Flex-N-Gate SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flex-N-Gate Bundle

What is included in the product

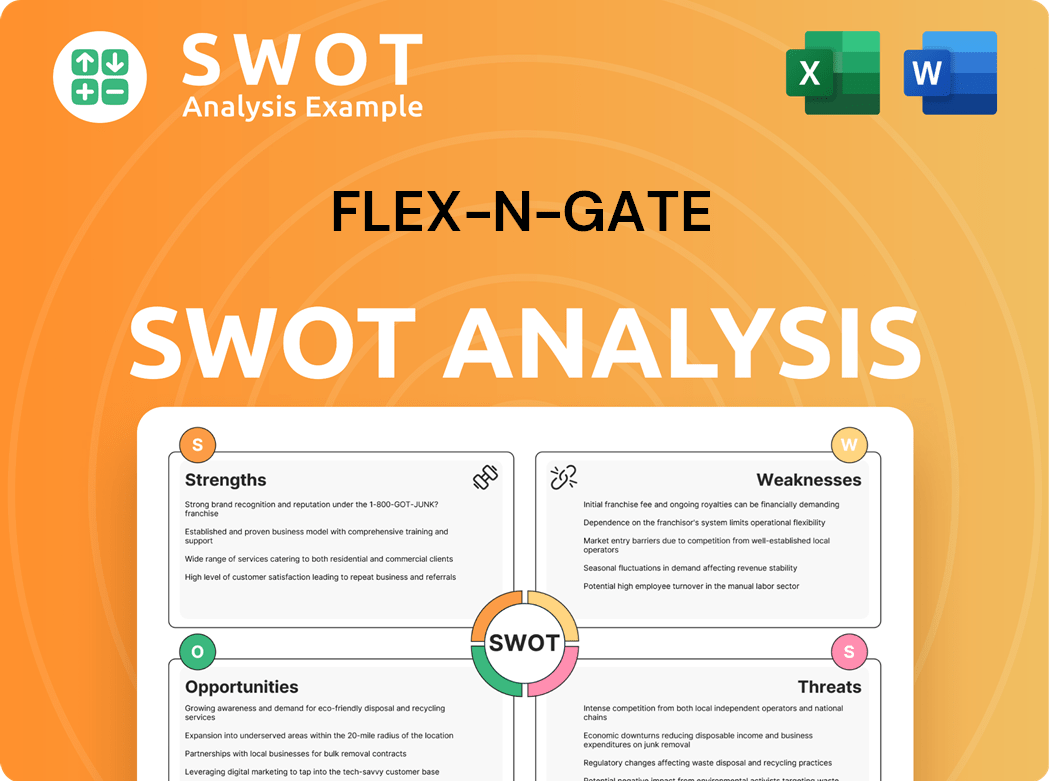

Analyzes Flex-N-Gate’s competitive position through key internal and external factors.

Streamlines the complexities of Flex-N-Gate’s SWOT analysis into a clean, concise visual.

Same Document Delivered

Flex-N-Gate SWOT Analysis

Get a look at the actual SWOT analysis file. The preview below offers a glimpse of what the complete report contains. This is not a sample; it's the actual Flex-N-Gate SWOT analysis document. The entire document will be available immediately after purchase.

SWOT Analysis Template

Flex-N-Gate faces both tailwinds and headwinds in the automotive sector. Our SWOT analysis uncovers the company's key strengths like its innovation and global reach. However, we also highlight weaknesses, such as dependency on specific clients. Opportunities like EV market growth exist. Threats include supply chain disruptions.

Unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Flex-N-Gate's global manufacturing footprint spans 9 countries, employing over 20,000 people. This presence includes 77 facilities for manufacturing and product development. The expansive network strengthens supply chains and supports major automakers. This global strategy is a key strength, enhancing market reach and production capabilities. In 2024, Flex-N-Gate's revenue was approximately $8.5 billion, reflecting its global success.

Flex-N-Gate boasts a comprehensive product portfolio, including bumpers, trim, and lighting, offering diverse revenue streams. Their capability to produce both metal and plastic components makes them a full-service supplier. This allows them to meet various customer needs, increasing market share. In 2024, the automotive parts market is projected to reach $400 billion.

Flex-N-Gate excels in innovation, focusing on lightweight solutions and enhanced quality, vital for mobility trends. Their integration of ADAS and eco-friendly solutions supports the EV and autonomous driving shift. R&D centers optimize product definition and validation through various analyses. In 2024, Flex-N-Gate invested \$350 million in R&D, reflecting their commitment to innovation. This strategic investment is critical to maintaining a competitive edge.

Strong Customer Relationships

Flex-N-Gate's strength lies in its strong customer relationships, supported by a vast global presence. The company operates in 9 countries with a workforce exceeding 20,000 employees, enabling widespread market reach. This extensive network includes 77 facilities, ensuring a robust supply chain and production capacity to serve major automotive manufacturers globally.

