Flow Traders Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

What is included in the product

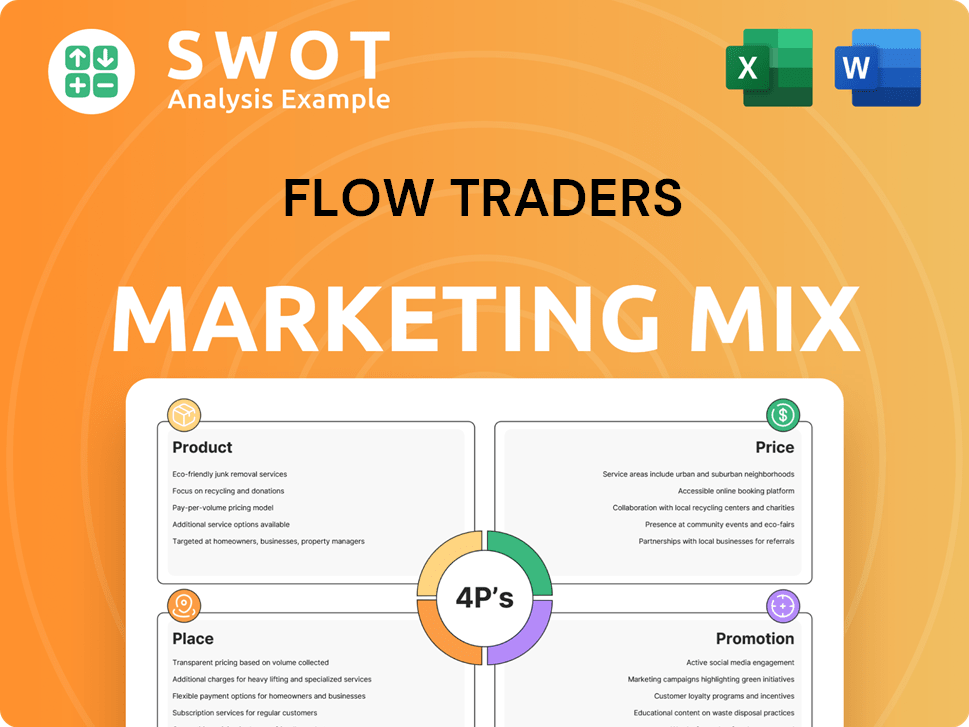

Provides a thorough analysis of Flow Traders' marketing, examining Product, Price, Place, and Promotion strategies.

Flow Traders 4Ps Analysis: Delivers strategic clarity. Perfect for meetings or succinct overviews.

Same Document Delivered

Flow Traders 4P's Marketing Mix Analysis

This preview of the Flow Traders 4Ps Marketing Mix is what you get immediately. It's the complete, finalized document.

4P's Marketing Mix Analysis Template

Flow Traders navigates the complex world of trading. Their product: market access. Pricing? Based on volume & market volatility. Distribution: electronic platforms. Promotion: subtle, focused branding. This offers crucial insights into their methods. Analyzing these aspects unlocks strategic understanding. Curious? Purchase the in-depth Marketing Mix Analysis for practical application!

Product

Flow Traders excels in providing liquidity for ETPs, a core product. They facilitate seamless trading by continuously buying and selling ETPs on exchanges. As market makers, they reduce the bid-ask spread, enhancing trading efficiency. In 2024, the ETP market saw significant growth, with global assets reaching over $12 trillion, highlighting the importance of their services.

Flow Traders has broadened its scope beyond Exchange Traded Products (ETPs). The firm now offers liquidity in fixed income, commodities, FX, and digital assets. This strategic shift aims to diversify revenue streams and capture new market opportunities. By 2024, this diversification contributed significantly to overall trading volume, increasing it by 15%.

Flow Traders relies on a cutting-edge proprietary trading technology platform. This platform is essential for their high-frequency trading, allowing quick price quotes and risk management. In 2023, Flow Traders' net trading income was €736.1 million, showcasing the platform's impact. The technology supports trading in over 10,000 financial instruments worldwide.

Strategic Investments in Financial Innovation

Flow Traders strategically invests in financial innovation through a specialized unit, supporting advancements within the financial ecosystem. This approach enhances market transparency and operational efficiency. These investments totaled approximately $10 million in 2024, focusing on fintech startups. Flow Traders aims to remain at the forefront of market evolution by fostering innovation.

