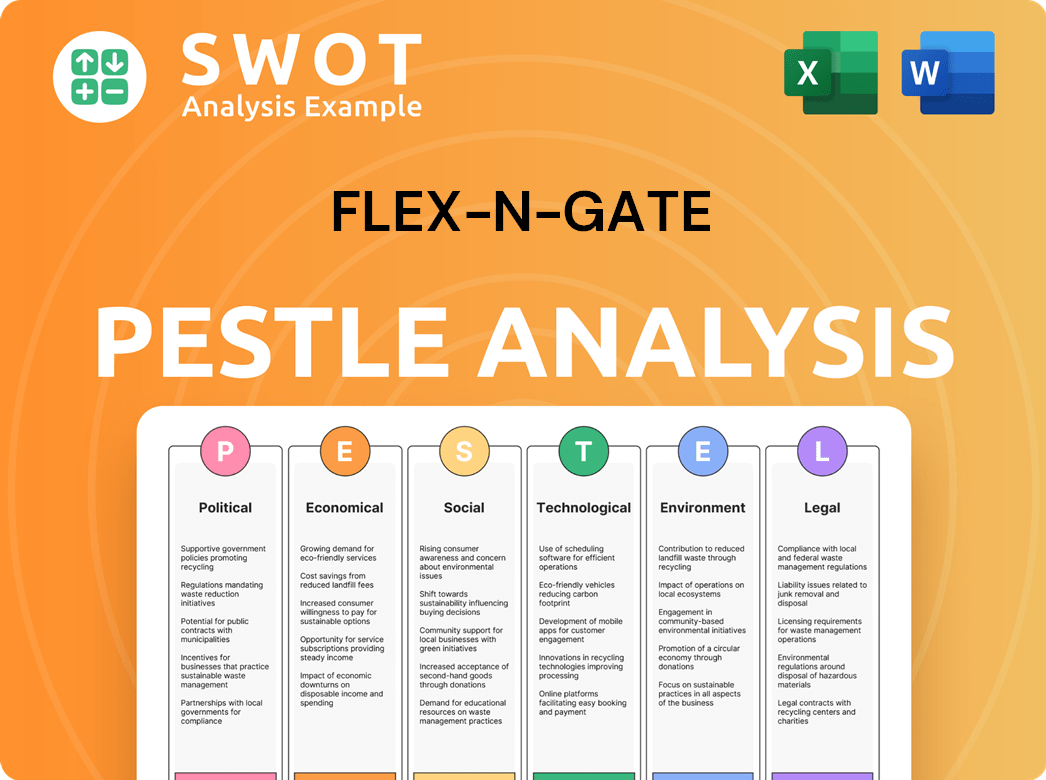

Flex-N-Gate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flex-N-Gate Bundle

What is included in the product

Analyzes external macro-environmental factors impacting Flex-N-Gate using Political, Economic, Social, etc., dimensions. Includes forward-looking insights.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Flex-N-Gate PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Flex-N-Gate PESTLE Analysis provides a detailed look at external factors influencing the company. You'll get insights into political, economic, social, technological, legal, and environmental aspects. Immediately after purchase, download the same document!

PESTLE Analysis Template

Navigating the automotive industry demands understanding the forces impacting Flex-N-Gate. Our PESTLE Analysis provides a clear view of the external factors affecting the company. Uncover how political changes, economic shifts, and more impact their operations. This vital research empowers you to make informed decisions. Download the full report now and gain a competitive edge.

Political factors

Trade policies and tariffs are crucial for Flex-N-Gate, impacting costs. The USMCA's role affects vehicle/part costs. For instance, in 2024, tariffs on steel and aluminum remain a concern. These costs can shift production and supply strategies. Changes in these agreements can influence Flex-N-Gate's profitability.

Government regulations mandate rigorous vehicle safety standards, directly impacting manufacturing. These regulations, like those from the National Highway Traffic Safety Administration (NHTSA), dictate safety features and component designs. Compliance raises production costs, but also spurs innovation; in 2024, NHTSA proposed updates to side impact standards.

