | Electrification, digitalization |

Cash Cows

The 407 ETR, a toll road in Toronto, is a reliable cash cow for Ferrovial. In 2023, the road saw a 5.5% increase in traffic. Revenues from the 407 ETR consistently contribute to Ferrovial's financial stability. This asset provides steady income and dividends, proving its value. The 407 ETR's profitability is enhanced by rising mobility needs.

Existing highways in North America, like I-66 and I-77 Express, are reliable dividend distributors. These assets, generating significant cash flow, require minimal ongoing investment, fitting the cash cow profile. For instance, in 2024, these projects contributed substantially to Ferrovial's North American revenue. This strong performance boosts the company's overall financial health.

The North Tarrant Express (NTE), LBJ, and NTE 35W Express Lanes in Texas are cash cows for Ferrovial. These managed lanes benefit from the Dallas-Fort Worth area's growing population and mobility needs. Despite ongoing construction, they generate consistent revenue. For example, in 2024, the NTE generated substantial tolls.

Dalaman Airport

Dalaman Airport, a cash cow for Ferrovial, saw 5.6 million passengers in 2024, a 7.7% increase year-over-year. This strong performance stems from increased airline capacity and new routes, particularly to the UK and Europe. As a market leader, Dalaman generates substantial cash flow, exceeding its investment needs.

- Passenger growth: 7.7% increase in 2024.

- Passenger count: 5.6 million in 2024.

- Market position: Leader, cash generator.

- Key drivers: New routes, airline capacity.

Water Infrastructure Projects in the US

Ferrovial's U.S. water infrastructure projects are prime examples of cash cows, generating steady revenue. The company has secured over $200 million in contracts, with significant projects like the Walnut Branch WWTP and Geronimo Creek WWTP. These projects ensure a reliable income stream, bolstering Ferrovial's financial stability. The water infrastructure sector offers consistent returns, making it a valuable asset.

- $178 million: Value of the Walnut Branch and Geronimo Creek WWTP projects.

- Consistent Revenue: Water infrastructure provides a stable income source.

- Portfolio Contribution: These projects enhance Ferrovial's overall portfolio.

Ferrovial's cash cows, like the 407 ETR, consistently deliver financial stability through steady revenues. In 2024, Dalaman Airport saw 5.6 million passengers, boosting cash flow. U.S. water infrastructure projects add reliable income with over $200 million in contracts.

| Asset | 2024 Performance | Financial Impact |

|---|---|---|

| 407 ETR | Traffic Growth (2023): 5.5% | Provides steady revenue and dividends. |

| Dalaman Airport | 5.6 million passengers, 7.7% YoY growth | Generates substantial cash flow. |

| U.S. Water Projects | Over $200M in contracts | Ensures a reliable income stream. |

Dogs

Ferrovial's divested assets, like its 19.75% Heathrow stake sold for £2.37 billion in 2024, are "Dogs" in the BCG matrix. These no longer generate revenue. Divestitures help Ferrovial concentrate on growth. The sale of IRB stake also fits here, enhancing financial stability.

The sale of Ferrovial's 50% stake in AGS Airports signals potential underperformance. Low growth prospects and limited cash generation likely categorize these airports as dogs. Ferrovial's decision to divest aligns with shifting resources to higher-growth ventures. In 2024, AGS Airports' revenue was approximately £100 million.

Underperforming construction projects, like those in Ferrovial's portfolio, that have incurred losses or face limited future potential are classified as dogs. Turnaround strategies often prove costly. Minimizing involvement with these projects is crucial for financial health. Divesting from underperforming construction projects can enhance overall profitability. In 2024, Ferrovial's construction division saw a decrease in revenue due to project delays.

Mature or Declining Markets

In Ferrovial's BCG Matrix, "Dogs" represent business units in low-growth markets with low market share. These units typically generate minimal cash, often hovering around break-even. Divestiture is frequently considered for these operations, as they offer limited returns. For example, in 2024, Ferrovial might assess certain infrastructure projects with slow growth. The goal is to free up capital.

- Low growth, low market share.

- Often break even.

- Prime candidates for divestiture.

- Tie up money with little return.