- Investment Focus: Fintech, market infrastructure.

- 2024 Investment: Approximately $10 million.

- Strategic Goal: Enhance market efficiency and transparency.

- Impact: Supporting development of innovative financial solutions.

Continuous Trading in Global Markets

Flow Traders' product strategy focuses on continuous trading in global markets. The firm offers 24/7 liquidity on major exchanges worldwide. This constant availability is vital for investors across different time zones. For instance, in 2024, Flow Traders traded an average daily volume of €20.8 billion.

- 24/7 trading ensures liquidity for global participants.

- Flow Traders' 2024 ADV was €20.8 billion.

- Global presence is key to market access.

Flow Traders' core product is liquidity provision for various instruments, like ETPs. They constantly provide bid and ask prices, making it easier for investors to trade. The firm's expansion to different asset classes showcases adaptability.

| Product Aspect | Details | Impact |

|---|---|---|

| Core Offering | Liquidity for ETPs and other assets. | Improves trading efficiency |

| Asset Class Expansion | Fixed income, commodities, FX, digital assets. | Diversifies revenue. |

| 24/7 Market Access | Continuous trading services worldwide. | Facilitates global trading. |

Place

Flow Traders boasts a substantial global presence, offering liquidity on prominent exchanges spanning Europe, the Americas, and Asia. They have trading desks strategically located in key regions. In 2024, the firm's global presence facilitated approximately €2.7 billion in daily trading volume. This global approach allows for 24/7 market coverage.

Flow Traders facilitates trading through both on-screen and off-exchange channels. On-screen trading occurs on regulated exchanges, while off-exchange trading involves direct transactions with institutional clients. In 2024, off-exchange trading accounted for a significant portion of overall market activity, providing tailored liquidity solutions. For Q1 2024, Flow Traders reported a trading volume of EUR 196 billion. The off-exchange trading, especially via RFQ platforms, allows for efficient execution of large orders.

Flow Traders utilizes advanced proprietary technology, crucial for its global market access. Their infrastructure spans multiple trading platforms worldwide, ensuring broad market coverage. This technology enabled Flow Traders to trade an average daily volume of EUR 20.7 billion in Q1 2024. They efficiently connect with diverse counterparties, optimizing trading.

Physical Office Locations

Flow Traders strategically places physical offices globally to support its 24/7 trading operations and client needs. Key locations include Amsterdam, New York, and London, reflecting significant trading volumes. The firm also maintains a presence in Milan, Paris, and other cities, demonstrating its extensive global reach. These offices facilitate direct client interactions and ensure continuous market access.

- Amsterdam: Headquarters, crucial for European trading.

- New York: Key for North American market operations.

- London: Important hub for global financial activities.

- Singapore: Strategic location for Asia-Pacific markets.

Connectivity with Counterparties

Flow Traders' strong connectivity with over 2,000 counterparties is key for its market role. This broad network enables efficient trade execution and liquidity provision. The firm's ability to connect with various market participants facilitates its trading operations. Data from 2024 shows that Flow Traders executed an average daily volume of €18.3 billion.

- Extensive Network: Over 2,000 counterparties.

- Trade Facilitation: Enables smooth trade execution.

- Liquidity Provision: Supports market liquidity.

- Daily Volume: Average €18.3 billion in 2024.

Flow Traders' 'Place' strategy centers on its worldwide physical and digital presence. Offices in major financial hubs ensure constant market access and facilitate client interactions. This structure supports its trading volume and helps maintain market connectivity.

| Aspect | Details | Data (2024) |

|---|---|---|

| Global Presence | Strategic office locations worldwide | Amsterdam, NY, London, Singapore, other cities |

| Trading Volume | Average daily trading volume facilitated. | €18.3 billion daily |

| Counterparties | Network of entities enabling trade execution | Over 2,000 |

Promotion

Flow Traders spotlights its commitment to market transparency and efficiency. They communicate how their liquidity provision supports well-functioning financial markets. For example, in 2024, Flow Traders executed over 200 million trades. This approach aligns with the growing investor demand for clear, efficient market operations. The company's focus on transparency builds trust and enhances market stability.

Flow Traders excels in thought leadership, releasing reports on market trends. They focus on ETPs, digital assets, and fixed income. This expert positioning boosts market education. In Q1 2024, ETP trading volume reached $3.5 trillion globally.