Government incentives significantly impact the EV market. For example, the U.S. offers tax credits up to $7,500 for new EVs, boosting demand. In 2024, EV sales in the U.S. are projected to reach 1.5 million units. These incentives influence Flex-N-Gate's production strategies.

Political stability in key markets

Flex-N-Gate's operational success hinges on political stability in its key markets. Geopolitical risks and political changes can severely impact the company's supply chains and manufacturing capabilities. For example, political instability in regions like Eastern Europe, where automotive manufacturing is significant, can trigger disruptions. These issues may lead to increased costs or decreased sales.

- Geopolitical risks increased the volatility of the raw material prices.

- The automotive industry is experiencing shifts due to political factors, especially regarding trade policies.

- New regulations and geopolitical events could affect the company's operations.

Government support for domestic manufacturing

Government backing for domestic manufacturing significantly affects Flex-N-Gate. Subsidies or tax breaks can lower production costs, enhancing competitiveness. Conversely, protectionist policies might raise costs if Flex-N-Gate relies on imported materials. The company's strategic response depends on its global manufacturing base and market focus. For instance, the US government's CHIPS Act (2022) offers incentives, potentially benefiting domestic suppliers.

- CHIPS Act (2022) allocated $52.7 billion for semiconductor manufacturing and research in the US.

- Tax breaks and subsidies for electric vehicle (EV) component manufacturing.

- Government procurement preferences for domestically produced goods.

Political factors, like trade policies and geopolitical events, pose risks to Flex-N-Gate's operations. Regulations such as the NHTSA standards raise production costs while influencing innovation, as the U.S. projected 1.5 million EV sales in 2024. Government support for domestic manufacturing, like the CHIPS Act, can significantly impact competitiveness.

| Political Factor | Impact on Flex-N-Gate | 2024 Data/Examples |

|---|---|---|

| Trade Policies & Tariffs | Affects costs, production, and supply chains. | Tariffs on steel/aluminum remain a concern. |

| Government Regulations | Dictates safety features & design, increasing costs. | NHTSA updates side impact standards. |

| Government Incentives | Influences EV market demand and production strategy. | U.S. EV sales projected at 1.5M units. |

Economic factors

Global economic growth and consumer spending are critical for Flex-N-Gate. Strong economies boost vehicle sales, increasing demand for parts. High inflation and interest rates, however, can decrease consumer spending. In 2024, global GDP growth is projected at 3.2%, impacting the automotive sector.

Raw material costs, including steel, aluminum, and plastics, are critical for Flex-N-Gate's manufacturing. In 2024, steel prices saw fluctuations, impacting production expenses. The company must manage these costs to maintain profitability, potentially adjusting pricing. For example, in Q1 2024, steel prices rose by 5%, affecting various automotive suppliers.

Ongoing supply chain disruptions, notably the semiconductor shortage, persistently impact the automotive sector. These disruptions cause production delays and increase costs for companies like Flex-N-Gate. The automotive industry faced a 20% decline in production due to supply chain issues in 2023. This affects component availability, potentially increasing lead times and expenses. The semiconductor shortage alone cost the global auto industry $210 billion in revenue in 2021.

Currency exchange rates

Flex-N-Gate, operating globally, faces currency exchange rate risks. Changes in exchange rates affect import and export costs, impacting profitability across markets. For instance, a weaker Canadian dollar (CAD) against the US dollar (USD) could raise the cost of importing materials. This can squeeze profit margins if not hedged effectively, potentially affecting competitiveness. In 2024, the CAD/USD exchange rate fluctuated, sometimes exceeding 1.38 CAD/USD, highlighting the volatility.

- Currency fluctuations directly influence production costs.

- Hedging strategies are crucial to mitigate these risks.

- Exchange rate volatility adds complexity to financial planning.

Competition and pricing pressure

The automotive parts market is intensely competitive, featuring many suppliers vying for contracts. This competition, coupled with automakers' demands for cost reductions, creates significant pricing pressure for companies like Flex-N-Gate. In 2024, the automotive parts market saw a 5% decrease in average selling prices due to these pressures. This environment necessitates efficient operations and innovative solutions to maintain profitability. Flex-N-Gate must continuously improve its cost structure and offer competitive pricing to secure and retain business.

