Flow Traders PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flow Traders Bundle

What is included in the product

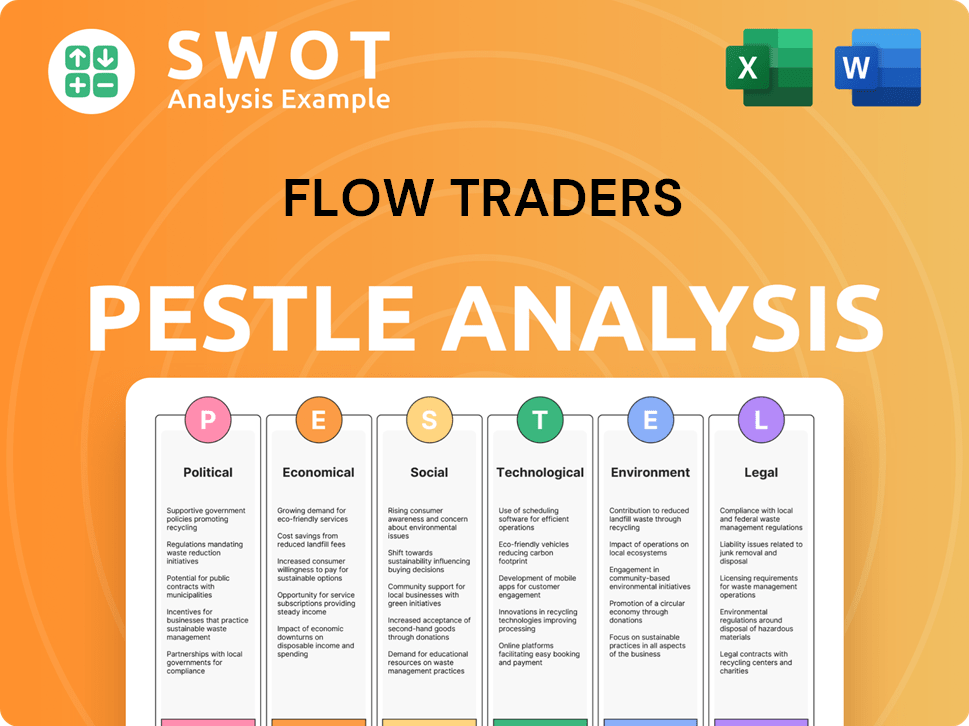

It examines how external macro factors impact Flow Traders across political, economic, social, tech, environmental, and legal realms.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

Flow Traders PESTLE Analysis

The preview offers a glimpse of the comprehensive Flow Traders PESTLE analysis.

It explores the company's Political, Economic, Social, Technological, Legal, and Environmental factors.

This detailed analysis is delivered as is.

After purchasing, you’ll download the exact document you’re previewing.

Fully formatted, and professionally crafted; ready to download and use!

PESTLE Analysis Template

Flow Traders operates in a dynamic global landscape, heavily influenced by various external forces. Our PESTLE Analysis unveils these critical factors impacting the firm, from regulatory changes to technological advancements. We examine the political climate's effect on trading and economic trends shaping the markets Flow Traders operates in. Understand the social shifts impacting its workforce and client base, along with legal frameworks and environmental considerations. This comprehensive analysis provides essential insights for investors and stakeholders. Get the full version for actionable strategies.

Political factors

Government policies, like fiscal adjustments and trade tariffs, heavily influence financial markets. For instance, the U.S. government's fiscal policy in 2024, with potential tax reforms, directly affects market sentiment. Trade regulations, such as the U.S.-China trade tariffs, also play a role. Labor laws, too, affect operational costs. These factors can shift market volatility and trading volumes, impacting Flow Traders' profitability.

Flow Traders' success hinges on political stability. Unstable regions increase market risks. For instance, emerging markets saw volatility in 2024 due to political events. This impacts trading volumes and profitability. Therefore, monitoring global political landscapes is vital for Flow Traders.