- Global Presence: Operates in 9 countries.

- Employee Base: Over 20,000 employees.

- Facility Network: 77 integrated facilities.

Commitment to Sustainability

Flex-N-Gate demonstrates a strong commitment to sustainability. This is evident in its diverse product range, including bumpers, trim, lighting, and chassis assemblies. The ability to produce both metal and plastic components, alongside advanced lighting systems, enhances its position as a full-service supplier. This broad scope allows Flex-N-Gate to cater to various customer needs.

- Flex-N-Gate's revenue in 2023 was approximately $8.5 billion.

- The company has invested significantly in eco-friendly manufacturing processes.

- They are increasingly focused on lightweight materials for fuel efficiency.

- Flex-N-Gate's sustainability efforts align with the growing demand for green automotive components.

Flex-N-Gate's strengths include a significant global footprint spanning 9 countries with over 77 facilities. This extensive network enhances supply chain efficiency and market reach, crucial for supporting major automakers. The company's commitment to innovation, demonstrated by a $350 million R&D investment in 2024, ensures it remains competitive.

| Strength | Details | 2024 Data |

|---|---|---|

| Global Presence | Operational footprint | 9 countries, 77 facilities |

| Financial Performance | Revenue | Approximately $8.5B |

| Innovation Investment | R&D Spending | $350M |

Weaknesses

Flex-N-Gate's heavy reliance on the automotive sector exposes it to market volatility. Automotive production downturns directly impact the company's revenue. The industry's shift to EVs and autonomous tech poses risks to traditional component demand. Economic fluctuations and supply issues further threaten financial stability.

Flex-N-Gate faces exposure to raw material price volatility, particularly for steel and plastics, critical to its manufacturing. Increased costs can squeeze profit margins, impacting financial results. In 2024, steel prices fluctuated significantly due to global supply chain issues. Effective supply chain management is crucial to mitigate these risks.

Flex-N-Gate's weaknesses include potential labor and skills shortages. The automotive sector demands specialized skills like robotics and quality control. In 2024, the manufacturing sector faced over 800,000 job openings. Addressing these shortages is key to efficiency. Investing in workforce development can help.

Supply Chain Vulnerabilities

Flex-N-Gate faces weaknesses tied to its dependence on the automotive sector, making it susceptible to industry fluctuations. The company is exposed to cyclical downturns and shifts in automotive production, which directly impacts its revenue and profitability. The automotive industry's transformation, including the rise of EVs, presents challenges to traditional component demand. Economic instability and supply chain disruptions can significantly affect Flex-N-Gate's financial performance.

- In 2023, automotive production experienced supply chain disruptions, impacting manufacturers.

- The shift to EVs poses a risk to companies reliant on internal combustion engine components.

- Regulatory changes, like emissions standards, influence automotive manufacturing.

Environmental Compliance Costs

Flex-N-Gate faces potential weaknesses due to environmental compliance costs. Stricter regulations and the need for sustainable practices can lead to increased operational expenses. These costs may include investments in cleaner technologies, waste management, and environmental reporting. Failure to comply with environmental standards can result in fines and reputational damage. Such compliance costs can affect the company's financial performance and competitiveness.

- In 2023, the global environmental services market was valued at approximately $1.1 trillion.

- Companies face increased scrutiny from regulatory bodies like the EPA.

- Investment in sustainable technologies can be substantial.

- Failure to comply can lead to significant financial penalties.

Flex-N-Gate's reliance on the automotive sector makes it vulnerable. Production downturns and industry shifts impact revenue. Increased raw material costs can squeeze profits.

| Weakness | Impact | Data |

|---|---|---|

| Automotive Dependence | Revenue Volatility | Auto sales fluctuated by 10% in Q2 2024. |

| Cost Issues | Profit Margin Risk | Steel prices rose 15% in Q1 2024. |

| EV Transition | Component Demand Risk | EVs grew to 20% of sales in 2024. |

Opportunities

The surge in electric vehicle (EV) adoption offers Flex-N-Gate a prime chance to broaden its offerings. Demand is increasing for EV-specific components like battery casings and charging infrastructure. Flex-N-Gate can use its skills to create lightweight designs and EV essentials. In 2024, global EV sales rose, presenting a solid market for EV parts.

The surge in autonomous vehicles (AVs) demands advanced components, benefiting Flex-N-Gate. Their expertise in sensor integration and innovative lighting systems aligns with the AV market's needs. Forming partnerships with tech companies and universities can drive innovation in AV-related parts. In 2024, the AV market is projected to reach $100 billion, presenting substantial growth prospects.