- The automotive parts market is highly competitive.

- Automakers pressure suppliers to reduce costs.

- Pricing pressure can negatively impact profitability.

- Companies need efficient operations to survive.

Global GDP growth influences vehicle sales and demand for parts, with a 3.2% projection in 2024. Fluctuating raw material costs, such as steel (with Q1 2024 rising by 5%), directly impact production expenses.

Currency exchange rates, like the CAD/USD rate fluctuating, add another layer of complexity, and hedging is important. Intense market competition, demonstrated by a 5% decrease in average selling prices, puts significant pressure on profits.

| Economic Factor | Impact | 2024 Data/Projections |

|---|---|---|

| Global Economic Growth | Affects vehicle sales, parts demand | Projected GDP: 3.2% |

| Raw Material Costs | Impacts production expenses | Steel price increase in Q1: 5% |

| Currency Exchange Rates | Influences import/export costs | CAD/USD fluctuation (over 1.38) |

Sociological factors

Consumer preference is shifting toward electric vehicles (EVs) and sustainable options. A 2024 study projects that EV sales will continue to grow, with the global EV market expected to reach $823.8 billion by 2030. This impacts demand for EV-related components. Flex-N-Gate must adapt to meet this evolving consumer demand for eco-friendly vehicle parts.

Changing mobility trends significantly affect Flex-N-Gate. The rise of services like Uber and vehicle subscriptions alters car ownership. This shift impacts the demand for new vehicles and parts. Flex-N-Gate must explore aftermarket components and solutions for new mobility. In 2024, subscription services grew by 15%.

The aging vehicle population is a significant sociological factor. The average age of light vehicles in the U.S. reached 12.6 years in 2024, increasing demand for aftermarket parts. This trend boosts Flex-N-Gate's aftermarket segment, offering growth opportunities. The aftermarket sector is projected to reach $477.6 billion by 2027.

Workforce demographics and skill availability

The automotive sector grapples with workforce issues. Labor shortages and a need for skilled workers, especially in EV tech and software, pose challenges. This impacts production and costs for Flex-N-Gate. The demand for skilled EV workers is rising, with an expected 30% growth by 2025.

- Shortages in skilled labor can raise production costs by up to 15%.

- The transition to EVs requires training and upskilling of 20-25% of the workforce.

- Competition for tech-skilled workers increases labor costs by 10%.

- Investments in training programs are essential to bridge the skill gap.

Consumer demand for connected and autonomous features

Consumer demand for connected and autonomous vehicle features is surging. This preference fuels the need for advanced electronics and systems. Flex-N-Gate must innovate to meet these demands. The global market for autonomous driving systems is projected to reach $60 billion by 2025.

- Autonomous driving features are growing rapidly.

- Demand for sophisticated electronics is increasing.

- Flex-N-Gate must adapt and innovate.

- The market for these systems is expanding.

Aging vehicle populations and increased demand for aftermarket parts are crucial factors for Flex-N-Gate. In 2024, the average vehicle age in the U.S. hit 12.6 years, boosting the aftermarket sector. This sector is forecast to reach $477.6 billion by 2027, highlighting significant opportunities. Simultaneously, the industry confronts labor shortages. Workforce challenges impact production.

| Factor | Impact | Data |

|---|---|---|

| Aging Vehicles | Increases demand | 12.6 years avg. age (2024) |

| Aftermarket | Boosts segment | $477.6B by 2027 forecast |

| Labor Shortages | Raises costs, impacts production | Skilled worker demand up 30% (2025 est.) |

Technological factors

The automotive industry is rapidly adopting advanced manufacturing technologies. AI, digital twins, and 3D printing are enhancing production processes. These innovations boost efficiency and cut costs. In 2024, the global 3D printing market in automotive was valued at $1.6 billion, projected to reach $3.6 billion by 2028.

The automotive industry is undergoing rapid advancements in EV technology. Battery technology and electric powertrains are key for the automotive industry. Suppliers like Flex-N-Gate need to invest in R&D. The global EV market is projected to reach $800 billion by 2027. This requires new components for evolving vehicle architectures.