Legacy Technologies and Processes

Legacy technologies and processes within Ferrovial, especially in low-growth markets with low market share, need careful attention. Minimizing these areas is crucial. Turnaround plans are often costly and ineffective. Streamlining operations is key to boosting efficiency. In 2024, Ferrovial's focus is on sustainable practices.

- Avoid investing in outdated technologies.

- Focus on operational efficiency improvements.

- Prioritize resource allocation to high-growth areas.

- Reduce operational costs.

Dogs in Ferrovial's BCG Matrix are underperforming assets in low-growth markets. They generate minimal cash and often lead to losses. Divestiture frees capital, as seen with the £2.37B Heathrow stake sale. By 2024, divesting from Dogs improved profitability.

| Category | Characteristic | Example (2024 Data) |

|---|---|---|

| Market Position | Low Market Share | AGS Airports, ~£100M revenue |

| Growth Rate | Low | Delayed Construction Projects |

| Financial Performance | Break-even or losses | Heathrow stake sold for £2.37B |

Question Marks

Ferrovial's Energy division, a recent addition, operates in a high-growth sector, yet holds a low market share. Despite rising revenues, the division's adjusted EBITDA remains modest. For instance, the renewable energy sector's global market was valued at approximately $881.1 billion in 2023. Strategic investments and partnerships are crucial to boosting market share and seizing opportunities in renewables.

Ferrovial's expansion into new geographies, particularly in Asia and Latin America, is classified as a question mark within the BCG matrix. These regions present substantial growth opportunities, yet Ferrovial's market presence is currently limited. For example, in 2024, infrastructure spending in Latin America is projected to increase by 6%, indicating high potential. Strategic investment decisions and thorough assessments are crucial to determine the long-term viability of these ventures. Consider that in 2023, Ferrovial's international revenue was approximately 45% of the total, highlighting the importance of global expansion.

Ferrovial's past venture into vertiports for eVTOL aircraft is a question mark in its portfolio. Although Ferrovial sold Ferrovial Vertiports to Atlantic Aviation, the AAM sector is still growing, with projections estimating a market size of $12.4 billion by 2030. It's unclear if Atlantic Aviation will capitalize on this or sell. The future of these vertiports remains uncertain.

IRB Infrastructure Trust Investment

Ferrovial's 24% stake in IRB Infrastructure Trust in India lands in the "Question Mark" quadrant of the BCG Matrix. The Indian infrastructure market boasts significant growth potential, mirroring the broader trend of emerging market expansion. However, Ferrovial's current market share is relatively small, indicating a need for strategic decisions. The company must decide whether to invest further to increase its presence or divest its stake.

- India's infrastructure sector is projected to reach $1.4 trillion by 2025.

- IRB Infrastructure Developers reported a revenue of ₹6,750.45 crore in FY24.

- Ferrovial's total revenue in 2023 was €8.5 billion.

- The decision requires assessing potential returns against the investment needed to grow market share.

Digital Infrastructure Division

Ferrovial's digital infrastructure division, led by CEO András Szakonyi, faces a critical juncture. Despite a decade of experience building data centers for major clients in Europe and the Americas, its market share remains relatively small. The BCG Matrix suggests strategic options: invest to grow or divest.

Strategic investments could boost market share, but require significant capital. Alternatively, selling the division could free up resources for more profitable ventures. The decision hinges on a thorough analysis of market trends and competitive positioning.

In 2024, the data center market is booming, with global spending expected to reach $280 billion. Ferrovial must decide if it can capture a substantial piece of this pie. The company's financial performance in 2024 will be crucial in determining the best course of action.

- Market share is key for Ferrovial.

- Data center market is expected to reach $280 billion in 2024.

- Strategic investment decisions are critical.

- Divestment could be an option.

Question marks represent high-growth, low-share business areas for Ferrovial. Strategic decisions are crucial in these quadrants. These ventures need significant investment to boost market share and are crucial for Ferrovial’s future.

| Division | Market | Status |

|---|---|---|

| Energy | Renewables | High growth, low market share |

| Geographic Expansion | Asia, Latin America | High growth potential |

| Digital Infrastructure | Data Centers | Critical Junction |

BCG Matrix Data Sources

This BCG Matrix utilizes Ferrovial's financial reports, market analysis, and industry benchmarks, ensuring a data-driven approach.