Flow Traders, operating globally, faces risks from international relations and trade policies. For instance, the Russia-Ukraine conflict significantly impacted global markets in 2022 and 2023. Changes in trade agreements, like those potentially impacting the EU, can alter trading costs and volumes. Political instability in key markets creates uncertainty, affecting investment decisions and trading strategies. The firm must monitor geopolitical events to adjust its operations.

Regulatory Environment for Financial Markets

Flow Traders faces a complex regulatory landscape. Regulations regarding ETPs and digital assets are evolving rapidly. These changes influence Flow Traders' operations and compliance demands. For instance, the SEC's increased scrutiny of crypto ETPs affects market access. Regulatory shifts can alter strategic choices and increase costs.

- SEC fines and compliance costs are rising, impacting profitability.

- The EU's MiCA regulation introduces new rules for digital asset trading.

- Changes in reporting requirements affect operational efficiency.

Government Support for Financial Innovation

Government backing for financial innovation significantly impacts Flow Traders. Initiatives promoting financial technology and digital assets offer expansion opportunities. For instance, in 2024, global fintech funding reached $51.7 billion. Such support aids the electronification of trading, crucial for Flow Traders.

- Regulatory Support: Favorable regulations can reduce operational costs.

- Incentives: Tax breaks or grants for fintech ventures.

- Digital Asset Frameworks: Clear rules for crypto trading.

- Public-Private Partnerships: Collaboration to drive innovation.

Political factors like fiscal policies and trade regulations substantially impact market dynamics and trading volumes, influencing Flow Traders' financial performance. Instability in key markets elevates risks, as observed with the Russia-Ukraine conflict's market impacts in 2022-2023, causing uncertainty. Increased regulatory scrutiny, such as the SEC's focus on crypto ETPs, can affect market access, and the firm's ability to comply will influence the ability to remain competitive. In 2024, global fintech funding totaled $51.7 billion, and governmental backing for financial innovation offers expansion possibilities for entities such as Flow Traders.

| Political Factor | Impact | Example (2024-2025) |

|---|---|---|

| Fiscal Policy | Market Sentiment, Volatility | U.S. tax reforms. |

| Trade Regulations | Trading Costs, Volumes | US-China trade tariffs |

| Geopolitical Instability | Risk, Uncertainty | Emerging market volatility |

Economic factors

Market volatility significantly influences Flow Traders' earnings. Increased volatility typically boosts trading volumes and spreads, directly benefiting their net trading income. In 2024, periods of heightened market volatility, such as those seen during geopolitical events, often led to substantial profit increases. For example, during Q1 2024, Flow Traders reported a significant rise in trading revenue due to increased volatility in various asset classes.

Interest rates and inflation are critical economic factors. Rising rates can make bonds more appealing, potentially diverting funds from riskier assets. Inflation erodes purchasing power, impacting investor decisions and trading volumes. In the U.S., the Federal Reserve held rates steady in May 2024. The inflation rate was 3.3% as of April 2024.

Economic expansion is crucial for Flow Traders. Strong GDP growth in key markets like the US and Europe boosts trading activity. For instance, the US GDP grew by 3.3% in Q4 2023, signaling potential for increased market participation. This growth can lead to higher trading volumes and profitability. Conversely, economic downturns could decrease trading activity.

ETP Market Growth

The expansion of the Exchange Traded Product (ETP) market directly impacts Flow Traders. Increased assets under management (AUM) in ETPs often correlate with higher trading volumes, which benefits Flow Traders. The ETP market's growth offers considerable opportunities for Flow Traders to expand its business operations. Global ETP assets reached approximately $12 trillion by the end of 2024, indicating a strong growth trajectory.

- Continued ETP market growth provides more trading opportunities.

- Increased AUM in ETPs often leads to higher trading volumes.

- Flow Traders can capitalize on the ETP market's expansion.

Liquidity in Financial Markets

Flow Traders' core business revolves around providing liquidity in financial markets. Overall market liquidity, significantly influenced by central bank policies and periods of market stress, directly affects their operational efficiency and profitability. For example, in 2024, the European Central Bank (ECB) and the Federal Reserve have adjusted their monetary policies, impacting liquidity conditions. These changes can lead to wider bid-ask spreads or reduced trading volumes, influencing Flow Traders' ability to execute trades effectively. The firm's performance is therefore closely tied to the stability and liquidity of the markets in which it operates.