Flow Traders actively engages in industry events, boosting its profile. They attend high-profile forums like the World Economic Forum. This participation strengthens their influence within the financial sector. In 2024, Flow Traders' revenue was approximately EUR 1.2 billion.

Investor Relations and Reporting

Flow Traders focuses on investor relations through regular updates. They share trading data, financial results, and annual reports to keep shareholders informed. This commitment to transparency helps build trust with investors and the financial world. In 2024, the company's annual report showed a net profit of €154.3 million.

- Trading updates released quarterly.

- Annual reports published yearly.

- Dedicated IR team for shareholder inquiries.

- Focus on clear and timely financial disclosures.

Strategic Partnerships and Collaborations

Flow Traders strategically partners with entities like blockchain associations and tech providers, including AWS and Wormhole. These alliances bolster their capacity and market presence, especially in digital assets. Such collaborations are crucial for navigating the ever-changing crypto landscape. For example, in 2024, Flow Traders expanded its collaborations to enhance its digital asset trading infrastructure.

- Partnerships expand market reach and capabilities.

- Focus on digital asset space is crucial.

- Collaborations enhance technological infrastructure.

- Strategic alliances are vital for growth.

Flow Traders' promotion strategies focus on market transparency and thought leadership. They actively participate in industry events and build strong investor relations. In 2024, Flow Traders reported a significant revenue, enhancing its market position.

| Aspect | Details | Impact |

|---|---|---|

| Market Transparency | Regular financial disclosures and trading updates. | Builds trust and ensures market stability. |

| Thought Leadership | Reports on market trends. | Enhances market education. |

| Investor Relations | Dedicated IR team. | Strengthens shareholder trust. |

Price

Flow Traders profits from the bid-ask spread, the difference between buying and selling prices. This is their main revenue source. In 2024, the spread contributed significantly to their €700 million net trading income. Their efficiency in managing these spreads is key to profitability.

Flow Traders' profitability is heavily tied to trading volume and market volatility. Increased volatility and trading activity create more chances for them to profit from their liquidity services. In 2024, the company saw a significant increase in trading volumes, particularly in ETFs, which boosted their revenue. For example, a 20% rise in market volatility can lead to a 15% increase in their trading revenue.

Flow Traders' pricing hinges on effective risk management. Their capacity to mitigate risks linked to asset positions influences pricing decisions. For instance, in Q1 2024, they reported a risk-weighted assets decrease. This directly affects the prices offered on various assets.

Competitive Pricing in a Fierce Market

Flow Traders faces intense competition in the high-frequency trading arena. Their pricing strategy centers on providing competitive prices, specifically tight bid-ask spreads, to draw in substantial trading volume. This approach is vital for maintaining market share against rivals. For instance, in 2024, Flow Traders handled an average daily trading volume of over EUR 20 billion.

- Tight bid-ask spreads attract traders.

- High trading volume is a key goal.

- Competition demands sharp pricing.

Impact of Operating Expenses

Flow Traders' profitability hinges significantly on managing operating expenses, which include technology and employee costs. In 2024, the company's operating expenses were approximately €350 million, a key factor in determining net profit. Efficient cost management is crucial because, although revenue is driven by trading activities, these expenses directly impact the bottom line. Maintaining profitability is vital for investor confidence and future growth.

- Operating expenses in 2024 were around €350 million.

- Technology costs are a significant component.

- Employee costs also play a crucial role.

- Profitability depends on effective cost management.

Flow Traders' pricing strategy centers around tight bid-ask spreads, crucial for attracting trading volume in a competitive landscape. These spreads directly influence their revenue, with competitive pricing vital for market share. Maintaining low expenses is also a crucial factor in ensuring profit in this context.

| Aspect | Details | Impact |

|---|---|---|

| Spread Management | Key revenue source; 2024 contributed significantly | Affects overall profitability directly. |

| Competition | Competitive market; needs sharp pricing | Helps retain/grow market share. |

| Expense | Approximately €350 million in 2024. | Needs cost efficiency to ensure profit. |

4P's Marketing Mix Analysis Data Sources

The 4P's analysis draws from Flow Traders' public filings, investor presentations, industry reports, and trading platform data. We leverage these to analyze strategy.