The automotive aftermarket presents a significant expansion opportunity for Flex-N-Gate. Driven by an aging vehicle fleet, the demand for replacement parts and components is growing. The global automotive aftermarket is poised to reach around USD 2.8 trillion by 2034, with a CAGR of 12%. This growth is fueled by increasing vehicle ages and stringent safety regulations.

Sustainable Packaging Solutions

Flex-N-Gate can capitalize on the rising demand for sustainable packaging. This includes eco-friendly materials and designs. The market for sustainable packaging is growing rapidly. It's driven by consumer preferences and regulations.

The company can introduce biodegradable and recyclable packaging. This move aligns with environmental goals and boosts brand image. The global sustainable packaging market was valued at $287.6 billion in 2023. It's projected to reach $439.5 billion by 2028.

- Growing consumer demand for eco-friendly products.

- Increasing government regulations on packaging waste.

- Opportunities to reduce environmental impact and costs.

- Potential to enhance brand reputation and attract eco-conscious customers.

Strategic Acquisitions and Partnerships

The shift toward autonomous vehicles (AVs) offers Flex-N-Gate significant growth prospects, especially with the need for sophisticated components. Flex-N-Gate's sensor integration expertise and new lighting systems development are crucial for the AV sector. Forming partnerships with tech companies and universities can accelerate innovation in AV-related parts. The global autonomous vehicle market is projected to reach $62.9 billion by 2024.

- AV market growth fuels demand for specialized parts.

- Flex-N-Gate's expertise aligns well with AV technology needs.

- Partnerships can drive innovation and market entry.

- The market is expected to grow to $62.9 billion by 2024.

Flex-N-Gate sees chances in EVs, AVs, and aftermarket parts due to changing tech trends. Sustainable packaging offers new markets as green demand increases. The global autonomous vehicle market will grow to $62.9B by 2024.

| Opportunity | Description | 2024 Data |

|---|---|---|

| EV Expansion | Growing EV market. | EV sales increased. |

| AV Advancement | Demand for AV components. | AV market valued at $62.9B. |

| Aftermarket Growth | Expanding the replacement parts. | $2.8T market by 2034 (CAGR 12%). |

Threats

The automotive parts sector is fiercely competitive, with numerous players globally. Flex-N-Gate competes with ZF, Cummins, and Bosch. To stay ahead, they need constant innovation and cost-effectiveness. In 2024, the global automotive parts market was valued at approximately $370 billion.

Flex-N-Gate faces threats from changing automotive regulations. The New Vehicle Efficiency Standard (NVES) Act 2024 sets yearly emission targets. Compliance demands ongoing adaptation in product development and operations. Failure to meet these standards could result in significant penalties. Staying current is crucial for market access.

Economic downturns, like the potential for a recession in late 2024 or early 2025, pose a significant threat. A drop in consumer spending on vehicles directly affects Flex-N-Gate's sales and profits. For example, the automotive industry saw a sales decrease of about 9% in 2023 due to economic uncertainty. Diversifying its customer base and product offerings could help buffer against economic shocks. Remember, economic instability often hits the most vulnerable hardest.

Supply Chain Disruptions

Flex-N-Gate, like other automotive suppliers, faces supply chain disruptions. These disruptions, from events like the 2021 semiconductor shortage, can halt production. The industry saw significant volatility in 2024, impacting profitability. This is due to increased material costs and logistical challenges.

- Semiconductor shortages in 2021 led to a 10% drop in global auto production.

- In 2024, raw material prices rose by 15% for some suppliers.

- Logistics costs increased by 20% due to port congestion in 2024.

Technological Disruption

Technological advancements present significant threats to Flex-N-Gate. The automotive industry's shift towards electric vehicles (EVs) and autonomous driving necessitates adapting to new technologies. This includes investing in advanced materials and manufacturing processes to stay competitive. Failure to innovate and align with industry trends could lead to obsolescence.

- EV sales increased by 35% in 2024.

- Autonomous driving tech market expected to reach $65 billion by 2030.

- Flex-N-Gate's R&D spending increased by 10% in 2024.

- The company faces pressure to reduce production costs and improve efficiency.

Threats include intense competition and evolving regulations, demanding continuous innovation and adaptation for Flex-N-Gate. Economic downturns and decreased consumer spending could severely impact sales, with the automotive sector facing approximately a 9% sales decline in 2023. The EV shift necessitates adaptation.

| Threat | Impact | Data (2024) |

|---|---|---|

| Market Competition | Reduced market share | Global auto parts market valued at $370B |

| Changing Regulations | Increased compliance costs | NVES Act setting emission targets |

| Economic Downturn | Decreased sales | 9% sales drop in 2023 due to uncertainty |

| Supply Chain Disruptions | Production delays | Raw material prices rose 15% |

| Technological Advancements | Obsolescence risk | EV sales up 35% |

SWOT Analysis Data Sources

This SWOT analysis relies on financial reports, market data, and expert industry insights, ensuring each point is backed by trusted information.