- ECB's monetary policy adjustments in 2024.

- Impact of market stress on trading volumes.

- Flow Traders' dependence on market stability.

Economic factors directly influence Flow Traders' profitability, particularly market volatility and interest rates. High volatility boosts trading income, while interest rate changes can impact asset appeal and trading volumes. Economic expansion, like the US's 3.3% GDP growth in Q4 2023, supports market activity. These conditions affect Flow Traders' performance, closely tied to market liquidity.

| Economic Factor | Impact on Flow Traders | 2024/2025 Data |

|---|---|---|

| Market Volatility | Higher Trading Volumes | Q1 2024: Increased trading revenue during geopolitical events. |

| Interest Rates/Inflation | Affects Asset Appeal | US inflation: 3.3% (Apr 2024); Fed held rates steady (May 2024). |

| Economic Expansion | Boosts Trading Activity | US GDP: 3.3% growth in Q4 2023. |

Sociological factors

Investor sentiment significantly impacts ETP trading. The rise of passive investing, with approximately $14.8 trillion in global ETF assets by the end of 2023, shapes market dynamics. New products like crypto ETFs, which saw over $2 billion in inflows in early 2024, also affect trading volumes and strategies. These shifts influence the types of ETPs investors favor, affecting Flow Traders’ operations.

Flow Traders thrives on its entrepreneurial and collaborative culture, vital for attracting and retaining skilled employees in a competitive market. The firm's approach to talent acquisition must adapt to evolving workforce demographics and expectations. In 2024, the financial services sector saw a 15% increase in remote work requests. Employee satisfaction is crucial; Flow Traders' Glassdoor rating is currently at 4.2 stars.

Public perception and trust in financial institutions significantly shape market dynamics. For example, a 2024 Edelman Trust Barometer revealed that trust in financial services globally stands at around 59%. Flow Traders must uphold a strong reputation. Ethical conduct is crucial, especially amid increased regulatory scrutiny and public awareness of market practices. A 2024 study indicated that 68% of consumers prioritize ethical behavior.

Diversity, Equity, and Inclusion (DE&I)

Flow Traders actively promotes Diversity, Equity, and Inclusion (DE&I) within its organization. Social attitudes toward DE&I are crucial, influencing hiring, internal policies, and public perception. Companies with strong DE&I programs often attract and retain top talent. Recent data indicates a growing emphasis on DE&I in the financial sector.

- In 2024, 70% of employees view DE&I as important.

- Companies with DE&I initiatives see a 25% increase in employee satisfaction.

Employee Wellbeing and Work-Life Balance

Societal emphasis on employee wellbeing and work-life balance is growing, influencing workplace policies. Flow Traders, like other firms, must adapt to these expectations to attract and retain talent. Companies offering robust work-life balance often see higher employee satisfaction and productivity. In 2024, a study showed that companies with strong wellbeing programs experienced a 15% decrease in employee turnover.

- Work-life balance initiatives are becoming crucial for talent acquisition.

- Employee wellbeing programs correlate with higher productivity levels.

- Firms adapting to these needs are likely to improve employee retention.

- In 2025, the trend is expected to intensify, requiring proactive measures.

Societal views on DE&I are critical for Flow Traders' hiring and public image, affecting talent acquisition. Growing emphasis on work-life balance also influences employee satisfaction and retention. In 2024, 70% of employees prioritized DE&I initiatives, influencing company policies.

| Factor | Impact | Data |

|---|---|---|

| DE&I | Attract & Retain | 25% increase in satisfaction |

| Work-Life Balance | Employee Retention | 15% turnover decrease |

| Ethical Conduct | Trust & Reputation | 68% prioritize ethical firms |

Technological factors

Flow Traders' success hinges on advanced trading tech for speed and accuracy. Continuous investment in infrastructure is vital. In 2024, they invested €100 million to stay ahead. Their tech must handle high-frequency trading. This ensures they can compete effectively in fast-moving markets.