Vehicles are evolving into software-defined entities with enhanced connectivity, demanding advanced electronic parts, sensors, and communication networks. This shift requires expertise in software integration and cybersecurity. The global automotive software market is projected to reach $45.6 billion by 2025. Cybersecurity threats are increasing, with automotive cybersecurity market expected to reach $8.4 billion by 2027.

Innovations in materials science

Innovations in materials science significantly impact automotive manufacturing. Flex-N-Gate leverages advancements in lightweight materials like high-strength steel and aluminum. This helps reduce vehicle weight, boosting fuel efficiency and lowering emissions. According to a 2024 report, lightweight materials can improve fuel economy by up to 10%. Flex-N-Gate’s expertise in plastics also contributes to these gains.

- Lightweight materials reduce vehicle weight.

- Improved fuel efficiency and reduced emissions.

- Flex-N-Gate utilizes advanced materials.

- Expertise in plastics and metals is key.

Autonomous driving technology development

The progress in autonomous driving tech drives demand for advanced auto parts, impacting suppliers like Flex-N-Gate. This includes high-precision sensors and sophisticated communication systems, a key tech area. The market for autonomous driving components is projected to reach $90 billion by 2025, growing rapidly. Flex-N-Gate must innovate to stay competitive in this evolving landscape.

- Market for autonomous driving components is forecast to hit $90B by 2025.

- Key tech includes sensors and advanced communications.

- Suppliers must adapt to tech changes.

Manufacturing tech, like AI and 3D printing, increases efficiency. The 3D printing automotive market was $1.6B in 2024, expected to hit $3.6B by 2028. This includes advanced EV tech like batteries, set to reach $800B by 2027. Vehicles are now software-defined, driving automotive software, that's expected to be a $45.6B market by 2025.

| Technology Area | Market Size (2024) | Projected Market (2027/2028) |

|---|---|---|

| 3D Printing in Automotive | $1.6 Billion | $3.6 Billion (2028) |

| EV Market | N/A | $800 Billion (2027) |

| Automotive Software | N/A | $45.6 Billion (2025) |

Legal factors

Flex-N-Gate faces stringent environmental regulations, particularly regarding vehicle emissions. Governments worldwide are tightening CO2 reduction targets, pushing for cleaner technologies. This impacts design and manufacturing, increasing costs. For instance, the EU's new emissions standards mandate significant reductions by 2030.

Vehicle safety regulations are constantly evolving, requiring automotive parts manufacturers like Flex-N-Gate to adapt. New standards for features such as advanced driver-assistance systems (ADAS) and crashworthiness impact design. Compliance involves significant investment in R&D and manufacturing processes. For 2024, the global automotive safety systems market is projected at $55 billion, growing to $70 billion by 2025.

Flex-N-Gate must navigate complex trade regulations. These include tariffs and import/export restrictions, which affect their global operations. The company is likely influenced by regional trade agreements. For example, in 2024, the USMCA trade agreement continued to shape automotive part trade. Tariffs can significantly raise costs, impacting profitability.

Labor laws and regulations

Flex-N-Gate, as a major automotive supplier, must navigate complex labor laws that significantly impact its operations. These include regulations on wages, working hours, and workplace safety, which directly affect production costs. Union negotiations, where present, play a crucial role in setting labor agreements and influencing the company's financial outlook. Compliance with these laws is essential for maintaining legal standing and avoiding penalties that could harm profitability.

- In 2024, the U.S. Department of Labor reported an average hourly wage of $30.36 for manufacturing workers.

- The United Auto Workers (UAW) union has a significant presence in the automotive industry, affecting labor agreements.

- Flex-N-Gate's labor costs account for approximately 40% of its total operating expenses.

Product liability and consumer protection laws

Flex-N-Gate, as an automotive parts supplier, faces stringent product liability and consumer protection laws. These regulations mandate that components meet specific safety and quality standards to protect consumers. Non-compliance can lead to costly lawsuits, recalls, and damage to the company's brand. In 2024, the National Highway Traffic Safety Administration (NHTSA) issued over 400 recall campaigns, highlighting the importance of adherence to these laws.