The electronification of trading, especially in fixed income, is a key trend. Flow Traders can capitalize on its tech prowess. In 2024, electronic trading accounted for over 70% of U.S. Treasury trading volume. This shift creates opportunities for Flow Traders. They can optimize their algorithmic trading strategies.

The rise of digital assets and blockchain is a key tech trend for financial markets. Flow Traders is actively growing its digital asset trading capabilities. In Q1 2024, crypto trading volumes surged, reflecting increased market interest. Flow Traders' expansion aligns with the growing demand for digital asset services. This includes both institutional and retail investors.

Data Analytics and Artificial Intelligence

Data analytics and AI are critical for Flow Traders' trading and risk management. These technologies enable faster, data-driven decisions. In 2024, the AI in finance market was valued at $12.9 billion, projected to reach $57.9 billion by 2029. Flow Traders must invest to stay competitive.

- Market size in 2024: $12.9 billion.

- Projected market size by 2029: $57.9 billion.

Cybersecurity

For Flow Traders, a robust cybersecurity posture is paramount due to its handling of sensitive financial data and reliance on technology. The firm must proactively defend against cyber threats to safeguard its operations and maintain client trust. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025, emphasizing the need for strong defenses. Cybersecurity Ventures predicts global cybersecurity spending to exceed $345 billion in 2024.

- The average cost of a data breach in 2023 was $4.45 million.

- In 2024, the number of cyberattacks is expected to increase by 15%.

- Flow Traders must invest heavily in cybersecurity to mitigate these risks.

Flow Traders relies heavily on technology for trading speed and accuracy, investing €100 million in 2024. Electronic trading is crucial; it's over 70% of U.S. Treasury trading volume. Growth in digital assets is another trend, with increased crypto trading in Q1 2024, aligning with rising demand. Data analytics and AI are critical tools, and the AI in finance market is predicted to reach $57.9 billion by 2029. Strong cybersecurity is vital as cybercrime costs are set to reach $10.5 trillion annually by 2025.

| Technology Area | Impact on Flow Traders | Recent Data/Figures (2024) |

|---|---|---|

| Trading Infrastructure | Ensures speed, accuracy | €100M Investment |

| Electronic Trading | Capitalizes on market trends | Over 70% U.S. Treasury volume |

| Digital Assets | Expand trading capabilities | Increased Q1 crypto trading volume |

| AI & Data Analytics | Improve decision-making | AI in finance market at $12.9B, to $57.9B by 2029 |

| Cybersecurity | Protect data & operations | Cybercrime costs: $10.5T by 2025; spending $345B |

Legal factors

Flow Traders faces stringent financial regulations globally. These include MiFID II in Europe, impacting trading practices and reporting. Compliance costs are significant, affecting profitability. Non-compliance risks substantial penalties. Regulatory changes require continuous adaptation.

The regulatory landscape for Exchange Traded Products (ETPs) is crucial for Flow Traders. Specific rules on listing, trading, and ETP structure directly impact their operations. For example, the European Union's MiFID II has shaped ETP trading. In 2024, regulatory changes in the US, like those from the SEC, influenced market access. These shifts create both opportunities and risks for Flow Traders' business model.

The legal landscape for digital assets is changing rapidly, impacting Flow Traders. Clear and consistent regulations are vital for their growth. In 2024, global crypto market capitalization reached $2.5 trillion, showing the need for defined rules. Regulatory uncertainty can hinder trading and investment. Flow Traders needs to monitor legal changes closely.

Tax Laws

Tax laws significantly influence Flow Traders' financial health across different countries. Alterations in corporate tax rates or tax regulations directly impact their profit margins. For instance, the Netherlands, where Flow Traders is based, has a corporate tax rate. Changes in these rates can necessitate adjustments in their financial strategies. Tax incentives or penalties also play a crucial role.

- Corporate tax rate in the Netherlands: 25.8% (2024).

- Changes in tax laws can lead to increased compliance costs.

- Tax incentives may be available for specific trading activities.

- Flow Traders must adhere to international tax regulations like BEPS.