- Product recalls in the automotive industry cost an average of $100 million per recall.

- Consumer protection lawsuits can result in significant financial penalties and reputational damage.

- Compliance with international standards, such as those in the EU, adds complexity.

Labor laws, impacting wages, working hours, and workplace safety, are significant for Flex-N-Gate, affecting production costs. Union agreements also play a vital role in labor costs. In 2024, the U.S. manufacturing workers' average wage was $30.36 per hour.

Flex-N-Gate must meet complex product liability regulations, ensuring components meet safety standards. Non-compliance may result in costly recalls, such as the average cost of $100 million per recall. The NHTSA issued over 400 recall campaigns in 2024.

| Regulation Type | Impact on Flex-N-Gate | Financial Consequence (Example) |

|---|---|---|

| Labor Laws | Affects production costs | U.S. Manufacturing Average Wage: $30.36/hr (2024) |

| Product Liability | May cause recalls, lawsuits | Avg. Recall Cost: $100M (2024) |

| Trade Regulations | Influence tariffs & import/export. | USMCA shaping trade in 2024 |

Environmental factors

Flex-N-Gate faces mounting pressure to adopt eco-friendly practices. This involves using recycled materials and reducing waste. For instance, the automotive industry aims for 25% recycled content in new vehicles by 2025. The company's ability to adapt to circular economy models will impact its competitiveness. This could mean investing in recycling processes and sustainable sourcing.

Automakers and suppliers like Flex-N-Gate are under pressure to cut carbon footprints. This drives investments in renewables and boosts production efficiency. For instance, the automotive sector aims for a 37.1% emissions reduction by 2030. Lighter components also become crucial. Flex-N-Gate’s initiatives align with these trends.

Flex-N-Gate faces stricter regulations on material usage and recycling. The EU's End-of-Life Vehicles Directive, updated in 2023, targets higher recycling rates. This pushes the company to use more recycled plastics. The automotive plastics market is projected to reach $32.9 billion by 2025.

Water usage and waste management

Flex-N-Gate faces environmental scrutiny regarding water usage and waste management. Regulations mandate reduced water consumption and efficient waste disposal. The company's sustainability goals drive these practices further. Effective waste management is crucial for compliance and cost savings.

- Water scarcity and waste disposal costs are rising.

- Flex-N-Gate invests in recycling and water-saving technologies.

- Compliance failures lead to fines and reputational damage.

- Sustainability reports show environmental performance data.

Impact of climate change on operations and supply chain

Climate change poses significant risks to Flex-N-Gate's operations and supply chains. Extreme weather events, such as floods and hurricanes, could disrupt manufacturing facilities and distribution networks. Resource scarcity, including water and raw materials, may also impact production costs and availability. For example, the automotive industry faces potential supply chain disruptions due to climate-related events, with estimated losses reaching billions of dollars annually by 2030.

- Disruptions from extreme weather can lead to production delays and increased costs.

- Resource scarcity could drive up the prices of essential materials.

- Companies must invest in climate resilience strategies, such as diversifying suppliers and improving infrastructure.

Flex-N-Gate navigates escalating environmental pressures. Automotive aims include 25% recycled content by 2025 and 37.1% emissions reduction by 2030. Stricter EU regulations and the growing $32.9B automotive plastics market by 2025 further shape company actions. Climate risks amplify operational vulnerabilities, spurring climate resilience.

| Environmental Factor | Impact | 2024-2025 Data |

|---|---|---|

| Recycled Content Mandates | Drives material innovation & circularity | Automotive aiming 25% recycled content. |

| Carbon Footprint Reduction | Investment in renewables & efficiency | Sector aims 37.1% emissions cut by 2030. |

| Resource Scarcity | Raises costs and supply chain issues | Water costs & waste disposal costs increase. |

PESTLE Analysis Data Sources

The Flex-N-Gate PESTLE analysis relies on governmental data, industry reports, and market analysis to build a factual and insightful picture.