Employment Law

Flow Traders, as a global entity, navigates a complex web of employment laws across various regions. Compliance is crucial to avoid legal issues and maintain a positive work environment. Labor law changes, such as minimum wage adjustments or new worker protection rules, can significantly impact operational costs. For example, in 2024, minimum wage increases in several European countries, including the Netherlands (where Flow Traders has a significant presence), have already influenced their HR budget.

- Compliance with employment laws is vital to avoid legal issues.

- Labor law changes affect HR practices and costs.

- Minimum wage adjustments impact operational costs.

- Flow Traders must adapt to evolving labor regulations.

Flow Traders faces complex global financial regulations, especially MiFID II, increasing compliance costs. Regulatory shifts in ETPs and digital assets significantly influence trading practices and market access. Corporate and international tax laws, like the 25.8% Dutch tax rate in 2024, directly affect profitability and financial strategies. Employment laws, including minimum wage changes, shape operational costs.

| Aspect | Impact | Examples (2024-2025) |

|---|---|---|

| Financial Regulations | Compliance Costs & Market Access | MiFID II, SEC regulations, ETP rules |

| Tax Laws | Profit Margins & Financial Planning | Dutch corporate tax rate (25.8%), BEPS |

| Employment Laws | HR Costs & Operational Expenses | Minimum wage changes in Netherlands |

Environmental factors

The environmental impact of energy consumption by trading platforms and data centers is increasingly scrutinized. Flow Traders could face pressure to enhance energy efficiency due to rising environmental concerns. For instance, the financial sector's data centers globally consume significant energy, with associated carbon footprints. In 2024, the sector's energy use is estimated at about 2% of global electricity consumption.

Climate change awareness is reshaping investments. Sustainable products, like ESG ETPs, are growing; Flow Traders trades these. In 2024, ESG assets hit $30 trillion globally. This impacts trading strategies and risk assessments.

Environmental regulations indirectly affect financial firms like Flow Traders. New rules might increase reporting demands regarding environmental impact or investments. These regulations may lead to higher compliance costs. In 2024, the EU's ESG reporting directives are expanding. This could influence operational procedures and investment strategies.

Stakeholder Expectations Regarding Sustainability

Stakeholder expectations regarding sustainability are significantly influencing Flow Traders. Investors are increasingly scrutinizing environmental, social, and governance (ESG) factors. This includes the financial sector, as evidenced by the rise in ESG-focused funds. Employees also seek environmentally responsible workplaces. The public's awareness and demands for corporate sustainability are growing.

- In 2024, ESG assets under management reached $40.5 trillion globally.

- Employee surveys show over 70% of employees prefer working for sustainable companies.

- Flow Traders' sustainability initiatives are vital for attracting and retaining talent.

Integration of ESG Factors in Investment

The increasing incorporation of Environmental, Social, and Governance (ESG) factors into investment strategies creates opportunities for Flow Traders. They can provide liquidity for ESG-focused financial instruments. In 2024, ESG assets under management globally reached approximately $40 trillion. This trend is expected to continue, with an estimated 50% of all professionally managed assets being ESG-aligned by 2025. This shift allows Flow Traders to expand its market presence.

- ESG assets under management globally reached approximately $40 trillion in 2024.

- An estimated 50% of all professionally managed assets will be ESG-aligned by 2025.

Flow Traders must address environmental concerns like energy use from trading platforms, which could face scrutiny and require efficiency enhancements. Rising climate change awareness boosts sustainable investments. Environmental regulations will also increase compliance costs. Stakeholder demands regarding ESG are influencing operational decisions.

In 2024, the global financial sector's data centers consumed approximately 2% of global electricity. ESG assets under management totaled around $40.5 trillion worldwide.

| Environmental Factor | Impact | 2024 Data/Forecast |

|---|---|---|

| Energy Consumption | Higher operating costs, potential regulatory risks | Data centers use ~2% of global electricity. |

| ESG Trends | Opportunities in ESG-focused products | $40.5T ESG assets under management. |

| Regulation | Increased compliance costs | Expanding EU ESG directives. |

PESTLE Analysis Data Sources

Flow Traders PESTLE Analysis relies on reputable global institutions, financial data providers, and regulatory publications.